Ferguson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferguson Bundle

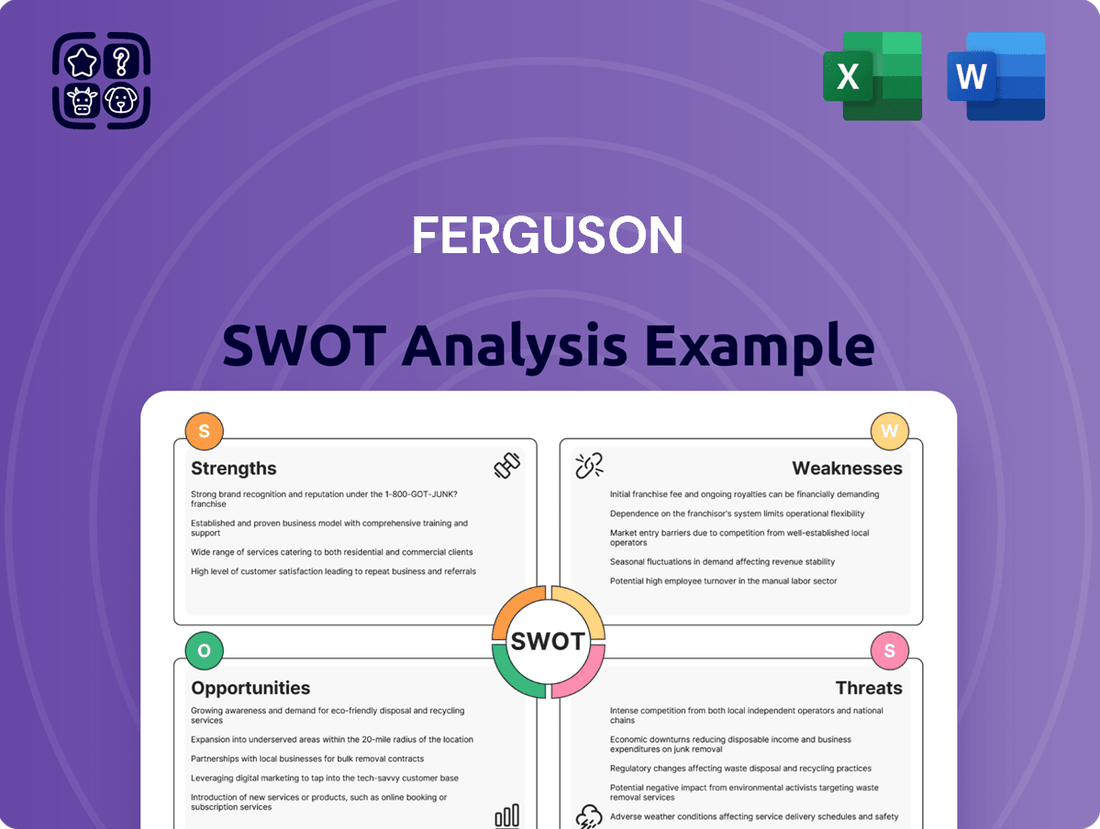

While a glance at Ferguson's SWOT reveals key strengths like its extensive product range and established brand, and highlights potential threats from market competition, the full analysis unlocks the deeper strategic context. Discover the critical opportunities for expansion and the specific weaknesses that require immediate attention to truly understand Ferguson's market position and future trajectory.

Ready to move beyond the highlights and gain a comprehensive understanding of Ferguson's strategic landscape? Purchase the full SWOT analysis to access detailed insights into their competitive advantages, potential risks, and actionable growth strategies, empowering you to make informed decisions.

Strengths

Ferguson's dominant market position in North America is a cornerstone of its strength, solidifying its role as the largest value-added distributor within the construction sector. This extensive reach spans both residential and non-residential building segments, underscoring its broad influence and operational scale in a vast and often fragmented industry.

Ferguson's comprehensive product and service offering is a significant strength. They provide a vast array of materials, including plumbing, HVAC, waterworks, and fire and fabrication supplies. This extensive portfolio allows them to cater to a wide spectrum of customer needs throughout the entire construction process, from initial builds to ongoing maintenance and renovation.

Ferguson's strength lies in its robust acquisition strategy, consistently integrating bolt-on acquisitions that bolster organic growth and extend its reach. This approach has proven effective in broadening its market presence and enhancing its service offerings.

