Financière Marc de Lacharrière (Fimalac) Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financière Marc de Lacharrière (Fimalac) Bundle

Discover the intricate workings of Financière Marc de Lacharrière (Fimalac) with our comprehensive Business Model Canvas. This detailed document unpacks their diverse portfolio, from entertainment to real estate, revealing how they leverage synergies and strategic investments to drive value. Understand their customer relationships and key resources that underpin their success.

Unlock the full strategic blueprint behind Financière Marc de Lacharrière (Fimalac)'s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Financière Marc de Lacharrière (Fimalac)’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Fimalac often collaborates with leading private equity firms and major financial institutions, forming strategic co-investment partnerships. These alliances enable participation in larger acquisitions, such as significant real estate ventures or infrastructure projects, by pooling substantial capital. By diversifying investments across multiple partners, Fimalac mitigates risk exposure, enhancing portfolio stability. For instance, in 2024, such partnerships facilitated Fimalac's continued expansion in areas like digital media and financial services. This collaborative approach also provides access to a broader network of expertise and robust due diligence capabilities, streamlining complex deal executions.

The leadership teams of Fimalac's portfolio companies, like the digital marketing group Jellyfish and hospitality giant Groupe Lucien Barrière, are crucial partners. Fimalac, operating as a holding company, relies heavily on their operational expertise and deep industry knowledge. These management teams drive day-to-day performance and execute growth strategies, ensuring the successful implementation of business plans. For instance, Jellyfish, acquired by Fimalac in 2024, continues to expand its global reach under its existing leadership, contributing significantly to Fimalac's diversified revenue streams.

For its digital services segment, Fimalac's subsidiary Jellyfish critically partners with global technology platforms like Google, Meta, and Amazon. These strategic alliances grant Jellyfish access to advanced advertising tools and exclusive beta programs, ensuring cutting-edge service delivery. Furthermore, maintaining official partner certifications with these giants, as seen in their 2024 operational activities, is indispensable for effectively serving a diverse global client base. This deep integration allows Jellyfish to leverage the latest platform innovations, driving digital marketing performance for its clients worldwide.

Entertainment Promoters & Talent Agencies

Fimalac Entertainment, a key division of Financière Marc de Lacharrière, cultivates vital alliances with international show promoters, artist management firms, and leading talent agencies. These collaborations are crucial for securing top-tier acts and orchestrating extensive international tours, directly bolstering the programming of its managed venues. For instance, the venues often host over 100 major events annually, attracting hundreds of thousands of attendees. Such partnerships also facilitate the co-production of large-scale events, ensuring a consistent pipeline of high-profile entertainment offerings. The strategic importance of these relationships is underscored by the continued growth in live entertainment revenue, with global concert ticket sales projected to reach significant figures in 2024.

- Collaboration with major international promoters like Live Nation and AEG.

- Securing artists for venues such as the Accor Arena, which hosted 1.8 million spectators in 2023.

- Co-production of events, sharing risks and maximizing audience reach.

- Leveraging agency networks for diverse talent booking across genres.

Real Estate Developers & Operators

Financière Marc de Lacharrière (Fimalac) strengthens its real estate portfolio by partnering with leading property developers, asset managers, and luxury hotel operators. These collaborations are crucial for identifying prime investment opportunities, particularly in high-demand urban centers and resort areas. For instance, in 2024, Fimalac continues to expand its hospitality footprint through strategic alliances, ensuring premium positioning for assets like those under the Groupe Barrière umbrella. These partnerships also streamline complex development projects, from initial acquisition to operational readiness.

- Strategic alliances identify key urban and luxury resort investment opportunities.

- Partnerships facilitate end-to-end development project management.

- Collaborations ensure premium market positioning for hospitality assets.

- Fimalac leverages expertise to enhance its diverse real estate holdings.

Fimalac cultivates vital partnerships with private equity firms and financial institutions for co-investments, facilitating major acquisitions in 2024 across digital media and financial services. Collaborations with global tech giants like Google are crucial for its digital subsidiary Jellyfish, ensuring access to cutting-edge tools. Its entertainment division partners with major promoters such as Live Nation, securing top-tier acts for venues like Accor Arena, which saw 1.8 million spectators in 2023. Additionally, alliances with real estate developers strengthen its hospitality portfolio, including Groupe Barrière assets.

| Partner Category | Key Role | 2024 Impact Example | ||

|---|---|---|---|---|

| Financial Institutions | Co-investments, capital pooling | Expansion in digital media and financial services | ||

| Technology Platforms | Advanced tools, certifications | Jellyfish leveraging Google for digital marketing | ||

| Entertainment Promoters | Artist booking, event co-production | Securing acts for venues like Accor Arena |

What is included in the product

Fimalac's business model focuses on acquiring and managing diverse, established businesses across sectors like entertainment and services, leveraging synergies and financial expertise to drive profitable growth and shareholder value.

