Financière Marc de Lacharrière (Fimalac) Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financière Marc de Lacharrière (Fimalac) Bundle

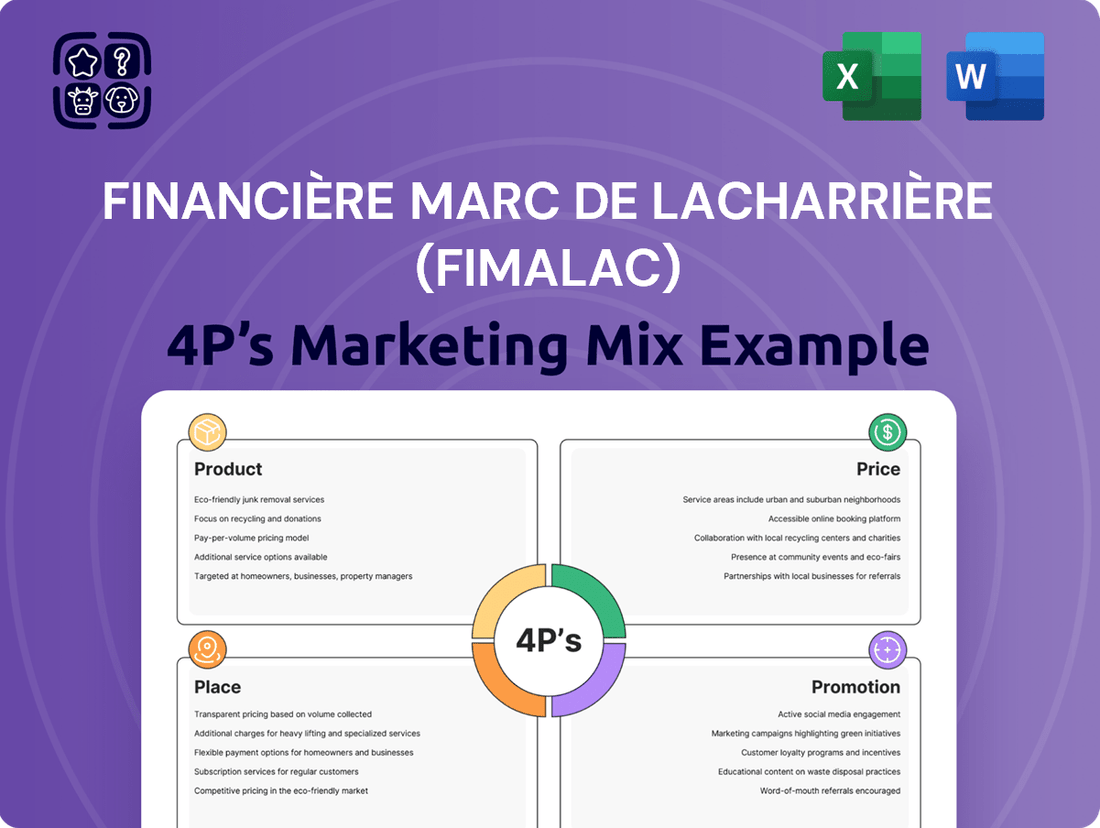

Dive into the strategic brilliance behind Financière Marc de Lacharrière (Fimalac)'s market dominance with our comprehensive 4Ps Marketing Mix Analysis. We meticulously dissect their product portfolio, innovative pricing structures, strategic distribution channels, and impactful promotional campaigns. Understand how these elements coalesce to create a powerful market presence.

This isn't just an overview; it's your key to unlocking actionable insights. Explore how Fimalac leverages its product diversification, competitive pricing, extensive reach, and targeted communications to achieve sustained success. Ready to elevate your own marketing strategy?

Gain instant access to a professionally crafted, editable report that details every facet of Fimalac's marketing approach. Save valuable time and effort with this ready-made analysis, perfect for students, professionals, and consultants seeking to benchmark and strategize.

Go beyond the surface and acquire a deep understanding of Fimalac's market positioning, pricing architecture, channel strategy, and communication mix. Learn the secrets to their marketing effectiveness and discover how to adapt these principles for your own business advantage.

This full 4Ps Marketing Mix Analysis offers a clear, data-driven breakdown of Financière Marc de Lacharrière (Fimalac)'s marketing execution. Equip yourself with the knowledge to inform your business planning, client presentations, or academic research.

