Fire & Flower Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

Unlock the strategic blueprint behind Fire & Flower's innovative approach to the cannabis market. This comprehensive Business Model Canvas details their customer relationships, key resources, and revenue streams, offering a clear view of their competitive edge. Dive into the full, professionally crafted document to gain actionable insights for your own business endeavors.

Partnerships

Fire & Flower's strategic alliance with Alimentation Couche-Tard (Circle K) was a cornerstone of its retail strategy. This partnership began with a substantial investment, signaling Couche-Tard's intent to deepen its involvement and potentially increase its stake in Fire & Flower.

The core of this collaboration was the co-location of cannabis retail outlets within Couche-Tard's vast network of convenience stores. This strategy aimed to capitalize on Circle K's existing high-traffic locations, thereby boosting Fire & Flower's brand visibility and customer accessibility.

This co-location model offered a distinct competitive edge, placing cannabis dispensaries in proximity to established convenience shopping habits. For instance, by mid-2024, Fire & Flower operated numerous stores within or adjacent to Circle K locations, demonstrating the practical application of this partnership.

Fire & Flower’s key partnerships with licensed cannabis producers and distributors were fundamental to its retail operations. These relationships ensured a steady and varied supply of products like dried flower, pre-rolls, edibles, and extracts for its stores. In 2023, the Canadian cannabis market saw continued growth, with retail sales reaching an estimated CAD 5.0 billion, underscoring the importance of robust supplier networks for retailers like Fire & Flower to capture market share.

Fire & Flower's Hifyre digital platform likely necessitates strategic alliances with data analytics and technology firms. These collaborations are vital for advancing Hifyre's capabilities, enabling real-time data processing and generating forward-looking insights into customer habits and market shifts. For instance, in 2023, Fire & Flower reported that its Hifyre platform processed over $1 billion in gross merchandise value, highlighting the scale and importance of data management.

Licensing and Franchisees

Fire & Flower's strategy included licensing agreements to support cannabis retail operations, partnering with independent operators or franchisees. This approach enabled the expansion of the Fire & Flower brand and its Hifyre technology platform into new markets, potentially including international ventures. This licensing model allowed for wider market reach without the need for direct corporate ownership of every retail location.

These partnerships are crucial for scaling operations efficiently. For instance, in 2024, Fire & Flower continued to explore opportunities to leverage its brand and technology through these strategic alliances, aiming to increase its footprint across various jurisdictions.

- Brand Expansion: Licensing allows Fire & Flower to extend its brand presence into new geographic areas more rapidly than through company-owned stores alone.

- Technology Deployment: Franchisees and licensees gain access to Fire & Flower's proprietary Hifyre technology platform, enhancing their operational efficiency and customer engagement.

- Market Penetration: This model facilitates deeper market penetration by partnering with local operators who understand regional nuances and regulations.

- Capital Efficiency: By relying on licensees and franchisees, Fire & Flower can reduce its capital expenditure requirements for store openings and expansion.

Real Estate and Property Owners

Fire & Flower's growth strategy heavily relied on securing prime retail locations, necessitating strong partnerships with real estate owners and developers. These collaborations were crucial for expanding their physical footprint across Canada.

Beyond the well-known co-location strategy with Couche-Tard, Fire & Flower actively pursued agreements with landlords to gain access to high-traffic areas. This approach was fundamental to establishing their brand presence in key urban and suburban markets.

- Securing prime retail spaces: Partnerships with property owners were essential for Fire & Flower to acquire strategically located stores, a key component of their expansion.

- Geographic expansion: These real estate relationships facilitated their entry into new Canadian provinces and markets, building a robust network of corporate-owned locations.

- Brand visibility: By partnering with landlords, Fire & Flower ensured its stores were situated in visible, accessible areas, enhancing customer reach and brand recognition.

Fire & Flower's key partnerships with licensed cannabis producers and distributors were fundamental to its retail operations, ensuring a steady supply of diverse products. In 2023, the Canadian cannabis market's retail sales were estimated at CAD 5.0 billion, highlighting the critical role of these supplier networks for market share capture.

The Hifyre digital platform's advancement likely involved strategic alliances with data analytics and technology firms to enhance real-time processing and customer insights. By 2023, Fire & Flower reported that Hifyre processed over $1 billion in gross merchandise value, underscoring the significance of these data management collaborations.

Licensing agreements with independent operators and franchisees were crucial for expanding the Fire & Flower brand and its Hifyre technology platform into new markets. This model allowed for broader market reach, with Fire & Flower continuing to explore such opportunities in 2024 to increase its jurisdictional footprint.

Strong partnerships with real estate owners and developers were vital for securing prime retail locations and expanding Fire & Flower's physical presence across Canada. These collaborations enabled the company to enter new provinces and markets, enhancing brand visibility and accessibility.

| Partnership Type | Key Collaborators | Strategic Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Retail Co-location | Alimentation Couche-Tard (Circle K) | Leveraged high-traffic convenience store locations for increased visibility and accessibility. | Continued operation of numerous stores within or adjacent to Circle K locations through mid-2024. |

| Supply Chain | Licensed Cannabis Producers & Distributors | Ensured consistent and varied product availability (flower, edibles, etc.). | Supported capture of market share in a CAD 5.0 billion Canadian cannabis retail market (2023). |

| Technology & Data | Data Analytics & Tech Firms | Enhanced Hifyre platform capabilities for customer insights and market trend analysis. | Hifyre processed over $1 billion in gross merchandise value (2023), demonstrating platform scale. |

| Brand & Operations Expansion | Independent Operators & Franchisees | Facilitated rapid brand expansion and technology deployment into new markets. | Ongoing exploration of these alliances in 2024 to increase geographic footprint. |

| Real Estate | Property Owners & Developers | Secured strategically located retail spaces for network expansion. | Essential for entry into new Canadian provinces and markets, building a robust store network. |

What is included in the product

A detailed Fire & Flower Business Model Canvas outlining their strategy for cannabis retail, focusing on customer segments, channels, and value propositions.