Fimalac's Business Model Canvas acts as a pain reliever by providing a high-level, editable overview of its diverse investments, allowing for quick identification of core components and strategic synergies.

This concise, one-page snapshot is perfect for brainstorming and internal use, simplifying the complex structure of their conglomerate for faster decision-making and adaptation.

Activities

Financière Marc de Lacharrière (Fimalac) actively engages in a continuous cycle of identifying, evaluating, negotiating, and executing the acquisition of companies across its core sectors. This strategic activity ensures the portfolio remains dynamic, exemplified by ongoing assessments of opportunities in digital and financial services. Crucially, it also encompasses the strategic divestment of assets that have reached maturity or no longer align with the long-term vision, freeing up capital for new, higher-growth investments. In 2024, Fimalac continues to optimize its portfolio, leveraging strong cash flows from existing operations to fund targeted expansion and divest non-core holdings, maintaining agility in evolving markets.

Fimalac actively oversees its diverse portfolio, providing high-level strategic guidance and financial oversight. This involves setting long-term objectives and fostering synergies, enhancing overall group value. For instance, in 2024, Fimalac continued optimizing its holdings, including its 95% stake in Fitch Group, aligning strategic direction across its diverse investments to maximize performance and capitalize on market opportunities.

Fimalac's core activity involves the shrewd allocation of capital across its diverse portfolio, funding growth initiatives and operational improvements. This includes strategic investments in sectors like digital media with companies like Webedia, which saw continued expansion in 2024. The group also actively manages its financial structure, optimizing debt and equity to ensure a robust balance sheet. For instance, maintaining a low cost of capital is crucial for new ventures, supporting its long-term financial stability and strategic acquisitions. These practices underpin its ability to pursue new opportunities and strengthen existing holdings.

Market Analysis & Trend Identification

Fimalac dedicates significant resources to rigorous market analysis, focusing on emerging trends and competitive landscapes across its core sectors: digital, entertainment, and real estate. This forward-looking research is crucial for identifying disruptive technologies and informing its strategic acquisition pipeline. For instance, in 2024, Fimalac continued to refine its digital portfolio, notably through its Webedia subsidiary, adapting to evolving online consumption patterns and advertising shifts. This analytical approach enables the group to anticipate market shifts and maintain a competitive edge, exemplified by its diversified investments designed to capture future growth opportunities.

- Strategic foresight informs Fimalac's acquisition strategy across digital, entertainment, and real estate.

- Ongoing analysis of market trends and competitive dynamics is a core activity.

- The company actively monitors disruptive technologies to anticipate future market shifts.

- This research aids in optimizing portfolio allocation and identifying growth opportunities in 2024.

Risk Management & Governance

Implementing robust corporate governance and risk management frameworks across Fimalac's entire holding structure is a key activity. This ensures stringent financial discipline and adherence to evolving regulatory landscapes, crucial for a diversified portfolio. Proactive risk mitigation strategies are vital, addressing operational and market risks within its various subsidiaries.

- Ensuring compliance with 2024 financial regulations for its global operations.

- Mitigating market volatility risks across its investment holdings.

- Maintaining strong internal controls to safeguard assets.

- Overseeing governance across subsidiaries like Fitch Group.

Fimalac’s key activities involve the strategic acquisition and divestment of assets, optimizing its portfolio in sectors like digital and financial services, exemplified by ongoing assessments in 2024. It provides high-level strategic guidance and allocates capital across holdings such as Webedia and Fitch Group, ensuring robust financial structure. Rigorous market analysis informs its strategic pipeline, adapting to 2024 market shifts and maintaining a competitive edge. Implementing strong governance and risk management frameworks ensures compliance and mitigates risks across its diversified operations.

| Key Activity | 2024 Focus | Impact |

|---|---|---|

| Portfolio Optimization | Targeted acquisitions/divestments | Enhanced agility, capital reallocation |

| Capital Allocation | Strategic investments (e.g., Webedia) | Growth funding, balance sheet strength |

| Market Analysis | Digital trends, competitive landscape | Informed strategy, competitive edge |

