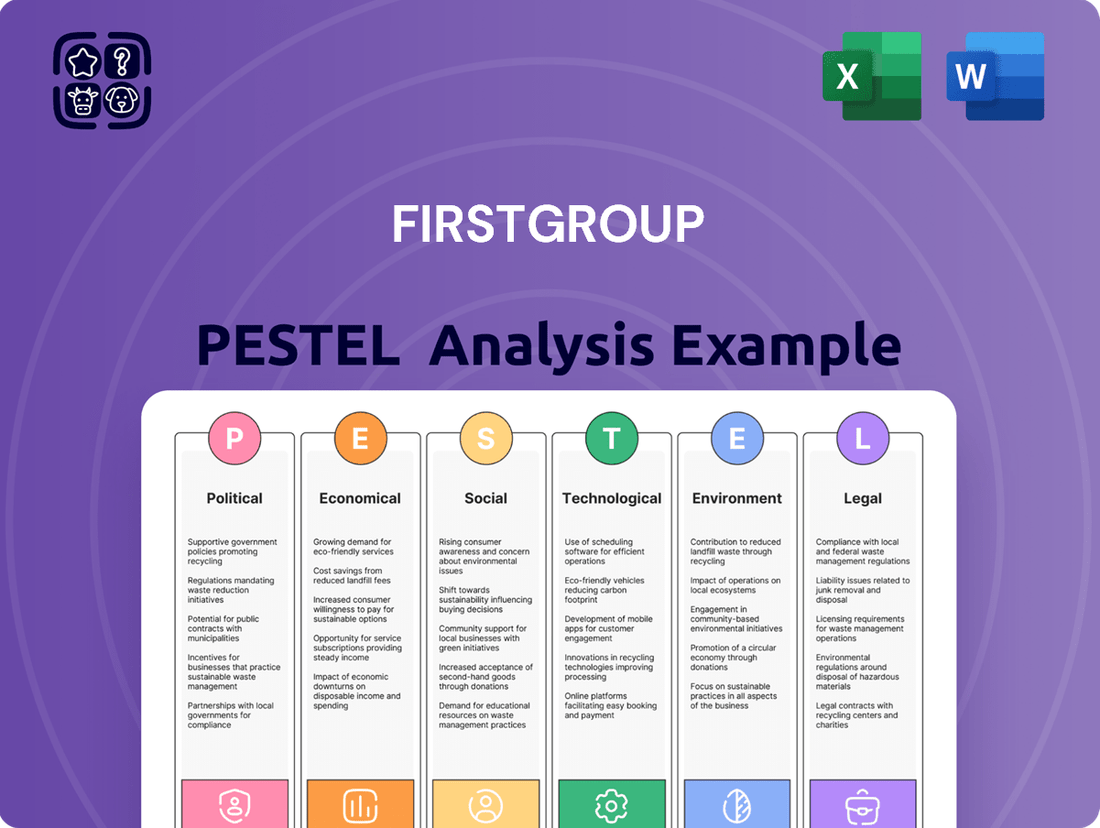

Firstgroup PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

Navigate the complex external forces shaping Firstgroup's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are impacting its operations and strategic direction. This in-depth analysis provides actionable intelligence to inform your own market strategies and investment decisions. Unlock a deeper understanding of Firstgroup's landscape – download the full PESTLE analysis now.

Political factors

FirstGroup's performance is significantly shaped by UK government transport policies, particularly concerning funding for bus services and the regulatory environment for rail. The government has committed over £1 billion in bus funding through to 2026, aiming to improve services and help operators maintain affordable fares.

A key policy is the national £3 maximum single bus fare, which is extended until December 2025, a continuation from the earlier £2 cap. This directly impacts revenue streams for FirstGroup's bus operations.

The UK's political landscape is reshaping its rail sector, with franchising officially ending in 2024. This means rail contracts are gradually moving under government management as they expire, a transition anticipated to conclude by October 2027.

As a key player, FirstGroup is directly affected by these changes. For instance, its South Western Railway contract is set to move to public ownership in May 2025, highlighting the immediate impact of this political shift on the company's operations.

The UK government's commitment to devolving more transport powers to regional and local authorities, as detailed in a December white paper, presents a significant political shift. This means local bodies will gain more control over transport planning and execution.

