Firstgroup Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

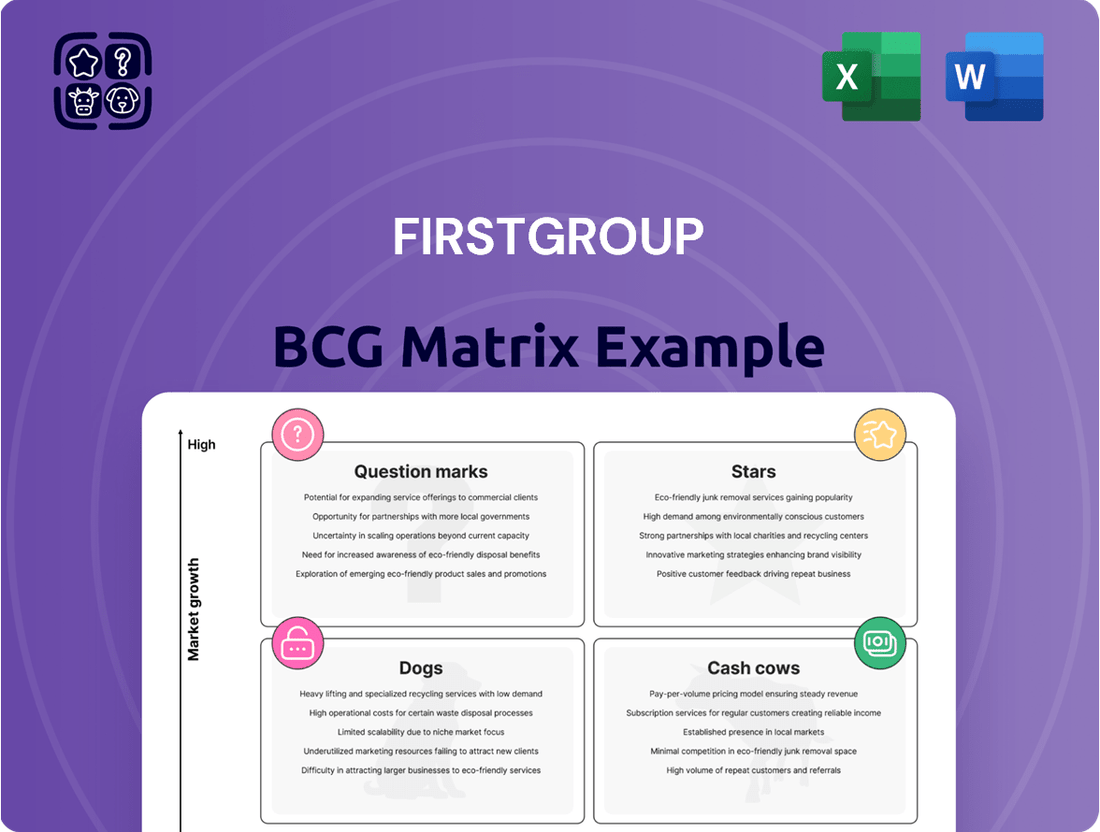

FirstGroup's current BCG Matrix reveals a dynamic portfolio, with some segments showing strong growth potential and others requiring careful management. Understanding these positions is crucial for any investor or stakeholder looking to navigate the transportation sector effectively.

This preview offers a glimpse into FirstGroup's strategic landscape. To truly unlock the insights and develop a winning strategy, dive deeper into the full BCG Matrix. It provides a comprehensive breakdown of each business unit's market share and growth rate, empowering you to make informed decisions.

Purchase the complete BCG Matrix report now and gain a clear, actionable understanding of FirstGroup's Stars, Cash Cows, Dogs, and Question Marks. Equip yourself with the data-driven insights needed to optimize resource allocation and drive future success.

