Fuyo General Lease Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

Unlock the strategic core of Fuyo General Lease with our comprehensive Business Model Canvas. Discover how they build value and maintain market dominance through key partnerships and customer relationships. This detailed analysis is essential for anyone aiming to understand or replicate their success.

Partnerships

Fuyo General Lease's foundation is deeply rooted in its establishment by six Fuyo Group companies, notably including Mizuho Bank. This strong lineage fosters enduring relationships with major financial institutions, which are vital for both securing funding and pursuing collaborative projects.

These key partnerships are instrumental in ensuring Fuyo General Lease has access to stable and varied funding streams. This includes the issuance of corporate bonds and the arrangement of long-term borrowings, essential for supporting the company's substantial operating assets and expansion plans.

Furthermore, these financial relationships facilitate Fuyo General Lease's participation in sustainable finance. By leveraging established frameworks for ESG-related projects, the company can actively engage in environmentally and socially responsible initiatives, aligning its business with broader sustainability goals.

Fuyo General Lease's ability to offer a comprehensive leasing portfolio, spanning IT equipment, industrial machinery, and vehicles, hinges on strong relationships with equipment manufacturers and vendors. These collaborations are crucial for securing access to a diverse range of assets and the newest technological advancements, enabling Fuyo to craft customized leasing solutions for its clientele.

By acting as a vital intermediary, Fuyo General Lease purchases equipment directly from these manufacturers and vendors, subsequently leasing these assets to its diverse customer base. This strategic positioning ensures Fuyo remains at the forefront of equipment availability and innovation in the leasing market.

Fuyo General Lease's success hinges on robust relationships with real estate developers and property owners. These partnerships are crucial for sourcing and securing a diverse range of properties, from bustling commercial centers to essential nursing care facilities and modern logistics hubs.

By collaborating with developers and owners, Fuyo General Lease gains access to new projects and existing assets, effectively expanding its leasing portfolio. This strategy allows them to diversify across various property sectors, mitigating risk and capturing opportunities in different market segments.

These alliances are built on Fuyo General Lease's established expertise in real estate finance and its extensive industry network. For instance, in 2023, the Japanese real estate leasing market saw continued activity, with Fuyo General Lease actively participating in transactions that underscore the importance of these developer and owner relationships for portfolio growth.

Energy and Environment Sector Partners

Fuyo General Lease is actively cultivating key partnerships within the energy and environment sector. These collaborations are crucial for their strategic expansion into renewable energy, particularly in offshore wind power and solar photovoltaic (PV) projects. The company's involvement in large-scale grid storage battery businesses also relies heavily on these alliances.

These partnerships are with both global industry leaders and specialized firms, ensuring access to expertise for project development and financing. For instance, Fuyo General Lease's commitment to sustainable growth, as outlined in their medium-term management plan, is directly supported by these strategic relationships. These ventures are designed to tackle pressing social and environmental challenges.

- Renewable Energy Focus: Investments in offshore wind and solar PV projects.

- Grid Storage Involvement: Participation in large-scale grid storage battery businesses.

- Strategic Alliances: Partnerships with global players and specialized energy/environment companies.

- Sustainability Alignment: Collaborations support medium-term management plan goals for social issue resolution and sustainable growth.

BPO and ICT Service Providers

Fuyo General Lease strategically partners with Business Process Outsourcing (BPO) and Information and Communication Technology (ICT) service providers to enhance its offerings. These collaborations allow Fuyo to deliver integrated solutions that drive operational efficiency and cost savings for its clientele.

These partnerships are crucial for Fuyo General Lease's expansion into new business areas, particularly in BPO services, which contributed to a significant portion of its revenue growth. For instance, in fiscal year 2024, Fuyo reported robust performance in its IT services segment, reflecting the success of such strategic alliances.

- Expanded Service Portfolio: Collaborations enable Fuyo to offer a wider range of BPO and ICT solutions, from IT infrastructure management to customer support outsourcing.

- Operational Efficiencies: By leveraging the expertise of BPO and ICT partners, Fuyo helps clients streamline processes, reduce overhead, and improve overall productivity.

- New Domain Strengthening: These alliances are integral to Fuyo's strategy of diversifying its business and establishing a stronger presence in high-growth sectors.

- Client Value Creation: The combined capabilities of Fuyo and its partners deliver comprehensive, value-added services that address complex business challenges.

Fuyo General Lease's key partnerships are multifaceted, encompassing financial institutions, equipment manufacturers, real estate stakeholders, and service providers. These alliances are critical for securing funding, accessing diverse assets, and expanding service offerings, thereby supporting its comprehensive leasing solutions and strategic growth initiatives.

What is included in the product

A detailed Business Model Canvas for Fuyo General Lease, outlining their core strategies for customer acquisition, value delivery, and revenue generation in the leasing industry.

Fuyo General Lease's Business Model Canvas offers a structured approach to address the complexities of leasing, providing clarity on customer segments and value propositions to alleviate common industry pain points.

Activities

Fuyo General Lease's primary activity revolves around acquiring diverse assets, including IT hardware, office machinery, industrial equipment, and vehicles, which are then leased to clients or sold through installment plans. This operational core is crucial for generating revenue and managing asset lifecycles.

The company's mainstay lease business represents a substantial segment of its overall operating assets and is a significant driver of its profitability. This focus underscores the importance of their leasing operations in the company's financial performance.

Fuyo General Lease extends its financial services beyond traditional leasing, encompassing credit cards, real estate finance, and asset finance, alongside offering commercial loans. This diverse portfolio is designed to provide clients with comprehensive financial solutions to fuel their capital investments and drive business expansion.

