Fedbank Financial Services Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fedbank Financial Services Bundle

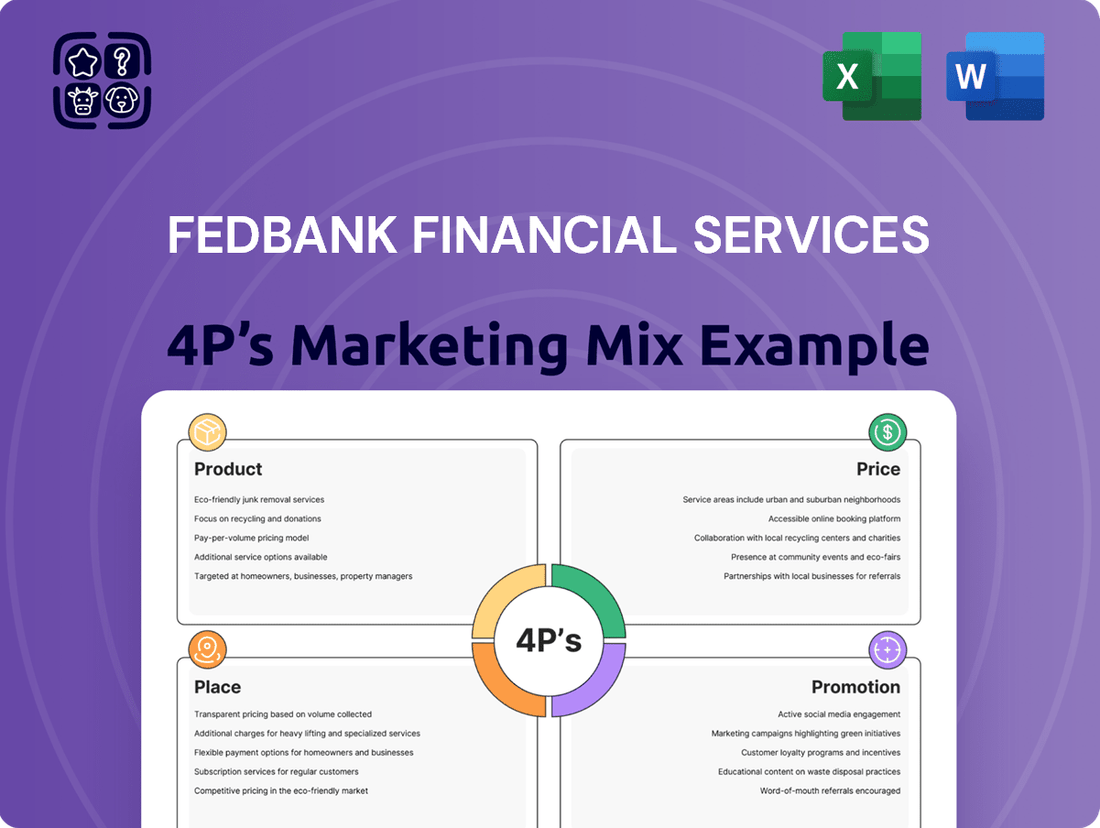

Discover how Fedbank Financial Services leverages its product offerings, competitive pricing, strategic distribution, and targeted promotions to capture market share. This analysis delves into the synergy of their 4Ps, revealing the core elements of their marketing success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Fedbank Financial Services' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Fedbank Financial Services boasts a diverse loan portfolio, encompassing gold loans, home loans, loans against property (LAP), and business loans. This broad spectrum of products effectively addresses varied financial requirements across their customer base, from individual homeownership aspirations to essential business expansion capital.

This strategic product diversification allows Fedbank to serve a wide array of customer needs, ensuring relevance for both retail and commercial segments. The emphasis on secured lending solutions, particularly with gold loans and LAP, underscores a commitment to asset-backed financial services, aiming for robust risk management.

As of Q4 FY24, Fedbank Financial Services reported a total loan book of approximately ₹12,500 crore, with gold loans forming a significant portion, demonstrating strong customer trust in this segment. The company's home loan and LAP offerings are also experiencing steady growth, reflecting an increasing demand for secured credit solutions in the Indian market.

Fedbank Financial Services' Fast Gold Loan is a cornerstone product, designed for rapid disbursement to meet urgent liquidity requirements. This offering provides customers with flexible repayment structures, often allowing for interest-only payments throughout the loan term, with the principal due at maturity.

The product efficiently caters to individuals needing immediate funds, accepting gold jewelry ranging from 20 to 24 carats. It supports loan amounts up to 90% of the prevailing market value of the pledged gold, reflecting a strong commitment to customer accessibility and value realization.

