Financière Marc de Lacharrière (Fimalac) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financière Marc de Lacharrière (Fimalac) Bundle

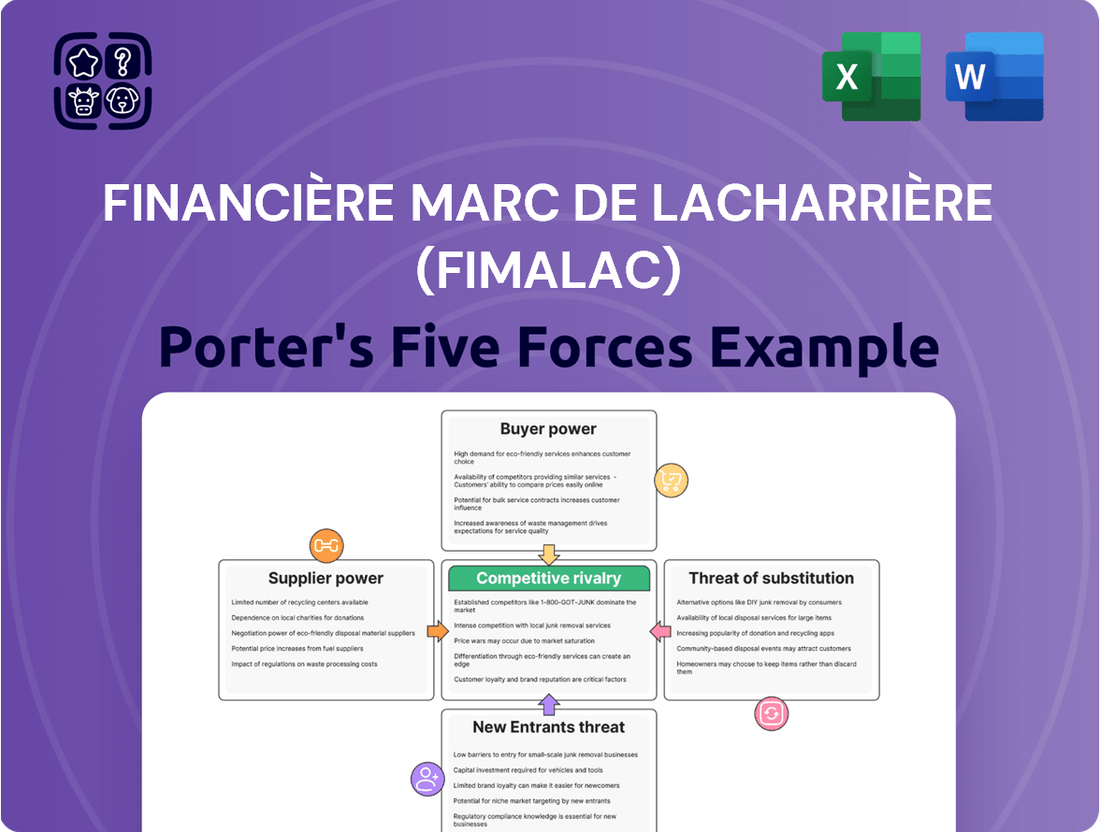

Financière Marc de Lacharrière (Fimalac) navigates a complex landscape shaped by intense rivalry and significant buyer power within its diverse portfolio companies. The threat of new entrants, while varying across sectors, presents a constant challenge to established players. Furthermore, the bargaining power of suppliers can impact Fimalac's profitability, particularly in capital-intensive industries.

The threat of substitutes also looms, requiring Fimalac to continuously innovate and adapt its offerings. Understanding the interplay of these forces is crucial for Fimalac to maintain and enhance its competitive advantage. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Financière Marc de Lacharrière (Fimalac)’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

In the digital services sector, Fimalac's Webedia relies on highly skilled professionals like data scientists and AI specialists. These talents and specialized technology firms hold significant bargaining power due to soaring demand. For instance, the average salary for AI specialists in France saw an increase of approximately 8% in 2024, reflecting this market leverage. This allows them to command higher compensation and favorable contract terms, directly impacting Fimalac's digital ventures' cost structure. The scarcity of these critical skills amplifies supplier power.