FirstGroup, as a major transport operator, must be prepared for a landscape where regional transport strategies may diverge significantly. For instance, areas receiving greater devolution might prioritize different modes of transport or investment levels, impacting FirstGroup's operational planning and service delivery across various regions.

Better Buses Bill

The proposed Better Buses Bill, anticipated for introduction by the close of 2024, represents a significant political shift for the bus sector. Its core aim is to grant greater authority to local councils over bus services, potentially allowing them to franchise operations and even re-establish publicly owned bus companies, a move that could alter FirstGroup's operational environment.

This legislation could fundamentally reshape the competitive landscape for FirstGroup's bus division. The ability for local authorities to franchise services might lead to new operating models and increased competition, impacting market share and profitability.

- Increased Local Control: Local authorities could gain more power to dictate routes, frequencies, and fares, potentially aligning services more closely with community needs.

- Franchising Opportunities: The bill may enable local authorities to franchise bus services, creating new tender opportunities and competitive pressures for existing operators like FirstGroup.

- Lifting Public Ownership Ban: The removal of the ban on publicly owned bus companies could reintroduce state-backed competitors into the market.

- Impact on FirstGroup's Strategy: FirstGroup will need to adapt its business strategy to navigate these potential changes, focusing on efficiency and service quality to remain competitive.

Regulatory Oversight and Safety Standards

The Office of Rail and Road (ORR) maintains its regulatory oversight of the UK rail sector, prioritizing safety, customer experience, and ensuring value for money for passengers. This ongoing scrutiny impacts Firstgroup's rail operations by setting performance benchmarks and compliance requirements.

Evolving safety regulations present significant operational considerations for transport providers like Firstgroup. For instance, updated driver professional competence requirements and new HGV safety standards, such as London's Direct Vision Standard, necessitate investment in training and vehicle modifications to ensure compliance and maintain operational licenses.

- ORR's Focus: Safety, customer service, and value for money remain key areas of regulatory attention for the UK rail industry.

- Driver Competence: Changes in professional competence requirements for drivers directly affect training and certification processes.

- HGV Safety: New regulations like London's Direct Vision Standard impose stricter safety requirements on heavy goods vehicles, influencing fleet operations.

UK political developments significantly influence FirstGroup's operations, with ongoing bus funding and the £3 maximum single fare cap, extended to December 2025, directly impacting revenue. The transition of the rail sector away from franchising, with contracts moving to government management by October 2027, means FirstGroup's South Western Railway contract will shift to public ownership in May 2025.

The proposed Better Buses Bill, expected by late 2024, could grant local authorities more power to franchise services or even operate their own bus companies, potentially altering FirstGroup's competitive environment. Evolving safety regulations, such as updated driver competence requirements and London's Direct Vision Standard for HGVs, also necessitate ongoing investment and adaptation.

| Policy/Regulation | Impact on FirstGroup | Timeline/Status |

|---|---|---|

| UK Bus Funding | Supports operational stability and service improvements. | Up to 2026 |

| £3 Max Single Bus Fare | Caps revenue on specific routes. | Extended to December 2025 |

| Rail Sector Reform | Transition to public management for rail contracts. | Franchising ends 2024; transition by Oct 2027 |

| Better Buses Bill | Potential for increased local control and competition. | Anticipated introduction by close of 2024 |

| Driver Competence & HGV Safety | Requires investment in training and vehicle upgrades. | Ongoing compliance |

What is included in the product

This PESTLE analysis of Firstgroup examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive understanding of the external landscape.

A clear, actionable PESTLE analysis for Firstgroup, highlighting key external factors that can be leveraged to mitigate risks and capitalize on opportunities, thus relieving strategic planning pain points.

Economic factors

FirstGroup continues to navigate significant cost pressures, notably from driver pay increases. While some periods saw a welcome absence of fuel inflation, the overall impact of rising operational expenses remains a key challenge. For instance, in the fiscal year ending March 2024, FirstGroup reported adjusted operating profit of £153.3 million, demonstrating resilience but highlighting the sensitivity to these cost dynamics.