This model reflects Fire & Flower's real-world operations and plans, organized into 9 classic BMC blocks with narrative and insights for informed decision-making.

Provides a clear, structured framework to identify and address operational inefficiencies and market gaps, simplifying complex business challenges.

Activities

Fire & Flower’s core activity revolved around the day-to-day management of its numerous corporate-owned cannabis retail locations spread across Canada. This encompassed meticulous inventory control, strict adherence to evolving cannabis legislation, and cultivating a positive customer journey within each store. For instance, as of late 2023, the company operated over 100 retail locations.

Fire & Flower's key activities centered on the ongoing development and upkeep of its Hifyre digital platform. This included enhancing the Spark Perks loyalty program and refining the Hifyre IQ data analytics capabilities. These efforts were vital for fostering customer loyalty and extracting actionable market intelligence.

Maintaining and improving the Hifyre platform involved significant investment in software engineering and robust data management practices. The company focused on ensuring a seamless user experience and leveraging data to personalize offerings and drive sales across its various channels.

By 2024, Fire & Flower continued to emphasize the Hifyre platform as a core component of its business. This digital infrastructure was instrumental in supporting their omnichannel retail approach and generating supplementary revenue streams through data-driven insights and enhanced customer engagement.

Fire & Flower's strategic licensing and brand expansion activities are crucial for its growth. The company actively pursues licensing agreements for its brand and Hifyre technology, aiming to penetrate new markets like the United States and potentially Europe.

These agreements are not just about brand presence; they involve detailed negotiations, providing ongoing operational support to licensees, and meticulously maintaining brand consistency. This approach allows for an asset-light growth model, enabling faster market penetration without the full capital commitment of direct ownership.

For instance, in fiscal year 2023, Fire & Flower reported that its licensing revenue contributed to its overall financial performance, demonstrating the viability of this expansion strategy as a driver of market reach and revenue diversification.

Inventory Management and Procurement

Effectively managing inventory and procuring a diverse range of cannabis products from licensed producers was a continuous key activity for Fire & Flower. This involved forecasting demand, negotiating with suppliers, and ensuring product availability and freshness across their retail network. Optimized procurement directly impacted gross margins and customer satisfaction.

In 2024, Fire & Flower focused on refining its supply chain to enhance product variety and availability. Their ability to forecast demand accurately allowed them to maintain optimal stock levels, minimizing waste and maximizing sales opportunities. This strategic approach to procurement was crucial for meeting evolving consumer preferences and maintaining competitive pricing.

- Demand Forecasting: Utilizing data analytics to predict consumer purchasing patterns and adjust inventory accordingly.

- Supplier Negotiations: Securing favorable terms with licensed producers to ensure competitive pricing and consistent supply.

- Product Assortment: Curating a diverse range of cannabis products, including flower, edibles, and concentrates, to cater to a broad customer base.

- Quality Assurance: Implementing rigorous checks to guarantee product freshness and compliance with regulatory standards.

Marketing and Customer Engagement

Fire & Flower's key activities in marketing and customer engagement revolve around attracting and retaining customers through strategic initiatives. This includes the development and execution of targeted marketing campaigns designed to build brand awareness and drive sales. A significant component is the management of their proprietary Spark Perks loyalty program, which incentivizes repeat purchases and fosters a sense of community among customers. For instance, in 2023, the company focused on enhancing its digital marketing efforts and expanding the reach of its loyalty program.

Educational initiatives are also a cornerstone of their customer engagement strategy. These programs aim to guide consumers through the process of product selection, ensuring they make informed choices and understand responsible consumption practices. This commitment to education helps differentiate Fire & Flower in a crowded market and builds trust with their customer base. The company reported a notable increase in participation in its educational webinars throughout 2023, indicating growing consumer interest.

- Marketing Campaigns: Development and execution of advertising, social media, and promotional activities to attract new customers and increase brand visibility.

- Loyalty Program Management: Operation and enhancement of the Spark Perks program to reward repeat customers and gather valuable consumer data.

- Customer Education: Providing resources and information to help consumers understand cannabis products and promote responsible use.

- Digital Engagement: Utilizing online platforms and data analytics to personalize customer experiences and optimize marketing outreach.

Fire & Flower's key activities involved managing its extensive network of corporate-owned cannabis retail stores across Canada. This included meticulous inventory management, strict adherence to evolving cannabis regulations, and fostering a positive customer experience in each location. By late 2023, the company operated over 100 retail outlets.

A central focus was the ongoing development and maintenance of the Hifyre digital platform, enhancing features like the Spark Perks loyalty program and Hifyre IQ data analytics. These efforts were crucial for building customer loyalty and gathering actionable market insights. By 2024, the Hifyre platform remained instrumental in supporting their omnichannel retail strategy and generating revenue through data-driven insights.

Strategic licensing and brand expansion were vital for growth, with Fire & Flower actively pursuing agreements to enter new markets. These agreements involved detailed negotiations and ongoing operational support, enabling an asset-light expansion. In fiscal year 2023, licensing revenue demonstrated the success of this strategy in broadening market reach and diversifying income.