In the fiscal year 2023-24, the gold loan segment, a crucial part of the non-banking financial company (NBFC) sector, saw significant growth. NBFCs collectively disbursed over ₹1 lakh crore in gold loans, indicating robust demand and the critical role these loans play in the Indian financial ecosystem.

Fedbank Financial Services' home loan offerings are a cornerstone of their product strategy, specifically targeting the emerging middle and lower-middle-income segments. These loans start at a accessible ₹5 lakhs, providing a crucial entry point for aspiring homeowners.

The product's strength lies in its financing flexibility, covering up to 90% of a property's value. This generous loan-to-value ratio significantly reduces the upfront financial burden for buyers. Repayment periods extend up to 20 years, offering manageable monthly installments.

In 2024, the Indian housing market saw continued growth, with demand particularly strong in Tier 2 and Tier 3 cities, areas where Fedbank's target demographic is concentrated. The competitive interest rates offered by Fedbank aim to attract these first-time homebuyers, aligning with the government's push for affordable housing initiatives.

Loans Against Property (LAP) and Business Loans

Fedbank Financial Services offers Loans Against Property (LAP) for both small and medium ticket sizes, alongside unsecured business loans. These products are designed to meet the diverse financial requirements of businesses and individuals by utilizing existing assets, thereby providing essential capital for growth initiatives and personal financial needs.

The LAP offering allows individuals and businesses to unlock the value of their property for various purposes, such as expansion, working capital, or personal exigencies. Similarly, unsecured business loans cater to entities needing capital without the immediate requirement of collateral, fostering agility in their operations.

- Product Variety: LAP for diverse ticket sizes and unsecured business loans cater to a broad customer base.

- Asset Leverage: LAP enables customers to leverage owned property for capital access.

- Business Growth: Unsecured business loans support operational expansion and working capital needs.

- Financial Flexibility: Both product types offer solutions for business and personal financial responsibilities.

Tailored for Target Segments

Fedbank Financial Services' product development is keenly focused on the unique requirements of India's emerging middle-income and lower-middle-income families and businesses. This targeted approach ensures loan products are not only accessible but also highly relevant to their primary customer base.

This strategic product tailoring allows Fedbank Financial Services to effectively serve these specific market segments by offering solutions that directly address their financial needs and aspirations. For instance, in FY23, the company saw a significant rise in its retail loan portfolio, indicating strong demand from these segments.

- Focus on Affordability: Products are designed with repayment capacities of lower-middle-income groups in mind.

- Diverse Loan Options: Catering to needs ranging from housing to small business expansion.

- Simplified Processes: Making loan acquisition easier for first-time borrowers.

- Market Penetration: Aiming to capture a larger share of the underserved segments.

Fedbank Financial Services offers a diverse range of products, including gold loans, home loans, loans against property (LAP), and unsecured business loans, catering to various financial needs. The Fast Gold Loan is a key product, designed for quick disbursement and flexible repayment, accepting gold jewelry with loan amounts up to 90% of its market value. Home loans, starting at ₹5 lakhs with up to 90% property value financing and 20-year repayment terms, target the middle and lower-middle-income segments, aligning with affordable housing initiatives. LAP and unsecured business loans provide capital for expansion and personal needs by leveraging property or offering collateral-free options.

| Product Category | Key Features | Target Segment | FY24 Data/Context |

|---|---|---|---|

| Gold Loans | Rapid disbursement, flexible repayment, up to 90% LTV | Individuals needing urgent funds | Significant portion of ₹12,500 crore loan book; NBFCs disbursed over ₹1 lakh crore in FY24 |

| Home Loans | Starting ₹5 lakhs, up to 90% LTV, up to 20-year tenure | Emerging middle/lower-middle income, first-time homebuyers | Steady growth, competitive rates, aligns with affordable housing |

| Loans Against Property (LAP) | Small to medium ticket sizes, leverages property value | Individuals and SMEs needing capital | Supports expansion, working capital, personal needs |

| Unsecured Business Loans | Collateral-free, supports operational agility | Small and medium enterprises | Facilitates business growth and working capital |

What is included in the product

This analysis offers a comprehensive examination of Fedbank Financial Services' marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Fedbank Financial Services' 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, actionable framework to optimize product, price, place, and promotion strategies, ensuring alignment and addressing market challenges effectively.

Place

Fedbank Financial Services leverages its extensive branch network as a cornerstone of its distribution strategy, prioritizing a physical presence to connect with its customer base. This branch-led model is designed to foster trust and accessibility, particularly for those who prefer in-person financial interactions.

