Ferguson Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferguson Bundle

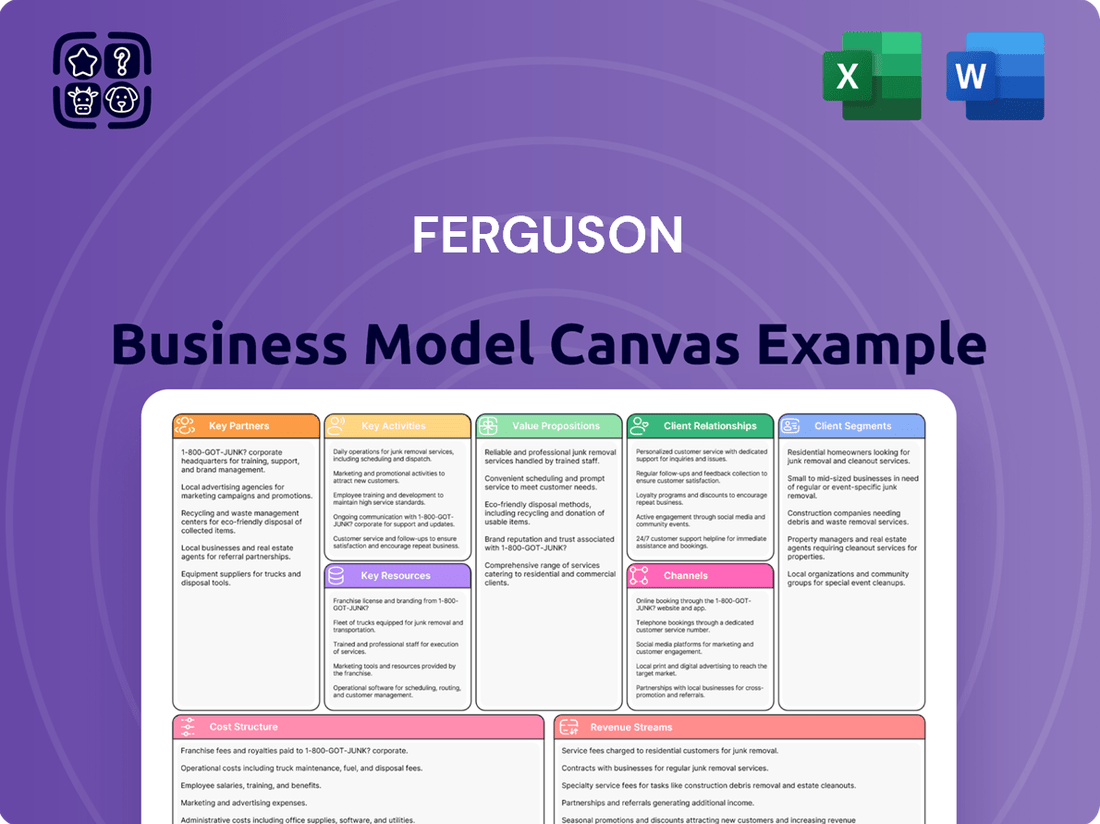

Discover the intricate framework that fuels Ferguson's success with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Equip yourself with this strategic blueprint to refine your own business strategy.

Partnerships

Ferguson maintains critical relationships with a broad array of suppliers and manufacturers, ensuring a comprehensive inventory of plumbing, HVAC, waterworks, and fire and fabrication products. These partnerships are vital for competitive pricing and product availability, with over 35,000 suppliers contributing to their extensive catalog.

Securing favorable terms and consistent product flow from these key partners is paramount. In 2023, Ferguson reported net sales of $15.7 billion, underscoring the scale of operations and the importance of reliable supply chains to meet customer demand.

Collaboration with leading manufacturers allows Ferguson to offer innovative products and maintain a competitive edge. Exclusive distribution agreements with select suppliers further strengthen their market position and product differentiation.

Ferguson's strategic alliances with a vast network of residential and commercial contractors form a cornerstone of its business model. These partnerships are built on understanding the unique demands of each project, offering customized material solutions, and providing essential technical guidance from inception to completion.

In 2024, Ferguson continued to strengthen these relationships, recognizing that a substantial portion of its revenue is driven by the ongoing needs of these professional clients. This focus on long-term engagement not only secures consistent business but also provides invaluable market intelligence on emerging trends and customer preferences within the construction sector.

Ferguson's growth hinges on acquiring smaller distributors, integrating them as vital partners. These acquisitions bolster Ferguson's reach and product diversity. For instance, in 2023, Ferguson completed 17 acquisitions, contributing to its robust revenue growth.

Technology and Digital Solution Providers

Ferguson’s partnerships with technology and digital solution providers are crucial for modernizing operations and improving customer interactions. These collaborations are vital for developing and maintaining sophisticated e-commerce platforms, robust inventory management systems, and advanced supply chain optimization tools. For instance, in 2024, many distributors like Ferguson are investing heavily in AI-powered inventory forecasting to reduce stockouts and carrying costs, a trend expected to continue growing.

These alliances also enable Ferguson to offer digital solutions that simplify home renovation projects for its customers. By integrating smart home technology platforms and providing digital tools for project planning and visualization, Ferguson enhances its value proposition. By the end of 2024, the digital transformation in the building materials sector is projected to see a significant uptick in adoption rates for customer-facing digital tools, with companies reporting up to a 15% increase in customer engagement through these channels.

- E-commerce Platform Enhancement: Collaborations to build and refine user-friendly online purchasing experiences.

- Supply Chain Visibility: Partnerships for real-time tracking and management of goods, improving delivery efficiency.

