Financière Marc de Lacharrière (Fimalac) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financière Marc de Lacharrière (Fimalac) Bundle

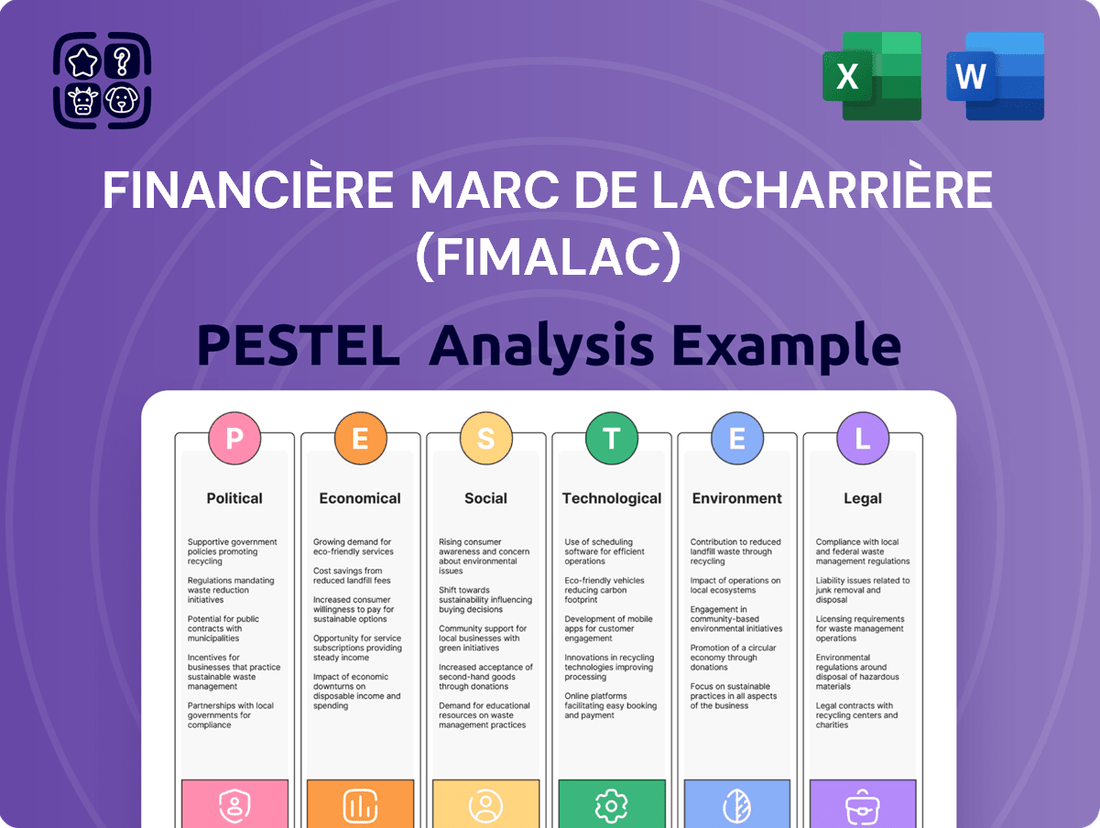

Gain a critical edge by understanding the external forces shaping Financière Marc de Lacharrière (Fimalac). Our PESTLE analysis delves into the political landscape, economic shifts, and technological advancements impacting its operations. Explore how societal trends and environmental regulations present both challenges and opportunities. Equip yourself with this vital intelligence to refine your market strategy.

Ready to make informed decisions about Fimalac? Our comprehensive PESTLE analysis provides actionable insights into the factors influencing its performance. Don't miss out on understanding the full external environment. Download the complete report now and unlock a deeper understanding of Fimalac's strategic position.

Political factors

France's political landscape significantly shapes Fimalac's operational environment, especially given the ongoing fiscal reforms and potential shifts in the 2024-2025 budgetary cycle. Policy changes following elections, such as the potential impact of legislative elections on the government's majority, can directly alter taxation, labor laws, and industry regulations affecting Fimalac's diverse holdings. For example, changes to corporate tax rates, currently at 25% for most large companies, or labor market flexibility, directly influence profitability. Political uncertainty, particularly concerning public debt management projected at nearly 110% of GDP for 2025, could lead Fimalac to adopt a more cautious investment strategy across its portfolio. This climate necessitates close monitoring of government stability and its impact on economic predictability.