As of June 2024, Fedbank Financial Services boasts a significant physical footprint with 619 branches strategically located across 18 states and union territories in India. This wide reach ensures that a substantial portion of the Indian population has convenient access to the company's financial products and services.

Fedbank Financial Services is strategically expanding its physical presence, with a notable focus on southern India. As of early 2024, the company has been actively increasing its branch network across Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana. This deliberate expansion targets regions with a high concentration of their desired customer demographic, aiming to enhance accessibility and reach into areas that are currently underserved by financial services.

Fedbank Financial Services' localized branch network functions much like a hub-and-spoke system, with each branch acting as a local service point. This structure facilitates direct customer engagement, fostering the strong relationships essential for their secured asset-backed lending business. For instance, their focus on tier-2 and tier-3 cities in India, where personal trust is paramount, underscores the effectiveness of this approach.

Digital Integration for Reach

Fedbank Financial Services, while rooted in a strong branch network, is actively enhancing its digital integration to broaden its customer reach. This strategy acknowledges the evolving financial landscape where customers expect seamless online and offline experiences. By leveraging digital interfaces and secure communication channels, Fedbank aims to streamline customer engagement and application processes, making financial services more accessible and efficient.

The company's approach combines its traditional branch-led model with digital tools to create a hybrid experience. This blend is designed to maximize customer convenience and unlock greater sales potential by catering to diverse customer preferences. For instance, as of early 2024, the Indian digital payments market is projected to reach significant growth, with mobile banking transactions forming a substantial part of this expansion, indicating a strong customer appetite for digital financial solutions.

- Digital Channels: Fedbank utilizes digital platforms to support customer interactions and manage applications efficiently.

- Hybrid Model: The integration of physical branches with digital interfaces aims to offer a comprehensive customer experience.

- Market Trend: The increasing adoption of mobile banking and digital payments in India highlights the importance of this digital integration.

- Sales Optimization: This strategy is geared towards enhancing convenience and maximizing sales opportunities through a wider reach.

Proximity to Target Customers

Fedbank Financial Services strategically positions its branches to be close to its core customer base, primarily emerging middle-income and lower middle-income families and businesses. This proximity is crucial for ensuring that essential financial services are not just available but also convenient and easily accessible. For instance, as of early 2024, Fedbank operates a significant number of branches across India, with a particular focus on Tier 2 and Tier 3 cities where these demographics are concentrated.

This focus on local presence allows Fedbank to cater effectively to the specific needs of these communities. The accessibility factor is a key differentiator, enabling customers to engage with the bank for everyday transactions, loan applications, and financial advice without significant travel or time commitment. This approach directly supports the company's mission to provide inclusive financial solutions.

Key aspects of Fedbank's proximity strategy include:

- Targeted Branch Locations: Branches are situated in high-footfall areas within residential neighborhoods and commercial hubs catering to the target income segments.

- Accessibility Enhancements: Beyond physical branches, Fedbank leverages digital platforms to complement its physical network, ensuring customers can access services conveniently.

- Community Integration: A local branch network fosters trust and allows for a deeper understanding of community financial needs, facilitating tailored product offerings.

- Market Penetration: By being physically close, Fedbank aims to capture a larger share of the unbanked and underbanked population within its chosen markets.

Fedbank Financial Services' extensive physical network is central to its marketing strategy, emphasizing accessibility and trust. With 619 branches across 18 Indian states and union territories as of June 2024, the company ensures a strong physical presence, particularly in southern India, targeting tier-2 and tier-3 cities. This localized approach fosters deep customer relationships, crucial for their secured asset-backed lending business.

The company is also enhancing its digital integration, creating a hybrid model that combines physical branches with online platforms. This strategy acknowledges the growing demand for digital financial services in India, with mobile banking transactions expected to form a significant part of the market's expansion. By blending traditional and digital channels, Fedbank aims to improve customer convenience and broaden its sales reach.

| Metric | Value (as of June 2024) | Significance |

|---|---|---|

| Number of Branches | 619 | Ensures wide geographical coverage and accessibility. |

| States/Union Territories Covered | 18 | Demonstrates broad market penetration across India. |

| Targeted Cities | Tier 2 and Tier 3 | Focuses on areas with high potential for their core customer demographic. |

What You Preview Is What You Download

Fedbank Financial Services 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Fedbank Financial Services 4P's Marketing Mix Analysis details Product, Price, Place, and Promotion strategies. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Fedbank Financial Services is actively focusing on digital engagement, recognizing its importance in today's market. They provide online platforms where customers can explore various loan options, check their eligibility, and manage their applications seamlessly. This digital-first approach is crucial for reaching and serving a wider customer base efficiently.

