Ferguson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferguson Bundle

Ferguson's competitive landscape is shaped by five critical forces, from the bargaining power of its buyers to the threat of new entrants. Understanding these dynamics is crucial for any business operating in or looking to enter this market. This brief overview highlights the key pressures, but the full analysis offers a deeper dive.

Unlock the full Porter's Five Forces Analysis to explore Ferguson’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ferguson's reliance on a concentrated supplier market for specialized plumbing, HVAC, and waterworks components grants significant bargaining power to these suppliers. For instance, in the broader construction materials sector, the top five suppliers for certain high-performance pipes or specialized valves can control a substantial market share, dictating terms to distributors like Ferguson.

Ferguson's reliance on value-added distribution means suppliers who consistently deliver high-quality products on time hold significant sway. In 2024, the construction industry faced ongoing supply chain challenges, making reliable suppliers even more valuable to distributors like Ferguson.

When suppliers can ensure prompt delivery and superior product quality, they strengthen their bargaining position. This is because Ferguson's commitment to contractors and facility managers hinges on these very attributes, directly impacting Ferguson's own service levels and reputation.

Suppliers who can integrate forward into distribution channels pose a significant threat to Ferguson. If a supplier has the capability and motivation to bypass Ferguson and sell directly to customers, they effectively become a competitor. This is particularly relevant for suppliers of specialized or high-demand products where distribution is a key value-add. For instance, if a major plumbing fixture manufacturer in 2024 decided to establish its own direct-to-contractor sales network, it could directly challenge Ferguson's market share and leverage.

Switching Costs for Ferguson

Ferguson faces substantial switching costs when changing suppliers for critical or specialized products. These costs can include the expense of re-establishing new supplier relationships, adapting existing inventory management systems, and rigorously testing new products for compatibility and consistent quality. For instance, integrating a new plumbing fixture supplier might necessitate retraining installation staff and recalibrating order fulfillment processes.

These elevated switching costs directly bolster the bargaining power of Ferguson's current suppliers. When it is costly and time-consuming for Ferguson to move to an alternative, suppliers are in a stronger position to negotiate pricing, payment terms, and delivery schedules. This dynamic is particularly pronounced in 2024 for suppliers of unique or proprietary building materials where direct substitutes are scarce.

- High Switching Costs: Ferguson incurs significant expenses when changing suppliers for specialized products, impacting operational continuity.

- Supplier Leverage: Increased switching costs empower existing suppliers to dictate terms, potentially leading to less favorable pricing for Ferguson.

- Operational Impact: Re-establishing relationships, system adjustments, and quality assurance processes add complexity and cost to supplier transitions.

Impact of Commodity Price Volatility

Ferguson, as a distributor of diverse materials, faces significant exposure to commodity price swings. For instance, the price of lumber, a key material Ferguson distributes, saw considerable volatility in 2024, with futures contracts experiencing fluctuations of over 15% within a single quarter due to supply chain disruptions and demand shifts.

Suppliers of raw materials or components with volatile pricing can leverage this to increase their bargaining power. This is particularly true if they can readily pass on these increased costs up the supply chain, directly impacting Ferguson's margins and pricing strategies.

- Lumber Price Volatility: In early 2024, U.S. lumber futures traded on the CME Group experienced price swings of up to 15% quarter-over-quarter, driven by factors like housing market activity and logging capacity.

- Impact on Distributors: Such volatility forces distributors like Ferguson to manage inventory more cautiously and potentially absorb some cost increases, weakening their own negotiating position with customers.

- Supplier Leverage: Suppliers of materials like copper or PVC, also subject to global market forces, can exert greater influence if their input costs rise sharply, demanding higher prices from Ferguson.

Suppliers to Ferguson possess significant bargaining power, especially when they are few in number or provide unique, essential products. This leverage allows them to influence pricing and terms, impacting Ferguson's profitability.

