Firstgroup Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

Firstgroup operates in a dynamic transport sector, facing varying degrees of buyer power and the ever-present threat of substitutes. Understanding the intensity of these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Firstgroup’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FirstGroup's reliance on a limited number of suppliers for specialized rolling stock, like Hitachi trains for its rail operations, and unique bus manufacturers grants these suppliers considerable bargaining power. For instance, the rail industry often sees a few dominant manufacturers capable of producing the specific types of trains required, limiting FirstGroup's options.

The highly specialized nature of public transport vehicles and systems means there are few readily available substitutes. This scarcity of alternatives for critical components and manufacturing capabilities inherently strengthens the position of the suppliers who can meet these demanding specifications.

FirstGroup's reliance on essential inputs like fuel, vehicle parts, and technology systems means suppliers hold considerable sway. For instance, fluctuations in diesel prices, a key operational cost, can significantly impact profitability. In 2024, the global price of Brent crude oil, a benchmark for diesel, experienced volatility, directly affecting FirstGroup's fuel expenditure.

Switching suppliers for major assets like bus fleets or train sets for FirstGroup is a costly endeavor. Consider the significant capital outlay required to replace an entire fleet, which can run into tens or even hundreds of millions of pounds. This isn't just about buying new vehicles; it involves re-tooling maintenance facilities and retraining staff, creating substantial barriers to simply changing suppliers.

These high switching costs effectively lock FirstGroup into existing supplier relationships for these large-scale assets. This lack of flexibility inherently strengthens the bargaining power of the current suppliers. They know that FirstGroup faces considerable financial and operational hurdles if they attempt to move elsewhere, allowing them to potentially dictate terms or maintain higher prices.

Labour Market Dynamics

The public transport sector, where FirstGroup operates, is grappling with a persistent shortage of skilled workers, especially drivers. This scarcity significantly bolsters the bargaining power of employees and their unions.

This heightened employee leverage translates directly into upward pressure on wage costs and demands for improved employment conditions. For instance, in 2024, reports indicated ongoing wage negotiations in the UK transport sector, with driver shortages contributing to demands for pay increases exceeding inflation.

- Driver Shortages: Many regions experienced critical driver shortages throughout 2024, impacting service reliability.

- Union Influence: Strong union representation in the transport industry allows for collective bargaining on wages and benefits.

- Wage Pressures: Rising living costs in 2024 further intensified demands for higher wages from transport workers.

- Recruitment Challenges: FirstGroup, like its peers, faced difficulties attracting and retaining qualified personnel, exacerbating the bargaining power of existing staff.

Impact of Decarbonisation Initiatives

The push towards decarbonisation significantly shifts the bargaining power towards suppliers of new technologies and specialized components. FirstGroup's commitment to zero-emission transport, exemplified by a substantial £500 million order for new Hitachi trains and an £88 million investment in bus electrification, underscores its dependence on these emerging, often concentrated, suppliers.

- New Supplier Landscape: The transition to electric buses and hydrogen trains necessitates entirely new infrastructure and specialized parts, creating a new tier of powerful, often nascent, suppliers.

- FirstGroup's Investment: FirstGroup is investing heavily in decarbonisation, with significant capital allocated to new fleets, highlighting reliance on these specialized suppliers.

- Component Dependency: Key components for electric and hydrogen vehicles, such as advanced battery systems and fuel cells, are often sourced from a limited number of manufacturers, increasing their bargaining leverage.

Suppliers of specialized rolling stock and bus manufacturers hold significant bargaining power due to the limited number of capable producers. FirstGroup's substantial investments in fleet modernization, such as the £500 million order for Hitachi trains and an £88 million investment in bus electrification, highlight this dependency. The scarcity of alternatives for these critical, high-value assets amplifies supplier leverage.

The cost and complexity of switching suppliers for major transport assets are exceptionally high, creating strong lock-in effects for FirstGroup. These switching costs extend beyond vehicle acquisition to include necessary upgrades in maintenance facilities and staff retraining, making it financially prohibitive to change providers frequently. This situation inherently strengthens the negotiating position of existing suppliers.