For its leisure and entertainment segment, Financière Marc de Lacharrière (Fimalac) relies on rights to unique content, artists, and event venues. Suppliers, including major production studios, leading artists' agencies, and owners of iconic venues such as Salle Pleyel, wield significant bargaining power. The scarcity and uniqueness of premier talent and content enable these suppliers to dictate prices and contractual terms. Fimalac navigates this by forging strategic partnerships and securing long-term agreements, a common strategy in the 2024 entertainment landscape to manage rising content acquisition costs.

Fimalac's real estate segment faces supplier power from construction materials, specialized labor, and land. Macroeconomic factors, like the 2024 rise in construction costs, and local market dynamics significantly influence input availability and pricing. Suppliers in concentrated markets, or those providing essential, specialized services for high-profile projects, such as London's Canary Wharf developments, can leverage their position. This often leads to increased costs for crucial inputs like premium steel or bespoke architectural services, impacting project profitability.

Digital Advertising Platforms

Fimalac's digital media entities, like Webedia, heavily rely on dominant digital advertising platforms such as Google and Meta to monetize their content. These platforms command significant market power, controlling access to a vast pool of advertisers and possessing advanced ad-serving technologies. They dictate revenue share agreements and advertising policies, directly impacting the profitability of Fimalac's online operations. For instance, Alphabet's Google Ads and Meta's advertising networks collectively held a substantial portion of the global digital ad spending in 2024, emphasizing their leverage.

- Google and Meta controlled over 50% of global digital ad spending in 2024.

- These platforms set terms for ad placement and revenue distribution.

- Their sophisticated targeting tools are crucial for advertiser reach.

- Fimalac's profitability is sensitive to changes in platform policies.

Financial Capital and Investment Partners

Fimalac, as an investment holding entity, relies heavily on strong access to capital and strategic co-investors to fuel its growth and large-scale acquisitions. Despite its significant liquidity, major strategic moves, such as past ventures like the SYSTRA acquisition, often necessitate engaging with external financial partners. The bargaining power of these lenders and co-investors stems from their ability to dictate terms, influencing the overall structure and potential returns of Fimalac's substantial investments.

- Fimalac reported a strong net cash position of €266.3 million as of December 31, 2023, reflecting robust internal financing capacity.

- Access to diverse financing sources, including banks and institutional investors, is crucial for large-scale projects in 2024.

- Negotiated interest rates and equity stakes with financial partners directly impact Fimalac's cost of capital and future profitability.

- The company's ability to secure favorable terms reflects its strong credit profile and strategic vision.

Fimalac faces significant supplier power across its diverse operations, from highly specialized digital talent commanding higher 2024 salaries to dominant digital advertising platforms dictating revenue terms. The scarcity of unique content and premier real estate inputs also empowers suppliers. This necessitates strategic partnerships and robust financial management to mitigate rising costs.

| Segment | Key Suppliers | 2024 Impact |

|---|---|---|

| Digital Services | AI Specialists, Tech Firms | 8% average salary increase for AI specialists in France. |

| Digital Media | Google, Meta | Controlled over 50% of global digital ad spending. |

| Real Estate | Construction Materials, Labor | Rising construction costs influencing project profitability. |

What is included in the product

This analysis unpacks the competitive intensity faced by Financière Marc de Lacharrière (Fimalac) by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors within its diverse portfolio.

Quickly gauge Fimalac's competitive landscape with a visual, easily digestible five forces analysis, eliminating the time-consuming task of manual data compilation and interpretation.

Effortlessly adapt the analysis to changing market dynamics by swapping in new data points, providing a real-time understanding of strategic pressures faced by Fimalac.