In fiscal year 2024, Ferguson successfully completed ten acquisitions, a testament to its disciplined M&A execution. This momentum has carried into fiscal year 2025, with ongoing acquisitions further solidifying its leadership in key markets and expanding its operational capabilities.

Resilient Financial Performance and Capital Allocation

Ferguson has shown remarkable financial resilience, even when markets have been a bit unpredictable. They've managed to generate strong cash, and their balance sheet is in good shape, with their net debt being low compared to their adjusted EBITDA. For instance, in the first half of fiscal year 2024, Ferguson reported adjusted EBITDA of £1,207 million, with net debt to adjusted EBITDA at a healthy 0.9x.

This financial stability is a real advantage. It means Ferguson can keep investing in new growth areas, which is crucial for staying ahead. They're also able to return value to shareholders through dividends and by buying back their own stock, which signals confidence in their future prospects.

- Strong Cash Generation: Ferguson consistently produces robust cash flows, enabling reinvestment and shareholder returns.

- Healthy Balance Sheet: Low net debt to adjusted EBITDA ratios, such as 0.9x in H1 FY24, underscore financial strength.

- Strategic Capital Allocation: Financial capacity supports investments in growth, dividends, and share repurchases.

Commitment to Sustainability and Innovation

Ferguson demonstrates a strong commitment to sustainability, actively pursuing initiatives to lessen its environmental footprint and support customers in their own green objectives through novel products and services. The company has already surpassed its target for reducing Scope 1 and 2 greenhouse gas (GHG) emissions intensity, achieving this ahead of schedule.

This dedication to environmental responsibility has garnered recognition for Ferguson's sustainable solutions. For instance, in fiscal year 2023, the company reported a 14% reduction in Scope 1 and 2 GHG emissions intensity compared to its 2020 baseline, exceeding its 12% reduction target.

- Ahead of Schedule GHG Reduction: Ferguson achieved its Scope 1 and 2 GHG emissions reduction intensity target ahead of its planned timeline.

- Customer Sustainability Support: The company actively helps customers meet their sustainability goals with innovative products and solutions.

- Fiscal Year 2023 Performance: Reported a 14% reduction in Scope 1 and 2 GHG emissions intensity against a 2020 baseline, surpassing the 12% target.

- Recognition for Sustainability: Ferguson has received accolades for its commitment and advancements in sustainable practices and offerings.

Ferguson's market leadership in North America, as the largest value-added distributor in the construction sector, is a significant strength. Their broad reach across residential and non-residential segments highlights their extensive operational scale and influence in a diverse industry.

The company's comprehensive product and service portfolio, encompassing plumbing, HVAC, waterworks, and fire and fabrication supplies, allows them to meet a wide array of customer needs throughout the construction lifecycle. This extensive offering positions Ferguson as a one-stop solution provider for many clients.

Ferguson's disciplined acquisition strategy, focused on bolt-on acquisitions, consistently enhances organic growth and market penetration. This approach has led to the successful integration of ten acquisitions in fiscal year 2024, with continued momentum in fiscal year 2025, further solidifying their market position.

Financially, Ferguson demonstrates remarkable resilience. In the first half of fiscal year 2024, they reported adjusted EBITDA of £1,207 million, with a healthy net debt to adjusted EBITDA ratio of 0.9x. This financial strength enables strategic capital allocation for growth investments, dividends, and share repurchases.

Ferguson's commitment to sustainability is a key strength, evidenced by exceeding its Scope 1 and 2 greenhouse gas emissions intensity reduction target ahead of schedule. In fiscal year 2023, they achieved a 14% reduction against a 2020 baseline, surpassing their 12% goal, and actively supports customer sustainability objectives.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Market Position | Largest Value-Added Distributor in North America | Dominant presence in residential and non-residential construction sectors. |

| Product & Service Offering | Comprehensive Portfolio | Supplies plumbing, HVAC, waterworks, fire, and fabrication materials. |

| Growth Strategy | Disciplined Acquisition Approach | Completed 10 acquisitions in FY24, continuing momentum in FY25. |

| Financial Health | Strong Cash Generation & Low Debt | H1 FY24 Adjusted EBITDA: £1,207m; Net Debt/Adjusted EBITDA: 0.9x. |

| Sustainability | Exceeded GHG Reduction Targets | 14% reduction in Scope 1 & 2 GHG emissions intensity (FY23 vs. FY20 baseline), surpassing 12% target. |

What is included in the product

Analyzes Ferguson’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing organizational weaknesses and external threats.

