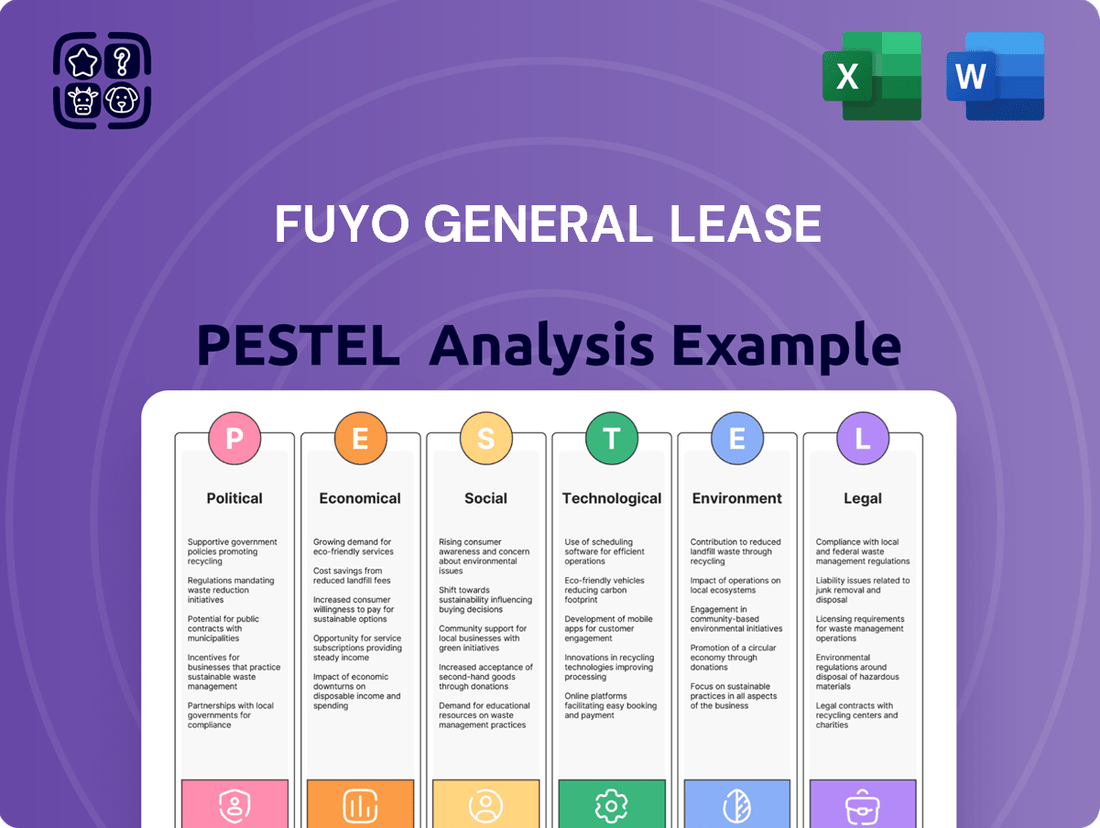

Fuyo General Lease PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors impacting Fuyo General Lease's strategic direction. Our expertly crafted PESTLE analysis provides a clear roadmap of external forces shaping the leasing industry. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

The Japanese government is strongly backing digital transformation, with initiatives like the Digital Governance Code encouraging widespread adoption of new technologies. This creates a favorable landscape for companies such as Fuyo General Lease to invest in digital solutions, boosting their efficiency and market position.

The Ministry of Economy, Trade and Industry (METI) is particularly focused on this, offering incentives to prevent a substantial economic downturn. Projections indicated that a failure to digitalize by 2025 could lead to significant economic losses, underscoring the urgency and government commitment to this shift.

The Financial Services Agency (FSA) in Japan is prioritizing a stable financial system alongside fostering innovation, with a specific focus on corporate governance reforms and sustainable finance for 2024-2025. This commitment to regulatory clarity offers leasing companies like Fuyo General Lease a predictable environment for operations and strategic planning.

Global trade policies, especially the ongoing discussions around potential U.S. tariffs, create a degree of uncertainty for Japan's export-reliant economy. While Japan's economic performance in 2024 has shown resilience, with GDP growth projected around 0.5% to 1.0% by various institutions, these external trade shifts could still influence corporate earnings for companies like Fuyo General Lease.