Customers Bargaining Power

Large corporate clients utilizing Fimalac's digital marketing and services via The Brandtech Group and Webedia possess significant bargaining power. These clients, representing a substantial portion of the over $700 billion projected global digital ad spending in 2024, often purchase services in bulk and are highly knowledgeable about market rates. They frequently demand customized solutions and performance-based pricing, such as cost-per-acquisition models. This intense client leverage pressures Fimalac's margins and necessitates continuous innovation to retain their lucrative business within the competitive digital landscape.

In digital media, Fimalac's Webedia platforms face ultimate customer power from their audience and end-users. These users possess extremely low switching costs, effortlessly moving between countless online content sources. Their collective attention directly dictates advertising revenue, a critical factor given the global digital advertising market reached an estimated $665 billion in 2024. This forces Fimalac to continuously produce high-quality, engaging content to retain traffic and attract advertisers, as user disengagement directly impacts platform value.

Ticket buyers for Fimalac Entertainment's live events hold significant bargaining power due to their heightened price sensitivity and the vast array of leisure choices available in 2024. Consumers can easily opt for numerous entertainment alternatives, ranging from competing live concerts and sporting events to an ever-expanding universe of at-home digital entertainment platforms, where global video streaming subscriptions are projected to exceed 1.7 billion by 2024. This dynamic compels Fimalac to meticulously craft ticketing strategies, ensuring perceived value aligns with market prices and focusing on delivering unique, must-see events to attract and retain audiences.

Tenants in Commercial Real Estate

The bargaining power of tenants significantly influences Financière Marc de Lacharrière's commercial real estate performance. Large corporate tenants, especially those leasing substantial office space, can negotiate favorable lease terms, impacting Fimalac's rental income. In 2024, elevated office vacancy rates globally, such as the approximately 19.8% recorded in the US during Q1, strengthen tenant leverage. This environment allows tenants to secure better rental rates and concessions, directly affecting property valuations and Fimalac's financial returns.

- US office vacancy rates reached approximately 19.8% in Q1 2024, reflecting increased tenant leverage.

- High vacancy rates allow major tenants to negotiate lower rental rates and improved lease incentives.

- This market dynamic directly impacts the valuation and profitability of commercial properties.

- Favorable tenant terms can lead to reduced rental income and longer lease up periods for property owners.

Strategic Acquisition Targets

For Financière Marc de Lacharrière (Fimalac), its strategic acquisition targets function as a distinct class of 'customers' or partners. The owners of these target companies, especially those possessing unique assets or strong market positions, wield substantial bargaining power. This power allows them to significantly influence acquisition prices and deal structures, often demanding Fimalac clearly demonstrate strategic value and synergy to successfully close transactions in 2024. For instance, in a competitive M&A landscape, sellers can leverage multiple bids to maximize their valuation.

- The global M&A market saw a 30% increase in deal value in Q1 2024 compared to Q4 2023.

- Strategic assets, particularly in digital and ESG sectors, command premium valuations.

- Fimalac's 2024 strategy emphasizes selective acquisitions, focusing on high-growth potential.

- Owners of target companies often engage financial advisors to optimize their negotiation position.

Clients of Fimalac Gestion, particularly institutional investors and large corporations, exert significant bargaining power. These sophisticated clients, managing a portion of the estimated $120 trillion in global assets under management in 2024, demand competitive fee structures and transparent performance reporting. Their ability to easily switch asset managers or reallocate funds pressures Fimalac to deliver consistent returns and tailor solutions. This client leverage necessitates continuous value demonstration to retain mandates.

| Customer Segment | Bargaining Levers | 2024 Impact |

|---|---|---|

| Financial Services Clients | Fee Negotiation, Fund Reallocation | Pressure on AUM growth and profit margins |

| Large Corporate Clients | Bulk Purchases, Performance-based Pricing | Demand for tailored solutions and cost efficiency |

| Digital Media Audiences | Low Switching Costs, Attention Economy | Necessity for continuous engaging content production |

Same Document Delivered

Financière Marc de Lacharrière (Fimalac) Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The analysis meticulously details Fimalac's competitive landscape, examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of existing rivalry within its diverse portfolio of businesses, including entertainment, real estate, and industrial services. This comprehensive breakdown provides actionable insights into Fimalac's strategic positioning and potential vulnerabilities.

