Firstgroup Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

Firstgroup's marketing mix is a fascinating study in how a major transport operator navigates diverse markets. Their product strategy, encompassing buses and rail, is vast, while pricing must balance accessibility with profitability. Understanding their distribution (place) and promotional efforts is key to grasping their operational success.

Dive deeper into Firstgroup's strategic brilliance with our complete 4Ps Marketing Mix Analysis. We dissect their product offerings, pricing models, distribution networks, and promotional campaigns, providing actionable insights for business professionals, students, and consultants. Get a ready-made, editable report that saves you hours of research and offers a clear roadmap to understanding their market impact.

Product

FirstGroup's product offering is robust, covering extensive local and long-distance bus services through First Bus, which operates around 5,800 buses. This segment saw a substantial boost with the recent acquisition of First Bus London, adding approximately 1,000 buses and 83 routes, enhancing their presence in key urban areas.

In the rail sector, First Rail manages critical Department for Transport (DfT) contracts for operators like Avanti West Coast and Great Western Railway. They also successfully operate open-access services, demonstrating a diversified approach to the rail market.

FirstGroup's product strategy heavily emphasizes decarbonisation and zero-emission fleets, aligning with broader sustainability goals. They are committed to a zero-emission bus fleet by 2035 and support the UK's target to eliminate diesel-only trains by 2040.

Significant investment underpins this commitment, with over £300 million channeled into bus electrification. This has resulted in approximately 1,115 zero-emission buses currently operating, supported by ten depots that are fully or substantially electric.

The Lumo rail service exemplifies this focus, already running a completely electric fleet. This demonstrates FirstGroup's proactive approach and leadership in adopting environmentally sustainable transport solutions.

FirstGroup is actively enhancing its digital and smart ticketing solutions to boost customer convenience. They were pioneers as the first national bus operator to accept contactless card payments across all their services. This commitment to innovation is evident in their widespread adoption of 'Tap On, Tap Off' technology, which simplifies fare calculation based on distance traveled and significantly speeds up boarding processes, making travel smoother for passengers.

Expansion of Open Access Rail and Adjacent Services

FirstGroup is actively expanding its open-access rail operations, a key part of its product strategy. This involves increasing capacity and introducing new routes. For instance, recent extensions to Hull Trains and Lumo services are set to boost their open-access capacity, with new routes planned to Glasgow and more services connecting major cities.

Beyond rail, FirstGroup's First Bus division is also broadening its product offering through 'Adjacent Services.' This diversification is being driven by strategic acquisitions, allowing them to enter new markets. These services now include areas such as school transport, private charters, and airport transfers, broadening their customer base and revenue streams.

- Open-Access Rail Growth: Increased capacity via Hull Trains and Lumo, with new Glasgow routes and inter-city service enhancements planned.

- Adjacent Services Expansion: First Bus division diversifies with acquisitions into school transport, private charters, and airport services.

- Strategic Diversification: Focus on growing non-contracted revenue streams to complement core operations.

Improved Customer Experience and Accessibility

FirstGroup is actively focusing on improving the customer experience across its operations. This includes providing better real-time travel information, enhancing onboard amenities, and establishing dedicated communication channels for passengers with disabilities. For instance, in 2024, they continued to roll out digital solutions aimed at giving passengers more accurate and timely updates on their journeys.

Accessibility is a key pillar of their customer experience strategy. FirstGroup collaborates with various disability advocacy groups to ensure their services meet the needs of all passengers. Investments in technology are ongoing to make their transport networks more inclusive. By the end of 2024, a significant portion of their fleet had been upgraded with features designed to assist disabled customers, reflecting a commitment to universal access.

These efforts are reflected in their performance metrics. For example, customer satisfaction scores for accessibility features saw a notable uptick in their 2024 reports. FirstGroup's investment in technology, such as real-time information apps, aims to reduce travel anxiety and improve overall journey planning for all users.

Key initiatives include:

- Enhanced real-time information systems: Providing passengers with up-to-the-minute updates on service status and arrival times.