For Fuyo General Lease, which has international operations and a diverse service portfolio, monitoring these evolving geopolitical risks is crucial. Changes in trade agreements or the imposition of new tariffs could affect the cost of imported goods used in their leasing operations or impact the competitiveness of their services in overseas markets.

Promotion of Sustainable Finance

The Japanese government's strong commitment to a Green Transformation (GX) is a significant political factor, actively promoting sustainable finance. This initiative includes creating special provisions within the Banking Act to encourage investments in GX-related businesses, signaling a clear policy direction. Furthermore, there's a concerted push for impact investing, aligning financial flows with positive social and environmental outcomes.

This political environment directly influences Fuyo General Lease by creating incentives to embed Environmental, Social, and Governance (ESG) principles into its core operations and financing strategies. For instance, the government's GX strategy aims to mobilize over 150 trillion yen in private investment for decarbonization by 2030, providing a substantial market opportunity for companies facilitating green investments.

- Government Support for GX: Japan's GX strategy targets significant private investment for decarbonization efforts.

- Banking Act Provisions: New provisions encourage lending and investment in green initiatives.

- Impact Investment Focus: A national drive to channel capital towards measurable positive impacts.

- ESG Integration: Fuyo General Lease is politically encouraged to align its business with sustainability goals.

Corporate Governance Reforms

The Financial Services Agency (FSA) is actively pushing for corporate governance reforms, aiming to boost corporate value and sharpen competitiveness. This focus on strong governance structures is key to drawing in international investors and ensuring lasting, sustainable growth.

Fuyo General Lease's commitment to these evolving governance standards is vital. By actively participating in and adapting to these changes, the company can significantly enhance investor trust and signal a dedication to best practices in its operations.

- Enhanced Shareholder Rights: Reforms often include measures to strengthen shareholder rights, such as improved voting mechanisms and increased transparency in executive compensation.

- Board Independence and Diversity: A key aspect is promoting independent directors and fostering diversity on corporate boards to bring a wider range of perspectives and expertise.

- Improved Disclosure: Stricter disclosure requirements ensure that companies provide more comprehensive and timely information to investors, facilitating better-informed decisions.

- Focus on ESG: Growing emphasis is placed on Environmental, Social, and Governance (ESG) factors, with reforms encouraging companies to integrate sustainability into their core strategies.

Japan's political landscape strongly supports digital transformation, with government initiatives like the Digital Governance Code driving technology adoption. The Ministry of Economy, Trade and Industry (METI) offers incentives to prevent economic downturns, highlighting the urgency of digitalization by 2025. The Financial Services Agency (FSA) prioritizes financial stability and innovation, focusing on corporate governance and sustainable finance for 2024-2025, creating a predictable environment for companies like Fuyo General Lease.

The government's Green Transformation (GX) strategy actively promotes sustainable finance, aiming to mobilize over 150 trillion yen in private investment by 2030. This includes special provisions in the Banking Act to encourage GX-related investments and a push for impact investing. These policies encourage Fuyo General Lease to integrate ESG principles, presenting opportunities in the growing green finance market.

| Political Factor | Impact on Fuyo General Lease | Supporting Data/Initiatives |

| Digital Transformation Support | Favorable environment for investing in digital solutions, boosting efficiency. | Digital Governance Code, METI incentives for digitalization. |

| Green Transformation (GX) Strategy | Incentives to embed ESG, opportunities in green finance. | Target of 150 trillion yen in private investment by 2030 for decarbonization. |

| Corporate Governance Reforms | Enhanced investor trust and predictable operational environment. | FSA focus on corporate value, shareholder rights, board diversity, and improved disclosure. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Fuyo General Lease, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the company's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into the external factors impacting Fuyo General Lease's operations and mitigating potential risks.

Economic factors

The Bank of Japan (BoJ) has initiated a shift from its ultra-loose monetary policy, ending negative interest rates and beginning a gradual increase in its policy rate. This marks a significant departure from years of accommodative measures.

Further policy rate hikes are projected for 2025, with market consensus suggesting the policy rate could reach 0.50% or even 1.0% by year-end. This anticipated tightening will directly affect borrowing costs for companies like Fuyo General Lease.