The ongoing driver shortage in the UK transport sector, a trend that persisted through 2024, has notably increased the bargaining power of employees and their unions. This scarcity, coupled with rising living costs in 2024, has fueled demands for higher wages and improved working conditions, directly impacting FirstGroup's operational costs and labor relations.

| Supplier Category | Key Factors Affecting Bargaining Power | Impact on FirstGroup |

|---|---|---|

| Rolling Stock Manufacturers (e.g., Hitachi) | High specialization, limited number of producers, high switching costs | Potential for higher prices, limited negotiation flexibility on new fleet orders |

| Bus Manufacturers | Specialized production, significant capital investment for fleet replacement | Similar to rolling stock, impacting fleet renewal costs |

| Fuel Suppliers (e.g., Diesel) | Commodity price volatility, essential operational input | Direct impact on operating expenses; Brent crude oil price fluctuations in 2024 affected fuel costs |

| Technology & Decarbonisation Suppliers (e.g., Battery systems, Fuel cells) | Nascent industry, limited suppliers for new technologies, high R&D costs | Dependency on emerging suppliers for zero-emission transition, potential for premium pricing |

| Labor (Drivers, Maintenance Staff) | Critical skill shortages (especially drivers in 2024), strong union influence, wage pressures due to inflation | Upward pressure on wages and benefits, potential for industrial action impacting service delivery |

What is included in the product

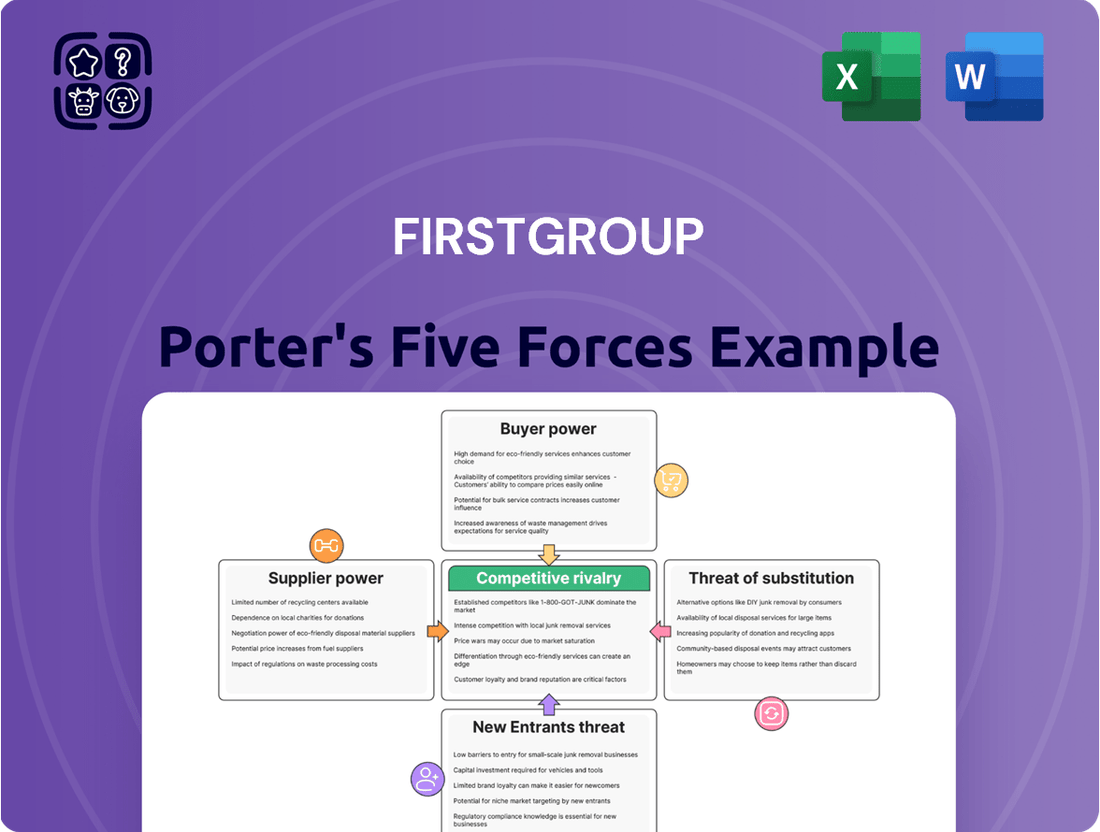

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Firstgroup's bus and rail operations.