Stars

FirstGroup's commitment to a zero-emission bus fleet positions it as a strong contender in the burgeoning sustainable transport sector. The company invested £88 million in FY 2025 to expand its eco-friendly fleet, bringing the total to 1,115 zero-emission buses, which now represent 20.5% of its total commercial fleet. This strategic move aligns with increasing environmental regulations and consumer demand for greener transportation options, marking it as a Stars category investment.

FirstGroup's open access operations, specifically Lumo and Hull Trains, are demonstrating robust performance. In the fiscal year 2025, these services saw a notable increase in passenger journeys and a rise in adjusted operating profit, underscoring their strong market appeal.

Significant investment is being channeled into expanding these operations. A major £500 million order for 14 new Hitachi trains, coupled with securing track access rights for new routes, highlights FirstGroup's commitment to growth in this segment. Lumo's expansion to Glasgow and additional Hull Trains services are key components of this strategy.

This strategic push aims to double the existing open access capacity, signaling a clear intent to capture a high market share in a high-growth sector. The company's proactive investment and service expansion position these operations as a key driver for future revenue.

FirstGroup's acquisition of RATP Dev Transit London for £90 million in February 2025 significantly bolsters its presence in the UK bus market. This move introduces approximately 1,000 buses operating on 83 routes within the dense London network, a key urban transport hub.

Operating under the First Bus London banner, this acquisition is poised to contribute substantially to FirstGroup's revenue streams. The company is now positioned to leverage the high demand and growth potential inherent in the London metropolitan transport sector, aiming to secure a considerable market share.

Growth in First Bus Adjacent Services

First Bus's adjacent services, encompassing supported local services, workplace shuttles, and rail replacement, have experienced robust revenue expansion. These services generated £270.8 million in revenue in FY 2025, marking a significant increase.

This upward trend is fueled by a combination of securing new contracts and executing strategic acquisitions. Key additions include York Pullman, Anderson Travel, Lakeside Group, and Tetley's coaches, which have broadened First Bus's service portfolio.

This strategic diversification within the bus division targets specific, growing market niches. These specialized segments are demonstrating high growth rates and a corresponding increase in market share for First Bus.

- Revenue Growth: Adjacent services revenue reached £270.8 million in FY 2025.

- Acquisition Strategy: Key acquisitions include York Pullman, Anderson Travel, Lakeside Group, and Tetley's coaches.

- Market Focus: Targeting expanding niches like supported local services, workplace shuttles, and rail replacement.

- Performance: Demonstrating high growth and increasing market share in specialized segments.

Digital Innovation and AI Optimisation

FirstGroup is actively integrating digital innovation and AI to sharpen its competitive edge. For instance, the company is rolling out new journey software systems that provide real-time travel information to customers, a move designed to boost convenience and attract more passengers.

Their strategic partnerships, such as the one with AI firm Prospective, are geared towards optimizing operations. This collaboration focuses on refining timetables and scheduling for First Bus services, aiming for greater efficiency and better resource allocation. In 2023, FirstGroup reported a significant increase in passenger numbers across its bus operations, partly attributed to these service enhancements.

These technological advancements, while demanding upfront capital, are fundamental to increasing demand and enhancing the customer experience. By positioning itself as a leader in modern transport solutions, FirstGroup is adapting to a rapidly evolving market. The company's investment in digital transformation is expected to yield substantial operational efficiencies and improved service delivery, crucial for sustained growth.

- Digital Transformation: Implementation of new journey software for real-time passenger information.

- AI Optimization: Partnership with Prospective to enhance bus timetables and scheduling.

- Customer Experience: Focus on improving convenience and service delivery through technology.

- Operational Efficiency: Driving cost savings and resource optimization via AI and digital tools.

FirstGroup's open access rail operations, including Lumo and Hull Trains, are performing exceptionally well, demonstrating strong passenger growth and increased profitability in FY 2025. The company is making substantial investments, such as a £500 million order for new Hitachi trains, to expand capacity and secure new routes. This aggressive expansion strategy aims to double existing capacity, positioning these services as key revenue drivers in a high-growth market segment.

