Fire & Flower Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

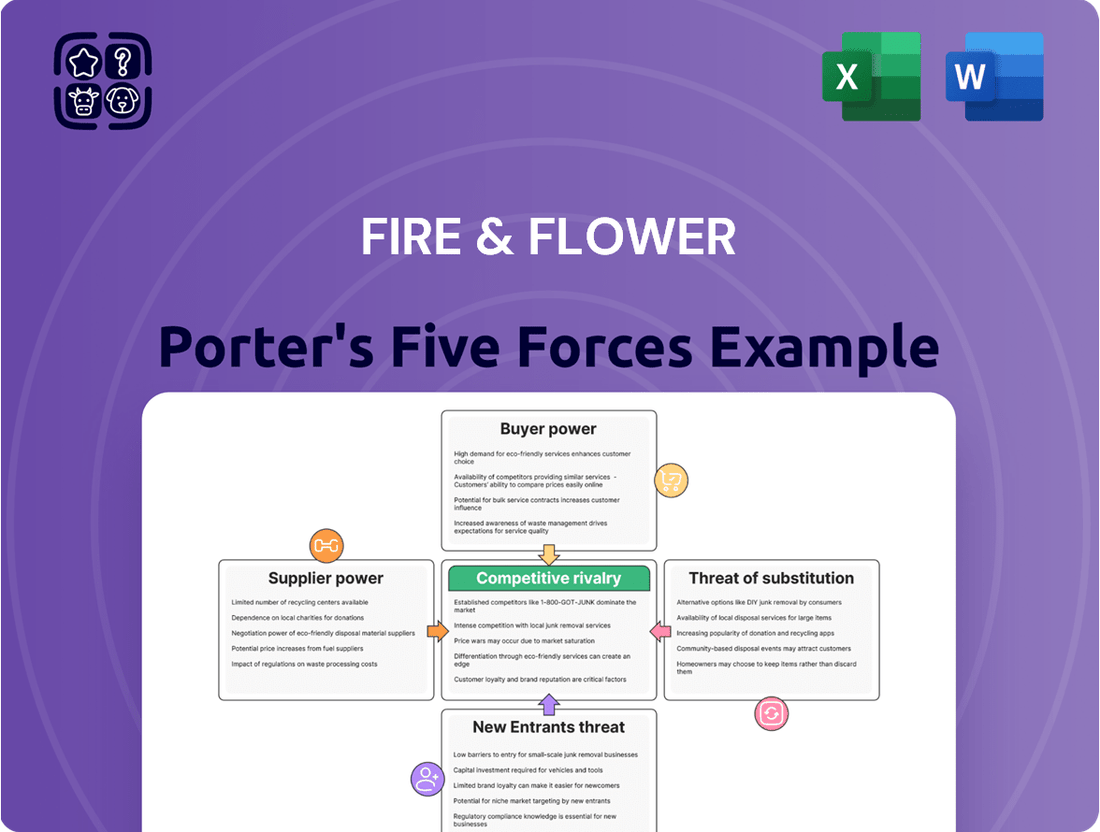

Fire & Flower navigates a dynamic cannabis retail landscape, facing moderate buyer power and significant competitive rivalry. The threat of new entrants is a key consideration, while supplier power and the threat of substitutes present distinct challenges.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fire & Flower’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

While the Canadian cannabis market has experienced significant consolidation among licensed producers, a substantial number of cultivators and processors remain. This fragmentation generally dilutes the individual bargaining power of suppliers when dealing with retailers such as Fire & Flower, as they have multiple sourcing options.

Despite the overall fragmentation, a few larger, established licensed producers (LPs) may still exert considerable influence. These LPs can often command premium pricing due to strong brand recognition or exclusive product formulations, potentially impacting Fire & Flower's procurement costs.

The cannabis sector in Canada operates under a stringent regulatory framework, with Health Canada dictating rigorous standards for cultivation, processing, and distribution. This compliance adds significant operational costs for suppliers, potentially leading them to seek higher prices from retailers like Fire & Flower.

Fluctuations in government policies, such as adjustments to excise tax rates on cannabis products, directly affect supplier margins. For instance, changes in tax structures can alter a supplier's profitability, influencing their bargaining position and their willingness to negotiate favorable terms with their retail partners.

