Fire & Flower PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

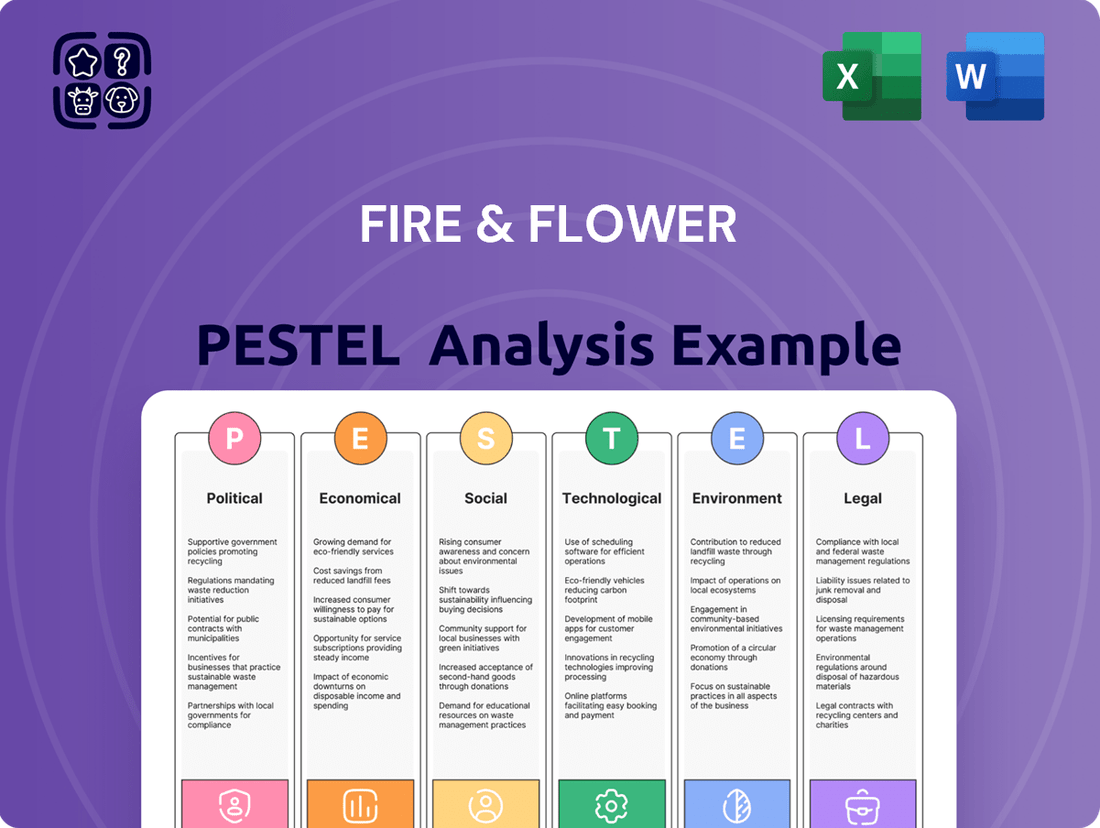

Navigate the dynamic cannabis market with our comprehensive PESTEL Analysis of Fire & Flower. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental considerations, and legal frameworks are impacting this innovative company. Gain the strategic foresight needed to make informed decisions and stay ahead of the curve.

Unlock critical insights into the external forces shaping Fire & Flower's future. From evolving regulations to consumer preferences, our PESTEL analysis provides a detailed roadmap for success. Invest in actionable intelligence that empowers your strategy.

Ready to gain a competitive edge? Our Fire & Flower PESTEL Analysis delivers expert-level insights into the political, economic, social, technological, environmental, and legal landscape. Download the full version now and equip yourself with the knowledge to thrive.

Political factors

The governmental regulatory landscape in Canada's cannabis sector, including for companies like Fire & Flower, is a key political factor. This industry is governed by a comprehensive federal and provincial regulatory structure that dictates everything from product standards to retail operations and market access.

Health Canada has been actively reviewing and proposing adjustments to the Cannabis Act, with recent initiatives focused on easing administrative requirements and fostering greater industry diversity. For instance, in late 2023 and early 2024, discussions around streamlining licensing processes and addressing market concentration were prominent.