The acquisition of RATP Dev Transit London for £90 million in early 2025 significantly strengthens FirstGroup's position in the UK bus market, adding approximately 1,000 buses and 83 routes in London. This strategic move leverages the high demand and growth potential of the London metropolitan transport sector, aiming to capture a substantial market share.

First Bus's adjacent services, focusing on specialized niches like supported local services, workplace shuttles, and rail replacement, saw robust revenue growth, reaching £270.8 million in FY 2025. This expansion is supported by strategic acquisitions of companies like York Pullman and Anderson Travel, allowing FirstGroup to increase its market share in these high-growth segments.

FirstGroup is actively integrating digital innovation and AI to enhance customer experience and operational efficiency. Investments in new journey software for real-time information and partnerships with AI firms like Prospective for timetable optimization are key initiatives. These technological advancements are expected to drive demand and improve service delivery, contributing to sustained growth.

What is included in the product

Highlights which units to invest in, hold, or divest for Firstgroup.

A clear visual of Firstgroup's BCG Matrix, categorizing business units, alleviates the pain of strategic uncertainty.

Cash Cows

First Bus's established regional operations, excluding recent London expansions, are a prime example of a Cash Cow within the Firstgroup BCG Matrix. These mature operations boast a significant market share, demonstrating consistent performance.

In FY 2025, this segment delivered a substantial £1.08 billion in revenue. Furthermore, adjusted operating profit saw an increase, with the division on track to hit a 10% operating margin in the latter half of 2025.

These operations are a reliable source of considerable cash flow for Firstgroup, bolstered by ongoing efforts to enhance operational efficiencies and improve driver availability across the network.

First Rail's Department for Transport (DfT) contracted rail operations are a classic cash cow within the BCG matrix. These operations generate consistent and predictable revenue thanks to government agreements, offering a stable financial foundation.

In fiscal year 2025, these train operating companies (TOCs) exceeded financial projections, largely driven by increased variable fees. This performance underscores the resilience and profitability of these contracted services.

Despite transitions in some operations, such as South Western Railway moving towards public ownership, the existing contracts remain lucrative. They are projected to deliver approximately £120 million in cash over the next three years, highlighting their significant contribution to Firstgroup's cash flow.

FirstGroup's mature and profitable operations are a clear cash cow, fueling substantial returns to shareholders. In FY 2025, the company returned approximately £92 million through share buybacks, demonstrating a commitment to capital allocation. This, coupled with an 18% increase in the total dividend to 6.5p per share for FY 2025 compared to FY 2024, underscores the robust cash generation from its established businesses.

Established Infrastructure and Depots

FirstGroup's established infrastructure, including a vast network of bus depots and rail facilities, represents a significant Cash Cow. This existing asset base underpins its consistent revenue generation, requiring minimal incremental investment for core operations. For instance, in the fiscal year ending March 2024, FirstGroup reported a strong performance in its UK bus division, a key beneficiary of this infrastructure, with revenue growth contributing to its overall financial stability.

The modernization efforts focused on decarbonization are enhancing the efficiency and long-term value of these depots. This strategic investment ensures the infrastructure remains relevant and cost-effective. The company's commitment to transitioning its fleet to zero-emission vehicles, supported by these upgraded facilities, positions its Cash Cow assets for continued profitability and operational excellence.

- Extensive Network: FirstGroup operates a substantial number of depots across the UK, providing a solid foundation for its bus services.

- Consistent Revenue: The mature nature of these operations, supported by established infrastructure, leads to predictable and stable cash flows.

- Low Incremental Investment: Unlike growth areas, the existing infrastructure requires relatively low additional capital expenditure for maintenance and upgrades, boosting profitability.

- Decarbonization Investment: Ongoing investments in modernizing depots for electric vehicle charging and maintenance further solidify the long-term value and operational efficiency of these Cash Cow assets.