As a French company, Financière Marc de Lacharrière (Fimalac) is directly subject to European Union directives, which significantly influence its operations, particularly in digital services and cross-border investments. Regulations like the Digital Services Act (DSA), fully applicable since February 2024, and the General Data Protection Regulation (GDPR) impose substantial compliance requirements on Fimalac's diverse subsidiaries, including those in digital media and financial advisory. Furthermore, ongoing efforts towards a deeper European single market and capital markets union (CMU) present both strategic opportunities for streamlined cross-border operations and challenges through increased regulatory scrutiny, with new CMU initiatives anticipated through 2025 aimed at harmonizing financial services. This regulatory landscape demands continuous adaptation and investment in compliance infrastructure to navigate the evolving EU framework effectively.

International trade agreements and escalating geopolitical events pose significant considerations for Fimalac, particularly concerning its diversified investment portfolio with global reach. For instance, the ongoing US-China trade dynamics and potential EU tariff adjustments in early 2025 could directly affect the supply chain profitability of portfolio companies like those in digital media or real estate services. Heightened geopolitical risks, such as the Red Sea disruptions impacting global shipping costs by an estimated 15-20% in late 2024, influence Fimalac's investment decisions and asset valuations. Such instability necessitates proactive risk assessment for international holdings, impacting potential returns.

Industrial policy and government support

The French government's industrial policy, including substantial support for sectors like green technology and digital innovation, presents significant opportunities for Fimalac. Initiatives such as the France 2030 plan, a €54 billion investment program launched in 2021 with ongoing allocations through 2025, directly benefit companies within Fimalac's investment scope, particularly those focused on sustainable development and digital transformation. This strategic governmental backing can profoundly influence Fimalac's strategic acquisitions and growth initiatives, aligning with national priorities for economic development. The plan aims to invest €8 billion in decarbonizing industry by 2030 and €2.5 billion in digital innovation, creating a favorable environment for Fimalac's portfolio.

- France 2030 allocates €54 billion for industrial and technological innovation through 2026.

- Specific focus areas include €8 billion for industrial decarbonization by 2030.

- Approximately €2.5 billion is directed towards digital transformation and deep tech.

- Government incentives foster growth in sectors relevant to Fimalac's investment strategy.

Taxation policies for holding companies

Changes in French taxation policies significantly influence Fimalac's financial structure and profitability as a holding company. The standard corporate tax rate in France remains at 25% for 2024, directly impacting Fimalac's consolidated earnings from its diverse portfolio. The tax treatment of dividends and capital gains from its subsidiaries, especially under the French participation exemption regime, is pivotal for its investment strategy and returns. This regime generally exempts 99% of dividends received from qualifying subsidiaries, subject to a 1% reintegration for expenses. France's regime for holding companies, including these favorable participation exemptions, enhances its appeal as an investment hub for entities like Fimalac.

- France's corporate tax rate is 25% as of 2024.

- Dividends received by Fimalac from qualifying subsidiaries are 99% exempt from corporate tax under the "mère-fille" regime.

- A 1% reintegration of gross dividends for expenses applies to the participation exemption.

- Capital gains on qualifying share disposals can also benefit from participation exemptions, with a small taxable fraction.

France's political stability and the 2024-2025 budgetary cycle significantly influence Fimalac's operational environment, affecting corporate taxation, labor laws, and public debt management. European Union directives, including the Digital Services Act (fully applicable February 2024) and ongoing Capital Markets Union initiatives, impose compliance demands and shape strategic opportunities. Geopolitical events, such as potential EU tariff adjustments in early 2025 and Red Sea disruptions, necessitate agile risk assessment for Fimalac's global portfolio. Furthermore, the French government's France 2030 plan, allocating €54 billion through 2025, strategically supports sectors relevant to Fimalac's investments.

| Factor | Key Impact Area | 2024/2025 Data |

|---|---|---|

| French Fiscal Policy | Corporate Taxation | 25% standard corporate tax rate (2024) |

| EU Regulation | Digital Services | DSA fully applicable February 2024 |

| Geopolitical Risks | Shipping Costs | Red Sea disruptions: 15-20% impact (late 2024) |

| Industrial Policy | Investment Allocation | France 2030: €54 billion (through 2025) |

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Financière Marc de Lacharrière (Fimalac), offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by highlighting key external factors and their potential implications for the company's future success.