These ongoing modifications are a direct result of the broad impact of cannabis legalization, which commenced in 2018, and the government's commitment to a continuous evaluation of the legislation's effectiveness and unintended consequences.

Canada's Cannabis Act, implemented in 2018, is currently under a comprehensive review to evaluate its economic, social, and environmental effects. This process is crucial for understanding the Act's real-world impact since legalization.

The review has generated significant recommendations and potential amendments, which could substantially alter the cannabis industry's landscape, particularly concerning licensing procedures and market entry for businesses. These changes aim to optimize the regulatory framework.

The expert panel's final report was submitted to Parliament in March 2024, and proposals for specific amendments were released in June 2024, indicating a proactive approach to refining cannabis policy based on empirical data and industry feedback.

High excise taxes have consistently squeezed cannabis producers' margins, impacting their ability to invest and compete. For instance, in 2023, the Canadian cannabis industry faced substantial tax burdens that contributed to ongoing profitability challenges for many licensed producers.

A key development is the expert panel's recommendation to Finance Canada for a revised tax structure. This proposal suggests a model that could vary excise duties based on the tetrahydrocannabinol (THC) content of cannabis products, aiming to reduce the financial strain on businesses and potentially reshape market pricing.

Provincial retail regulations

Beyond federal oversight, Canadian provinces implement distinct retail regulations for cannabis, impacting store density, product offerings, and operational standards. This patchwork of provincial rules creates a challenging landscape for companies like the former Fire & Flower, demanding region-specific approaches. For instance, as of early 2024, provinces like Alberta continued to permit a higher density of cannabis stores compared to some other provinces, reflecting differing policy objectives regarding market access and competition.

These provincial variances necessitate adaptive business strategies. Some provinces are actively reviewing and potentially easing existing restrictions. For example, discussions in Ontario throughout 2024 have centered on increasing the number of retail store authorizations, aiming to curb the illicit market by providing more legal access points for consumers.

- Provincial Regulatory Divergence: Each Canadian province maintains unique rules on cannabis retail, affecting everything from how many stores can open in an area to what products are allowed.

- Operational Complexity: These differing provincial regulations force retailers to develop tailored operational plans for each market they operate in, increasing complexity and cost.

- Evolving Policies: Several provinces are considering or implementing changes to their retail frameworks, such as allowing more stores, to improve market access and combat illegal sales.

- Market Access Impact: By early 2024, provinces like Alberta had notably higher cannabis store-to-population ratios than some other provinces, showcasing the direct impact of regulatory differences on market saturation.

Illicit market displacement efforts

Illicit market displacement remains a central focus for governments regulating cannabis. While the legal market has made considerable inroads, the illegal market continues to present a competitive challenge. Ongoing policy and regulatory adjustments are designed to enhance the legal market's competitiveness and consumer accessibility.

These efforts are showing tangible results, with a significant majority of Canadian cannabis consumers now opting for legal channels.

- Progressive Success: Nearly 72% of Canada's cannabis users now purchase from the legal market.

- Policy Aims: Government policies are continually adjusted to make the legal market more competitive.

- Ongoing Challenge: The illicit market, though diminished, still represents a source of competition.

Canada's cannabis sector is shaped by evolving federal and provincial regulations, with ongoing reviews of the Cannabis Act aiming to streamline processes and boost industry diversity. For example, proposals released in June 2024 suggested changes to licensing and market entry, reflecting a data-driven approach to policy refinement.

Taxation remains a significant political factor, with recommendations in early 2024 proposing a THC-content-based excise duty structure to alleviate financial pressure on businesses and potentially influence market pricing.

Provincial regulatory differences create operational complexities, though some provinces, like Ontario, were considering easing restrictions in 2024 to increase legal market access and combat illicit sales, a trend mirrored by Alberta's higher store-to-population ratios earlier in the year.

Government efforts continue to focus on displacing the illicit market, with nearly 72% of Canadian cannabis users now purchasing legally, indicating progressive success in policy aims.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors influencing Fire & Flower, dissecting the impact of Political, Economic, Social, Technological, Environmental, and Legal forces.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the cannabis retail landscape.