- Data Analytics & AI: Leveraging technology providers for insights into customer behavior and operational improvements.

- Digital Project Tools: Developing or integrating software that assists customers with planning and executing home projects.

Industry Associations and Training Organizations

Ferguson actively engages with industry associations and training organizations like Explore The Trades. This collaboration is crucial for staying informed about evolving industry trends and for shaping important standards within the construction sector.

These partnerships are vital for workforce development, directly supporting skilled trades education. By investing in these relationships, Ferguson helps ensure a consistent supply of qualified professionals entering the construction industry, a critical element for future growth.

- Industry Trend Monitoring: Associations provide real-time insights into market shifts and technological advancements.

- Standards Influence: Participation allows Ferguson to contribute to and adopt best practices in the trades.

- Workforce Pipeline: Partnerships with organizations like Explore The Trades directly address the skilled labor shortage, a persistent challenge in the construction industry. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a significant demand for skilled trades, with electricians, plumbers, and HVAC technicians expected to see job growth well above the average for all occupations.

- Educational Support: Ferguson's involvement aids in curriculum development and the promotion of vocational training programs.

Ferguson's key partnerships extend to technology and digital solution providers, crucial for modernizing operations and enhancing customer interactions. These collaborations are vital for developing sophisticated e-commerce platforms and advanced supply chain optimization tools, with many distributors like Ferguson investing heavily in AI-powered inventory forecasting in 2024 to reduce stockouts.

These alliances also enable Ferguson to offer digital solutions that simplify home renovation projects, integrating smart home technology and digital planning tools. By the end of 2024, customer-facing digital tools are projected to see up to a 15% increase in customer engagement through these channels.

| Partnership Type | Key Activities | Impact/Benefit |

|---|---|---|

| Technology Providers | E-commerce enhancement, Supply chain visibility, Data analytics & AI integration | Improved customer experience, operational efficiency, data-driven insights |

| Digital Solution Providers | Development of project planning tools, smart home integration | Enhanced value proposition for customers, simplified project execution |

What is included in the product

A structured framework for outlining and analyzing a business's core components, facilitating strategic planning and communication.

It streamlines complex business ideas into a single, actionable page, eliminating the confusion and wasted time often associated with developing new strategies.

Activities

Ferguson's product sourcing and procurement is a massive undertaking, involving the identification, negotiation, and ongoing management of a vast network of suppliers for plumbing, HVAC, waterworks, and fire & fabrication products. This critical activity directly impacts product quality, pricing competitiveness, and crucially, product availability to satisfy a wide spectrum of customer needs.

In 2024, Ferguson continued to leverage its scale to secure favorable terms, a strategy that has historically driven its market position. Effective management of inventory across its extensive network of branches and distribution centers is paramount to ensuring timely delivery and minimizing carrying costs, a constant balancing act in a dynamic market.

Ferguson's distribution and logistics management is centered on its extensive network of over 1,700 branches and 30 distribution centers across North America, a critical component of its business model. This robust infrastructure is key to efficiently storing, moving, and delivering a vast array of plumbing, HVAC, and utility products. In 2024, the company continued to invest in optimizing this network to ensure products reach customers when and where they are needed, whether directly to job sites or for convenient in-branch pickup.

Ferguson's key activities in sales and customer service involve directly engaging with a broad customer base, including residential and commercial contractors, facility managers, and even individual homeowners. This direct interaction is crucial for understanding and meeting diverse project requirements.

Beyond simple transactions, Ferguson provides expert consultative services and robust technical support. This ensures customers receive tailored solutions for even the most complex project needs, fostering a problem-solving approach rather than just product delivery.

A cornerstone of Ferguson's strategy is its unwavering commitment to customer service. This focus is evident in their efforts to build lasting relationships, evident in their 2023 fiscal year revenue of $15.7 billion, demonstrating the success of their customer-centric approach.

Value-Added Solutions and Expertise

Ferguson goes beyond simply supplying products; they offer specialized value-added solutions. This includes expert design and specification services tailored for both commercial and residential building projects.

Their deep technical knowledge extends to critical areas like fire protection engineering, ensuring safety and compliance. They also provide essential services for environmental management, such as erosion control and stormwater management, helping clients achieve sustainable project outcomes.

- Design and Specification Services: Assisting customers in planning and detailing project requirements.

- Fire Protection Engineering: Offering specialized expertise to meet stringent safety codes.

- Erosion Control and Stormwater Management: Providing solutions for environmental compliance and site stability.

Strategic Acquisitions and Integration

Ferguson's growth hinges on strategic acquisitions, particularly bolt-on deals that enhance its market presence and capabilities. This involves meticulous due diligence to ensure acquired businesses align with Ferguson's objectives, expanding its geographic footprint and product portfolio. For instance, in fiscal year 2023, Ferguson completed 18 acquisitions, adding approximately $500 million in revenue and strengthening its position in key markets.

- Acquisition Strategy: Focus on bolt-on acquisitions to expand geographic reach and product offerings.

- Due Diligence: Rigorous evaluation of potential acquisitions to ensure strategic fit and financial viability.

- Integration: Seamlessly incorporating acquired businesses to realize synergies and maximize value.

- Fiscal Year 2023 Performance: 18 acquisitions completed, contributing around $500 million in revenue.

Ferguson's key activities encompass robust product sourcing, efficient distribution, and exceptional customer engagement. The company excels in managing its vast supply chain and extensive branch network to ensure product availability and timely delivery.

Furthermore, Ferguson provides specialized value-added services, including design and specification assistance, alongside expert technical support to meet diverse customer project needs.