Visualize competitive intensity with a dynamic five forces dashboard, allowing Firstgroup to quickly identify and address key strategic threats.

Customers Bargaining Power

Individual passengers using FirstGroup's bus and open access rail services exhibit significant price sensitivity. This is largely due to the readily available alternative transportation methods, making fare increases a direct deterrent to ridership.

Government interventions, such as the January 2025 £3 fare cap in England for bus services, directly impact FirstGroup's ability to set prices. This cap curtails revenue potential from passenger fares, illustrating a clear limitation on the company's pricing power.

The availability of alternative transport modes significantly empowers FirstGroup's customers. With options like private cars, cycling, walking, and other public transport providers, customers have considerable leverage. This broad choice means they can easily switch if FirstGroup's prices increase or service quality falters, directly impacting the company's pricing power and profitability.

Government bodies and Local Transport Authorities (LTAs) wield considerable influence over FirstGroup as key customers for its contracted bus and rail operations. Their power stems from their ability to award, renew, or terminate these vital contracts, directly affecting FirstGroup's revenue streams and operational reach.

These authorities also dictate service specifications and funding levels, creating a significant leverage point. For instance, in 2023, FirstGroup's UK Bus division generated £1.3 billion in revenue, much of which is derived from contracts with these governmental bodies, highlighting their critical role in the company's financial performance.

Increasing Regulatory Control and Potential Nationalisation

The bargaining power of customers, particularly the government, is significantly amplified by increasing regulatory control and the potential for nationalisation. Recent legislative actions, such as the Bus Services (No. 2) Bill 2024 and the Passenger Railway Services (Public Ownership) Bill enacted in late 2024, signal a clear move towards greater public sector involvement and potential renationalisation of rail operations.

This shift directly empowers the government as a major customer, allowing it to dictate terms, influence pricing, and potentially reduce the operational autonomy of private entities like Firstgroup. For instance, the government’s ability to set service level agreements and fare structures can exert considerable pressure on profitability.

- Increased Government Leverage: Legislation in 2024 grants governments more direct control over public transport services, strengthening their position as a customer.

- Potential for Nationalisation: Bills passed in late 2024, like the Passenger Railway Services (Public Ownership) Bill, raise the prospect of public ownership, giving the government ultimate say over operations and contracts.

- Influence on Pricing and Terms: As a dominant customer, the government can impose specific fare policies and service standards that private operators must adhere to, impacting revenue and cost structures.

Access to Information and Digital Ticketing

The increasing availability of digital ticketing and real-time information significantly bolsters customer bargaining power. Passengers can effortlessly compare routes, prices, and service quality across various transport providers. For instance, in 2024, the widespread adoption of mobile ticketing apps meant that a significant portion of Firstgroup’s transactions were digital, providing customers with immediate access to competitive data.

This transparency empowers customers to make more informed decisions and readily switch to alternatives if they find better value. This ease of comparison puts pressure on operators like Firstgroup to maintain competitive pricing and high service standards. In the UK, the Transport Focus 2024 survey indicated that over 70% of rail passengers used digital methods for booking and information, highlighting the shift in customer behavior.

- Digital Platforms: Customers can easily access and compare information on multiple transport options.

- Real-time Data: Live updates on schedules and fares allow for immediate decision-making.

- Price Transparency: Direct comparison of costs across operators increases price sensitivity.

- Ease of Switching: Digital ticketing simplifies the process of changing providers.