Weaknesses

Ferguson's significant reliance on the North American construction sector, despite its diversification, exposes it to considerable market volatility. A slowdown in residential repair and remodeling, a key segment, continued into 2024, impacting sales. While projections suggest a modest recovery, the inherent cyclicality of construction means that fluctuations in demand can directly affect Ferguson's financial performance.

Ferguson, like many in the construction sector, grapples with volatile material costs. While some anticipate stabilization by 2025, the lingering effects of past price surges and the potential for new tariffs could continue to squeeze profit margins and complicate inventory management.

Ferguson faces challenges from ongoing labor shortages in the U.S. construction sector. As of early 2024, the industry consistently reports hundreds of thousands of job openings, indicating a substantial talent deficit. This scarcity of skilled workers can impede project timelines and elevate labor costs for builders, potentially dampening demand for Ferguson's extensive product lines.

Integration Risks from Acquisitions

Ferguson's reliance on acquisitions for growth introduces significant integration risks. Merging diverse operations, IT systems, and corporate cultures can be complex and resource-intensive, potentially hindering the expected synergies. For example, during fiscal year 2024, Ferguson completed several acquisitions, and the success of these integrations will be critical to realizing their projected financial benefits.

The challenges in smoothly combining acquired businesses can lead to operational disruptions and a dilution of management focus. Without meticulous planning and execution, the potential for culture clashes and system incompatibilities remains high. This can impact employee morale and customer service, ultimately affecting profitability.

- Operational Disruption: Inefficient integration can lead to supply chain hiccups and service quality issues.

- Cultural Misalignment: Merging distinct company cultures requires deliberate effort to avoid internal friction.

- IT System Integration: The technical complexity of merging disparate IT platforms can be a major hurdle.

- Synergy Realization: Failure to integrate effectively can prevent Ferguson from achieving the cost savings and revenue enhancements anticipated from acquisitions.

Dependence on North American Market

Ferguson's heavy reliance on the North American market presents a significant vulnerability. This concentration means the company is particularly susceptible to economic downturns or unfavorable regulatory changes within the United States and Canada. For instance, a slowdown in construction or housing starts, which are key drivers in North America, directly impacts Ferguson's revenue streams. In fiscal year 2023, North America accounted for nearly all of Ferguson's revenue, highlighting this concentrated risk.

This lack of geographic diversification limits Ferguson's ability to offset regional economic challenges with performance from other global markets. Should the North American economy face a prolonged recession, Ferguson lacks the buffer that a more globally distributed business might possess. This dependence could lead to more volatile financial results compared to competitors with a broader international footprint.

- Geographic Concentration: Ferguson's operations are almost exclusively within North America.

- Economic Sensitivity: Highly dependent on the economic health and regulatory environment of the US and Canada.

- Vulnerability to Downturns: A prolonged recession in North America could severely impact sales and profitability.

- Limited Diversification Benefits: Lacks the ability to balance regional economic fluctuations with international market performance.

Ferguson's significant reliance on the North American construction sector, despite its diversification, exposes it to considerable market volatility. A slowdown in residential repair and remodeling, a key segment, continued into 2024, impacting sales. While projections suggest a modest recovery, the inherent cyclicality of construction means that fluctuations in demand can directly affect Ferguson's financial performance.

Ferguson, like many in the construction sector, grapples with volatile material costs. While some anticipate stabilization by 2025, the lingering effects of past price surges and the potential for new tariffs could continue to squeeze profit margins and complicate inventory management.

Ferguson faces challenges from ongoing labor shortages in the U.S. construction sector. As of early 2024, the industry consistently reports hundreds of thousands of job openings, indicating a substantial talent deficit. This scarcity of skilled workers can impede project timelines and elevate labor costs for builders, potentially dampening demand for Ferguson's extensive product lines.

Ferguson's reliance on acquisitions for growth introduces significant integration risks. Merging diverse operations, IT systems, and corporate cultures can be complex and resource-intensive, potentially hindering the expected synergies. For example, during fiscal year 2024, Ferguson completed several acquisitions, and the success of these integrations will be critical to realizing their projected financial benefits.

