Fuyo General Lease SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

Fuyo General Lease demonstrates notable strengths in its established market presence and diverse leasing portfolio, but faces potential threats from evolving market regulations and technological disruption. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Fuyo General Lease's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fuyo General Lease's strength lies in its exceptionally diversified business portfolio. Beyond its core leasing operations, the company actively engages in credit cards, real estate, and various asset finance sectors. This broad operational scope significantly reduces dependence on any single market, fostering resilience.

This strategic diversification is a key advantage, allowing Fuyo General Lease to cater to a wide array of industries and customer needs. For instance, in fiscal year 2023, its leasing segment contributed approximately 70% of revenue, while other segments like credit and real estate provided crucial balance, demonstrating the mitigating effect of this varied business model.

Fuyo General Lease has showcased impressive financial resilience, marked by eight consecutive periods of record-high ordinary profit. This consistent profitability underscores the company's effective business model and management.

Even with a minor dip in net sales for Fiscal Year 2024, the company saw an increase in operating profit, signaling enhanced operational efficiency and cost management. This suggests a focus on profitability over sheer revenue volume.

The company's financial stability is further validated by its strong credit ratings: AA-/Stable from JCR and A+/Stable from R&I. These ratings reflect a conservative approach to financial management and a solid position in the market.

Fuyo General Lease is strategically channeling its management resources into high-potential sectors like mobility, energy and environment, BPO/ICT, and healthcare. This focus is designed to capture emerging market opportunities and ensure long-term competitive advantage.

For instance, in the fiscal year ending March 2024, the company reported a significant increase in its IT services segment, reflecting its commitment to BPO/ICT growth. This proactive investment strategy underpins its ambition to lead in these dynamic and evolving industries.

Established Market Position and Customer Base

Fuyo General Lease holds a commanding position in the Japanese leasing market, a testament to its enduring legacy since 1969. This established presence has cultivated a loyal and substantial customer base, primarily consisting of large, reputable enterprises. Its deep-rooted connections with major financial institutions, such as Mizuho Bank, further bolster its market standing, ensuring reliable access to a diverse range of funding avenues and enhancing its overall credibility.

The company's strength is underscored by its ability to leverage these long-standing relationships. For instance, Fuyo General Lease's consistent partnerships with large corporations provide a stable revenue stream. In fiscal year 2023, the company reported consolidated operating revenue of ¥378.1 billion, reflecting the ongoing demand from its established clientele.

- Strong Franchise: Fuyo General Lease is recognized as a leading diversified leasing company in Japan.

- Stable Customer Base: A significant portion of its clients are large enterprises, ensuring consistent business.

- Long-Standing Relationships: Established in 1969, the company has built trust and reliability over decades.

- Financial Institution Ties: Close connections with banks like Mizuho Bank provide strong funding support and market access.

Commitment to Sustainability and ESG Initiatives

Fuyo General Lease has deeply embedded Creating Shared Value (CSV) into its fundamental management strategy. This approach focuses on achieving sustainable corporate growth by simultaneously tackling societal challenges and generating economic value, positioning the company as a responsible corporate citizen.

The company's dedication to environmental, social, and governance (ESG) factors is further evidenced by its proactive sustainable financing initiatives. Fuyo General Lease has also garnered high ratings in climate change reports, signaling a strong commitment that appeals to ethically-minded investors and bolsters its overall reputation in the market.

- Commitment to Sustainability: Fuyo General Lease integrates Creating Shared Value (CSV) into its core management strategy.

- Sustainable Growth Focus: Aims to achieve growth by addressing social issues alongside economic value creation.

- Proactive Financing: Engages in sustainable financing initiatives, demonstrating a forward-thinking approach to ESG.

- Strong ESG Ratings: Achieves high ratings in climate change reports, enhancing its appeal to responsible investors.

Fuyo General Lease benefits from a robust and diversified business model, extending beyond traditional leasing into areas like credit cards and real estate. This diversification proved advantageous in fiscal year 2023, where leasing contributed about 70% of revenue, balanced by other segments, showcasing its resilience.

The company demonstrates strong financial performance, achieving eight consecutive periods of record-high ordinary profit. Even with a slight dip in net sales for Fiscal Year 2024, operating profit increased, highlighting improved operational efficiency and cost management.

Fuyo General Lease boasts strong market positioning in Japan, established in 1969, with a loyal client base of large corporations. Its close ties with financial institutions like Mizuho Bank provide crucial funding access and market credibility, supporting its consolidated operating revenue of ¥378.1 billion in fiscal year 2023.