The Fire & Flower PESTLE analysis provides a clear, summarized version of the external factors impacting the cannabis industry, offering a pain point reliever by simplifying complex market dynamics for easier referencing during strategic discussions.

Economic factors

The Canadian cannabis sector, after its initial boom post-legalization, is now grappling with market saturation. This means there are more products and retailers than the current demand can comfortably support, leading to price pressures and a tougher environment for growth.

Intense competition and an oversupply of products are key drivers of this saturation. Many cannabis companies are finding it challenging to turn a profit, forcing them to re-evaluate their strategies or seek partnerships. For instance, in 2023, the Canadian adult-use cannabis market saw a significant increase in retail outlets, further intensifying competition.

This challenging landscape is fueling consolidation within the industry. Companies are either merging, being acquired, or going out of business. Fire & Flower's acquisition by Alimentation Couche-Tard in early 2023, a deal valued at approximately $380 million CAD, is a prime example of this trend, showcasing how larger entities are absorbing struggling players.

Many cannabis retailers, even those with robust sales figures, are struggling to turn a profit. This is largely due to significant burdens from high taxation, the ongoing costs of regulatory compliance, and intense market competition. For instance, in some Canadian provinces, excise taxes can represent a substantial percentage of a retailer's revenue, directly impacting their bottom line.

These financial pressures are leading to industry consolidation and downsizing. Businesses are forced to cut costs, and the sheer weight of regulatory fees can consume a considerable portion of operational expenses, making it difficult to achieve sustainable profitability. Industry stakeholders are actively advocating for tax relief and a more streamlined regulatory environment to improve the financial health of cannabis businesses.

Canadian cannabis consumers are showing a growing preference for value, with price increasingly dictating purchase decisions. This trend is particularly pronounced among younger demographics who are actively seeking out more affordable options.

This heightened price sensitivity directly affects retailers like Fire & Flower by squeezing profit margins and demanding agile, competitive pricing strategies to remain attractive in the market.

Data from 2022/2023 indicated that the average Canadian spent approximately $150 annually on cannabis, a figure that likely reflects this growing consumer focus on cost-effectiveness.

Economic contribution to GDP and jobs

The legal cannabis industry is increasingly making its mark on Canada's economy. It's a significant source of both economic output and employment. This sector is not just a niche market anymore; it's a growing contributor to the nation's financial health.

The impact is substantial, with billions added to the Gross Domestic Product and tens of thousands of Canadians finding employment within the industry. For instance, in 2024, the sector contributed an impressive $7.4 billion to Canada's GDP. This economic injection underscores the industry's maturing role and its potential for continued expansion, even as it navigates current market dynamics.

- Economic Growth: The cannabis sector added $7.4 billion to Canada's GDP in 2024.

- Job Creation: The industry supports tens of thousands of jobs across the country.

- Sector Importance: This demonstrates the growing significance of legal cannabis to the Canadian economy.

Regional market growth variances

The cannabis market in Canada isn't a single, uniform entity; it's a patchwork quilt of provincial growth rates. Ontario and Alberta are consistently showing the strongest consumer spending, with projections indicating they will continue to lead the pack through 2025. This means retailers must tailor their approaches, recognizing that what works in one province might not fly in another.

Quebec, for instance, has also demonstrated robust sales figures in its legal cannabis market, showcasing a distinct regional dynamic. Understanding these variances is crucial for effective market penetration and strategic planning.

- Ontario and Alberta lead in projected cannabis consumer spending through 2025.

- Retail strategies must account for diverse provincial demand and preferences.

- Quebec's legal cannabis market is experiencing significant sales growth.

- Regulatory landscapes also differ, influencing market accessibility and operations.

The Canadian cannabis industry is facing significant economic headwinds, primarily due to market saturation and intense competition. This has led to price wars and squeezed profit margins for retailers, impacting overall profitability. For instance, while the sector contributed an estimated $7.4 billion to Canada's GDP in 2024, many individual businesses struggle to achieve sustainable profits due to high operational costs and taxes.

Consumer spending patterns are shifting towards value, with price sensitivity increasing, particularly among younger demographics. This necessitates agile pricing strategies for companies like Fire & Flower to remain competitive and attract customers. Data from 2022/2023 showed Canadians spent an average of $150 annually on cannabis, a figure likely influenced by this growing focus on cost-effectiveness.