Procurement and inventory management were continuous key activities, involving demand forecasting, supplier negotiations, and ensuring product availability and quality across the retail network. In 2024, the company refined its supply chain to improve product variety and availability, with accurate demand forecasting ensuring optimal stock levels.

| Key Activity | Description | 2023/2024 Focus |

|---|---|---|

| Retail Operations | Managing corporate-owned stores, inventory, and customer experience. | Maintaining over 100 locations, ensuring regulatory compliance. |

| Digital Platform Development | Enhancing Hifyre platform, Spark Perks loyalty, and Hifyre IQ analytics. | Driving customer loyalty and data insights; supporting omnichannel sales. |

| Licensing & Expansion | Pursuing licensing agreements for brand and technology. | Penetrating new markets, focusing on asset-light growth. |

| Procurement & Inventory | Forecasting demand, negotiating with suppliers, managing product assortment. | Optimizing supply chain for variety, availability, and competitive pricing. |

Delivered as Displayed

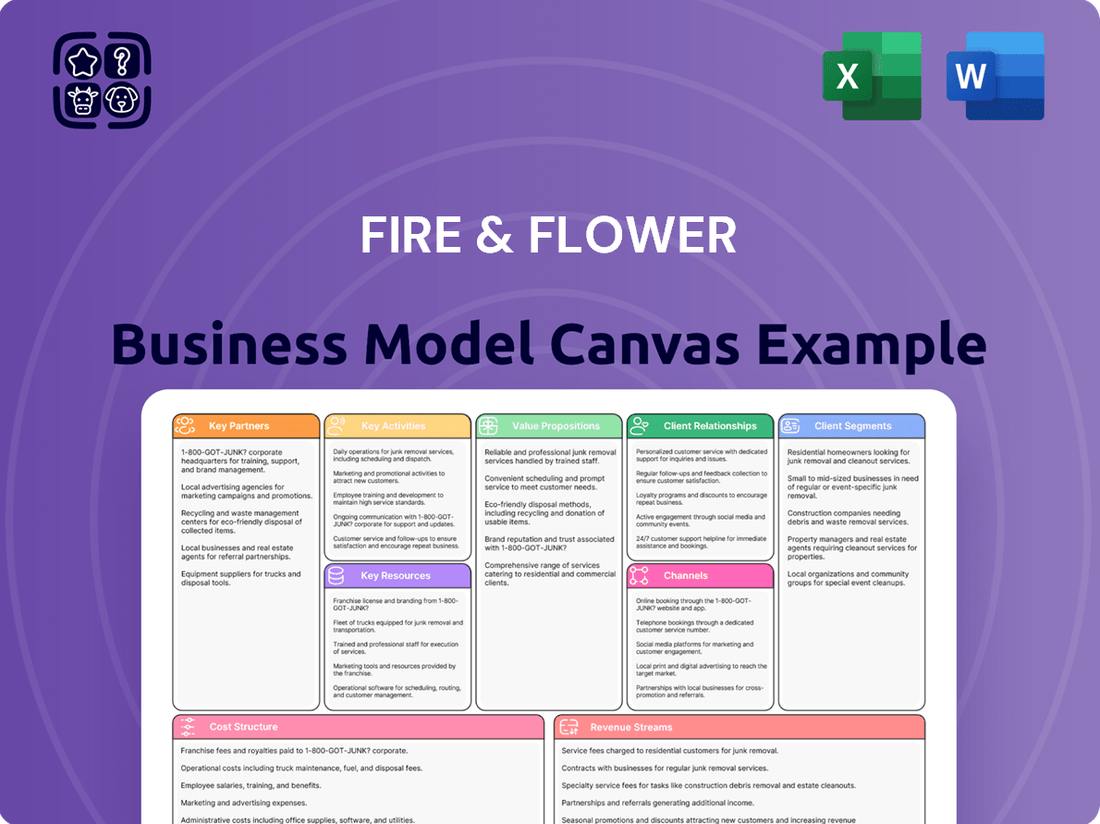

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Fire & Flower's strategic approach to customer segments, value propositions, channels, revenue streams, key resources, activities, partnerships, and cost structure. When you complete your transaction, you'll gain full access to this same, professionally formatted canvas, ready for your analysis and application.

Resources

Fire & Flower's extensive network of corporate-owned cannabis retail stores across multiple Canadian provinces was a core physical asset. These locations offered direct sales channels and crucial brand presence, forming the foundation of their retail strategy. By the end of 2023, Fire & Flower operated over 100 retail locations, strategically positioned to capture market share and enhance customer accessibility.

The proprietary Hifyre digital platform, encompassing Spark Perks, Hifyre ONE, Hifyre IQ, and Hifyre Reach, served as a crucial intangible asset for Fire & Flower. This technology was instrumental in facilitating advanced retail operations and was designed to collect valuable consumer data.

This data collection capability was a cornerstone of the platform, providing Fire & Flower with deep insights into consumer behavior and preferences. The platform's ability to gather and analyze this information allowed for more targeted marketing and product development strategies.

Furthermore, Hifyre IQ provided sophisticated data analytics, offering market insights that were vital for optimizing business decisions. In 2023, Fire & Flower reported that its Hifyre platform processed over 1.5 million transactions, underscoring the volume of data generated and utilized for enhancing customer experience and operational efficiency.

Fire & Flower's brand equity, encompassing its flagship brand and sub-brands like Friendly Stranger and Firebird Delivery, was a cornerstone of its market presence. This intangible asset fostered consumer recognition and loyalty within the competitive Canadian cannabis sector.

The company's portfolio of provincial and municipal retail licenses was a critical legal resource. These licenses, essential for legal operation, represented a significant barrier to entry and a key enabler of Fire & Flower's business model, allowing it to build trust and a customer base.

Human Capital and Expertise

Fire & Flower’s success hinged on its human capital, particularly its experienced management teams and well-trained retail staff. These individuals possessed crucial expertise in the cannabis sector, technology integration, and retail operations, enabling the company to navigate a highly regulated market effectively.

The depth of their knowledge was indispensable for educating customers, ensuring compliance with evolving cannabis laws, and managing both the physical retail footprint and the company's digital presence. This human resource was a cornerstone in delivering a consistent and informed customer experience.

The quality of Fire & Flower's human capital directly impacted its operational efficiency and the caliber of its customer service. For instance, in 2023, employee training programs focused on product knowledge and customer engagement were highlighted as key drivers for sales growth and customer retention within the competitive Canadian cannabis retail landscape.

- Management Expertise: Skilled leadership in navigating cannabis regulations and market dynamics.

- Retail Staff Training: Employees equipped with product knowledge and customer service skills.

- Technology Integration: Staff proficient in managing digital platforms and in-store technology.