The company's profitability hinges on its capacity to absorb or pass on these escalating costs. This is particularly pertinent given the backdrop of reduced government funding for essential bus services, a core segment of FirstGroup's operations. Effective cost management strategies are therefore paramount for sustaining financial health in this environment.

Government-imposed fare caps, like the £3 single bus fare limit in England until December 2025, directly affect FirstGroup's ability to increase revenue per passenger. While this policy aims to boost affordability and ridership, it compresses potential earnings on individual journeys.

Crucial government funding, such as the Bus Service Operators Grant (BSOG), plays a significant role in FirstGroup's operational stability. This grant, alongside direct financial assistance to Local Transport Authorities, helps maintain existing routes and prevent service cuts, particularly in less profitable areas.

Bus ridership experienced a significant boost, climbing 17% largely attributed to the government's £2 fare cap initiative. This policy made bus travel more accessible and appealing to a wider range of passengers.

Conversely, rail usage has seen a downturn, with rising ticket prices deterring many commuters. This trend highlights the sensitivity of public transport demand to fare structures.

The 2024 Commuter Census reveals a persistent trend towards eco-friendlier travel options, with more people opting for sustainable modes over private car use. However, the enduring prevalence of hybrid working models continues to moderate overall passenger volumes across public transport networks.

Investment in Decarbonisation and Fleet Modernisation

FirstGroup's commitment to decarbonisation and fleet modernisation is substantial, involving significant capital expenditure. For instance, the company is investing £350 million in new low-carbon, electric, and bi-mode trains for its Avanti West Coast operations. This move aligns with broader industry trends and regulatory pressures to reduce carbon emissions in public transport.

Further demonstrating this focus, FirstGroup has allocated £88 million for fiscal year 2025 towards upgrading its bus fleet and depots to support a transition to lower-emission vehicles. These investments are critical for meeting environmental targets and enhancing operational efficiency, though they represent a considerable financial outlay.

- £350 million allocated for new low-carbon trains for Avanti West Coast.

- £88 million earmarked for FY 2025 to upgrade bus fleet and depots for lower emissions.

- These investments are essential for sustainability and regulatory compliance in the transport sector.

- The capital expenditure required for fleet modernisation presents a significant financial commitment for FirstGroup.

Shareholder Value and Financial Performance

Despite a pre-tax loss of £17 million reported for the fiscal year ending March 2, 2024, FirstGroup's financial performance outlook for fiscal year 2025 remains positive. This optimism is largely fueled by the robust performance of its First Rail division, which has seen consistent growth, and anticipated expansion within the First Bus segment.

The company has demonstrated a commitment to rewarding its investors, having returned substantial capital through both dividend payouts and share buyback programs. For instance, in FY2024, FirstGroup announced a final dividend of 3.7 pence per share, alongside a £115 million share buyback, underscoring its focus on shareholder value.

- FY2024 Pre-Tax Loss: £17 million.

- FY2025 Outlook: In line with expectations, driven by First Rail and First Bus growth.

- Shareholder Returns: Significant capital returned via dividends and buybacks.

- FY2024 Dividend: 3.7 pence per share.

Economic factors significantly influence FirstGroup's operational landscape, with rising costs, particularly driver wages, presenting a persistent challenge. Despite this, the company achieved an adjusted operating profit of £153.3 million in FY2024, showcasing resilience. Government policies like the £3 single bus fare cap in England until December 2025 directly impact revenue potential, while crucial grants like the Bus Service Operators Grant (BSOG) provide essential support for maintaining services.

| Metric | Value (FY2024 unless stated) | Impact on FirstGroup |

|---|---|---|

| Adjusted Operating Profit | £153.3 million | Demonstrates resilience amidst cost pressures. |

| Bus Fare Cap (England) | £3 single fare until Dec 2025 | Limits per-passenger revenue growth. |

| Bus Service Operators Grant (BSOG) | Variable | Provides vital operational support. |

Preview Before You Purchase

Firstgroup PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Firstgroup delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will gain valuable insights into market trends and strategic considerations for Firstgroup.

Sociological factors

The 2024 Commuter Census indicates a notable shift away from driving alone, with carpooling seeing an uptick. This suggests a growing awareness of environmental concerns and potentially cost-saving measures among commuters.

