Ferguson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferguson Bundle

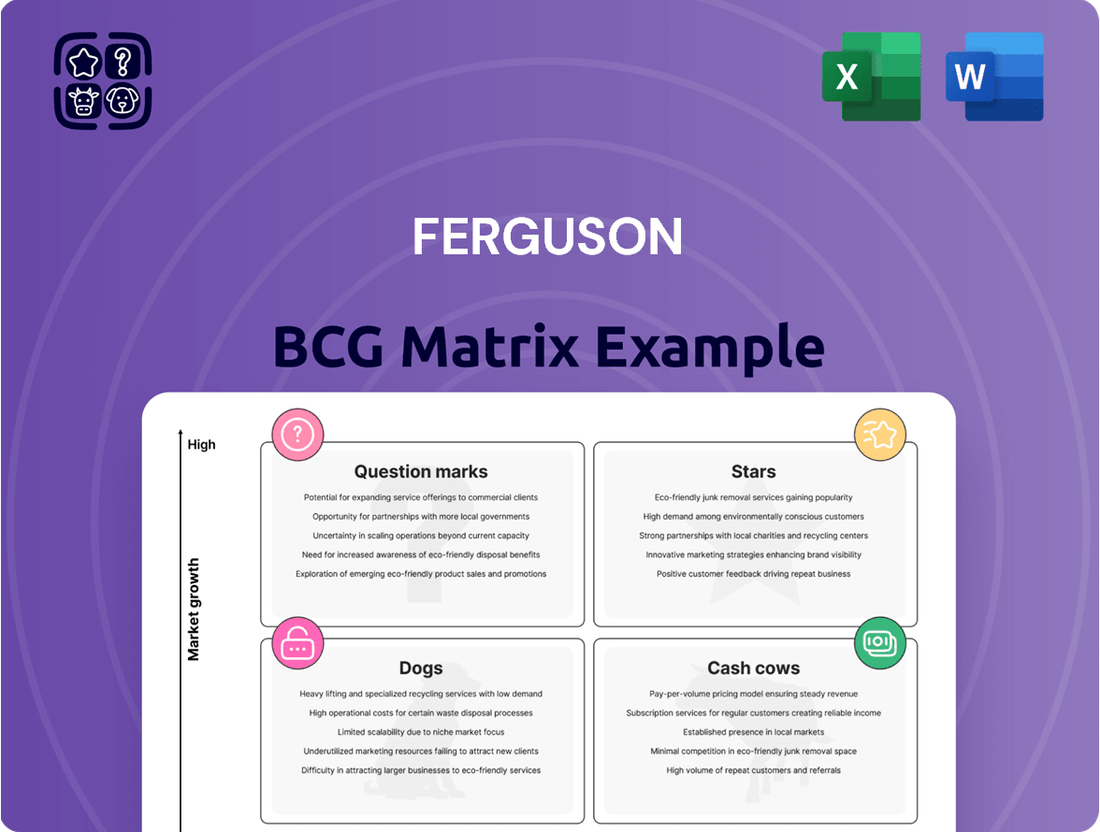

The Boston Consulting Group (BCG) Matrix is a powerful business tool that helps companies analyze their product portfolio based on market growth and relative market share. Understanding whether your products are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making and resource allocation.

This preview offers a glimpse into how your company's products might be categorized within this framework. To unlock the full strategic advantage, purchase the complete BCG Matrix report. It provides detailed quadrant placements, data-driven insights, and actionable recommendations to optimize your product strategy and drive profitable growth.

Stars

Ferguson's HVAC distribution business is a significant player in the North American market, a sector valued at approximately $70 billion. This segment is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) between 4.10% and 5.6% extending to 2034.

With a 5% market share, Ferguson holds a leading position in a highly fragmented industry that includes over 10,000 competitors. This strong standing allows them to effectively navigate and capitalize on market opportunities.

The company is actively pursuing strategic investments and acquisitions within the HVAC sector. These initiatives are designed to accelerate revenue growth and expand their market share, further solidifying their competitive advantage.

Ferguson is a dominant force in the Waterworks sector, commanding a significant 21% of the $28 billion market. This strong position is bolstered by consistent demand from public works and infrastructure development, projecting healthy growth.

The company's strategic engagement in major capital projects is a key driver for its ongoing expansion and potential for enhanced profitability within this diverse segment.

Ferguson's Fire & Fabrication Services are a strong performer, holding a 24% market share in a $4 billion industry. This positions them as a leader in a specialized and expanding segment of the market.