In 2024, the construction sector continued to grapple with supply chain constraints, which amplified the power of reliable suppliers. For Ferguson, securing consistent access to specialized HVAC and plumbing components meant suppliers with proven track records and dependable delivery schedules held considerable sway.

High switching costs for Ferguson, particularly for proprietary or highly integrated systems, further strengthen supplier positions. The effort and expense involved in finding, vetting, and integrating new suppliers for critical materials mean existing suppliers can often command better terms.

When suppliers can easily pass on rising input costs, like those seen in 2024 for copper and PVC due to global market dynamics, their bargaining power increases. This directly affects Ferguson's ability to maintain stable pricing for its customers.

| Supplier Characteristic | Impact on Ferguson | 2024 Relevance |

|---|---|---|

| Concentrated Market / Few Suppliers | Increased pricing power for suppliers | High for specialized plumbing components |

| Unique or Differentiated Products | Higher switching costs for Ferguson | Critical for proprietary HVAC systems |

| Ability to Pass on Costs | Pressure on Ferguson's margins | Significant for commodity-linked materials like copper |

| Reliability and Quality | Supplier leverage due to demand | Amplified by 2024 supply chain disruptions |

What is included in the product

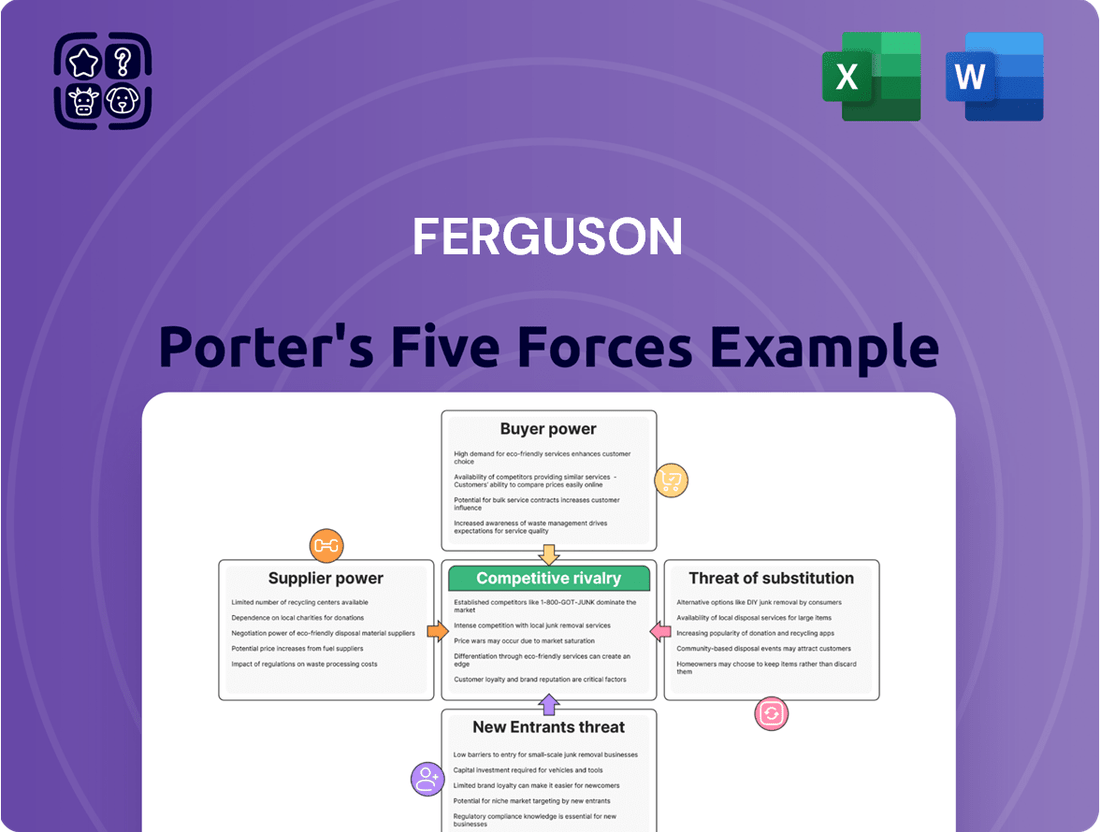

Ferguson's Porter's Five Forces Analysis dissects the competitive intensity within the plumbing and HVAC supply industry, examining threats from new entrants, the power of buyers and suppliers, the risk of substitutes, and the rivalry among existing firms.

