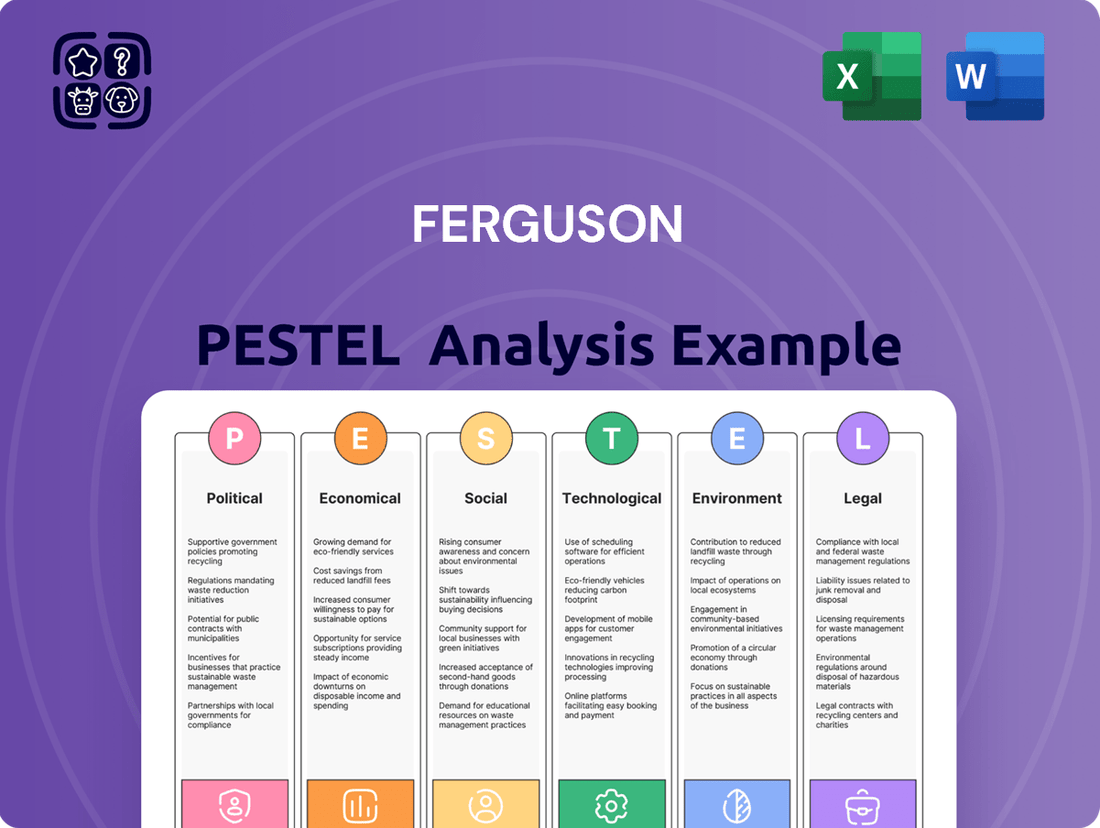

Ferguson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferguson Bundle

Navigate the complex external forces shaping Ferguson's industry with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting their operations. Gain a strategic advantage by leveraging these critical insights to inform your own business decisions. Download the full report now for actionable intelligence.

Political factors

Government investment in infrastructure projects directly impacts demand for Ferguson's extensive product lines, which include pipes, valves, and fittings crucial for water systems, as well as materials for road and building construction. The Bipartisan Infrastructure Investment and Jobs Act (IIJA) is a significant driver, allocating substantial federal funds through 2026. For 2024 and 2025 specifically, billions of dollars are still slated for distribution across various infrastructure initiatives, providing a robust tailwind for the construction sector and, by extension, Ferguson's sales.

Changes in trade policies and tariffs significantly influence the cost of building materials. For instance, proposed tariffs on steel and aluminum imports could directly increase prices for construction inputs, impacting Ferguson's procurement costs.

The U.S. International Trade Commission reported that tariffs on imported steel and aluminum, implemented in 2018, led to price increases for domestic producers and downstream industries, including construction. This trend highlights the potential for similar impacts on Ferguson's material expenses in 2024 and 2025.