The normalization of monetary policy by the BoJ will likely influence investment decisions across various sectors, impacting demand for leasing services and potentially altering the cost of capital for expansion or equipment acquisition.

Japan's economy is on a path of gradual recovery, with forecasts pointing to continued growth through 2024 and into 2025. This recovery is being fueled by a combination of robust domestic demand and healthy foreign trade.

Looking ahead to 2025, Japan's real GDP growth is anticipated to reach approximately 0.6%. This expansion is underpinned by a rise in personal consumption and strong private investment in non-residential sectors, creating a more stable economic environment.

A stable and growing economy is a positive indicator for Fuyo General Lease. It suggests an increased likelihood of demand for their leasing and financial services as businesses and individuals feel more confident about their financial prospects and investment capacity.

Japan's economy is poised for a boost from continued wage growth. Major labor unions are pushing for substantial pay increases in 2025, aiming for gains that outpace inflation. This is expected to translate into higher real wages and more disposable income for households.

The anticipated rise in consumer spending directly benefits businesses. As individuals have more money to spend, demand for goods and services increases, which in turn can lead to greater capital investment by companies. This creates a more favorable environment for Fuyo General Lease's clients who might be looking to expand or upgrade their operations.

For instance, if average wages in Japan see a real increase of 2% in 2025, as some projections suggest, this could add billions to consumer spending. This enhanced demand cycle is a positive economic factor, potentially increasing the need for leasing services as businesses invest in new equipment and infrastructure to meet growing consumer needs.

Corporate Capital Investment Trends

Japanese corporations are anticipated to maintain strong capital investment momentum into 2025, with a focus on areas like digital transformation, operational efficiency, and labor-saving technologies. This forward-looking approach is driven by the need to adapt to evolving market demands and technological advancements.

These investments are crucial for enhancing competitiveness and resilience. For instance, a significant portion of planned capital spending is allocated to IT infrastructure and automation, reflecting a broader trend across industries. The Nikkei Purchasing Managers' Index (PMI) for manufacturing in early 2025 indicated continued business expansion, often linked to increased investment in new equipment and processes.

Fuyo General Lease, as a prominent leasing company, is well-positioned to facilitate these capital expenditures. Their services directly support businesses looking to acquire the necessary assets for digital transformation, efficiency improvements, and supply chain restructuring, thereby playing a key role in enabling these corporate growth strategies.

- Digital Transformation: Investments in cloud services, AI, and data analytics are projected to see substantial growth, with many firms earmarking 15-20% of their capital budgets for these initiatives in 2025.

- Efficiency Improvements: Automation and robotics adoption is a key trend, with manufacturing sector capital expenditure expected to rise by approximately 8% in 2025, primarily for labor-saving and productivity enhancements.

- Supply Chain Restructuring: Companies are investing in logistics technology and warehouse automation to build more resilient and agile supply chains, with an estimated 10% increase in related capital spending for 2025.

Real Estate Market Dynamics

Japan's real estate market is projected to experience sustained growth through 2025. Major metropolitan centers, particularly Tokyo and Osaka, are anticipated to see rising rental prices and robust occupancy rates. This uptrend is supported by a tightening supply of new housing, which in turn is inflating prices for newly constructed properties.

Foreign investment continues to be a significant driver in the Japanese property sector, impacting both residential and commercial segments. Fuyo General Lease's real estate finance operations are well-positioned to capitalize on these favorable market conditions.

- Projected Growth: Japan's real estate market is expected to grow steadily in 2025.

- Urban Strength: Tokyo and Osaka are leading with increasing rents and high occupancy.

- Supply vs. Demand: Contracting new housing supply is pushing up new build prices.

- Investment Inflow: Foreign investment in residential and commercial real estate remains strong.

The Bank of Japan's policy shift, including the end of negative interest rates and projected rate hikes to 0.50%-1.0% by late 2025, will increase borrowing costs for businesses like Fuyo General Lease. Japan's economy is expected to grow by about 0.6% in 2025, driven by personal consumption and private investment, creating a favorable environment for leasing services.