Gain immediate clarity on competitive pressures with a visually intuitive threat matrix, simplifying complex strategic analysis.

Customers Bargaining Power

Ferguson caters to a broad customer base, encompassing residential and commercial contractors, facility managers, and individual homeowners. While the homeowner segment is inherently fragmented, large-scale contractors, both in commercial and residential construction, are significant volume purchasers. This volume allows them to exert some bargaining leverage, especially when acquiring more standardized product lines.

In the highly competitive distribution sector, contractors often prioritize price, readily comparing offerings from various suppliers. This behavior directly impacts Ferguson's profitability, especially on products lacking unique features, as it drives prices down.

For instance, in 2024, the plumbing supply industry saw intense price competition, with many contractors leveraging bulk purchasing power to negotiate better terms. This trend put pressure on distributors like Ferguson to maintain competitive pricing, potentially squeezing profit margins on standard inventory items.

Customers for Ferguson Porter have numerous choices for sourcing plumbing, HVAC, and other construction materials. The market features a wide array of regional and national distributors, allowing customers to easily compare and switch suppliers based on pricing, service quality, or product availability.

This competitive landscape is evident in the broader building materials distribution sector, where consolidation has occurred but many independent and regional players remain. For instance, in 2024, the U.S. building materials distribution market continued to see robust activity, with numerous smaller acquisitions and ongoing competition among larger entities, reinforcing customer choice.

Customer's Ability to Self-Perform Sourcing

Ferguson's customers, particularly larger contractors, possess the capability to source materials directly from manufacturers for certain high-volume products. This potential for backward integration, where customers essentially perform the sourcing function themselves, significantly bolsters their bargaining power. For instance, a major construction firm might negotiate directly with a large plumbing fixture manufacturer for a significant project, potentially bypassing distributors like Ferguson for those specific needs. This ability to self-perform sourcing reduces their reliance on intermediaries.

- Direct Sourcing Advantage: Large contractors can leverage their scale to negotiate better terms directly with manufacturers, cutting out the distributor's margin.

- Reduced Dependency: By sourcing key materials independently, customers decrease their dependence on Ferguson, enhancing their leverage in negotiations.

- Cost Savings Potential: Direct sourcing can lead to substantial cost savings for customers, making it an attractive alternative for high-volume purchases.

Importance of Value-Added Services and Expertise

Ferguson's emphasis on value-added services and deep expertise significantly diminishes customer bargaining power. By offering specialized knowledge and support throughout the construction lifecycle, Ferguson shifts the customer's focus from mere price to the overall value and efficiency gained. This is particularly impactful when dealing with professional customers who understand the cost of delays and errors.

This strategy is evident in Ferguson's engagement with specialized professional customers. These clients are less sensitive to price alone because they recognize that Ferguson's expertise can prevent costly mistakes and project overruns. For instance, in 2024, the demand for integrated project delivery solutions, which rely heavily on supplier expertise, continued to grow.

Consider these points:

- Expertise as a Differentiator: Ferguson's technical support and product knowledge reduce reliance on price competition.

- Lifecycle Support: Services spanning design, installation, and maintenance add significant value, making customers less likely to switch for minor price differences.

- Targeting Professional Segments: Focusing on customers who value reliability and efficiency over the lowest upfront cost strengthens Ferguson's position.

- Industry Trends: The increasing complexity of construction projects in 2024 further elevates the importance of supplier expertise.

Customers, particularly large contractors, possess significant bargaining power due to the availability of numerous alternative suppliers and the potential to source directly from manufacturers. This leverage is amplified when purchasing standardized products where price comparison is easy, as seen in the competitive 2024 plumbing supply market.