While basic dried cannabis flower is largely a commodity, suppliers who specialize in differentiated products like edibles, beverages, and unique craft strains can wield more bargaining power. These specialized offerings, often referred to as 'Cannabis 2.0' and 'Cannabis 3.0' products, can command higher profit margins for retailers by appealing to specific consumer preferences. For instance, in 2024, the Canadian cannabis market saw continued growth in the edibles and beverages segment, with sales reaching billions, indicating a strong consumer demand for these specialized items.

Vertical Integration by Suppliers

Some licensed cannabis producers, like those in the burgeoning Canadian market, have pursued vertical integration by establishing their own retail outlets. This strategic move lessens their dependence on third-party retailers, thereby strengthening their position. For instance, by 2024, several major Canadian Licensed Producers (LPs) had secured a significant number of retail licenses, allowing them to control more of the value chain from cultivation to sale.

This integration directly impacts the bargaining power of these suppliers. When a supplier can directly reach the end consumer, their need to offer attractive terms to independent retailers diminishes. This can lead to less favorable pricing or stricter terms for retailers who still rely on these integrated suppliers.

- Reduced Reliance: Suppliers integrating forward into retail operations decrease their dependence on independent retailers, shifting the power dynamic.

- Increased Leverage: By controlling more of the supply chain, integrated suppliers gain leverage to dictate terms, potentially reducing margins for standalone retailers.

- Market Control: This strategy allows suppliers to capture a larger share of the profit margin and gain direct consumer insights, further enhancing their market control.

Impact of Export Opportunities

The burgeoning international demand for Canadian medical cannabis, notably in Germany and Australia, presents a significant alternative revenue avenue for suppliers. This export potential directly impacts their bargaining power within Canada.

Should these overseas markets offer more attractive profit margins, Canadian cannabis suppliers are likely to redirect their focus and resources towards fulfilling these international orders. This strategic shift can result in a reduced supply of cannabis available to domestic retailers.

Consequently, when supply tightens in the Canadian market due to export prioritization, suppliers gain increased leverage. They can then negotiate more favorable terms, including higher prices and potentially stricter supply agreements, with their Canadian retail partners.

- Export Market Growth: Germany's medical cannabis market, for instance, has seen substantial growth, with imports playing a crucial role. In 2023, Germany imported approximately 12,000 kilograms of medical cannabis, a significant portion of which originated from Canada.

- Margin Differential: Suppliers often find that export markets can command higher wholesale prices due to different regulatory frameworks, demand dynamics, and perceived product quality, leading to better profit margins compared to the domestic Canadian market.

- Supply Diversion: This diversion of supply to more lucrative export channels directly translates to a tighter domestic supply for Canadian retailers, thereby strengthening the suppliers' position in price and contract negotiations.

The bargaining power of suppliers to Fire & Flower is influenced by market fragmentation and the rise of specialized products. While a large number of cultivators exist, a few dominant Licensed Producers (LPs) can leverage strong brands to command higher prices. Furthermore, the increasing demand for differentiated products like edibles and beverages, which saw significant growth in 2024, allows specialized suppliers to negotiate more favorable terms.

Vertical integration by suppliers into retail operations strengthens their position by reducing reliance on third-party retailers. This trend, observed with several major Canadian LPs securing retail licenses by 2024, allows them to capture more of the value chain and dictate terms more effectively to independent retailers like Fire & Flower.

International demand, particularly from markets like Germany which imported around 12,000 kilograms of medical cannabis in 2023, offers lucrative alternatives for Canadian suppliers. This export focus can tighten domestic supply, giving suppliers more leverage in negotiations with Canadian retailers due to potentially higher profit margins abroad.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Market Fragmentation | Generally Dilutes Power | Numerous cultivators and processors in Canada. |

| Dominant LPs | Increases Power | Strong brand recognition allows for premium pricing. |

| Specialized Products (e.g., edibles) | Increases Power | Billions in sales for edibles/beverages in Canada in 2024. |

| Vertical Integration | Increases Power | Major Canadian LPs securing retail licenses by 2024. |

| International Demand | Increases Power | Germany imported ~12,000 kg medical cannabis in 2023. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Fire & Flower's position in the evolving cannabis retail landscape.