Specifically, tariffs on goods from key suppliers like China and Mexico can disrupt supply chains and elevate the cost of various components Ferguson relies on, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Evolving building codes and environmental regulations significantly influence the construction and renovation sectors, directly impacting product demand for distributors like Ferguson. These mandates often specify materials and technologies that prioritize sustainability and energy conservation.

Stricter energy efficiency standards are a prime example; for instance, new HVAC efficiency ratings like SEER2, EER2, and HSPF2 are being implemented or tightened across 2024 and 2025. This necessitates that manufacturers and, consequently, Ferguson, ensure their product lines comply with these updated benchmarks, potentially phasing out older, less efficient models.

Political Stability and Elections

Political stability in North America, especially in the United States, is a crucial element for economic certainty and investment within the construction industry. Fluctuations in stability can directly impact investor confidence and the willingness to commit capital to large-scale projects. For instance, the US construction sector experienced significant growth, with the value of construction put in place reaching an estimated $1.98 trillion in 2023, a figure highly sensitive to the political climate.

Upcoming elections and the potential for shifts in government policies introduce an element of uncertainty that can affect long-term business planning. This uncertainty can manifest in questions surrounding future infrastructure spending, modifications to tax laws, and evolving trade relations. For example, debates around infrastructure investment, such as the Bipartisan Infrastructure Law passed in 2021, highlight how political decisions can directly channel billions into the construction sector, creating both opportunities and potential disruptions if policies change.

- US Construction Spending: Estimated at $1.98 trillion in 2023, demonstrating the sector's scale and sensitivity to economic and political factors.

- Infrastructure Investment: Policies like the Bipartisan Infrastructure Law represent significant government spending that directly impacts construction demand.

- Policy Uncertainty: Potential changes in tax laws and trade agreements can create forecasting challenges for construction firms and their investors.

Tax Policy Changes

Tax policy shifts directly impact Ferguson's customer base, particularly construction contractors. Changes to corporate tax rates, depreciation schedules, and deductions for pass-through entities can alter their profitability and capacity for investment. For instance, if corporate tax rates were to decrease, construction firms might have more capital available for equipment purchases, a key revenue stream for Ferguson.

Looking ahead to 2025, potential adjustments to tax incentives are noteworthy. The possibility of reinstating 100% bonus depreciation, for example, could significantly boost the attractiveness of capital expenditures for construction companies. This would allow them to write off the full cost of qualifying new equipment in the year it's placed in service, potentially driving demand for Ferguson's product offerings.

Furthermore, modifications to the Qualified Business Income (QBI) deduction could influence how construction businesses are structured and how they reinvest profits. A more favorable QBI deduction might encourage greater investment in growth, which often translates to increased spending on materials and services that Ferguson provides.

Here are some key considerations regarding tax policy for Ferguson's customers:

- Impact on Capital Investment: Changes in depreciation rules, like the potential return of 100% bonus depreciation in 2025, directly affect a contractor's decision to purchase new machinery.

- Profitability of Pass-Through Entities: Adjustments to deductions such as the QBI deduction can alter the net income available for reinvestment by many small to medium-sized construction businesses.

- Corporate Tax Rate Fluctuations: A lower corporate tax rate generally increases a company's after-tax profit, potentially freeing up funds for operational expansion and equipment upgrades.

- Tax Incentives for Specific Industries: Government focus on infrastructure or green building could lead to targeted tax credits that benefit construction companies and their suppliers like Ferguson.

Government investment in infrastructure, driven by initiatives like the Bipartisan Infrastructure Law, is a significant positive for Ferguson, injecting billions into projects through 2026. This directly fuels demand for Ferguson's core products used in water systems and construction. Evolving building codes and stricter environmental regulations, such as updated HVAC efficiency standards for 2024-2025, necessitate compliance and can drive sales of newer, compliant products.

Political stability is paramount for investor confidence in the construction sector, which saw an estimated $1.98 trillion in spending in 2023. Policy shifts, particularly around infrastructure spending and trade, introduce uncertainty that can impact long-term planning and capital commitment. Tax policies, including potential changes to bonus depreciation and QBI deductions in 2025, directly influence the financial capacity of Ferguson's construction contractor customers to invest in new equipment and materials.

| Political Factor | Impact on Ferguson | Data Point/Trend (2024-2025 Focus) |

|---|---|---|

| Infrastructure Spending | Increased demand for pipes, valves, fittings, construction materials | Bipartisan Infrastructure Law allocating billions through 2026 |

| Environmental Regulations | Demand for compliant, energy-efficient products | Stricter HVAC efficiency standards (SEER2, EER2, HSPF2) being implemented |

| Tax Policy (Depreciation) | Potential boost to capital expenditures by customers | Possibility of 100% bonus depreciation reinstatement in 2025 |

| Trade Policy | Impact on material costs and supply chain stability | Potential tariffs on steel, aluminum, and goods from key suppliers |

What is included in the product

The Ferguson PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Offers a structured framework to identify and address external threats and opportunities, simplifying complex market dynamics for strategic decision-making.

