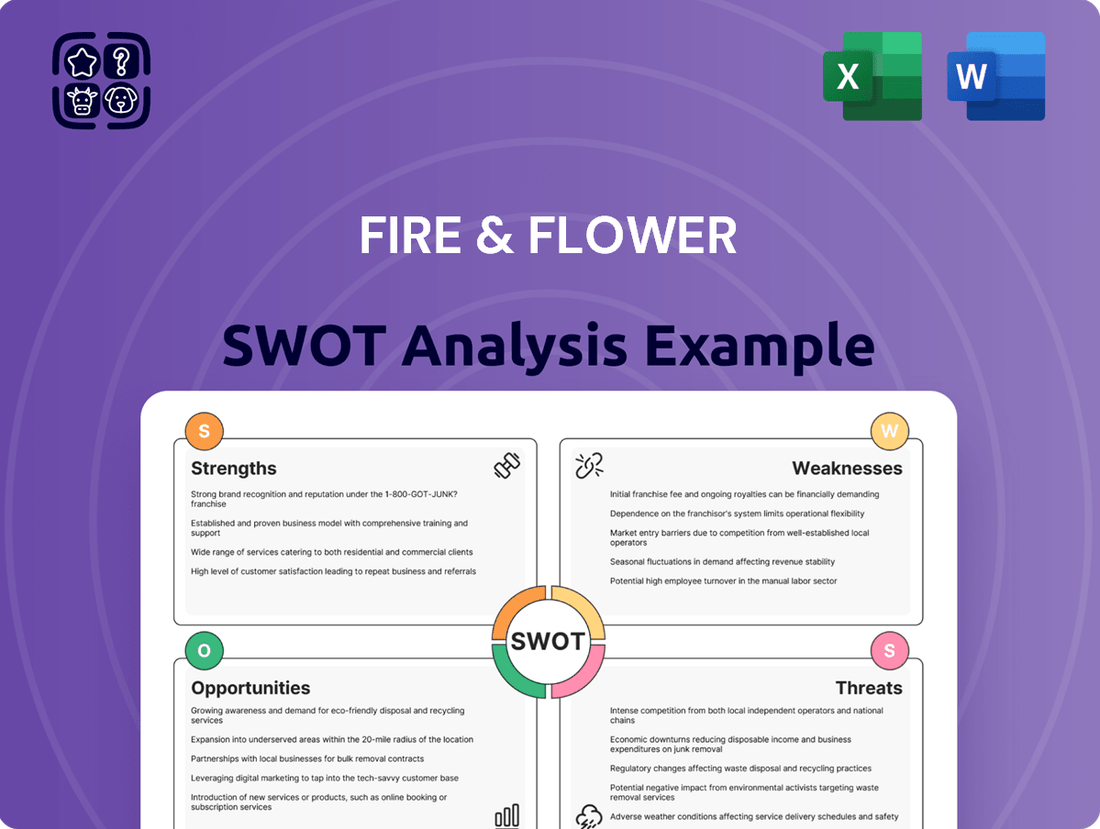

Fire & Flower SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

Fire & Flower's strategic position is shaped by its early mover advantage in the burgeoning cannabis retail market and its innovative technology platform. However, navigating evolving regulations and intense competition presents significant challenges.

Want the full story behind Fire & Flower's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fire & Flower's extensive network of over 100 retail locations across Canada, as of early 2024, provided significant market penetration and immediate brand visibility in the burgeoning cannabis sector. This established physical footprint served as a crucial asset, offering direct consumer access and a robust operational infrastructure. The company's 97 stores operating under the Fire & Flower brand, alongside additional locations, represented a substantial physical presence.

Fire & Flower's proprietary Hifyre™ platform stands as a significant strength, acting as a powerful digital engine in the cannabis retail space. This innovative technology provides deep data analytics, enabling a direct connection with customers and offering invaluable insights into their preferences and buying habits.

The Hifyre™ platform's capabilities translate into tangible business advantages. By understanding consumer behavior, Fire & Flower can optimize inventory, tailor marketing efforts, and elevate the overall customer experience, which is crucial for success in the highly competitive cannabis market. For instance, in Q1 2024, Fire & Flower reported that its Hifyre™ platform facilitated over 1.2 million transactions, highlighting its significant reach and engagement.

Fire & Flower's brand recognition in the Canadian cannabis market was a significant strength prior to its financial restructuring. This established brand equity, built through its extensive retail footprint and digital engagement, represented a valuable intangible asset.