Instantly understand competitive pressures with a dynamic threat matrix, allowing for rapid identification of potential disruptions.

Customers Bargaining Power

The Canadian cannabis retail landscape, particularly in provinces like Ontario and Alberta, has experienced significant market saturation. This proliferation of retailers means consumers have a wide array of choices, directly impacting their bargaining power.

Declining prices for key cannabis products, such as dried flower, further amplify consumer leverage. In 2024, average prices for dried flower in Canada have seen a downward trend, making consumers highly price-sensitive and encouraging them to shop around for the best value.

This environment allows consumers to easily switch between retailers in pursuit of lower prices or better promotions. The ease of switching retailers in a crowded market significantly strengthens the bargaining power of customers.

Consumers now have unprecedented access to product information, pricing, and reviews across numerous digital platforms. This readily available data significantly enhances their ability to compare offerings and make informed choices. For instance, in 2024, e-commerce platforms continued to dominate retail, with a significant portion of consumer purchasing decisions influenced by online research and reviews, a trend that directly impacts the cannabis retail sector.

Fire & Flower's Hifyre™ platform exemplifies this shift, offering customers transparency into product availability and pricing. This digital accessibility empowers consumers, allowing them to easily compare different cannabis products and their associated costs. Such transparency directly increases the bargaining power of customers, as they can readily identify the best value propositions available in the market.

Consumer tastes are definitely changing. We're seeing a real move away from just dried cannabis flower towards newer options like vapes and edibles, often called 'Cannabis 2.0' products. This shift means retailers need to adapt their offerings to stay relevant.

When customers can easily find the specific product types they want, like a particular strain in an edible form, their ability to shop around and choose the best deal increases. This flexibility gives them more leverage, strengthening their bargaining power against any single retailer.

Brand Loyalty vs. Price/Selection

While some consumers might exhibit loyalty to specific cannabis brands or dispensaries, the broader market dynamics heavily favor price and product variety. For instance, in 2024, the sheer number of licensed cannabis retailers, particularly in competitive markets, means consumers have ample choice. This ease of access to alternative suppliers directly diminishes a single retailer's pricing power.

The ability for customers to readily compare prices and explore a wider selection of cannabis products across different dispensaries significantly erodes loyalty to any one establishment. If a competitor offers a comparable product at a lower price or a more extensive range, consumers are incentivized to switch. This price sensitivity is a key factor influencing purchasing decisions.

- Price Sensitivity: Consumers often prioritize cost savings, especially with the increasing number of dispensaries vying for market share.

- Product Variety: A wider selection of strains, formats, and brands attracts customers, making them less reliant on a single retailer.

- Market Saturation: In 2024, many regions experienced a significant increase in cannabis retail outlets, intensifying competition and empowering consumers.

- Information Accessibility: Online menus and reviews allow customers to easily compare offerings and prices before making a purchase.

Regulatory Framework for Consumers

The regulatory framework significantly shapes consumer bargaining power in the cannabis sector. Rules dictating sales channels, such as online versus physical stores, and the presence of provincial monopolies, directly impact the availability and variety of products consumers can access. For instance, provinces with more private retail outlets, like Alberta, tend to foster greater competition, which in turn can empower consumers by offering more choices and potentially better pricing.

In 2024, the landscape continues to evolve, with ongoing discussions and adjustments to retail models across Canada. Provinces that have embraced a more liberalized retail environment generally see a more active consumer base, capable of leveraging competitive offerings. This contrasts with regions where government-controlled retail dominates, often leading to more limited consumer options and reduced bargaining leverage.

The impact of these regulations on consumer bargaining power can be observed through several key aspects:

- Consumer Choice: Regulations on store locations and types (e.g., standalone vs. integrated) directly affect how many purchasing options consumers have.

- Price Competition: Provinces with a higher density of licensed private retailers, such as Alberta, often experience more aggressive pricing strategies as businesses compete for market share.

- Product Availability: Restrictions on product types or brands allowed in certain retail formats can limit consumer options, thereby reducing their bargaining power.