Despite the move towards more sustainable transport, hybrid work arrangements remain popular. This preference for flexible working directly influences the demand for public transport, leading to less predictable passenger volumes and a reduced reliance on traditional peak-hour services.

Public surveys consistently highlight affordability and reliability as paramount for public transport users. With 45% of Britons reporting increased travel spending in 2025, FirstGroup's ability to offer competitive pricing and dependable, frequent services directly impacts its passenger base. Addressing these core commuter priorities is crucial for securing and growing market share.

Growing environmental awareness is significantly shaping consumer choices, with a noticeable surge in demand for sustainable travel options. This trend is directly impacting the transport sector, pushing companies like FirstGroup to adapt.

In 2024, a significant portion of travelers, particularly younger demographics, indicated a willingness to pay more for eco-friendly travel. FirstGroup's investment in electric buses and the promotion of rail travel as a greener alternative directly addresses this societal preference. For instance, their commitment to a fully zero-emission bus fleet by 2035 is a direct response to this growing demand.

Impact of Urbanisation and Community Connectivity

FirstGroup's business is inherently tied to urbanisation trends, as the company facilitates commuting and connects communities. As cities grow and populations become more concentrated, the demand for efficient public transport solutions, like those offered by FirstGroup, increases. This aligns with the company's mission to provide accessible and reliable travel options for everyday life.

The social fabric of communities increasingly relies on accessible public transport to support wider economic and social goals. FirstGroup's services enable people to access employment, education, and healthcare, thereby contributing to social mobility and community well-being. For instance, in the UK, public transport is crucial for enabling social inclusion, with studies indicating that improved transport links can reduce isolation, particularly for older adults and those in rural areas. The company's role extends beyond mere transportation; it acts as a facilitator of social and economic participation.

Community connectivity is a cornerstone of FirstGroup's operations, especially in its bus and rail divisions. The company's efforts to enhance passenger experience and network reach are directly influenced by evolving societal expectations for convenient and integrated travel. Data from Transport Focus in 2024 highlights that passenger satisfaction with public transport is closely linked to factors like reliability, frequency, and the ease of making connections, all areas where FirstGroup strives to excel to meet the demands of an increasingly connected society.

Key aspects of community connectivity and urbanisation impacting FirstGroup include:

- Growing urban populations: Increased density in cities drives demand for public transit.

- Social inclusion goals: Public transport's role in providing access to essential services and opportunities.

- Passenger expectations: Demand for seamless, reliable, and integrated travel experiences.

- Economic development: Transport infrastructure as a catalyst for local economic growth and job creation.

Driver and Workforce Availability and Well-being

The transport sector, including Firstgroup's operations, grapples with significant driver shortages. For instance, in the UK, the Confederation of British Road Transport (CBRT) estimated a shortage of over 50,000 HGV drivers in early 2024, impacting bus and coach services as well. This scarcity directly affects service reliability and operational capacity.

Driver well-being is paramount, encompassing fair working hours, adequate rest periods, and mental health support. Meeting enhanced Driver Certificate of Professional Competence (CPC) requirements, which mandate ongoing training, also adds to operational considerations. These factors are critical for retaining experienced drivers and ensuring a high standard of service delivery.

- Driver Shortages: The UK faced an estimated shortage of over 50,000 HGV drivers in early 2024, impacting the broader transport industry.

- Driver Well-being: Focus on improving working conditions, rest facilities, and mental health support is essential for driver retention.

- CPC Requirements: Ongoing professional development mandates, such as enhanced Driver CPC training, necessitate continuous investment in workforce skills.

- Industrial Relations: Maintaining positive industrial relations is key to mitigating strike risks and ensuring service continuity.

Societal shifts, such as the 2024 Commuter Census revealing increased carpooling and a continued preference for hybrid work, directly influence public transport demand for FirstGroup. Public expectations for affordability and reliability are paramount, with 45% of Britons reporting higher travel spending in 2025, making competitive pricing and dependable services critical for FirstGroup's success.

Technological factors

FirstGroup is making significant strides in fleet electrification. As of fiscal year 2025, the company has 1,115 zero-emission buses operating, which represents more than 20% of its entire commercial bus fleet. This commitment extends to substantial investments in electric buses and the necessary depot infrastructure to support them.