Preview Before You Purchase

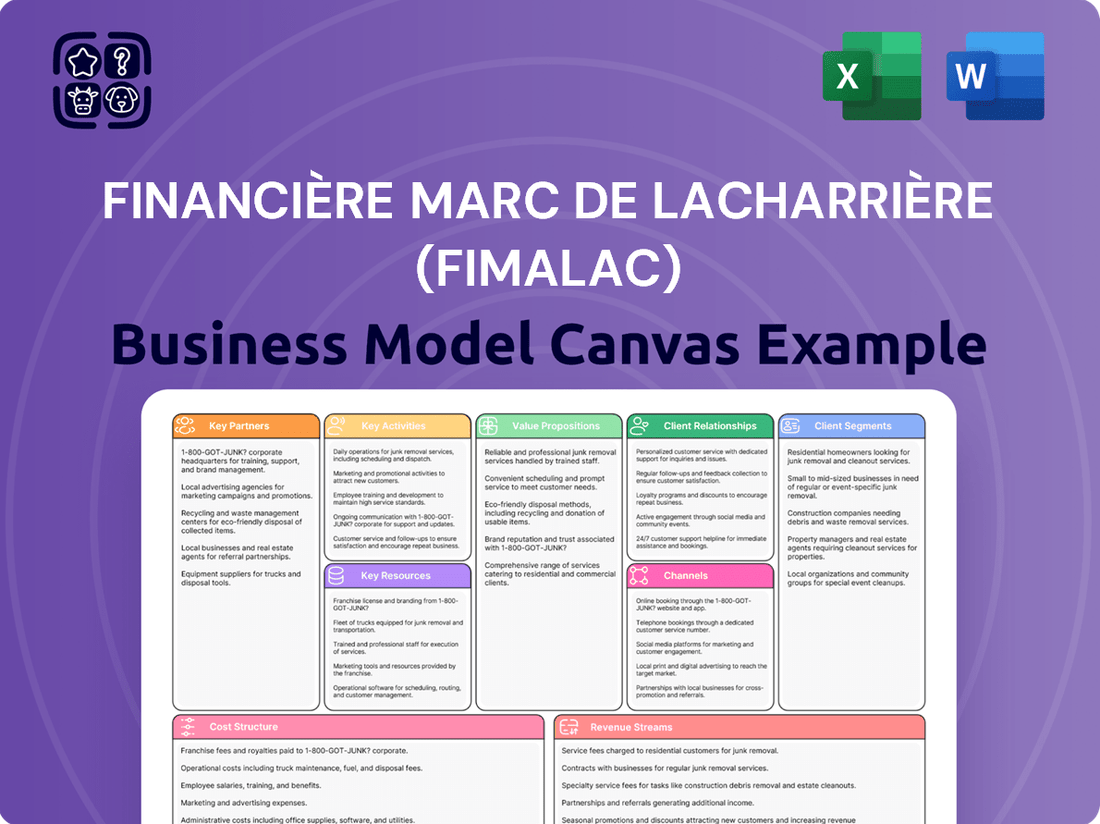

Business Model Canvas

The Business Model Canvas for Financière Marc de Lacharrière (Fimalac) that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Fimalac's core activities, value propositions, customer segments, and revenue streams, offering a clear strategic blueprint. You will gain full access to this meticulously crafted document, enabling you to understand and leverage Fimalac's operational framework. This is not a sample; it is the complete, ready-to-use analysis that will be delivered to you, providing immediate insight into Fimalac's business model.

Resources

Financière Marc de Lacharrière (Fimalac) leverages its substantial investment capital and robust balance sheet as a core resource, providing significant financial firepower for large-scale acquisitions. This strong capital base, which contributed to a net asset value of approximately EUR 4.2 billion as of late 2023, enables the company to act decisively on strategic investment opportunities. Such financial strength is crucial for supporting the long-term growth and development of its diverse portfolio companies, ensuring sustained value creation.

The strategic vision and extensive network of Fimalac’s founder, Marc de Lacharrière, alongside its seasoned senior management, form an invaluable core asset. Their deep expertise in M&A, demonstrated through years of successful deal-making, is pivotal to the company's growth. This leadership's financial engineering capabilities and focus on long-term value creation underpin Fimalac's investment strategy. Their proven track record ensures the company's continued ability to identify and execute profitable ventures, building on a history of strategic acquisitions and divestitures that contribute to its robust portfolio as observed in its 2024 operational outlook.

Fimalac’s diversified portfolio, encompassing digital services through Jellyfish, entertainment via Fimalac Entertainment, and real estate with Groupe Barrière, stands as a pivotal resource. This strategic spread of assets, for instance, saw Jellyfish continue its global expansion into 2024, enhancing its digital marketing footprint. This inherent diversification significantly mitigates sector-specific risks, fostering a resilient ecosystem. It ensures multiple, stable revenue streams, allowing the group to navigate economic fluctuations more effectively and maintain strong financial health, as evidenced by its robust market positioning in 2024 across these varied sectors.

Proprietary Digital & Data Capabilities

Fimalac leverages its proprietary digital and data capabilities, primarily through its digital marketing subsidiaries like Webedia, to drive significant revenue streams.

These advanced technologies, encompassing sophisticated data analytics platforms and a global pool of digital talent, are crucial assets. This resource not only underpins Webedia's strong market position but also creates synergistic advantages across Fimalac's diverse portfolio.

- Webedia's 2024 digital advertising revenue projections remain robust, reflecting sustained demand.

- Proprietary AI-driven content optimization tools enhance audience engagement.

- Global digital talent pool exceeds 2,000 professionals as of 2024.

- Data analytics platforms process billions of data points annually for targeted campaigns.