Strategic acquisitions are also a vital activity, enabling Ferguson to expand its market reach and product offerings, as demonstrated by its 2023 acquisition performance.

| Key Activity | Description | 2023 Impact |

|---|---|---|

| Product Sourcing & Procurement | Securing favorable terms from a wide supplier network. | Drives pricing competitiveness and product availability. |

| Distribution & Logistics | Managing over 1,700 branches and 30 distribution centers. | Ensures efficient storage, movement, and delivery of products. |

| Sales & Customer Service | Direct engagement and consultative support for contractors and facility managers. | Contributed to $15.7 billion in fiscal year 2023 revenue. |

| Value-Added Services | Design, specification, fire protection engineering, and environmental solutions. | Enhances project outcomes and client satisfaction. |

| Strategic Acquisitions | Bolt-on acquisitions to expand market presence and capabilities. | 18 acquisitions completed, adding ~$500 million in revenue. |

Delivered as Displayed

Business Model Canvas

The Ferguson Business Model Canvas preview you're viewing is an authentic representation of the final product. This is not a sample or a mockup; it's a direct excerpt from the complete document you will receive upon purchase. Once your order is confirmed, you'll gain full access to this exact, professionally structured Business Model Canvas, ready for your strategic planning needs.

Resources

Ferguson’s extensive product inventory, encompassing plumbing, HVAC, waterworks, and fire & fabrication materials, is a cornerstone of its business. This vast selection ensures customers can source a wide range of needs from a single, reliable supplier, streamlining their procurement processes.

Complementing its product breadth, Ferguson operates a robust supply chain network. With nearly 1,800 branches and 19 strategically located distribution centers across North America, the company ensures high product availability and efficient, timely delivery to its diverse customer base.

Ferguson's approximately 35,000 associates are a cornerstone of its business model, encompassing sales professionals, technical experts, and logistics personnel. This vast team's deep industry knowledge and specialized skills are directly leveraged to provide value to customers.

The technical expertise of Ferguson's workforce across various trades, from plumbing to HVAC, is a key differentiator. This allows them to offer informed advice and solutions, directly contributing to their value proposition of expert support.

A significant portion of Ferguson's operational success hinges on the commitment of its associates to exceptional customer service. This dedication ensures that clients receive personalized attention and efficient problem-solving, reinforcing loyalty and repeat business.

Ferguson cultivates deep, enduring connections with a broad spectrum of manufacturers and suppliers. These aren't just transactional ties; they're built on years of trust and shared success, guaranteeing Ferguson consistent access to a vast array of high-quality products. This strong supplier network is a cornerstone of their business, enabling them to secure favorable pricing and reliable inventory, which directly translates to a competitive edge in the marketplace.

Digital Platforms and Technology Infrastructure

Ferguson's investment in digital platforms and technology infrastructure is a cornerstone of its business model. This focus on technology enables efficient operations and enhances customer engagement. For instance, in fiscal year 2024, the company continued to invest in its e-commerce capabilities, aiming to streamline the customer journey and expand its digital reach. This commitment to digital transformation supports their ability to manage vast inventories and process orders with increasing speed and accuracy.

The company's robust IT infrastructure underpins critical functions like inventory management, order processing, and customer relationship management (CRM). These systems are vital for maintaining a competitive edge by ensuring product availability and providing personalized customer experiences. Ferguson’s digital tools are designed to provide real-time data, facilitating smarter, data-driven decisions across the organization.

Key aspects of Ferguson’s digital platforms and technology infrastructure include:

- E-commerce Growth: Continued expansion and enhancement of online sales channels, contributing significantly to overall revenue.

- Supply Chain Technology: Advanced systems for inventory tracking and warehouse management, improving efficiency and reducing stockouts.

- Customer Relationship Management (CRM): Investments in CRM software to better understand and serve customer needs, fostering loyalty.

- Data Analytics: Utilization of data analytics to optimize operations, personalize marketing efforts, and identify new business opportunities.

Brand Reputation and Customer Trust

Ferguson's brand reputation as a dependable, value-adding distributor in North America's construction sector is a crucial intangible asset. This strong standing is built on years of delivering consistent service and high-quality products, fostering deep customer loyalty and drawing in new clientele.

Customer trust is the bedrock of Ferguson's success, directly impacting repeat business and market share. In 2023, Ferguson reported net sales of $14.7 billion, underscoring the significant commercial impact of this trust.

- Brand Strength: Ferguson's name is synonymous with reliability in the construction supply chain.

- Customer Loyalty: Years of trust translate into a stable and recurring customer base.

- Market Differentiation: A strong reputation sets Ferguson apart from competitors, attracting customers seeking proven partners.

- Growth Driver: Trust facilitates the adoption of new products and services, fueling expansion.

Ferguson's key resources include its extensive product portfolio, a sophisticated supply chain network, and a dedicated workforce of approximately 35,000 associates. These resources are further bolstered by strong supplier relationships and significant investments in digital platforms and technology. The company's strong brand reputation and the resulting customer trust are invaluable intangible assets that drive repeat business and market differentiation.

| Resource Category | Key Components | Impact/Value |

|---|---|---|

| Product Inventory | Plumbing, HVAC, Waterworks, Fire & Fabrication | One-stop shop, streamlines procurement |

| Supply Chain Network | 1,800+ Branches, 19 Distribution Centers | High availability, efficient delivery |

| Human Capital | Sales, Technical Experts, Logistics Personnel | Expert advice, customer service |

| Supplier Relationships | Long-term, trust-based partnerships | Consistent access to quality products, favorable pricing |

| Digital & Technology | E-commerce, Supply Chain Tech, CRM, Data Analytics | Operational efficiency, enhanced customer engagement |

| Brand & Reputation | Dependability, Value-adding Distributor | Customer loyalty, market differentiation |

Value Propositions

Ferguson's value proposition centers on its exceptionally comprehensive product range, encompassing plumbing, HVAC, waterworks, and fire & fabrication materials. This broad selection makes it a true one-stop-shop for professionals and homeowners alike, simplifying procurement.