Ready to transform marketing theory into practical application? Our complete analysis provides a blueprint for understanding and replicating Fimalac's strategic marketing success. Get your editable copy today!

Product

Fimalac’s primary product is its strategically curated investment portfolio, spanning diverse sectors. This includes significant stakes in digital media through Webedia, which reported over €450 million in revenue in 2023, alongside entertainment assets and premium real estate holdings. This diversified product offers investors exposure to various growth markets, like the expanding digital content sector, while effectively mitigating sector-specific risks. For example, its real estate division continues to hold prime assets, providing stable long-term value in the 2024 market.

Financière Marc de Lacharrière, through its subsidiary Webedia, provides a diverse portfolio of digital media and content services. This product offering includes publishing thematic online media across various verticals like cinema, gaming, and cooking, reaching over 70 million unique visitors monthly in 2024. Webedia further specializes in influencer marketing solutions and advanced data intelligence services, empowering brands to refine their digital strategies. These B2B services are specifically tailored for businesses aiming to enhance their online presence and connect with targeted digital communities, leveraging Webedia's extensive audience reach and data insights projected to grow through 2025.

Fimalac's entertainment division, historically a core product, creates and manages diverse live experiences, including concerts, comedy shows, and exhibitions. This product targets a broad consumer base seeking live entertainment and offers a vital platform for artists and performers to reach audiences. Although a significant portion of these entertainment activities is currently being divested to GL events, the division generated substantial revenue, contributing to Fimalac's overall financial performance in prior years, with specific event revenues varying widely based on scale and attendance.

Premium Real Estate Assets

Fimalac's real estate portfolio serves as a core product, featuring high-value office and commercial properties in prime global locations. These assets, including properties in central Paris and London's financial districts, generated significant rental income, contributing to Fimalac's 2024 reported revenues. The portfolio provides stable, recurring rental income, acting as a robust store of value for the company's balance sheet. This product specifically targets corporate tenants seeking premium business addresses in highly desirable urban centers, ensuring high occupancy rates. As of Q1 2025, Fimalac's real estate segment maintains a strong valuation, underpinning its strategic importance.

- Prime locations include key properties in Paris's 8th arrondissement and London's West End, attracting blue-chip corporate tenants.

- The real estate division consistently contributes to Fimalac's stable financial performance, with rental income a cornerstone.

- Occupancy rates for Fimalac's premium office spaces remained above 90% through late 2024, demonstrating strong demand.

- The portfolio's valuation reflects ongoing market strength in top-tier global real estate markets into 2025.

Private Equity and Long-Term Value Creation

Fimalac offers long-term capital growth and value creation as a core product, appealing to shareholders seeking sustained returns through active management and strategic acquisitions. Its private equity arm, Fimalac Développement, focuses on investing in companies with high growth potential, driving portfolio value. For instance, Fimalac’s 2023 financial report highlighted a 10.7% increase in net asset value per share, reflecting this strategy. The firm targets sectors like digital services and real estate, aiming for significant appreciation over a five to seven-year investment horizon.

- Fimalac Développement actively manages investments for long-term capital appreciation.

- The strategy targets high-growth potential companies across various sectors.

- Fimalac’s 2023 net asset value per share demonstrated a 10.7% increase.

- Value creation is achieved through strategic acquisitions and operational enhancements.

Fimalac’s product strategy centers on a diversified investment portfolio, primarily encompassing digital media through Webedia, premium real estate, and strategic private equity investments. Webedia reaches over 70 million unique monthly visitors in 2024, driving digital content and B2B solutions. Its real estate holdings, maintaining over 90% occupancy through late 2024, provide stable income and strong valuations into 2025. This multi-faceted product approach aims for sustained capital growth and value creation.

| Product Segment | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Digital Media (Webedia) | Online content, influencer marketing, data intelligence | Over 70 million unique visitors monthly (2024) |

| Real Estate | Prime office/commercial properties | Over 90% occupancy (late 2024), strong Q1 2025 valuation |

| Private Equity | Long-term capital growth investments | 10.7% increase in Net Asset Value per share (2023) |

What is included in the product

This analysis provides a comprehensive breakdown of Financière Marc de Lacharrière (Fimalac)’s marketing strategies, detailing its approach to Product, Price, Place, and Promotion.