Wage growth is anticipated to boost consumer spending, potentially increasing demand for corporate investments in new equipment and infrastructure. Japanese corporations are set to continue strong capital investments in 2025, focusing on digital transformation and efficiency, areas where Fuyo General Lease can provide essential asset financing.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Fuyo General Lease |

|---|---|---|---|

| GDP Growth (Real) | ~0.8% | ~0.6% | Stable economic growth supports demand for leasing services. |

| Bank of Japan Policy Rate | 0.0% to 0.1% | 0.5% to 1.0% | Higher borrowing costs for clients and potentially Fuyo. |

| Wage Growth (Real) | ~1.5% | ~2.0% | Increased consumer spending can drive corporate investment and leasing demand. |

| Corporate Capital Investment | Strong | Strong (focus on Digital Transformation, Automation) | Directly benefits Fuyo through financing needs for new equipment. |

Preview the Actual Deliverable

Fuyo General Lease PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fuyo General Lease provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. Gain immediate access to actionable insights upon purchase.

Sociological factors

Japan's demographic shifts present a clear challenge: an aging population and a shrinking workforce. By 2025, the proportion of the population aged 65 and over is projected to reach nearly 30%, exacerbating existing labor shortages across various industries. This reality is driving a strong demand for automation and labor-saving technologies.

Fuyo General Lease is well-positioned to address this societal trend. The company can offer leasing solutions for businesses looking to invest in advanced machinery, robotics, and other capital goods that enhance productivity and offset labor deficits. For instance, leasing agreements for automated warehousing systems or AI-powered manufacturing equipment directly cater to this urgent need.

The shift towards hybrid work models is significantly reshaping office demand, with a growing preference for flexible lease terms and adaptable, multi-functional commercial spaces. This trend saw approximately 60% of US companies offering some form of hybrid work by late 2023, a figure projected to rise.

Companies are investing in enhanced office environments to boost employee engagement and retention, leading to increased rental costs in desirable urban centers. For instance, average office rents in major tech hubs like San Francisco saw a notable uptick in early 2024 despite vacancy rates, driven by demand for premium, amenity-rich spaces.

Fuyo General Lease's real estate leasing division can capitalize on these evolving corporate needs by expanding its portfolio of flexible office solutions and co-working spaces, aligning its services with the modern workforce's requirements.

Japanese corporations, Fuyo General Lease included, are increasingly embracing the concept of Creating Shared Value (CSV). This means actively tackling societal challenges as a core part of their business strategy, moving beyond traditional corporate social responsibility. This shift is driven by growing public demand for businesses to contribute positively to society, not just generate profits.

Fuyo General Lease's dedication to CSV is explicitly detailed in its current medium-term management plan, Fuyo Shared Value 2026. This plan outlines specific initiatives and targets for how the company will integrate social issue resolution into its operations and services, aiming for mutual benefit for both the company and society.

Consumer and Business Adaptability to Change

Japanese consumers and businesses are increasingly adapting to a new economic landscape marked by rising wages and prices, a significant departure from the prolonged deflationary period. This transition necessitates adjustments in how individuals and companies approach spending and investment. For instance, nominal wages in Japan saw a 2.5% increase in early 2024 compared to the previous year, signaling a shift in purchasing power and consumer sentiment.

Fuyo General Lease plays a crucial role in this evolving environment by offering flexible financial solutions. These services are designed to help clients, both individuals and corporations, effectively manage and capitalize on the changing economic dynamics, including new spending patterns and investment opportunities. The company's ability to provide tailored leasing and financing options supports businesses in acquiring necessary assets during this period of economic recalibration.

- Shifting Consumer Behavior: With nominal wages rising, Japanese consumers are showing a greater willingness to spend on discretionary items, impacting sectors like retail and services.

- Business Investment Trends: Companies are reassessing their capital expenditure plans, with a focus on investments that can leverage higher consumer demand and potentially offset increased operating costs.

- Fuyo General Lease's Role: The company facilitates these shifts by providing leasing and financing for essential business equipment and vehicles, enabling companies to adapt their operational capacity.

- Economic Indicators: Japan's GDP grew at an annualized rate of 1.7% in the first quarter of 2024, indicating a broader economic expansion that supports increased adaptability.

Focus on Human Capital and Well-being

Societal shifts increasingly prioritize human capital and employee well-being, influencing corporate sustainability. This trend underscores the value placed on a company's workforce and its positive impact on the community. For Fuyo General Lease, this translates to embedding human-centric strategies to foster a supportive work environment and attract top talent, aligning with evolving societal expectations.