This extensive inventory, supported by a robust distribution network, ensures high product availability. For instance, Ferguson's commitment to having products readily accessible is a key differentiator, allowing customers to find what they need, when they need it, minimizing project delays.

Ferguson's value proposition centers on providing deep expertise and robust technical support throughout a customer's construction journey. Their associates offer specialized knowledge, guiding clients from initial design and specification phases through to installation and ongoing maintenance, ensuring project success and optimal product selection.

This hands-on assistance is crucial for navigating complex projects. For instance, in 2024, Ferguson reported that over 70% of their customer interactions involved some level of technical consultation, highlighting the integral role of their knowledgeable staff in problem-solving and solution-finding for diverse construction needs.

Ferguson's robust supply chain is a cornerstone of its value proposition, ensuring contractors get the materials they need precisely when they need them. This operational excellence is backed by a vast network of over 1,900 locations as of their 2023 fiscal year-end, allowing for efficient distribution across North America.

The company's commitment to timely delivery directly translates to reduced downtime for its customers. By minimizing delays on job sites, Ferguson helps contractors maintain project schedules and improve their own profitability, a critical factor in the fast-paced construction industry.

This logistical prowess not only facilitates on-time deliveries but also offers convenient pick-up options, catering to the diverse operational needs of their clientele. In 2023, Ferguson reported net sales of $15.7 billion, underscoring the scale and effectiveness of their distribution capabilities.

Value-Added Services and Solutions

Ferguson goes beyond simply supplying materials by offering specialized services that are crucial for project success. These include expert fire protection system design and comprehensive engineering support, ensuring compliance and optimal performance.

Furthermore, Ferguson provides innovative solutions for critical environmental challenges like erosion control and effective stormwater management. These services streamline complex construction processes and enhance the long-term sustainability of projects.

- Fire Protection Design: Ferguson's specialized design services ensure fire safety systems meet all regulatory requirements and project-specific needs.

- Engineering Services: Access to professional engineering expertise helps clients navigate complex technical challenges and optimize their building designs.

- Erosion Control Solutions: These offerings help manage soil stability and prevent environmental damage during and after construction phases.

- Stormwater Management: Ferguson provides solutions that address water runoff, crucial for environmental compliance and site integrity.

Customer-Centric Approach and Reliability

Ferguson's value proposition is built on a foundation of unwavering customer focus, striving to simplify complex projects and ensure their successful completion. This dedication to the customer experience, coupled with a proven track record of reliability, fosters deep and enduring connections across its wide-ranging clientele.

This customer-centricity translates into tangible benefits for Ferguson's partners. For instance, in fiscal year 2023, Ferguson reported a revenue of $15.7 billion, demonstrating the scale of its operations and the trust placed in its services by a broad customer base. Their commitment to consistent performance underpins this trust.

- Customer-Centricity: Ferguson aims to simplify complex projects for its customers, making them more manageable and successful.

- Reliability: The company has built a strong reputation for consistent performance, ensuring customers can depend on their services.

- Relationship Building: This combination of service and reliability cultivates lasting, strong relationships with a diverse customer base.

- Market Presence: With $15.7 billion in revenue in fiscal year 2023, Ferguson showcases its significant market penetration and customer trust.

Ferguson offers unparalleled product breadth, serving as a single source for plumbing, HVAC, waterworks, and fire protection needs. This extensive selection simplifies procurement for professionals and homeowners alike.

Their vast inventory, coupled with a robust distribution network boasting over 1,900 locations as of fiscal year 2023, ensures high product availability and minimizes project delays for customers.

Ferguson differentiates itself through deep technical expertise and support, assisting clients from design to installation. In 2024, over 70% of customer interactions involved technical consultation, underscoring the value of their knowledgeable staff.

The company's logistical strength ensures timely material delivery, reducing contractor downtime and improving project profitability. Ferguson's commitment to operational excellence is reflected in its fiscal year 2023 net sales of $15.7 billion.

Beyond materials, Ferguson provides specialized services like fire protection design and engineering support, crucial for project compliance and success. They also offer environmental solutions such as erosion and stormwater management.

| Value Proposition Component | Description | Supporting Data/Fact |

| Comprehensive Product Range | One-stop-shop for plumbing, HVAC, waterworks, fire protection. | Extensive inventory across multiple categories. |

| High Product Availability & Distribution | Readily accessible products, minimizing project delays. | Over 1,900 locations (FY23 end); $15.7 billion net sales (FY23). |

| Technical Expertise & Support | Guidance from design to installation, problem-solving. | Over 70% of customer interactions involved technical consultation (2024). |

| Specialized Services | Fire protection design, engineering, environmental solutions. | Expertise in complex project needs and compliance. |

Customer Relationships

Ferguson prioritizes building strong connections with its professional clientele by assigning dedicated sales teams and account managers. These professionals are trained to grasp the unique needs of each customer's projects, offering tailored support and advice. This personalized touch is crucial for fostering trust and ensuring consistent assistance throughout the customer lifecycle.