The bargaining power of customers for FirstGroup is substantial, driven by the availability of alternatives and government influence. Individual passengers can easily switch to other transport modes or providers due to readily available information and digital ticketing, as evidenced by over 70% of UK rail passengers using digital booking in 2024. This price sensitivity is further amplified by government interventions, such as the £3 bus fare cap implemented in England in January 2025, which directly limits FirstGroup's pricing flexibility.

| Customer Segment | Source of Power | Impact on FirstGroup | Key Data/Event |

|---|---|---|---|

| Individual Passengers | Availability of alternatives, digital information, price transparency | High price sensitivity, potential for ridership loss | 70%+ UK rail passengers used digital booking in 2024 |

| Government/LTAs | Contract awarding/renewal, service specification, funding levels, regulatory control | Significant influence on revenue, operational terms, and pricing | £1.3bn UK Bus revenue (2023) heavily reliant on contracts |

| Government (Policy) | Legislation (e.g., Bus Services Bill 2024, Passenger Railway Services Bill 2024), potential nationalisation | Increased leverage, ability to dictate terms, potential reduction in private operator autonomy | Late 2024 legislative push towards public sector involvement |

Preview Before You Purchase

Firstgroup Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Firstgroup's competitive landscape through a thorough Porter's Five Forces analysis, covering the threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

FirstGroup operates in a highly competitive UK public transport market, facing significant rivalry from other major players. Companies like The Go-Ahead Group, National Express Group, Mobico Group (formerly National Express), and Arriva are all established operators vying for market share in both the bus and rail sectors.

The public transport sector, including companies like FirstGroup, is characterized by significant fixed costs. These costs stem from investments in large vehicle fleets, maintenance depots, and sometimes even dedicated infrastructure. For example, acquiring and maintaining a bus or train fleet represents a substantial capital outlay that doesn't easily diminish.

These high upfront investments, combined with the specialized nature of assets and the long duration of many operating contracts, create formidable exit barriers. Companies are often locked into long-term commitments, making it difficult and costly to withdraw from the market. This lack of flexibility forces players to compete intensely within the existing landscape, rather than easily exiting when conditions become unfavorable.

In 2024, the ongoing need for fleet modernization and electrification further amplifies these fixed costs. FirstGroup, for instance, has been investing in new, lower-emission vehicles to meet regulatory requirements and customer expectations. These capital-intensive decisions, while strategic for the future, reinforce the high fixed cost structure and contribute to the intense competitive rivalry as companies strive to maintain market share despite these ongoing financial demands.

Competitive rivalry within the transport sector extends beyond direct service overlap to the crucial arena of bidding for government-subsidised routes and rail franchises. For instance, in the UK, the Department for Transport's franchising system for railways has seen intense competition among operators vying for long-term contracts, with significant financial commitments involved.

The evolving regulatory landscape, including shifts towards greater local authority control over bus services, introduces new competitive dimensions. In 2024, several local authorities are exploring or implementing enhanced powers, potentially leading to the establishment of municipal bus companies, directly challenging incumbent private operators on previously exclusive routes.

Differentiation Challenges in a Commoditized Service

While FirstGroup strives to differentiate its public transport services through a focus on safety, reliability, and sustainability, the inherent nature of these services leans towards commoditization. This means that, fundamentally, many offerings can be seen as similar by consumers, making it difficult to establish lasting unique selling propositions.

The competitive landscape is often dominated by price and frequency. Operators frequently engage in aggressive pricing strategies to attract and retain passengers, which can erode profit margins and make it challenging to build a sustainable competitive advantage based on factors other than cost. For instance, in the UK bus market, fare wars have been a recurring feature in certain regions.

- Commoditization: Public transport services are largely viewed as interchangeable by many customers.

- Price and Frequency Dominance: Competition often centers on offering the lowest fares and the most frequent services.

- Differentiation Hurdles: Building and maintaining a distinct competitive edge beyond these core factors is difficult.

- Impact on Strategy: This dynamic necessitates constant vigilance on operational efficiency and cost control to remain competitive.