A readily digestible summary of Fimalac's PESTLE analysis, presented in a clean, bulleted format for rapid understanding and strategic decision-making.

This PESTLE analysis for Fimalac is designed to alleviate pain points by offering a concise, actionable overview that can be easily integrated into strategic planning discussions or shared for quick team alignment.

Economic factors

The overall economic health of France and the Eurozone is a primary driver for Fimalac's performance. Projections indicate Eurozone GDP growth at 0.6% in 2024 and 1.5% in 2025. French GDP is similarly projected to grow by 0.8% in 2024 and 1.5% in 2025, influencing consumer spending and business investment. These figures directly impact Fimalac's leisure, entertainment, and real estate sectors, supporting revenue and expansion. A slowdown in economic growth, however, could temper these positive prospects for its portfolio companies.

Inflation and interest rates, heavily influenced by the European Central Bank (ECB), directly affect Fimalac's borrowing costs and investment valuations. For instance, with the ECB's main refinancing operations rate holding at 4.50% as of late 2024, the cost of capital for Fimalac's new acquisitions and real estate development projects has increased. Conversely, if Eurozone inflation, which was around 2.5% in late 2024, stabilizes near the ECB's 2% target, potential rate cuts in mid-2025 could lower financing costs. This environment would stimulate investment activity, particularly benefiting Fimalac's diverse portfolio.

Fimalac's leisure and entertainment divisions, including event production and hotels, directly depend on consumer confidence and discretionary spending. Economic uncertainty, such as the Eurozone's projected 2025 GDP growth of 1.4%, impacts public willingness to spend on non-essentials. High unemployment rates, even with the EU's 2024 forecast at 6.0%, and stagnant real wage growth can reduce demand for Fimalac's offerings. A notable decline in consumer confidence, as seen in recent fluctuations, could lead to reduced bookings for events and hotel stays, impacting revenue streams.

Real estate market trends

The vitality of the French commercial real estate market is pivotal for Financière Marc de Lacharrière's (Fimalac) significant holdings. Factors like property valuations and rental yields directly influence the value of its assets and rental income, with prime office yields in Paris stabilizing around 3.5% in early 2024. Vacancy rates, particularly in the Paris CBD, remained relatively low at approximately 7.5% in Q1 2024, indicating stable demand. Furthermore, the accelerating shift towards sustainable and green buildings is a critical trend, with new regulations pushing for energy-efficient properties, impacting investment decisions and development costs in the sector.

- Paris prime office yields stabilized at 3.5% in early 2024.

- Paris CBD vacancy rates were around 7.5% in Q1 2024.

- Demand for sustainable properties is increasing, influencing investment.

Foreign investment and capital flows

Fimalac's capacity to attract capital and execute international investments is intrinsically tied to global economic conditions and investor sentiment. The flow of foreign direct investment (FDI) into France, reaching an estimated €35 billion in 2023, presents both opportunities for strategic partnerships and increased competition for valuable assets. Sustained global economic stability, coupled with the French market's attractiveness, which saw over 1,200 new foreign investment projects in 2023, are pivotal for Fimalac's strategic financial maneuvers.

- Global FDI trends directly impact Fimalac’s access to capital for expansion.

- France's appeal to foreign investors, evidenced by its 2023 FDI performance, influences local competition.

- Investor confidence in major economies dictates the availability of funds for international ventures.

Economic growth in France and the Eurozone, projected at 0.8% and 0.6% for 2024 respectively, directly influences Fimalac's leisure and real estate sectors. ECB rates, at 4.50% in late 2024, impact borrowing costs, while consumer confidence and real estate market stability, with Paris prime office yields at 3.5% in early 2024, are vital. Global FDI trends, like France's €35 billion in 2023, also shape investment opportunities.

| Economic Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Eurozone GDP Growth | 0.6% | 1.5% |

| French GDP Growth | 0.8% | 1.5% |

| ECB Refinancing Rate (late 2024) | 4.50% | Potential Cuts |

| Paris Prime Office Yields (early 2024) | 3.5% | Stable |

| France FDI (2023) | €35 Billion | Continued Inflow |

What You See Is What You Get

Financière Marc de Lacharrière (Fimalac) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Financière Marc de Lacharrière (Fimalac). It meticulously details how shifts in government regulations, economic downturns or upturns, evolving consumer behaviors, technological advancements in its diverse sectors, legal frameworks, and environmental sustainability concerns can shape Fimalac's strategic landscape and operational effectiveness.