Ferguson excels in providing robust technical support and expertise sharing, acting as a crucial component of their customer relationships. This support extends beyond simple product sales, offering valuable guidance on product selection, application, and even troubleshooting. For instance, in 2024, Ferguson continued to invest in its online knowledge base and in-person training sessions, aiming to equip customers with the confidence to tackle complex projects.

Ferguson provides robust online tools and self-service options through its digital platforms and customer accounts. These features empower clients to efficiently manage their orders, track shipments in real-time, and access a wealth of product details, all at their convenience.

This digital approach offers significant flexibility, aligning with the dynamic needs of modern businesses. In 2024, Ferguson reported that a substantial portion of its customer interactions and transactions occurred through these online channels, highlighting their importance in the customer relationship strategy.

Branch Network and Local Presence

Ferguson's extensive branch network is a cornerstone of its customer relationships, fostering a strong local presence. This allows for direct, in-person interactions where customers can receive personalized product consultations and gain immediate access to a wide range of inventory. This localized strategy is crucial for building trust and offering support that truly meets the specific needs of each community they serve.

The company's commitment to a physical footprint means customers can rely on tangible points of contact for their project needs. This accessibility translates into faster problem-solving and a more efficient procurement process, particularly for time-sensitive construction or renovation projects.

- Extensive Branch Network: Ferguson operates over 1,700 locations across the United States, ensuring a widespread local presence.

- In-Person Consultations: Branches provide expert advice and product demonstrations, enhancing customer understanding and purchasing decisions.

- Immediate Inventory Access: Local stock availability reduces lead times and supports project continuity for contractors and tradespeople.

- Tailored Local Support: Branch staff build relationships, understanding regional needs and offering customized solutions.

Strategic Partnerships and Acquisitions Integration

Ferguson strategically integrates customer relationships from acquired businesses, ensuring a seamless transition and maintaining service continuity. This approach capitalizes on the existing trust and rapport built by the acquired entity, introducing those customers to Ferguson's expanded offerings and value proposition.

For example, in 2024, Ferguson continued its strategy of acquiring businesses that complement its existing portfolio. The successful integration of these new customer bases into Ferguson's operational framework is a key driver for sustained growth and market penetration.

- Customer Retention: Maintaining relationships with customers of acquired businesses is paramount to avoid churn and preserve revenue streams.

- Cross-selling Opportunities: Introducing acquired customers to Ferguson's wider product and service range creates new revenue avenues.

- Brand Leverage: The established trust in acquired brands is leveraged to foster loyalty within the larger Ferguson ecosystem.

- Service Continuity: Ensuring that customers experience no disruption in service post-acquisition is critical for satisfaction and long-term engagement.

Ferguson cultivates deep customer loyalty through a multi-faceted approach, blending personalized service with robust digital tools and a strong physical presence.

Dedicated account managers and extensive online resources empower customers, while the company's vast branch network ensures localized support and immediate product access.

In 2024, Ferguson's commitment to integrating acquired customer bases further solidified its market position, demonstrating a strategic focus on relationship continuity and expansion.

| Customer Relationship Aspect | Key Features | Impact/Benefit |

|---|---|---|

| Dedicated Support | Sales teams, account managers | Tailored advice, trust building |

| Technical Expertise | Online knowledge base, training | Product confidence, problem-solving |

| Digital Self-Service | Online portals, mobile app | Order management, real-time tracking |

| Physical Presence | Over 1,700 branches | In-person consultations, immediate inventory |

| Acquisition Integration | Seamless transition, service continuity | Customer retention, cross-selling |

Channels

Ferguson's extensive physical branch network, comprising nearly 1,800 locations across North America, acts as a crucial customer interface. These branches facilitate product browsing, expert consultations, and immediate order pickups, reinforcing a strong local presence.

Ferguson's e-commerce platforms, Ferguson.com and Build.com, are central to its customer engagement strategy, offering a seamless omnichannel experience. These digital storefronts facilitate online ordering, account management, and provide access to an extensive product catalog, effectively serving customers who prioritize digital interactions.

In 2024, Ferguson reported significant growth in its digital channels, with online sales contributing a substantial portion of its revenue. Build.com, in particular, continues to be a key driver, attracting a broad customer base seeking convenience and a wide selection of products for their home improvement projects.

Ferguson's direct sales force and account managers are the backbone of their customer relationships, primarily serving residential and commercial contractors, as well as facility managers. This hands-on approach fosters strong partnerships and allows for the delivery of customized solutions and essential on-site support, directly addressing customer needs.

In 2024, this channel was crucial for understanding evolving project demands and providing expert advice. For instance, a significant portion of Ferguson's revenue is generated through these direct interactions, highlighting the value placed on personalized service and technical expertise in complex projects.

Distribution Centers

Ferguson's network of 19 distribution centers is the backbone of its efficient supply chain, ensuring products reach branches and major customer sites promptly. These strategically located facilities are key to maintaining inventory and fulfilling customer demands across their extensive network.

These centers are vital for ensuring timely product availability, directly impacting customer satisfaction and operational efficiency. They handle a vast volume of goods, supporting the company's ability to serve a diverse customer base across various industries.

- Network Size: Operates 19 strategically located distribution centers.

- Supply Chain Role: Acts as critical hubs for product flow to branches and direct-to-project customers.

- Efficiency Driver: Facilitates timely fulfillment and supports the overall distribution strategy.

- Impact: Crucial for maintaining inventory levels and meeting customer demand across the U.S.