- Improved onboard amenities: Focusing on comfort and convenience for all passengers.

- Dedicated accessibility support: Working with disability groups to refine services and communication for disabled customers.

- Technological investments: Upgrading fleet and infrastructure to ensure greater accessibility and ease of use.

FirstGroup's product strategy is multifaceted, encompassing extensive bus operations and strategic rail services. They are aggressively pursuing decarbonisation, aiming for a zero-emission bus fleet by 2035, with over £300 million invested in electrification, resulting in approximately 1,115 zero-emission buses operational by early 2025. Their rail offerings include managing key DfT contracts and expanding open-access services like Lumo and Hull Trains, with new routes to Glasgow planned.

| Product Area | Key Offerings | Strategic Focus | Recent Developments (2024/2025) |

|---|---|---|---|

| First Bus | Local & Long-distance bus services, School Transport, Private Charters, Airport Transfers | Decarbonisation, Fleet Electrification, Adjacent Services Expansion | Acquisition of First Bus London (approx. 1,000 buses), ~1,115 zero-emission buses operating |

| First Rail | DfT Contracted Services (Avanti West Coast, GWR), Open-Access Services (Lumo, Hull Trains) | Open-Access Growth, Service Enhancements, Decarbonisation Support | Increased Hull Trains/Lumo capacity, planned Glasgow routes |

| Digital & Ticketing | Contactless Payments, Tap On, Tap Off technology | Customer Convenience, Streamlined Boarding | Continued rollout of digital solutions for real-time information |