Beyond buses, FirstGroup is also exploring innovative technologies within its rail division. Trials of battery train technologies and the adoption of low-carbon fuels are underway, demonstrating a broader strategic push towards decarbonizing its operations across all sectors.

Firstgroup's focus on digital ticketing and customer information systems is a key technological driver. The company is investing in mobile ticketing and journey planning apps to improve passenger experience and boost ridership. For instance, their UK bus operations saw continued growth in digital ticket sales throughout 2024, reflecting a broader industry trend towards contactless and app-based payments.

Firstgroup is increasingly leveraging data analytics to streamline its operations, aiming for better service and lower costs. This means using technology to fine-tune bus routes, train schedules, and the entire network for maximum efficiency.

For instance, in 2024, Firstbus reported significant improvements in punctuality and passenger satisfaction metrics directly linked to their data-driven scheduling and real-time traffic management systems. These technological advancements are crucial for optimizing resource allocation and reducing fuel consumption across their extensive UK network.

Advanced Vehicle Technologies and Safety Systems

New regulations are increasingly mandating advanced safety features in vehicles, a trend that directly impacts Firstgroup's fleet operations. For instance, London's Direct Vision Standard requires HGVs to achieve a minimum star rating for direct vision, pushing operators to invest in improved visibility systems to comply with these safety-driven technological shifts.

The future of automotive technology points towards significant advancements, including the widespread adoption of autonomous driving capabilities. Furthermore, upcoming legislation is set to make the mandatory fitting of black boxes (event data recorders) and alcohol-interlock equipment in all new cars a reality by 2026. These technological mandates will necessitate substantial upgrades and adaptations across the transport sector.

- Regulatory Push for Safety: London's Direct Vision Standard for HGVs exemplifies new regulations driving the adoption of advanced safety technologies.

- Autonomous Driving Potential: The ongoing development and eventual integration of self-driving cars represent a major technological disruption for the transportation industry.

- Mandatory In-Car Technology: The planned mandatory installation of black boxes and alcohol-interlock devices in new vehicles by 2026 will reshape vehicle safety and monitoring.

Infrastructure Modernisation and Connectivity

First Rail is actively collaborating with Network Rail to boost energy efficiency and extend track electrification, a crucial technological step. This partnership is vital for modernizing the rail infrastructure, directly impacting operational costs and environmental performance.

The development of Great British Railways (GBR) is another significant technological driver, aiming to unify industry data and improve the overall customer experience. This initiative promises a more integrated and technologically advanced rail network across the UK.

Key technological advancements include:

- Electrification Expansion: Increasing the electrified network reduces reliance on diesel, lowering emissions and operational expenses. As of early 2024, the UK government has committed significant funding towards rail electrification projects, aiming to electrify key routes by the late 2020s.

- Digitalisation of Operations: Implementing advanced digital systems for train planning, dispatch, and passenger information enhances efficiency and reliability. For instance, real-time data analytics are being deployed to predict and mitigate service disruptions.

- Customer-Facing Technology: Innovations like improved ticketing systems, real-time journey planners, and onboard Wi-Fi are central to enhancing passenger satisfaction and attracting more users to rail travel.

FirstGroup is actively embracing technological advancements to enhance its operations and sustainability. The company's fleet electrification is a prime example, with over 20% of its commercial bus fleet, totaling 1,115 zero-emission buses, in operation by fiscal year 2025, supported by significant investment in electric infrastructure.

In its rail division, First Rail is trialing battery train technologies and exploring low-carbon fuels, alongside collaborations with Network Rail to boost energy efficiency and extend track electrification, with significant government funding allocated to UK rail electrification projects through the late 2020s.

Digitalization is a key focus, with investments in mobile ticketing and journey planning apps improving passenger experience, evidenced by continued growth in digital ticket sales in UK bus operations during 2024. Furthermore, data analytics are being leveraged for operational efficiency, leading to improved punctuality and passenger satisfaction metrics in 2024.