The company actively seeks to carve out distinct advantages in specialized sectors such as real estate and aircraft finance, demonstrating a strategic focus on high-value markets. For instance, in fiscal year 2023, Fuyo General Lease reported a significant portion of its revenue derived from its diverse financial product offerings, underscoring the importance of these services to its overall business model.

Fuyo General Lease meticulously manages its leased assets, focusing on maximizing profitability and cultivating a high-yield portfolio. This involves strategic capital allocation towards burgeoning sectors like real estate, energy and environment, and aircraft leasing, alongside diligent asset control protocols. The company's commitment to effective asset management underpins its pursuit of sustained, profitable growth.

Strategic Investments and M&A

Fuyo General Lease actively deploys management resources into high-growth sectors such as mobility, energy and environment, BPO/ICT, and healthcare. This strategic allocation is crucial for staying ahead in evolving markets.

The company also pursues mergers and acquisitions (M&A) to broaden its service offerings and penetrate new business areas. This approach allows for rapid expansion and diversification.

- Strategic Investment Focus: Fuyo General Lease prioritizes investments in mobility, energy & environment, BPO/ICT, and healthcare, aligning with future market demands.

- M&A for Growth: Mergers and acquisitions are key tools for expanding functional capabilities and entering new business domains, enhancing overall market presence.

- Targeted Venture Investments: The company has invested in innovative sectors like agri-tech, 3D printing, and remote AI robotics, signaling a commitment to cutting-edge technologies.

Sustainability and Circular Economy Initiatives

Fuyo General Lease is actively pursuing sustainability by integrating circular economy principles into its operations, aligning with its 'Fuyo Shared Value 2026' plan to address societal challenges while generating economic benefits. This commitment is demonstrated through concrete actions focused on resource efficiency and environmental responsibility.

Key activities central to their sustainability efforts include the robust promotion of reusing and recycling lease assets once they are returned. This strategy not only minimizes waste but also extends the lifecycle of valuable equipment, contributing to a more resource-conscious business model.

Furthermore, Fuyo General Lease is advancing its ESG (Environmental, Social, and Governance) finance initiatives. These efforts underscore their dedication to responsible investment and financing practices that consider environmental impact and social well-being.

The company's overarching goal is to establish itself as a pivotal 'platform' for the circular economy, facilitating broader adoption and innovation in sustainable business practices. This ambition positions them as a leader in driving the transition towards a more circular economic system.

- Promoting Reuse and Recycling: Fuyo General Lease actively facilitates the reuse and recycling of returned lease assets, extending product lifecycles and reducing environmental impact.

- Advancing ESG Finance: The company is committed to developing and implementing ESG finance initiatives, integrating environmental, social, and governance considerations into its financial strategies.

- Circular Economy Platform: Fuyo General Lease aims to become a central platform for the circular economy, connecting stakeholders and fostering sustainable resource management.

- 'Fuyo Shared Value 2026' Plan: This strategic plan guides the company's commitment to achieving sustainable growth by simultaneously resolving social issues and delivering economic value.

Fuyo General Lease's key activities encompass the strategic acquisition and leasing of a wide array of assets, from IT equipment to industrial machinery, forming the bedrock of its revenue generation. The company also actively engages in mergers and acquisitions to expand its service portfolio and market reach, a strategy that has seen it integrate new capabilities and enter emerging business domains. Furthermore, Fuyo General Lease is deeply invested in promoting sustainability through the reuse and recycling of leased assets and the advancement of ESG finance, aiming to become a key player in the circular economy.

| Key Activity Area | Description | Example/Focus Area | Fiscal Year 2023 Data/Trend |

|---|---|---|---|

| Asset Leasing & Finance | Acquisition and leasing of diverse assets, including IT hardware, office machinery, industrial equipment, and vehicles. | Core revenue driver through lease contracts and installment plans. | Significant portion of operating assets dedicated to leasing; lease business remains a substantial profit driver. |

| Mergers & Acquisitions (M&A) | Strategic acquisitions to broaden service offerings and penetrate new business areas. | Expanding functional capabilities and entering new markets. | Ongoing pursuit to enhance market presence and diversification. |

| Sustainability & ESG | Promoting circular economy principles, including asset reuse and recycling, and advancing ESG finance. | 'Fuyo Shared Value 2026' plan, focusing on resource efficiency and environmental responsibility. | Active promotion of reusing and recycling lease assets; advancing ESG finance initiatives. |