Sociological factors

Consumer leisure preferences are evolving, driving demand for unique, experiential activities impacting Fimalac's entertainment and hospitality sectors. The global experience economy is projected to exceed $10 trillion by 2025, emphasizing immersive and personalized offerings. This trend requires continuous innovation in event production and hotel management. Market demand is also polarizing, with growth seen in both luxury and budget-friendly experiences. For instance, high-end experiential travel saw a 15% increase in bookings for 2024, while budget travel also expanded significantly.

The increasing consumption of digital content, particularly within social media, significantly influences Fimalac's Webedia segment. Global daily social media usage averaged 151 minutes in Q1 2024, highlighting the shift. The rise of short-form video content and influencer marketing, with TikTok alone projected to exceed 1.8 billion users by 2025, necessitates a highly adaptive content strategy. Understanding these evolving digital habits is crucial for Webedia to enhance audience engagement and maximize monetization opportunities.

Societal expectations for companies to operate sustainably and ethically are rapidly increasing, impacting all of Financière Marc de Lacharrière's (Fimalac) diverse sectors. This trend affects everything from the environmental footprint of its real estate holdings to the social impact of its entertainment events. A strong ESG (Environmental, Social, and Governance) proposition is now critical for attracting capital, with global sustainable investment assets projected to exceed $50 trillion by 2025, according to Bloomberg Intelligence. Furthermore, companies with robust ESG practices often see enhanced brand reputation and a competitive edge in securing talent and customers.

Demographic shifts

An aging population and the evolving preferences of younger generations, like Gen Z, are significantly reshaping the workforce and consumer markets. By 2025, the median age in the European Union is projected to approach 45, influencing demand for health, wellness, and specialized leisure services. Simultaneously, Gen Z, comprising over 25% of the global population, prioritizes digital experiences and sustainability, impacting entertainment and digital service consumption. Fimalac's portfolio companies must adapt their offerings to cater to these diverse demographic needs and values, ensuring relevance in a shifting landscape.

- By 2025, Gen Z and millennials are projected to constitute over 60% of the global workforce, demanding flexible work models and digital-first services.

- Global digital ad spending is forecast to exceed $800 billion in 2025, driven by younger demographics' online engagement.

- The global leisure and entertainment market is expected to reach over $3 trillion by 2025, with significant growth in digital streaming and experiential offerings.

Work-life balance and the future of work

The growing emphasis on work-life balance and the prevalence of hybrid work models are significantly reshaping demand within the hospitality and leisure sectors. This fuels a rise in bleisure travel, with projections indicating it could account for over 60% of business trips by 2025, creating new revenue streams for Fimalac's hotel assets like Groupe Barrière. Concurrently, Fimalac's real estate portfolio, managed by entities such as Augusta REIM, must adapt to evolving office space needs, with occupancy rates potentially shifting.

- Bleisure travel is projected to constitute 60-70% of business trips by late 2025.

- Hotel groups are reconfiguring spaces to support extended stays combining work and leisure.

- Office space utilization rates are adapting, influencing Fimalac's commercial property valuations.

Societal shifts significantly influence Fimalac, with consumer preferences evolving towards experiential activities and digital content, impacting its entertainment and media segments. The global experience economy is projected to exceed $10 trillion by 2025, while digital ad spending is forecast to surpass $800 billion in 2025. Rising ESG expectations and demographic shifts, including an aging population and Gen Z's digital-first values, necessitate adaptive strategies across all Fimalac's operations. This also fuels bleisure travel, projected to constitute 60-70% of business trips by late 2025, reshaping hospitality and real estate demands.

| Sociological Factor | 2024/2025 Trend/Projection | Impact on Fimalac |

|---|---|---|

| Experience Economy Growth | > $10 Trillion by 2025 | Drives demand for unique entertainment and hospitality offerings. |

| Digital Ad Spending | > $800 Billion in 2025 | Influences Webedia's content and monetization strategies. |

| Bleisure Travel Prevalence | 60-70% of business trips by late 2025 | Reshapes hotel revenue streams and real estate utilization. |