- Online Sales: The ability for consumers to purchase cannabis online, where permitted, expands their reach and bargaining power by allowing them to compare prices and products across a wider geographical area.

The bargaining power of customers in the Canadian cannabis retail sector is significantly high, driven by market saturation and increasing price sensitivity. With numerous retailers competing for market share, consumers can easily switch providers to find better deals or a wider product selection. This dynamic is further amplified by readily available product information and reviews online, enabling informed purchasing decisions.

In 2024, the average price per gram of dried cannabis flower in Canada continued to be a key factor influencing consumer choices, with competitive pricing strategies becoming essential for retailers. For instance, provinces with a higher density of private retailers, like Alberta, often see more aggressive pricing as businesses vie for customer attention.

| Factor | Impact on Customer Bargaining Power | 2024 Trend Example |

|---|---|---|

| Market Saturation | High | Increased number of licensed retailers in provinces like Ontario. |

| Price Sensitivity | High | Downward pressure on average dried flower prices. |

| Information Accessibility | High | Growth in online reviews and price comparison platforms. |

| Product Variety | Moderate to High | Consumer shift towards vapes and edibles alongside traditional flower. |

Preview Before You Purchase

Fire & Flower Porter's Five Forces Analysis

This preview showcases the comprehensive Fire & Flower Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the cannabis retail industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The Canadian cannabis retail landscape is quite crowded, with a significant number of licensed stores operating across the country. This high density of retailers naturally fuels intense competition, making it a challenge for individual businesses to stand out and capture market share. For instance, by the end of 2023, Ontario alone had over 1,500 cannabis retail stores licensed.

This high number of retailers, coupled with what some observers have called over-licensing in certain provinces, has led to market saturation. This saturation creates a difficult environment for many stores trying to achieve consistent profitability. The sheer volume of competitors means that customer acquisition costs can be high, and margins may be squeezed as businesses vie for the same customer base.

The cannabis retail landscape is marked by fierce competition, leading to significant price compression across many product categories, especially dried flower. This intense rivalry directly translates into considerable margin pressure for retailers like Fire & Flower. For instance, in 2023, average retail prices for premium dried cannabis in Canada saw a noticeable decline compared to previous years, forcing businesses to operate on thinner margins.

This environment necessitates that retailers move beyond a purely price-driven strategy. To combat margin erosion, companies must focus on operational efficiencies and explore avenues for differentiation that add value for the consumer. This could involve enhanced customer service, curated product selections, or loyalty programs, all aimed at building brand loyalty in a crowded market.

In the competitive cannabis retail landscape, product innovation and differentiation are paramount for Fire & Flower. The company must actively curate a diverse product portfolio, encompassing not only traditional flower but also the evolving Cannabis 2.0 and 3.0 offerings like edibles, beverages, and advanced wellness products. This focus on unique strains and novel product formats is essential for capturing customer attention and fostering loyalty amidst a growing number of competitors.

Digital Platforms and Customer Experience

Digital platforms are a key battleground for cannabis retailers like Fire & Flower. Their Hifyre™ platform aims to boost customer engagement through personalized recommendations and loyalty programs. This focus on digital experience is crucial in a market where consumers increasingly expect convenience and tailored offerings.

The effectiveness of these digital tools directly impacts competitive advantage. For instance, by offering a seamless online ordering and pickup experience, companies can differentiate themselves. In 2023, Fire & Flower reported that its Hifyre™ platform facilitated approximately 40% of its total sales, highlighting the growing importance of digital channels in the Canadian cannabis market.

- Digital Engagement: Platforms like Hifyre™ enhance customer experience through personalization and loyalty initiatives.

- Competitive Differentiator: Superior digital tools can create a significant edge in the convenience-driven cannabis market.

- Sales Impact: In 2023, Hifyre™ accounted for roughly 40% of Fire & Flower's total sales, underscoring digital channel importance.

Market Consolidation and Strategic Partnerships

The Canadian cannabis sector is experiencing significant consolidation. Mergers and acquisitions are increasingly common as companies seek to gain market share and operational efficiencies. This trend is driven by the need for scale in a competitive landscape and the pursuit of strategic partnerships.