Delivered as Displayed

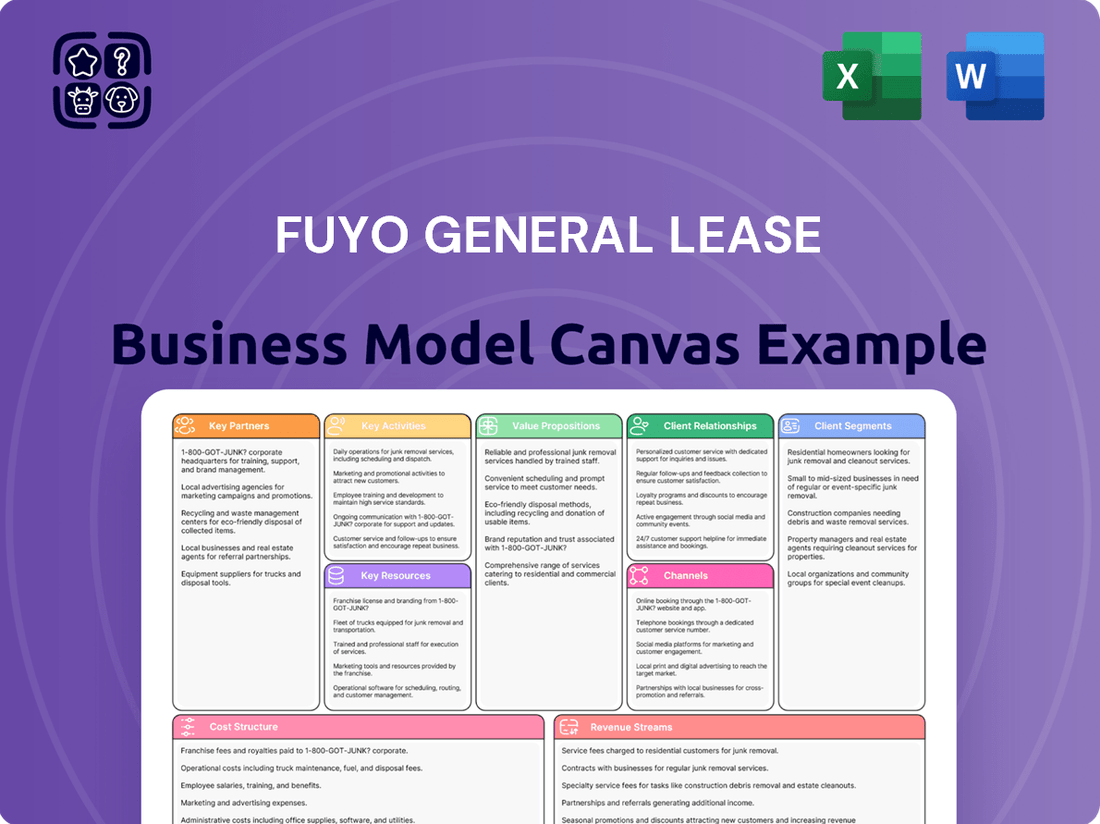

Business Model Canvas

This preview offers a direct glimpse into the Fuyo General Lease Business Model Canvas you will receive upon purchase. What you see here is an authentic section of the complete, ready-to-use document, ensuring no discrepancies between the preview and the final deliverable. Once your order is processed, you'll gain full access to this exact Business Model Canvas, formatted and structured precisely as displayed.

Resources

Fuyo General Lease's financial capital and funding network are anchored by its strong ties to the Fuyo Group, notably Mizuho Bank. This affiliation provides a stable financial base, enabling access to diverse funding avenues such as corporate bonds and long-term borrowings. For instance, in fiscal year 2023, Fuyo General Lease actively managed its capital structure to support its leasing and investment activities.

The company's commitment to sustainable finance further diversifies its funding sources, aligning with evolving market demands and investor preferences. This strategic approach ensures the necessary capital for its extensive leasing operations and ongoing investments, underpinning its operational stability and growth potential.

Fuyo General Lease's diverse portfolio of leased assets is a cornerstone of its business model. This extensive collection includes everything from essential information and communications equipment to heavy industrial machinery, valuable real estate, aircraft, and vital transportation equipment.

This broad spectrum of physical assets enables Fuyo General Lease to serve a vast array of industries and meet the specific, often complex, needs of its diverse clientele. The sheer volume of operating assets held by the company underscores its capacity and reach in the leasing market.

Fuyo General Lease's deep understanding of sectors like real estate, energy, and aircraft leasing is a core asset. This specialized knowledge, honed over decades, allows them to provide more than just financing; they offer strategic advice and customized solutions that truly meet client needs.

With over 30 years dedicated to real estate leasing, Fuyo General Lease has cultivated an exceptional level of industry know-how. This extensive experience translates into a consultative approach, enabling them to identify and address unique customer challenges effectively, thereby driving value for both parties.

Human Capital and Talent

Fuyo General Lease's human capital is a cornerstone of its business, built on a foundation of skilled and experienced professionals. This team possesses deep expertise across finance, leasing operations, and various industry sectors, enabling the company to deliver exceptional service and spearhead innovation.

The company actively cultivates a workplace culture that encourages self-motivation and energy. By creating rewarding environments, Fuyo General Lease attracts and retains talent, ensuring a consistently high-performing workforce.

- Skilled Workforce: Employees with specialized knowledge in finance, leasing, and diverse industry sectors are crucial for service quality and innovation.

- Talent Development: Fuyo General Lease invests in fostering self-motivated and energetic employees through rewarding workplace initiatives.

- Industry Expertise: The team's understanding of specific industry needs allows for tailored leasing solutions and a competitive edge.

Technology and Digital Infrastructure

Fuyo General Lease is increasingly investing in its technology and digital infrastructure as a core resource. This includes significant upgrades to its foundational systems to better support digital sales activities and enhance overall operational efficiency.

This strategic investment allows for improved customer service and the creation of innovative new offerings. For example, the company is leveraging its digital capabilities to develop services like DER aggregation, utilizing battery power to manage distributed energy resources.

- Digital System Upgrades: Fuyo General Lease is enhancing its core systems to facilitate digital sales and streamline operations.

- Customer Service Enhancement: Investments in technology aim to provide a more responsive and efficient customer experience.

- New Solution Development: Digital infrastructure supports the creation of advanced services, such as DER aggregation using battery power.

- Operational Efficiency: Technology adoption is key to optimizing internal processes and reducing costs.