Preview the Actual Deliverable

Ferguson SWOT Analysis

This is the actual Ferguson SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Ferguson's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, detailing all aspects of Ferguson's strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

The Repair, Maintenance, and Improvement (RMI) market presents a significant opportunity for Ferguson. This sector is bolstered by enduring trends like the aging U.S. housing stock, which requires ongoing upkeep. For instance, the average age of U.S. homes has been steadily increasing, with many built before 1980, creating a consistent need for repairs and upgrades.

Favorable demographics, including a growing population and shifting household compositions, also fuel RMI demand. Furthermore, the increasing consumer interest in smart home technology and energy-efficient upgrades adds another layer of growth potential. Ferguson's established presence in this RMI segment positions it well to capitalize on these expanding market dynamics.

Government initiatives, such as the Infrastructure Investment and Jobs Act (IIJA) in the United States, are poised to inject substantial capital into infrastructure development. This translates to a significant opportunity for Ferguson, particularly in supplying materials for large-scale construction and renovation projects. The IIJA, with its multi-year funding commitments, is expected to boost demand across various sectors, including water, wastewater, and renewable energy infrastructure.

Consumer preferences are definitely shifting, and regulations are getting tougher, pushing the demand for HVAC systems that use less energy and construction materials that are better for the environment. Ferguson's commitment to offering these types of products puts them in a great spot to capitalize on this expanding market. For instance, in 2024, the global market for green building materials was projected to reach over $250 billion, showing a clear trend towards sustainability.

Technological Adoption and Digital Transformation

Ferguson has a significant opportunity to capitalize on the accelerating technological adoption within the construction and distribution sectors. The integration of artificial intelligence (AI), the Internet of Things (IoT), and cloud-based platforms is revolutionizing how businesses operate, from streamlining supply chains to enhancing customer interactions. For instance, in 2024, the global construction technology market was projected to reach over $10 billion, indicating a strong trend towards digital solutions.

By embracing these digital tools, Ferguson can unlock substantial operational efficiencies and improve its service delivery. This includes leveraging AI for predictive analytics in inventory management, utilizing IoT devices for real-time tracking of materials and equipment, and employing cloud solutions for seamless data sharing and collaboration across its network. These advancements are crucial for maintaining a competitive edge in an increasingly digitized marketplace.

- AI-powered demand forecasting to optimize inventory levels and reduce carrying costs.

- IoT integration for asset tracking, improving logistics and reducing loss.

- Cloud-based collaboration platforms to enhance communication with suppliers and customers.

- Digital customer portals offering personalized experiences and self-service options.

Consolidation in Fragmented Markets

The North American HVAC/R distribution sector is still quite fragmented, with many smaller, independent players. Ferguson's established strategy of acquiring these businesses presents a significant opportunity to consolidate these markets. This approach allows Ferguson to quickly expand its reach into new geographic areas, onboard new brands and suppliers, and attract a broader customer base.

Ferguson's acquisition strategy is a key driver for growth in a fragmented market. For instance, in 2023, the company completed several strategic acquisitions, adding to its already extensive network. This ongoing consolidation allows Ferguson to leverage economies of scale, improve operational efficiencies, and enhance its competitive position against larger, more integrated rivals.

- Market Consolidation: Ferguson can continue to acquire smaller, independent HVAC/R distributors, increasing its market share.

- Brand and Supplier Access: Acquisitions provide entry into new product lines and strengthen relationships with key manufacturers.

- Geographic Expansion: Consolidating fragmented markets allows Ferguson to establish a stronger presence in underserved regions.

- Customer Acquisition: Buying out competitors brings their customer lists and loyalty directly to Ferguson.

Ferguson can capitalize on the growing demand for sustainable building materials and energy-efficient HVAC systems, driven by consumer preferences and stricter regulations. The global green building materials market was projected to exceed $250 billion in 2024, highlighting a significant trend towards environmentally conscious construction.

Threats

Persistent high interest rates, like those seen throughout 2024, can significantly dampen construction activity. This directly impacts demand for Ferguson's extensive product lines, especially in interest-rate sensitive sectors such as residential new builds and commercial development.