The company's strategic focus on high-growth sectors such as mobility and BPO/ICT, evidenced by increased investment in its IT services segment in the fiscal year ending March 2024, positions it for future competitive advantage.

| Metric | FY2023 (¥ billion) | FY2024 (¥ billion) | Change (%) |

|---|---|---|---|

| Consolidated Operating Revenue | 378.1 | N/A | N/A |

| Ordinary Profit | Record High | Record High | N/A |

| Operating Profit (FY24 vs FY23) | N/A | Increased | N/A |

| IT Services Segment Growth | N/A | Significant Increase | N/A |

What is included in the product

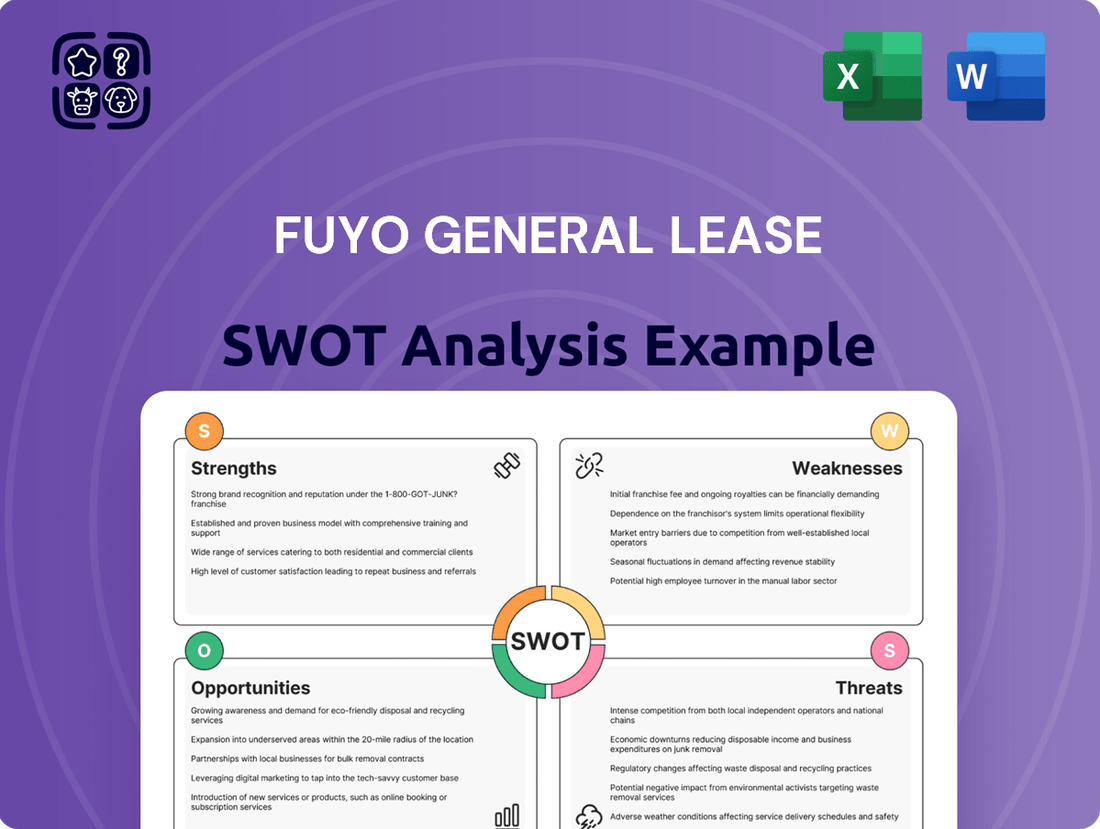

Analyzes Fuyo General Lease’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address Fuyo General Lease's strategic challenges, transforming potential weaknesses into actionable opportunities.

Weaknesses

Fuyo General Lease experienced a notable downturn in its financial performance for the fiscal year ending March 31, 2025. Despite an improvement in operating profit, the company saw its net sales decrease by 4.3% year-on-year.

Furthermore, the profit attributable to owners also declined, indicating that while core operations might be performing better, other factors are negatively impacting the bottom line. This trend necessitates a closer examination of revenue streams and cost structures to identify areas for improvement.

The recent uptick in domestic interest rates, with the Bank of Japan's policy rate moving from -0.1% to 0.1% in March 2024, has directly impacted Fuyo General Lease by increasing its funding costs. This rise in borrowing expenses can squeeze profit margins, a significant concern for a capital-intensive industry like leasing.