First Rail Additional Services

Within FirstGroup's portfolio, the additional services offered by First Rail, such as First Customer Contact, Mistral Data, and First Rail Consultancy, represent established Cash Cows. These ventures are significant contributors to the company's financial performance, demonstrating a consistent ability to generate revenue. For the fiscal year 2025, these complementary services achieved a notable revenue of £110.7 million.

While these additional services may not exhibit high growth potential, their strategic value lies in their consistent profitability and their ability to leverage First Rail's existing infrastructure and expertise. They provide stable, complementary revenue streams that enhance overall financial stability for the company.

- Revenue Generation: First Rail's additional services, including customer contact, data management, and consultancy, are consistent revenue generators.

- FY 2025 Performance: These services collectively reported revenues of £110.7 million in fiscal year 2025.

- Strategic Advantage: They capitalize on existing expertise and infrastructure, offering stable, complementary income.

- Profitability Profile: Characterized by relatively low growth but high profit margins, fitting the Cash Cow archetype.

FirstGroup's established UK bus operations, excluding recent London ventures, are a prime example of a Cash Cow. These mature businesses hold a significant market share and consistently deliver strong financial results.

In FY 2025, this segment generated £1.08 billion in revenue and was on track to achieve a 10% operating margin in the latter half of the year, showcasing its reliable profitability and contribution to Firstgroup's overall financial health.

First Rail's contracted train operating companies also function as classic cash cows. These operations benefit from government agreements, ensuring predictable revenue streams and a stable financial base for the company.

In FY 2025, these services exceeded financial projections due to increased variable fees, and despite some contract transitions, existing agreements are projected to deliver approximately £120 million in cash over the next three years.

| Segment | FY 2025 Revenue | FY 2025 Operating Margin Target | Projected Cash Contribution (Next 3 Years) |

| UK Bus (Established) | £1.08 billion | 10% (H2 2025) | N/A |

| First Rail (DfT Contracts) | Exceeded Projections | N/A | ~£120 million |

What You See Is What You Get

Firstgroup BCG Matrix

The preview you're currently viewing is the identical, fully realized Firstgroup BCG Matrix report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content; you'll get the complete, professionally formatted strategic analysis ready for immediate application in your business planning.

Dogs

FirstGroup's legacy pension scheme obligations represent a significant historical liability. In fiscal year 2024, the company recognized non-cash charges of £146.9 million specifically related to exiting local government pension schemes. This highlights past operational decisions that continue to affect current financial statements.

These pension liabilities are essentially 'cash traps' from prior activities, tying up capital that could otherwise be invested in growth areas. While FirstGroup is actively working to resolve and discharge these obligations, they are not indicative of current profitable operations but rather a consequence of historical commitments.

FirstGroup's outdated diesel-only bus and train fleets are firmly positioned as Dogs in the BCG Matrix. These assets operate within a shrinking market due to stringent environmental regulations and the company's own ambitious zero-emission targets, such as electrifying its bus fleet by 2035.

The operational reality for these older diesel vehicles is a high cost of maintenance and fuel compared to their modern, sustainable counterparts. This makes them a drain on resources, with limited potential for future growth and increasing pressure for replacement or disposal.

FirstGroup's divestment of Greyhound and First Transit, though prior to the 2024-2025 period, signals a strategic move away from operations perceived as having lower growth potential or market standing. These were significant parts of the business, but their sale reflects a deliberate sharpening of focus on the UK public transport market.

The decision to divest these North American entities, completed in 2021 and 2022 respectively, allowed FirstGroup to streamline its operations and concentrate resources on its core UK bus and rail services. This strategic pivot aimed to enhance profitability and market position within its primary geographical focus.

Underperforming or Subsidized Routes

Within First Bus's operations, certain routes may fall into the 'Dogs' category of the BCG matrix. These are typically routes with low market share and low growth potential, often requiring subsidies to operate.

These underperforming or subsidized routes consume valuable resources without generating substantial returns for the company. For instance, while specific route data isn't publicly itemized in Firstgroup's annual reports, the company has historically engaged in route reviews to improve efficiency.