Technological factors

Advancements in AI are profoundly transforming Fimalac's core sectors, from AI-powered personalization in digital marketing to AI-assisted production for events. Leveraging AI for data analysis, content creation, and operational efficiency offers a significant competitive edge in 2024. Fimalac's strategic investment, including its reported stake in The Brandtech Group, underscores its commitment to harnessing AI in marketing. This focus enhances capabilities for data-driven insights and streamlined operations, crucial for maintaining market relevance through 2025.

Technology is revolutionizing the event industry, pushing towards hybrid models that blend physical and virtual experiences. Innovations like virtual reality and augmented reality, along with sophisticated event management platforms, are enhancing attendee engagement. The global event technology market is projected to reach approximately $150 billion by 2025, driven by cloud-based AV systems and data-driven event design. Fimalac, through its digital subsidiaries, leverages these trends to optimize event production and management.

PropTech integration is reshaping real estate, significantly improving building management and enhancing tenant experiences for entities like Fimalac. Smart building technologies, projected to reach a global market value of over $300 billion by 2025, are becoming standard for optimizing operational efficiency and energy consumption. Data analytics for precise property valuation, alongside online platforms facilitating property transactions, streamline processes and boost market transparency. This technological shift is crucial for Fimalac to optimize its real estate asset performance, leveraging advancements for improved returns and reduced operational costs.

Data analytics and personalization

The ability to collect and analyze large datasets is fundamental for personalizing customer experiences across Fimalac's diverse portfolio, particularly within its digital and leisure segments. In digital marketing, data drives targeted advertising and content recommendations, with global digital ad spending projected to exceed $700 billion in 2024. For the leisure sector, leveraging analytics enables tailored offerings and improved customer service, enhancing engagement and loyalty as consumer expectations for personalized experiences rise.

- Global digital ad spending is forecast to reach $740 billion in 2024, emphasizing data-driven strategies.

- Personalization can boost customer satisfaction by over 20% in leisure and entertainment.

- Data analytics helps Fimalac identify emerging trends and optimize content delivery for its media assets.

- Enhanced data security protocols are crucial given the increasing volume of consumer data handled.

Cybersecurity and data privacy

With Fimalac's increasing reliance on digital technologies across its financial communication and hospitality sectors, robust cybersecurity and data privacy compliance are paramount. Protecting client data and proprietary information is critical for maintaining trust and avoiding significant legal and financial penalties. For instance, the average cost of a data breach is projected to exceed $4.5 million in 2024, emphasizing the financial imperative of strong defenses. This makes cybersecurity a core technological consideration for all of Fimalac's digital operations, especially concerning GDPR and other global privacy regulations.

- Global cybersecurity spending is expected to reach $215 billion in 2024.

- Regulatory fines for data breaches, like under GDPR, can reach up to 4% of global annual revenue.

- Phishing and ransomware attacks remain dominant threats, evolving rapidly in 2024.

- Consumer trust significantly erodes following data privacy incidents, impacting brand reputation.

AI advancements are reshaping Fimalac's digital marketing and event strategies, leveraging data for personalization and operational efficiency, with global digital ad spending nearing $740 billion in 2024. PropTech integration optimizes real estate, as the smart building market exceeds $300 billion by 2025. Robust cybersecurity is paramount, given data breach costs over $4.5 million in 2024, ensuring compliance and trust across all digital operations.

| Technological Trend | Market Value/Cost (2024/2025) | Impact on Fimalac |

|---|---|---|

| Global Digital Ad Spending | ~$740 Billion (2024) | Drives data-driven marketing and personalization. |

| Global Event Technology Market | ~$150 Billion (2025) | Enhances hybrid event models and attendee engagement. |

| Smart Building Market | >$300 Billion (2025) | Optimizes real estate operations and tenant experience. |

| Average Data Breach Cost | >$4.5 Million (2024) | Emphasizes critical need for robust cybersecurity. |

Legal factors

Fimalac, as a French holding company, must strictly adhere to the French Commercial Code, which governs corporate governance and shareholder rights. This includes complying with stringent financial reporting obligations under IFRS standards for its consolidated accounts by late 2024. The legal structure directly influences Fimalac's tax liabilities, subject to France's 25% corporate tax rate as of 2024, and its operational relationship with subsidiaries like Fitch Group. Ensuring full compliance with these evolving regulatory frameworks is paramount for Fimalac's legal standing and operational continuity.

