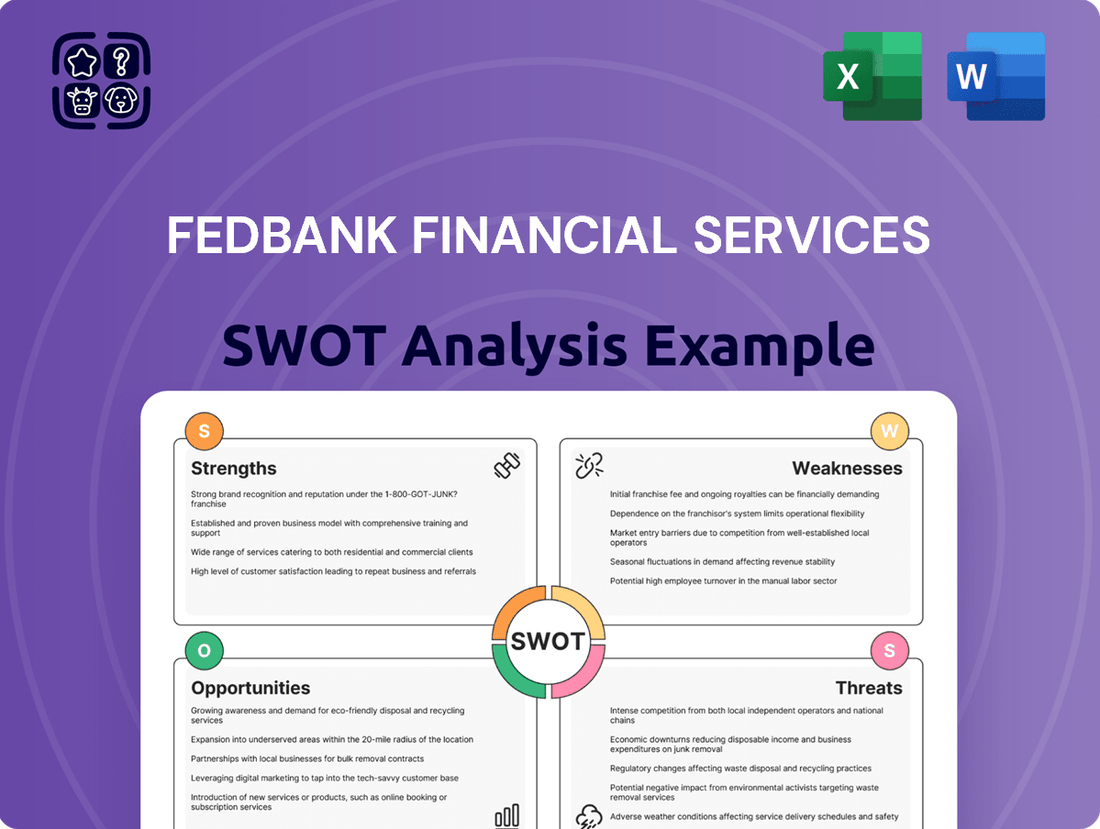

Fedbank Financial Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fedbank Financial Services Bundle

Fedbank Financial Services boasts strong brand recognition and a loyal customer base, but faces intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Fedbank Financial Services' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fedbank Financial Services benefits significantly from its primary shareholder, Federal Bank, which held a 61.7% stake post-IPO in late 2023. This substantial ownership underscores Federal Bank's ongoing commitment and strategic interest in Fedfina. This strong linkage provides crucial financial, managerial, and operational support, bolstering Fedfina's stability and its capacity to secure funding at favorable rates.

Fedbank Financial Services boasts a robust and diversified product portfolio. This breadth includes essential financial offerings such as gold loans, home loans, loans against property (LAP), and business loans, effectively reaching a wide array of customers.

This diversification is a significant strength, as evidenced by its Assets Under Management (AUM) as of June 2024. The AUM breakdown shows a balanced distribution: gold loans comprised 34.59%, medium-ticket LAP accounted for 24.47%, and small-ticket LAP represented 18.96%. Further contributing to this mix were unsecured business loans at 14.15% and home loans at 6.49%.

Fedbank Financial Services has demonstrated exceptional expansion in its Assets Under Management (AUM). From FY18 to March 31, 2024, the AUM grew at a remarkable compounded annual growth rate of 42.95%, reaching ₹12,191.88 crore.

This upward trajectory continued, with AUM climbing to ₹13,188.07 crore by June 30, 2024, and is projected to reach ₹15,697 crore by Q1 FY26. This robust growth is a direct result of strong performance and healthy demand across its various loan products.