What is included in the product

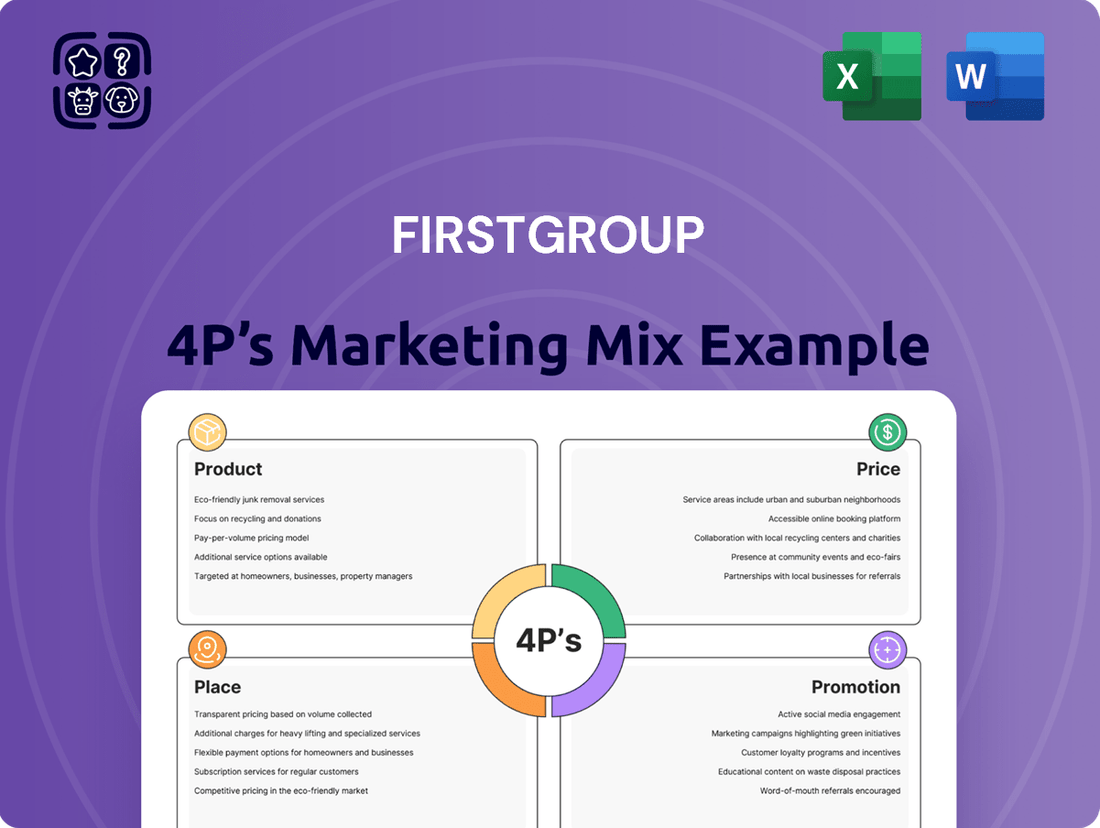

This analysis provides a comprehensive deep dive into Firstgroup's marketing mix, examining their strategies across Product, Price, Place, and Promotion to understand their market positioning.

It's designed for professionals seeking a grounded understanding of Firstgroup's actual brand practices and competitive context, offering a solid foundation for strategic planning and benchmarking.

Simplifies complex marketing strategies into actionable 4Ps insights, alleviating the pain of understanding Firstgroup's market approach.

Provides a clear, concise overview of Firstgroup's 4Ps, reducing the burden of deciphering their marketing tactics for busy executives.

Place

FirstGroup's extensive UK-wide network is a cornerstone of its offering. With bus services reaching over 25% of the population from roughly 70 depots, the company ensures significant reach. This physical footprint is further amplified by its rail operations, which manage approximately 380 stations, linking key cities and local areas.

FirstGroup's strategic hubs and depots are the backbone of its distribution network, ensuring efficient service delivery across its operations. These facilities are vital for maintaining fleet readiness and supporting the company's extensive route coverage.

The acquisition of First Bus London in 2023, which brought 10 depots into the fold, significantly bolsters FirstGroup's presence in critical urban centers. This expansion enhances their ability to serve high-demand metropolitan areas, a key component of their market strategy.

These strategically located depots are also instrumental in FirstGroup's ongoing commitment to sustainability. They serve as essential sites for the development and implementation of their decarbonisation strategy, including the infrastructure required for electric vehicle charging and maintenance, aiming for a zero-emission bus fleet by 2035.

FirstGroup significantly enhances customer access through integrated digital distribution channels. Their online ticketing systems and dedicated mobile apps allow for seamless journey planning, ticket purchases, and real-time service updates, making travel more convenient and efficient. This digital focus is crucial for engaging with a modern customer base.

Partnerships with Local Authorities and Transport Bodies

FirstGroup's strategy heavily relies on robust partnerships with local authorities, the Department for Transport (DfT), and Transport for London (TfL). These collaborations are crucial for securing tendered contracts, which form a significant portion of their revenue. For instance, in the fiscal year ending March 2024, FirstBus secured £1.1 billion in tendered contracts, highlighting the importance of these relationships.

These partnerships extend beyond just securing services; they are vital for co-developing infrastructure projects and ensuring public transport networks align with national and local transport objectives. This collaborative approach allows FirstGroup to adapt services to evolving community needs and government policies, fostering long-term sustainability and growth within the public transport sector.

- Securing Tendered Services: Partnerships are key to winning and operating contracts for essential public transport routes.

- Infrastructure Development: Collaboration enables joint investment in new stations, fleet upgrades, and technology.

- Policy Alignment: Working with authorities ensures services meet community needs and government transport strategies.

- Financial Stability: Tendered contracts provide a predictable revenue stream, contributing to FirstGroup's financial resilience.

Expansion into New and Complementary Markets

FirstGroup is actively pursuing expansion by entering new and complementary markets. This strategy involves both strategic acquisitions and the development of new service routes, aiming to broaden their customer base and revenue streams.

A key element of this is their re-entry into the competitive London bus market. Additionally, FirstGroup is expanding its open-access rail services, with recent moves to new destinations like Glasgow. These actions reflect a deliberate effort to increase their operational footprint and diversify their service portfolio in direct response to evolving market demands and opportunities.

- Market Expansion: FirstGroup's strategy focuses on entering new and complementary markets.