Rivalry Among Competitors

Competition among investment holding companies remains intense for Financière Marc de Lacharrière (Fimalac), operating within a dynamic landscape of French and European private equity firms and fellow investment vehicles. These entities, including active players like Latour Capital, vie aggressively for high-growth potential companies across sectors such as digital services and real estate, even as partners in some ventures. This fierce rivalry for attractive investment opportunities, particularly in 2024, consistently drives up acquisition valuations and necessitates a highly disciplined and sharp investment strategy to secure advantageous deals and maximize returns. The market sees continuous capital deployment by various funds, intensifying the bidding environment.

The digital media and marketing sector, where Fimalac's Webedia and The Brandtech Group operate, faces intense rivalry.

Competition is dynamic, stemming from large media conglomerates like Publicis Groupe, which reported €14.8 billion in net revenue in 2023, and agile digital startups.

This rivalry is fierce across content creation, audience engagement, and digital advertising, with global digital ad spend projected to exceed $700 billion in 2024.

Maintaining a competitive edge demands constant innovation and strategic investment in technology, particularly AI.

Many players are heavily investing in AI-driven solutions to enhance efficiency and personalization in 2024.

The leisure and entertainment market is exceptionally fragmented, with countless entities vying for consumer discretionary spending. Fimalac Entertainment faces intense competition from a diverse array of national and international event promoters and venue operators.

This rivalry, evident in the 2024 landscape where global live entertainment revenue reached billions, pressures Fimalac to secure top-tier acts and optimize venue utilization. Marketing efforts must be highly effective to stand out amidst numerous festivals and concerts.

Real Estate Investment and Development Competition

Fimalac faces intense competitive rivalry in real estate from a diverse group of investors, developers, and property funds. These rivals aggressively compete for prime properties and development projects in key markets like Paris and London. In 2024, the Parisian office market saw investment volumes around €5 billion, highlighting the fierce competition for attractive assets. This competition directly impacts property prices and rental yields, necessitating a highly disciplined and well-informed investment strategy for Fimalac.

- Global and local real estate funds actively bid on high-value assets.

- Developers vie for land and permits in desirable urban centers.

- Increased competition can compress rental yields and elevate acquisition costs.

- As of Q1 2024, London commercial real estate investment remained robust, driven by diverse capital sources.

Consolidation and Strategic Alliances

The competitive landscape for Fimalac is significantly shaped by ongoing consolidation and strategic alliances. Fimalac's proposed deal to merge its event businesses with GL events, announced in late 2023 and progressing into 2024, aims to create a dominant cultural operator, strengthening its position in the entertainment sector. This strategic move, along with similar maneuvers by rivals, continually reshapes the industry's competitive dynamics, driving efficiency and market share gains. Such alliances are critical for navigating market shifts and securing long-term growth.

- In 2024, the Fimalac-GL events merger discussions continued, aiming for a leading European event player.

- The combined entity would significantly increase market concentration in the event management industry.

- This consolidation reflects a broader trend of companies seeking scale to enhance competitive advantage.

- Strategic alliances reduce direct competition in specific segments, fostering market power.

Fimalac's competitive rivalry is significantly shaped by ongoing industry consolidation and strategic alliances, exemplified by its proposed merger of event businesses with GL events, which continued progressing in 2024. This strategic alignment aims to create a leading European event operator, enhancing market concentration and strengthening Fimalac's position against rivals. Such moves are vital for gaining scale, driving efficiencies, and securing market share amidst dynamic competitive pressures.

| Strategic Trend | Impact on Rivalry | 2024 Implication |

|---|---|---|

| Consolidation | Reduces number of direct competitors | Increased market concentration for Fimalac |

| Strategic Alliances | Creates larger, more dominant entities | Enhanced competitive positioning in events |

| Market Scale | Enables greater efficiency and reach | Stronger bargaining power for Fimalac |

SSubstitutes Threaten

The rise of digital alternatives significantly threatens Fimalac's live event revenues. Streaming services, online gaming, and virtual events offer convenient and often cheaper entertainment. In 2024, global video streaming subscriptions continued to climb, with platforms like Netflix reporting over 270 million paid memberships. This accessibility of high-quality digital content, like virtual concerts attracting millions of viewers, directly competes with physical attendance. Consumers increasingly opt for at-home options.