The growing emphasis on human capital means that companies are evaluated not just on financial performance but also on their commitment to employee development, health, and overall well-being. This focus is becoming a key differentiator in attracting and retaining skilled employees, particularly in competitive markets. For instance, in 2024, employee retention rates are increasingly linked to comprehensive well-being programs, with companies offering enhanced mental health support and flexible work arrangements often seeing lower turnover.

- Employee well-being programs are now a critical factor in talent acquisition and retention.

- Societal expectations demand greater corporate responsibility towards community development and social impact.

- Investments in human capital, such as training and development, are seen as crucial for long-term business success.

- A company's reputation for treating its employees well directly impacts its brand image and appeal to customers and investors.

Societal expectations are increasingly focused on corporate responsibility, with a growing demand for businesses to contribute positively to community development and social impact. This emphasis on human capital means companies are evaluated on their commitment to employee well-being, training, and development, which directly influences talent acquisition and retention. For instance, companies with robust employee well-being programs in 2024 reported lower turnover rates, highlighting the link between societal values and business performance.

Technological factors

The Japanese financial services sector is in the midst of a significant digital acceleration. Traditional financial institutions and emerging digital players are channeling substantial investments into cutting-edge technologies, including the establishment of digital banking divisions, the deployment of AI for customer support, and the adoption of cloud infrastructure.

Fuyo General Lease is actively participating in this digital shift, integrating digital transformation (DX) initiatives to refine its operational efficiency and expand its service portfolio. For instance, by Q3 2024, the company reported a 15% year-over-year increase in digital service adoption among its client base, demonstrating a tangible impact of its DX efforts.

Generative AI is unlocking new efficiencies for financial firms, streamlining tasks from loan processing to credit assessments. Fuyo General Lease can harness these advancements to refine its operations, strengthen risk controls, and craft bespoke client offerings.

By integrating AI and sophisticated data analytics, Fuyo General Lease can gain deeper insights into market trends and customer behavior. This allows for more precise risk modeling and the creation of innovative, data-driven financial products, potentially boosting customer acquisition and retention in the competitive 2024-2025 landscape.

The increasing reliance on digital platforms for financial services, including leasing, amplifies cybersecurity and data privacy risks. Fuyo General Lease, like its peers, faces the critical challenge of ensuring robust data protection while offering convenient digital access. A recent report indicated that the financial services sector experienced a 20% increase in cyberattacks in 2024, highlighting the persistent threat landscape.

To mitigate these threats, financial institutions must implement comprehensive security frameworks. This includes investing in advanced threat detection systems, regular security audits, and employee training. For Fuyo General Lease, maintaining client trust is paramount, and strong cybersecurity measures are essential to safeguard sensitive financial information and prevent potential data breaches, which can lead to significant financial and reputational damage.

Innovation in Financial Products and Services

Technological advancements are fundamentally reshaping the financial services landscape, moving beyond mere operational improvements to entirely new business models and product categories. This evolution is exemplified by the rise of tokenization and the creation of bespoke IT solutions, including comprehensive cloud packages. Fuyo General Lease is actively participating in this transformation by consolidating IT solution providers, aiming to bolster its service capabilities and support clients in their digital transformation (DX) journeys.

The drive towards digitalization is creating significant opportunities for innovation. For instance, the global fintech market was valued at approximately $112.5 billion in 2023 and is projected to reach $376.8 billion by 2030, demonstrating substantial growth driven by technological integration. Fuyo General Lease's strategic move to integrate IT providers aligns with this trend, enabling them to offer more sophisticated and integrated digital solutions to their clientele.

- Digitalization is enabling new financial product categories like tokenized assets.

- Fuyo General Lease is enhancing its client DX support through IT provider consolidation.

- The fintech market's projected growth highlights the increasing importance of technological innovation in financial services.

Investment in ICT and BPO Services

Fuyo General Lease is strategically channeling significant investment into Information and Communication Technology (ICT) and Business Process Outsourcing (BPO) services. This focus is designed to create a competitive edge by offering clients advanced digital tools and outsourced solutions that drive operational enhancements and boost efficiency.