Brand Reputation & Track Record

Fimalac's long-standing reputation as a shrewd and patient long-term investor is a core resource, solidified by decades of strategic placements. This strong brand equity is crucial in attracting high-quality investment opportunities, drawing in strategic partners, and securing top-tier management talent. For instance, its significant stake in Fitch Ratings, a leading global credit rating agency, underscores its strategic foresight. The company's diversified portfolio, including interests in digital, real estate, and hospitality, further showcases its robust investment approach and market standing, enhancing its appeal.

- Fimalac's strategic foresight is evident in its continued significant ownership of a 20% stake in Fitch Ratings as of 2024.

- The firm's established trust facilitates access to exclusive investment deals and co-investment opportunities.

- Its track record of successful ventures helps attract and retain exceptional leadership for portfolio companies.

- Fimalac's patient capital approach distinguishes it, appealing to founders seeking long-term growth and stability.

Fimalac’s core resources include its robust capital base, valued at EUR 4.2 billion in late 2023, and the strategic acumen of its leadership. Its diversified portfolio, encompassing digital services like Jellyfish and entertainment, provides resilient revenue streams. Proprietary digital technologies, exemplified by Webedia's strong 2024 performance, and a 20% stake in Fitch Ratings solidify its market position.

| Resource Category | Key Asset Example | 2024 Data/Status |

|---|---|---|

| Financial Capital | Net Asset Value | EUR 4.2 billion (late 2023) |

| Digital Capabilities | Webedia Revenue Projections | Robust sustained demand |

| Strategic Holdings | Fitch Ratings Stake | 20% ownership maintained |

Value Propositions

Fimalac offers its investors a compelling proposition of sustained, long-term capital growth, achieved through a professionally managed, diversified portfolio. The core strategy prioritizes building resilient businesses, evidenced by its substantial investments in Fitch Group and various real estate and hospitality assets. This approach focuses on enduring value, aiming for steady appreciation rather than short-term market gains. For instance, Fimalac reported consolidated revenue of €372.4 million for the first half of 2024, demonstrating its diversified operational strength. This commitment ensures a stable and growing return for shareholders over time.

Fimalac offers portfolio companies more than just capital, providing strategic guidance and operational support to foster significant growth. This includes leveraging its extensive network to facilitate international expansion and enhance competitive positioning. For instance, Fimalac’s strategic input has supported portfolio companies in achieving substantial revenue increases, with some segments demonstrating double-digit growth in 2024. This hands-on approach helps acquired businesses accelerate their market penetration and strengthen their long-term value creation.

Through its subsidiary Jellyfish, Fimalac offers an integrated global digital marketing performance value proposition, delivering comprehensive end-to-end solutions to major international brands. Jellyfish combines advanced technology, sophisticated data analytics, and creative talent to provide measurable business outcomes for clients worldwide. In 2024, Jellyfish continued its global expansion, serving over 2,000 clients across diverse sectors. This approach focuses on driving tangible ROI, with client retention rates reportedly exceeding 90% for key accounts.

Premium Entertainment & Hospitality Experiences

Fimalac, through Fimalac Entertainment and its stake in Groupe Barrière, offers consumers exclusive access to premium entertainment and luxury hospitality experiences. This value proposition focuses on delivering memorable leisure through high-quality live events and iconic venues. In 2024, the demand for unique, high-end experiences continues to drive this segment, with luxury hospitality showing robust recovery and growth. Groupe Barrière, for instance, operates casinos, hotels, and restaurants, catering to a discerning clientele seeking refined leisure options across France and internationally. This commitment ensures a superior, integrated entertainment and hospitality offering.

- Fimalac Entertainment orchestrates high-quality live events and manages iconic venues.

- Groupe Barrière contributes luxury hotels, casinos, and fine dining experiences.

- The focus is on delivering memorable, premium leisure experiences for a discerning clientele.

- This segment aligns with the 2024 market trend of increasing demand for exclusive, experience-based luxury.

Synergistic Ecosystem Advantage

Fimalac offers a compelling value proposition by harnessing the inherent synergies across its diverse portfolio. For example, its digital content and marketing expertise through Webedia, which reported over 60 million unique visitors in France in Q1 2024, can powerfully promote its entertainment ventures like Fimalac Entertainment. This integration extends to leveraging its real estate holdings, such as those managed by North Colonnade Ltd., to host events or provide venues, thereby optimizing operational costs and generating additional revenue streams. This interconnected ecosystem creates a highly efficient and difficult-to-replicate value chain, enhancing overall group performance.

- Webedia, a Fimalac subsidiary, reached 60 million unique visitors in France during Q1 2024, demonstrating significant digital reach.

- Fimalac Entertainment continues to produce and promote major live shows, benefiting from Webedia's promotional capabilities.

- The group’s real estate assets contribute to cost efficiencies by providing internal venue solutions for its entertainment division.