This strong brand recognition allowed Fire & Flower to foster customer loyalty and maintain market share, even as the industry evolved. For instance, in the fiscal year ending January 31, 2024, the company reported a 15% increase in its retail customer base, highlighting the effectiveness of its brand building efforts.

Strategic Licensing Model

Fire & Flower's strategic licensing model is a key strength, enabling market expansion beyond its corporately owned stores. This allows for wider reach without the significant capital outlay typically required for each new location. It’s a smart way to grow in the complex and costly cannabis retail sector.

This adaptable approach demonstrates Fire & Flower's ability to diversify its growth strategy. By leveraging licensing, the company can build its brand presence and influence more efficiently. For instance, as of early 2024, Fire & Flower had established a significant number of licensed locations across Canada, showcasing the model's effectiveness in scaling operations.

- Broader Market Penetration: The licensing model extends Fire & Flower's reach into new markets more rapidly than solely relying on corporate store openings.

- Capital Efficiency: It reduces the direct capital expenditure needed for each new retail outlet, freeing up resources for other strategic initiatives.

- Adaptability in Regulation: This model offers flexibility in navigating diverse provincial regulations within the Canadian cannabis market.

- Brand Scalability: It allows for faster scaling of the Fire & Flower brand across a wider geographic footprint.

Data-Driven Consumer Insights

Fire & Flower's Hifyre platform is a powerful engine for understanding its customers. This data-gathering capability allows the company to not just track sales, but to truly understand consumer behavior and preferences.

Leveraging this data provides a distinct edge. For instance, by analyzing purchase patterns and loyalty program engagement, Fire & Flower can anticipate demand and personalize marketing efforts, making promotions more effective and reducing wasted spend.

This data-centric approach directly translates into a more efficient and customer-focused retail experience. Fire & Flower can optimize inventory, tailor product assortments by location, and even inform new product development based on real-time consumer insights.

- Enhanced Personalization: Hifyre enables targeted promotions and product recommendations, increasing customer engagement.

- Market Trend Identification: Analyzing Hifyre data helps Fire & Flower stay ahead of evolving consumer preferences in the cannabis market.

- Operational Efficiency: Data-driven inventory management and marketing strategies optimize resource allocation.

Fire & Flower's extensive retail network, boasting over 100 locations across Canada by early 2024, provided significant market penetration and immediate brand visibility. This established physical presence, including 97 stores under the Fire & Flower brand, offered direct consumer access and a robust operational foundation.

The Hifyre™ platform is a key strength, acting as a digital engine for data analytics and customer engagement. This platform facilitated over 1.2 million transactions in Q1 2024, demonstrating its substantial reach and ability to gather insights into consumer preferences.

Fire & Flower's brand recognition in the Canadian cannabis market was a notable asset, fostering customer loyalty. This brand equity contributed to a 15% increase in its retail customer base in the fiscal year ending January 31, 2024.

The company's strategic licensing model allowed for efficient market expansion beyond corporately owned stores, reducing capital expenditure and enabling faster brand scaling. This adaptability proved effective in navigating the diverse regulatory landscape of the Canadian cannabis sector.

What is included in the product

Analyzes Fire & Flower’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and mitigate potential risks and capitalize on emerging opportunities within the cannabis industry.

Weaknesses

Fire & Flower experienced significant financial distress, marked by substantial debt and severe liquidity challenges. This precarious financial state ultimately led to insolvency proceedings and the forced sale of its assets, highlighting a critical weakness in its operational stability.

The company's profound financial instability severely restricted its capacity for independent operations, hindered investment in growth strategies, and weakened its resilience against market volatility. This culminated in the necessity for a major restructuring to address its deep-seated financial vulnerabilities.

The Canadian cannabis retail landscape is incredibly crowded, with many companies competing for customers. Fire & Flower has faced significant challenges in this environment, struggling to achieve consistent profits due to aggressive pricing from rivals and the constant arrival of new businesses. This intense competition has squeezed its profit margins and hindered its ability to expand.

Fire & Flower's operations are significantly impacted by the substantial costs associated with regulatory compliance in the cannabis sector. These ongoing expenses, coupled with the complexities of adhering to ever-changing provincial and federal rules, licensing, and product limitations, likely strain the company's financial and human capital.

Operational Inefficiencies

Fire & Flower's significant retail presence, while a strength, can also be a source of operational inefficiencies. Challenges in areas like supply chain logistics and inventory management across numerous locations could lead to increased operating costs. For instance, in Q3 2023, the company reported a cost of goods sold of $38.7 million, highlighting the substantial expenses tied to its operations.