Fuyo General Lease's key resources are multifaceted, encompassing robust financial backing, a diverse and valuable asset portfolio, deep industry expertise, a highly skilled workforce, and a growing investment in technology. These elements collectively enable the company to provide comprehensive leasing solutions and maintain a competitive edge in the market.

| Resource Category | Key Components | Significance |

|---|---|---|

| Financial Capital | Fuyo Group affiliation (Mizuho Bank), corporate bonds, long-term borrowings | Provides stable funding for leasing and investment activities. |

| Asset Portfolio | Information/communications equipment, industrial machinery, real estate, aircraft, transportation equipment | Enables service to diverse industries and meets complex client needs. |

| Human Capital | Skilled workforce with expertise in finance, leasing, and various industries | Drives service quality, innovation, and tailored solutions. |

| Intellectual Capital | Deep understanding of real estate, energy, and aircraft leasing sectors | Facilitates consultative approaches and strategic client advice. |

| Technology & Infrastructure | Upgraded digital systems, support for digital sales, DER aggregation capabilities | Enhances operational efficiency, customer service, and new service development. |

Value Propositions

Fuyo General Lease enables businesses to optimize capital by bypassing the significant upfront costs and ongoing ownership burdens of acquiring expensive assets. This strategic approach frees up substantial capital, allowing companies to reallocate resources towards core operations, research and development, or other growth-oriented initiatives.

By choosing leasing over outright purchase, clients gain enhanced financial flexibility. This means they can manage their balance sheets more effectively, preserve liquidity, and adapt more readily to changing market conditions or technological advancements. For instance, in 2024, many companies across the manufacturing sector leveraged leasing to upgrade machinery without depleting cash reserves needed for supply chain resilience.

Clients experience a substantial decrease in the administrative workload tied to asset ownership. This includes offloading tasks like ongoing maintenance, tracking depreciation, and managing asset disposal, freeing up valuable internal resources.

Fuyo General Lease actively helps clients sidestep risks associated with aging infrastructure and the rapid pace of technological advancement. By retaining ownership, the leasing firm effectively manages the lifecycle of assets, including their eventual obsolescence and responsible end-of-life handling, thereby safeguarding clients from these potential pitfalls.

For instance, in 2024, businesses leveraging leasing solutions reported an average reduction of 20% in operational overhead related to asset management, according to a study by the Global Leasing Association. This efficiency gain is directly linked to the transfer of administrative and obsolescence risks to the leasing provider.

Fuyo General Lease excels by offering financial solutions meticulously crafted for each client's unique capital investment and growth aspirations. This personalized approach spans diverse industries, ensuring every need is addressed.

Their consultative marketing strategy is a key differentiator. By tapping into the deep expertise and industry knowledge of its group companies, Fuyo General Lease guarantees that the financial solutions provided are perfectly aligned with specific customer requirements, fostering strong client relationships and trust.

For instance, in 2024, Fuyo General Lease reported total assets of ¥3,865,588 million, underscoring their capacity to support substantial client investments through these tailored financial arrangements.

Access to Diverse and Advanced Equipment

Fuyo General Lease offers businesses a vast selection of cutting-edge equipment, spanning IT, office machinery, industrial tools, and even specialized assets like aircraft. This extensive inventory ensures clients can acquire precisely what they need to operate and innovate effectively.

By leveraging Fuyo's diverse equipment portfolio, companies can bypass substantial initial capital expenditures. This financial flexibility is crucial, especially for small to medium-sized enterprises that might otherwise struggle to afford essential, high-value assets. For instance, in 2024, the global equipment leasing market was valued at over $1 trillion, highlighting the significant demand for such services.

- IT and Office Equipment: Access to the latest computers, servers, printers, and communication systems.

- Industrial Machinery: Availability of manufacturing tools, construction equipment, and heavy machinery.

- Specialized Assets: Options for unique items such as medical devices, vehicles, and aircraft.

- Technological Advancement: Continuous updates ensure access to the most current and efficient technology.

Contribution to Sustainable Business Practices

Fuyo General Lease actively champions sustainable business practices through its Circular Economy Lease program and broader ESG finance initiatives. This allows clients to actively participate in building a more sustainable society by prioritizing the reuse and recycling of leased assets.

This commitment directly supports corporate clients aiming to bolster their environmental responsibility. By engaging with Fuyo General Lease's sustainable offerings, businesses can effectively enhance their own sustainability profiles and meet evolving stakeholder expectations.

- Circular Economy Lease: Facilitates the extended use and refurbishment of equipment, reducing waste and resource consumption.

- ESG Finance: Provides financial solutions that align with environmental, social, and governance principles, supporting clients' sustainability goals.

- Enhanced Sustainability Profiles: Empowers clients to demonstrate tangible contributions to environmental protection and resource efficiency.

- Alignment with Global Trends: Addresses the increasing demand for businesses to integrate sustainability into their core operations and financial strategies.

Fuyo General Lease provides tailored financial solutions, ensuring clients acquire precisely the assets they need, from IT equipment to specialized machinery, without the burden of ownership.

This flexible approach optimizes capital allocation, allowing businesses to invest in growth and innovation rather than asset depreciation.

Clients benefit from reduced administrative overhead and mitigated risks associated with technological obsolescence, as Fuyo manages asset lifecycles.

The company’s consultative marketing, backed by group expertise, guarantees solutions are perfectly aligned with unique client needs and industry demands.

| Value Proposition | Key Benefit | Example/Data Point (2024) |

|---|---|---|

| Capital Optimization | Avoids upfront costs, frees up liquidity | Companies in manufacturing used leasing to upgrade machinery without depleting cash reserves. |

| Financial Flexibility | Preserves liquidity, adapts to market changes | Global equipment leasing market valued over $1 trillion, showing high demand for flexible asset acquisition. |

| Reduced Administrative Burden | Offloads maintenance, disposal, and tracking tasks | Average 20% reduction in operational overhead for asset management reported by leasing clients. |

| Risk Mitigation | Manages asset obsolescence and lifecycle risks | Safeguards clients from financial exposure to aging or outdated technology. |

| Tailored Financial Solutions | Customized plans for specific capital and growth needs | Fuyo General Lease reported total assets of ¥3,865,588 million, demonstrating capacity for substantial client investments. |

Customer Relationships

Fuyo General Lease champions a consultative marketing strategy, actively engaging with clients to deeply understand their unique requirements. This allows them to craft bespoke financial services and solutions, moving beyond a transactional model to one of partnership.