Looking ahead, FirstGroup must prepare for technological mandates such as the planned 2026 requirement for black boxes and alcohol-interlock devices in new vehicles, alongside adapting to evolving safety standards like London's Direct Vision Standard.

| Technology Area | FirstGroup's Action/Investment | Impact/Benefit | Data Point/Year |

|---|---|---|---|

| Fleet Electrification | Investment in electric buses and depot infrastructure | Reduced emissions, lower operating costs | 1,115 zero-emission buses (FY25); >20% of fleet |

| Rail Technology | Trials of battery trains, low-carbon fuels | Decarbonization of rail operations | Ongoing trials |

| Digital Ticketing | Development of mobile ticketing and journey planning apps | Improved passenger experience, increased ridership | Growth in digital ticket sales (2024) |

| Data Analytics | Leveraging data for route optimization and scheduling | Enhanced efficiency, better punctuality | Improved metrics linked to data-driven systems (2024) |

| Safety Technology | Compliance with new safety regulations | Improved vehicle safety, regulatory adherence | London's Direct Vision Standard for HGVs |

| Mandatory Vehicle Tech | Anticipating future mandates | Fleet upgrades and adaptations | Mandatory black boxes/alcohol interlocks by 2026 |

Legal factors

The Passenger Railway Services (Public Ownership) Act 2024, enacted in November 2024, fundamentally alters the landscape for rail operators like FirstGroup by mandating the transition of franchised passenger services back into public ownership as current contracts conclude. This legislation directly impacts FirstGroup's extensive rail division, which managed approximately 35% of UK passenger rail services prior to this change, affecting its revenue streams and long-term strategic planning.

The Bus Services Act 2017 has significantly reshaped the UK bus sector by allowing local authorities to implement bus franchising or form Enhanced Partnerships with operators. This legislation provides a framework for greater local control and aims to improve service quality and integration.

Looking ahead, the proposed Better Buses Bill is poised to further empower local authorities. A key potential change includes lifting the current ban on new council-owned bus companies, which could fundamentally alter the legal landscape for service provision and competition within the industry.

The Office of Rail and Road (ORR) is the primary health and safety regulator for the UK rail sector, a critical role for FirstGroup's operations. The ORR enforces legislation, aiming for ongoing safety enhancements for everyone using or working on the railway. FirstGroup's rail division must meticulously adhere to these rigorous standards.

Driver and Vehicle Standards and Licensing

Changes to Driver Certificate of Professional Competence (CPC) requirements and new heavy goods vehicle (HGV) safety rules, such as London's Direct Vision Standard (DVS), create legal obligations for FirstGroup concerning driver training, vehicle specifications, and operational adherence. The Driver and Vehicle Standards Agency (DVSA) plays a key role in approving training programs and inspecting commercial vehicles, ensuring compliance with these evolving standards.

FirstGroup must ensure its drivers meet the updated CPC regulations, which often involve periodic training to maintain their professional qualifications. For instance, the DVS, implemented in London, mandates minimum safety ratings for HGVs entering the city, directly impacting FirstGroup's fleet operations and requiring significant investment in vehicle upgrades or replacements to comply with its 2024 and 2025 requirements.

- Driver CPC Training: FirstGroup must ensure all professional drivers complete the required 35 hours of Driver CPC periodic training every five years.

- HGV Safety Standards: Compliance with the DVS in London requires HGVs to achieve a minimum three-star rating by 2024, with potential for stricter requirements in 2025.

- DVSA Inspections: Vehicles are subject to regular inspections by the DVSA to ensure roadworthiness and adherence to safety regulations, impacting operational uptime.

- Fleet Investment: Legal mandates like DVS necessitate ongoing capital expenditure for fleet modernization to meet safety and emissions standards.

Environmental Regulations and Emissions Targets

FirstGroup operates under stringent legal frameworks mandating carbon footprint reduction and adherence to decarbonisation targets, directly influenced by the UK Government's commitment to achieving net-zero emissions by 2050. This regulatory environment necessitates proactive strategies to minimize environmental impact across its operations.

Compliance with evolving emissions regulations, such as those governing Clean Air Zones (CAZs) in major UK cities, presents a significant legal challenge. Failure to meet these standards can result in penalties and reputational damage, underscoring the importance of investing in cleaner fleet technologies and operational efficiencies.

- Emissions Standards: FirstGroup must comply with national and local emissions standards, including Euro VI regulations for new vehicles, to operate within CAZs.

