Fuyo General Lease Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyo General Lease Bundle

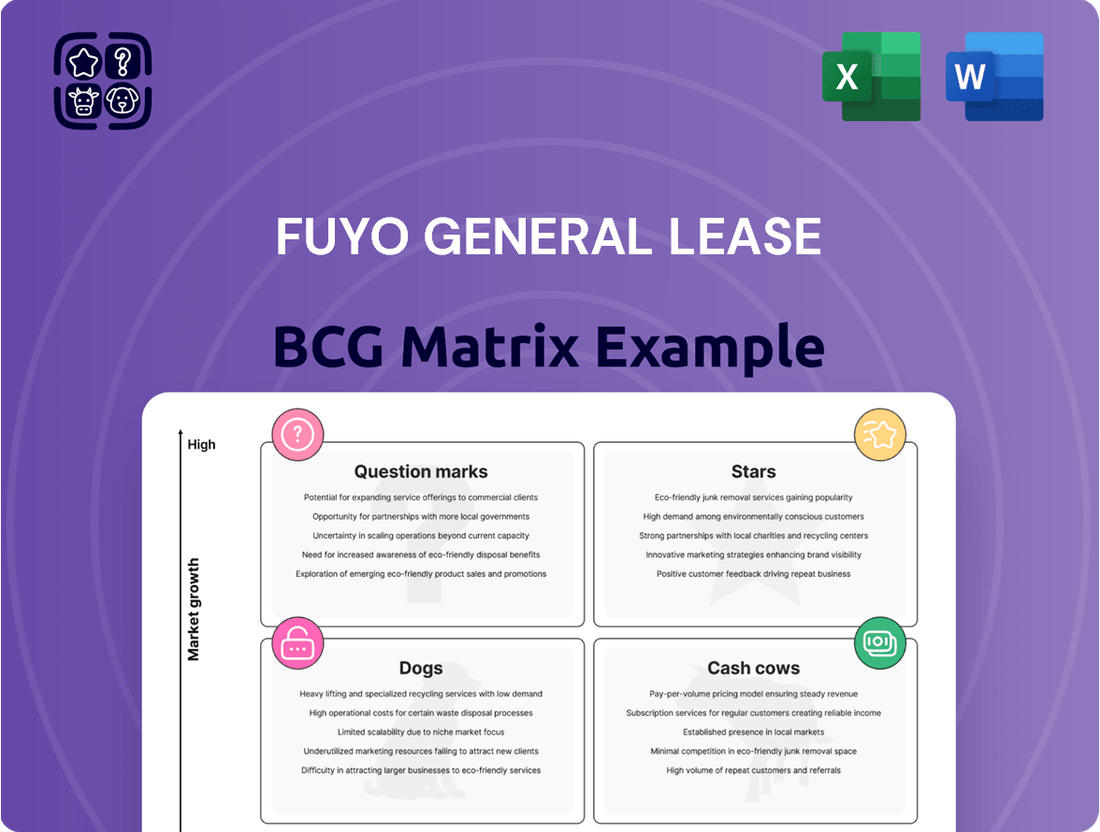

Curious about Fuyo General Lease's strategic positioning? This glimpse into their BCG Matrix reveals the potential of their product portfolio, highlighting areas ripe for growth and those requiring careful management. Understand which products are their Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock Fuyo General Lease's competitive advantage, dive into the full BCG Matrix report. Gain a comprehensive understanding of their market share and growth rates for each product, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable insights contained within the complete Fuyo General Lease BCG Matrix. Purchase the full report today to equip yourself with the strategic clarity needed to navigate the market with confidence and drive sustainable success.

Stars

Fuyo General Lease is making significant strides in the Energy & Environment sector, specifically targeting renewable energy. Their commitment is evident in their substantial investments, with over 50 billion yen channeled into European renewable energy projects and investment funds in a short timeframe. This aggressive expansion, including the establishment of a UK subsidiary in April 2024, underscores their belief in the high-growth potential of this market.