The economic landscape is also characterized by significant provincial variations in consumer spending and regulatory environments. Ontario and Alberta are projected to lead consumer spending through 2025, requiring tailored regional strategies. Furthermore, the industry is experiencing consolidation, with acquisitions like Alimentation Couche-Tard's purchase of Fire & Flower for approximately $380 million CAD in early 2023 highlighting this trend.

| Economic Factor | 2024/2025 Data/Trend | Impact on Fire & Flower |

|---|---|---|

| Market Saturation & Competition | Intense competition, oversupply. 2023 saw a significant increase in retail outlets. | Price pressures, squeezed profit margins, need for cost efficiency. |

| Consumer Spending Habits | Growing preference for value and affordability. | Requires competitive pricing strategies, focus on value proposition. |

| Provincial Economic Performance | Ontario & Alberta projected to lead consumer spending through 2025. Quebec showing robust sales. | Necessitates differentiated provincial market strategies. |

| Industry Consolidation | Acquisitions and mergers are common. Fire & Flower acquired by Alimentation Couche-Tard for ~$380M CAD (early 2023). | Indicates a challenging environment for smaller players, potential for strategic partnerships or acquisitions. |

Preview the Actual Deliverable

Fire & Flower PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Fire & Flower offers a comprehensive overview of the external factors impacting the company's operations and strategic decisions. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Public opinion on cannabis has significantly shifted, moving from a stance of cautious acceptance to broader endorsement. This evolving perception highlights a growing social acceptability of cannabis use across various age groups and demographics.

This normalization trend is evident in the expanding range of occasions for cannabis consumption. It's no longer solely for recreational purposes; people are integrating it into daily routines and social gatherings more frequently.

In Canada, this shift is quantifiable: over one in three adults aged 18 to 44 reported using cannabis within the past 12 months, underscoring the widespread acceptance and use.

Cannabis consumption is notably increasing among younger demographics, specifically Gen Z and Millennials. This trend is accompanied by a shrinking gender gap in usage patterns, indicating a broader societal acceptance. Retailers need to adapt to these evolving consumer preferences, particularly as younger consumers demonstrate a higher propensity for purchasing products featuring a diverse array of cannabinoids.

Consumer tastes are evolving, pushing demand for more than just dried cannabis. Shoppers are increasingly seeking out edibles, beverages, vape cartridges, and concentrates, reflecting a desire for convenience and varied consumption methods. This trend saw the Canadian cannabis edibles market alone reach approximately CAD 400 million in 2023, with continued growth projected.

There's a noticeable uptick in consumer interest for cannabis products aligned with wellness goals, such as those with specific cannabinoid ratios (like CBD-dominant options) or infused with other beneficial ingredients. The concept of microdosing is also gaining traction, appealing to consumers looking for subtler effects. This diversification necessitates that retailers like Fire & Flower broaden their product assortments to meet these nuanced preferences.

Consumer focus on quality and consistency

As the cannabis market matures, consumers are shifting their focus from sheer THC potency to a greater appreciation for quality, consistency, and distinct strain profiles. This evolution is driving demand for craft cannabis producers who can deliver unique and reliable products. For instance, a 2024 industry report indicated that over 60% of surveyed cannabis consumers now consider terpene profiles and overall product quality as key purchasing factors, a significant increase from previous years.

This consumer preference necessitates that retailers, like Fire & Flower, meticulously curate their product offerings. They need to ensure a steady supply of high-quality, consistently produced cannabis that meets these discerning tastes. Transparency regarding sourcing, cultivation methods, and cannabinoid/terpene data is becoming paramount for building consumer trust and loyalty.

The emphasis on quality and consistency directly impacts Fire & Flower’s operational strategy:

- Product Curation: Prioritizing suppliers known for consistent quality and unique offerings.

- Supply Chain Management: Strengthening relationships with cultivators to ensure product integrity from seed to sale.

- Consumer Education: Providing detailed product information, including terpene analysis and origin stories, to meet demand for transparency.