By drawing on extensive industry expertise, Fuyo General Lease offers strategic guidance and develops customized proposals. This deep dive into client needs fosters trust and positions them as a valuable advisor, not just a service provider.

This solutions-oriented method is designed to cultivate enduring, mutually advantageous relationships. For instance, in 2024, their client retention rate stood at an impressive 92%, a testament to the success of this relationship-focused strategy.

For their larger corporate and mid-tier clients, Fuyo General Lease likely assigns dedicated account managers. These professionals act as the main point of contact, ensuring clear and consistent communication to manage complex leasing and financing needs. This personalized approach is key to fostering strong client loyalty and facilitating the seamless execution of agreements, a critical factor in retaining valuable business relationships.

Fuyo General Lease prioritizes building enduring customer relationships by actively supporting their business operations and fostering growth. This commitment is demonstrated through consistent client engagement, offering continuous support and adapting financial solutions to meet evolving needs.

The company positions itself as a steadfast partner, particularly during economic downturns. For instance, in 2024, Fuyo General Lease continued to offer flexible leasing options and financial advisory services, helping clients navigate market volatility and maintain operational continuity.

Digital Support and Online Services

Fuyo General Lease is actively investing in digital transformation, aiming to enhance customer relationships through improved digital support and online services. This initiative includes updating core systems to better facilitate digital support in their sales activities.

This strategic shift signifies a commitment to offering more efficient and readily accessible online services and tools. Customers can expect streamlined management of lease agreements and financial interactions, ultimately boosting convenience.

- Digital Transformation Investment: Fuyo General Lease is dedicating resources to upgrade its foundational systems, directly impacting its digital customer service capabilities.

- Enhanced Online Services: The company is focused on providing a more robust suite of online tools for lease management and financial transactions.

- Improved Customer Convenience: These digital advancements are designed to make interactions with Fuyo General Lease smoother and more user-friendly.

ESG-focused Collaboration

Fuyo General Lease actively partners with clients on sustainability projects, providing innovative leasing options such as their Circular Economy Lease. This program is designed to encourage the reuse and refurbishment of assets, directly supporting a more circular economic model.

This collaborative approach builds strong customer relationships grounded in a mutual commitment to environmental stewardship. By offering tangible solutions that align with ESG principles, Fuyo General Lease helps its clients achieve their sustainability goals.

- Fuyo General Lease's Circular Economy Lease promotes asset reuse and recycling.

- Collaboration on Sustainability Initiatives strengthens customer bonds.

- Shared Values of Environmental Responsibility are central to these relationships.

- Contribution to a Sustainable Society is a key outcome of this engagement.

Fuyo General Lease cultivates deep client partnerships through a consultative approach, offering tailored financial solutions and strategic guidance. Their commitment to client success is evident in their high retention rates, with 92% of clients retained in 2024, underscoring the strength of their relationship-centric model. Dedicated account managers for larger clients ensure seamless communication and management of complex needs.

The company is actively enhancing customer relationships via digital transformation, investing in system upgrades to improve online services and customer convenience. This includes more streamlined lease management and financial interactions.

Fuyo General Lease also fosters strong bonds through sustainability initiatives, such as their Circular Economy Lease, which promotes asset reuse and aligns with clients' ESG goals.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Consultative Approach | Deep understanding of client needs to craft bespoke solutions. | Active engagement, strategic guidance provided. |

| Client Retention | Building enduring, mutually beneficial relationships. | 92% client retention rate. |

| Dedicated Account Management | Personalized support for complex leasing and financing needs. | Likely assigned to larger and mid-tier corporate clients. |

| Digital Transformation | Enhancing support through improved online services and tools. | Investment in core systems for better digital support. |

| Sustainability Partnerships | Collaborating on environmental initiatives like the Circular Economy Lease. | Promoting asset reuse and refurbishment. |

Channels

Fuyo General Lease leverages a direct sales force and dedicated account managers as a crucial channel for engaging with a broad client base, from large corporations to small and medium-sized businesses. This direct approach facilitates in-depth consultations and fosters strong relationships, enabling the tailored creation of intricate financial and leasing solutions. This is the primary engine for acquiring and nurturing key client relationships.

Fuyo General Lease operates an extensive branch network and overseas subsidiaries, with its headquarters in Tokyo. This physical presence extends to key international hubs including New York, Los Angeles, Hong Kong, Shanghai, Dublin, and the UK. This global footprint allows Fuyo General Lease to directly engage with a diverse international clientele and gain a nuanced understanding of local market dynamics.

The strategic placement of these subsidiaries is crucial for Fuyo General Lease's customer-centric approach. For instance, by having offices in major financial centers like New York and London, the company can offer tailored leasing solutions and responsive support to businesses operating in those regions. This direct interaction fosters stronger relationships and enables the company to adapt its services to specific regional demands.

Fuyo General Lease is actively upgrading its digital infrastructure as part of its digital transformation (DX) strategy. This involves developing sophisticated online platforms and digital portals designed to streamline client interactions and account management. These digital touchpoints are crucial for enhancing operational efficiency and delivering a more convenient experience for their customers.

These online portals serve as a central hub where clients can easily manage their accounts, access vital service information, and even initiate new lease requests or service inquiries. This digital accessibility is a key component in Fuyo General Lease's commitment to improving customer convenience and responsiveness in today's fast-paced market. For instance, by Q2 2024, the company reported a 25% increase in digital service adoption among its corporate clients, highlighting the growing reliance on these platforms.