- Low Ridership: Routes with consistently low passenger numbers struggle to cover operating costs.

- Subsidized Operations: Many of these routes rely on government contracts or subsidies to remain financially viable.

- Resource Drain: They tie up fleet, drivers, and maintenance resources that could be allocated to more profitable services.

- Strategic Review: Such routes are prime candidates for optimization, consolidation, or potential discontinuation if improvements aren't feasible.

Unprofitable Ancillary Services

Unprofitable ancillary services within FirstGroup's portfolio, while not explicitly detailed as underperforming in recent reports, would conceptually fall into the Dogs category of the Boston Consulting Group (BCG) matrix. These are offerings with low market share and low growth potential.

These might include minor partnerships or niche services that consume operational resources without generating substantial revenue or profit. Such initiatives, if they exist, would represent a drain on the company's financial resources, even if maintained for specific strategic, albeit non-financial, reasons.

- Low Market Share: Ancillary services that capture a minimal portion of their respective markets.

- Low Growth Prospects: Offerings that are not expected to expand significantly in demand or revenue generation.

- High Operational Overhead: Services that require disproportionate investment in management, infrastructure, or support relative to their financial return.

- Strategic Justification: Potentially retained for reasons such as customer retention or market presence, despite poor financial performance.

FirstGroup's legacy pension scheme obligations, amounting to £146.9 million in non-cash charges recognized in fiscal year 2024, represent a significant historical liability. These are cash traps from prior activities, not indicative of current profitable operations.

Outdated diesel fleets are firmly positioned as Dogs due to stringent environmental regulations and the company's zero-emission targets. These vehicles incur high maintenance and fuel costs compared to modern, sustainable alternatives.

Certain First Bus routes with low ridership and reliance on subsidies also fall into the Dogs category. These underperforming routes consume valuable resources without generating substantial returns.

Unprofitable ancillary services with low market share and growth prospects would also be considered Dogs, representing a drain on financial resources.

| BCG Category | FirstGroup Examples | Characteristics | Financial Implication |

|---|---|---|---|

| Dogs | Legacy Pension Liabilities | Historical obligations, non-cash charges | Resource drain, potential cash traps |

| Dogs | Outdated Diesel Fleets | High maintenance/fuel costs, shrinking market | Operational inefficiency, environmental compliance costs |

| Dogs | Low-Ridership/Subsidized Bus Routes | Low market share, low growth, reliance on subsidies | Resource consumption, limited profitability |

| Dogs | Unprofitable Ancillary Services | Low market share, low growth, high overhead | Financial drain, potential strategic review |

Question Marks

FirstGroup's pursuit of new open access rail services, like the proposed Rochdale to London route, positions these ventures as question marks within its BCG matrix. These routes tap into high-growth potential, serving new markets and potentially underserved communities.

Currently, these new services hold zero market share, demanding substantial investment in detailed performance and business case analysis. Success hinges on securing regulatory approval, a critical factor for these question marks.

The financial outlook for these open access services is characterized by uncertainty, yet they offer the prospect of significant future returns, aligning with the characteristics of question mark investments.

Firstgroup's acquisition of the London Cable Car operation in June 2024, with an eight-year contract valued at around £60 million, places this venture squarely in the Question Mark category of the BCG matrix. This move into a niche urban transport segment, particularly in a high-traffic tourist hub like London, presents significant growth opportunities.

The key challenge lies in its early integration phase and the need for operational refinement. Firstgroup must effectively manage this new asset to foster growth and market share, aiming to elevate it from a Question Mark to a Star within their portfolio.

FirstGroup is strategically positioning itself to capitalize on the burgeoning UK regional bus franchising market. This sector is experiencing significant growth as numerous local authorities explore and adopt franchising models to enhance public transport services.

While these future franchised areas represent a high-growth potential, FirstGroup currently possesses a limited market share within them. Securing these contracts will necessitate substantial investment in bidding processes and meticulous strategic planning, classifying these opportunities as Stars within the BCG matrix, poised for significant future market expansion.