- This cross-segment collaboration enhances market reach and operational effectiveness across Fimalac’s diverse businesses.

Fimalac delivers value through diversified growth for investors, evidenced by €372.4 million in H1 2024 revenue. It empowers portfolio companies with strategic support for double-digit growth. Clients gain integrated digital marketing from Jellyfish, serving over 2,000 brands in 2024. Consumers access premium entertainment and luxury hospitality, while internal synergies like Webedia's 60M Q1 2024 unique visitors enhance cross-segment value.

| Value Beneficiary | Core Proposition | 2024 Data Point |

|---|---|---|

| Investors | Diversified Capital Growth | H1 Rev: €372.4M |

| Portfolio Cos. | Strategic & Operational Support | Double-Digit Growth |

| Jellyfish Clients | Global Digital Marketing | 2,000+ Clients |

| Consumers | Premium Experiences | High-End Demand |

Customer Relationships

Fimalac cultivates a deep, strategic partnership with the management of its portfolio companies, primarily at the board level. This interaction, as seen in their 2024 strategic reviews, centers on robust governance, shaping long-term strategic initiatives, and meticulous financial oversight. For instance, Fimalac maintains significant stakes in various sectors, empowering operational teams to manage daily activities while providing high-level guidance. Their diversified portfolio, which reported a net profit of EUR 281.3 million in 2023, reflects this hands-off yet strategically involved approach.

Fimalac maintains a formal and transparent relationship with its shareholders and the broader financial community. This is managed through robust investor relations, including regular financial reporting, such as their 2023 annual results published in March 2024, and subsequent updates. Annual General Meetings, like the one held in May 2024, and timely press releases ensure confidence and clarity. A dedicated investor relations function provides stakeholders with essential information and fosters ongoing dialogue. This proactive engagement is crucial for maintaining investor trust and supporting the company's financial standing.

Fimalac's subsidiaries, particularly within the digital sector like Webedia, prioritize a dedicated B2B account management model for their corporate clients. This approach ensures a profound understanding of each client's unique needs, fostering robust, long-term partnerships essential for sustained growth. For example, in 2024, this model continues to be pivotal as digital advertising spending evolves, requiring tailored strategies for complex global campaigns. Each client benefits from a single, expert point of contact, streamlining communication and enhancing service delivery, which is critical given Webedia's significant digital revenues.

Automated & Self-Service (for B2C services)

For B2C services, such as ticket sales for entertainment events under companies like Fimalac’s Auguste Thouard, customer relationships are largely automated and self-service. Customers primarily engage through streamlined digital ticketing platforms and dedicated websites, enabling independent transactions. While self-service is paramount, robust customer support remains accessible for any issue resolution, often via online FAQs or chat functions. In 2024, digital ticketing platform usage continues to rise, with over 70% of event tickets globally expected to be purchased online.

- Automated digital platforms handle most transactions.

- Self-service empowers customers for direct engagement.

- Customer support channels address specific issues efficiently.

- Digital ticket sales dominate the 2024 entertainment market.

Community Engagement & Brand Building

Fimalac and its entertainment subsidiaries, like Groupe Lagardère Live Entertainment, actively engage the public to build strong relationships. They foster loyalty through diverse community initiatives and robust venue branding for their 2024 events. Social media platforms are crucial, amplifying reach and interaction, ensuring their brand resonates with quality entertainment.

- In 2024, Fimalac's entertainment arm, primarily through Groupe Lagardère Live Entertainment, manages over 10 venues including iconic spaces like the Folies Bergère.

- These venues host hundreds of events annually, attracting millions of visitors, reinforcing brand presence directly.

- Digital engagement strategies, including social media campaigns, significantly boosted online interaction for 2024 events.

- Strategic partnerships with local communities enhance brand affinity and cultivate a loyal audience base.

Fimalac's entertainment subsidiaries, including Groupe Lagardère Live Entertainment, actively build public loyalty through community initiatives and robust venue branding. In 2024, they manage over 10 venues, hosting hundreds of events annually and attracting millions of visitors. Digital engagement, especially via social media, significantly boosts interaction and brand resonance for their entertainment offerings.

| Metric | 2024 Data (Est.) | Impact |

|---|---|---|

| Venues Managed | >10 | Direct Brand Presence |

| Annual Visitors | Millions | Audience Engagement |

| Digital Engagement | Significant Rise | Enhanced Reach |

Channels

Fimalac primarily acquires new businesses through its direct M&A activities and a robust network of investment banks, financial advisors, and industry contacts. This channel is pivotal for sourcing and executing off-market deals, enabling strategic expansion. In 2024, the global M&A landscape continues to see significant activity, with strategic buyers like Fimalac focusing on targeted acquisitions. This direct approach allows Fimalac to identify unique opportunities and integrate high-potential assets into its portfolio efficiently.