Impact of Industry Transition and Funding Pressures

The UK transport sector is navigating a significant transition, marked by decarbonisation mandates and shifting funding landscapes. This evolution intensifies competitive rivalry as operators face substantial investment needs for new technologies, such as electric buses. For instance, the UK government has committed to phasing out the sale of new diesel buses by 2035, requiring significant capital outlay from companies like Firstgroup.

Compounding this pressure, some areas are experiencing reduced government funding for public transport services. This necessitates a more aggressive pursuit of profitable routes and contracts, as operators compete fiercely for limited opportunities. The financial strain of these investments, coupled with potentially tighter revenue streams, heightens the intensity of competition among existing players and new entrants alike.

- Decarbonisation Mandates: UK government targets aim for zero-emission public transport, forcing substantial fleet upgrades.

- Evolving Funding Models: Changes in government subsidies and contract structures create financial uncertainty and competitive pressure.

- Increased Investment Needs: Operators must finance new, greener technologies, impacting profitability and strategic decisions.

- Route and Contract Competition: Reduced funding intensifies the fight for commercially viable routes and service agreements.

Competitive rivalry is fierce in the UK's public transport sector, with FirstGroup facing strong competition from established players like Stagecoach and Arriva. This intense competition is driven by the commoditized nature of many public transport services, where price and frequency often dictate customer choice. Companies must constantly focus on operational efficiency and cost control to remain competitive in this dynamic market.

| Competitor | Bus Market Share (Approx. 2024) | Rail Operations (Key Franchises) |

|---|---|---|

| FirstGroup | ~20% | GWR, Avanti West Coast, SWR |

| Stagecoach | ~25% | South Western Railway (jointly), East Midlands Railway |

| Arriva | ~15% | Northern (jointly), CrossCountry |

| Mobico Group (National Express) | ~10% | TfW Rail Services |

SSubstitutes Threaten

Private cars continue to be a formidable substitute for public transportation, offering unmatched convenience and personalized travel. This deeply ingrained reliance on personal vehicles for daily commutes and recreational activities poses a consistent challenge to increasing public transport usage, even with ongoing initiatives to encourage modal shifts.

The increasing viability and promotion of active travel modes like walking and cycling, especially in urban centers with better infrastructure, pose a significant threat of substitutes for FirstGroup. These cost-free and eco-friendly alternatives directly compete with FirstGroup's bus services for shorter journeys.

In 2024, many UK cities saw continued investment in cycling infrastructure. For example, London's Ultra Low Emission Zone expansion, while primarily aimed at reducing vehicle emissions, also indirectly encourages active travel by making driving more expensive, thus making walking and cycling more attractive alternatives for shorter commutes that might have previously been served by buses.

The proliferation of ride-sharing platforms like Uber and Lyft, alongside other on-demand mobility solutions, presents a significant threat of substitutes for traditional public transport operators such as Firstgroup. These services offer unparalleled convenience and door-to-door flexibility, directly competing for passengers who prioritize ease of use over the often lower cost of scheduled bus and rail. For instance, in 2024, ride-sharing services continued to capture urban commuters, with global ride-sharing revenue projected to reach over $200 billion, indicating a substantial shift in transportation preferences.

Impact of Remote Work and E-commerce on Commuting

The increasing prevalence of remote and hybrid work arrangements, coupled with the robust expansion of e-commerce, has significantly diminished the need for traditional daily commutes. This fundamental change directly challenges FirstGroup's primary revenue source from commuting, as people opt for at-home activities instead of regular travel.

This shift presents a substantial threat of substitutes for FirstGroup's services. For instance, in the UK, the Office for National Statistics reported that in early 2024, around 25% of people were working in a hybrid model. This directly translates to fewer daily train and bus journeys. Furthermore, e-commerce growth means fewer people need to travel to physical retail locations, impacting bus and coach services that might serve these routes.

- Reduced Commuting Demand: The sustained adoption of hybrid work models directly substitutes regular commuting journeys with at-home activities.

- E-commerce Impact: The growth of online shopping reduces the necessity for travel to retail destinations, affecting bus and coach services.

- Shifting Travel Patterns: In 2023, UK rail passenger numbers were still below pre-pandemic levels, indicating a structural change in travel habits.