Ferguson's ability to offer value-added services and specialized expertise effectively counters this customer bargaining power by shifting focus from price to overall project value and efficiency. This strategy is particularly effective with professional clients who prioritize reliability and are willing to pay for expertise that prevents costly project delays or errors, a trend that intensified in 2024 with increasingly complex construction projects.

The direct sourcing capability of major clients, allowing them to bypass distributors for high-volume items, fundamentally strengthens their negotiation position. This reduces their dependence on Ferguson, making them less susceptible to price increases and more inclined to seek competitive terms, a dynamic that remained a key factor in the building materials distribution sector throughout 2024.

| Factor | Impact on Ferguson | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High volume purchasers (large contractors) have more leverage. | Continued consolidation in construction, leading to larger contractor entities. |

| Availability of Alternatives | Numerous suppliers mean customers can easily switch. | Robust activity in U.S. building materials distribution market with many regional players. |

| Switching Costs | Low for standardized products; higher for specialized services. | Customers seeking integrated solutions are less price-sensitive. |

| Price Sensitivity | High for commoditized items; lower for value-added solutions. | Intense price competition observed in plumbing supplies in 2024. |

| Direct Sourcing Potential | Customers can bypass distributors for bulk purchases. | Major construction firms increasingly explore direct manufacturer relationships. |

Preview Before You Purchase

Ferguson Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis, providing an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently expect to download this comprehensive analysis, ready for immediate application to your strategic planning needs.

Rivalry Among Competitors

The North American construction distribution market is characterized by its fragmentation, featuring a multitude of regional and local suppliers competing with larger entities like Ferguson. Despite its substantial size, this landscape sees continuous consolidation as companies acquire others to gain market share, signaling a highly competitive environment.

Ferguson's broad product and service offerings, encompassing plumbing, HVAC, waterworks, and fire & fabrication materials, create a significant competitive advantage. This comprehensive approach directly challenges rivals who might focus on more specialized or limited product lines, forcing them to either broaden their scope or concede market share in diverse segments.

In 2024, Ferguson reported net sales of $15.7 billion, underscoring the market's appetite for its extensive product catalog. Competitors offering narrower selections often struggle to match this scale and breadth, potentially limiting their ability to capture a larger portion of customer spending across multiple project needs.

Ferguson's vast network of nearly 1,800 locations, predominantly across North America, grants it a significant competitive edge. This extensive geographic reach allows for greater market penetration and customer accessibility, a key differentiator in the building materials distribution sector.

However, this advantage isn't insurmountable. Competitors with a strong foothold in specific regions or those catering to specialized market niches can still effectively challenge Ferguson's dominance. For instance, regional distributors might offer more tailored services or deeper product expertise within their concentrated areas, presenting a localized competitive threat.

Impact of Economic Cycles on Construction

The construction industry's inherent cyclicality significantly fuels competitive rivalry. During economic downturns or periods of decelerated growth, the available project pipeline shrinks, forcing distributors like Ferguson to compete more aggressively for a smaller market share. This intensified competition can lead to price wars and reduced profit margins for all players.

Ferguson itself experienced the impact of these economic cycles in its fiscal year 2024. The company reported softer revenue performance, partly attributed to deflationary pressures and a general slowdown in construction activity. Navigating these challenging market conditions requires astute strategic management and a keen understanding of the competitive landscape.

- Cyclical Nature: Construction demand fluctuates with broader economic cycles, impacting project availability.

- Intensified Competition: Downturns exacerbate rivalry as firms fight for fewer projects.

- Ferguson's FY24 Performance: The company faced softer revenue and deflationary pressures, highlighting economic cycle impacts.

Digital Capabilities and E-commerce Adoption

Ferguson's competitive landscape is increasingly shaped by digital capabilities and e-commerce adoption. As customers and rivals alike embrace online platforms, a robust digital presence and streamlined e-commerce systems are no longer optional but essential for market share. Ferguson's own investments in digital tools and value-added solutions aim to meet this evolving demand, positioning them to compete effectively in this digital-first environment.