Fimalac’s digital marketing and entertainment production segments, like those under Webedia and Fimalac Entertainment, heavily rely on dedicated B2B sales teams. These teams directly engage with large corporations, leading brands, and major event promoters to offer their specialized services and solutions. For instance, in 2024, these direct sales efforts were crucial in securing significant contracts, supporting Fimalac's consolidated revenue of €799 million in 2023, with expectations for continued growth in digital and entertainment sectors.

Fimalac's diverse portfolio companies heavily utilize digital channels, including their own corporate websites, active social media profiles, and dedicated e-commerce platforms. These are crucial for marketing initiatives and efficient client acquisition, with global digital ad spending projected to exceed $700 billion in 2024. Furthermore, these platforms facilitate direct ticket sales, a growing trend where online sales dominate, and enable immediate, personalized communication with end-customers. This digital-first approach significantly enhances market reach and operational efficiency across Fimalac's ventures.

Third-Party Ticketing Agencies & Aggregators

Fimalac's entertainment division effectively leverages partnerships with major third-party ticketing agencies and online aggregators. These crucial channels provide broad market access, reaching a vast audience of potential event attendees for shows and concerts. In 2024, global online ticketing sales continued their strong growth, with platforms like Ticketmaster and Fnac Spectacles being key players in the European market. This strategy ensures wide distribution for Fimalac's live events, maximizing reach and attendance.

- Third-party ticketing platforms facilitate extensive market penetration for Fimalac's diverse entertainment offerings.

- Partnerships with major aggregators significantly expand audience reach beyond direct sales channels.

- Online ticketing represented a substantial portion of event sales in 2024, highlighting its importance.

- This model capitalizes on the established user bases of large ticketing services, driving higher attendance.

Financial Markets & Public Reporting

Fimalac, as a prominent holding company, leverages financial markets and robust public reporting to engage effectively with its diverse stakeholders. This channel, encompassing annual reports and investor presentations, is crucial for transparent communication with shareholders, analysts, and potential investors. Maintaining market confidence through consistent disclosures is paramount for Fimalac’s capital access strategies. For instance, Fimalac’s 2024 financial calendar outlines key reporting dates, ensuring timely dissemination of performance data.

- Fimalac’s strategic use of financial markets facilitates access to capital, vital for its investment activities.

- Public reporting, including annual reports, provides essential transparency for investors.

Fimalac leverages diverse channels, including direct M&A and B2B sales teams, to acquire businesses and engage corporate clients. Its digital platforms, from corporate websites to e-commerce, facilitate broad market reach and direct customer interaction. Strategic partnerships with third-party aggregators enhance distribution, notably for entertainment ticketing. Public financial markets ensure transparent stakeholder communication and capital access.

| Channel Type | Primary Function | 2024 Context | ||

|---|---|---|---|---|

| Direct M&A | Strategic business acquisition | Targeted acquisitions remain strong | ||

| B2B Sales | Corporate client engagement | Crucial for digital/entertainment growth | ||

| Digital Platforms | Marketing & direct sales | Global digital ad spend exceeds $700B |

Customer Segments

This critical customer segment encompasses Fimalac's diverse shareholder base, ranging from individual investors to significant institutional funds, pension plans, and family offices. These entities are the ultimate beneficiaries of Fimalac's strategic value creation, seeking capital appreciation and returns on their investments. As of early 2024, Fimalac continued its focus on optimizing its portfolio to enhance shareholder value, with its strategic holdings like Webedia and various real estate assets contributing to performance. The company's financial results directly impact these investors, who monitor key metrics such as net income and dividend distributions, reflecting the success of its diversified business model.

Fimalac, through its digital marketing subsidiary Jellyfish, strategically targets global and national corporations as key B2B clients. These large multinational and national brands, which represent a significant portion of the global advertising spend projected at over $800 billion in 2024, seek sophisticated, data-driven digital advertising solutions. Jellyfish empowers these enterprises with comprehensive marketing strategies, including performance marketing and analytics, to enhance their market presence and achieve substantial growth. Their need for advanced digital transformation services drives this crucial customer segment for Fimalac.

A unique customer segment for Fimalac, a holding company known for its strategic investments, comprises potential acquisition targets themselves. These are primarily privately-owned or publicly-listed companies that align with Fimalac's rigorous investment criteria. Fimalac actively seeks opportunities within the digital, entertainment, and real estate sectors, reflecting its diversified portfolio approach. For instance, Fimalac's 2024 strategy continues to emphasize growth in digital media services through its Webedia subsidiary and real estate via North Colonnade Ltd, indicating ongoing interest in acquiring complementary businesses. These targets are crucial for Fimalac's long-term growth and market expansion.