- Brand Differentiation: Building a reputation for offering premium, reliable cannabis experiences that cater to evolving consumer preferences.

Public health awareness and education

There's a growing emphasis on public health and safety concerning cannabis, with initiatives aimed at informing consumers about its effects. This includes educating people on how long edibles might last and the link between THC concentration and impairment. For instance, Health Canada mandates warning messages on cannabis product packaging, underscoring the societal commitment to informed use.

The industry recognizes the need for continued research into both the potential risks and benefits of cannabis. This ongoing scientific inquiry is crucial for developing evidence-based public health strategies and product regulations. As of 2024, public health organizations continue to provide resources and guidelines for responsible cannabis consumption, reflecting this societal focus.

Key aspects of public health awareness include:

- Consumer Education: Providing clear information on product labels and through public campaigns regarding dosage, onset, and duration of effects, especially for edibles.

- Impairment Awareness: Highlighting the relationship between THC levels and the degree of impairment to promote safe practices, particularly concerning driving.

- Risk-Benefit Research: Supporting and disseminating research findings on the potential health impacts, both positive and negative, of cannabis use.

- Regulatory Compliance: Ensuring that all cannabis products adhere to strict Health Canada guidelines for packaging and labeling, including health warnings.

Societal attitudes towards cannabis have dramatically shifted, with increasing acceptance across demographics, especially among younger generations like Gen Z and Millennials. This normalization is reflected in the expanding occasions for use and a growing demand for diverse product formats beyond traditional dried flower, such as edibles and beverages, with the Canadian edibles market alone reaching approximately CAD 400 million in 2023.

Consumers are increasingly prioritizing quality, consistency, and unique strain profiles, with over 60% of surveyed cannabis consumers in 2024 citing terpene profiles and product quality as key purchasing factors. This evolution necessitates retailers like Fire & Flower to meticulously curate offerings and enhance transparency regarding sourcing and cannabinoid data to build consumer trust.

Public health and safety remain a significant focus, with ongoing efforts to educate consumers on responsible consumption, dosage, and the link between THC concentration and impairment. Health Canada mandates warning messages on product packaging, underscoring the commitment to informed use and continued research into cannabis's potential risks and benefits.

Technological factors

Digital platforms are revolutionizing how cannabis retailers like Fire & Flower connect with customers. Their Hifyre™ platform exemplifies this trend, offering online ordering, delivery, and loyalty programs that are crucial for customer engagement and operational efficiency. This digital-first approach is increasingly viewed as a key differentiator in the competitive cannabis market.

Seamless point-of-sale (POS) systems and advanced inventory management are vital for efficient cannabis retail operations. These technologies offer real-time data, boost productivity, and ensure adherence to strict regulations. For instance, Cova Software provides integrated payment processing and POS solutions specifically tailored for cannabis dispensaries, helping them manage sales and stock effectively.

Data analytics is revolutionizing how cannabis retailers like Fire & Flower understand their customers. By analyzing purchasing patterns and preferences, these businesses can personalize product recommendations and marketing efforts. For instance, in 2024, many leading cannabis retailers reported significant increases in customer engagement and sales conversion rates directly attributable to data-driven personalization strategies.

This sophisticated approach allows for better demand forecasting, ensuring optimal inventory management and reducing waste. AI-powered analytics tools are becoming increasingly crucial, enabling faster processing of vast datasets to uncover actionable insights. By 2025, it's projected that companies leveraging advanced data analytics will see a substantial competitive advantage in customer retention and market share growth within the evolving cannabis sector.

E-commerce and delivery innovations

E-commerce and delivery innovations are transforming cannabis retail, making online ordering and swift delivery essential for customer convenience and market competitiveness. Fire & Flower's investment in these areas directly enhances accessibility and broadens its customer base.

Platforms like Dutchie are key enablers, streamlining online transactions and delivery logistics. This integration is crucial for capturing market share, especially as consumer expectations for seamless digital experiences grow. For instance, by Q1 2024, the Canadian cannabis market saw a significant portion of sales occurring through online channels, highlighting the importance of these technological advancements.

- Enhanced Customer Reach: Online platforms extend Fire & Flower's physical store limitations, tapping into a wider demographic.

