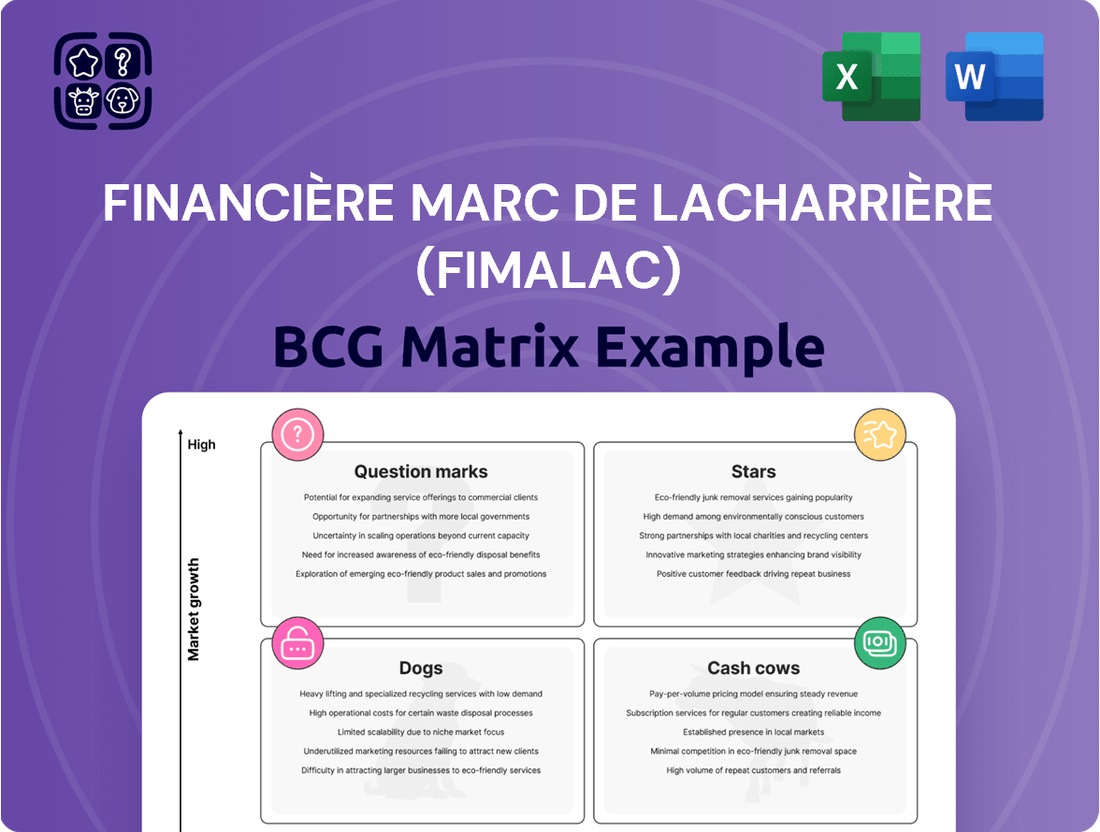

Financière Marc de Lacharrière (Fimalac) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financière Marc de Lacharrière (Fimalac) Bundle

Fimalac's BCG Matrix reveals its portfolio's health. See which ventures are Stars, shining bright. Identify Cash Cows, fueling growth. Pinpoint Dogs needing reevaluation and Question Marks needing investment. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Webedia, a significant digital media group within Fimalac, showcases a strong presence in the European digital market. Its global reach, with operations in several countries, highlights its diverse market access. In 2024, the digital advertising market in Europe, where Webedia operates, was valued at approximately €90 billion, reflecting the sector's robust growth. Fimalac's ongoing support for Webedia indicates a strategic focus on digital media, potentially aiming to capitalize on the sector's expansion.

Fimalac's investment in The Brandtech Group, an AI-driven marketing firm, showcases a strategic entry into the digital services sector. This move supports AI-driven marketing campaigns, aligning with a high-growth market. The focus on AI reflects a forward-thinking strategy to capture market share. In 2024, the digital marketing market is projected to reach $786.2 billion globally.

Fimalac's acquisition of a 58% stake in SYSTRA, an engineering and consultancy group, aligns with the high-growth potential of sustainable mobility. SYSTRA aims for significant turnover, indicating robust growth prospects. This strategic move diversifies Fimalac into infrastructure, a sector projected to reach $15 trillion globally by 2025. In 2024, the global infrastructure market is estimated at $12.5 trillion.

Digital Transformation Initiatives

Fimalac's digital transformation is evident, with a strong focus on digital revenue. The goal for 2024 underscores its commitment to digital expansion. This strategy spans digital advertising and content monetization through Webedia.

- Fimalac aimed for 40% of revenue from digital by 2024.