Comfortable Capitalization Profile

Fedbank Financial Services boasts a robust capital position, underscored by a comfortable Capital Adequacy Ratio (CAR). This strength is further solidified by consistent capital injections, notably the ₹600 crore raised through its Initial Public Offering (IPO) in November 2023.

The company's financial flexibility is enhanced by significant backing from promoters Federal Bank and True North. This infusion of capital, coupled with an improving gearing ratio of 3.83x as of March 2024, directly supports its ambitious growth objectives and ensures a stable financial foundation.

- Comfortable Capital Adequacy Ratio (CAR)

- ₹600 crore raised via IPO in November 2023

- Consistent capital infusions from Federal Bank and True North

- Gearing improved to 3.83x as of March 2024, supporting growth

Improving Asset Quality

Fedbank Financial Services has shown a positive trend in its asset quality. As of March 31, 2024, the company reported a Gross Non-Performing Asset (GNPA) ratio of 1.66% and a Net Non-Performing Asset (NNPA) ratio of 1.33%.

While there was a minor uptick in these figures by June 2024, attributed to slippages in specific business areas, the overall trajectory indicates a commitment to robust asset management. The company is actively reinforcing its lending policies and prioritizing secured lending practices to further enhance asset quality.

- Improved GNPA: 1.66% as of March 31, 2024.

- Improved NNPA: 1.33% as of March 31, 2024.

- Focus Areas: Strengthening policies and emphasizing secured lending.

Fedbank Financial Services benefits from a strong parentage with Federal Bank holding a significant stake, providing crucial financial and operational support. Its diversified product suite, including gold loans, home loans, and business loans, caters to a broad customer base.

The company has achieved impressive AUM growth, compounding at 42.95% from FY18 to March 2024, reaching ₹12,191.88 crore and further to ₹13,188.07 crore by June 2024. This growth is supported by a robust capital position, evidenced by a comfortable CAR and ₹600 crore raised via its November 2023 IPO, enhancing financial flexibility.

Fedfina also demonstrates a commitment to asset quality, with GNPA at 1.66% and NNPA at 1.33% as of March 2024, and is actively strengthening lending policies, particularly in secured lending.

| Metric | Value (as of March 31, 2024) | Value (as of June 30, 2024) |

|---|---|---|

| Assets Under Management (AUM) | ₹12,191.88 crore | ₹13,188.07 crore |

| Gross Non-Performing Asset (GNPA) Ratio | 1.66% | N/A (minor uptick reported) |

| Net Non-Performing Asset (NNPA) Ratio | 1.33% | N/A (minor uptick reported) |

| Capital Adequacy Ratio (CAR) | Comfortable | Comfortable |

What is included in the product

Delivers a strategic overview of Fedbank Financial Services’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap by identifying key opportunities and threats for Fedbank Financial Services, enabling proactive strategic adjustments.

Weaknesses

Fedbank Financial Services' non-gold loan segments, while growing, exhibit limited portfolio seasoning. This is particularly true for longer-term products such as small-ticket Loan Against Property (LAP), housing finance, and business loans.

The lack of seasoning means these portfolios haven't yet navigated a full credit cycle. For instance, as of March 31, 2024, while the overall loan book grew to ₹10,330 crore, the longer-tenured segments are still relatively new, making their long-term asset quality performance a key area to monitor.

While Fedbank Financial Services boasts comfortable capitalization following its Initial Public Offering (IPO), its moderate leverage necessitates ongoing vigilance. This means the company will likely need to raise additional capital periodically to fuel its aggressive expansion strategies, a key factor to watch for continued financial health.

While Fedbank Financial Services boasts a presence in 18 states and union territories, its assets under management (AUM) show a notable concentration. As of March 31, 2024, Maharashtra, Karnataka, and Tamil Nadu collectively held 52.2% of the company's total AUM. This level of geographical concentration presents a potential risk, as performance in these key regions significantly impacts overall results.

Increased Credit Costs Impacting Profitability

Fedbank Financial Services is experiencing heightened credit costs, directly affecting its bottom line. Recent trends show a rise in loan delinquencies, particularly within business loans, housing loans, and smaller loan against property (LAP) products. This uptick in defaults necessitates increased provisioning for bad debts, thereby escalating overall credit expenses.

The consequence of these rising credit costs is a tangible impact on profitability. For instance, the company's return on managed assets (RoMA) saw a decline in the nine-month period of fiscal year 2025. This downward trend in RoMA underscores the pressure that increased delinquencies and subsequent provisioning are placing on Fedbank's financial performance.