- Operational Efficiency: Human capital directly influencing day-to-day store performance and scalability.

Financial Capital

Financial capital, encompassing initial investments, debt, and sales revenue, was fundamental for Fire & Flower’s operations, expansion, and technological advancements. This access to funding was critical for its growth trajectory, including strategic acquisitions and the scaling of its physical and digital presence.

Despite facing financial headwinds that necessitated a restructuring, the company's historical reliance on capital underscores its importance for strategic initiatives. For instance, in 2023, Fire & Flower reported total revenue of CAD 273.4 million, highlighting the role of sales in generating operational capital.

- Access to Funding: Fire & Flower relied on a mix of equity, debt, and operational cash flow to fuel its business model.

- Investment in Growth: Capital was allocated towards store openings, technology investments, and mergers and acquisitions.

- Revenue Generation: Sales from its retail network and online platforms served as a primary source of ongoing financial capital.

- Restructuring Impact: Financial challenges in recent years have reshaped its capital structure and access to funding.

Fire & Flower's key resources are a blend of physical, digital, intellectual, human, and financial assets. The company's extensive network of over 100 corporate-owned retail stores across Canada provided essential physical presence and direct sales channels. Its proprietary Hifyre digital platform, including Hifyre IQ, was a vital intangible asset for data analytics and customer insights, processing over 1.5 million transactions in 2023. The brand equity of Fire & Flower and its sub-brands, coupled with crucial retail licenses, formed significant intellectual and legal resources. Experienced management and trained retail staff constituted critical human capital, ensuring operational efficiency and customer engagement. Finally, financial capital, including CAD 273.4 million in revenue reported for 2023, was fundamental for operations and growth.

| Resource Type | Specific Asset | 2023 Data/Notes |

|---|---|---|

| Physical | Retail Stores | Over 100 corporate-owned locations across Canada. |

| Digital | Hifyre Platform (incl. IQ, ONE, Reach) | Processed over 1.5 million transactions; key for data analytics. |

| Intellectual | Brand Equity | Flagship brand and sub-brands (Friendly Stranger, Firebird Delivery). |

| Legal | Retail Licenses | Provincial and municipal licenses enabling legal operation. |

| Human Capital | Management & Staff | Expertise in cannabis sector, technology, and retail operations. |

| Financial | Revenue & Capital | CAD 273.4 million in total revenue; reliance on funding for operations. |

Value Propositions

Fire & Flower distinguished itself by offering a carefully curated selection of cannabis products, prioritizing both quality and variety for adult-use consumers. This meant customers had access to legal, rigorously tested, and safe cannabis options sourced from a diverse array of licensed producers. For instance, in 2024, Fire & Flower continued to emphasize its commitment to quality control, with a significant portion of its product offerings undergoing third-party testing to ensure compliance with stringent provincial regulations and consumer safety standards.

The Hifyre digital platform, featuring the Spark Perks loyalty program and Hifyre IQ analytics, delivered a sophisticated and personalized customer journey. This technology facilitated seamless online ordering, tailored product suggestions, and access to special offers and content, enhancing customer engagement.

By integrating online and in-store interactions, Fire & Flower aimed to make cannabis acquisition both convenient and educational. In 2023, the company reported that its digital channels accounted for a significant portion of its sales, demonstrating the effectiveness of its technology-driven approach to customer experience.

Fire & Flower's strategic placement of corporate stores and co-location partnerships, notably with Alimentation Couche-Tard's Circle K brand, significantly enhanced retail accessibility. By situating dispensaries adjacent to high-traffic convenience stores, the company integrated cannabis purchases into everyday consumer habits, making it more convenient than ever before.

This approach effectively lowered the hurdles for consumers seeking legal cannabis products. In 2024, Fire & Flower continued to leverage these convenient locations, with over 100 Circle K locations across Canada featuring Fire & Flower dispensaries, demonstrating a commitment to broad market reach and ease of access for a wide customer base.

Educational and Informed Purchasing

Fire & Flower's value proposition centers on educating consumers, making the cannabis market less intimidating. They achieve this through well-trained staff who offer personalized guidance and clear product details. This approach fosters consumer confidence and helps individuals select products that best suit their specific needs and desired effects.

This educational focus is crucial in a rapidly evolving industry. For instance, by July 2024, Fire & Flower continued to emphasize staff training to ensure they could provide accurate and helpful information on a wide range of cannabis products, from THC and CBD concentrations to different consumption methods.

- Knowledgeable Staff: Employees are trained to be resources for consumers.

- Clear Product Information: Detailed labeling and accessible data empower informed choices.

- Consumer Trust: Education builds confidence, demystifying cannabis for all user levels.

- Needs-Based Purchasing: Guiding customers to select products aligned with their preferences and intended use.

Data-Driven Insights for Optimized Selection

Fire & Flower leverages its Hifyre platform to provide data-driven insights, optimizing product selection and retail strategies. This allows for real-time adaptation to consumer preferences and market trends, ensuring popular products are consistently available and emerging trends are quickly identified.

By analyzing vast amounts of data, Fire & Flower enhances its ability to curate a relevant and responsive retail experience for its customers. This focus on data ensures that inventory management and marketing efforts are aligned with actual demand.

- Data-Informed Merchandising: Hifyre data guides product assortment, ensuring popular items are stocked and underperforming products are adjusted.

- Trend Identification: Real-time analytics from Hifyre allow for swift recognition and adoption of emerging consumer trends in the cannabis market.

- Personalized Customer Experience: Insights derived from Hifyre enable more tailored promotions and product recommendations, boosting customer engagement.

- Operational Efficiency: Data analytics optimize inventory levels and supply chain management, reducing waste and improving profitability.

Fire & Flower's value proposition is built on providing a curated, high-quality selection of legal cannabis products, ensuring safety and variety for adult consumers. This commitment to quality is underscored by rigorous testing, with a significant portion of their offerings undergoing third-party verification in 2024 to meet strict regulatory standards and consumer safety expectations.