For Fimalac’s digital marketing services, substitute threats emerge as companies opt for in-house marketing solutions, a trend impacting agency reliance. The rise of accessible AI-powered marketing tools, with the global AI in marketing market valued at USD 19.8 billion in 2023, empowers more businesses to manage campaigns internally. Additionally, a shift in corporate marketing budgets towards alternative channels like experiential marketing or traditional media, which still hold significant global spend shares in 2024, can also act as a strong substitute for Fimalac’s offerings.

The widespread adoption of remote and hybrid work models presents a significant substitute for traditional office space, directly impacting Fimalac's real estate portfolio. By Q1 2024, global office vacancy rates reached 15.6%, reflecting companies opting for smaller footprints or fully remote setups. This shift reduces overall demand for large, centralized office buildings, with office utilization in major markets hovering around 50-60% of pre-pandemic levels in 2024. This structural change in how businesses operate is a long-term threat to conventional commercial real estate assets, necessitating strategic adjustments for portfolio holders.

Direct-to-Consumer (D2C) and Influencer Marketing

The rise of D2C brands and influential content creators presents a significant substitute threat to Webedia's traditional platform-based advertising. Brands increasingly bypass publishers, leveraging social media and their own channels to reach consumers directly. This shift is notable, with global D2C e-commerce sales projected to reach $175 billion in 2024. Influencers, building loyal audiences, offer brands a direct, often more authentic channel, further eroding the need for intermediary media platforms.

- Global D2C e-commerce sales are expected to hit $175 billion in 2024.

- Influencer marketing spend is projected to exceed $28 billion globally in 2024.

- Brands can achieve higher ROI directly compared to traditional digital display.

- Over 70% of consumers prefer engaging with brands directly through social media.

Alternative Investment Vehicles

For Financière Marc de Lacharrière (Fimalac), significant substitutes emerge from alternative investment vehicles available to investors. Rather than investing in a holding company, investors often consider direct public stocks, with global equity markets seeing robust activity in 2024. The accessibility and competitive returns of exchange-traded funds (ETFs) also pose a threat, as global ETF assets under management are projected to exceed $15 trillion by year-end 2024. Real estate investment trusts (REITs) offer another liquid alternative, alongside numerous private equity funds that directly compete for capital. These diverse options directly influence Fimalac's capacity to attract and retain investor capital.

- Global ETF AUM projected over $15 trillion by late 2024.

- Direct public equity investments remain highly liquid and accessible.

- Private equity fundraising continues, albeit with varied success rates in 2024.

- REITs offer yield and real estate exposure without direct property management.

The threat of substitutes for Fimalac is multifaceted, driven by digital alternatives like streaming services impacting live events and D2C brands challenging traditional advertising models. Remote work trends significantly reduce demand for commercial real estate, with office vacancy rates at 15.6% in Q1 2024. Furthermore, investors increasingly choose direct equities, ETFs, and REITs over holding companies, with global ETF AUM projected over $15 trillion by late 2024. These diverse shifts necessitate Fimalac's continuous adaptation across its varied business segments.

| Fimalac Segment | Key Substitute Threat | 2024 Data Point |

|---|---|---|

| Live Events | Digital Streaming/Virtual Events | Netflix: 270M+ paid memberships |

| Real Estate | Remote/Hybrid Work Models | Q1 2024 Global Office Vacancy: 15.6% |

| Webedia Advertising | D2C Brands/Influencer Marketing | Global D2C E-commerce: $175B (projected) |

| Investment Holding | ETFs, Direct Public Equities | Global ETF AUM: $15T+ (projected) |

Entrants Threaten

The digital media landscape presents low barriers for new content creators. With a smartphone and internet, individuals can produce content for platforms like YouTube or TikTok, directly competing for audience attention with Fimalac's Webedia. Although scaling to a large media entity is challenging, the continuous emergence of niche creators fragments the market. This influx intensifies competition for user engagement, with platforms like TikTok reporting over 1.5 billion global monthly active users in 2024.