- Increased Sales Volume: Convenience drives higher purchase frequency and basket size, as seen in markets with mature e-commerce integration.

- Operational Efficiency: Streamlined digital ordering and delivery reduce overhead and improve inventory management.

AI and automation in industry operations

Artificial intelligence (AI) and machine learning are becoming foundational in the cannabis sector, impacting everything from growing plants to serving customers. These technologies are key to making operations smoother and more profitable.

Efficiency gains are significant. For instance, AI can pinpoint the best plant genetics for stable growth and higher yields, while also helping to cut down on labor expenses throughout the entire production and distribution chain. This optimization is crucial for managing costs in a competitive market.

The customer experience is also being transformed. AI-powered tools like chatbots and sophisticated mobile applications are increasingly being used by dispensaries to handle customer inquiries, personalize recommendations, and streamline the purchasing process. This not only improves customer satisfaction but also drives sales.

Looking ahead, the integration of AI is expected to accelerate. By 2025, it's projected that AI will play an even larger role in predictive analytics for demand forecasting, inventory management, and quality control, further solidifying its importance for companies like Fire & Flower.

- AI in cultivation: Enhancing crop yields and genetic stability.

- Operational efficiency: Reducing labor costs and optimizing the supply chain.

- Customer engagement: AI-driven chatbots and apps for personalized service.

- Market trends: Increased adoption of AI for predictive analytics by 2025.

Technological advancements are reshaping the cannabis retail landscape, with digital platforms like Fire & Flower's Hifyre™ becoming central to customer engagement and operational efficiency. These innovations, including advanced POS systems and data analytics, are critical for navigating regulatory complexities and personalizing the customer experience. By 2025, companies leveraging AI for predictive analytics and operational optimization are expected to gain a significant competitive edge.

Legal factors

The Cannabis Act remains the bedrock of Canada's cannabis industry, with ongoing reviews and amendments designed to balance industry growth and public health. These legislative adjustments are crucial for companies like Fire & Flower, shaping their operational landscape.

Anticipated amendments effective March 2025 are set to simplify regulatory processes, lessen administrative hurdles, and foster greater market diversity. This is particularly relevant as the industry navigates evolving compliance requirements.

These forthcoming changes will directly influence key operational areas for Fire & Flower, including the acquisition and maintenance of licenses, adherence to security protocols, production standards, packaging regulations, and the necessary reporting procedures to government bodies.

Cannabis retailers operate under a stringent web of federal and provincial licensing, a significant legal hurdle. For instance, in 2024, Health Canada continued its efforts to streamline research licensing, a move that could indirectly benefit larger operational frameworks by improving the ecosystem. Proposed changes in 2025 aim to ease some of these burdens, such as potentially increasing cultivation limits for micro-licences, which could foster growth for smaller players.

Further regulatory adjustments in 2024 and anticipated for 2025 include a review of physical security requirements for cannabis businesses. Easing these mandates could lead to cost savings for operators, potentially improving their bottom line and allowing for greater investment in other operational areas.

Canadian cannabis regulations impose stringent rules on packaging and labelling to safeguard public health, focusing on preventing youth access and ensuring consumers receive clear, accurate product information. These regulations are crucial for maintaining market integrity and consumer trust.

Health Canada is actively considering updates to these rules, aiming to introduce greater design flexibility. Proposed changes include allowing features like color differentiation, cut-out windows, transparent packaging, and the integration of QR codes to provide consumers with supplementary factual details about the products they are purchasing.

Rules on promotion and advertising

The Cannabis Act in Canada places significant restrictions on how cannabis products can be promoted and advertised, primarily to shield young people from marketing that could increase their interest. While the industry has generally complied with these regulations, there's an ongoing conversation about balancing these public health goals with the need for industry expansion and innovation. For instance, as of early 2024, the requirement for an annual report on promotional expenses has been removed, simplifying some compliance burdens for businesses.

These rules impact how companies like Fire & Flower can reach consumers. The prohibition extends to various forms of advertising, including television, radio, and online platforms, making it challenging to build brand awareness and drive sales through traditional marketing channels.

- Prohibited Content: Marketing cannot depict people, animals, or characters, nor can it suggest association with lifestyles or activities appealing to youth.