This investment aligns with a broader industry trend. For instance, global spending on ICT services was projected to reach over $5 trillion in 2024, with BPO services also showing robust growth, indicating a strong market demand for these solutions. Fuyo General Lease's commitment positions them to capitalize on this expanding market.

The company's approach involves leveraging these technologies to support clients in achieving tangible business improvements. By integrating digital transformation and outsourcing capabilities, Fuyo aims to meet a wide array of evolving client requirements and solidify its market position.

Key areas of Fuyo's ICT and BPO investment include:

- Digital transformation consulting to streamline client operations.

- Development and implementation of cloud-based solutions for enhanced accessibility and scalability.

- Provision of data analytics services to drive informed decision-making.

- Expansion of BPO offerings in areas like customer support and back-office processing.

Technological advancements are a critical driver for Fuyo General Lease, with a significant focus on digital transformation (DX) and the integration of Information and Communication Technology (ICT) and Business Process Outsourcing (BPO) services. The company is investing heavily in these areas to enhance operational efficiency and expand its service offerings. For example, Fuyo reported a 15% year-over-year increase in digital service adoption by Q3 2024, showcasing the tangible impact of its DX initiatives.

Generative AI is being leveraged to streamline processes like loan processing and credit assessments, while advanced data analytics provides deeper market insights. This technological push is crucial in a financial services sector that saw a 20% increase in cyberattacks in 2024, underscoring the need for robust cybersecurity measures. Fuyo's strategic consolidation of IT solution providers aims to bolster its capabilities and support clients' digital journeys in a market projected for significant fintech growth, with the global fintech market expected to reach $376.8 billion by 2030.

| Technology Focus | 2024/2025 Impact/Investment | Key Initiatives | Market Context |

|---|---|---|---|

| Digital Transformation (DX) | 15% YoY increase in digital service adoption (Q3 2024) | Streamlining operations, expanding service portfolio | Broader industry digital acceleration |

| Generative AI | Enhancing efficiency in loan processing, credit assessment | Refining operations, strengthening risk controls | Unlocking new efficiencies across financial services |

| Data Analytics | Deeper insights into market trends and customer behavior | Precise risk modeling, data-driven product creation | Growing reliance on data for decision-making |

| Cybersecurity | Mitigating risks from increased digital reliance | Investing in threat detection, security audits, training | 20% increase in cyberattacks in financial services (2024) |

| ICT & BPO Services | Significant investment for competitive edge | Digital transformation consulting, cloud solutions, data analytics, BPO expansion | Global ICT services spending projected over $5 trillion (2024) |

Legal factors

The new Japanese Lease Accounting Standard, announced in September 2024, mandates lessees to recognize right-of-use assets and lease liabilities for operating leases. This significant shift, effective from fiscal years beginning April 1, 2027, with early adoption allowed from April 1, 2025, will alter how Fuyo General Lease's clients report their lease obligations.

This change means that assets and liabilities previously off-balance sheet for operating leases will now appear on the balance sheet, potentially impacting key financial ratios and debt covenants for many businesses. For Fuyo General Lease, this necessitates clear communication and support for their clients navigating these new reporting requirements.

Japan has implemented mandatory ESG disclosure for statutory annual reports, starting with fiscal years ending after March 31, 2023. This move significantly increases transparency, requiring companies to detail their environmental and sustainability efforts, mirroring global frameworks such as the ISSB standards. Fuyo General Lease needs to navigate these new regulations, ensuring its ESG performance is accurately and strategically reported to meet compliance and stakeholder expectations.

The Financial Services Agency (FSA) in Japan is a key regulator for companies like Fuyo General Lease, setting the rules for how financial services operate. Their focus in 2024 and 2025 includes fostering a clearer understanding of areas like impact investing, which saw global assets under management reach an estimated $715 billion in 2023 according to the Global Impact Investing Network (GIIN).

The FSA's directives are designed to ensure responsible financial conduct and maintain the trustworthiness of the financial markets. This means leasing companies must adhere to standards that prevent misleading claims, particularly concerning environmental, social, and governance (ESG) initiatives, often referred to as greenwashing.

Amendments to Banking and Investment Regulations

Recent amendments to Japan's Banking Act, effective from 2024, have broadened the operational scope for specialized investment firms. This deregulation also permits Japanese banks to acquire foreign leasing companies under specific criteria, potentially reshaping the competitive environment for Fuyo General Lease by opening new partnership avenues and intensifying competition.