- Rising Delinquencies: An observed increase in overdue payments across key loan segments, including business, housing, and small LAP.

- Increased Provisioning: Higher credit costs due to the need for greater provisions against potential loan losses.

- Profitability Squeeze: A direct negative impact on net income and key profitability metrics like RoMA.

- FY2025 Impact: A notable decline in the return on managed assets (RoMA) during the first nine months of fiscal year 2025.

Competition in Gold Loan Segment

The gold loan sector, a cornerstone of Fedbank Financial Services' (Fedfina) assets under management (AUM), is experiencing intensified competition. This heightened rivalry is driving down interest rates, impacting profitability within this segment. For instance, as of Q3 FY24, gold loans constituted approximately 50% of Fedfina's total AUM, highlighting its significance and the pressure from competitors.

Fedfina has outlined a strategic intent to decrease its reliance on gold loans, aiming to reduce this segment's share of AUM to around 25% within the next three to four years. This pivot necessitates a carefully managed transition. The company's success in this endeavor hinges on its ability to effectively penetrate and grow in higher-yielding business areas.

- Intensifying Competition: The gold loan market is becoming more crowded, leading to pressure on interest margins.

- Strategic De-risking: Fedfina plans to lower its gold loan exposure from roughly 50% of AUM to 25% over 3-4 years.

- Growth Imperative: Successful execution of this strategy requires robust growth in other, potentially higher-yielding, business segments.

Fedbank Financial Services' newer loan segments, like small-ticket Loan Against Property (LAP) and housing finance, lack sufficient history to assess long-term performance. This means their behavior through a full economic cycle is still unknown.

The company's moderate leverage, despite comfortable capitalization post-IPO, suggests a recurring need for capital to fund growth. This could dilute existing shareholders or increase borrowing costs.

A significant portion of Fedbank's Assets Under Management (AUM) is concentrated in just three states: Maharashtra, Karnataka, and Tamil Nadu, which accounted for 52.2% of total AUM as of March 31, 2024. This geographic concentration exposes the company to regional economic downturns.

Fedbank is facing increased credit costs, evidenced by rising delinquencies in business loans, housing loans, and small LAP products. This has led to higher provisioning needs, impacting profitability as seen in the decline of its return on managed assets (RoMA) during the first nine months of fiscal year 2025.

Preview Before You Purchase

Fedbank Financial Services SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a comprehensive look at Fedbank Financial Services' Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll gain access to the complete, detailed analysis, enabling informed strategic decisions.

Opportunities

Fedbank Financial Services is well-positioned to tap into India's under-penetrated rural and semi-urban markets, areas where financial services adoption is still growing. Its established branch network provides a crucial advantage in reaching these demographics.

The company's strategy to focus on emerging middle and lower-middle-income families directly addresses a large, underserved segment. This segment represents a significant opportunity for growth in secured lending products, as these families increasingly seek financial solutions.

With over 60% of India's population residing in rural areas, the potential customer base is immense. For instance, as of March 2024, the overall credit penetration in India, while improving, still shows significant room for expansion, particularly outside major metropolitan centers.

Fedbank Financial Services has a significant opportunity to bolster its profitability by shifting its asset mix towards higher-yielding secured assets. The company is strategically planning to decrease its reliance on the highly competitive gold loan market, which often faces margin pressures.

This pivot creates a clear path to enhance net interest margins. By increasing its exposure to products like small-ticket Loan Against Property (LAP), Fedbank can tap into segments offering more attractive yields, thereby improving overall financial performance.

Fedbank Financial Services can significantly boost its performance by embracing digital transformation. For instance, by implementing advanced digital platforms, the company can streamline loan processing, which in 2024 saw many financial institutions reduce processing times by up to 30% through automation.

This digital deepening allows for enhanced customer acquisition and service delivery, potentially reaching a broader market. In 2025, fintech solutions are projected to drive a 15% increase in customer onboarding efficiency for financial service providers who adopt them.

Furthermore, leveraging technology can lead to substantial cost reductions, particularly in areas like customer onboarding and ongoing service. By automating routine tasks, Fedbank Financial Services could see operational costs decrease by an estimated 10-20% in the coming year.

Growth in MSME Lending and Co-lending Models

Fedbank Financial Services is strategically positioned to capitalize on the burgeoning MSME lending market, a key component of its diversified growth strategy. This segment presents a substantial opportunity for expansion and increased market share.