Larger, financially robust companies are actively acquiring smaller players. This indicates a maturing market where survival and growth are often tied to the ability to achieve economies of scale and forge strategic alliances. For instance, Fire & Flower's acquisition by Alimentation Couche-Tard in 2022 for approximately $380 million exemplifies this consolidation strategy, integrating a retail network into a larger convenience store operator.

- Market Maturation: The cannabis industry's evolution is marked by a shift towards fewer, larger entities.

- Acquisition Activity: Well-capitalized companies are buying out smaller competitors to expand their reach and capabilities.

- Strategic Imperative: Survival and success increasingly depend on achieving scale and forming strategic partnerships.

- Example: Fire & Flower's acquisition by Alimentation Couche-Tard highlights the trend of integrating cannabis retail into broader consumer businesses.

The competitive rivalry within the Canadian cannabis retail sector is intense, characterized by a high number of licensed stores, particularly in provinces like Ontario which had over 1,500 licensed stores by the end of 2023. This saturation leads to price compression, especially on dried flower, squeezing retailer margins and necessitating a focus on operational efficiency and customer differentiation beyond just price.

Companies are leveraging digital platforms, such as Fire & Flower's Hifyre™, to enhance customer engagement through personalization and loyalty programs, with Hifyre™ facilitating approximately 40% of Fire & Flower's sales in 2023. The market is also undergoing consolidation, with acquisitions like Alimentation Couche-Tard's purchase of Fire & Flower in 2022 for around $380 million, signaling a trend towards larger entities seeking economies of scale and strategic partnerships.

| Metric | 2023 Data Point | Implication for Rivalry |

|---|---|---|

| Ontario Licensed Stores | > 1,500 (End of 2023) | High density fuels intense competition and price pressure. |

| Hifyre™ Sales Contribution | ~40% of Fire & Flower Sales (2023) | Digital engagement is a key differentiator and competitive battleground. |

| Fire & Flower Acquisition Value | ~$380 million (2022) | Consolidation trend indicates a drive for scale and market share. |

SSubstitutes Threaten

The illicit cannabis market continues to pose a significant threat of substitutes for Fire & Flower. Even with widespread legalization, this underground market often undercuts legal retailers by avoiding taxes and the considerable costs associated with regulatory compliance and product testing. This price advantage makes it an attractive alternative for consumers who prioritize affordability above all else.

While the legal market has made strides in capturing market share, data from 2023 indicated that the illicit market still held a notable portion of cannabis sales in Canada. For instance, reports suggested that while the legal market's share was growing, a substantial percentage of consumers still purchased from unregulated sources. This persistent presence means that a significant segment of potential customers remains accessible to these illicit substitutes, impacting the overall demand for legal products.

Other recreational products, like alcohol and tobacco, are significant substitutes for cannabis. Consumers often choose among these options for leisure and relaxation, meaning a shift in consumer preference from cannabis to another substance directly impacts Fire & Flower's sales. For instance, in 2023, the global legal cannabis market was valued at approximately $30 billion, while the global alcohol market was valued at over $1.5 trillion, highlighting the vast array of established alternatives.

Consumers looking for wellness or medicinal benefits have a vast array of options beyond cannabis. These include readily available over-the-counter medications for pain relief and sleep, as well as a growing market for natural and herbal supplements. For instance, the global herbal supplements market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating strong consumer interest in non-cannabis alternatives.

The accessibility and established trust in traditional pharmaceuticals and natural health products present a significant threat of substitution for Fire & Flower. Many consumers may opt for familiar, regulated, and often more affordable options like ibuprofen for pain or melatonin for sleep, rather than exploring cannabis-based alternatives. This broad category of non-cannabis wellness products directly competes for consumer spending and attention.

Home Cultivation

The threat of home cultivation for cannabis presents a significant substitute for licensed retailers like Fire & Flower. Canadian regulations permit adults to grow a limited number of cannabis plants for personal use, offering a cost-effective alternative for consumers. This can appeal to those seeking specific strains or interested in organic cultivation methods, bypassing the need to purchase from regulated dispensaries.