- Growth Drivers: Expansion is fueled by strategic acquisitions and the development of new routes.

- London Bus Re-entry: This move signifies a significant step in reclaiming market share in a key urban area.

- Open-Access Rail Growth: Expansion to destinations like Glasgow diversifies rail offerings and reach.

FirstGroup's physical presence is defined by its extensive network of depots and stations across the UK. These locations are crucial for operational efficiency, fleet maintenance, and service delivery, reaching a significant portion of the population. The company's strategic expansion, including its re-entry into the London bus market with the acquisition of 10 new depots in 2023, underscores its commitment to serving high-demand urban areas. Furthermore, these sites are central to FirstGroup's sustainability initiatives, housing the infrastructure for its transition to a zero-emission bus fleet by 2035.

| Asset Type | Quantity (approx.) | Key Function | Strategic Importance |

|---|---|---|---|

| Bus Depots | ~70 (UK-wide) + 10 (London, 2023) | Fleet maintenance, operations, EV charging infrastructure | Service delivery, network reach, decarbonisation |

| Rail Stations Managed | ~380 | Passenger services, connectivity | Linking cities and local areas, network coverage |

Same Document Delivered

Firstgroup 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Firstgroup 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to this ready-to-use document to understand their market approach.

Promotion

First Bus unveiled a significant brand refresh in December 2024, introducing the new slogan 'Moving the everyday.' This initiative underscores the essential role of bus services in fostering community connections. The updated identity is a crucial step in First Bus's ongoing transformation, aimed at boosting brand recognition and customer engagement.

FirstGroup strongly emphasizes its commitment to sustainability, particularly in decarbonisation efforts. This focus on green transport is a key promotional tool, aiming to attract customers and investors who prioritize environmental responsibility.

The company actively showcases its investments in zero-emission vehicles, such as electric buses, as tangible proof of its sustainability leadership. This proactive approach aims to encourage a shift from private car use to more eco-friendly public transportation options.

FirstGroup's high Environmental, Social, and Governance (ESG) ratings, including an MSCI AAA rating, are frequently highlighted. These accolades validate their sustainability claims and appeal to a growing segment of environmentally aware consumers and stakeholders.

Firstgroup leverages digital marketing extensively, using social media, its website, and mobile apps to connect with customers. This allows for direct communication, sharing service updates, and highlighting new offerings.

In 2024, Firstgroup continued to enhance its digital customer journey. For instance, their mobile app, a key engagement tool, saw consistent user growth, facilitating real-time travel information and ticket purchases, contributing to a smoother customer experience.

Advocacy for Public Transport and Modal Shift

FirstGroup actively advocates for public transport, highlighting its societal benefits. This advocacy aims to encourage a modal shift away from private vehicles towards their bus and rail services. For instance, in 2024, FirstGroup supported initiatives that demonstrated a reduction in carbon emissions for every passenger mile traveled by public transport compared to private cars.

Their engagement with government and policymakers focuses on showcasing the economic, social, and environmental advantages of public transportation. By influencing transport policy, FirstGroup seeks to create an environment more conducive to public transport usage. In 2024, their lobbying efforts contributed to discussions around government funding for public transport infrastructure upgrades, recognizing its role in economic development.

- Modal Shift Benefits: Public transport usage can reduce congestion and air pollution, with studies in 2024 indicating a significant decrease in particulate matter in urban areas with higher public transport ridership.

- Economic Impact: Investments in public transport infrastructure, as advocated by FirstGroup, have been shown to create jobs and stimulate local economies. For example, a project in 2024 was estimated to support thousands of jobs.

- Environmental Advantages: Shifting to public transport significantly lowers greenhouse gas emissions per passenger. FirstGroup's own data from 2024 showed their services offering a lower carbon footprint per passenger compared to single-occupancy vehicles.

Community Engagement and Local Partnerships

Firstgroup's community engagement is a cornerstone of its marketing strategy, fostering strong ties with local authorities and residents. This deep involvement ensures their transport services are not just functional but also responsive to the unique needs of each community they operate within.