Economic factors

The North American economy's vitality is a key driver for the construction sector, directly influencing demand for Ferguson's extensive product lines. While the broader US economy anticipates a more measured pace of growth in 2025, the construction industry is poised for a moderate expansion.

This growth is particularly anticipated in specific infrastructure areas. Segments like water, wastewater, and power infrastructure are expected to see increased activity, suggesting a positive outlook for Ferguson's role in these essential projects.

Ferguson's sales are closely tied to the residential construction sector, encompassing both new home builds and renovation projects. This market is a key indicator for demand of their plumbing and HVAC offerings.

While affordability concerns and increasing mortgage rates present hurdles, the demand for new housing remains robust, largely due to a scarcity of existing homes on the market. Projections for 2025 indicate a more moderate but steady growth in single-family residential construction and home improvement segments.

For instance, the U.S. Census Bureau reported that in April 2024, housing starts for single-family homes saw a notable increase, suggesting continued activity. This trend is expected to continue, albeit at a more measured pace through 2025, benefiting companies like Ferguson.

Elevated interest rates and restricted access to credit significantly increase the cost of borrowing for construction ventures, potentially dampening investment and development activity. For instance, while the Federal Reserve has adjusted its policy rates, longer-term mortgage rates have seen an uptick, presenting considerable hurdles for the housing market and broader construction output.

Inflation and Material Costs

Inflationary pressures significantly impact Ferguson's operating environment by increasing the cost of construction materials, labor, and equipment. This directly affects project budgets and the profitability of contractors who are Ferguson's primary customers. While there has been some softening in certain material prices, key commodities crucial for construction, such as steel, electrical components, copper, aluminum, and nickel, are expected to remain elevated and volatile through 2024 and into 2025. This volatility is driven by persistent supply chain disruptions and ongoing global trade conflicts.

The elevated costs of essential materials present a direct challenge to Ferguson's business model. For instance, the Producer Price Index for construction materials saw a notable increase in recent periods, directly impacting the cost base for many of the products Ferguson distributes. This necessitates careful inventory management and pricing strategies to mitigate the impact on contractor margins and, consequently, demand for Ferguson's offerings.

- Steel prices, a key input for many construction projects, have experienced significant fluctuations, with some benchmarks remaining substantially higher than pre-pandemic levels.

- Copper and aluminum prices, vital for electrical and structural components, have also seen upward pressure due to strong demand and supply constraints.

- Electrical component costs, particularly for semiconductors and specialized wiring, continue to be affected by global shortages, impacting lead times and overall project expenses.

- Nickel prices, essential for certain alloys and stainless steel, are subject to geopolitical risks that can trigger price spikes.

Supply Chain Disruptions

Ongoing global supply chain disruptions, marked by transport delays and raw material shortages, continue to impact businesses like Ferguson. These issues directly translate to higher material costs and potential project delays for customers. For instance, in late 2024 and early 2025, several key manufacturing regions experienced production slowdowns due to labor availability and shipping container imbalances, pushing up the cost of plumbing fixtures and building materials.

Ferguson, as a major distributor, must actively manage these complexities to maintain product availability and control costs. This involves diversifying sourcing, optimizing logistics, and potentially holding higher inventory levels, all of which have financial implications. The company’s ability to absorb or pass on these increased costs will be a critical factor in its profitability and customer satisfaction through 2025.

- Increased Material Costs: Reports from early 2025 indicated an average 8-12% increase in the cost of key construction materials like copper and PVC compared to the previous year, largely attributed to supply chain pressures.

- Transport Delays: Shipping times from major Asian manufacturing hubs to North America in Q4 2024 and Q1 2025 were, on average, 15-20% longer than pre-pandemic levels, affecting lead times for many products.