The EU Digital Services Act (DSA) and Digital Markets Act (DMA), fully applicable in 2024 and 2025 respectively, impose significant obligations on Fimalac's digital media entities like Webedia.

These regulations mandate stricter content moderation and enhanced advertising transparency, directly impacting Webedia's operational model within the EU.

Compliance costs for large online platforms under DSA are estimated to reach millions annually, affecting profitability.

Furthermore, the DMA's fair competition rules could alter digital advertising revenue streams, requiring Webedia to adapt its market strategies to avoid substantial fines, potentially up to 10% of global turnover.

Fimalac's real estate portfolio in France is heavily influenced by evolving national and local regulations, including stringent planning and zoning laws that dictate development potential. Changes in building codes, particularly those aimed at enhancing energy performance, directly impact project costs and timelines; for instance, the French RE2020 standard, fully effective in 2024, mandates significant reductions in carbon emissions for new constructions. Landlord-tenant laws also shape rental income and property management strategies. These legislative shifts necessitate continuous adaptation to maintain property values and ensure compliance across their investment holdings.

Labor and employment laws

Financière Marc de Lacharrière (Fimalac) must navigate France's comprehensive labor laws, which significantly impact its diverse portfolio companies. Regulations covering employment contracts, working hours, and employee representation, like those under the Labor Code, are critical. While the Macron reforms of 2017 aimed to introduce more flexibility, reducing some dismissal costs, compliance remains a central legal concern for 2024 and 2025 operations.

- French labor law has seen 11 reforms since 2000, illustrating ongoing evolution.

- Mandatory employee representation, through CSEs, affects companies with 11+ employees.

- The average weekly working hours in France remain around 35 hours, impacting operational planning.

- Compliance costs for French businesses can reach up to 1.5% of their total revenues.

Mergers and acquisitions (M&A) regulations

Fimalac's strategic growth through acquisitions is strictly governed by French and European Union competition and M&A laws. These transactions, such as any significant stake acquisition in 2024, are rigorously reviewed by authorities like the European Commission to prevent market monopolization. The legal framework for takeovers, including mandatory tender offers as seen in France's AMF regulations, dictates the acquisition of controlling stakes. Compliance ensures fair market practices and investor protection across its financial services and digital sectors.

- EU Merger Regulation (ECMR) applies to large-scale cross-border transactions.

- French Autorité de la Concurrence reviews domestic mergers and acquisitions.

- Mandatory tender offers are triggered by exceeding ownership thresholds, typically 30% in France.

- Antitrust scrutiny in 2024/2025 focuses on digital market dominance.

Fimalac navigates a complex legal landscape shaped by evolving French and EU regulations, including stringent financial reporting under IFRS by late 2024 and France's 25% corporate tax rate. The EU Digital Services Act and Digital Markets Act, fully applicable in 2024 and 2025 respectively, significantly impact digital entities like Webedia, requiring costly compliance. Real estate operations are influenced by new building codes like RE2020, effective in 2024, and labor laws dictate employment practices. Furthermore, M&A activities are subject to rigorous competition law scrutiny by EU and French authorities in 2024/2025.

| Legal Area | Key Regulation/Standard | Impact Date/Threshold |

|---|---|---|

| Corporate Governance | IFRS Reporting | Late 2024 |

| Digital Services | EU DSA/DMA | 2024/2025 |

| Real Estate | French RE2020 Standard | 2024 |

| M&A | French AMF Tender Offer | 30% Ownership |

Environmental factors

French and EU energy efficiency regulations significantly impact Fimalac's real estate portfolio, necessitating substantial investments. France's Décret Tertiaire, effective since 2019, mandates commercial buildings reduce energy consumption by 40% by 2030, compelling Fimalac to retrofit its properties. Additionally, stricter Energy Performance Certificate DPE requirements are phasing in for rental properties, with G-rated properties banned from renting as of January 2025. These regulations require Fimalac to allocate significant capital towards sustainable technologies and building upgrades across its diverse property holdings.