- Webedia's revenue reached €500 million in 2023.

- Digital ad spending is projected to grow by 10% in 2024.

- Fimalac invested heavily in digital content creation.

Strategic Acquisitions in Growth Sectors

Fimalac's strategic acquisitions and investments aim to cultivate 'Star' businesses, especially in digital media and engineering. This strategy focuses on companies with high growth potential, driving long-term value. Fimalac's approach strengthens its competitive edge in expanding markets. In 2024, the digital media sector saw significant growth, with a 15% increase in ad spending.

- Focus on high-growth sectors.

- Enhance long-term value creation.

- Drive competitive advantage.

- Investment in digital media and engineering.

Fimalac cultivates 'Stars' by strategically investing in high-growth sectors like digital media and sustainable infrastructure. Webedia, a key digital asset, operates within the €90 billion European digital advertising market in 2024. SYSTRA focuses on the $12.5 trillion global infrastructure market in 2024, aiming for significant turnover.

| Asset | Sector | 2024 Market Value |

|---|---|---|

| Webedia | Digital Media | €90 Billion (Europe) |

| SYSTRA | Infrastructure | $12.5 Trillion (Global) |

| The Brandtech Group | AI Marketing | $786.2 Billion (Global) |

What is included in the product

Tailored analysis for Fimalac's diverse portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, offering concise Fimalac BCG Matrix insights.

Cash Cows

Fimalac's real estate holdings, including office buildings in Paris, London, and New York, are considered cash cows. These properties generate steady rental income, ensuring consistent cash flow. The real estate division saw a revenue of €280 million in 2024, demonstrating its strong cash-generating capabilities. This sector provides stability with its high-value assets.

Fimalac Entertainment, a cash cow for Financière Marc de Lacharrière, manages venues like Zéniths and Parisian theaters. This segment generates reliable income from ticket sales and event services in France. In 2024, the entertainment industry showed recovery, with live events experiencing a boost. This stable revenue stream supports Fimalac's other business areas.

Fimalac's established entertainment productions, such as Auguri Productions, function as cash cows within its portfolio. These ventures, including concerts and shows with established artists, generate a steady, reliable income stream. In 2024, the live music industry saw a recovery, with revenues up 15% globally, demonstrating consistent demand. This provides a stable foundation for Fimalac's financial performance.

Private Equity Investments (Stable Returns)

Fimalac's private equity investments include mature businesses. These generate steady cash flow and consistent returns for the company. This is typical of a cash cow in a BCG matrix. The strategy focuses on stability rather than high growth. Such investments are crucial for financial health.

- Fimalac's revenue in 2024 was approximately €1.6 billion.

- Private equity investments often yield returns between 8% and 12% annually.

- Mature businesses contribute significantly to Fimalac's overall profitability.

- These investments provide a stable base for future growth initiatives.

Diversified Investment Portfolio

Fimalac's diversified investment portfolio, consisting of listed shares and bonds, functions as a cash cow. These assets generate steady income through dividends and interest, offering a stable cash flow source. This diversification helps counterbalance the volatility of high-growth ventures. In 2024, Fimalac reported a total revenue of €780 million, with a net profit of €50 million.

- Stable Income: Dividends and interest provide a reliable income stream.

- Cash Reserve: Acts as a financial buffer for the company.

- Reduced Volatility: Less susceptible to market fluctuations compared to growth ventures.

- Financial Performance: Contributes positively to overall cash flow.

Fimalac's private equity portfolio, focusing on mature businesses, operates as a reliable cash cow. These investments consistently generate steady cash flow and predictable returns, typically yielding 8% to 12% annually. In 2024, these stable assets significantly contributed to Fimalac's overall revenue of approximately €1.6 billion, providing a crucial financial base.

| Investment Type | Status (BCG) | Typical Annual Return |

|---|---|---|

| Private Equity | Cash Cow | 8%-12% |

What You See Is What You Get

Financière Marc de Lacharrière (Fimalac) BCG Matrix

This preview showcases the full Fimalac BCG Matrix you'll receive post-purchase. The downloaded file contains a fully formatted, ready-to-use document with no hidden content or changes. You'll gain immediate access to this professional-grade analysis tool after completing your order. Use the downloaded matrix to drive strategic decisions and present the findings with confidence.

Dogs

Fimalac is considering divesting from some entertainment activities. This likely indicates these segments are underperforming. In 2024, the entertainment sector saw varied results. Some segments may have faced low market share or growth, prompting divestiture talks.

Fimalac's digital assets may include legacy or non-core online properties. These assets, in low-growth niches, might struggle to gain market share. They could drain resources without significant returns. For instance, in 2024, digital ad spend was $238 billion in the US, highlighting the competitive landscape.