By actively participating in local events and tailoring their offerings, Firstgroup demonstrates a commitment to enhancing the quality of life and economic vitality of the areas they serve. For instance, in 2024, the company highlighted its role in supporting local employment, noting that its bus operations alone contributed to thousands of jobs across the UK.

Their partnerships often focus on improving accessibility and sustainability. Firstgroup's collaboration with local councils on initiatives like park-and-ride schemes or integrated ticketing systems directly addresses commuter needs and environmental concerns.

- Local Needs Tailoring: Firstgroup adapts routes and schedules based on community feedback and demographic shifts, exemplified by service adjustments in growing suburban areas in 2024.

- Community Event Participation: The company sponsors and participates in local festivals and events, increasing brand visibility and reinforcing its community presence.

- Economic Impact Communication: Firstgroup regularly publishes data on its local economic contributions, such as direct and indirect job creation and local supply chain spending, with recent reports from 2024 showing significant regional investment.

- Partnerships for Improvement: Collaborations with local authorities aim to enhance public transport infrastructure and service integration, leading to more efficient and user-friendly travel options.

FirstGroup's promotion strategy is multifaceted, focusing on sustainability, digital engagement, and community ties. The 'Moving the everyday' slogan, launched in December 2024, highlights their essential role. Their commitment to decarbonisation, demonstrated by investments in electric buses, appeals to environmentally conscious consumers and investors.

Digital marketing via social media, their website, and a growing mobile app user base in 2024 facilitates direct customer interaction and service updates. FirstGroup also actively advocates for public transport's societal benefits, influencing policy and promoting modal shifts. Their strong ESG ratings, including an MSCI AAA rating, further bolster their brand image.

Community engagement is central, with tailored services and participation in local events enhancing their presence. Partnerships with local councils for initiatives like park-and-ride schemes address commuter needs and environmental concerns, reinforcing their commitment to local economic vitality, as evidenced by their significant contribution to UK employment in 2024.

| Promotional Focus | Key Initiatives | Data/Evidence (2024/2025) |

|---|---|---|

| Brand Refresh & Core Message | 'Moving the everyday' slogan | Launched December 2024 |

| Sustainability & Decarbonisation | Investment in zero-emission vehicles (electric buses) | Highlighting lower carbon footprint per passenger compared to private cars. MSCI AAA rating. |

| Digital Engagement | Mobile app enhancements, social media presence | Consistent user growth for mobile app in 2024, facilitating real-time info and ticketing. |

| Advocacy & Policy Influence | Promoting societal benefits of public transport | Supported initiatives showing carbon emission reductions; lobbying for infrastructure funding. |

| Community Ties | Local event participation, tailored services, partnerships | Supported thousands of UK jobs via bus operations in 2024; adapted routes based on community feedback. |

Price

FirstGroup's fare structure has been significantly influenced by government policy, notably the introduction of a £3 fare cap in England starting January 2025. This initiative has driven a move towards simpler, distance-based pricing across their bus services.

The company has responded by implementing clear and straightforward fare structures, designed to enhance customer understanding and ease of use. This strategic shift aims to boost passenger confidence and potentially increase ridership by demystifying the cost of travel.

FirstGroup's commitment to flexible digital payments significantly boosts convenience for passengers. The widespread implementation of contactless card payments and the innovative 'Tap On, Tap Off' system on their bus services streamlines the entire fare payment experience.

This 'Tap On, Tap Off' technology, a key component of their digital strategy, automatically calculates fares based on journey distance, eliminating the need for passengers to pre-purchase tickets or guess the correct fare. This user-friendly approach directly addresses a common pain point, aiming to increase ridership and customer satisfaction.

FirstGroup offers a comprehensive range of ticket options, from single journeys to flexible season passes, designed to meet diverse passenger needs. This includes daily, weekly, and monthly tickets, as well as group fares, ensuring convenience and cost-effectiveness for various travel patterns.