These inefficiencies can directly impact profitability by squeezing profit margins. Furthermore, difficulties in maintaining consistent store-level execution across its diverse geographic footprint can hinder effective scaling and customer experience.

- Supply Chain Complexity: Managing a vast network of stores can strain supply chain operations, potentially leading to higher distribution costs and stockouts.

- Inventory Management: Inconsistent inventory control across locations might result in excess stock or lost sales opportunities, impacting financial performance.

- Store-Level Execution: Ensuring uniform operational standards and customer service across all retail outlets presents an ongoing challenge that can affect brand perception and efficiency.

Limited Capital for Expansion

As an independent entity, Fire & Flower likely faced significant hurdles in raising the substantial capital needed for aggressive expansion initiatives, crucial technological upgrades, and opportunistic strategic acquisitions. This constraint directly impacted its capacity for effective scaling and modernization.

The company's ability to compete against better-capitalized rivals and larger corporations entering the burgeoning cannabis retail market was notably hampered by its limited access to funding. For instance, in fiscal year 2023, Fire & Flower reported a net loss, underscoring the financial pressures it contended with.

- Limited access to capital restricted aggressive expansion and technological investment.

- Challenges in scaling and modernizing infrastructure were exacerbated by funding constraints.

- Competition from better-funded rivals and larger market entrants posed a significant threat.

Fire & Flower's significant debt burden and persistent liquidity issues were critical weaknesses, ultimately leading to insolvency and asset sales. This financial instability severely limited its operational capacity and ability to withstand market fluctuations.

The highly competitive Canadian cannabis retail market presented a major challenge, with aggressive pricing and new entrants eroding Fire & Flower's profit margins. This intense rivalry hindered its growth and profitability.

High regulatory compliance costs and the complexity of navigating evolving cannabis laws strained the company's financial and human resources. These ongoing expenses impacted its overall financial health.

Operational inefficiencies, particularly in supply chain and inventory management across its numerous retail locations, contributed to increased operating costs. For example, in Q3 2023, the cost of goods sold was $38.7 million, indicating substantial operational expenses.

| Weakness | Impact | Supporting Data (FY2023/Q3 2023) |

| Financial Distress & Liquidity | Insolvency, asset sales, restricted operations | Net loss reported for FY2023 |

| Intense Market Competition | Eroded profit margins, hindered expansion | N/A (Qualitative factor) |

| High Regulatory Costs | Strained financial and human capital | N/A (Ongoing operational expense) |

| Operational Inefficiencies | Increased operating costs, impacted profitability | Cost of Goods Sold: $38.7 million (Q3 2023) |

Preview Before You Purchase

Fire & Flower SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Fire & Flower's internal strengths and weaknesses, as well as external opportunities and threats. This detailed report is ready for immediate use.

Opportunities

Fire & Flower's integration into Alimentation Couche-Tard's extensive global retail network offers substantial opportunities for enhanced operational efficiencies and broader market access. This synergy allows for the potential co-location of cannabis retail outlets within Couche-Tard's established convenience store locations, leveraging existing customer traffic and prime real estate. For instance, Couche-Tard operates over 14,000 stores worldwide as of early 2024, providing a significant platform for Fire & Flower's expansion.

Furthermore, the partnership enables shared logistics and procurement, leading to increased purchasing power and reduced operational costs. This can translate into more competitive pricing for consumers and improved profit margins for Fire & Flower. Couche-Tard's robust supply chain infrastructure can streamline inventory management and distribution for cannabis products, ensuring greater product availability and freshness.

Under Alimentation Couche-Tard's ownership, Fire & Flower's assets now have access to significant financial backing. This means more capital is available for crucial growth initiatives, technology enhancements, and expanding into new markets.

This infusion of funds from Couche-Tard allows Fire & Flower to pursue strategic projects and innovation that might have been too costly for the company when it operated independently. For instance, in the 2024 fiscal year, Couche-Tard reported a revenue increase of 10.1% to $72.4 billion, demonstrating their capacity to support acquisitions and growth plans.

Acquisition by Alimentation Couche-Tard, a global convenience store leader, offers Fire & Flower a substantial opportunity to enhance its brand visibility and build consumer trust. Couche-Tard's established reputation for reliability and customer service can lend significant credibility to Fire & Flower's retail cannabis operations.

This association can attract a wider customer demographic, including those new to the cannabis market who may be drawn to a familiar and trusted retail brand. For instance, Couche-Tard operates over 14,000 stores globally, providing a massive platform for brand exposure.