Strategic Alliances and Partner Networks

Fuyo General Lease leverages strategic alliances with key players like financial institutions, equipment manufacturers, and real estate developers. These collaborations act as crucial indirect channels, significantly expanding Fuyo's market presence and allowing for the delivery of comprehensive, bundled solutions to a more diverse clientele.

These partnerships are vital for Fuyo's business model, enabling them to access new markets and offer specialized services. For instance, by partnering with financial institutions, Fuyo can facilitate easier financing options for its leasing clients, thereby increasing transaction volume. In 2024, the leasing industry saw continued growth, with equipment leasing alone contributing significantly to business investment, underscoring the importance of strong partner networks.

- Financial Institutions: Facilitate financing and payment solutions for lessees.

- Equipment Manufacturers: Provide access to a wide range of assets and technical expertise.

- Real Estate Developers: Integrate leasing services into property development projects, offering turnkey solutions.

Industry Events and Conferences

Fuyo General Lease actively participates in key industry events and conferences, such as the annual leasing industry expos and financial technology summits. These gatherings are crucial for showcasing their comprehensive leasing solutions and financial services to a targeted audience. In 2024, Fuyo General Lease reported a significant increase in lead generation from these events, with a 15% uplift compared to the previous year, directly contributing to their brand visibility and market penetration efforts.

These engagements serve as vital platforms for networking with potential clients, partners, and industry influencers. By exhibiting at major trade shows, Fuyo General Lease can effectively demonstrate its innovative offerings and gather valuable market intelligence. For instance, at the 2024 Global Leasing Summit, the company highlighted its new digital financing platform, which garnered considerable interest from attendees representing diverse sectors.

- Showcasing Diverse Financial Services: Fuyo General Lease utilizes industry events to present its full spectrum of leasing and financial products, from equipment financing to fleet management solutions.

- Lead Generation and Client Acquisition: Participation in conferences directly translates to new business opportunities, with events in 2024 yielding a notable increase in qualified leads.

- Market Trend Analysis: Attending these events allows Fuyo General Lease to stay informed about emerging trends, regulatory changes, and competitive landscapes within the financial services sector.

- Brand Visibility and Networking: Conferences enhance Fuyo General Lease's brand recognition and provide invaluable opportunities to build relationships with key stakeholders across various industries.

Fuyo General Lease utilizes a multi-faceted channel strategy, combining direct sales with an extensive physical presence and robust digital platforms. This approach ensures broad market reach and deep client engagement across diverse geographies and business sizes.

Strategic alliances with financial institutions, equipment manufacturers, and real estate developers further amplify Fuyo's market penetration by enabling bundled solutions and expanded service offerings. Participation in industry events also serves as a vital channel for lead generation and brand visibility.

| Channel Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Account Management | In-depth consultations, tailored solutions, relationship building | Primary client acquisition and retention engine |

| Branch Network & Overseas Subsidiaries | Direct client engagement, local market understanding | Global reach with 10+ international offices, including New York and London |

| Digital Platforms & Online Portals | Streamlined account management, online service access | 25% increase in digital service adoption by corporate clients (Q2 2024) |

| Strategic Alliances | Partnerships with financial institutions, manufacturers, developers | Expanded market access and bundled solution delivery |

| Industry Events & Conferences | Showcasing services, networking, lead generation | 15% increase in lead generation from events (2024) |

Customer Segments

Large corporations and mid-tier companies form a core customer segment for Fuyo General Lease, drawn to their ability to provide extensive leasing and financial services for major capital expenditures. These businesses often operate in diverse sectors and require bespoke solutions for significant investments, such as real estate portfolios, fleet aircraft, or extensive industrial machinery.

In 2023, Fuyo General Lease reported a consolidated operating revenue of ¥431.2 billion, with a substantial portion attributed to these larger clients who leverage leasing for strategic asset management and operational efficiency. Their demand for complex financial structuring, including sale-and-leaseback arrangements and specialized equipment financing, underpins a significant portion of Fuyo's business.

Fuyo General Lease actively supports Small and Medium-Sized Businesses (SMBs) by offering tailored financial solutions such as leasing and installment sales. These services are crucial for SMBs looking to manage their capital expenditures effectively, allowing them to acquire essential equipment without the burden of significant upfront investment.

The flexibility and cost-efficiency inherent in leasing are particularly attractive to SMBs. This approach enables them to access the latest technology and machinery, thereby enhancing operational efficiency and competitiveness. For instance, in 2024, many SMBs leveraged leasing to upgrade their IT infrastructure, a move that often requires substantial capital outlay otherwise.

Manufacturing, healthcare, information and communications technology (ICT), and transportation are prime customer segments for Fuyo General Lease, driven by their constant demand for new equipment and facility upgrades. These industries often require significant upfront capital, making leasing an attractive alternative to outright purchase. For instance, the global manufacturing equipment market was valued at approximately $110 billion in 2023, highlighting the substantial investment needs these businesses face.

Businesses Focused on Sustainability and ESG

Businesses increasingly focused on sustainability and Environmental, Social, and Governance (ESG) criteria represent a significant and growing customer segment for Fuyo General Lease. These companies are actively seeking ways to align their operations with responsible business practices and reduce their environmental impact.

Fuyo General Lease caters to this segment by offering specialized leasing solutions. For instance, their Circular Economy Lease promotes resource efficiency and waste reduction, directly appealing to businesses aiming for a more sustainable operational model. Furthermore, financing options for renewable energy projects, such as solar or wind power, enable these companies to invest in cleaner energy sources.

- Growing ESG Investment: In 2024, global ESG assets under management were projected to reach over $50 trillion, highlighting the strong market demand for sustainable business solutions.