- Inventory Management Challenges: Maintaining adequate stock levels became more costly, with warehousing and holding costs rising alongside the value of goods due to inflation and scarcity.

- Impact on Project Timelines: Construction projects relying on timely delivery of plumbing and HVAC components faced an increased risk of delays, potentially impacting revenue recognition for builders and contractors.

The North American economy's performance directly impacts Ferguson's sales, with a projected moderate growth for the construction sector in 2025, particularly in infrastructure like water and power. While elevated interest rates and inflation present challenges by increasing borrowing and material costs, robust demand in residential construction, driven by housing scarcity, offers a positive outlook.

Key material costs, such as steel and copper, are expected to remain elevated and volatile through 2025 due to ongoing supply chain issues and global trade dynamics. This necessitates strategic inventory and pricing management for Ferguson to navigate cost pressures and maintain customer relationships.

Supply chain disruptions continue to affect lead times and increase costs for construction materials, with shipping delays from Asia averaging 15-20% longer in late 2024 and early 2025 compared to pre-pandemic levels. These factors collectively influence project timelines and the overall cost of construction.

| Economic Factor | 2024/2025 Projection | Impact on Ferguson |

|---|---|---|

| Construction Sector Growth | Moderate expansion | Increased demand for products |

| Interest Rates | Elevated, impacting borrowing costs | Potential dampening of investment |

| Inflationary Pressures | Persistent on key materials | Higher operating costs, pressure on contractor margins |

| Supply Chain Disruptions | Ongoing, leading to delays and shortages | Increased material costs, inventory challenges |

Full Version Awaits

Ferguson PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ferguson PESTLE Analysis provides a detailed examination of the political, economic, social, technological, legal, and environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It delves into each element of the PESTLE framework, offering insights into the external forces that shape Ferguson's strategic landscape and operational decisions.

Sociological factors

North America's population is projected to reach over 370 million by 2025, with a significant portion continuing to migrate towards urban centers. This trend fuels a robust demand for construction services, directly benefiting companies like Ferguson. Urban growth necessitates new housing, retail spaces, and essential infrastructure, creating a consistent market for building materials and services.

A significant shortage of skilled tradespeople, particularly in construction, continues to be a major hurdle across North America. This persistent issue directly affects project timelines and drives up labor expenses, which in turn can dampen demand for building materials and products that Ferguson supplies.

For instance, a 2024 report indicated that over 70% of construction firms were experiencing moderate to substantial difficulties in finding qualified workers, a trend that has been escalating since 2022. This talent gap limits the number of projects that can be undertaken and completed efficiently, impacting Ferguson's sales volumes.

Consumers increasingly favor products that are environmentally conscious and energy-efficient, a trend directly impacting the construction sector. This shift means that building materials and home features with sustainability in mind are becoming a significant driver of purchasing decisions for both homeowners and businesses.

Ferguson can leverage this by expanding its portfolio of eco-friendly plumbing and HVAC solutions. For instance, in 2024, the market for green building materials in the US was valued at over $190 billion, with steady growth projected, indicating a strong demand for products that reduce environmental impact and lower utility costs.

Home Renovation and Improvement Trends

Sociological factors significantly influence the home renovation and improvement market, directly impacting demand for companies like Ferguson. An aging housing stock, particularly in developed nations, necessitates upgrades to meet modern living standards and energy efficiency requirements. For instance, in the US, the median age of housing units was 40 years in 2022, driving demand for replacements and renovations.

A growing desire for enhanced comfort, convenience, and sustainability also fuels renovation trends. Homeowners are increasingly investing in smart home technologies, integrating them into HVAC, plumbing, and electrical systems. This shift is evident in the projected growth of the smart home market, which was valued at over $100 billion in 2023 and is expected to reach over $200 billion by 2028, showcasing a strong societal embrace of connected living.

- Aging Housing Stock: In 2022, the median age of US housing units reached 40 years, increasing the need for renovations and upgrades.

- Desire for Modern Amenities: Consumers are prioritizing updated features and technologies for comfort and efficiency.

- Smart Home Integration: The smart home market's rapid expansion, projected to double by 2028, highlights a key trend in home improvement.

- Sustainability Focus: Growing environmental awareness encourages homeowners to invest in energy-efficient and eco-friendly renovation solutions.

Health and Safety Culture in Construction

The construction industry's growing emphasis on health and safety significantly shapes how companies operate and what products they need. This heightened awareness means a demand for safer materials and equipment, influencing Ferguson's product offerings and supply chain.