Consequently, Fuyo General Lease may need to re-evaluate its pricing strategies to offset these higher costs, potentially passing some of the burden onto customers. Alternatively, the company will likely intensify its efforts to achieve greater operational efficiencies and cost reductions across its business to maintain profitability.

While real estate and aircraft are key growth areas for Fuyo General Lease, both segments have experienced notable fluctuations. The real estate business saw a decrease in newly executed contract volumes, partly attributed to asset control measures and an increasingly competitive, overheated market in metropolitan areas. For instance, in the fiscal year ending March 2024, the real estate segment's operating profit experienced a decline compared to the previous year, reflecting these market pressures.

The aircraft business is also navigating a period of transition as it evolves its operational model. This strategic shift, while aimed at long-term improvement, introduces a degree of short-term uncertainty that could impact immediate performance metrics. Investors and stakeholders should monitor how Fuyo General Lease manages these transitions to mitigate potential impacts on revenue and profitability in the near term.

Reliance on Japanese Market Conditions

Fuyo General Lease's deep roots in Japan create a significant vulnerability. As a major player in the Japanese economy, the company's fortunes are closely tied to domestic market dynamics. For instance, Japan's GDP growth, which was projected to be around 0.5% in 2024 and 0.9% in 2025 by the IMF, directly impacts the demand for leasing services.

Any adverse shifts in Japan's economic landscape, such as a slowdown in corporate investment or changes in consumer spending, can have a pronounced negative effect on Fuyo General Lease. This over-reliance means that even strong performance in international markets might not fully offset domestic headwinds.

Furthermore, regulatory changes within Japan could pose a challenge. For example, shifts in financial regulations or tax policies affecting leasing operations could necessitate costly adjustments and impact profitability. The company's financial statements for the fiscal year ending March 2024 showed that the domestic leasing segment remains the primary revenue driver.

- Exposure to Japanese Economic Fluctuations: Fuyo General Lease's performance is heavily influenced by Japan's economic growth rate, which is forecast to be modest in 2024-2025.

- Sensitivity to Domestic Policy Changes: Regulatory shifts or tax policy alterations within Japan could directly impact the company's operational costs and revenue streams.

- Concentration Risk: A significant portion of Fuyo General Lease's revenue is generated from its domestic operations, creating a concentration risk that makes it susceptible to localized economic downturns.

Need for Continuous Portfolio Diversification and Competitiveness Enhancement

Fuyo General Lease faces a significant challenge in maintaining and enhancing the competitiveness of its core operations, particularly within the real estate sector. This area, a primary driver of the company's earnings, is characterized by intense competition, demanding continuous innovation in lease-finance solutions to stay ahead.

Furthermore, the company must actively pursue further diversification of its business portfolio. While current diversification efforts are in place, ongoing strategic adjustments are vital to mitigate risks and capitalize on emerging market opportunities.

- Competitive Real Estate Market: Fuyo General Lease's mainstay real estate business operates in a highly competitive environment, necessitating constant innovation in lease-finance solutions to maintain market share and profitability.

- Need for Portfolio Expansion: Continuous efforts are required to strengthen the competitiveness of existing businesses and to further diversify the company's portfolio to reduce reliance on any single sector and enhance long-term stability.

- Innovation in Lease-Finance: The dynamic nature of the real estate market demands that Fuyo General Lease consistently develops and refines its lease-finance offerings to meet evolving client needs and market trends.

Fuyo General Lease's reliance on the Japanese market presents a significant weakness, as its financial performance is closely tied to the nation's economic trajectory. For instance, the IMF projected Japan's GDP growth to be around 0.5% in 2024 and 0.9% in 2025, indicating a potentially sluggish demand for leasing services.

The company also faces challenges in its core real estate business due to intense competition, requiring continuous innovation in lease-finance solutions to maintain its market position. Additionally, Fuyo General Lease needs to further diversify its business portfolio to mitigate risks and capitalize on new opportunities, as its current diversification may not be sufficient to counter sector-specific downturns.

Full Version Awaits

Fuyo General Lease SWOT Analysis

This is a real excerpt from the complete Fuyo General Lease SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of their strategic position.

Opportunities

The Japanese car leasing market is seeing a surge in demand for flexible mobility options, largely due to rising car ownership expenses and the growing adoption of remote work. This shift is a significant tailwind for companies like Fuyo General Lease.

This trend creates a prime opportunity for Fuyo General Lease to broaden its automotive leasing offerings. Expanding into electric and hybrid vehicles, in particular, would not only meet evolving consumer preferences but also align with Japan's strong environmental and sustainability objectives, potentially capturing a larger market share.