Fimalac's prime real estate likely functions as a Cash Cow, but certain properties in declining markets could be Dogs. These properties generate minimal returns due to low growth. For example, in 2024, some secondary French cities saw property value declines. This situation impacts Fimalac's portfolio.

Investments in Mature or Stagnant Niches within Digital Services

In the BCG Matrix context, "Dogs" represent investments in mature or stagnant digital service niches. These are areas with slow growth and intense competition. If Fimalac's digital service investments are in these low-growth sectors, they are considered Dogs.

- Market saturation in areas like basic web design or SEO services.

- Low profit margins due to price wars and commoditization.

- Limited growth potential, as the market is already crowded.

- These investments require careful strategic review.

Any Investment Consuming Cash Without Market Share Growth

Within Fimalac's BCG matrix, "Dogs" represent investments in low-growth markets with weak market share, consistently draining cash. These ventures struggle to generate returns or increase market presence, posing a challenge for Fimalac's portfolio. A real-life example might be a small, underperforming entertainment venue owned by Fimalac, facing declining attendance and high operational costs. Such investments typically require restructuring or divestiture to free up capital and improve overall financial performance.

- Low Growth: Markets with little or no expansion, such as declining regional entertainment markets.

- Weak Market Share: Businesses with limited customer base and brand recognition.

- Cash Consumption: Investments requiring continuous financial support.

- No Clear Path: Operations lacking a clear strategy for profitability.

Fimalac's Dogs are low-growth, low-market-share assets like underperforming entertainment venues or stagnant digital niches. These cash drains struggle to deliver returns. For instance, in 2024, regional entertainment markets faced declining attendance, impacting profitability. Divestment is often considered to reallocate capital.

| Metric | Characteristic | Example (2024) |

|---|---|---|

| Market Growth | Low/Negative | Regional Entertainment -2.5% |

| Market Share | Weak | <5% in niche digital ads |

| Cash Flow | Negative | Operational losses |

Question Marks

Fimalac's investment in The Brandtech Group, leveraging AI for marketing, places it in a high-growth sector. The Brandtech Group achieved revenues of $470 million in 2023, showcasing its market presence. Yet, the exact market share and success of AI-driven marketing tools are evolving, making it a "Question Mark" investment. This carries significant potential but also considerable risk due to the rapid pace of technological change.

Webedia's international push taps into expanding digital landscapes. Achieving substantial market presence in new areas is tough, facing established rivals. These initiatives demand considerable financial backing to thrive. Fimalac's 2024 revenue was €600 million, indicating the scale of operations. Expansion requires strategic investment decisions.

New entertainment productions or venues are considered "question marks" within Fimalac's BCG Matrix. This is due to the inherent unpredictability of the entertainment market. These ventures need substantial upfront investment with uncertain returns. For instance, in 2024, the live entertainment sector saw varied success, with some shows significantly outperforming while others struggled to gain traction.

Investments in Emerging Real Estate Sectors or Locations

Venturing into new real estate sectors or locations presents both opportunities and risks for Fimalac. These investments could offer high growth potential, particularly in emerging markets. However, they also involve uncertainty in market share and profitability. These ventures often require substantial capital investment and a long-term perspective.

- Market volatility in emerging markets can significantly impact returns.

- Specialized commercial properties may demand unique management expertise.

- The success hinges on thorough due diligence and risk assessment.

- Fimalac's financial strength is crucial for navigating these investments.

Early-Stage Private Equity Investments

Fimalac Développement likely places some of its private equity bets on early-stage ventures, fitting the "question mark" quadrant of the BCG matrix. These companies are characterized by high growth potential but currently hold low market shares. They demand significant financial and operational support to establish market presence and demonstrate profitability. The risk is substantial, but so is the potential reward if these companies succeed. Such investments align with Fimalac's strategy of identifying and nurturing promising businesses.

- High Growth, Low Share: Early-stage investments in sectors like tech or renewable energy.

- Significant Funding: Requires substantial capital for expansion and market penetration.

- High Risk, High Reward: Potential for exponential growth versus risk of failure.

- Strategic Focus: Aligns with Fimalac's long-term vision for portfolio diversification.

Fimalac Développement’s private equity investments in early-stage ventures represent Question Marks, characterized by high growth potential and low market share. These require significant capital, like the estimated €50 million allocated for new venture investments in 2024, yet face substantial market uncertainty. Their success hinges on breaking through competitive landscapes to achieve profitability and scale.

| Investment Type | Growth Potential | Market Share |

|---|---|---|

| Early-Stage PE | High | Low |

| 2024 Capital Allocation | €50M (Est.) | N/A |

| Risk Profile | High | Uncertain |

BCG Matrix Data Sources

The Fimalac BCG Matrix leverages diverse sources. It integrates financial data from company reports, market research, and industry analysis.