The company's focus on offshore wind projects, a key driver of global decarbonization, is a strategic move to capitalize on increasing demand for clean energy. These investments are already contributing to Fuyo General Lease's growing earnings, demonstrating the financial viability of their renewable energy ventures. Their engagement in this sector positions them as a key player in the transition towards a more sustainable energy future.

Fuyo General Lease's strategic real estate finance operations are a cornerstone of its business, consistently delivering robust performance and substantial capital gains. The company is actively carving out a niche by targeting high-return real estate projects and developing innovative solutions that address critical societal needs, including decarbonization initiatives and evolving Corporate Real Estate (CRE) demands.

The Japanese real estate sector, particularly in sought-after prime locations, is currently exhibiting strong upward momentum. This favorable market condition is characterized by increasing rental yields and consistently high occupancy rates, creating an opportune environment for Fuyo General Lease's strategic real estate investments. For instance, in 2024, major Japanese cities like Tokyo continued to see office rental growth, with some prime districts experiencing year-on-year increases of over 5%.

Aircraft leasing is a cornerstone of Fuyo General Lease's operations, recognized as a significant growth driver. This segment contributes substantially to the company's overall lease portfolio and profitability, underscoring its importance in the company's strategic positioning.

Fuyo General Lease has cultivated deep expertise and a proven history in the specialized field of aircraft leasing. This long-standing experience allows the company to effectively navigate the complexities of the aviation finance market and maintain a competitive edge.

The aircraft leasing sector continues to demonstrate robust performance for Fuyo General Lease, solidifying its status as a leader within this expanding niche. For example, in fiscal year 2023, Fuyo General Lease's aircraft leasing business reported a notable increase in revenue, reflecting the sustained demand and its strong market presence.

Mobility & Logistics (Emerging Domains)

Fuyo General Lease is making significant strides in the Mobility & Logistics sector, identifying it as a key emerging domain with substantial growth prospects. The company is actively investing in areas like electric vehicles (EVs) and global logistics to capitalize on evolving market demands.

A prime example of this strategic focus is the consolidation of YAMATO LEASE as a subsidiary, a move designed to bolster Fuyo General Lease's footprint within the dynamic mobility landscape. This expansion is a direct response to anticipated market shifts and critical industry challenges, such as persistent labor shortages.

- EV Charging Infrastructure: Fuyo General Lease is exploring investments in EV charging infrastructure, a sector projected to grow significantly as EV adoption accelerates. For instance, the global EV charging market was valued at approximately $20 billion in 2023 and is expected to reach over $100 billion by 2030.

- Global Logistics Network Expansion: The company's focus on global logistics aims to create more efficient and resilient supply chains, a critical need highlighted by recent global disruptions. The global logistics market itself is a multi-trillion dollar industry, with continued growth driven by e-commerce and international trade.

- Fleet Management Solutions: Fuyo General Lease is enhancing its fleet management services, incorporating advanced technologies to optimize operations and address the logistics industry's labor challenges through increased efficiency.

BPO/ICT Services (Digital Transformation-driven)

The BPO/ICT Services segment is a key strategic focus for Fuyo General Lease, fueled by increasing demand for operational efficiency and evolving work styles. The company is leveraging digital transformation (DX) and artificial intelligence (AI) to drive earnings growth in this sector, aiming to capture the expanding market opportunities. This commitment is evidenced by the successful implementation of Robotic Process Automation (RPA) across a broad range of departments, highlighting Fuyo General Lease's progress in this high-growth area.

Fuyo General Lease's investment in BPO/ICT services aligns with a broader industry trend. For instance, the global BPO market was projected to reach over $370 billion in 2024, with significant growth driven by technology adoption. The company's strategic use of AI and RPA is not just about efficiency but also about creating new value propositions for its clients seeking to modernize their operations.

- Market Growth: The BPO/ICT sector is experiencing robust expansion, driven by digital transformation initiatives across industries.