Acquired Business

Ferguson's acquisition strategy significantly bolsters its Channels by integrating the sales and distribution networks of acquired businesses. This approach allows Ferguson to quickly enter new geographic markets and tap into previously unreached customer bases. For instance, their acquisition of Wolseley UK's plumbing and heating business in 2020 provided an immediate expansion of their branch footprint and customer relationships in the United Kingdom.

By absorbing existing branch networks and sales teams, Ferguson inherits established operational infrastructure and local market expertise. This accelerates market penetration and reduces the time and cost associated with organic expansion. In 2023, Ferguson continued this strategy with several smaller acquisitions, further solidifying its presence in key regions and diversifying its channel access.

- Geographic Expansion: Acquisitions provide immediate access to new territories, expanding Ferguson's physical presence.

- Customer Segment Reach: Integrates customer lists and relationships from acquired entities, broadening market penetration.

- Leveraged Infrastructure: Utilizes existing branch networks and distribution centers of acquired companies to enhance efficiency.

- Sales Team Integration: Incorporates experienced sales professionals, bringing established client relationships and market knowledge.

Ferguson effectively utilizes a multi-channel approach, blending its vast physical branch network with robust e-commerce platforms and a dedicated direct sales force. This strategy ensures broad customer reach and caters to diverse purchasing preferences, from in-person consultations to online convenience.

In 2024, Ferguson's digital channels saw continued strong performance, with online sales representing a significant revenue stream. The company's direct sales teams remain vital for cultivating relationships with contractors and facility managers, providing tailored solutions and expert support.

Ferguson's strategic use of acquisitions has consistently expanded its channel capabilities, integrating new branch networks and customer bases. This approach allows for rapid market penetration and enhanced distribution reach.

| Channel Type | Key Features | 2024 Performance Highlight |

|---|---|---|

| Physical Branches | Nearly 1,800 locations; product browsing, expert consultation, local pickup | Continued strong local customer engagement and order fulfillment |

| E-commerce (Ferguson.com, Build.com) | Online ordering, account management, extensive product catalog | Significant growth in online sales, key driver for broad customer acquisition |

| Direct Sales Force/Account Managers | Personalized service, on-site support, customized solutions for contractors/facility managers | Crucial for understanding project demands and generating substantial revenue through expert advice |

| Distribution Centers | 19 strategically located hubs; efficient supply chain, inventory management | Ensured timely product availability, supporting operational efficiency and customer satisfaction |

| Acquisitions | Integration of sales/distribution networks, market expansion | Continued expansion into new regions and customer segments through strategic purchases |

Customer Segments

Residential contractors, encompassing plumbers, HVAC specialists, and general builders focused on new homes, remodels, and repairs, represent a core customer segment. These professionals rely on a consistent and diverse supply of plumbing, heating, and cooling equipment.

In 2024, the U.S. residential construction market saw significant activity, with housing starts projected to reach over 1.4 million units, indicating robust demand for contractor services and materials. This segment values dependable product availability and expert technical assistance to ensure project efficiency and client satisfaction.

Commercial contractors, including large and small builders, mechanical specialists, and fire protection experts, are a key customer segment for Ferguson. These businesses focus on non-residential projects like offices, retail, and industrial sites, often requiring extensive materials for HVAC, plumbing, pipe, valves, and fittings (PVF), and fire protection systems. In 2024, the non-residential construction sector showed resilience, with the U.S. Census Bureau reporting a steady demand for these specialized materials.

Facility managers and institutional customers, encompassing those overseeing multi-family properties, government buildings, hotels, schools, and hospitals, represent a crucial segment. These professionals are tasked with the continuous maintenance, repair, and operational needs of their facilities, requiring a steady stream of supplies and solutions for both routine upkeep and larger renovation projects.

In 2024, the MRO market, a core area for these customers, was projected to reach over $1.2 trillion globally, highlighting the significant demand for the products and services Ferguson provides to this segment. These institutions often operate with strict budgets and require reliable, efficient procurement processes to manage their extensive operational requirements.

Homeowners (via Build.com)

Ferguson, while primarily a B2B supplier, effectively connects with individual homeowners through its Build.com platform. This channel caters to a diverse range of home improvement needs, offering everything from major appliances and lighting to essential plumbing fixtures.

Homeowners utilizing Build.com often prioritize convenience and a broad product selection for their renovation or repair projects. In 2024, the home improvement market continued to show robust activity, with homeowners investing in upgrades. For instance, spending on home renovations and repairs reached significant figures, demonstrating the ongoing demand from this segment.

- Broad Product Selection: Homeowners can access a vast array of products for various home improvement tasks.

- Convenience: Build.com offers a streamlined online shopping experience for homeowners.

- Project Focus: This segment typically undertakes projects ranging from minor upgrades to complete renovations.

- Market Demand: The home improvement sector saw continued strong consumer spending in 2024, indicating consistent demand from homeowners.

Industrial Customers

Industrial customers are a cornerstone for Ferguson, encompassing sectors like manufacturing, energy, and heavy construction. These clients often require highly specialized pipe, valve, and fitting (PVF) solutions, along with a broad range of other essential materials for their extensive capital projects and day-to-day operational demands. Their needs are typically driven by stringent product specifications and the critical importance of a dependable, uninterrupted supply chain.

Ferguson caters to these industrial clients by offering not just products, but also comprehensive project management support and a commitment to reliable delivery. For instance, in 2024, Ferguson's industrial segment likely played a significant role in supporting infrastructure development and energy sector projects, which saw substantial investment. The demand for specialized PVF solutions is directly tied to the health of these large-scale industrial undertakings.