This home-grown option can directly impact sales volumes for companies operating within the legal framework. For instance, while specific data on home cultivation's market share is still emerging, anecdotal evidence suggests a growing interest, particularly in provinces with less restrictive personal cultivation rules. This trend could lead to a reduction in demand for commercially produced cannabis, especially among price-sensitive consumers or hobbyist growers.

- Cost Savings: Home cultivation eliminates retail markups and taxes, making it a more economical choice for some consumers.

- Strain Customization: Individuals can cultivate specific strains not readily available through licensed retailers.

- Control Over Quality: Consumers can manage cultivation practices, opting for organic methods and ensuring product purity.

- Regulatory Landscape: Evolving regulations around personal cultivation can either mitigate or exacerbate this substitute threat.

Evolving Product Categories

Within the legal cannabis market, various product categories inherently serve as substitutes. For instance, a consumer might choose cannabis-infused edibles over traditional dried flower, or opt for a vape pen instead of a pre-roll, reflecting shifting consumer preferences and perceived utility. This internal substitution dynamic is a key consideration for Fire & Flower.

Furthermore, the rise of different cannabinoid profiles, such as CBD-dominant products versus THC-focused options, presents another layer of substitutability. Consumers may select CBD for its perceived wellness benefits, substituting it for THC products depending on their desired outcome or time of day. In 2023, the global CBD market was valued at approximately USD 12.5 billion, indicating a significant consumer base seeking alternatives to THC.

- Edibles vs. Dried Flower: Changing consumer habits and convenience drive this substitution.

- Vapes vs. Traditional Consumption: Portability and discretion make vapes a strong substitute for flower.

- CBD vs. THC Products: The growing wellness trend fuels demand for CBD, offering an alternative for those avoiding psychoactive effects.

- Product Innovation: New product formats continually emerge, creating new substitution possibilities.

The threat of substitutes for Fire & Flower is multifaceted, encompassing both illicit and legal alternatives. The persistent illicit cannabis market, despite legalization efforts, continues to offer a price advantage due to tax avoidance and lower compliance costs. In 2023, while the legal market gained ground, a significant portion of Canadian cannabis sales still originated from unregulated sources, impacting Fire & Flower’s potential customer base.

Beyond cannabis, established recreational products like alcohol and tobacco represent substantial substitutes. Consumers often choose between these for relaxation, meaning shifts in preference directly affect Fire & Flower's revenue. For context, the global alcohol market in 2023 was valued at over $1.5 trillion, dwarfing the legal cannabis market's approximately $30 billion valuation.

For wellness-seeking consumers, a wide array of non-cannabis options exist, including over-the-counter medications and herbal supplements. The global herbal supplements market, valued at around $50 billion in 2023, demonstrates strong consumer interest in these alternatives. This broad category competes directly for consumer spending on well-being.

Home cultivation also poses a direct substitute threat, as Canadian regulations allow personal cultivation. This bypasses retail markups and taxes, appealing to consumers seeking cost savings or specific strains. While precise market share data for home cultivation is still developing, its potential to reduce demand for commercially produced cannabis is notable.

Within the legal cannabis market itself, different product formats act as substitutes. Consumers might choose edibles over dried flower, or vapes over pre-rolls, based on convenience and desired experience. The growing popularity of CBD-dominant products, with the global CBD market reaching approximately USD 12.5 billion in 2023, further highlights the diverse range of alternatives available to consumers seeking specific effects or benefits.

Entrants Threaten

The Canadian cannabis sector, including companies like Fire & Flower, faces substantial hurdles due to stringent federal and provincial regulations. Health Canada mandates rigorous licensing for all stages, from cultivation and processing to retail sales, creating a complex and costly environment for newcomers.

These high regulatory barriers significantly deter new entrants. For instance, obtaining a cannabis retail license in Ontario, a key market, involves multiple application stages, background checks, and significant fees, making it a challenging and time-consuming process. This ensures that only well-capitalized and prepared businesses can navigate the initial setup, thereby protecting existing players.

Establishing a cannabis retail business, like Fire & Flower, demands significant upfront capital. This includes costs for prime real estate acquisition or leasing, extensive store renovations and build-outs, and robust inventory management systems. For instance, in 2024, the average cost to open a single cannabis dispensary in a major market could range from $500,000 to over $2 million, depending on location and scale.