This strategy aligns perfectly with the industry's shift towards digital transformation. For instance, in 2023, digital channels accounted for a significant portion of new account openings in the financial services sector, with many customers preferring online interactions for convenience. Fedbank's investment in these digital tools, such as their online eligibility checkers and application portals, directly supports this trend, aiming to enhance customer experience and streamline service delivery.

Content marketing is a cornerstone for Fedbank Financial Services, fostering thought leadership and customer education within the competitive financial landscape. By offering insightful articles, webinars, and guides on topics like investment strategies or retirement planning, Fedbank can empower its audience to make smarter financial choices, thereby building significant trust and engagement.

In 2024, the demand for accessible financial education is soaring, with reports indicating that 65% of consumers actively seek online content to improve their financial literacy. Fedbank's strategic deployment of content marketing, aligning with its 4Ps, can directly address this need, positioning the firm as a trusted advisor and driving customer acquisition and retention.

In the highly competitive and regulated financial services sector, personalized communication is paramount for Fedbank Financial Services. By leveraging customer data, potentially augmented by AI, Fedbank can segment its audience more effectively. This allows for the delivery of highly tailored product recommendations and messaging, significantly boosting customer engagement and conversion rates.

For instance, a customer who recently inquired about home loans might receive targeted information about specific mortgage products or government housing schemes, rather than generic marketing. This approach, which saw a significant uptick in engagement metrics for similar financial institutions in 2024, ensures that communication resonates with individual needs and preferences, driving deeper connections and ultimately, business growth.

Building Digital Trust and Security

Fedbank Financial Services' promotional strategy for Building Digital Trust and Security is paramount, especially given the growing digital landscape. In 2024, cybersecurity threats continue to evolve, making robust security measures a key differentiator. Fedbank’s communication should highlight its commitment to protecting customer information, a critical factor for fostering loyalty.

Transparently detailing data protection protocols and fraud prevention mechanisms is essential. This approach directly addresses consumer anxieties about online transactions. For instance, by showcasing advanced encryption standards and multi-factor authentication, Fedbank can build confidence. The company's investment in secure digital infrastructure is a direct response to the increasing volume of digital transactions, which saw a significant surge in 2023 and is projected to grow further in 2024.

- Emphasis on Advanced Encryption: Highlighting the use of industry-leading encryption to safeguard sensitive customer data.

- Multi-Factor Authentication (MFA): Promoting the availability and importance of MFA for secure account access.

- Fraud Monitoring Systems: Communicating the deployment of sophisticated systems to detect and prevent fraudulent activities in real-time.

- Data Privacy Policies: Clearly articulating Fedbank's commitment to data privacy and compliance with relevant regulations.

Brand Awareness and Reputation Management

Fedbank Financial Services leverages its status as a subsidiary of Federal Bank to capitalize on an existing, trusted brand reputation. Marketing efforts will concentrate on reinforcing this established trust while distinctly showcasing its specialized financial products and services tailored to specific customer segments. This approach aims to solidify its position in the market by building upon the parent company's goodwill.

Effective brand awareness and reputation management are crucial for Fedbank Financial Services. This includes actively monitoring and responding to online reviews and social media sentiment to maintain a positive public image. For instance, in early 2024, the Indian financial services sector saw a significant rise in digital customer engagement, with platforms like social media and review sites playing a pivotal role in shaping brand perception. Fedbank's strategy would involve proactive engagement to ensure its online narrative aligns with its brand values.

- Brand Leverage: Capitalizing on Federal Bank's established trust and recognition.

- Targeted Messaging: Highlighting specialized offerings for distinct customer segments.

- Digital Reputation: Active online presence management, including review monitoring.

- Customer Trust: Reinforcing confidence through consistent service and communication.

Fedbank Financial Services' promotion strategy centers on building trust through digital security, leveraging its parent company's brand, and engaging customers with personalized, educational content. This multifaceted approach aims to enhance customer acquisition and retention by addressing modern consumer needs for convenience, security, and reliable financial guidance.

Price

Fedbank Financial Services strategically positions its interest rates to draw in emerging middle-income and lower-middle-income families and businesses. This approach ensures their offerings are not only competitive but also accessible to their core demographic.

For instance, their home loan interest rates can begin as low as 8.75% as of early 2024, a figure carefully calibrated against prevailing market conditions and the perceived value proposition of their loan products, aiming to capture a significant market share.

Fedbank Financial Services leverages Loan to Value (LTV) ratios as a key pricing element for its secured loan products. This strategy directly impacts product accessibility and competitiveness in the market.

For gold loans, Fedbank offers disbursements up to 90% of the gold's current market value. Similarly, for home loans, the LTV can extend up to 90% of the property's assessed value. This approach makes their offerings attractive and attainable for a wider customer base.