The shift towards e-commerce presents a significant competitive battleground. For instance, in the broader building materials sector, e-commerce sales have seen substantial growth. By the end of 2023, online sales for home improvement products reached an estimated $150 billion in the US, a figure projected to climb further. This highlights the critical need for companies like Ferguson to not only offer digital tools but also to ensure their online ordering and fulfillment processes are highly efficient to retain and attract customers.

- Digital Investment: Ferguson is actively investing in digital tools and value-added solutions to enhance customer experience and operational efficiency.

- E-commerce Growth: The building materials sector, including plumbing and HVAC, is witnessing a significant surge in e-commerce adoption by both customers and competitors.

- Competitive Imperative: A strong digital presence and efficient online ordering systems are becoming crucial differentiators and essential for maintaining competitiveness.

- Market Share Impact: Failure to adapt to digital trends and e-commerce can lead to a loss of market share as customers gravitate towards more digitally accessible suppliers.

The competitive rivalry within the North American construction distribution market is intense, driven by fragmentation and ongoing consolidation. Ferguson's extensive product offerings and vast network of nearly 1,800 locations provide a significant advantage, enabling it to serve a broad customer base across multiple project needs.

However, this advantage is challenged by regional specialists and niche players who can offer tailored services. The industry's cyclical nature, as seen in Ferguson's softer revenue performance in fiscal year 2024 due to deflationary pressures and slower construction activity, intensifies this rivalry, leading to greater competition for fewer projects.

Furthermore, the increasing adoption of digital capabilities and e-commerce platforms by customers and competitors alike is reshaping the competitive landscape. Companies like Ferguson must invest in robust digital strategies and efficient online systems to maintain market share and meet evolving customer demands.

| Metric | Ferguson (FY24) | Industry Trend |

|---|---|---|

| Net Sales | $15.7 billion | Fragmented market with consolidation |

| Locations | ~1,800 | Geographic reach is a key differentiator |

| E-commerce Growth (Building Materials) | Investing in digital | Estimated $150 billion in US home improvement online sales (2023) |

SSubstitutes Threaten

The threat of substitutes is significant for Ferguson, particularly concerning direct sourcing from manufacturers. Large contractors, armed with substantial purchasing power and established relationships, can bypass distributors for common or high-volume materials. This trend was evident in 2024, with many large construction firms exploring direct procurement to potentially reduce costs and streamline supply chains, especially for plumbing fixtures and HVAC components where standardization is high.

The threat of substitutes for Ferguson's traditional plumbing and HVAC components is growing with innovative construction methods. For instance, the increasing adoption of cross-laminated timber (CLT) in mid-rise buildings might reduce the need for certain steel and concrete-based plumbing infrastructure compared to traditional construction. Furthermore, the rise of 3D-printed construction, which can integrate conduits directly into building elements, could bypass the need for some of Ferguson's core product offerings.

For homeowners, the threat of substitutes is significant, especially for less complex plumbing and HVAC needs. Retail giants like Home Depot and Lowe's, along with numerous online DIY platforms, provide direct access to a wide array of products. These channels empower homeowners to undertake their own repairs and installations, bypassing the need for professional services and Ferguson's specialized distribution.

In 2023, the home improvement retail sector in the U.S. generated over $470 billion in sales, highlighting the substantial consumer preference for DIY solutions and readily available retail channels. This robust market indicates that a considerable portion of the homeowner segment is willing and able to source their own materials, directly impacting Ferguson's potential market share for these less specialized projects.

Rental of Equipment vs. Purchase

The threat of substitutes is a key consideration for Ferguson. For certain specialized equipment, contractors may choose to rent rather than buy, especially for short-term projects. This rental market can act as a direct substitute for Ferguson's sales of those specific items.

For instance, the construction equipment rental market is substantial. In 2023, the global construction equipment rental market was valued at approximately $120 billion, with projections indicating continued growth. This shows a significant alternative for contractors who might otherwise purchase equipment from a distributor like Ferguson.