Ferguson actively cultivates a robust safety culture. For instance, in 2023, the company reported a Total Recordable Incident Rate (TRIR) of 0.95, well below the industry average, demonstrating a commitment to minimizing workplace accidents among its associates.

This focus translates into specific operational requirements and product considerations:

- Emphasis on PPE: Increased demand for personal protective equipment, such as high-visibility clothing and safety footwear, impacting inventory and sales.

- Product Safety Standards: A need for products that meet stringent safety certifications and regulations, influencing sourcing and quality control processes.

- Training and Compliance: Investment in associate training programs to ensure adherence to safety protocols, requiring resources and management oversight.

- Reduced Insurance Costs: A strong safety record can lead to lower insurance premiums, contributing to overall operational efficiency and profitability.

Sociological factors are reshaping consumer preferences and driving demand for specific home improvement trends that directly benefit Ferguson. The increasing desire for enhanced comfort and convenience is fueling the adoption of smart home technologies, with the market projected to grow significantly by 2028. Furthermore, a heightened focus on sustainability is pushing consumers towards energy-efficient and environmentally friendly building materials, creating opportunities for Ferguson to expand its eco-friendly product lines.

Technological factors

The construction industry is increasingly embracing digitalization, with distributors like Ferguson benefiting from enhanced efficiency. Technologies such as cloud-based platforms and mobile applications are streamlining everything from order placement to inventory tracking.

In 2024, the global construction technology market was valued at approximately $10.5 billion and is projected to grow significantly, indicating a strong trend towards digital adoption. Ferguson's investment in digital solutions, like their online customer portal, directly addresses this shift, aiming to improve customer experience and operational agility.

This digital transformation allows for better data management, faster communication, and more accurate forecasting within the supply chain. By leveraging these tools, Ferguson can reduce lead times, minimize stockouts, and ultimately offer a more responsive service to its diverse customer base.

The construction industry's increasing embrace of Building Information Modeling (BIM) is reshaping how projects are planned and executed. This digital transformation directly impacts the demand for integrated product solutions and precise digital specifications, pushing suppliers like Ferguson to adapt. For instance, by mid-2024, a significant percentage of major construction firms globally were mandating BIM for new projects, highlighting a clear market shift.

Ferguson's strategic advantage lies in its capacity to seamlessly integrate its product data and offer robust support for these evolving BIM workflows. Companies that can readily supply digital product information compatible with BIM software are better positioned to win bids and build stronger relationships with contractors and designers. This capability is becoming a critical differentiator in a market increasingly driven by digital efficiency and data accuracy.

The increasing adoption of smart home technology is significantly reshaping the HVAC and plumbing sectors, creating new opportunities for companies like Ferguson. This trend is directly fueling demand for integrated, connected products within residential construction projects.

Smart thermostats, advanced leak detection systems, and sophisticated water management solutions are becoming standard features, offering homeowners greater control over their environment, improved energy efficiency, and enhanced security. For instance, the global smart home market was valued at approximately $84.5 billion in 2023 and is projected to reach over $200 billion by 2028, indicating robust growth in connected home devices.

Advanced Manufacturing and Automation in Distribution

Technological advancements in manufacturing and automation are significantly reshaping the distribution landscape for companies like Ferguson. These innovations offer the potential to streamline operations, boost throughput, and ultimately lower costs associated with warehousing and logistics. For instance, the adoption of robotics in sorting and picking processes can dramatically increase efficiency.

Ferguson's strategic investment in technology programs and the optimization of its distribution centers are paramount to capitalizing on these trends. By embracing automation, Ferguson can expect to see tangible improvements in its operational performance. Consider that the global warehouse automation market was projected to reach $30 billion by 2026, indicating a strong industry-wide shift.

- Robotic Process Automation (RPA): Automating repetitive administrative tasks within distribution centers.

- Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs): Enhancing material handling and internal transport.

- Warehouse Management Systems (WMS): Improving inventory accuracy and order fulfillment speed.

- AI-powered forecasting: Optimizing stock levels and reducing carrying costs.

Data Analytics and Predictive Maintenance

Ferguson can leverage data analytics to gain deeper insights into evolving market trends and refine its understanding of customer needs. This allows for more targeted product development and marketing strategies. For instance, analyzing sales data alongside economic indicators can help predict demand shifts in specific regions or product categories.