Customer Relationships

Fire & Flower cultivated strong customer connections via its Spark Perks loyalty program, encouraging repeat business and offering unique advantages. This initiative was key in gathering customer data, enabling personalized promotions and building a community feel for regular patrons.

Spark Perks members enjoyed access to special deals, discounts, and exclusive events, driving engagement. For instance, in Q1 2024, Fire & Flower reported that Spark Perks members accounted for a significant portion of their revenue, demonstrating the program's effectiveness in fostering loyalty and driving sales.

Fire & Flower's Hifyre digital platform is central to its customer relationships, offering personalized digital interactions. This platform provided tailored product recommendations and content, drawing from individual purchasing histories and preferences. For example, in 2024, the platform aimed to boost engagement by leveraging data analytics to understand consumer behavior more deeply, fostering a more relevant and convenient shopping journey.

Fire & Flower prioritized in-store expert consultation and education, a key aspect of their customer relationships. Trained staff offered personalized guidance, helping customers navigate product selections and understand responsible consumption practices.

This human-centric approach aimed to build trust and foster a knowledgeable customer base. By 2024, Fire & Flower continued to invest in staff training, recognizing that expert advice was crucial for customer retention and satisfaction in the evolving cannabis retail landscape.

Community Building and Events

Fire & Flower actively fosters community through various initiatives. In 2024, they continued to host in-store events and educational workshops, providing spaces for cannabis consumers to connect and learn about products and responsible use.

These efforts are designed to build brand loyalty and encourage customer advocacy. By creating engaging experiences, Fire & Flower aims to cultivate a strong sense of belonging among its patrons.

- Community Engagement: Fire & Flower's strategy includes building a community around cannabis culture and education.

- In-Store Events & Workshops: The company utilizes physical locations for events that foster customer interaction and learning.

- Brand Loyalty: These initiatives are key to cultivating repeat business and turning customers into brand advocates.

- Customer Connection: The goal is to create platforms where cannabis enthusiasts can connect with each other and the brand.

Customer Service and Support

Fire & Flower prioritizes responsive and effective customer service across both its physical retail locations and digital platforms. This focus is crucial for swiftly resolving customer issues and answering inquiries, ensuring a seamless experience from product discovery through to after-sales support. In 2024, the company continued to invest in training its staff to provide knowledgeable assistance, aiming to build trust and foster loyalty.

A key aspect of their customer relationship strategy involves creating a positive overall experience. This extends beyond simple transactions to encompass helpful interactions that encourage customers to return. By consistently delivering excellent service, Fire & Flower aims to solidify its brand reputation in a competitive market.

- In-store assistance: Knowledgeable budtenders providing personalized recommendations and answering product-related questions.

- Digital support: Accessible online chat, email, and FAQ sections to address customer queries efficiently.

- Issue resolution: Prompt and effective handling of returns, exchanges, and order discrepancies to maintain customer satisfaction.

- Loyalty programs: Rewarding repeat customers to encourage continued engagement and build a strong community.

Fire & Flower's customer relationships hinge on a multi-faceted approach, blending digital innovation with personal connection. The Spark Perks loyalty program, a cornerstone of their strategy, incentivizes repeat purchases and gathers valuable customer data. In Q1 2024, this program significantly contributed to revenue, underscoring its role in fostering loyalty.

The Hifyre digital platform further personalizes the customer journey, offering tailored recommendations based on purchase history. This data-driven approach aims to enhance engagement and convenience. In 2024, continued investment in Hifyre's analytics was directed at a deeper understanding of consumer behavior.

Beyond digital, Fire & Flower emphasizes in-store expertise, with trained staff providing guidance and education. This human touch builds trust and a knowledgeable customer base, a strategy that saw continued investment in staff development throughout 2024.

Community building is also central, with in-store events and workshops fostering customer interaction and education. These initiatives are designed to cultivate brand loyalty and advocacy.

| Customer Relationship Aspect | Key Initiative | 2024 Focus/Data |

|---|---|---|

| Loyalty Program | Spark Perks | Significant revenue driver; focused on personalized offers and data collection. |

| Digital Engagement | Hifyre Platform | Tailored recommendations; enhanced by data analytics for deeper consumer understanding. |

| In-Store Experience | Expert Consultation | Continued investment in staff training for knowledgeable customer guidance. |

| Community Building | Events & Workshops | Fostering connection and education around cannabis culture. |

Channels

Fire & Flower's core channel was its expansive network of company-owned physical cannabis retail stores strategically positioned across Canada. These brick-and-mortar locations served as the primary touchpoint for customers to engage with the brand, explore a wide array of cannabis products, receive expert advice from trained staff, and complete their purchases in person. By the end of fiscal year 2023, Fire & Flower operated 107 retail stores, a testament to their commitment to a strong physical presence.

The Hifyre digital platform was a key online e-commerce channel for Fire & Flower, enabling customers to view product selections, order for in-store pickup, and engage with tailored content. This digital storefront significantly broadened Fire & Flower's market access, providing a convenient and integrated shopping journey that connected online and physical retail experiences.

The Spark Marketplace app further enhanced this digital ecosystem by offering an additional avenue for customer interaction and product discovery, reinforcing the company's commitment to a robust omnichannel strategy. This digital focus was critical in 2024 for driving customer loyalty and expanding sales channels.

Fire & Flower strategically employed a licensing model to extend its brand and Hifyre technology into new territories, enabling growth without the burden of direct ownership for each location. This approach facilitated swift expansion and wider market reach by collaborating with existing retail partners, a key element in their 2024 US market entry strategy.

Digital Advertising and Content Platforms

Fire & Flower leveraged its Hifyre Reach digital advertising network and strategic acquisitions, such as PotGuide and Wikileaf, to serve as key channels for both digital marketing and content dissemination. These platforms were instrumental in attracting significant online traffic and actively engaging potential customers, effectively converting digital interest into tangible retail purchases.