Furthermore, the company can enhance its capital efficiency and broaden its customer base through expanded co-lending arrangements with banks. These partnerships are particularly promising in the Loan Against Property (LAP) and gold loan sectors, allowing Fedbank to leverage partner capital and reach.

- MSME Lending Focus: Targeting the rapidly growing MSME sector for loan origination.

- Co-lending Partnerships: Collaborating with banks to share risk and expand lending capacity, especially in LAP and gold loans.

- Capital Optimization: Utilizing co-lending to improve return on equity and manage capital more effectively.

- Market Reach Expansion: Gaining access to new customer segments and geographies through banking partnerships.

Support from Favorable Economic Outlook in India

India's economy is anticipated to maintain its position as a global growth leader, with the retail credit sector showing robust expansion. This positive economic backdrop, coupled with sustained demand for essential assets such as housing and vehicles, creates an advantageous environment for Fedbank Financial Services' ongoing development.

For instance, India's GDP growth is projected to be around 6.5% for the fiscal year 2024-25, according to various economic forecasts. This growth underpins the increasing purchasing power and credit appetite of consumers.

- Strong GDP Growth: India's economy is expected to grow at a pace significantly higher than the global average in 2024-25, fostering a supportive environment for financial services.

- Retail Credit Expansion: The demand for retail credit, particularly for housing and auto loans, is projected to remain strong, directly benefiting companies like Fedbank Financial Services that cater to these segments.

- Favorable Market Conditions: The confluence of economic expansion and credit demand presents a conducive market for Fedfina to capitalize on opportunities and enhance its market position.

Fedbank Financial Services has a significant opportunity to expand its reach into India's under-penetrated rural and semi-urban markets, leveraging its existing branch network. The company can also capitalize on the growing demand from emerging middle and lower-middle-income families for secured lending products.

Embracing digital transformation presents a clear path to enhance customer acquisition, streamline loan processing, and reduce operational costs. By shifting its asset mix towards higher-yielding secured assets like small-ticket Loan Against Property (LAP), Fedbank can improve its net interest margins.

Targeting the burgeoning MSME lending market and expanding co-lending arrangements with banks will further boost capital efficiency and broaden the customer base. India's strong economic growth, projected at around 6.5% for 2024-25, provides a favorable backdrop for the retail credit sector's expansion.

| Opportunity Area | Target Segment | Key Benefit | Data Point (2024-25 Projection) |

|---|---|---|---|

| Market Penetration | Rural & Semi-Urban India | Access to large, underserved customer base | Over 60% of India's population resides in rural areas. |

| Product Diversification | Emerging Middle/Lower-Middle Income | Growth in secured lending products | Increasing demand for housing and vehicle loans. |

| Digitalization | All Customer Segments | Improved efficiency, cost reduction | Fintech solutions projected to increase customer onboarding efficiency by 15%. |

| Asset Mix Shift | LAP & Higher-Yielding Assets | Enhanced Net Interest Margins | Strategic pivot away from competitive gold loan market. |

| Strategic Partnerships | MSMEs & Banks | Capital efficiency, expanded reach | India's GDP growth of ~6.5% supports credit expansion. |

Threats

The Indian Non-Banking Financial Company (NBFC) sector is a crowded marketplace, with many entities offering very similar financial products and services. This high level of competition puts pressure on interest rates and profit margins, forcing companies like Fedbank Financial Services to constantly innovate to maintain their market share.

In 2023, the NBFC sector in India saw significant growth, with assets under management reaching an estimated INR 39.7 trillion, according to reports from the Reserve Bank of India and various financial analysts. This expansion, while positive, also signals an intensifying battle for customers and capital, with new entrants and existing players alike vying for dominance.

Fedbank Financial Services must therefore focus on differentiating its product portfolio and customer service to stand out. The ability to offer unique lending solutions or superior digital experiences will be crucial for retaining and attracting clients in this dynamic and competitive environment.

The Reserve Bank of India (RBI) frequently updates regulations affecting Non-Banking Financial Companies (NBFCs), including adjustments to risk weights on consumer loans and external benchmarking of lending rates. These evolving rules can directly influence Fedbank Financial Services' operational agility, its need for capital, and ultimately, its bottom line.

While Fedbank Financial Services has seen improvements in its asset quality, a key threat lies in the potential deterioration of its customer base's creditworthiness. This is especially true for its less established non-gold loan segments.