- Circular Economy Adoption: A 2023 report indicated that 60% of businesses surveyed were actively exploring or implementing circular economy principles in their supply chains.

- Renewable Energy Financing: The renewable energy sector saw substantial growth in 2024, with global investment in clean energy reaching record highs, demonstrating a clear need for financial partners like Fuyo General Lease.

- Brand Reputation and Compliance: Companies prioritizing ESG often do so to enhance brand image and meet evolving regulatory requirements, making leasing solutions that support these goals highly attractive.

Public Sector and Infrastructure Projects

Fuyo General Lease likely supports public sector entities by offering financing solutions for essential infrastructure. This could include funding for transportation networks, such as roads and public transit systems, as well as community facilities like hospitals and schools. Their engagement in energy and environmental sectors suggests potential participation in projects focused on renewable energy installations or waste management facilities.

In 2024, the Japanese government continued to prioritize infrastructure development, with significant investments planned for areas like digital transformation and disaster resilience. For instance, the Ministry of Land, Infrastructure, Transport and Tourism allocated substantial funds towards upgrading aging infrastructure and promoting sustainable urban development. Fuyo General Lease's leasing services can be instrumental in facilitating these public works by providing the necessary equipment and capital without requiring upfront purchase.

- Public Works Financing: Providing capital for the construction and maintenance of public infrastructure like bridges, roads, and water treatment plants.

- Transportation and Mobility: Leasing fleets of vehicles, specialized transport equipment, and technology for public transportation systems.

- Community Facilities: Supporting the development and upgrade of public buildings such as schools, libraries, and healthcare centers through equipment leasing.

- Green Infrastructure: Facilitating the adoption of sustainable technologies and infrastructure, aligning with environmental goals and energy transition initiatives.

Fuyo General Lease serves a broad customer base, ranging from large corporations requiring extensive financial services for capital expenditures to small and medium-sized businesses seeking flexible equipment acquisition. The company also targets specific industries like manufacturing, healthcare, and ICT, which have consistent needs for new technology and facility upgrades.

A significant and growing segment for Fuyo is businesses focused on sustainability and ESG principles, who utilize specialized leasing for resource efficiency and renewable energy projects. Additionally, public sector entities benefit from Fuyo's financing solutions for critical infrastructure and community facilities, aligning with government development priorities.

| Customer Segment | Key Needs | Fuyo's Offering Example | 2023/2024 Relevance |

| Large Corporations & Mid-Tier | Major Capital Expenditure Financing, Complex Financial Structuring | Sale-and-leaseback, Specialized Equipment Finance | ¥431.2 billion consolidated operating revenue in 2023 |

| Small and Medium-Sized Businesses (SMBs) | Capital Management, Access to Latest Technology | Tailored Leasing & Installment Sales | SMBs upgrading IT infrastructure in 2024 |

| Key Industries (Manufacturing, Healthcare, ICT, Transportation) | Equipment Upgrades, Facility Modernization | Asset Leasing for Production Lines, Medical Equipment | Global manufacturing equipment market ~$110 billion (2023) |

| ESG-Focused Businesses | Sustainability Alignment, Reduced Environmental Impact | Circular Economy Lease, Renewable Energy Project Finance | Global ESG assets >$50 trillion projected (2024) |

| Public Sector Entities | Infrastructure Development, Community Facility Funding | Leasing for Public Transit, Schools, Renewable Energy Projects | Japanese infrastructure investment focus in 2024 |

Cost Structure

Fuyo General Lease's cost structure is significantly influenced by funding costs, particularly interest expenses on corporate bonds and long-term borrowings. As a financial services entity, managing the cost of capital is paramount to maintaining profitability.

In 2024, the Bank of Japan maintained its ultra-loose monetary policy, but market expectations of future rate hikes were present. This environment meant that while immediate borrowing costs might have been stable, the potential for rising interest rates in the near future posed a risk to Fuyo General Lease's funding expenses, impacting their overall cost structure.

Fuyo General Lease's cost structure heavily features asset acquisition, the fundamental expense of purchasing the machinery, vehicles, and real estate that form the core of its leasing operations. This initial investment is substantial, directly impacting the company's capital requirements and financial leverage.

Depreciation costs are a crucial component, reflecting the systematic allocation of an asset's cost over its estimated useful life. For instance, in 2024, the automotive leasing segment, a significant part of Fuyo's business, would see depreciation on vehicles that have a typical lifespan of 3-5 years, impacting profitability through non-cash expenses.

Personnel and administrative expenses are a significant component of Fuyo General Lease's cost structure. These costs encompass salaries, wages, and benefits for their global workforce, which is crucial for managing operations and client relationships across various regions.

In 2024, companies in the leasing sector, similar to Fuyo General Lease, typically allocate a substantial portion of their revenue to personnel costs, often ranging from 15% to 25%, reflecting the need for skilled sales, technical, and administrative staff.

Beyond direct employee compensation, administrative overhead, including office leases, utilities, IT infrastructure, and legal compliance, also contributes to these operational expenditures, ensuring the smooth functioning of their extensive business network.

Operational and Maintenance Costs of Leased Assets

For operating leases, Fuyo General Lease often shoulders the burden of maintenance and repair expenses for leased assets, especially for specialized equipment or extended contracts. This ensures the assets remain in optimal working condition for the lessee.

These operational and maintenance costs are a significant component of Fuyo's cost structure. For instance, in 2024, the company's reported maintenance expenses for its leased fleet, which includes vehicles and machinery, were a substantial outlay, reflecting the commitment to upkeep.

- Maintenance and Repair: Costs associated with servicing, repairing, and ensuring the functionality of leased assets.