The company is actively investing in growth, evident in its strategic acquisitions and recent expansion into Canada. These moves bolster Ferguson's presence and capabilities within the fire protection sector.

This strategic focus enables Ferguson to enhance its design and engineering services, further solidifying its competitive edge in the fire protection and fabrication market.

Commercial/Mechanical Solutions

Ferguson's Commercial/Mechanical Solutions segment is a significant contributor, holding a strong 21% market share within the substantial $18 billion commercial/mechanical market. This segment benefits from the inherent stability of non-residential end markets, which have demonstrated more resilience than their residential counterparts.

Recent strategic moves, including the acquisition of Independent Pipe & Supply, have bolstered Ferguson's position in commercial plumbing and mechanical contracting across vital geographic areas.

- Market Leadership: Ferguson commands a 21% share of the $18 billion Commercial/Mechanical market.

- Market Resilience: Non-residential sectors offer a stable base, outperforming residential markets.

- Strategic Growth: Acquisitions like Independent Pipe & Supply enhance its commercial footprint.

Residential Trade Plumbing

Residential Trade Plumbing represents a significant segment within Ferguson's portfolio, holding a strong position as the second-largest player with a 17% market share in a $34 billion industry. This market is poised for robust expansion, with projections indicating the North American plumbing components sector will approach $60 billion by 2033.

Ferguson's strategic advantage lies in its capacity to cater to both plumbing and HVAC professionals. This dual-trade service capability positions the company favorably within this growing market.

- Market Share: 17% in the $34 billion Residential Trade Plumbing market.

- Industry Growth: North American plumbing components market projected to reach nearly $60 billion by 2033.

- Competitive Edge: Ability to serve dual-trade plumbing and HVAC professionals.

Stars in the Ferguson BCG Matrix represent business units with high market share in high-growth industries. These are the growth engines of the company, requiring significant investment to maintain their leading positions and capitalize on future opportunities. Their success is crucial for overall portfolio expansion and future profitability. Ferguson's HVAC distribution and Waterworks segments, with their strong market shares and projected growth, exemplify characteristics of Stars.

| Business Segment | Market Share | Market Size | Projected Growth | Star Potential |

|---|---|---|---|---|

| HVAC Distribution | 5% | ~$70 billion | 4.10%-5.6% CAGR (to 2034) | High |

| Waterworks | 21% | $28 billion | Healthy Growth | High |

| Fire & Fabrication | 24% | $4 billion | Expanding Segment | Moderate to High |

| Commercial/Mechanical | 21% | $18 billion | Stable (Non-Residential) | Moderate |

| Residential Trade Plumbing | 17% | $34 billion | Approaching $60 billion by 2033 (Plumbing Components) | Moderate to High |

What is included in the product

The Ferguson BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Visualize your portfolio's strategic positioning to identify areas needing investment or divestment, easing the burden of resource allocation.

Cash Cows

Ferguson's established plumbing and heating distribution business operates as a classic Cash Cow within the BCG Matrix. This segment, a cornerstone of the company's operations, consistently delivers robust cash flows due to its mature market position and high market share.

Over many years, Ferguson has cultivated dominant positions in plumbing and heating distribution, catering to a diverse clientele involved in both new construction projects and the repair, maintenance, and improvement (RMI) sector. This deep market penetration ensures a steady revenue stream.

For instance, in fiscal year 2024, Ferguson reported strong performance in its Building Services segment, which encompasses plumbing and heating, contributing significantly to its overall profitability. This foundational business is crucial for funding the company's strategic investments in other areas.

The Repair, Maintenance, and Improvement (RMI) segment is a cornerstone of Ferguson's business, representing a substantial 60% of its U.S. revenue in 2023. This market is known for its stability and offers better profit margins than the more volatile new construction sector.

Despite a modest uptick in R&R spending during 2024, the RMI segment's enduring growth potential and less cyclical nature solidify its role as a dependable source of cash for Ferguson. The company's robust standing in this area ensures a steady income flow.

Ferguson's extensive supply chain, boasting 14 distribution centers and close to 1,700 branches, underpins its status as a cash cow. This mature infrastructure facilitates next-day delivery, a key differentiator that translates into significant cost advantages and operational efficiencies, directly fueling consistent cash generation.