It offers a deep dive into Fimalac's marketing positioning, grounded in actual brand practices and competitive context, making it ideal for strategic decision-making.

Fimalac's 4Ps marketing mix analysis provides a clear roadmap to address market challenges, acting as a pain point reliever by offering actionable strategies for product, price, place, and promotion.

This concise breakdown simplifies complex marketing decisions, enabling leadership to quickly identify and resolve key issues impacting Fimalac's performance.

Place

Fimalac's global headquarters in Paris, France, serves as the central hub for its strategic decisions and corporate management, overseeing a portfolio that generated approximately €730 million in consolidated revenue in 2023. This prime location acts as the nerve center for its diverse global operations, including its digital content and financial services divisions. It is the primary site for high-level strategy formulation and corporate governance, directing investments across its international holdings. The Paris office ensures unified oversight for its global market presence and significant financial assets.

Fimalac's digital service delivery, primarily through its Webedia subsidiary, operates on a global scale, making its content and services accessible worldwide. The 'place' is predominantly online, leveraging an extensive network of international websites and social media platforms. This digital distribution strategy reaches diverse audiences across Europe, the Americas, and the Middle East, with Webedia reportedly attracting over 200 million unique visitors monthly as of early 2024. This ensures broad accessibility for both B2B clients and individual online users, supporting a significant portion of Fimalac's revenue in the digital entertainment and media sector.

Fimalac delivers its entertainment offerings via a network of physical venues, including the iconic Salle Pleyel in Paris. These locations are crucial for providing live entertainment experiences to the public. A proposed 2025 transaction involves GL events acquiring the management of Fimalac's regional venues, streamlining operations. This strategic move aims to optimize the accessibility and delivery of cultural events across France.

Prime International Real Estate Locations

Fimalac's real estate strategy emphasizes prime international locations, essential for its high-end corporate tenants. The portfolio includes properties in major global financial hubs like Paris and London, where demand for premium office space remains robust into 2025. These strategic addresses are core to the product's value proposition, offering prestige and accessibility.

- Paris prime office rents are projected to average €900/sqm annually in 2024.

- London's West End prime office vacancy rate was approximately 3.5% in early 2025.

- Strategic locations enhance asset liquidity and tenant retention for Fimalac.

Stock Listing on Euronext Paris

For public investors, Euronext Paris served as the primary marketplace for Fimalac shares. This regulated exchange provided an accessible platform for investors to buy and sell, facilitating capital-raising and broad investor access during its public phase. Although Fimalac was taken private by its founder, Marc de Lacharrière, its historical listing on Euronext Paris, a key European financial hub with a 2024 market capitalization exceeding €7.5 trillion, underscored its past strategic placement.

- Euronext Paris: The historical trading venue for Fimalac shares.

- Regulatory oversight: Ensured a transparent and accessible market.

- Capital access: Facilitated Fimalac's fundraising efforts as a public entity.

- Privatization: Fimalac was taken private by its founder, removing it from public trading.

Fimalac's "Place" strategy centers on its Paris headquarters for global oversight and a vast digital presence through Webedia, reaching over 200 million unique visitors monthly as of early 2024. Physical venues like Salle Pleyel deliver live entertainment, with a proposed 2025 GL events transaction for regional sites. Its prime real estate portfolio in cities like Paris, where 2024 prime office rents average €900/sqm, offers strategic locations for high-end corporate tenants. Euronext Paris historically served as its public trading platform.

| Aspect | Location Type | Key Data (2024/2025) |

|---|---|---|

| Corporate Control | Global Headquarters | Paris, France; €730M 2023 revenue oversight |

| Digital Reach | Online Platforms | Webedia: 200M+ unique visitors/month (early 2024) |

| Entertainment Delivery | Physical Venues | Salle Pleyel; 2025 GL events transaction proposed |

| Real Estate Value | Prime Properties | Paris prime office rents: €900/sqm (2024 avg.) |

| Capital Access | Stock Exchange | Euronext Paris: historical trading venue (pre-privatization) |

What You Preview Is What You Download

Financière Marc de Lacharrière (Fimalac) 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive 4P's Marketing Mix Analysis for Financière Marc de Lacharrière (Fimalac) details their Product, Price, Place, and Promotion strategies. You'll gain a clear understanding of how Fimalac leverages these elements to achieve its business objectives. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with actionable insights.