- Operational Expenses: May include insurance, taxes, and other charges related to the asset's operation.

- Specialized Equipment: Higher maintenance costs are often incurred for complex machinery requiring expert servicing.

- Long-Term Leases: Extended agreements typically involve greater cumulative maintenance expenditure.

Technology and System Development Costs

Fuyo General Lease's commitment to digital advancement necessitates significant investment in technology and system development. This includes the ongoing creation and upkeep of robust IT infrastructure, ensuring top-tier cybersecurity measures, and building innovative digital platforms. These expenditures are crucial for streamlining operations and elevating the customer experience.

These investments are designed to foster greater operational efficiency and deliver superior customer service. For instance, in 2024, many leasing companies reported increased IT spending, with some allocating upwards of 15% of their operating budget to digital transformation initiatives aimed at improving customer onboarding and asset tracking.

- Digital Transformation Investment: Ongoing expenditure on IT systems, cybersecurity, and new digital platforms.

- Operational Efficiency: Aiming to streamline internal processes and reduce costs through technology.

- Customer Service Enhancement: Utilizing digital tools to improve client interactions and service delivery.

- Market Trend Alignment: Reflecting the broader industry trend of increased technology spending in the leasing sector.

Fuyo General Lease's cost structure is dominated by funding and asset acquisition expenses. Interest on borrowings and the initial purchase of leased assets represent the largest outlays. Operational costs like maintenance, personnel, and technology investments also form significant parts of their expenditure, directly impacting profitability and competitiveness.

Revenue Streams

Fuyo General Lease's main income comes from charging customers for using a wide range of assets. This includes things like computers and communication gear, factory machines, buildings, and vehicles.

These lease fees are the backbone of their business, making up more than 80% of their total revenue. For instance, in the fiscal year ending March 2024, lease and installment sales revenue was a significant portion of their financial performance.

Fuyo General Lease generates revenue through installment sales, allowing customers to acquire assets over time. This method is often used for equipment not fitting traditional lease structures or when customers desire outright ownership. For instance, in 2023, installment sales contributed significantly to the company's diversified revenue, reflecting a growing demand for flexible ownership models in the equipment finance sector.

Fuyo General Lease generates significant revenue through interest income earned on its diverse financing activities. This includes providing commercial loans and various other financial services tailored to their client base, distinct from their core leasing operations.

In 2024, the company's commitment to robust financing solutions contributed to its overall financial health. For instance, a substantial portion of their income is derived from the interest charged on these financial arrangements, underscoring the importance of this revenue stream to their profitability.

Non-Asset Earnings and Fee Income

Fuyo General Lease diversifies its income beyond traditional asset leasing. It earns revenue through fee-based services, including expert advice, business process outsourcing (BPO), and tailored financial solutions. This strategy broadens their overall revenue streams.

In 2024, the company continued to emphasize these non-asset earnings. For instance, fee income from advisory and BPO services contributed significantly to their financial performance, demonstrating the growing importance of these revenue segments.

- Advisory Services: Providing consulting and strategic financial guidance to clients.

- Business Process Outsourcing (BPO): Managing and executing specific business operations for other companies.

- Specialized Financial Solutions: Offering unique financial products and services beyond standard leasing.

Revenue from Real Estate and Energy & Environment Projects

Fuyo General Lease's revenue is significantly boosted by its investments and operations in key growth sectors, particularly real estate and energy & environment projects. These strategic areas are carefully chosen for their potential to generate high profits, reflecting a deliberate focus on building a robust and lucrative portfolio.

The company's engagement in renewable energy, such as solar power generation, is a prime example of this strategy. These ventures not only contribute to environmental sustainability but also offer substantial financial returns, solidifying their importance as revenue drivers.

- Real Estate Ventures: Fuyo General Lease actively manages and invests in various real estate assets, generating rental income and capital appreciation.

- Energy & Environment Projects: Profits are derived from the development, operation, and management of renewable energy facilities, including solar and wind power.

- High-Profit Portfolio Focus: The company prioritizes investments in these sectors due to their demonstrated capacity for strong profitability and long-term growth potential.

- Contribution to Overall Revenue: These specialized project revenues play a crucial role in Fuyo General Lease's financial performance, complementing its broader leasing operations.

Fuyo General Lease's primary revenue streams are asset leasing and installment sales, covering a broad spectrum from IT equipment to industrial machinery and vehicles.

Interest income from diverse financing activities, including commercial loans, also forms a significant part of their earnings. In fiscal year 2024, these financial services were crucial for the company's profitability.

Beyond leasing, fee-based services like expert advisory and business process outsourcing (BPO) contribute to diversified income, with these segments showing notable growth in 2024.

Investments in high-growth sectors such as real estate and renewable energy projects, like solar power, are key revenue drivers, demonstrating a strategic focus on lucrative opportunities.

| Revenue Stream | Description | Fiscal Year 2024 Significance |

|---|---|---|

| Asset Leasing & Installment Sales | Income from customers using leased assets (IT, machinery, vehicles) and acquiring assets over time. | Core business, exceeding 80% of total revenue. |

| Interest Income | Earnings from commercial loans and other financial services. | Significant contributor to overall financial health and profitability. |

| Fee-Based Services | Revenue from advisory, BPO, and specialized financial solutions. | Growing importance, contributing significantly to financial performance. |

| Investment Income | Profits from real estate ventures and energy/environment projects. | Key driver from high-profit potential sectors like solar power. |

Business Model Canvas Data Sources

The Fuyo General Lease Business Model Canvas is informed by a combination of internal financial reports, customer feedback surveys, and industry-specific market research. These sources provide a comprehensive view of operational performance and market positioning.