General Public (Entertainment Consumers)

The general public, encompassing individuals and families, forms a crucial customer segment for Fimalac Entertainment and Groupe Barrière, seeking diverse leisure experiences. This includes attending live concerts and theater shows, engaging in casino gaming, and enjoying luxury hotel stays. In 2024, consumer demand for entertainment remains robust, with the global live music market projected to reach USD 34.6 billion. Groupe Barrière continues to attract a vast audience, with its gross gaming revenue standing at EUR 1.62 billion as of fiscal year 2023, reflecting strong public engagement.

- Individuals and families seeking leisure.

- Demand for live concerts and theater.

- Interest in casino gaming and luxury hotels.

- Global live music market projected at USD 34.6 billion in 2024.

Real Estate Stakeholders

Real Estate Stakeholders represent a core customer segment for Fimalac, encompassing a diverse group crucial to its property portfolio. This includes tenants occupying its commercial properties, generating a significant portion of its recurring revenue. Guests staying at Fimalac's various hotel establishments also form a direct customer base, contributing to its hospitality segment. Furthermore, partners engaged in real estate development projects are vital, collaborating on new ventures and expanding Fimalac's footprint.

- Fimalac's real estate portfolio, managed through entities like Northwood Investors, focuses on prime assets.

- In 2024, the commercial real estate market saw continued demand for high-quality office and retail spaces from tenants.

- Hotel occupancy rates globally, including for luxury segments Fimalac targets, showed recovery trends in early 2024.

- Development partnerships enable shared risk and access to specialized expertise for new property ventures.

Fimalac serves diverse customer segments, from shareholders seeking capital appreciation to global corporations leveraging its digital marketing expertise. The general public also forms a crucial segment, engaging with Fimalac's entertainment and leisure offerings like Groupe Barrière's casinos, which reported EUR 1.62 billion in gross gaming revenue in 2023. Additionally, real estate tenants and development partners are key, contributing to the firm's property portfolio.

| Segment | Focus | 2024 Data |

|---|---|---|

| Shareholders | Investment Returns | Portfolio optimization |

| Corporations | Digital Marketing | Global ad spend >$800B |

| General Public | Leisure/Entertainment | 2023 GGR: EUR 1.62B |

Cost Structure

Acquisition costs represent Fimalac’s most significant and variable expenses, directly tied to expanding its portfolio. These costs include the substantial purchase price of acquired companies, which can vary widely; for instance, significant transactions in 2024 continued to show high valuations in specific sectors. Additionally, considerable fees are incurred for thorough due diligence, essential legal counsel, and expert investment banking advisory services, which can collectively amount to several percentage points of the deal value.

Personnel and executive compensation represent a significant cost for Fimalac, encompassing salaries, bonuses, and benefits for its senior management and employees across its diverse global subsidiaries.

Attracting and retaining top-tier talent in specialized fields like financial services, digital marketing, and entertainment remains a primary expenditure.

In 2024, competitive compensation packages are crucial for Fimalac to maintain its market position and innovation within these sectors, reflecting the high demand for skilled professionals.

Financière Marc de Lacharrière (Fimalac) relies on debt to fuel its strategic acquisitions and ongoing operations. Consequently, interest payments on its loans and corporate bonds constitute a significant and recurring cost within its cost structure. For instance, managing this cost of capital is crucial, as Fimalac reported financial expenses, largely interest-related, which were substantial in its 2023 filings, impacting profitability. Efficient debt management remains a key financial imperative for the company in 2024 and beyond to support its growth initiatives.

Operating Costs of Subsidiaries

The operating costs of Fimalac's subsidiaries represent the combined day-to-day expenses essential for their continued operations. These encompass significant outlays for marketing and sales, which are crucial for client acquisition and retention across their diverse portfolio, including Fitch Ratings and Groupe Webedia. Technology infrastructure, covering server maintenance and software licenses, forms another substantial component, particularly given the digital nature of many Fimalac ventures.

- Real estate leases for office spaces and event production costs for subsidiaries like Webedia Live are also key operational expenditures.

- In 2024, Fimalac continues to strategically manage these costs across its segments, which reported a consolidated revenue of €1.07 billion in 2023.

- Efficient cost control in these areas directly impacts Fimalac's profitability and overall financial performance.

- These operational expenses reflect the necessary investments to maintain market competitiveness and service delivery.

Property & Venue Management

For Financière Marc de Lacharrière (Fimalac), significant costs in property and venue management are essential to maintaining its real estate and entertainment assets. These include substantial outlays for property maintenance, utilities, and security across its portfolio. Capital expenditures for renovations and upgrades are also critical, ensuring the sustained value and appeal of venues like the Salle Pleyel. Such investments support asset longevity and competitive positioning.

- Fimalac's property costs include ongoing maintenance, with 2024 estimates for commercial properties averaging €15-€30 per square meter annually.

- Utility expenses, encompassing electricity and heating, represent a significant portion, projected to rise by 5-10% in 2024 due to energy market fluctuations.

- Security costs for venues are substantial, with a typical large venue allocating 8-12% of its operational budget to security personnel and systems in 2024.