These digital assets provided a broad and expansive reach for Fire & Flower's brand messaging and detailed product information. For instance, by the end of 2023, Hifyre Reach was reported to have reached millions of unique users, demonstrating its substantial audience engagement capabilities.

- Hifyre Reach: A proprietary digital advertising network designed to connect with consumers interested in cannabis.

- PotGuide & Wikileaf Acquisitions: These platforms brought established online communities and content libraries, enhancing digital reach and customer engagement.

- Customer Conversion: The channels were designed to drive traffic to Fire & Flower's retail locations and e-commerce platforms, directly impacting sales.

- Brand Messaging: Provided a scalable platform for consistent and targeted communication of brand values and product offerings.

Third-Party Delivery Services (Firebird Delivery)

Fire & Flower’s Firebird Delivery service offered a direct-to-consumer channel, bringing cannabis products directly to customers' homes in select areas. This enhanced convenience aligned with growing consumer demand for at-home delivery options.

By expanding accessibility through Firebird Delivery, Fire & Flower catered to a broader customer base and adapted to evolving purchasing habits in the cannabis market. This strategy aimed to capture market share by offering a seamless and convenient shopping experience.

- Channel: Third-Party Delivery Services (Firebird Delivery)

- Purpose: Direct-to-consumer home delivery in specific regions.

- Customer Benefit: Increased convenience and accessibility for at-home purchases.

- Market Adaptation: Responds to evolving consumer preferences for delivery services.

Fire & Flower's channels are a blend of physical retail, robust digital platforms, and strategic partnerships. The company's 107 retail stores as of fiscal year-end 2023 formed the backbone, complemented by the Hifyre e-commerce platform for online browsing and pickup. The Spark Marketplace app further integrated digital engagement, while the Hifyre Reach advertising network and acquisitions like PotGuide and Wikileaf amplified online presence and customer acquisition. Licensing agreements and the Firebird Delivery service expanded market reach and convenience, creating a comprehensive omnichannel experience.

| Channel | Description | Key Metric/Data Point | Fiscal Year 2023 Impact |

|---|---|---|---|

| Company-Owned Retail Stores | Physical locations for in-person sales and brand experience. | 107 stores operated. | Primary revenue driver and customer touchpoint. |

| Hifyre Digital Platform | E-commerce website for product browsing, ordering, and pickup. | Facilitates integrated online-to-offline shopping. | Broadened market access and enhanced customer convenience. |

| Spark Marketplace App | Additional digital avenue for customer interaction and product discovery. | Reinforces omnichannel strategy. | Drove customer loyalty and expanded sales channels. |

| Hifyre Reach & Acquisitions (PotGuide, Wikileaf) | Digital advertising network and content platforms for marketing and engagement. | Hifyre Reach reached millions of unique users. | Attracted online traffic, engaged potential customers, and drove retail purchases. |

| Licensing Model | Extends brand and technology into new territories through partnerships. | Key to US market entry strategy. | Facilitated rapid expansion and wider market reach. |

| Firebird Delivery | Direct-to-consumer home delivery service. | Enhanced convenience and accessibility. | Catered to evolving consumer purchasing habits and captured market share. |

Customer Segments

Fire & Flower's core customer base consists of adults legally permitted to purchase recreational cannabis. This segment is diverse, with varying preferences for product types, from flower and edibles to vapes, and differing desired potency levels and consumption methods.

In 2023, the Canadian cannabis market saw significant growth, with adult-use sales reaching an estimated CAD 4.1 billion, indicating a robust demand from this primary customer segment. Fire & Flower, operating within this legal framework, caters to these consumers across its retail network.

Fire & Flower specifically aimed to attract individuals who were new to cannabis or felt uncertain about making purchases. Their strategy revolved around providing education and employing well-informed staff to assist this segment in understanding product options and safe consumption practices.

This customer group prioritizes trustworthy information and a welcoming retail atmosphere. In 2024, the Canadian cannabis market continued to see growth, with a significant portion of consumers being relatively new to the product, underscoring the relevance of Fire & Flower's educational approach.

Fire & Flower also actively targets experienced cannabis users, often referred to as connoisseurs. This segment is looking for more than just the basics; they seek specific, often rarer, strains with unique terpene profiles, higher THC or CBD potencies, and specialized consumption accessories. For instance, in 2024, Fire & Flower's premium product lines, which often feature these sought-after characteristics, saw consistent demand, reflecting this user's discerning taste.

These discerning customers value a retail experience that acknowledges their knowledge and preferences. They appreciate curated selections that highlight quality and variety, and they are more likely to engage with brands that offer data-driven insights into product attributes. The company's investment in data analytics and its ability to provide detailed product information likely resonates strongly with this group, fostering loyalty through informed purchasing decisions.

Convenience-Oriented Shoppers

Convenience-oriented shoppers represent a significant customer base for Fire & Flower, valuing quick and easy access to cannabis products. These individuals often seek to integrate their purchases seamlessly into existing routines, appreciating efficient service and readily available options. The company's strategy of co-locating with Circle K stores directly addresses this need for accessibility. In 2024, Fire & Flower continued to leverage these partnerships to enhance convenience.

The digital platform, coupled with physical store accessibility, caters effectively to this segment. Online ordering for in-store pickup offers a streamlined experience, minimizing wait times and allowing customers to plan their purchases efficiently. This focus on a frictionless journey is paramount for shoppers prioritizing ease of access and rapid transactions.

- Co-location Strategy: Fire & Flower's integration with Circle K aims to capture convenience shoppers who are already frequenting these locations.

- Digital Integration: Online ordering and pickup options provide a key channel for this segment, enhancing speed and flexibility.

- Efficiency Focus: The business model prioritizes quick transactions and minimal friction, aligning with the core needs of convenience-oriented consumers.

- Market Reach: By offering multiple touchpoints, Fire & Flower expands its ability to serve this broad customer segment across various geographic areas.