- Specialized PVF Needs: Industrial clients require specific grades and types of pipes, valves, and fittings tailored to unique operating conditions, such as high pressure, extreme temperatures, or corrosive environments.

- Project-Driven Demand: A significant portion of their business is tied to large capital projects, where timely delivery and adherence to precise specifications are paramount for project success.

- Operational Continuity: Ongoing operational needs for maintenance, repair, and expansion also drive consistent demand, emphasizing the importance of reliable inventory and logistics.

- Technical Expertise and Support: These customers often rely on suppliers for technical advice, product selection assistance, and solutions to complex fluid handling challenges.

Ferguson's customer base is diverse, primarily serving professionals in the residential and commercial construction sectors, alongside facility managers and industrial clients. These groups rely on Ferguson for a wide array of plumbing, HVAC, pipe, valve, and fitting (PVF) products, as well as fire protection systems. The company also reaches individual homeowners through its online platform, Build.com, catering to renovation and repair needs.

In 2024, the U.S. housing market projected over 1.4 million housing starts, indicating strong demand for residential contractors. Simultaneously, the non-residential construction sector demonstrated resilience, supporting commercial contractors. Facility managers and industrial clients, crucial for maintenance, repair, and operations (MRO), also represent significant demand drivers, with the global MRO market exceeding $1.2 trillion in 2024.

| Customer Segment | Primary Needs | 2024 Market Context |

|---|---|---|

| Residential Contractors | Plumbing, HVAC equipment, new builds, remodels | Over 1.4 million housing starts projected |

| Commercial Contractors | HVAC, plumbing, PVF, fire protection for non-residential | Steady demand in non-residential construction |

| Facility Managers/Institutions | MRO supplies, maintenance, repair for multi-family, government, etc. | Global MRO market > $1.2 trillion |

| Homeowners (via Build.com) | Appliances, lighting, plumbing fixtures for renovations | Robust home improvement spending |

| Industrial Customers | Specialized PVF, materials for manufacturing, energy, heavy construction | Significant investment in infrastructure and energy projects |

Cost Structure

Cost of Goods Sold (COGS) is the most significant expense for Ferguson, representing the direct costs of acquiring the vast array of plumbing, HVAC, waterworks, and fire protection products they sell. In fiscal year 2023, Ferguson reported a COGS of $20.1 billion, highlighting the sheer volume of goods purchased from their extensive network of suppliers and manufacturers.

Effectively managing these procurement costs is paramount. Ferguson's ability to negotiate favorable terms with suppliers and maintain lean inventory levels directly impacts their profitability. For instance, optimizing their supply chain to reduce lead times and storage expenses can translate into substantial savings on their COGS.

Ferguson's distribution and logistics costs are substantial, driven by its vast network of over 1,900 branches and numerous distribution centers. These expenses encompass warehousing, fleet maintenance, fuel, driver salaries, and sophisticated inventory management systems. For instance, in fiscal year 2023, Ferguson reported significant investments in its supply chain to enhance efficiency and reduce delivery times, a critical factor in managing these operational outlays.

Ferguson's significant personnel and labor costs are a core element of its expense structure. With a workforce of around 35,000 associates, the company dedicates substantial resources to salaries, wages, and comprehensive benefits packages. This includes compensation for its extensive sales teams, the backbone of its customer relationships, as well as the essential branch staff who manage daily operations.

Beyond direct compensation, these costs encompass investments in training and development to ensure its warehouse personnel and technical experts remain proficient. For instance, in fiscal year 2023, Ferguson reported selling, general, and administrative expenses of $6.3 billion, a significant portion of which is attributable to its large employee base and associated labor costs.

Selling, General, and Administrative (SG&A) Expenses

Ferguson's Selling, General, and Administrative (SG&A) expenses are critical to its operational efficiency. These costs encompass a broad range of activities, from direct sales and marketing efforts to the essential administrative functions that keep the business running smoothly. In 2024, a significant portion of SG&A would likely be allocated to supporting their extensive distribution network and customer service operations.

Efficient management of SG&A is paramount for profitability, especially given the competitive landscape of the building materials distribution sector. For instance, in the fiscal year ending July 31, 2023, Ferguson reported SG&A expenses of $3.7 billion. This figure underscores the substantial investment in the infrastructure and personnel required to serve a diverse customer base.

- Sales and Marketing: Costs associated with sales teams, advertising, and promotional activities to reach contractors and trade professionals.

- General and Administrative: Expenses for corporate functions, including finance, human resources, legal, and IT infrastructure.

- Technology Investment: Spending on digital platforms, e-commerce capabilities, and supply chain management systems to enhance efficiency.

- Corporate Overhead: Costs related to executive management, office facilities, and other central support services.

Acquisition and Integration Costs

Ferguson's strategy of growth through bolt-on acquisitions means they actively incur significant costs in identifying, evaluating, and closing deals. These expenses are crucial for expanding their market reach and capabilities. For instance, in fiscal year 2023, Ferguson completed several acquisitions, which involved substantial investment in due diligence and legal fees to ensure smooth integration.

The integration phase itself presents further costs, encompassing the merging of IT systems, operational processes, and staff. These efforts are vital for realizing the full potential of acquired businesses and achieving synergies. While specific integration cost figures for 2024 are still being finalized, the company has historically allocated a notable portion of its capital expenditure to these activities to ensure seamless transitions.

- Due Diligence Fees: Costs incurred for investigating potential acquisition targets.

- Legal and Advisory Costs: Expenses related to legal counsel, investment bankers, and other advisors during the acquisition process.