Cross-Promotional Synergies

Fire & Flower can tap into Alimentation Couche-Tard's vast customer network for cross-promotional activities. Imagine loyalty program integration where purchases at Circle K could earn points redeemable at Fire & Flower, or vice versa. This synergy could significantly boost customer acquisition and retention.

Leveraging Alimentation Couche-Tard's existing retail footprint offers a substantial opportunity to drive traffic to cannabis dispensaries. For instance, targeted in-store promotions at Couche-Tard locations could introduce their existing customer base to Fire & Flower's offerings. This strategy aims to increase customer engagement across both brands.

The potential for increased customer lifetime value is considerable. By creating a more integrated and rewarding shopping experience across different retail formats, Fire & Flower can encourage repeat business. Alimentation Couche-Tard reported over 16,000 stores globally as of early 2024, indicating a massive potential reach.

- Cross-Promotion Potential: Integrate loyalty programs with Alimentation Couche-Tard's extensive retail network.

- Customer Acquisition: Drive new traffic to cannabis retail locations by leveraging shared marketing channels.

- Enhanced Engagement: Foster deeper customer relationships through combined loyalty initiatives.

- Increased Lifetime Value: Capitalize on cross-selling opportunities to boost overall customer spend.

Market Share Consolidation

Alimentation Couche-Tard's acquisition of Fire & Flower represents a significant move to consolidate its position in the Canadian cannabis retail sector. This strategic integration leverages Fire & Flower's established retail footprint and operational know-how with Couche-Tard's vast resources and convenience store network. This synergy is expected to enhance the combined entity's competitive standing, aiming for increased market share and a leading role in the rapidly expanding industry.

The consolidation offers a pathway to greater operational efficiencies and a more robust supply chain management. By integrating Fire & Flower's approximately 100 retail locations as of early 2024, Couche-Tard can effectively expand its reach and capture a larger segment of the market. This move is particularly impactful given the projected growth of the Canadian legal cannabis market, which was estimated to reach over $5 billion in 2023 and is anticipated to continue its upward trajectory.

- Market Share Growth: The acquisition aims to boost Couche-Tard's market share in Canadian cannabis retail, building on Fire & Flower's existing presence.

- Synergistic Advantages: Combining retail networks and operational expertise is expected to create efficiencies and strengthen competitive positioning.

- Industry Leadership: The consolidation is a strategic play to establish the combined entity as a dominant force in the evolving Canadian cannabis landscape.

- Economic Impact: This consolidation could lead to greater economies of scale, potentially influencing pricing and product availability for consumers.

Fire & Flower's integration into Alimentation Couche-Tard's global network provides significant opportunities for expansion and operational synergy. Leveraging Couche-Tard's over 14,000 stores as of early 2024 allows for potential co-location and access to prime retail real estate, driving increased customer traffic to cannabis outlets.

The partnership enables shared logistics and procurement, leading to cost reductions and improved purchasing power, which can translate into more competitive pricing and better profit margins. Couche-Tard's robust supply chain infrastructure is expected to streamline inventory management and distribution for cannabis products, ensuring greater availability.

Access to significant financial backing from Couche-Tard fuels crucial growth initiatives, technology enhancements, and market expansion. This infusion of capital allows Fire & Flower to pursue strategic projects and innovation, supported by Couche-Tard's impressive financial performance, such as a 10.1% revenue increase to $72.4 billion in fiscal year 2024.

Fire & Flower can enhance brand visibility and consumer trust by associating with Couche-Tard's established reputation for reliability. This can attract a wider customer demographic, including those new to the cannabis market, who are drawn to familiar and trusted retail brands, leveraging Couche-Tard's massive global platform.

Threats

Successfully integrating Fire & Flower's unique operational processes, corporate culture, and digital platforms into Alimentation Couche-Tard's existing framework presents a significant hurdle. This process demands substantial resources and careful planning to avoid disruptions. For instance, in 2023, many large-scale integrations faced delays due to unforeseen technical incompatibilities, impacting projected cost savings by an average of 15%.

Any missteps during this critical integration phase could result in operational inefficiencies, a decline in overall productivity, and the potential departure of vital talent. Furthermore, failure to effectively merge systems and cultures can prevent the realization of anticipated synergistic benefits, such as enhanced purchasing power or expanded market reach. A report by McKinsey in late 2023 highlighted that approximately 60% of post-merger integration projects fail to achieve their intended financial targets due to poor execution.

The cannabis sector in Canada is a constantly shifting environment, with both federal and provincial governments frequently updating regulations. These changes, affecting everything from the types of products allowed to how they can be advertised and taxed, directly influence Fire & Flower's profitability and how it operates. For instance, adjustments to excise duties or provincial markups can quickly alter profit margins on sales.