A broad economic slowdown, a risk heightened by global geopolitical tensions and inflation concerns in 2024, further exacerbates these pressures. Reduced consumer confidence and tighter business investment budgets can lead to fewer large-scale projects and a general pullback in spending across the construction industry, affecting Ferguson's revenue streams.

Ferguson operates in a North American distribution market for plumbing, HVAC, and related products that is highly competitive. This crowded landscape means many companies are vying for the same customers, which can make it tough to stand out. In 2023, for instance, the market saw significant consolidation and aggressive pricing strategies from both large national players and smaller regional distributors.

This intense competition directly translates into pressure on pricing and profit margins for Ferguson. When many suppliers offer similar products, buyers have more leverage to negotiate lower prices, impacting overall profitability. The ongoing economic climate in 2024 is expected to further intensify this pressure as businesses look to cut costs.

Ongoing global events and geopolitical instability, such as the continued impacts of the Russia-Ukraine conflict and potential trade tensions, pose a significant threat. These factors can trigger unforeseen supply chain disruptions, leading to material shortages and increased operational costs for Ferguson.

For instance, the global shipping industry has faced significant volatility, with freight rates fluctuating. In late 2024, while some rates may have stabilized from earlier peaks, the underlying geopolitical risks mean that sudden surges or disruptions remain a possibility, directly impacting Ferguson's ability to source and deliver products efficiently.

Regulatory Changes and Environmental Compliance Costs

New environmental regulations, like the EPA's planned phase-out of certain refrigerants by 2025, could affect the availability and cost of HVAC products for Ferguson. These changes necessitate investment in compliant alternatives, potentially impacting profit margins.

Furthermore, growing pressure for sustainable supply chains and ethical sourcing practices may increase operational expenses. For example, enhanced traceability requirements or investments in lower-emission logistics could add to compliance costs, affecting Ferguson's bottom line.

- Regulatory Impact: EPA refrigerant phase-outs by 2025 could alter product mix and pricing in HVAC.

- Supply Chain Costs: Increased demands for greener supply chains may raise operational expenses for Ferguson.

- Compliance Burden: Adhering to new environmental standards could lead to higher overall compliance costs.

Technological Disruption from New Entrants

Ferguson faces a significant threat from technological disruption, particularly from agile new entrants or existing competitors who are quicker to adopt advanced technologies. These disruptors can rapidly reshape traditional distribution models and customer expectations, potentially leaving established players like Ferguson behind.

For instance, the rise of direct-to-consumer (DTC) platforms and sophisticated e-commerce solutions, often leveraged by smaller, tech-native businesses, presents a challenge to Ferguson's established wholesale and branch-based model. These new players can offer greater convenience and potentially lower prices by bypassing traditional intermediaries.

- E-commerce Acceleration: The global B2B e-commerce market is projected to reach $35.3 trillion by 2027, indicating a significant shift in how businesses procure goods, a trend that could bypass traditional distribution channels.

- Digitalization of Services: Competitors are investing heavily in digital tools for customer service, project management, and supply chain visibility, setting new benchmarks for customer experience that Ferguson must match.

- AI and Automation: The adoption of artificial intelligence in areas like inventory management, predictive analytics, and customer support by new entrants could offer significant operational efficiencies and competitive advantages.

Ferguson operates in a highly competitive North American market, facing pressure from both large national distributors and smaller regional players. This intense competition, evident in 2023 with aggressive pricing strategies and market consolidation, directly impacts Ferguson's pricing power and profit margins, a trend expected to continue into 2024 due to the economic climate.

Economic headwinds, including persistent high interest rates seen in 2024 and the risk of a broader slowdown due to geopolitical tensions, threaten demand for Ferguson's products. Reduced consumer confidence and business investment can lead to fewer large projects, impacting revenue across key sectors like residential and commercial construction.

Supply chain vulnerabilities persist due to global instability, with potential for material shortages and increased costs. Fluctuations in global shipping rates, a concern throughout 2024, highlight the risk of disruptions impacting Ferguson's sourcing and delivery efficiency.

New environmental regulations, such as the EPA's refrigerant phase-outs by 2025, and increasing demands for sustainable supply chains could increase operational and compliance costs for Ferguson, potentially affecting profit margins.

SWOT Analysis Data Sources

This Ferguson SWOT analysis is built on a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations, ensuring a robust and accurate strategic assessment.