Fedbank Financial Services structures its pricing with various fees, including processing fees, a common element in the financial sector. These fees are designed to cover the administrative costs associated with loan origination and management.

For home loans specifically, processing fees can vary significantly. This variation is often tied to the applicant's employment type, with salaried individuals and self-employed professionals sometimes facing different fee structures. For instance, in early 2024, processing fees for home loans in the industry typically ranged from 0.25% to 1% of the loan amount, with some institutions offering waivers or concessions as part of promotional offers.

Flexible Repayment Options

Fedbank Financial Services understands that financial flexibility is key. To make their offerings more accessible, they provide a range of adaptable repayment structures. This approach aims to cater to diverse customer needs and financial situations, enhancing the overall appeal of their products.

For instance, with their gold loans, customers have the option to service only the interest throughout the loan term, with the entire principal amount becoming due at the maturity date. This can significantly ease immediate cash flow concerns for borrowers. This aligns with market trends where lenders are increasingly offering such structured repayment plans to attract and retain customers, especially in the current economic climate of 2024-2025.

Furthermore, Fedbank extends this flexibility to its home loans, offering extended repayment periods that can stretch up to a maximum of 20 years. This long-term repayment horizon is designed to make homeownership more achievable by lowering monthly installments. Such extended tenures are a common feature in the competitive mortgage market, helping institutions like Fedbank to stand out.

Key aspects of Fedbank's flexible repayment options include:

- Interest-only payment options for gold loans.

- Principal repayment deferred until loan maturity for gold loans.

- Extended repayment tenures of up to 20 years for home loans.

- A focus on easing customer cash flow and improving affordability.

Market Positioning and External Factors

Fedbank Financial Services' pricing strategy is carefully calibrated to its market position as a Non-Banking Financial Company (NBFC) serving specific income segments in India. This positioning, coupled with a focus on secured asset-backed lending, directly shapes its pricing model, aiming to balance risk and return.

External factors significantly influence their pricing decisions. Competitor pricing benchmarks, prevailing market demand for credit, and the broader economic climate in India are all critical considerations. For instance, during periods of high inflation or economic uncertainty, lending rates might adjust to reflect increased risk premiums.

Fedbank's emphasis on asset-backed lending, which typically involves collateral, allows for potentially more competitive pricing compared to unsecured lending. This approach is supported by the fact that as of Q4 FY24, the NBFC sector in India saw its assets under management grow, indicating a robust demand for credit where collateral can be provided.

Key pricing considerations include:

- Targeted Interest Rates: Pricing is tailored to the risk profiles of specific customer segments, often those underserved by traditional banks.

- Competitive Benchmarking: Monitoring competitor rates for similar loan products is essential to remain attractive in the market.

- Economic Sensitivity: Interest rates are adjusted in response to macroeconomic indicators such as inflation, GDP growth, and monetary policy changes by the Reserve Bank of India.

- Collateral Value Assessment: The value and liquidity of the underlying assets used as security directly impact the loan's pricing and terms.

Fedbank Financial Services' pricing strategy is designed to attract middle and lower-middle-income segments by offering competitive interest rates, such as home loans starting around 8.75% in early 2024. This is further enhanced by flexible Loan to Value (LTV) ratios, with up to 90% LTV for gold and home loans, making their products accessible.

Processing fees are a standard component, varying by loan type and applicant profile, typically aligning with industry averages of 0.25% to 1% for home loans in early 2024. The company also offers adaptable repayment structures, like interest-only options for gold loans and extended tenures up to 20 years for home loans, to ease customer cash flow and improve affordability.

Fedbank's pricing is influenced by its NBFC status, focus on secured lending, competitor rates, and macroeconomic factors. As of Q4 FY24, the NBFC sector's growth in assets under management reflects strong demand for collateralized credit, supporting Fedbank's asset-backed lending model.

| Loan Type | Typical Starting Interest Rate (Early 2024) | Maximum LTV | Typical Processing Fee Range | Flexible Repayment Options |

|---|---|---|---|---|

| Home Loans | 8.75% | 90% | 0.25% - 1% of loan amount | Up to 20-year tenure |

| Gold Loans | (Not specified, but competitive) | Up to 90% of gold value | (Not specified) | Interest-only option, principal at maturity |

4P's Marketing Mix Analysis Data Sources

Our Fedbank Financial Services 4P's Marketing Mix Analysis is built upon a foundation of verified financial disclosures, official company communications, and current market data. We leverage insights from investor relations materials, industry reports, and competitive analysis to ensure accuracy and relevance.