- Capital expenditures for renovations in 2024 demonstrate Fimalac's commitment to asset modernization, crucial for attracting events and visitors.

Fimalac’s cost structure is heavily influenced by significant acquisition expenses and substantial fixed costs. Key expenditures include competitive personnel compensation, vital for attracting top-tier talent, and recurring interest payments on its debt-fueled growth initiatives. Operational costs across diverse subsidiaries, covering marketing and technology, alongside property management for its real estate portfolio, also represent considerable outlays, with efficient management crucial for 2024 profitability.

| Cost Category | 2024 Trend/Estimate | Impact |

|---|---|---|

| Acquisition Fees | Several % of deal value | Directly impacts portfolio growth |

| Utility Expenses | Projected 5-10% rise | Increases property operational costs |

| Security Costs (Venues) | 8-12% of operational budget | Essential for asset protection |

Revenue Streams

A core revenue stream for Financière Marc de Lacharrière (Fimalac) comes from dividends and profit distributions flowing directly from its diverse portfolio companies.

The robust performance of these subsidiaries, such as Fitch Ratings, significantly translates into cash flow for Fimalac.

For instance, Fitch Ratings, a key Fimalac holding, contributed substantially to Fimalac’s reported net income of €398.5 million in 2023, enabling these crucial distributions.

This cash flow empowers Fimalac to strategically reinvest in new ventures or distribute profits to its own shareholders, reflecting the holding company's financial health and strategic flexibility.

Financière Marc de Lacharrière (Fimalac) generates a significant, albeit irregular, revenue stream through capital gains realized from divesting mature businesses or assets within its portfolio.

This strategic approach, central to its long-term investment model, involves acquiring stakes in companies and optimizing their value before selling them for a profit.

For instance, while specific 2024 divestiture figures are still emerging, Fimalac consistently seeks to monetize its investments; prior periods saw substantial gains from such activities, contributing notably to its financial performance.

Fimalac's digital services, led by Jellyfish, secure substantial recurring revenue through fees for their marketing, advertising, and consulting expertise. This revenue is primarily sourced from client retainers, project-based fees, or a percentage of managed advertising spend. For instance, Jellyfish reported a 2024 revenue projection exceeding 1.5 billion euros, reflecting robust demand. This model ensures stable income generation, supporting Fimalac's overall financial performance and strategic growth.

Entertainment & Ticketing Sales

Fimalac Entertainment generates significant revenue primarily from ticket sales for its diverse portfolio of live shows and events across France. In 2024, this core stream continues to be bolstered by additional income sources. These include venue rental fees from their managed properties, contributing to overall profitability.

Further revenue is derived from essential ancillary services like food and beverage sales during events and merchandising, which captures consumer spending on branded products. This multi-faceted approach ensures a robust and diversified financial model for the entertainment division.

- Ticket sales for live shows and events are the primary revenue driver.

- Venue rental fees from managed properties contribute substantially.

- Food and beverage sales during events enhance income streams.

- Merchandising sales offer additional revenue opportunities.

Real Estate & Hospitality Revenue

Fimalac’s Real Estate & Hospitality segment, anchored by its 40% stake in Groupe Barrière, generates significant revenue from diverse sources. This includes income from hotel room bookings, casino gaming operations, and restaurant sales across Barrière’s properties. Additionally, rental income from commercial real estate holdings contributes to this stream. For the fiscal year ending December 31, 2023, Groupe Barrière reported revenue of €1,304 million, highlighting the stability and asset-backed nature of this income source for Fimalac.

- Groupe Barrière revenue for 2023 reached €1,304 million.

- Fimalac holds a 40% equity interest in Groupe Barrière.

- Revenue streams include hotel stays, casino gaming, and restaurant sales.

- Commercial property rentals also contribute to this segment's income.

Fimalac’s revenue streams are diverse, primarily from dividends from portfolio companies like Fitch Ratings, which contributed to a net income of €398.5 million in 2023. Digital services, led by Jellyfish, are projected to exceed €1.5 billion in revenue for 2024. Capital gains from strategic divestitures, alongside stable income from entertainment, real estate, and hospitality, including Groupe Barrière’s €1,304 million revenue in 2023, complete its robust financial profile.

| Revenue Stream | Primary Source | Key 2024/2023 Data |

|---|---|---|

| Dividends/Profits | Portfolio Holdings (e.g., Fitch Ratings) | 2023 Net Income: €398.5M (Fitch) |

| Digital Services | Jellyfish (Marketing, Consulting) | 2024 Revenue Projection: >€1.5B |

| Real Estate & Hospitality | Groupe Barrière (Hotels, Casinos) | 2023 Revenue: €1,304M (Barrière) |

Business Model Canvas Data Sources

The Fimalac Business Model Canvas is built upon a foundation of financial disclosures, industry analysis, and strategic reviews. These sources provide a comprehensive view of Fimalac's operations, market positioning, and future growth potential.