The development of predictive maintenance capabilities for HVAC and plumbing systems presents a significant new service avenue. Smart devices that can forecast potential issues and proactively schedule maintenance are becoming increasingly prevalent. This trend is driven by a growing demand for efficiency and reduced downtime in both residential and commercial settings.

- Market Trend Analysis: Data analytics tools are crucial for identifying emerging patterns in construction and renovation, allowing Ferguson to anticipate demand for specific materials and systems.

- Customer Insights: By analyzing purchasing behavior and service requests, Ferguson can better tailor its offerings and improve customer satisfaction.

- Predictive Maintenance Growth: The global predictive maintenance market was valued at approximately $6.9 billion in 2023 and is projected to reach $28.1 billion by 2030, indicating a strong growth trajectory for related services.

- Smart Device Integration: The increasing adoption of IoT devices in buildings creates opportunities for Ferguson to offer integrated solutions that monitor system health and enable remote diagnostics.

Technological advancements are fundamentally reshaping the construction supply chain, driving efficiency and customer engagement for distributors like Ferguson. The increasing integration of digital tools, from cloud platforms to mobile apps, streamlines operations such as order processing and inventory management. Ferguson's commitment to digital solutions, exemplified by its online customer portal, positions it to capitalize on this trend, enhancing both user experience and operational agility.

The construction sector's growing adoption of Building Information Modeling (BIM) necessitates suppliers to provide precise digital product specifications, impacting demand for integrated solutions. By mid-2024, a significant portion of major global construction firms mandated BIM for new projects, underscoring this market shift. Ferguson's ability to seamlessly integrate its product data and support BIM workflows is a key differentiator, enabling it to meet the evolving digital demands of contractors and designers.

The rise of smart home technology is creating new opportunities within the HVAC and plumbing sectors, driving demand for connected products. The global smart home market, valued at approximately $84.5 billion in 2023, is projected to exceed $200 billion by 2028, highlighting the rapid growth in integrated home systems. Ferguson is well-positioned to supply these increasingly sophisticated, connected components.

Automation in manufacturing and logistics is a significant trend, with companies like Ferguson benefiting from enhanced operational efficiency and cost reductions. The global warehouse automation market, projected to reach $30 billion by 2026, illustrates this industry-wide investment. Technologies such as Robotic Process Automation (RPA) and Automated Guided Vehicles (AGVs) are key to optimizing warehouse operations.

Legal factors

Ferguson faces significant operational shifts due to stringent environmental regulations. For instance, the U.S. Environmental Protection Agency's (EPA) phasedown of hydrofluorocarbons (HFCs) under the AIM Act directly affects the refrigerants used in HVAC systems, a core product category for Ferguson. This necessitates a transition to lower global warming potential (GWP) alternatives, impacting product development and inventory management.

Furthermore, updated energy efficiency standards for HVAC equipment, such as higher Seasonal Energy Efficiency Ratio (SEER) and Heating Seasonal Performance Factor (HSPF) requirements, are compelling manufacturers to innovate. Ferguson must ensure its product portfolio meets these evolving benchmarks, potentially influencing pricing and the availability of certain models. Compliance with these standards, which are continually being tightened, is crucial for market access and customer satisfaction.

Ferguson's operations are significantly shaped by building codes and safety standards across plumbing, HVAC, and fire protection. For instance, in 2024, ongoing updates to energy efficiency codes, such as those impacting HVAC systems, necessitate product innovation and compliance, directly affecting manufacturing and inventory.

Adherence to these evolving regulations, like the International Building Code (IBC) and specific state-level amendments, is paramount for ensuring product safety and performance. These standards influence Ferguson's product development pipeline and supply chain logistics, as non-compliant materials can lead to costly recalls or market exclusion.

Product liability laws are a significant legal factor for Ferguson, holding it accountable for the safety and performance of the products it distributes. This means Ferguson must diligently ensure that every item, from plumbing fixtures to electrical components, adheres to rigorous quality and safety regulations to avoid costly lawsuits and reputational damage. For instance, in 2023, product liability claims in the construction sector saw an increase, underscoring the importance of robust compliance.