- Limited Messaging: Advertisements are restricted to factual information about products, prices, and availability, often requiring specific health warnings.

- Channel Restrictions: Promotion is largely confined to company websites, point-of-sale displays, and direct communication with registered customers, limiting broad public reach.

- Industry Adaptation: Companies are focusing on in-store experiences, loyalty programs, and educational content to engage consumers within the regulatory framework.

Mergers and acquisitions regulatory hurdles

Mergers and acquisitions within Canada's burgeoning cannabis sector, including transactions involving companies like Fire & Flower, face significant regulatory oversight. Both federal and provincial governments impose stringent rules that must be navigated for any deal to proceed. This scrutiny is a key factor influencing the speed and success of industry consolidation, a trend actively shaping the market landscape.

Key regulatory hurdles include obtaining necessary security clearances for involved parties and ensuring strict adherence to the Excise Act, which governs cannabis taxation and production. The ongoing consolidation within the Canadian cannabis industry means that many companies are actively seeking strategic partnerships or acquisitions, making the navigation of these legal complexities a critical determinant of their growth strategies and market positioning.

- Federal and Provincial Oversight: All cannabis-related M&A in Canada is subject to review by Health Canada and relevant provincial regulatory bodies, impacting deal timelines and structures.

- Security Clearances: Individuals and entities involved in acquiring cannabis licenses must undergo rigorous background checks and obtain security clearances, a process that can be lengthy.

- Excise Act Compliance: Transactions must ensure continuity and compliance with excise duty payments and reporting requirements, adding a layer of financial and operational complexity.

- Industry Consolidation: The drive for consolidation means an increasing number of M&A activities are occurring, intensifying the focus on regulatory compliance and potentially creating bottlenecks if not managed effectively.

The legal landscape for Fire & Flower is defined by the Cannabis Act, with ongoing reviews and anticipated amendments for March 2025 aiming to simplify regulations and reduce administrative burdens. These changes will directly impact licensing, security, production, packaging, and reporting requirements.

Navigating federal and provincial licensing remains a significant legal challenge, though efforts to streamline research licensing in 2024 could indirectly benefit larger operations. Anticipated 2025 changes may ease some burdens, potentially increasing cultivation limits for micro-licenses.

Packaging and labeling regulations are stringent to protect public health, with proposed 2025 updates allowing for greater design flexibility, such as color differentiation and QR codes for enhanced product information. Advertising restrictions remain, prohibiting depictions appealing to youth and limiting promotion to factual product details and specific channels.

Mergers and acquisitions are under significant regulatory oversight, requiring federal and provincial approvals, security clearances, and adherence to the Excise Act, all of which are critical for industry consolidation and growth strategies.

Environmental factors

The cannabis industry is prioritizing sustainable cultivation, with growers adopting organic farming and water conservation to lessen environmental impact. This trend is driven by increasing consumer preference for eco-conscious products.

Techniques like drip irrigation, rainwater harvesting, and water recycling are becoming standard practice, significantly reducing water consumption. For example, by 2024, many cultivators aim to cut water usage by 30% compared to traditional methods.

Cannabis cultivation, particularly indoor grows, demands significant energy, driving a push for efficiency. Companies like Fire & Flower are exploring advanced LED lighting systems, which can reduce electricity usage by up to 50% compared to traditional HID lights. This focus on energy reduction is crucial for managing operational costs and environmental impact.

To combat high energy demands, many cannabis producers are increasingly adopting renewable energy solutions. Investments in solar panel installations are becoming more common, aiming to power cultivation facilities and reduce dependence on grid electricity derived from fossil fuels. For instance, some Canadian licensed producers reported a 15-20% increase in renewable energy usage in their 2024 sustainability reports.

Furthermore, energy audits are a key tool for identifying and rectifying inefficiencies within cultivation operations. By pinpointing areas of high consumption, businesses can implement targeted strategies to lower their overall energy footprint, contributing to both cost savings and environmental responsibility. These audits often reveal opportunities for optimizing HVAC systems and ventilation, which are major energy consumers in indoor grows.