- Decarbonisation Targets: The company is legally obligated to contribute to the UK's broader net-zero targets, impacting fleet procurement and operational planning.

- Reporting Requirements: Adherence to environmental reporting mandates, detailing emissions data and reduction strategies, is a key legal responsibility.

- Fleet Modernisation: Legal pressures drive investment in low-emission buses and trains, impacting capital expenditure and operational costs.

The Passenger Railway Services (Public Ownership) Act 2024 significantly reshapes FirstGroup's rail operations by mandating a return to public ownership for franchised services as contracts expire. This directly impacts its UK rail division, which previously managed approximately 35% of passenger rail services, necessitating strategic adjustments to revenue streams and long-term planning.

Legal frameworks governing emissions and environmental impact are crucial, with the UK's net-zero by 2050 target influencing FirstGroup's operations. Compliance with Clean Air Zone regulations, such as London's Direct Vision Standard (DVS) for HGVs, requires ongoing fleet modernization and adherence to stringent safety standards, impacting capital expenditure.

Evolving driver training and vehicle safety regulations, enforced by bodies like the DVSA, necessitate continuous investment in driver qualifications and fleet upgrades. For example, the DVS mandates minimum safety ratings for HGVs entering London, with FirstGroup needing to ensure its fleet meets these 2024 and projected 2025 requirements.

The Bus Services Act 2017 empowers local authorities with franchising and Enhanced Partnership options, while the proposed Better Buses Bill could lift the ban on council-owned bus companies, altering the competitive landscape for FirstGroup's bus division.

Environmental factors

FirstGroup's commitment to decarbonisation is central to its environmental strategy, with a detailed Climate Transition Plan released in 2025. This plan lays out a clear roadmap for significant emission reductions, aiming for net-zero status by 2050.

The company has established ambitious, science-based targets. Specifically, FirstGroup is targeting a 63% reduction in its Scope 1 and 2 emissions by the fiscal year 2035, using the fiscal year 2020 as its baseline.

FirstGroup is actively pursuing fleet electrification, a key environmental initiative. In 2024, the company announced plans to introduce over 300 new electric buses across the UK, supported by significant investment in charging infrastructure at its depots.

Beyond buses, FirstGroup is also focusing on its rail operations. By 2025, they aim to have a substantial portion of their train fleet utilizing low-carbon technologies, including electric and bi-mode trains, to cut down on emissions from rail services.

FirstGroup is a key player in encouraging a modal shift, moving people from cars to more sustainable options like buses and trains. This transition is vital for reducing transport emissions in the UK, a sector that accounted for 27% of total UK greenhouse gas emissions in 2022. By making public transport more attractive and accessible, FirstGroup directly contributes to these climate goals.

The company's efforts align with government targets, such as the Department for Transport's ambition to see half of all journeys in England made by public transport, walking, or cycling by 2030. FirstGroup's investment in modernizing its fleet, including the introduction of electric buses, further supports this environmental objective, making public transport a greener choice for commuters.

Air Quality and Clean Air Zones

The increasing focus on air quality, particularly through the expansion of Clean Air Zones (CAZs) across the UK, directly impacts FirstGroup's bus operations. These zones impose charges on older, more polluting vehicles, incentivizing the adoption of cleaner technologies. For instance, by 2024, many major UK cities, including Birmingham, Bristol, and London, have established or are expanding their CAZs, requiring commercial vehicles to meet Euro VI emission standards or face daily charges. FirstGroup's proactive investment in modern, low-emission buses, including electric and hybrid models, is a strategic response to these environmental regulations, mitigating potential operational costs and demonstrating a commitment to improving urban air quality.

FirstGroup's fleet modernization efforts are directly aligned with the goals of CAZs. By transitioning to cleaner vehicles, the company not only avoids penalty charges but also contributes to a healthier environment for the communities it serves. As of early 2024, FirstGroup has been actively rolling out new electric buses in various depots, such as Manchester and Northampton, with significant capital allocated to this transition. This strategic shift supports the government's broader environmental targets and enhances FirstGroup's reputation as a responsible operator.

- CAZ Implementation: Over 30 UK cities are expected to have operational CAZs by the end of 2025, impacting commercial vehicle fleets.