- Rental Market Growth: The construction equipment rental sector is expanding, offering a viable alternative to ownership.

- Cost-Effectiveness for Short-Term Needs: Renting specialized machinery for singular projects can be more economical than purchasing it, directly impacting sales of certain Ferguson product lines.

- Availability of Alternatives: A wide range of rental companies provide access to diverse equipment, reducing the necessity for contractors to maintain their own large fleets.

Repair vs. Replacement Decisions

For existing systems, customers frequently weigh the cost and effectiveness of repairing older equipment against the expense of purchasing entirely new units. This decision is heavily influenced by the availability and price of replacement parts and skilled labor for repairs.

If repair costs remain substantially lower than the price of new systems, or if the performance gap between old and new is minimal for the customer's needs, it can significantly dampen demand for new product sales. For instance, in the HVAC sector, a homeowner might opt to repair an aging but functional air conditioning unit for a few hundred dollars rather than invest in a new system costing several thousand, especially if the repair extends the unit's life for a few more seasons.

The threat of substitutes in this context is amplified when:

- New technologies offer only marginal improvements in efficiency or functionality that don't justify the replacement cost.

- The lifespan of existing equipment can be extended through affordable and reliable repair services.

- Economic downturns lead customers to prioritize cost savings by delaying capital expenditures on new equipment.

For example, in 2024, the average cost of repairing a major appliance like a refrigerator could range from $200 to $500, whereas a new unit might cost upwards of $1,000 to $3,000, making repair a compelling substitute for many consumers facing budget constraints.

The threat of substitutes for Ferguson is multifaceted, encompassing direct sourcing by large contractors, innovative construction methods, and readily available retail channels for homeowners. Additionally, the rental market for specialized equipment and the option to repair existing systems instead of purchasing new ones present significant competitive pressures.

In 2024, the trend of large contractors pursuing direct procurement from manufacturers continued, particularly for standardized plumbing and HVAC items, aiming to reduce costs. Simultaneously, advancements like 3D-printed construction offer integrated conduits, potentially bypassing traditional plumbing infrastructure needs.

The DIY market remains a strong substitute, with U.S. home improvement retail sales exceeding $470 billion in 2023, demonstrating a consumer inclination towards self-sourcing for less complex projects.

The construction equipment rental market, valued at approximately $120 billion globally in 2023, provides contractors with a cost-effective alternative to purchasing equipment for short-term needs.

| Substitute Category | Description | Impact on Ferguson | 2023/2024 Data Point |

|---|---|---|---|

| Direct Sourcing | Large contractors buying directly from manufacturers. | Reduces sales volume for distributors. | Exploration by many large construction firms in 2024. |

| Innovative Construction | Methods like 3D printing integrating infrastructure. | Decreases demand for traditional components. | Growing adoption of advanced building techniques. |

| DIY Retail | Homeowners purchasing from large retailers or online. | Captures a segment of the homeowner market. | U.S. home improvement retail sales > $470 billion (2023). |

| Equipment Rental | Contractors renting specialized machinery. | Limits sales of owned equipment. | Global construction equipment rental market ~ $120 billion (2023). |

| Repair vs. Replace | Repairing existing systems instead of buying new. | Delays or eliminates new system sales. | Appliance repair costs ($200-$500) vs. new units ($1,000-$3,000) in 2024. |

Entrants Threaten

Launching a new venture in the construction materials distribution sector, particularly for plumbing and HVAC supplies, demands a significant financial outlay. This includes substantial investments in acquiring and maintaining a diverse inventory, securing and equipping large warehousing facilities, and building an efficient, widespread distribution network capable of timely deliveries across various regions.

Ferguson's established infrastructure, boasting a vast network of branches and advanced distribution centers, acts as a formidable barrier. For instance, as of fiscal year 2023, Ferguson operated over 1,900 locations, a scale that new entrants would struggle to replicate without immense capital and time.