The threat of new entrants into large-scale real estate investment and major corporate acquisitions remains low for Fimalac. These sectors demand substantial capital, with prime European commercial real estate transactions often exceeding €50 million per asset in 2024, alongside deep industry expertise. Fimalac’s established network and capability to manage complex transactions create significant barriers. Such high capital requirements and specialized knowledge inherently protect Fimalac's strong market position.

New entrants in the European digital services and media space face significant regulatory hurdles, notably the Digital Services Act (DSA), which became fully applicable across the EU on February 17, 2024. Complying with evolving rules on data privacy, content moderation, and competition demands substantial legal and operational resources. This high compliance cost creates a considerable barrier for smaller, nascent players attempting to enter the market. Consequently, established entities like those within Fimalac's portfolio, possessing the financial and structural capacity to navigate these complexities, are inherently shielded from potential new competition. This regulatory burden effectively elevates the entry barrier, benefiting incumbents.

Brand Reputation and Established Relationships

Established brand reputation and deep relationships act as significant barriers for new entrants in Fimalac's core leisure, entertainment, and digital sectors. Fimalac, through subsidiaries like Webedia and Fitch Group, has cultivated trust and extensive networks over decades. A new competitor would struggle immensely to replicate these connections and the loyalty of major clients, which are crucial in securing exclusive content or high-value contracts. For instance, Webedia’s digital reach, with over 100 million unique visitors monthly as of early 2024, underscores the scale new players must overcome.

- Fimalac’s brand equity stems from decades of operation.

- Replicating established client networks is a significant hurdle.

- New entrants face high costs to build comparable trust and market presence.

- Long-term contracts with key talent and content providers further solidify Fimalac’s position.

Economies of Scale in Venue and Portfolio Management

Fimalac leverages substantial economies of scale across its diverse portfolio, from managing a vast network of entertainment venues like the 2024 Paris La Défense Arena to optimizing data utilization across its digital platforms. A new entrant would struggle significantly to achieve comparable operational efficiencies or negotiating power with suppliers. This inherent cost advantage, bolstered by Fimalac's estimated 2024 revenue streams, makes it exceedingly difficult for new competitors to price their offerings competitively and attain profitability, effectively deterring new market entry.

- Fimalac's extensive venue network optimizes operational costs.

- Data leverage across digital assets enhances efficiency.

- New entrants face higher per-unit costs without scale.

- Supplier negotiation power is significantly lower for newcomers.

Fimalac faces a generally low threat from new entrants across its diversified portfolio. Significant capital requirements, exemplified by prime European commercial real estate transactions often exceeding €50 million in 2024, create formidable barriers. Stringent regulatory hurdles, such as the EU’s Digital Services Act fully applicable from February 2024, further deter new competition. Established brand reputation, deep client relationships, and substantial economies of scale solidify Fimalac's market position.

| Barrier Type | Impact on Fimalac | 2024 Data Point |

|---|---|---|

| Capital Requirements | High deterrence in real estate/M&A | Prime EU Commercial Real Estate: >€50M per asset |

| Regulatory Compliance | Increased entry costs | Digital Services Act (EU): Fully applicable Feb 2024 |

| Brand & Networks | Difficult to replicate trust/reach | Webedia Unique Visitors: >100M monthly (early 2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fimalac leverages data from Fimalac's annual reports, investor presentations, and publicly available financial statements to understand its internal competitive position and strategic decisions. We also incorporate industry-specific research from reputable sources like Statista and IBISWorld, alongside news from financial publications to assess external market dynamics.