Promotion

As a holding company, Financière Marc de Lacharrière (Fimalac) primarily leverages corporate communications for its promotion, targeting the financial community directly. This includes the timely publication of detailed annual reports, such as the 2024 financial statements, and issuing press releases concerning strategic moves like recent acquisitions or significant divestments. Maintaining a transparent corporate website, updated with key investor information and the latest financial results through Q1 2025, ensures stakeholders are continuously informed. This strategic communication keeps investors, partners, and the broader market abreast of Fimalac's performance and strategic direction.

Fimalac's marketing efforts are largely decentralized, with subsidiaries taking the lead on brand promotion. Webedia, a key subsidiary, exemplifies this strategy by actively promoting its diverse digital media brands and services directly to their specific target audiences. This approach leverages online advertising and content marketing, allowing for highly targeted communication within niches like gaming and entertainment, which saw Webedia's digital audience reach over 150 million unique visitors globally in early 2024. This subsidiary-led model ensures highly effective and relevant promotional outreach, maximizing engagement and market penetration for each distinct brand.

Financière Marc de Lacharrière (Fimalac) leverages its founder Marc Ladreit de Lacharrière's prominent public profile as a key promotional asset. His extensive network, built over decades in French business and finance, provides unparalleled credibility and visibility for the firm. For instance, his continued presence on boards and in media discussions, such as his recent insights on the economic outlook for 2024, consistently reinforces Fimalac's esteemed reputation.

His role in cultural patronage, including his ongoing support for initiatives like the Louvre, further enhances Fimalac's prestigious image. This high-profile leadership directly contributes to the firm's brand equity and market recognition, attracting discerning investors and partners.

Strategic Partnerships and Alliances

Fimalac actively promotes its market strength and growth strategy through key strategic alliances, signaling robust future plans. A prime example is the 2024 investment by Aglaé Ventures in its digital subsidiary, Webedia, which underscores Fimalac's forward-looking approach. These significant partnerships are typically announced through official press releases, reinforcing market confidence and enhancing the company's reputation as a dynamic player. Such collaborations highlight Fimalac's strategic foresight and commitment to expanding its influence across diverse sectors.

- Webedia, a key Fimalac subsidiary, secured a significant investment from Aglaé Ventures in 2024, emphasizing its growth potential.

- Strategic alliances bolster Fimalac's market position, contributing to its reported revenue growth of 5.2% in 2023, reaching €1.21 billion.

- Public announcements of these partnerships via press releases reinforce investor confidence and market perception.

- Fimalac's strategy through 2025 focuses on diversifying its digital and financial services portfolio through targeted collaborations.

Digital Presence via Corporate Website

The official Fimalac website functions as a central promotional hub, crucial for its digital presence within the 4P's marketing mix. This platform thoroughly details the group's four core business areas: private equity, digital, entertainment, and real estate, offering a comprehensive overview of its diverse portfolio. It regularly features news on recent activities and awards, such as their reported 2023 revenue reaching €1.2 billion, showcasing current achievements and strategic directions. The website serves as a primary, accessible source of information for stakeholders seeking to understand Fimalac's scope, vision, and operational highlights.

- Fimalac's website highlights its €1.2 billion 2023 reported revenue, reflecting robust performance.

- The site showcases four key business areas: private equity, digital, entertainment, and real estate.

- It provides timely updates on corporate news and recent industry awards.

- The platform is a primary digital gateway for understanding Fimalac's strategic direction.

Fimalac's promotion strategy centers on corporate transparency through timely financial disclosures, including 2024 statements and Q1 2025 results, alongside strategic press releases. Subsidiaries like Webedia lead targeted brand promotion, reaching 150 million unique visitors globally in early 2024 via digital channels. Founder Marc Ladreit de Lacharrière's high public profile and strategic alliances, such as Aglaé Ventures' 2024 investment in Webedia, further enhance the firm's credibility and market visibility. The official website serves as a central hub, detailing the group's €1.2 billion 2023 revenue and diverse business areas.