- Digital Alternatives: Virtual meetings and online services offer convenient substitutes for many trips previously undertaken by public transport.

Inter-City Coach and Air Travel Alternatives

For long-distance travel, passengers can opt for inter-city coach services, like National Express, or domestic air travel as alternatives to FirstGroup's rail offerings. These substitutes can present a compelling value proposition, either through lower fares or reduced travel times, depending on the specific route and individual priorities. For instance, in 2024, the average domestic flight price in the UK saw fluctuations, while coach services continued to offer a budget-friendly option, making them strong contenders for price-sensitive travelers.

The threat of substitutes is amplified as both coach and air travel sectors invest in improving their offerings and sustainability. As airlines increasingly focus on fuel efficiency and eco-friendly practices, they become more attractive to environmentally conscious travelers. Similarly, coach operators are upgrading their fleets and services to enhance passenger comfort and appeal. This ongoing evolution means that FirstGroup must continually assess and adapt its rail services to remain competitive against these dynamic alternatives.

- Cost Sensitivity: Coach services often provide a significantly lower price point compared to rail, particularly for advance bookings.

- Time Efficiency: For certain routes, particularly those with direct flights and efficient airport transfers, air travel can offer a faster overall journey time than rail.

- Route Specificity: The attractiveness of substitutes varies greatly by route; a direct flight might be a clear winner over a multi-leg train journey, while a coach might be the only viable option for some destinations.

- Sustainability Focus: Growing environmental awareness means that both airlines and coach operators highlighting their green initiatives can sway passenger choice away from traditional rail.

The threat of substitutes for FirstGroup is substantial and multifaceted. Private cars offer unparalleled convenience, while active travel modes like walking and cycling are gaining traction, especially with improved urban infrastructure. In 2024, London's ULEZ expansion indirectly boosted active travel by increasing driving costs.

Ride-sharing services like Uber are a significant competitor, providing door-to-door flexibility that appeals to many commuters. Global ride-sharing revenue was projected to exceed $200 billion in 2024. Furthermore, the rise of remote work, with approximately 25% of UK workers in hybrid models in early 2024, directly reduces demand for traditional commuting.

Long-distance travel also faces competition from inter-city coaches and domestic flights, which can offer lower fares or faster journey times. The sustainability efforts within these sectors are also making them more attractive to a wider range of travelers.

| Substitute Mode | Key Advantages | 2024 Relevance/Data Point |

|---|---|---|

| Private Cars | Convenience, Flexibility | Deeply ingrained reliance for daily commutes. |

| Walking & Cycling | Cost-free, Eco-friendly | Increased urban infrastructure investment, e.g., London's ULEZ. |

| Ride-Sharing (Uber, Lyft) | Door-to-door service, On-demand | Global revenue projected >$200 billion. |

| Remote/Hybrid Work | Reduced need for commuting | ~25% of UK workers in hybrid models (early 2024). |

| Inter-city Coaches | Lower cost | Budget-friendly option for price-sensitive travelers. |

| Domestic Air Travel | Time efficiency (for some routes) | Focus on fuel efficiency and eco-friendly practices. |

Entrants Threaten

Entering the public transport sector, especially rail and extensive bus operations, requires massive upfront spending. This includes acquiring or leasing vehicles, building maintenance facilities, and implementing advanced ticketing systems. For instance, FirstGroup's significant investment in new trains, such as a £500 million order, underscores the substantial financial commitment necessary, presenting a major hurdle for new competitors.

The UK public transport sector is burdened by a complex web of regulations, including stringent safety mandates, route approvals, and operating licenses. This intricate regulatory environment, continually shaped by new legislation like the Transport Act 2023 which aims to improve passenger experience and sustainability, acts as a substantial barrier for potential new competitors.

Established operators like FirstGroup benefit from significant economies of scale in areas such as procurement of vehicles and fuel, maintenance operations, and administrative functions. For instance, in 2023, FirstGroup's fleet size across its UK bus operations alone numbered in the thousands, allowing for bulk purchasing discounts on vehicles and parts that smaller competitors cannot match.