Fuyo General Lease is strategically focusing on the healthcare and BPO/ICT sectors, recognizing them as key areas for future growth and value maximization through integrated, one-stop services.

The aging demographic in Japan presents a significant opportunity, with an increasing demand for healthcare services and related equipment leasing, a trend expected to continue through 2025 and beyond.

Furthermore, the ongoing digital transformation and the persistent need for businesses to enhance operational efficiencies through outsourced IT and business process services create a robust market for Fuyo General Lease's BPO/ICT offerings.

Japan's real estate sector, particularly logistics and data centers, presents a significant opportunity. Investor interest remains robust, driven by e-commerce growth and digital transformation needs. Fuyo General Lease can leverage this by prioritizing sustainable development, aligning with the growing demand for green buildings.

Sustainable Finance and ESG Investment Growth

The escalating global emphasis on sustainability and environmental stewardship offers a significant avenue for Fuyo General Lease to broaden its green leasing operations and sustainable finance strategies. This trend directly addresses the increasing investor appetite for companies demonstrating strong Environmental, Social, and Governance (ESG) credentials, potentially improving Fuyo General Lease's capital accessibility and bolstering its market standing.

This strategic direction is supported by robust market data. For instance, global sustainable investment assets reached an estimated $37.8 trillion in early 2024, according to the Global Sustainable Investment Alliance. Furthermore, a 2024 report by Morningstar indicated that ESG funds in Europe saw net inflows of €41.1 billion in the first quarter, highlighting strong investor demand.

- Expanding Green Leasing: Fuyo General Lease can capitalize on the growing demand for eco-friendly equipment and infrastructure by offering more leasing options that incorporate energy-efficient technologies and renewable energy sources.

- Sustainable Finance Initiatives: The company has an opportunity to develop and promote financial products and services that support environmentally responsible business practices, aligning with a global shift towards a low-carbon economy.

- Enhanced Investor Relations: By actively pursuing ESG-aligned strategies, Fuyo General Lease can attract a wider pool of investors, including those specifically seeking sustainable investment opportunities, thereby potentially lowering its cost of capital.

- Improved Corporate Reputation: Demonstrating a commitment to sustainability can significantly enhance Fuyo General Lease's brand image and corporate reputation, differentiating it from competitors and fostering stronger stakeholder relationships.

Digital Transformation and Advanced Lease Management Solutions

The Japan Lease Management Market is on a steady upward trajectory, fueled by the increasing integration of cutting-edge technologies such as cloud computing and artificial intelligence. This presents a significant opportunity for Fuyo General Lease to enhance its service offerings by developing and deploying sophisticated lease management software. Such solutions can greatly simplify operational processes for their clientele, ensuring adherence to regulations and boosting overall efficiency.

By capitalizing on this digital wave, Fuyo General Lease can position itself as a leader in providing value-added services. For instance, a 2024 market report indicated that companies adopting advanced lease management systems saw an average reduction of 15% in administrative costs and a 10% improvement in compliance rates.

- Leveraging AI for Predictive Analytics: Implementing AI to forecast lease renewals, identify potential defaults, and optimize asset utilization for clients.

- Cloud-Based Platform Development: Offering a scalable, secure, and accessible cloud platform that centralizes all lease-related data and workflows.

- Streamlining Compliance and Reporting: Developing automated features within the software to ensure adherence to evolving leasing standards and simplify reporting procedures.

- Enhancing Client Productivity: Providing tools that automate tasks like invoicing, payment processing, and asset tracking, freeing up client resources.

Fuyo General Lease can capitalize on the growing demand for eco-friendly equipment and infrastructure by expanding its green leasing operations, aligning with the global shift towards sustainability. The company can also develop sustainable finance initiatives to support environmentally responsible business practices, attracting investors focused on ESG credentials.

| Opportunity Area | Description | Potential Impact | Supporting Data (2024/2025) |

|---|---|---|---|

| Green Leasing Expansion | Offering leasing for energy-efficient equipment and renewable energy infrastructure. | Increased market share, enhanced brand reputation. | Global sustainable investment assets estimated at $37.8 trillion (early 2024). |

| Sustainable Finance | Developing financial products supporting eco-friendly business practices. | Lower cost of capital, improved investor relations. | ESG funds in Europe saw €41.1 billion in net inflows (Q1 2024). |

| Digital Transformation in Leasing | Leveraging AI and cloud for advanced lease management software. | Reduced administrative costs, improved compliance for clients. | Adoption of advanced lease management systems can reduce admin costs by 15% (2024 report). |

Threats

The Bank of Japan's move towards monetary policy normalization, including potential interest rate hikes, presents a significant threat to Fuyo General Lease. Higher interest rates directly translate to increased borrowing costs for the company, impacting its ability to finance new leases and potentially reducing margins on existing ones. For instance, if the Bank of Japan were to raise its policy rate from near-zero to, say, 0.25% or 0.50% in 2024 or 2025, Fuyo General Lease’s funding expenses would climb.