New entrants into the market would struggle to establish strong relationships with key manufacturers. These suppliers often prioritize their existing partnerships with established distributors, like Ferguson, which can lead to preferential pricing and product availability for incumbents. For instance, in 2024, many leading plumbing fixture manufacturers reported that over 70% of their sales volume was with long-term, high-volume distributors.

Ferguson has cultivated significant brand recognition and deep customer loyalty among professional contractors. This is built on decades of providing specialized expertise, reliable service, and a comprehensive product offering that contractors depend on. For instance, Ferguson's commitment to customer service is a key differentiator, fostering repeat business and making it difficult for newcomers to capture market share.

Regulatory Requirements and Industry Standards

The plumbing, HVAC, and construction sectors are heavily regulated, with stringent building codes, environmental mandates, and industry-specific standards. For instance, in the US, the International Building Code (IBC) and ASHRAE standards dictate many aspects of construction and system design. New companies must invest significant resources to understand and comply with these requirements, which can act as a substantial barrier to entry.

Navigating these complex regulatory landscapes often necessitates specialized expertise and certifications. Failure to comply can result in fines, project delays, and reputational damage, making it a critical consideration for potential new market participants.

- Building Codes: Compliance with local and national building codes is mandatory for all construction projects.

- Environmental Regulations: Adherence to EPA standards and other environmental laws impacts material sourcing and waste disposal.

- Industry Standards: Organizations like ANSI and ASME set standards for equipment and installation practices, requiring adherence for quality and safety.

- Licensing and Certification: Many trades require specific licenses and certifications, adding to the upfront investment for new entrants.

Talent Acquisition and Skilled Workforce

The construction and related distribution industries are grappling with persistent talent deficits, especially concerning skilled tradespeople and experienced sales professionals. This scarcity means any new competitor must commit substantial resources to recruit and keep qualified staff, presenting a significant hurdle to market entry.

For instance, in 2024, the U.S. Bureau of Labor Statistics projected that employment for construction laborers would grow by 6% from 2022 to 2032, indicating continued demand for skilled workers. Similarly, the demand for sales representatives in the wholesale trade sector remains robust, with new entrants needing to compete for a limited pool of experienced individuals.

- Talent Shortages: Ongoing difficulties in finding skilled trades and knowledgeable sales staff.

- High Investment: New entrants must make significant investments in attracting and retaining talent.

- Barrier to Entry: The need for substantial investment in human capital acts as a deterrent for potential new competitors.

The threat of new entrants in the construction materials distribution sector, particularly for plumbing and HVAC supplies, is relatively low due to significant barriers. High capital requirements for inventory and distribution networks, coupled with established supplier relationships and strong brand loyalty, make market entry challenging.

Regulatory compliance and the need for specialized expertise further deter new players. Additionally, the scarcity of skilled labor and experienced sales professionals means new companies must invest heavily in talent acquisition, creating another substantial hurdle.

Ferguson's extensive operational scale, with over 1,900 locations as of fiscal year 2023, demonstrates the immense investment needed to compete. In 2024, manufacturers reported that over 70% of their sales volume was with high-volume distributors, highlighting the difficulty for newcomers to secure supply agreements.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment for inventory, warehousing, and distribution networks. | Significant financial hurdle, limiting the number of potential entrants. |

| Supplier Relationships | Established distributors like Ferguson have preferential terms. | New entrants struggle to secure favorable pricing and product availability. |

| Brand Loyalty & Customer Relationships | Decades of service build strong contractor loyalty. | New companies face difficulty in capturing market share from established players. |

| Regulatory Compliance | Navigating building codes, environmental mandates, and industry standards is complex. | Requires specialized expertise and investment, increasing entry costs. |

| Talent Shortages | Scarcity of skilled trades and experienced sales professionals. | New entrants must invest heavily in recruitment and retention, facing stiff competition for talent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, incorporating information from industry-specific market research reports, company annual filings, and expert analyst commentary to provide a comprehensive view of competitive dynamics.