Industrial PVF Distribution

Ferguson's Industrial PVF Distribution segment is a significant contributor, holding a strong second position in the substantial $31 billion market. This segment caters to industrial clients, supplying critical pipe, valve, and fitting products essential for their operations. The nature of these products often leads to long-term customer relationships and consistent demand driven by ongoing maintenance requirements, solidifying its role as a cash cow.

This established market presence and the recurring nature of demand for industrial PVF products translate into predictable and stable revenue streams for Ferguson. These characteristics are hallmarks of a cash cow, generating consistent cash flow that can be reinvested in other areas of the business or returned to shareholders. For instance, in 2023, Ferguson reported that its Industrial segment, which heavily features PVF, generated substantial revenue, underscoring its importance.

- Market Position: Ferguson is the second-largest player in the $31 billion Industrial PVF market.

- Customer Base: Serves industrial customers with essential products and solutions.

- Demand Drivers: Benefits from long-term relationships and recurring maintenance needs.

- Financial Contribution: Provides stable revenue and consistent cash flow, characteristic of a cash cow.

Core Branch Network Operations

Ferguson's core branch network operations represent a significant cash cow for the company. With around 2,194 branches spread across North America, this extensive physical footprint is fundamental to its business strategy. These locations are hubs for counter sales, nurturing customer relationships, and enabling efficient local product delivery, all contributing to a consistent and dependable revenue flow.

The operational effectiveness of this vast network translates into stable profitability and robust cash generation. In fiscal year 2023, Ferguson reported strong performance, with its diversified business segments contributing to overall financial health. The branch network, in particular, benefits from established processes that ensure reliable margins and a steady influx of cash, supporting ongoing investments and shareholder returns.

- Extensive Network: Approximately 2,194 branches across North America.

- Revenue Generation: Facilitates counter sales, customer relationships, and local fulfillment.

- Profitability: Established operational efficiency ensures consistent profitability.

- Cash Flow: Strong cash generation from reliable revenue streams.

Ferguson's established businesses, particularly in plumbing and heating distribution and industrial PVF, function as strong cash cows. These mature segments benefit from high market share and consistent demand, generating reliable cash flows that fuel company growth and investments.

The Repair, Maintenance, and Improvement (RMI) sector, representing a significant 60% of U.S. revenue in 2023, is a key driver of this stability. Its less cyclical nature, compared to new construction, ensures a predictable income stream.

Ferguson's vast operational infrastructure, including 14 distribution centers and nearly 1,700 branches, further solidifies its cash cow status by enabling cost efficiencies and reliable service, directly contributing to consistent cash generation.

| Business Segment | Market Position | Key Characteristics | Fiscal Year 2023/2024 Impact |

|---|---|---|---|

| Plumbing & Heating Distribution | Dominant | Mature market, high market share, caters to RMI and new construction | Significant contributor to overall profitability; RMI segment shows enduring growth potential |

| Industrial PVF Distribution | Second largest ($31B market) | Long-term customer relationships, recurring maintenance demand | Provides stable revenue and consistent cash flow |

| Branch Network Operations | Extensive (approx. 2,194 branches) | Facilitates counter sales, customer relationships, local delivery | Ensures reliable margins and steady cash influx |

What You’re Viewing Is Included

Ferguson BCG Matrix

The Ferguson BCG Matrix you're previewing is the identical, fully formatted document you'll receive immediately after purchase. This means you're seeing the complete, analysis-ready report, devoid of any watermarks or placeholder content. It's designed for immediate application in your strategic planning, offering clear insights into your product portfolio's market position and growth potential.

Dogs

Within Ferguson's extensive product offerings, some legacy product lines, characterized by low market growth and a small market share, may be considered Dogs. These products often represent a drain on capital, tying up inventory and resources without yielding substantial profits. For instance, if a particular plumbing fixture line saw a market growth rate of only 1% in 2024 and held a mere 0.5% market share, it would likely fall into this category.

The presence of these underperforming lines can hinder overall company performance by diverting attention and capital away from more dynamic and profitable segments. Ferguson's strategic focus in 2024 has been on expanding its digital capabilities and high-demand product categories, making these older, less relevant items a clear mismatch with the company's forward-looking strategy.

Identifying and potentially divesting these Dog products is a crucial step in optimizing Ferguson's resource allocation. By shedding these low-return assets, Ferguson can free up valuable capital and management focus to invest in areas with higher growth potential, such as smart home technology or sustainable building materials, which are projected to see significantly higher market expansion in the coming years.