New entrants would struggle to achieve similar cost efficiencies, putting them at a competitive disadvantage from the outset. For example, a new entrant starting with a fleet of just 50 buses would likely pay a higher per-unit cost for vehicles and fuel compared to FirstGroup's negotiated rates, making it harder to compete on price.

Difficulty in Securing Prime Routes and Infrastructure Access

Securing prime routes and infrastructure access presents a significant barrier for new entrants in the transportation sector, particularly for bus and rail operations. Existing operators often hold exclusive or preferential rights to the most profitable urban bus networks and established rail lines, making it difficult for newcomers to gain a foothold. For instance, in the UK, bus route franchises are typically awarded through competitive tenders, where incumbent operators with established infrastructure and customer bases often have an advantage.

The challenge is amplified by the complexities of obtaining track access rights for rail services. These rights are frequently governed by long-standing agreements and regulatory frameworks that favor incumbent operators. In 2024, the process for securing new rail access slots remains intricate, with capacity often being a limiting factor, especially on congested main lines.

- Limited Route Availability: Profitable urban bus routes and established rail corridors are often already operated by established companies.

- Franchise and Concession Hurdles: Winning new franchises or concessions requires significant capital and navigating complex bidding processes, favoring those with existing market presence.

- Infrastructure Access Costs: Gaining access to essential infrastructure like tracks, stations, and depots can be prohibitively expensive for new entrants.

- Regulatory and Political Factors: Existing relationships with transport authorities and political considerations can influence route allocation and franchise awards.

Brand Recognition and Customer Loyalty

FirstGroup, like many established players in the transportation sector, benefits significantly from strong brand recognition and a loyal customer base cultivated over years of operation. This is a substantial barrier for any potential new entrant aiming to disrupt the market.

Building this level of trust and consistent service quality requires considerable time and resources. For instance, in the UK bus and rail sectors where FirstGroup operates, customer satisfaction surveys often highlight reliability and familiar branding as key decision factors for commuters. New companies would need to overcome this inertia.

- Brand Equity: FirstGroup's established brands, such as Avanti West Coast and Lumo, have built significant recognition.

- Customer Loyalty: Years of service have fostered a degree of loyalty among regular commuters and travelers.

- Marketing Investment: New entrants must allocate substantial funds to marketing campaigns to even begin competing for customer attention.

- Service Differentiation: Attracting customers requires not just marketing but demonstrably superior service quality, a costly endeavor.

The threat of new entrants into FirstGroup's public transport markets, particularly rail and bus operations, is significantly mitigated by immense capital requirements and substantial economies of scale enjoyed by incumbents. These barriers, coupled with stringent regulatory hurdles and established brand loyalty, make it exceedingly difficult for newcomers to gain traction and compete effectively. For example, in 2023, FirstGroup's UK bus fleet alone comprised thousands of vehicles, enabling significant purchasing power for parts and fuel, a scale unachievable by nascent competitors.

| Barrier Type | Description | Impact on New Entrants | Example for FirstGroup (2023-2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment in vehicles, infrastructure, and technology. | Prohibitive for many potential entrants. | FirstGroup's £500 million investment in new trains highlights this. |

| Economies of Scale | Cost advantages from large-scale operations in procurement and maintenance. | New entrants face higher per-unit costs. | Thousands of vehicles in FirstGroup's UK bus fleet allow for bulk discounts. |

| Regulatory Environment | Complex safety, route, and operating license requirements. | Time-consuming and costly to navigate. | Ongoing compliance with UK transport legislation, including the Transport Act 2023. |

| Brand Recognition & Loyalty | Established reputation and customer base built over time. | Requires significant marketing investment and time to build trust. | Strong brand equity in services like Avanti West Coast and Lumo. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Firstgroup is built upon a foundation of verified data, including Firstgroup's annual reports, investor presentations, and regulatory filings. We also incorporate insights from industry-specific market research reports and reputable financial news outlets to provide a comprehensive view of the competitive landscape.