Continued Investment in Battery Technology and Charging Infrastructure

Firstgroup's continued investment in battery technology and charging infrastructure falls into the Question Mark category of the BCG Matrix. While the broader trend of decarbonization is a Star, the specific focus on advanced battery chemistries, smart charging solutions, and potential secondary revenue from battery storage and recycling represents a high-growth but uncertain area. These innovations are crucial for electrification, but their market penetration and profitability are still developing, necessitating substantial ongoing research and development alongside significant capital investment to achieve their full potential.

This strategic focus requires careful management due to the inherent risks and rewards. The company is betting on these emerging technologies to capture future market share in the rapidly evolving transportation sector.

- Investment in Advanced Battery Technologies: Firstgroup is exploring next-generation battery chemistries, such as solid-state batteries, which promise higher energy density and faster charging times compared to current lithium-ion technology. This aligns with industry trends, as the global EV battery market was valued at approximately $50 billion in 2023 and is projected to grow significantly.

- Development of Smart Charging Infrastructure: The company is investing in intelligent charging software and hardware that optimizes charging schedules, potentially leveraging off-peak electricity rates and managing grid load. This is critical as electric vehicle adoption increases, with global charging infrastructure investment expected to reach hundreds of billions of dollars by 2030.

- Exploration of Adjacent Revenue Streams: Firstgroup is investigating opportunities to generate revenue from battery capacity through vehicle-to-grid (V2G) services and by establishing battery recycling programs. The circular economy for batteries is gaining traction, with significant economic and environmental benefits.

- High R&D and Capital Deployment: These initiatives require substantial upfront investment in research, development, and infrastructure. For example, the cost of establishing a new battery gigafactory can run into billions of dollars, highlighting the capital-intensive nature of this segment.

Exploration of New Transport Modalities/Partnerships

FirstGroup's exploration of new transport modalities and partnerships, such as monitoring open access opportunities in Europe, places these ventures squarely in the 'Question Marks' category of the BCG matrix. These initiatives hold the promise of significant future growth, but their current market share is minimal, necessitating careful evaluation.

The company's strategic approach involves substantial due diligence and investment to assess the long-term viability and potential of these nascent ventures. For example, FirstGroup's 2024 strategy continues to emphasize the evaluation of potential acquisitions and partnerships that align with its growth objectives, particularly in areas offering diversification or enhanced market access.

- Potential High Growth: These new ventures could tap into emerging market trends or underserved transport needs, offering substantial upside if successful.

- Low Market Share: Currently, these initiatives represent a very small portion of FirstGroup's overall business, indicating early-stage development or market entry.

- Substantial Investment Required: Significant capital outlay and resources are needed for research, development, market testing, and scaling these new transport solutions.

- Strategic Importance: While risky, these 'Question Marks' are crucial for FirstGroup's long-term competitive positioning and ability to adapt to evolving transportation landscapes.

FirstGroup's new open access rail services and the London Cable Car acquisition are classified as Question Marks. These ventures represent high-growth potential but currently have minimal market share, demanding significant investment and careful strategic management to transition into Stars.

The company's investment in battery technology and exploration of new transport modalities, including European open access, also fall into the Question Mark category. These areas require substantial R&D and capital, with their future market success being uncertain but strategically important for long-term growth.

| Venture | BCG Category | Market Share | Growth Potential | Investment Needs |

| New Open Access Rail Services | Question Mark | Zero | High | Substantial (Regulatory, operational analysis) |

| London Cable Car (Acquired June 2024) | Question Mark | Low (Niche segment) | High (Urban transport hub) | Significant (Integration, operational refinement) |

| Battery Technology & Charging Infrastructure | Question Mark | Developing | High (Decarbonization trend) | High (R&D, capital for infrastructure) |

| European Open Access Opportunities | Question Mark | Minimal | High (Emerging markets) | Substantial (Due diligence, partnerships) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.