While Fuyo General Lease aims to pass on some of these increased costs through rental adjustments, there's a limit to how much can be absorbed by clients. Sustained or aggressive rate increases could therefore erode profitability and make the company more cautious about undertaking new, capital-intensive leasing projects, potentially slowing down growth.

Fuyo General Lease faces heightened competition in its core real estate leasing business, especially in bustling metropolitan areas where market saturation is a growing concern. This intensified rivalry, fueled by both established domestic companies and aggressive international entrants, poses a significant risk to the company's profitability and its established market position.

The company's diversified business segments are also not immune to this competitive pressure. As more players enter these markets, Fuyo General Lease could see its margins squeezed and market share eroded, necessitating strategic adjustments to maintain its competitive edge.

Global economic instability, fueled by prolonged conflicts and persistent high inflation, is a significant threat, potentially dampening business sentiment and capital expenditure. This could translate to reduced demand for leasing services as companies become more cautious about investments.

While Japan has shown relative economic resilience, a substantial global or regional economic downturn could still negatively impact Fuyo General Lease's financial performance. For instance, the IMF projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting ongoing economic uncertainties that could affect client spending on leasing.

Demographic Shifts and Vacant Properties in Japan

Japan's demographic challenges, including a declining birthrate and an aging population, are creating a growing number of vacant properties, particularly in rural areas. This trend directly impacts the demand for leased spaces, potentially affecting Fuyo General Lease's real estate portfolio. For instance, the Japan Policy Council estimated in 2023 that the number of vacant homes could reach 30% by 2033 in some regions.

These demographic shifts necessitate strategic adjustments for Fuyo General Lease. The company may need to re-evaluate its property holdings and consider diversifying into areas less affected by depopulation or focusing on property types that cater to an aging demographic. The increasing number of akiya (vacant homes) presents both a challenge and an opportunity for innovative leasing solutions.

- Declining Birthrate: Japan's total fertility rate was around 1.26 in 2023, well below the replacement level.

- Aging Population: Over 29% of Japan's population was aged 65 or older as of late 2023, a figure projected to rise.

- Vacant Homes: The Ministry of Land, Infrastructure, Transport and Tourism reported over 8.5 million vacant homes in Japan in 2023.

Supply Chain Disruptions and Vehicle Delivery Delays

Even as corporate demand for vehicles bounces back, persistent supply chain issues continue to cause significant delays in vehicle deliveries. This directly impacts Fuyo General Lease's capacity to meet new leasing agreements promptly, particularly in the automotive segment. For instance, the average delivery time for new cars in Japan remained extended into early 2024, with some models facing wait times exceeding six months, a direct consequence of semiconductor shortages and logistics bottlenecks.

These extended lead times pose a tangible threat by potentially limiting the company's ability to capitalize on resurgent demand. Fuyo General Lease might struggle to secure sufficient inventory to fulfill anticipated leasing contracts, leading to missed revenue opportunities and potential customer dissatisfaction. The overall automotive production in Japan saw only a modest recovery in late 2023, with some manufacturers still reporting production adjustments due to component shortages.

- Extended Delivery Times: Vehicle delivery times for certain models in Japan extended well into 2024, impacting fleet availability.

- Supply Chain Vulnerability: Lingering effects of global supply chain disruptions, including semiconductor shortages, continue to affect automotive production.

- Impact on Leasing Contracts: Fuyo General Lease faces challenges in fulfilling new automotive leasing agreements efficiently due to inventory constraints.

The Bank of Japan's potential monetary policy normalization, including interest rate hikes, poses a significant threat by increasing Fuyo General Lease's borrowing costs and potentially squeezing profit margins. Persistent global economic instability, marked by conflicts and inflation, could dampen business sentiment and reduce demand for leasing services as companies become more cautious with capital expenditures. Intensified competition in real estate leasing, from both domestic and international players, threatens to erode market share and profitability, particularly in saturated urban markets.

SWOT Analysis Data Sources

This Fuyo General Lease SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-informed strategic overview.