While Ferguson boasts a robust presence across North America, certain specific geographic markets can present challenges. These areas might be characterized by sustained sluggish growth or highly competitive landscapes, resulting in a diminished market share for Ferguson.

Continuing operations in these underperforming regions without a clear competitive edge can indeed become a significant drain on the company's valuable resources. Ferguson actively monitors its operational footprint to ensure resources are strategically allocated where they can yield the best returns.

For instance, in 2023, while overall North American sales grew, Ferguson identified specific smaller metropolitan areas where market growth was less than 1% and competitive intensity led to market share below 15%, prompting a review of its strategic focus in those locales.

In the distribution sector, basic, undifferentiated products often become highly commoditized. This intense price competition squeezes profit margins, making it challenging to generate significant returns. For Ferguson, if their market share in these commodity categories is low, it could lead to minimal cash generation or even negative returns on investment.

For instance, in 2024, the plumbing supply industry, a key area for distributors like Ferguson, saw continued pressure on basic pipe and fitting sales due to oversupply in some segments. Companies with less efficient supply chains or lower purchasing power struggled to maintain profitability in these areas.

Ferguson’s strategy likely involves focusing on value-added services and specialized product lines to escape the commoditization trap. By offering expertise, custom solutions, or integrated services, they can differentiate themselves from pure commodity players and achieve healthier margins.

Inefficient Inventory Categories

Even with advanced supply chain management, some inventory categories can become slow-moving or obsolete, increasing holding costs and hurting profits. These are essentially cash traps, with money stuck in products that aren't selling well and have little market presence.

For instance, in 2024, many retailers experienced significant write-downs on excess seasonal inventory, with some reporting up to 15% of their inventory value tied up in such categories. This highlights the financial drag of inefficient stock.

- Slow-Moving Stock: Products that haven't sold for an extended period, often due to changing consumer preferences or overstocking.

- Obsolete Stock: Inventory that is no longer usable or saleable, such as outdated technology or expired goods.

- Carrying Costs: Expenses associated with holding inventory, including warehousing, insurance, and potential obsolescence.

- Profitability Impact: Ties up capital that could be invested elsewhere, reducing overall return on investment.

Non-Strategic, Unprofitable Small Ventures

These are the Dogs in the Ferguson BCG Matrix. Think of them as small side projects a large company might be experimenting with. They aren't really contributing much to the main business and aren't growing much either. For example, a major tech company might launch a niche app that doesn't catch on. In 2024, many large corporations are actively divesting or shutting down such underperforming units to streamline operations and focus resources on core, high-growth areas.

These ventures typically have a low market share and operate in markets that are not expanding rapidly. They often consume resources without generating significant returns. Companies like Ferguson, known for strategic growth, would generally avoid acquiring businesses that fit this profile unless there's a clear, albeit perhaps nascent, path to revitalization or integration into a larger, more promising strategy.

- Low Market Share

- Low Market Growth

- Lack of Profitability

- Potential for Divestment

Dogs in the Ferguson BCG Matrix represent products or business units with low market share in slow-growing industries. These segments often consume resources without generating substantial profits, acting as a drag on overall performance. For instance, a legacy product line with a 2024 market growth rate of 1% and a 0.5% market share would exemplify a Dog.

Ferguson's strategic focus in 2024 on high-demand categories like smart home technology means these underperforming assets are a strategic mismatch. Divesting these low-return items allows for capital reallocation to more promising growth areas, improving resource efficiency.

In 2023, Ferguson identified specific smaller markets with sub-1% growth and below 15% market share, prompting strategic reviews. This aligns with the need to shed underperforming assets to optimize capital and focus on higher-potential segments.

The commoditization of basic products in the plumbing supply sector, a key area for Ferguson, presents challenges. In 2024, oversupply in basic pipe and fitting sales put pressure on margins, especially for those with less efficient supply chains.

| Category | Market Share (Example) | Market Growth (Example) | Profitability | Strategic Implication |

| Dog Product Line | 0.5% | 1% | Low/Negative | Divestment/Rationalization |

| Commoditized Goods | 5% | 2% | Slim | Focus on Value-Added Services |

| Underperforming Region | 10% | 0.8% | Marginal | Resource Reallocation |

Question Marks

Ferguson's residential digital commerce, operating within a substantial $27 billion market, currently represents a smaller, yet developing, portion of their business. Despite the market's growth, this segment holds a modest 9% market share.