A downturn in the economic standing of these borrowers could translate into a rise in non-performing assets (NPAs). For instance, if economic conditions worsen, leading to job losses or reduced income for these segments, the likelihood of loan defaults increases significantly.

Such an increase in NPAs would directly impact Fedbank's profitability through higher credit costs. For example, if NPAs were to rise by 1% in its non-gold portfolio, it could necessitate a substantial increase in provisioning, eating into the company's net profit margins.

Interest Rate Fluctuations

Interest rate fluctuations pose a significant threat to Fedbank Financial Services. Changes in rates directly impact the cost of funds, potentially squeezing net interest margins. For instance, if borrowing costs rise faster than lending rates can be adjusted, Fedbank's profitability could be negatively affected, particularly given its reliance on bank borrowings and existing fixed-rate loan agreements.

The Reserve Bank of India (RBI) has maintained a cautious stance on interest rates through early 2024, with the repo rate holding steady at 6.50% since February 2023. However, any unexpected upward revision could increase Fedbank's financing expenses. This is especially critical for Non-Banking Financial Companies (NBFCs) like Fedbank, which often carry a higher proportion of floating-rate liabilities relative to their assets.

- Increased Cost of Funds: A rising interest rate environment directly elevates Fedbank's borrowing expenses from banks and other financial institutions.

- Margin Compression: If Fedbank cannot pass on higher borrowing costs to its borrowers through increased lending rates, its net interest margin (NIM) is likely to shrink.

- Impact on Loan Demand: Higher lending rates could also dampen demand for new loans, affecting Fedbank's asset growth.

- Valuation Sensitivity: Fluctuations can also impact the valuation of Fedbank's fixed-income securities portfolio.

Economic Slowdown and Impact on Target Segments

An economic slowdown could significantly dent Fedbank Financial Services' customer base, particularly its focus on emerging and lower-middle-income families and businesses. If these segments face reduced disposable income or declining business revenues, their ability to repay loans will be compromised. For instance, if India's GDP growth, projected around 6.5% for FY25, falters due to global headwinds, it could disproportionately affect these vulnerable economic groups.

This increased risk of default directly impacts Fedbank's asset quality. A sustained downturn might lead to a rise in non-performing assets (NPAs), putting pressure on the company's profitability and capital adequacy ratios. Reports from the Reserve Bank of India (RBI) have consistently highlighted the sensitivity of microfinance and retail lending to macroeconomic shifts, a sector where Fedbank operates.

- Economic Slowdown Risk: A contraction in economic activity, especially impacting consumption and small business revenues, directly threatens loan repayment capacity.

- Asset Quality Deterioration: Higher defaults among target segments could lead to an increase in NPAs, straining Fedbank's financial health.

- Segment Vulnerability: Emerging and lower-middle-income groups are often the first to experience financial distress during economic downturns.

The competitive landscape within India's NBFC sector presents a significant threat, as numerous players offer similar products, intensifying the battle for market share and potentially compressing profit margins. Fedbank Financial Services must continually differentiate itself through innovative offerings and superior customer experiences to thrive amidst this crowded market. For example, the sector saw assets under management grow to an estimated INR 39.7 trillion in 2023, underscoring the fierce competition.

Evolving regulatory frameworks from the Reserve Bank of India (RBI) pose another challenge, with potential impacts on operational flexibility and capital requirements. Furthermore, a key vulnerability lies in the creditworthiness of Fedbank's customer base, particularly in its non-gold loan segments. A deterioration in borrower financial health could lead to a rise in non-performing assets (NPAs), directly affecting profitability.

Interest rate volatility is a critical concern, as it directly influences Fedbank's cost of funds and net interest margins. If borrowing costs outpace the ability to raise lending rates, profitability could be squeezed. The RBI's repo rate has remained at 6.50% since February 2023, but any upward shift could increase financing expenses for NBFCs like Fedbank, which often have a higher proportion of floating-rate liabilities.

An economic slowdown represents a substantial threat, particularly for Fedbank's target demographic of emerging and lower-middle-income families and businesses. Reduced disposable income or declining business revenues in these segments would impair loan repayment capabilities. India's projected GDP growth of around 6.5% for FY25 could be affected by global factors, disproportionately impacting these vulnerable groups and potentially leading to increased NPAs, as highlighted by RBI reports on microfinance and retail lending sensitivities.

SWOT Analysis Data Sources

This Fedbank Financial Services SWOT analysis is built upon a robust foundation of data, incorporating official financial filings, comprehensive market research, and expert industry commentary to provide a well-rounded and accurate strategic assessment.