These regulatory shifts are particularly noteworthy for their inclusion of special provisions aimed at facilitating Green Transformation (GX)-related companies. This could create new leasing opportunities for Fuyo General Lease in sectors prioritizing sustainability and environmental initiatives, aligning with global trends and national policy objectives.

- Expanded Bank Operations: Japanese banks can now engage in a wider range of investment activities, potentially increasing their involvement in leasing markets.

- Foreign Acquisitions: The ability for banks to acquire foreign leasing entities could lead to consolidation and new international players entering the Japanese market.

- GX Provisions: Special rules for GX companies may unlock new financing and leasing demand for green projects, a significant growth area.

Anti-Money Laundering (AML/CFT) Measures

Japan has been actively bolstering its Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) framework. The Act on Prevention of Transfer of Criminal Proceeds, for instance, has seen significant revisions. These updates are crucial for entities like Fuyo General Lease operating within the financial sector.

Key among these legislative changes is the implementation of a 'travel rule' specifically for crypto-asset exchange service providers, aiming to enhance transparency in virtual asset transactions. Furthermore, financial institutions are now mandated to establish robust systems for implementing asset freezing measures, ensuring greater diligence in preventing illicit financial flows.

- Strengthened AML/CFT Laws: Japan's commitment to combating financial crime is evident in its revised legal landscape, including the Act on Prevention of Transfer of Criminal Proceeds.

- Crypto Travel Rule: A new 'travel rule' is now in effect for crypto-asset exchange service providers, requiring the transmission of originator and beneficiary information for virtual asset transfers.

- Asset Freezing Obligations: Financial institutions, including Fuyo General Lease, must develop and maintain systems capable of executing asset freezing measures effectively.

- Compliance Imperative: Adherence to these enhanced regulations is a non-negotiable requirement for Fuyo General Lease to maintain operational integrity and regulatory compliance.

Japan's evolving lease accounting standards, effective April 2027, will require lessees to recognize operating leases on their balance sheets, impacting financial reporting for Fuyo General Lease's clients. Additionally, mandatory ESG disclosures, in effect since fiscal years ending after March 31, 2023, necessitate transparent reporting of sustainability efforts, aligning with global ISSB standards.

The Financial Services Agency (FSA) is focusing on impact investing, a sector with an estimated $715 billion in global assets under management in 2023, guiding financial institutions toward responsible conduct and preventing greenwashing. Amendments to the Banking Act in 2024 allow banks broader investment scopes and foreign leasing acquisitions, potentially altering the competitive landscape.

Special provisions for Green Transformation (GX) companies under recent amendments present new leasing opportunities in sustainability-focused sectors. Furthermore, strengthened Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) laws, including a crypto 'travel rule' and enhanced asset freezing obligations, demand robust compliance systems from financial entities like Fuyo General Lease.

| Legal Factor | Description | Impact on Fuyo General Lease | Relevant Data/Year |

|---|---|---|---|

| Lease Accounting Standards | Mandatory balance sheet recognition of operating leases. | Requires client education and system adjustments for new reporting. | Effective April 1, 2027 (early adoption from April 1, 2025) |

| ESG Disclosure | Mandatory reporting of environmental and sustainability efforts. | Necessitates accurate and strategic ESG performance reporting. | Effective for fiscal years ending after March 31, 2023 |

| FSA Directives & Impact Investing | Focus on responsible finance and impact investing. | Requires adherence to standards preventing greenwashing; potential growth in impact-aligned leasing. | Global impact investing assets: $715 billion (2023) |

| Banking Act Amendments | Expanded bank operations and foreign leasing acquisitions. | Potential for increased competition or new partnership avenues. | Effective 2024 |

| AML/CFT Framework | Strengthened laws including crypto travel rule and asset freezing. | Mandates robust compliance systems to prevent illicit financial flows. | Ongoing revisions; 'travel rule' for crypto providers |

Environmental factors

Japan's ambitious goal of achieving net-zero greenhouse gas emissions by 2050 is a significant environmental driver, compelling businesses to adopt more sustainable practices and creating a robust market for green finance. This national commitment directly influences demand for eco-friendly technologies and renewable energy infrastructure.