The event industry is experiencing a significant shift towards environmentally friendly practices, driven by increasing client and consumer demand for sustainability. This includes a strong focus on reducing waste and minimizing carbon footprints, with real-time tracking becoming crucial for achieving targets like the 2024 goal for a 25% reduction in event-related emissions from 2019 levels in some European venues. Fimalac's entertainment division, notably through its GL Events subsidiary, faces mounting pressure to adopt these measures, including sourcing from sustainable suppliers to meet the rising demand for green events, reflecting a market where 70% of attendees prioritize eco-conscious options by 2025. This trend necessitates significant investment in sustainable infrastructure and operational adjustments to remain competitive and align with evolving stakeholder expectations.

Financière Marc de Lacharrière (Fimalac) is subject to the EU's Corporate Sustainability Reporting Directive (CSRD), effective for large companies from financial year 2025. This regulation mandates comprehensive disclosure of environmental, social, and governance (ESG) impacts and risks. Fimalac must conduct a double materiality analysis, assessing its impact on society and the environment, alongside how sustainability matters affect its business and finances. Compliance requires robust data collection and transparent reporting, impacting over 50,000 EU companies.

Climate change risks to real estate

Physical risks from climate change, like increased flooding and extreme weather events, directly threaten Fimalac's real estate portfolio, especially in vulnerable coastal or flood-prone regions. These environmental shifts are projected to escalate insurance premiums significantly, with some estimates suggesting a 15-20% rise in property insurance costs for high-risk areas by mid-2025 across Europe. Such elevated costs, coupled with potential physical damages, could lead to a tangible decline in property valuations. Fimalac must integrate these long-term climate risks into its real estate investment and development strategies to safeguard asset value and ensure portfolio resilience.

- Global average flood losses are predicted to increase by over 26% by 2050.

- Regions like coastal France and Italy, key investment areas for Fimalac, face heightened risks.

- Property insurance costs in climate-vulnerable zones are forecast to increase by 10-25% by late 2025.

- The value of commercial real estate in high-risk areas could see a 5-10% depreciation by 2030 due to climate impacts.

Shift to a circular economy

The broader economic shift towards a circular economy, emphasizing waste reduction and material reuse, presents both challenges and opportunities for Fimalac's diverse businesses. This necessitates re-evaluating supply chains and operational processes to enhance resource efficiency across its portfolio, including its financial and media segments. Aligning with growing consumer and regulatory demand, sustainable business models are becoming essential for long-term viability and brand perception.

- By 2025, global circular economy initiatives are projected to significantly influence corporate sustainability reporting.

- Regulatory pressures for extended producer responsibility (EPR) are increasing, impacting material sourcing and waste management.

- Consumer preferences show a rising demand for products and services from companies with demonstrable environmental commitments.

Fimalac navigates stringent environmental regulations, including France's Décret Tertiaire and EU's CSRD, mandating substantial investments in energy efficiency and comprehensive ESG reporting by 2025. Climate change escalates physical risks, with property insurance costs in high-risk areas forecast to increase by 10-25% by late 2025. The company must also adapt to the event industry's push for sustainability and the broader shift towards a circular economy, driven by consumer demand for eco-conscious options. These factors necessitate strategic adjustments for long-term viability and asset protection.

| Environmental Factor | Key Mandate/Trend | Impact on Fimalac |

|---|---|---|

| Energy Efficiency Regulations | Décret Tertiaire: 40% energy reduction by 2030 | Mandatory property retrofits; G-rated rental ban January 2025 |

| Climate Physical Risks | Property insurance costs up 10-25% by late 2025 | Increased operating costs, potential asset depreciation |

| Event Industry Sustainability | 25% emission reduction goal (2024); 70% attendees prioritize eco by 2025 | Investment in green infrastructure, sustainable sourcing |

| EU CSRD Compliance | Effective for large companies from financial year 2025 | Mandatory double materiality analysis, robust ESG reporting |

PESTLE Analysis Data Sources

Our PESTLE analysis for Financière Marc de Lacharrière (Fimalac) synthesizes data from official financial reports, reputable business news outlets, and market analysis firms. We draw upon regulatory filings, economic forecasts, and industry-specific trend reports to provide a comprehensive overview.