Data-Engaged and Loyalty Program Participants

This segment comprises customers actively engaging with Fire & Flower's digital ecosystem, particularly those enrolled in loyalty programs like Spark Perks. These customers demonstrate a clear preference for personalized promotions and exclusive benefits, valuing the convenience offered by digital platforms. Their participation is crucial, providing Fire & Flower with rich data to refine product assortments and marketing strategies.

In 2024, Fire & Flower reported a significant portion of its revenue was driven by its loyalty program members. These data-engaged customers are more likely to make repeat purchases and respond positively to targeted marketing campaigns, contributing to higher customer lifetime value.

- Loyalty Program Value: Customers in this segment exhibit a higher average transaction value and purchase frequency compared to non-members.

- Data Generation: Their engagement with digital tools and personalized offers provides Fire & Flower with essential data for customer behavior analysis.

- Marketing Efficiency: Targeted campaigns for this segment show improved conversion rates, optimizing marketing spend.

- Customer Retention: The focus on exclusive access and personalized experiences fosters strong customer loyalty and reduces churn.

Fire & Flower's customer base is primarily adults legally allowed to purchase recreational cannabis, a segment that is diverse in its product preferences, from flower to edibles, and varying desired potency levels.

The company also actively targets new cannabis users by offering educational resources and knowledgeable staff, aiming to demystify products and consumption for a less experienced audience.

Experienced cannabis users, or connoisseurs, are another key segment, seeking premium, often rare, strains with specific terpene profiles and higher potency levels.

Convenience-seeking shoppers are attracted by efficient service and accessible locations, with Fire & Flower's co-location strategy with Circle K directly addressing this need.

Data-engaged customers, particularly those in loyalty programs like Spark Perks, are crucial for their repeat purchases and responsiveness to personalized offers.

| Customer Segment | Key Characteristics | Fire & Flower Strategy | 2024 Relevance/Data |

|---|---|---|---|

| Legal Adult Consumers | Diverse preferences (flower, edibles, vapes), varying potency needs. | Broad retail network, product variety. | Canadian adult-use cannabis sales projected to exceed CAD 4.5 billion in 2024, indicating strong demand. |

| New/Uncertain Consumers | Seek education, guidance, and a welcoming environment. | In-store education, knowledgeable staff. | Continued growth in new consumers entering the market, emphasizing the need for accessible information. |

| Experienced/Connoisseur Consumers | Seek specific strains, high potency, unique terpene profiles, premium products. | Curated premium product lines, detailed product information. | Demand for high-THC products remains strong, with specialized strains showing consistent sales growth. |

| Convenience Shoppers | Value quick access, efficient service, seamless integration into routines. | Co-location with Circle K, online ordering for pickup. | Expansion of co-located stores continues, improving accessibility for impulse and convenience-driven purchases. |

| Data-Engaged/Loyalty Members | Value personalized offers, exclusive benefits, digital engagement. | Spark Perks loyalty program, targeted marketing. | Loyalty program members represent a significant portion of repeat business, driving higher average transaction values. |

Cost Structure

A substantial part of Fire & Flower's expenses stemmed from running its extensive network of physical retail locations. These costs encompassed rent for prime locations, essential utilities, employee salaries and benefits, security measures, and ongoing store upkeep. For instance, in the first quarter of 2024, Fire & Flower reported operating expenses that were heavily influenced by these retail overheads.

Fire & Flower's investment in its Hifyre digital ecosystem, encompassing platforms like Spark Perks and Hifyre IQ, was a significant cost driver. These expenses covered software development, robust IT infrastructure, and substantial data storage needs. In 2024, the company continued to allocate resources to ensure these critical digital assets remained competitive and functional for their omnichannel strategy.

Fire & Flower's cost structure was significantly shaped by the procurement of cannabis products. The expenses associated with purchasing from licensed producers represented a substantial outlay. For instance, in the fiscal year ending March 3, 2024, Fire & Flower reported cost of goods sold of $327.2 million, highlighting the direct impact of inventory acquisition on its finances.

Beyond the direct purchase cost, the company incurred considerable expenses related to its supply chain. These included the costs of logistics, warehousing, and transportation, all essential for getting products from producers to retail locations. Effective management of these operational aspects was key to keeping these costs in check and ensuring a steady supply of inventory.

The company's profitability was also sensitive to market dynamics, particularly fluctuations in wholesale cannabis prices. These price variations could directly impact the cost of goods sold and, consequently, the gross margin. The ability to navigate these wholesale price swings was a critical factor in maintaining financial performance.

Marketing and Advertising Expenses

Fire & Flower's cost structure includes significant marketing and advertising expenses to build brand awareness and drive customer acquisition. These costs cover a range of activities, from digital campaigns targeting specific demographics to in-store promotions and the management of their Hifyre platform and loyalty programs.

In 2024, the cannabis retail landscape remained highly competitive, necessitating ongoing investment in marketing to differentiate Fire & Flower and its offerings. The company also faced the challenge of navigating complex and often restrictive advertising regulations specific to the cannabis industry, which can increase the cost and complexity of promotional efforts.

- Digital Advertising: Investment in online ads across various platforms to reach potential customers.

- In-Store Promotions: Costs associated with point-of-sale displays, discounts, and events within retail locations.

- Loyalty Program Management: Expenses related to operating and incentivizing the Hifyre platform and its associated rewards.

- Regulatory Compliance: Costs incurred to ensure all marketing activities adhere to provincial and federal cannabis advertising guidelines.

Compliance, Licensing, and Regulatory Costs

Operating within the highly regulated cannabis sector means significant expenses for licenses and ongoing compliance. Fire & Flower, like its peers, faces substantial costs associated with obtaining and maintaining provincial and federal operating licenses. These expenditures are crucial for the company's legal standing and long-term viability.

These compliance efforts are not one-time fees; they are continuous. This includes adhering to stringent product testing, packaging, and marketing regulations, all of which contribute to the overall cost structure. Legal fees are also a recurring expense, ensuring the business navigates the complex and evolving regulatory landscape correctly.