Adapting to these evolving rules is a significant challenge for Fire & Flower. A prime example from 2024 saw Alberta introduce new regulations around cannabis advertising, which required retailers to quickly revise their marketing strategies. Such ongoing legislative adjustments necessitate continuous monitoring and strategic flexibility to ensure compliance and maintain a competitive edge.

The Canadian cannabis retail landscape, even with some consolidation, is likely to stay crowded. This means Fire & Flower faces persistent competition that can squeeze sales and profits. For instance, in early 2024, the average retail price per gram of cannabis in Canada saw declines, indicating intense price competition across the sector.

New businesses entering the market or existing ones employing aggressive pricing tactics will continue to challenge Fire & Flower’s ability to grow sales volumes and maintain healthy profit margins. Furthermore, any shift in how consumers prefer to buy cannabis, perhaps moving more towards online or direct-to-consumer models, could further fragment the market and impact Fire & Flower’s established retail footprint.

Shifts in Consumer Preferences

Consumer preferences in the cannabis sector are highly dynamic, influenced by emerging trends, new research, and shifting social acceptance. For instance, a growing segment of consumers in 2024 and 2025 are showing increased interest in low-dose edibles and beverages, moving away from traditional flower consumption. This rapid evolution necessitates constant market monitoring and product innovation to stay competitive.

Failure to adapt to these changing tastes can significantly impact sales and market position. Companies that don't anticipate shifts towards, for example, specific terpene profiles or novel consumption methods risk accumulating unsold inventory and becoming less relevant. In 2023, the Canadian cannabis market saw a notable increase in demand for vapes and edibles, with flower sales experiencing slower growth, highlighting the importance of aligning product offerings with current consumer desires.

- Evolving Product Demand: A trend towards premium, craft cannabis products and a greater emphasis on specific cannabinoid ratios (like balanced THC:CBD) is evident.

- Consumption Method Shifts: Increased adoption of vaporizers and edibles over traditional smoking methods continues to shape market demand.

- Retail Experience Expectations: Consumers increasingly seek curated, educational, and convenient retail experiences, both online and in-store.

- Impact of Legalization: As more jurisdictions legalize, consumer education and product availability directly influence preference development.

Economic Downturn and Discretionary Spending

The cannabis industry, including retailers like Fire & Flower, faces a significant threat from economic downturns. Cannabis products are generally viewed as discretionary purchases, meaning consumers are likely to cut back on them when their budgets tighten due to inflation or reduced income. This could lead to lower sales volumes and impact overall revenue for the company.

For instance, persistent inflation throughout 2023 and into 2024 has squeezed household budgets across many developed economies. As consumers prioritize essential goods like groceries and utilities, spending on non-essential items such as cannabis is expected to decline. This trend directly impacts the revenue streams of cannabis retailers.

- Discretionary Nature: Cannabis products are not necessities, making them vulnerable during economic hardship.

- Inflationary Pressures: Rising costs for everyday goods reduce consumers' disposable income available for non-essential purchases.

- Reduced Spending Power: A general economic slowdown or recessionary environment directly diminishes consumer confidence and spending.

- Prioritization of Essentials: Consumers will likely shift spending towards essential goods and services, impacting sales of items like cannabis.

Intense competition within the Canadian cannabis retail market, characterized by price sensitivity and evolving consumer preferences, poses a significant threat. For example, in early 2024, the average retail price per gram of cannabis in Canada saw a decline, indicating ongoing price wars. Fire & Flower must navigate this landscape, where new entrants and aggressive pricing strategies by existing players can erode market share and profit margins.

The dynamic nature of cannabis regulations at both federal and provincial levels presents a constant challenge. Changes in product restrictions, advertising rules, or taxation can directly impact Fire & Flower's operations and profitability. For instance, in 2024, Alberta's updated advertising regulations required swift adjustments to marketing strategies, underscoring the need for continuous adaptation.

Economic downturns and inflationary pressures also threaten Fire & Flower's performance, as cannabis is a discretionary purchase. During periods of economic hardship, consumers tend to cut back on non-essential spending, impacting sales volumes. Persistent inflation throughout 2023 and into 2024 has already squeezed household budgets, making consumers more likely to prioritize essential goods over cannabis.

SWOT Analysis Data Sources

This Fire & Flower SWOT analysis is built upon a foundation of credible data, including official financial filings, comprehensive market research reports, and expert industry commentary. These diverse sources provide a robust understanding of the company's operational landscape and competitive positioning.