- Technology Adoption: Fuyo General Lease is actively deploying AI and RPA to enhance service offerings and operational capabilities.

- Strategic Importance: This segment represents a crucial area for Fuyo General Lease's future earnings growth and competitive positioning.

- Efficiency Gains: The successful rollout of RPA across multiple departments demonstrates tangible improvements in operational efficiency.

Fuyo General Lease's aircraft leasing segment is a clear Star in the BCG matrix. It consistently demonstrates robust performance and significant growth, contributing substantially to the company's overall lease portfolio and profitability. This segment's leadership position is solidified by deep expertise and a proven history in the aviation finance market, as evidenced by a notable revenue increase in fiscal year 2023.

What is included in the product

Fuyo General Lease's BCG Matrix analysis categorizes its business units by market share and growth, guiding strategic decisions.

Fuyo General Lease's BCG Matrix offers a clear, visual roadmap to reallocate resources, alleviating the pain of inefficient investment decisions.

Cash Cows

The mainstay lease business, covering general machinery, equipment, and office gear, is the bedrock of Fuyo General Lease. This segment is a significant contributor to the company's profitability, even before accounting for interest and operating assets.

Despite operating in a market that has matured, this established business generates reliable and steady cash flow. It demands minimal investment for marketing and sales, solidifying its position as a cash cow.

Installment sales are a cornerstone of Fuyo General Lease's operations, mirroring the stability of its core leasing business. This segment acts as a dependable cash generator, requiring minimal additional investment to maintain its consistent performance.

In 2023, Fuyo General Lease reported total revenue of ¥380.5 billion, with installment sales contributing a significant portion to this figure, underscoring its role as a mature yet vital revenue source. The company's commitment to this segment highlights its strategy of leveraging established business lines for steady financial health.

Fuyo General Lease's established real estate leasing portfolio represents a classic cash cow. These mature assets, while not experiencing rapid expansion, consistently deliver strong rental income and healthy profit margins. This stability allows Fuyo to generate reliable cash flow, effectively milking these assets to fund other strategic ventures within the company.

General Financial Services (Traditional Lending)

Fuyo General Lease's traditional lending and general asset finance services are mature offerings within the broader financial services sector. These segments, while not exhibiting rapid expansion, command a substantial market share, bolstered by long-standing customer connections. In 2024, the company's leasing segment, which encompasses many of these traditional finance offerings, reported a significant contribution to its overall revenue, demonstrating the stability of these operations.

These established services are crucial for generating steady financial returns, which can then be strategically reinvested into Fuyo General Lease's more dynamic and growth-focused business areas. This consistent income stream also serves to absorb essential administrative expenditures, ensuring operational efficiency across the organization.

- Stable Revenue Generation: Traditional lending and asset finance provide a predictable income stream, vital for overall financial health.

- High Market Share: Established client relationships in these mature segments contribute to a dominant market position.

- Funding Growth Initiatives: Profits from these cash cows are essential for investing in high-potential, emerging business units.

- Operational Cost Coverage: The consistent income helps to cover the day-to-day administrative and operational expenses of the company.

Domestic General Leasing (Broad Customer Base)

Fuyo General Lease's domestic general leasing segment, serving a broad customer base, is a clear Cash Cow. This segment benefits from a well-established network of large enterprise clients within Japan's mature leasing market, ensuring consistent demand for its established services.

The stability of this customer base allows for predictable and reliable cash flow, requiring minimal investment in new market development. For instance, in the fiscal year ending March 2024, Fuyo General Lease reported total revenue of ¥461.9 billion, with a significant portion attributable to its domestic leasing operations.

This mature segment consistently generates substantial profits, providing the financial resources to invest in other areas of the business or return capital to shareholders. Key characteristics include:

- Stable and large enterprise customer base in Japan.

- Mature market with consistent demand for established leasing services.

- High and reliable cash generation with low reinvestment needs.

- Contributes significantly to overall profitability and financial stability.