This considerable financial barrier acts as a strong deterrent for many aspiring entrepreneurs. The need for substantial seed funding and ongoing operational capital creates a high barrier to entry, limiting the number of new players who can realistically compete in the cannabis retail space.

The Canadian cannabis market, where Fire & Flower operates, is highly saturated. Numerous established retailers and brands already exist, making it difficult for newcomers to gain traction. For instance, as of early 2024, the number of licensed cannabis retailers across Canada continued to grow, with provinces like Ontario seeing significant expansion, intensifying competition.

New entrants must overcome the hurdle of building brand recognition against established players. These incumbents have already cultivated customer loyalty through years of operation and marketing efforts. They also benefit from established supply chains and economies of scale, which new entrants will struggle to replicate quickly.

Access to Supply Chains and Distribution

New entrants face significant hurdles in accessing established supply chains and distribution networks within the cannabis sector. Navigating complex provincial distribution frameworks and securing reliable supply from licensed producers are critical challenges. For instance, in provinces with government-controlled wholesale monopolies, like Ontario or British Columbia, access to product can be a substantial barrier to entry, limiting the volume and variety of goods available to new retailers.

The reliance on licensed producers for product means that new entrants must establish relationships and secure agreements, which can be time-consuming and difficult, especially for smaller operations. This dependence can also lead to supply chain disruptions or limitations, impacting a new business's ability to consistently meet customer demand. In 2024, the landscape continued to show these pressures, with many smaller licensed producers struggling to gain shelf space against larger, more established brands.

The threat of new entrants is therefore moderated by the difficulty in establishing these foundational operational elements:

- Provincial Distribution Frameworks: Each province has unique regulations governing how cannabis products can be distributed, creating a complex patchwork for new entrants to understand and comply with.

- Securing Supply: Gaining consistent and reliable access to a diverse range of products from licensed producers is a prerequisite for market entry and ongoing success.

- Government Monopolies: In markets where the government controls wholesale distribution, new retailers must operate within the allocated product streams, which can limit competitive differentiation.

- Established Relationships: Existing retailers often have long-standing relationships with key licensed producers, giving them preferential access to popular or new product releases.

Digital Platform and Data Expertise

The threat of new entrants is significantly influenced by the need for sophisticated digital platforms and data expertise. Companies like Fire & Flower have demonstrated the competitive advantage gained through proprietary technology, such as their Hifyre™ platform, which streamlines operations and enhances customer interaction. For instance, in 2023, Fire & Flower reported that its Hifyre™ platform facilitated over 2.5 million transactions, highlighting its critical role in market penetration and efficiency.

New players entering the market must therefore be prepared for substantial upfront investment in developing or acquiring comparable technological infrastructure and robust data analytics capabilities. This barrier is amplified by the increasing reliance on personalized consumer experiences driven by data insights, a trend that became even more pronounced throughout 2024 as companies refined their data-driven strategies. Without this digital foundation, newcomers would struggle to match the operational agility and targeted marketing effectiveness of established players.

- Digital Platform Investment: New entrants face significant capital requirements to develop or license advanced e-commerce and operational platforms.

- Data Analytics Expertise: Acquiring and retaining skilled data scientists and analysts is crucial for understanding consumer behavior and optimizing offerings.

- Competitive Technology Gap: Companies lacking sophisticated digital tools risk falling behind in customer engagement and operational efficiency, as seen with platforms like Hifyre™.

- Scalability Challenges: Building a scalable digital infrastructure from the ground up presents a considerable hurdle for emerging businesses in the sector.

The threat of new entrants in the Canadian cannabis market, impacting companies like Fire & Flower, is significantly mitigated by high capital requirements and complex regulatory landscapes. For instance, obtaining a cannabis retail license in Ontario in 2024 involved substantial fees and extensive background checks, creating a formidable barrier. The need for significant upfront investment, potentially ranging from $500,000 to over $2 million for a single dispensary in 2024, further deters new players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fire & Flower leverages data from company annual reports, investor presentations, and regulatory filings to understand internal strategies and financial health. We also incorporate industry-specific market research reports and news articles to gauge external competitive pressures and market trends.