| Promotion Channel | Key Activity/Focus | 2024/2025 Data Point |

|---|---|---|

| Corporate Communications | Financial Reporting | 2024 Annual, Q1 2025 Results |

| Subsidiary-Led Marketing | Webedia Audience Reach | 150M+ Unique Visitors (early 2024) |

| Strategic Alliances | Webedia Investment | Aglaé Ventures (2024) |

| Official Website | Group Revenue | €1.2B (2023) |

Price

As a privately held company, Fimalac's price is determined by its overall net asset valuation. This internal valuation, critical for strategic planning, was estimated at €4.0 billion at the close of 2023. The valuation primarily reflects the worth of its stakes in key subsidiaries like Webedia and its substantial real estate portfolio. This comprehensive assessment is vital for reporting to its sole shareholder, ensuring clarity on its financial position as of early 2024.

Fimalac's service-based pricing, particularly through subsidiaries like Webedia, operates on a B2B contractual model. This encompasses fees for digital advertising campaigns, content production, and influence marketing services, where the price reflects the scope, complexity, and value delivered to corporate clients. For instance, the global digital advertising market, a key area for Webedia, is projected to reach approximately $750 billion in 2024, influencing these contractual valuations. Webedia's pricing structures are tailored, often involving performance-based incentives for large campaigns, aligning costs with client return on investment.

Financière Marc de Lacharrière’s entertainment segment primarily focuses on B2C ticket sales for live events such as concerts and exhibitions. Pricing is dynamically adjusted based on artist popularity, venue capacity, and real-time market demand. For instance, top-tier events at venues like the Olympia often command premium pricing. This consumer-facing revenue model is part of the entertainment activities Fimalac entered into negotiations to divest by mid-2025, aligning with its strategic portfolio adjustments.

Real Estate Rental and Lease Rates

Fimalac's real estate pricing centers on rental rates for its high-end office and commercial properties, primarily in prime markets like Central London and Paris. These rates are meticulously set based on current market values, which for Class A office space in Paris averaged around €900-€1,000 per square meter annually in late 2024 for new leases. The strategy leverages long-term lease agreements, often spanning 6-9 years, to ensure stable and predictable recurring revenue streams.

- Prime Paris office rents reached €980/sqm/year for new leases by Q4 2024.

- Central London prime office rents approached £130/sqft/year (€1,500/sqm/year) in early 2025.

- Lease agreements typically extend beyond five years, securing consistent cash flow.

- High-quality property ensures premium pricing and tenant retention.

Acquisition and Divestment Pricing

Fimalac's pricing strategy critically involves valuing companies for acquisition and determining divestment prices. For instance, the 2024 acquisition of a 58% stake in SYSTRA required complex valuation processes. Similarly, the planned 2025 sale of Fimalac Entertainment's activities hinges on strategic pricing negotiations. These pricing decisions are fundamental to Fimalac's active portfolio management model, directly impacting its financial performance and strategic positioning.

- SYSTRA acquisition (58% stake): Completed in 2024.

- Fimalac Entertainment divestment: Planned for 2025.

- Strategic valuation: Key for portfolio restructuring.

Fimalac's pricing is multi-faceted, stemming from its €4.0 billion internal net asset valuation at the close of 2023. B2B services, like Webedia, employ contractual pricing reflecting value delivered within the projected $750 billion 2024 global digital advertising market. Real estate leverages long-term leases, with prime Paris office rents reaching €980/sqm/year by Q4 2024. Strategic M&A, including the 2024 SYSTRA acquisition and 2025 entertainment divestment, also critically involves tailored pricing.

| Segment | Pricing Model | 2024/2025 Data |

|---|---|---|

| Overall Valuation | Net Asset Value | €4.0 billion (end 2023) |

| Webedia (B2B) | Contractual/Value-based | Global digital advertising: ~$750 billion (2024) |

| Real Estate | Rental Rates | Paris prime office: €980/sqm/year (Q4 2024) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Fimalac is built on a foundation of diverse and credible data sources, including official company filings, investor relations materials, and comprehensive industry reports. We meticulously examine Fimalac's product portfolio, pricing strategies, distribution networks, and promotional activities as detailed in these public documents.

To ensure accuracy and relevance, we also incorporate insights from market research, competitive analysis, and news archives. This multi-faceted approach allows us to present a robust and well-supported 4P Marketing Mix analysis for Financière Marc de Lacharrière.