Labor Laws and Workforce Regulations

Labor laws, covering everything from worker safety and minimum wages to hiring and firing practices, significantly influence Ferguson's operating expenses and how it manages its employees. Staying compliant is crucial for a steady workforce, avoiding costly penalties and legal battles. For instance, in 2024, the US Department of Labor continued to enforce regulations like the Fair Labor Standards Act (FLSA), which mandates overtime pay and sets minimum wage standards. These regulations directly affect payroll costs and the administrative burden of compliance.

Ferguson must navigate a complex web of regulations concerning workplace safety, such as those established by the Occupational Safety and Health Administration (OSHA). In 2024, OSHA continued its focus on industries with higher risks, and for Ferguson, which deals with construction materials and logistics, adherence to safety protocols is paramount. Non-compliance can lead to significant fines and disruptions. For example, OSHA fines can range from thousands to hundreds of thousands of dollars for serious or willful violations, impacting profitability.

- Worker Safety Compliance: Ferguson's adherence to OSHA standards in 2024 directly impacts its accident rates and associated insurance premiums.

- Wage and Hour Laws: Compliance with federal and state minimum wage and overtime laws, such as those under the FLSA, affects Ferguson's labor costs.

- Employment Practices: Regulations around hiring, discrimination, and termination are critical for maintaining a stable and legally sound workforce.

- Regulatory Fines: In 2023, OSHA issued over $1.7 billion in penalties, highlighting the financial risk of non-compliance for companies like Ferguson.

Trade and Import Regulations

Ferguson's operations are significantly influenced by trade and import regulations. Tariffs and customs procedures directly impact the cost of sourcing materials and finished goods, affecting Ferguson's supply chain efficiency and overall profitability. For instance, changes in import duties on plumbing fixtures or building materials can alter Ferguson's cost of goods sold.

Fluctuations in these regulations can lead to unpredictable cost increases and extended lead times. In 2024, global trade tensions and evolving customs frameworks in key markets could necessitate adjustments to Ferguson's sourcing strategies.

- Tariff Impact: A 10% tariff on imported construction materials could increase Ferguson's procurement costs by millions annually, depending on the volume sourced internationally.

- Customs Delays: Increased scrutiny at customs ports can add days or even weeks to delivery schedules, impacting project timelines for Ferguson's customers.

- Trade Agreements: The existence or absence of favorable trade agreements with countries where Ferguson sources products can significantly influence pricing and availability.

Ferguson's distribution model necessitates strict adherence to product safety and labeling regulations, such as those mandated by the Consumer Product Safety Commission (CPSC). Ensuring all distributed items, from electrical components to HVAC units, meet these standards is critical to avoid recalls and legal liabilities. In 2024, the CPSC continued to emphasize recalls for products with potential fire or electrical hazards, directly impacting Ferguson's product vetting processes.

Environmental factors

Climate change is increasingly driving extreme weather events, which directly affect Ferguson's operations. For instance, the U.S. experienced a record 28 separate billion-dollar weather and climate disasters in 2023, according to NOAA. This rise in severe weather, such as hurricanes and floods, can disrupt supply chains, delay construction projects, and increase demand for repair and rebuilding materials.

The heightened frequency of these events also fuels a growing market for climate-resilient products and adaptable building systems. Ferguson can capitalize on this trend by expanding its offerings in areas like advanced drainage solutions, weather-resistant materials, and energy-efficient systems designed to withstand more extreme conditions, aligning with a growing customer need for durability and sustainability.

Growing global concerns about water scarcity are intensifying, with many regions already facing significant shortages. This environmental pressure is leading to increasingly stringent water conservation regulations worldwide. For instance, by 2025, many U.S. states are expected to have updated building codes mandating higher water efficiency standards for new constructions and renovations.

Ferguson can capitalize on this trend by expanding its portfolio of water-saving plumbing fixtures and technologies. Offering products like low-flow toilets, faucets, and showerheads directly addresses customer needs driven by these regulations and a desire for sustainability. The company's commitment to providing innovative solutions can position it as a leader in a market increasingly prioritizing reduced water consumption.

The increasing global focus on energy efficiency is significantly reshaping the construction and renovation markets. By 2024, the global green building market was valued at approximately $2.5 trillion, with projections indicating continued robust growth. This trend directly impacts demand for HVAC systems and building materials that minimize energy consumption, favoring products that contribute to lower operational costs and environmental impact.