The cannabis industry, including companies like Fire & Flower, faces significant waste challenges from packaging and plant byproducts. In response, many are implementing robust waste reduction and recycling programs. For instance, by 2024, a growing number of Canadian provinces saw cannabis retailers actively promoting the return of recyclable packaging, with some municipalities reporting diversion rates of over 30% for specific packaging components.

These initiatives focus on diverting materials from landfills through composting of plant waste and the adoption of recyclable or compostable packaging. The push for a circular economy within the sector is also driving innovation in eco-friendly labels and inks, aiming to reduce the environmental footprint associated with product presentation and compliance labeling.

Consumer demand for eco-conscious products

Consumers are increasingly prioritizing sustainability, driving demand for eco-conscious cannabis products. This shift is prompting companies like Fire & Flower to re-evaluate their sourcing and operational practices to align with these evolving consumer values. For instance, a 2024 survey indicated that over 60% of Canadian cannabis consumers consider environmental impact when making purchasing decisions.

The growing appeal of certifications, such as those aligned with the Canada Organic Regime, signals a market readiness for brands that demonstrably commit to greener operations. This trend presents a strategic opportunity for Fire & Flower to differentiate itself and potentially capture a larger market share by emphasizing its environmental stewardship. By 2025, it's projected that the market for certified organic cannabis products in Canada could reach $500 million annually.

- Growing consumer preference for sustainable and ethically sourced cannabis.

- Increased importance of eco-certifications in purchasing decisions.

- Opportunity for Fire & Flower to leverage 'going green' as a competitive advantage.

- Projected market growth for organic cannabis products in Canada.

Environmental impact assessment and reporting

Environmental impact assessment and reporting are becoming increasingly crucial for companies like Fire & Flower. Industry groups are actively collaborating on surveys to gauge corporate social and environmental sustainability, with a particular focus on the energy and environmental footprint of cannabis cultivation. For instance, by 2024, many Canadian provinces are expected to have stricter environmental regulations impacting cannabis producers.

Regulatory bodies are also scrutinizing the environmental implications of the Cannabis Act. This means Fire & Flower must be prepared to demonstrate its commitment to sustainable practices, from energy efficiency in its retail operations to responsible sourcing and waste management. The company's approach to these assessments will directly influence its public image and potential regulatory compliance costs.

- Growing emphasis on sustainability: Industry partnerships are driving surveys on corporate environmental responsibility.

- Cultivation footprint assessment: Energy and water usage in cannabis growing are key areas of focus.

- Regulatory scrutiny: The Cannabis Act's environmental impacts are under review by governing bodies.

- Data-driven reporting: Companies are expected to provide transparent data on their environmental performance.

The cannabis sector is increasingly focused on sustainability, with consumers favoring eco-friendly products. This shift is compelling companies like Fire & Flower to adopt greener practices, from cultivation to packaging.

Energy efficiency is a major concern, driving adoption of LED lighting and renewable energy sources. For example, by 2024, many Canadian cultivators aimed to reduce water usage by 30% and increase renewable energy use by 15-20%.

Waste reduction through recycling and composting is also a priority, with some municipalities reporting over 30% diversion rates for cannabis packaging by 2024.

Environmental impact reporting and regulatory scrutiny are intensifying, requiring companies like Fire & Flower to demonstrate their commitment to sustainable operations.

| Environmental Factor | Industry Trend/Action | Impact on Fire & Flower | Supporting Data (2024/2025) |

|---|---|---|---|

| Sustainable Cultivation | Water conservation, organic farming | Enhances brand image, meets consumer demand | 30% water usage reduction target by 2024 |

| Energy Efficiency | LED lighting, renewable energy adoption | Reduces operational costs, lowers carbon footprint | 50% energy reduction with LEDs; 15-20% renewable energy increase |

| Waste Management | Recycling programs, compostable packaging | Minimizes landfill waste, improves public perception | >30% packaging diversion rates reported |

| Consumer Preferences | Demand for eco-conscious products | Drives product development and marketing strategies | >60% consumers consider environmental impact |

PESTLE Analysis Data Sources

Our Fire & Flower PESTLE analysis is grounded in a comprehensive review of public company filings, industry-specific market research, and government regulatory updates. We also incorporate insights from reputable financial news outlets and economic forecasting reports to ensure a holistic view.