The company also provides valuable concessions and passes, such as student and senior discounts, making public transportation more accessible and affordable for key demographic groups. For instance, in 2024, FirstGroup continued to promote its railcards, which offer significant savings for eligible passengers, contributing to increased ridership and customer loyalty.

Yield Management in Open Access Operations

FirstGroup's open-access rail operations, such as Hull Trains and Lumo, leverage sophisticated yield management to fine-tune pricing. This strategy involves real-time adjustments to ticket costs based on anticipated passenger volume and available seating. The aim is to strike a balance, offering competitive fares to attract customers while simultaneously maximizing revenue on these commercially operated routes.

This dynamic pricing approach is crucial for profitability. For instance, during peak travel periods or for popular services, prices can increase, reflecting higher demand. Conversely, off-peak times or less busy services might see reduced fares to stimulate bookings. This ensures that capacity is utilized efficiently, contributing to the financial success of these ventures.

- Dynamic Pricing: Ticket prices fluctuate based on demand, time of booking, and availability.

- Revenue Optimization: Strategies are designed to capture the maximum possible revenue from each journey.

- Competitiveness: Fares are managed to remain attractive against other transport options.

- Capacity Management: Yield management helps to ensure that seats are filled efficiently, reducing waste.

Impact of Government Funding and Policy on Pricing

FirstGroup's pricing is heavily shaped by government funding and transport policies, particularly in its UK bus and rail operations. For instance, the UK government's Bus Service Improvement Plan (BSIP) funding, which saw significant allocations in 2022 and 2023 to boost bus services, directly influenced the company's ability to maintain or adjust fare levels. However, any future reductions in such subsidies or the imposition of stricter fare caps, as seen in some regional transport authorities, would compel FirstGroup to re-evaluate its pricing to safeguard revenue streams.

These policy shifts necessitate a dual approach for FirstGroup: adapting fare strategies and aggressively pursuing operational efficiencies. For example, in response to rising inflation and wage pressures in 2023, the company focused on cost-saving measures across its fleet and network to mitigate the need for substantial fare hikes. The company's 2024/2025 strategy will likely continue to balance these external policy influences with internal cost management to maintain competitive pricing and profitability.

- Government funding for bus services in the UK, such as BSIP, directly supports FirstGroup's operational capacity and pricing flexibility.

- Changes in fare capping policies by transport authorities can limit revenue growth potential, requiring strategic pricing adjustments.

- FirstGroup's financial performance in 2023 was impacted by inflationary pressures, leading to a focus on operational efficiencies to offset cost increases and manage pricing.

FirstGroup's pricing strategy is a carefully balanced act, influenced by government mandates like the £3 fare cap in England from January 2025, which pushes for simpler, distance-based fares. This is complemented by a strong digital focus, with contactless and 'Tap On, Tap Off' systems automatically calculating fares, enhancing user convenience. The company also offers a wide array of ticket options, including concessions and railcards, to cater to diverse passenger needs and promote affordability.

| Pricing Strategy Element | Description | Impact/Goal |

|---|---|---|

| Government Policy Influence | £3 fare cap in England (from Jan 2025), Bus Service Improvement Plan (BSIP) funding. | Drives simpler, distance-based pricing; influences operational capacity and pricing flexibility. |

| Digital Payment Integration | Contactless, 'Tap On, Tap Off' technology. | Streamlines payment, automatically calculates distance-based fares, increases convenience. |

| Ticket Variety & Concessions | Single, season passes (daily, weekly, monthly), group fares, student/senior discounts, railcards. | Meets diverse passenger needs, enhances affordability and accessibility, boosts ridership. |

| Open-Access Rail Yield Management | Dynamic pricing based on demand, time, and availability. | Optimizes revenue, ensures competitive fares, manages capacity efficiently. |

4P's Marketing Mix Analysis Data Sources

Our Firstgroup 4P's Marketing Mix Analysis is built upon a foundation of verified public disclosures, including annual reports, investor presentations, and press releases. We also incorporate data from industry reports, competitor analyses, and Firstgroup's official brand websites and service information to ensure accuracy.