Fuyo General Lease's domestic general leasing segment is a prime example of a cash cow within its BCG matrix. This segment benefits from a well-established network of large enterprise clients in Japan's mature leasing market, ensuring consistent demand for its established services.

The stability of this customer base allows for predictable and reliable cash flow, requiring minimal investment in new market development. For instance, in the fiscal year ending March 2024, Fuyo General Lease reported total revenue of ¥461.9 billion, with a significant portion attributable to its domestic leasing operations.

This mature segment consistently generates substantial profits, providing the financial resources to invest in other areas of the business or return capital to shareholders. Key characteristics include a stable and large enterprise customer base, a mature market with consistent demand, high and reliable cash generation with low reinvestment needs, and a significant contribution to overall profitability and financial stability.

| Segment | Market Growth | Relative Market Share | Cash Flow Generation |

| Domestic General Leasing | Low | High | High |

Full Transparency, Always

Fuyo General Lease BCG Matrix

The Fuyo General Lease BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed and analysis-ready strategic tool. You can be confident that the comprehensive insights and clear visualization presented here are precisely what you'll be able to download and utilize for your business planning and decision-making. This is the complete, unadulterated BCG Matrix report, ready for immediate application.

Dogs

Outdated IT and office equipment leasing often falls into the Dogs category of the BCG Matrix. As technology advances at a breakneck pace, older models of computers, printers, and other office essentials see their demand and resale values plummet. This segment typically represents products with a small market share in a declining industry niche.

The costs associated with maintaining and remarketing these aging assets can quickly outweigh the revenue they generate. For instance, a 2024 report indicated that the average residual value for office computers older than five years had dropped by nearly 20% compared to the previous year, making their continued leasing less profitable.

Fuyo General Lease's stated intention to divest from nontraditional leasing and non-financial services positions certain smaller, less profitable segments as potential 'dogs' in its BCG matrix. These are likely offerings that have not demonstrated substantial market traction or future growth potential, potentially consuming resources without commensurate returns.

For instance, if Fuyo General Lease's 'other' financial services segment, which might include niche lending or specialized advisory services outside its core leasing business, showed a mere 1.5% year-over-year revenue growth in 2024 and held less than 2% of the relevant market share, it would exemplify a dog. Such segments could represent cash traps, diverting capital that could be better allocated to higher-potential business units.

Underperforming legacy real estate assets, often situated in stagnant regional markets or representing older properties, can become liabilities within a company's portfolio. These assets may not align with a strategic pivot towards more profitable and sustainable ventures, such as eco-friendly developments. For instance, a portfolio might include office buildings constructed in the 1980s that require substantial modernization to meet current energy efficiency standards and tenant expectations.

Such properties frequently face difficulties in attracting and retaining tenants, leading to high vacancy rates and consequently, low rental income. In 2024, the commercial real estate sector, particularly for older office spaces, has seen a notable increase in vacancy rates in many metropolitan areas, with some markets experiencing rates exceeding 15% for Class B and C properties. This directly impacts market share growth and profitability for owners of these legacy assets.

Highly Commoditized Leasing Segments

Highly commoditized leasing segments, such as basic office equipment or standard vehicle leasing, often feature intense competition. This can drive down prices and significantly compress profit margins for companies like Fuyo General Lease if they don't possess a strong differentiator or economies of scale.

In these 'dog' categories, Fuyo General Lease might find itself breaking even or even consuming cash without contributing substantial strategic value to its overall portfolio. For instance, in 2024, the global equipment leasing market saw increased competition in segments like IT hardware, with average profit margins in some sub-sectors reportedly dipping below 5% due to price wars.

- Intense Competition: Many players offer similar products, leading to price-based decision-making by customers.

- Thin Margins: Profitability is squeezed due to high competition and limited pricing power.

- Low Strategic Value: These segments may not offer growth potential or competitive advantages for Fuyo General Lease.

- Cash Consumption: Operations might require ongoing investment without generating significant returns.