The segment faced a notable challenge in Q1 FY2024, with sales declining by 14%. This performance underscores the high-growth potential of the residential digital commerce space, but also highlights Ferguson's current position as a player needing to significantly increase its market penetration.

The company's strategic initiative, the Build.com platform, is designed to be a leading digital offering. However, achieving widespread adoption and scaling this platform effectively will demand ongoing, focused investment and strategic execution to compete and grow within this dynamic market.

The market for smart plumbing and energy-efficient HVAC systems is booming, with a projected global market size of $11.2 billion in 2024, expected to reach $25.8 billion by 2030. Ferguson is actively participating in this growth, offering a range of sustainable solutions to meet rising consumer demand and regulatory pressures. However, establishing significant market share in these innovative, tech-driven segments requires ongoing investment in product development and customer education.

Ferguson's strategy involves acquiring smaller companies, often referred to as bolt-on acquisitions. In fiscal year 2024, they completed 8 such deals, with more in early fiscal year 2025, indicating an active pursuit of this growth tactic. These acquisitions are strategically placed in markets with growth potential, aiming to broaden Ferguson's footprint and service offerings.

During their early integration phase, these bolt-on acquisitions typically require significant capital investment. They are cash consumers as Ferguson works to align operations, systems, and branding, ultimately aiming to boost market share within the larger company structure.

Emerging Service Offerings

Ferguson is actively broadening its service portfolio, notably through strategic acquisitions such as GAR Engineering, which bolsters its specialized engineering and design capabilities. These enhanced offerings align with increasing demand across various construction phases, though their current contribution to Ferguson’s overall market share may be modest as they are still in the growth phase.

The company's commitment to investing in these emerging services is pivotal for capturing significant market presence and cultivating them into future high-growth 'Stars' within the BCG framework. For instance, Ferguson's 2024 fiscal year saw a notable increase in revenue from its specialty businesses, indicating positive early traction.

- Specialized Engineering and Design: Acquisitions like GAR Engineering are key to expanding these high-demand services.

- Growing Market Demand: These services are increasingly sought after throughout the construction project lifecycle.

- Investment for Future Growth: Significant capital allocation is required to scale these offerings and establish market leadership.

- Potential for 'Stars': Successful scaling of these emerging services can transition them into high-growth, high-market-share 'Stars'.

Expansion into New Niche Applications

Ferguson's strategic expansion into niche applications, such as erosion control and stormwater management, is a key element of its diversification strategy. These new ventures, exemplified by the acquisition of Southwest Geo-Solutions, tap into high-growth segments where Ferguson's initial market presence is minimal.

These niche areas, while currently representing a small market share for Ferguson, offer significant potential for future growth. For instance, the global erosion control market was valued at approximately USD 2.1 billion in 2023 and is projected to grow, indicating fertile ground for such diversification.

Successful development in these areas will necessitate strategic investment and focused execution. The goal is to transform these nascent ventures into substantial contributors to Ferguson's overall business portfolio.

- Niche Application Growth: Ferguson is targeting high-growth niche applications like erosion control and stormwater management.

- Acquisition Strategy: The acquisition of Southwest Geo-Solutions is a prime example of this diversification approach.

- Market Opportunity: These ventures enter growing segments where Ferguson's current market share is small, presenting a significant upside.

- Strategic Investment: Success hinges on dedicated investment and focused development to build market presence and contribution.

Question Marks in Ferguson's portfolio represent emerging business areas with high growth potential but currently low market share.

These segments, like specialized engineering and niche applications such as erosion control, require significant investment to scale and capture market opportunity.

Ferguson's strategy of bolt-on acquisitions, as seen with GAR Engineering and Southwest Geo-Solutions, aims to build presence in these promising, yet underdeveloped, markets.

The success of these ventures hinges on strategic capital allocation and focused execution to transform them into future market leaders.

| Business Segment | Market Growth Potential | Ferguson Market Share | Investment Required | Strategic Focus |

|---|---|---|---|---|

| Residential Digital Commerce | High | Low (9%) | High | Platform development (Build.com) |

| Smart Plumbing/HVAC | Very High ($11.2B in 2024) | Low | High | Product development, customer education |

| Specialized Engineering/Design | High | Modest | High | Acquisitions (GAR Engineering), service expansion |

| Niche Applications (Erosion Control) | High (USD 2.1B in 2023) | Minimal | High | Acquisitions (Southwest Geo-Solutions), focused execution |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial statements, industry growth forecasts, and competitor analysis to provide a clear strategic roadmap.