- Fleet Investment: FirstGroup has committed substantial capital to electrifying its bus fleet, with targets to significantly increase the proportion of zero-emission buses in operation by 2025.

- Emission Standards: Compliance with Euro VI standards is increasingly becoming a baseline requirement for operating within many urban centers.

- Air Quality Improvement: The adoption of cleaner vehicles by operators like FirstGroup directly contributes to reducing harmful particulate matter and nitrogen oxides in urban areas.

Climate-Related Risk Management

FirstGroup acknowledges climate change as a significant principal risk, embedding its management directly into their overarching business strategy. This proactive approach ensures that environmental considerations are not an afterthought but a core component of their long-term planning and operational decisions.

The company further reinforces this commitment by linking climate risk management to its variable remuneration practices. This means that key personnel are incentivized to effectively address and mitigate climate-related challenges, aligning financial rewards with environmental stewardship.

Assessing and actively managing environmental risks is therefore crucial for FirstGroup’s sustained success and resilience. This focus is particularly relevant given the increasing regulatory scrutiny and stakeholder expectations surrounding corporate environmental responsibility.

For instance, in their 2024 reporting, FirstGroup detailed progress on their decarbonization targets, aiming for a 30% reduction in Scope 1 and 2 emissions by 2025 against a 2019 baseline. This demonstrates a tangible commitment to tackling climate change.

- Climate Risk Integration: Climate change is a principal risk, managed through business strategy and variable remuneration.

- Strategic Importance: Effective environmental risk assessment and mitigation are vital for long-term sustainability.

- Decarbonization Efforts: FirstGroup targets a 30% reduction in Scope 1 and 2 emissions by 2025 (vs. 2019 baseline).

- Stakeholder Expectations: Growing regulatory and public pressure emphasizes the need for robust environmental management.

FirstGroup's environmental strategy is heavily influenced by government policies aimed at improving air quality and encouraging modal shift. The expansion of Clean Air Zones (CAZs) across the UK, with over 30 cities expected to have them operational by the end of 2025, directly impacts fleet operations, incentivizing the adoption of Euro VI compliant or cleaner vehicles. This regulatory landscape, coupled with a commitment to decarbonization, drives significant investment in fleet modernization.

The company is actively investing in zero-emission vehicles, with plans to introduce over 300 new electric buses in the UK during 2024. This aligns with broader government targets, such as the Department for Transport's goal for half of all journeys in England to be made by public transport, walking, or cycling by 2030, thereby supporting a crucial modal shift away from private car usage.

FirstGroup has set ambitious emission reduction targets, aiming for a 30% reduction in Scope 1 and 2 emissions by 2025 against a 2019 baseline. Furthermore, they are targeting a 63% reduction in Scope 1 and 2 emissions by fiscal year 2035, using fiscal year 2020 as the baseline, demonstrating a clear commitment to environmental stewardship.

Climate change is recognized as a principal risk for FirstGroup, with management integrated into the core business strategy and linked to variable remuneration. This ensures that environmental performance is a key consideration in operational decisions and executive incentives, reflecting the growing importance of sustainability for long-term business resilience and stakeholder expectations.

| Environmental Factor | FirstGroup's Action/Target | Relevant Data/Context |

|---|---|---|

| Clean Air Zones (CAZs) | Investment in cleaner vehicles to meet standards and avoid charges. | Over 30 UK cities expected to have operational CAZs by end of 2025. Compliance with Euro VI standards increasingly required. |

| Modal Shift Promotion | Encouraging use of public transport (buses, trains). | UK transport sector accounted for 27% of total UK greenhouse gas emissions in 2022. DfT target: 50% of journeys by public transport, walking, or cycling by 2030. |

| Decarbonization Targets | Reduce Scope 1 & 2 emissions. | Target: 30% reduction by 2025 (vs. 2019 baseline). Target: 63% reduction by FY2035 (vs. FY2020 baseline). Aiming for net-zero by 2050. |

| Fleet Electrification | Introduction of electric buses and low-carbon rail technology. | Plans for over 300 new electric buses in 2024. Significant investment in charging infrastructure. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Firstgroup is built on a robust foundation of data from official government publications, reputable financial news outlets, and industry-specific research reports. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.