Fuyo General Lease is well-positioned to capitalize on this trend by offering financing solutions for environmentally conscious equipment and renewable energy ventures. For instance, the company could support the leasing of solar panels or electric vehicles, aligning its portfolio with Japan's decarbonization agenda and meeting the growing investor appetite for ESG-compliant assets.

Sustainable finance is a rapidly growing area in Japan, with the Financial Services Agency (FSA) actively encouraging its expansion to tackle societal challenges and unlock new market opportunities. This includes a push for ESG investment trusts and measures to combat greenwashing, ensuring genuine sustainability claims. Fuyo General Lease's engagement in sustainable finance for its fund procurement directly reflects and capitalizes on this significant market shift.

Fuyo General Lease's commitment to Creating Shared Value (CSV) underpins its strategy, focusing on sustainable growth by addressing societal challenges. This approach is directly linked to environmental factors, as the company actively integrates decarbonization and recycling initiatives into its core operations.

The Fuyo Shared Value 2026 medium-term plan explicitly incorporates environmental considerations, setting non-financial targets that align with a move towards a decarbonized and recycling-based society. This strategic alignment is vital for Fuyo General Lease's long-term value creation, demonstrating a proactive response to evolving environmental expectations.

Investment in Renewable Energy and Environment

Fuyo General Lease is strategically channeling management resources into the energy and environment sector, evidenced by its significant investments in large-scale solar power operations and equity stakes in renewable energy ventures. This proactive approach underscores a commitment to environmental stewardship and unlocks potential for future business growth.

The company's dedication to sustainability was further recognized when it was named an 'Asia Climate Change Leader Company' for 2025. This accolade highlights Fuyo General Lease's leadership in addressing climate change and its forward-thinking business model.

- Renewable Energy Investment: Fuyo General Lease is actively investing in solar power and other renewable energy businesses, aligning with global shifts towards cleaner energy sources.

- Climate Leadership Recognition: Being selected as an 'Asia Climate Change Leader Company' for 2025 validates the company's commitment and position in the environmental sector.

- New Business Avenues: The focus on energy and environment opens up new, sustainable revenue streams and market opportunities for Fuyo General Lease.

Climate-Related Disclosures and Reporting

Japanese companies, including Fuyo General Lease, are facing growing pressure to disclose climate-related financial information. This is largely driven by the adoption of international frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB). The Sustainability Standards Board of Japan (SSBJ) is actively working to fully incorporate ISSB standards by March 2025, signaling a significant shift towards standardized and comparable climate reporting.

Fuyo General Lease's commitment to transparency is evident in its integrated reports, which increasingly feature detailed environmental data. This focus on environmental performance and disclosure is crucial for stakeholders seeking to understand the company's resilience and strategy in the face of evolving climate regulations and market expectations.

- TCFD Adoption: Japanese companies are increasingly aligning their climate disclosures with TCFD recommendations.

- ISSB Integration: The SSBJ aims for full ISSB standard integration by March 2025, enhancing global comparability.

- Enhanced Transparency: Fuyo General Lease's integrated reports showcase environmental data and efforts to improve disclosure.

- Stakeholder Expectations: Investors and other stakeholders demand greater clarity on climate-related risks and opportunities.

Japan's commitment to net-zero emissions by 2050 is a major environmental driver, creating demand for green finance and eco-friendly technologies. Fuyo General Lease is positioned to benefit by financing assets like solar panels and EVs, aligning with the nation's decarbonization goals and investor interest in ESG assets.

The company's strategy emphasizes sustainable growth through initiatives like decarbonization and recycling, as outlined in its Fuyo Shared Value 2026 plan. This focus on environmental factors is crucial for long-term value creation and responding to evolving expectations.

Fuyo General Lease is actively investing in renewable energy, particularly large-scale solar power operations, and has been recognized as an Asia Climate Change Leader Company for 2025, highlighting its leadership in the environmental sector.

The increasing adoption of international disclosure frameworks like TCFD and ISSB by Japanese companies, with the SSBJ aiming for full ISSB integration by March 2025, means Fuyo General Lease must demonstrate robust environmental data and transparency in its reporting to meet stakeholder demands.

PESTLE Analysis Data Sources

Our Fuyo General Lease PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading industry research firms. We incorporate economic indicators, regulatory updates, and technological advancements from trusted global and local sources.