- Integration Expenses: Costs associated with merging operations, systems, and personnel of acquired companies.

Ferguson's cost structure is heavily influenced by its extensive product offerings and broad distribution network. The primary drivers include the cost of goods sold, logistics, personnel, and sales, general, and administrative expenses.

Managing these costs is crucial for maintaining profitability in the competitive building materials sector. For fiscal year 2023, Ferguson reported Cost of Goods Sold at $20.1 billion and Selling, General, and Administrative expenses at $3.7 billion, underscoring the scale of these operational outlays.

Investments in technology and growth through acquisitions also contribute significantly to their overall cost base, reflecting a strategic approach to market expansion and operational efficiency.

| Expense Category | Fiscal Year 2023 (USD Billions) | Key Components |

|---|---|---|

| Cost of Goods Sold (COGS) | 20.1 | Product procurement from suppliers |

| Selling, General, and Administrative (SG&A) | 3.7 | Sales teams, marketing, corporate overhead, IT |

| Distribution & Logistics | Significant portion of SG&A | Warehousing, fleet, fuel, inventory management |

| Personnel & Labor | Substantial portion of SG&A | Salaries, wages, benefits for ~35,000 associates |

| Acquisition & Integration Costs | Variable, significant investment | Due diligence, legal fees, system merging |

Revenue Streams

Ferguson's primary revenue stream stems from the sale of a vast array of plumbing products. This includes everything from essential pipes and fittings to decorative fixtures and complex plumbing systems.

These products cater to a broad customer base, encompassing both residential and commercial contractors, as well as individual homeowners undertaking renovation projects.

In fiscal year 2023, Ferguson reported significant sales in this category, reflecting strong demand in the construction and home improvement sectors.

Ferguson's sales of HVAC products represent a substantial revenue stream, encompassing equipment, parts, and essential supplies. This segment serves a broad customer base, including contractors and facility managers in both residential and commercial sectors, addressing needs from initial installations to ongoing maintenance and upgrades.

Ferguson generates revenue by selling a wide array of waterworks products crucial for municipal and civil infrastructure development. This includes essential items like piping, alongside products for water, storm, and sewer systems, supporting the backbone of community services.

Further bolstering its revenue, Ferguson also profits from the sale of fire and fabrication materials and related services. This diversification captures a broader segment of the construction and industrial markets, adding to the company's overall income.

Sales from Acquired Businesses

Ferguson's revenue is significantly boosted by integrating businesses it acquires. These strategic additions, often referred to as bolt-on acquisitions, are crucial for expanding market presence and diversifying product portfolios.

These acquisitions directly contribute to Ferguson's top-line growth by bringing in their existing sales and customer bases. For instance, in fiscal year 2023, Ferguson completed several acquisitions that added to its revenue stream.

- Acquisition Impact: Bolt-on acquisitions are a key driver of Ferguson's revenue expansion.

- Market Share Growth: Acquisitions help increase the company's penetration in existing markets and entry into new ones.

- Product Diversification: The acquired businesses often bring complementary products and services, broadening Ferguson's overall offering.

Value-Added Services and Solutions Fees

Ferguson generates significant revenue beyond just selling products by offering a suite of value-added services. These services are designed to support customers throughout their project lifecycle, from initial planning to final execution.

These specialized offerings include expert design and specification assistance, crucial for complex projects. Additionally, their fire protection engineering services provide essential safety compliance and planning. For the fiscal year ending July 31, 2023, Ferguson reported that its services segment contributed meaningfully to its overall financial performance, though specific segment revenue breakdown is not publicly detailed. The company's focus on these solutions enhances customer loyalty and project outcomes.

- Design and Specification Services: Ferguson offers professional assistance in selecting and detailing the right products for specific project needs, ensuring optimal performance and compliance.

- Fire Protection Engineering: This specialized service provides expertise in designing and implementing fire suppression and detection systems, a critical component for many construction projects.

- Other Specialized Solutions: Ferguson also provides a range of other tailored services, such as project management support and technical consulting, to address unique customer challenges and improve project efficiency.

Ferguson's revenue streams are robust, driven by the sale of essential products across multiple categories. The company's core business involves distributing plumbing, HVAC, and waterworks products, serving a diverse customer base from contractors to homeowners.

In addition to product sales, Ferguson generates income through value-added services like design assistance and fire protection engineering, enhancing project outcomes and customer relationships. Strategic acquisitions also play a significant role, expanding market reach and product offerings, as seen in their fiscal year 2023 growth initiatives.

| Revenue Stream | Description | Fiscal Year 2023 Highlight |

|---|---|---|

| Plumbing Products | Sale of pipes, fittings, fixtures, and systems for residential and commercial use. | Strong demand in construction and home improvement sectors. |

| HVAC Products | Distribution of equipment, parts, and supplies for heating, ventilation, and air conditioning. | Caters to contractors and facility managers for installation and maintenance. |

| Waterworks Products | Supply of piping and systems for municipal infrastructure, water, storm, and sewer applications. | Supports critical community service development. |

| Fire and Fabrication | Sales of materials and related services for fire protection and industrial markets. | Broadens reach into construction and industrial sectors. |

| Value-Added Services | Design, specification, and engineering support for projects. | Contributed meaningfully to overall financial performance. |

| Acquisitions | Revenue generated from integrated businesses and expanded market presence. | Key driver of top-line growth and diversification. |

Business Model Canvas Data Sources

The Ferguson Business Model Canvas is built using a combination of internal financial data, extensive market research, and competitive analysis. These diverse data sources ensure each component of the canvas is grounded in factual information and strategic understanding.