Divestiture Candidates from Past Acquisitions

Divestiture candidates within Fuyo General Lease's portfolio, particularly those stemming from past acquisitions, would likely fall into the Dogs quadrant of the BCG Matrix. These are typically business units or assets that have struggled to gain significant market traction post-acquisition, especially in segments characterized by limited growth prospects. For instance, if Fuyo General Lease acquired a niche leasing operation in a declining industry sector, and that operation failed to achieve its projected market share, it would fit this profile.

These underperforming acquisitions represent a drain on resources without a clear path to substantial future returns. Attempting costly turnaround strategies for such units is often economically unviable. Consider a scenario where a acquired technology leasing subsidiary in a rapidly commoditizing market failed to capture even 5% market share within three years of the acquisition, despite significant investment. This entity would be a prime divestiture candidate.

- Low Market Share: Acquired units failing to establish a significant presence in their respective markets.

- Low Growth Segments: Businesses operating within industries experiencing stagnation or decline.

- Ineffective Turnaround: High costs associated with revitalization efforts that show little promise of success.

- Strategic Misfit: Acquired assets that no longer align with Fuyo General Lease's evolving strategic objectives.

Segments within Fuyo General Lease's portfolio that exhibit low market share in declining industries are classified as Dogs. These are often legacy assets or niche offerings that struggle to generate significant revenue or growth. For example, outdated IT equipment leasing saw a nearly 20% drop in residual value for older models in 2024, highlighting the challenges in this category.

Such 'dog' segments, like underperforming acquired businesses in stagnant sectors, typically consume resources without offering substantial strategic value or future returns. Their low market share and lack of growth potential make them prime candidates for divestiture rather than costly turnaround efforts.

Intensely competitive and commoditized leasing markets, such as basic office equipment or standard vehicle leasing, often result in thin profit margins for companies like Fuyo General Lease. In 2024, some IT hardware leasing sub-sectors reported profit margins below 5% due to aggressive price competition.

These 'dog' areas may be at best break-even operations, potentially draining capital that could be better invested in more promising business units, illustrating the need for strategic portfolio management.

| BCG Category | Characteristics | Fuyo General Lease Examples (Potential) | 2024 Data/Trends | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low market share, declining industry, low growth potential | Outdated IT/office equipment leasing, underperforming acquired niche businesses, legacy real estate assets in stagnant markets | Residual value of office computers >5 years old dropped ~20% YoY; IT hardware leasing margins <5% in some sub-sectors due to price wars. | Divestiture, liquidation, or minimal investment to maintain operations. |

| Dogs | High competition, thin margins, low strategic value | Commoditized office equipment leasing, standard vehicle leasing | Intense competition in global equipment leasing market driving down prices. | Focus on cost control, efficiency, or potential exit if no competitive advantage can be established. |

Question Marks

Fuyo General Lease is actively investing in the burgeoning self-driving vehicle and electric vehicle (EV) sectors. These areas represent significant growth opportunities, driven by rapid technological innovation and a global push towards sustainability. For instance, the global EV market was valued at approximately $380 billion in 2023 and is projected to grow substantially in the coming years.

Within the BCG Matrix framework, Fuyo General Lease's ventures into self-driving and EVs likely fall into the Question Mark category. This is due to the high market growth potential coupled with the company's potentially low current market share. The development and deployment of autonomous driving technology, for example, require substantial capital expenditure for research, development, and infrastructure, with the global autonomous vehicle market expected to reach hundreds of billions by the end of the decade.

Specific new overseas market entries for Fuyo General Lease, particularly in high-growth geographical regions or specialized international asset finance niches, would be classified as Question Marks in the BCG Matrix. These initiatives represent areas where the company is building an initial presence and require significant investment to establish a competitive foothold.

These ventures face considerable market entry barriers, necessitating substantial upfront capital to overcome challenges and achieve a viable market position. For instance, entering a new market like Southeast Asia in 2024, which is projected to see a compound annual growth rate of 7.5% in its leasing market through 2028, demands extensive research and localized strategies.