- Licensing Fees: Costs incurred to acquire and renew operating permits across various jurisdictions.

- Regulatory Compliance: Expenses tied to meeting evolving provincial and federal cannabis laws, including product safety and reporting.

- Legal Counsel: Ongoing fees for legal advice to ensure adherence to all applicable regulations and to manage potential legal challenges.

Fire & Flower's cost structure is heavily influenced by its extensive retail operations, including rent, utilities, and staffing for its numerous stores. The company also invests significantly in its digital Hifyre ecosystem, covering software development and IT infrastructure. Crucially, the procurement of cannabis products represents a major expense, with cost of goods sold reaching $327.2 million in fiscal year 2024.

Marketing and advertising are essential, though costly, given the competitive and regulated cannabis market, with expenses covering digital campaigns, in-store promotions, and loyalty program management. Furthermore, substantial costs are associated with obtaining and maintaining licenses and ensuring ongoing compliance with provincial and federal cannabis regulations, including legal fees.

| Cost Category | Key Components | Fiscal Year 2024 Impact |

|---|---|---|

| Retail Operations | Rent, Utilities, Staffing, Security, Upkeep | Significant driver of operating expenses |

| Digital Ecosystem (Hifyre) | Software Development, IT Infrastructure, Data Storage | Ongoing investment for competitive platforms |

| Product Procurement | Purchasing Cannabis from Licensed Producers | Cost of Goods Sold: $327.2 million (FY 2024) |

| Supply Chain & Logistics | Warehousing, Transportation, Distribution | Essential for inventory management and availability |

| Marketing & Advertising | Digital Ads, In-Store Promotions, Loyalty Programs | Crucial for brand awareness and customer acquisition in a competitive market |

| Licensing & Compliance | Operating Licenses, Regulatory Adherence, Legal Fees | Continuous and substantial expenditure for legal operation |

Revenue Streams

Fire & Flower's main income came from selling cannabis products directly to consumers in its own stores. This included a wide variety of items like dried cannabis, pre-rolled joints, edibles, concentrates, and accessories. These retail sales were the biggest contributor to the company's overall revenue.

Fire & Flower's digital platform, Hifyre, represented a significant revenue stream through licensing agreements. This allowed other cannabis retailers, both within Canada and notably in the United States, to leverage Fire & Flower's proprietary technology. This strategy offered a high-margin, recurring revenue model that was not directly tied to the company's own retail sales performance.

Fire & Flower's revenue model extends beyond its direct retail operations through strategic licensing support and royalties. This allows the company to expand its brand presence and generate income without the significant capital outlay typically associated with opening new physical locations.

For instance, in 2023, Fire & Flower continued to explore and implement licensing agreements, leveraging its established brand and operational expertise to partner with other cannabis retailers. While specific royalty figures for 2024 are not yet fully detailed, the strategy aims to capture value from brand recognition and standardized operating procedures provided to licensees.

E-commerce Sales and Delivery Services

Fire & Flower's e-commerce operations, primarily through its Hifyre platform, alongside its Firebird Delivery service, represent a significant revenue stream. These digital channels offer customers the convenience of purchasing cannabis products from home, directly contributing to the company's overall sales volume and market reach.

In 2024, the company continued to leverage these online sales avenues to meet growing consumer demand for accessible and convenient delivery options. This strategy aims to capture a larger share of the market by catering to a digitally-native customer base.

- E-commerce Platform: Hifyre facilitates online transactions for a wide range of cannabis products.

- Delivery Services: Firebird Delivery ensures efficient and compliant home delivery of online orders.

- Convenience Factor: These channels address the increasing consumer preference for at-home shopping experiences.

- Market Expansion: Online sales and delivery extend Fire & Flower's reach beyond its physical store locations.

Data and Analytics Services

Fire & Flower's Hifyre IQ platform is a key revenue generator, transforming raw consumer purchasing data into actionable market insights. This data-driven approach allows them to offer valuable consulting services and market intelligence reports to other businesses within the cannabis industry. In 2023, Fire & Flower reported that its data analytics segment contributed significantly to its overall strategy, highlighting the growing importance of leveraging proprietary data for external revenue.

The monetization of this data asset is crucial. By providing these analytics, Fire & Flower not only diversifies its income but also solidifies its position as a thought leader in the cannabis retail space. This strategy capitalizes on the vast amounts of consumer behavior information gathered through their extensive retail footprint and digital channels.

- Hifyre IQ Platform: Leverages extensive consumer purchasing data.

- Revenue Generation: Through market insights and consulting services for industry stakeholders.

- Data Asset Monetization: Capitalizes on valuable data collected from retail and digital operations.

- Strategic Importance: Enhances Fire & Flower's market intelligence and industry influence.

Fire & Flower's revenue streams are diverse, primarily driven by direct-to-consumer retail sales of a wide array of cannabis products. These sales, encompassing everything from flower to edibles and accessories, form the bedrock of their income. The company also generates revenue through its Hifyre platform, offering licensing opportunities and e-commerce sales, which extends its market reach and provides a scalable income source. Furthermore, Fire & Flower monetizes its proprietary data through the Hifyre IQ platform, selling market insights and consulting services to other industry players.

| Revenue Stream | Description | 2023/2024 Focus |

|---|---|---|

| Retail Sales | Direct sale of cannabis products in physical stores. | Continued expansion and optimization of store footprint. |

| Hifyre Platform (Licensing & E-commerce) | Licensing proprietary technology and facilitating online sales. | Growth in US licensing and expansion of delivery services. |

| Hifyre IQ (Data Analytics) | Monetizing consumer data through market insights and consulting. | Leveraging extensive data for strategic industry partnerships. |

Business Model Canvas Data Sources

The Fire & Flower Business Model Canvas is informed by a blend of internal financial data, comprehensive market research on the cannabis industry, and strategic insights from operational performance. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's current state and future direction.