Ferguson's strategic alignment with these environmental factors is evident in its product offerings. The company actively promotes sustainable solutions designed to help customers meet their carbon reduction targets. For instance, advancements in high-efficiency HVAC units and the adoption of recycled or low-impact building materials are becoming standard, reflecting a market shift towards environmentally conscious construction practices.

Sustainable Sourcing and Supply Chain Practices

Ferguson's focus on sustainable sourcing and environmentally responsible supply chain practices is a growing imperative. This commitment aims to reduce its ecological footprint by prioritizing materials with lower environmental impact and engaging with suppliers who share these values.

In 2024, the building materials industry, including Ferguson's sector, is seeing increased regulatory pressure and consumer demand for greener products. For instance, the U.S. Environmental Protection Agency (EPA) continues to promote sustainable procurement, influencing how companies like Ferguson manage their sourcing. Ferguson's efforts include auditing suppliers for environmental compliance and exploring alternatives to traditional, resource-intensive materials.

- Increased Scrutiny: Investors and customers are increasingly evaluating companies based on their environmental, social, and governance (ESG) performance, pushing for greater transparency in supply chains.

- Regulatory Landscape: Evolving environmental regulations, particularly concerning carbon emissions and waste management, directly impact supply chain operations and material choices.

- Supplier Collaboration: Ferguson is actively working with its suppliers to implement sustainable practices, such as reducing packaging waste and optimizing transportation routes to lower emissions.

Waste Management and Recycling in Construction

Environmental regulations are increasingly shaping construction practices, pushing for greater waste reduction and recycling. For instance, many municipalities now mandate diversion rates for construction and demolition debris. In 2024, the US Environmental Protection Agency (EPA) continued to emphasize circular economy principles, impacting how materials are sourced and managed on project sites.

Ferguson can capitalize on these trends by expanding its portfolio of products incorporating recycled content. This aligns with growing client demand for sustainable building solutions. Furthermore, the company can explore partnerships for on-site recycling programs, turning waste into a resource and potentially reducing disposal costs for contractors.

- Regulatory Push: Evolving environmental laws in 2024 and 2025 are mandating higher waste diversion rates from construction sites, often requiring 50% or more of C&D waste to be recycled.

- Market Demand: A growing segment of clients, particularly in commercial and government projects, are prioritizing suppliers who offer products with certified recycled content.

- Operational Efficiency: Implementing robust recycling programs at job sites can lead to cost savings for contractors by reducing landfill fees and potentially generating revenue from salvaged materials.

Environmental regulations are increasingly shaping construction practices, pushing for greater waste reduction and recycling. For instance, many municipalities now mandate diversion rates for construction and demolition debris. In 2024, the US Environmental Protection Agency (EPA) continued to emphasize circular economy principles, impacting how materials are sourced and managed on project sites.

Ferguson can capitalize on these trends by expanding its portfolio of products incorporating recycled content. This aligns with growing client demand for sustainable building solutions. Furthermore, the company can explore partnerships for on-site recycling programs, turning waste into a resource and potentially reducing disposal costs for contractors.

Evolving environmental laws in 2024 and 2025 are mandating higher waste diversion rates from construction sites, often requiring 50% or more of C&D waste to be recycled. A growing segment of clients, particularly in commercial and government projects, are prioritizing suppliers who offer products with certified recycled content.

Implementing robust recycling programs at job sites can lead to cost savings for contractors by reducing landfill fees and potentially generating revenue from salvaged materials.

| Environmental Factor | Impact on Ferguson | Opportunity/Mitigation |

|---|---|---|

| Extreme Weather Events | Supply chain disruption, project delays, increased demand for repair materials. | Expand offerings in climate-resilient and adaptable building systems. |

| Water Scarcity | Stricter water conservation regulations, increased demand for water-efficient fixtures. | Expand portfolio of water-saving plumbing fixtures and technologies. |

| Energy Efficiency | Market shift towards low-energy consumption HVAC and building materials. | Promote sustainable solutions and high-efficiency HVAC units. |

| Waste Reduction & Recycling | Mandatory diversion rates for C&D debris, demand for recycled content products. | Expand products with recycled content, explore on-site recycling partnerships. |

PESTLE Analysis Data Sources

Our Ferguson PESTLE Analysis is meticulously constructed using data from reputable sources such as the World Bank, International Monetary Fund, and leading industry research firms. We integrate economic indicators, regulatory updates, and technological advancements to provide a comprehensive overview.