The success of these Question Mark ventures is critically dependent on rapid market adoption and the ability to scale operations efficiently. Without swift customer uptake and effective expansion, these investments could drain resources without generating the necessary returns, potentially hindering overall company growth.

Fuyo General Lease's exploration into advanced DX and AI for business model transformation, moving beyond its established BPO/ICT services, positions these ventures as Question Marks within the BCG framework. These strategic pivots are inherently high-risk, high-reward, demanding substantial investment in research and development, with an estimated ¥10 billion allocated for AI and DX initiatives in 2024 alone. The success of these nascent projects hinges on market adoption and Fuyo's capacity to operationalize and scale these cutting-edge solutions effectively.

Innovative Healthcare Financing Solutions

Fuyo General Lease views healthcare as a crucial sector, evidenced by its substantial project backlog. However, creating and expanding novel financing for nascent, rapidly growing healthcare innovations poses a challenge, placing it in the Question Mark category of the BCG matrix. This is because these markets are still developing, demanding considerable resources for market analysis and specialized knowledge acquisition.

The current market share for these innovative healthcare financing solutions is relatively small, but the potential for future expansion is considerable. For instance, in 2024, the global digital health market was projected to reach over $300 billion, highlighting the vast opportunity for specialized financing. Fuyo General Lease's investment in understanding these evolving needs is key to capitalizing on this growth.

- High Growth Potential: The healthcare sector, particularly with emerging technologies, offers significant future growth prospects.

- Market Uncertainty: Developing financing for new healthcare services with evolving market dynamics presents a challenge.

- Investment Needs: Substantial investment is required to build expertise and understand the specific needs of these innovative areas.

- Low Current Share: Existing market penetration for these specialized financing solutions is currently limited, indicating room for expansion.

Emerging Sustainable Finance Products/Frameworks

Fuyo General Lease is actively developing and promoting innovative sustainable finance products. The company's commitment is underscored by its receipt of the ESG Finance Award in 2023, recognizing its leadership in this domain.

While the overall sustainable finance market is experiencing robust growth, emerging products and frameworks beyond traditional green bonds and sustainability-linked loans are still in nascent stages. These newer offerings, such as transition finance or biodiversity-focused instruments, represent potential high-growth areas but currently require substantial market education and investment to achieve widespread adoption and create a distinct competitive advantage.

- Transition Finance: Supporting companies in their shift towards lower-carbon operations, a segment projected for significant expansion.

- Biodiversity Bonds: Instruments aimed at funding projects that protect and restore natural ecosystems, gaining traction as environmental awareness grows.

- Impact Investing Funds: Portfolios specifically designed to generate measurable social and environmental impact alongside financial returns.

- Circular Economy Financing: Products that support businesses adopting circular economy principles, reducing waste and promoting resource efficiency.

Fuyo General Lease's ventures into areas like self-driving vehicles, EVs, and advanced DX/AI solutions are positioned as Question Marks. These represent high-growth potential markets where the company is likely establishing an initial presence, requiring significant investment to build market share.

These initiatives face substantial market entry barriers and demand considerable capital for research, development, and infrastructure. For example, the global EV market was valued at around $380 billion in 2023, and autonomous vehicle market projections are in the hundreds of billions by 2030, illustrating the scale of investment needed.

The success of these Question Marks hinges on rapid market adoption and efficient scaling. Without swift customer uptake and effective expansion, these investments could consume resources without yielding the anticipated returns, potentially impacting overall company growth.

Fuyo's strategic pivots into novel healthcare financing and sustainable finance products also fall into the Question Mark category. These are developing markets with considerable future expansion potential, such as the digital health market exceeding $300 billion in 2024, but currently require substantial investment to build expertise and market share.

BCG Matrix Data Sources

Our Fuyo General Lease BCG Matrix is built on comprehensive market data, encompassing financial performance reports, industry growth forecasts, and competitive landscape analyses to provide strategic insights.