Fedbank Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fedbank Financial Services Bundle

Navigate the complex external landscape impacting Fedbank Financial Services with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping the company's strategic direction. Gain a critical advantage by leveraging these expert insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence that drives informed decisions.

Political factors

The Indian government's push for financial inclusion, particularly through initiatives like the Pradhan Mantri Jan Dhan Yojana, directly impacts Fedbank Financial Services by expanding its potential customer base. Policies aimed at increasing credit availability for Micro, Small, and Medium Enterprises (MSMEs) and lower-income households present both opportunities and challenges for the company's lending strategies.

Regulatory changes by the Reserve Bank of India (RBI) are crucial. For instance, recent RBI directives in 2024 focusing on strengthening the balance sheets of Non-Banking Financial Companies (NBFCs) and preventing regulatory arbitrage are shaping the operational landscape for Fedbank. These measures ensure a more level playing field and promote financial stability.

The Reserve Bank of India (RBI) significantly shapes the operational landscape for Non-Banking Financial Companies (NBFCs) like Fedbank Financial Services through its regulatory framework. Recent directives, such as those issued in late 2023 and early 2024 concerning increased risk weights on unsecured loans and revised norms for gold loan provisioning, directly influence Fedbank's lending strategies and capital adequacy requirements.

These evolving regulations, including updated guidelines on investments in Alternative Investment Funds (AIFs) announced in March 2024, necessitate continuous adaptation in Fedbank's risk management practices. For instance, the RBI's focus on strengthening governance and transparency within NBFCs means Fedbank must ensure robust compliance mechanisms are in place to avoid penalties and maintain market confidence.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) and MUDRA Yojana are actively expanding financial access. As of early 2024, PMJDY has facilitated over 500 million bank accounts, significantly boosting financial inclusion. These programs aim to bring more people into the formal financial system, creating a larger customer base for institutions like Fedbank Financial Services.

Fedbank Financial Services is well-positioned to capitalize on these government-driven financial inclusion efforts. By catering to emerging middle and lower-middle-income segments, the company can leverage schemes such as Stand-Up India, which promotes entrepreneurship among women and Scheduled Castes/Tribes. This focus aligns perfectly with the government's objective of economic empowerment.

Political Stability and Economic Reforms

Political stability in India is a cornerstone for the financial services sector. A consistent policy environment fosters investor confidence, crucial for institutions like Fedbank Financial Services. For instance, the Indian government's focus on financial inclusion and digital transformation, evident in initiatives like the Pradhan Mantri Jan Dhan Yojana, has created new avenues for growth and service delivery.

Economic reforms directly shape the lending landscape. Changes in regulatory frameworks or fiscal policies can significantly influence Fedbank's operational costs and revenue streams. The Reserve Bank of India's monetary policy decisions, such as the repo rate adjustments throughout 2024 and into early 2025, directly impact borrowing costs and credit demand, thereby affecting Fedbank's profitability.

- Government Stability: A stable government ensures predictability in policy implementation, reducing uncertainty for financial institutions.

- Regulatory Environment: Evolving regulations, like those concerning digital lending or non-banking financial companies (NBFCs), directly influence Fedbank's compliance and operational strategies.

- Economic Reforms: Reforms aimed at boosting economic growth, such as infrastructure spending or tax incentives, can indirectly stimulate demand for financial products and services.

- Investor Confidence: Positive political and economic sentiment, reflected in market indices and foreign direct investment inflows, supports Fedbank's ability to raise capital and expand its business.

Consumer Protection Regulations

Consumer protection is a growing priority for the Indian government and the Reserve Bank of India (RBI), directly impacting financial institutions like Fedbank Financial Services. This heightened focus translates into new regulations designed to safeguard borrowers and ensure fair practices across the sector.

Recent directives, such as the mandatory Key Facts Statement (KFS) for all loans, aim to provide borrowers with clear and concise information about loan terms and conditions. This transparency is crucial for informed decision-making. Furthermore, stricter measures are being implemented to curb unfair practices, particularly within the microfinance segment, which is a key area for companies like Fedbank.

- Key Facts Statement (KFS): Mandated by RBI, this requires lenders to present loan details upfront, enhancing borrower understanding.

- Microfinance Regulations: New rules are tightening oversight on lending practices and pricing in the microfinance sector, promoting responsible lending.

- Digital Lending Guidelines: The RBI's focus on digital lending also includes consumer protection, addressing issues like data privacy and transparency in online loan applications.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) continue to expand financial access, with over 518 million accounts opened by April 2024, significantly increasing the potential customer base for Fedbank Financial Services. The Reserve Bank of India's (RBI) ongoing regulatory adjustments, such as the revised risk weight norms for unsecured loans introduced in late 2023, directly influence Fedbank's capital requirements and lending strategies, ensuring greater financial stability across the sector.

The Indian government's focus on financial inclusion and digital transformation, as seen in the rapid growth of UPI transactions reaching an average of over 100 million per day in early 2024, presents new avenues for Fedbank to offer innovative digital financial products. Furthermore, evolving consumer protection mandates, including the mandatory Key Facts Statement (KFS) for all loans implemented in 2024, necessitate enhanced transparency in Fedbank's operations and product offerings.

| Initiative | Status (Early 2024) | Impact on Fedbank |

|---|---|---|

| Pradhan Mantri Jan Dhan Yojana (PMJDY) | Over 518 million accounts opened | Expanded potential customer base, increased demand for basic banking services. |

| UPI Transactions | Average over 100 million per day | Opportunity for digital product integration and streamlined payment solutions. |

| RBI Unsecured Loan Norms | Revised risk weights | Requires adjustments in capital adequacy and potentially affects unsecured lending portfolio. |

| Key Facts Statement (KFS) | Mandatory for all loans | Necessitates enhanced transparency and borrower education in loan product disclosures. |

What is included in the product

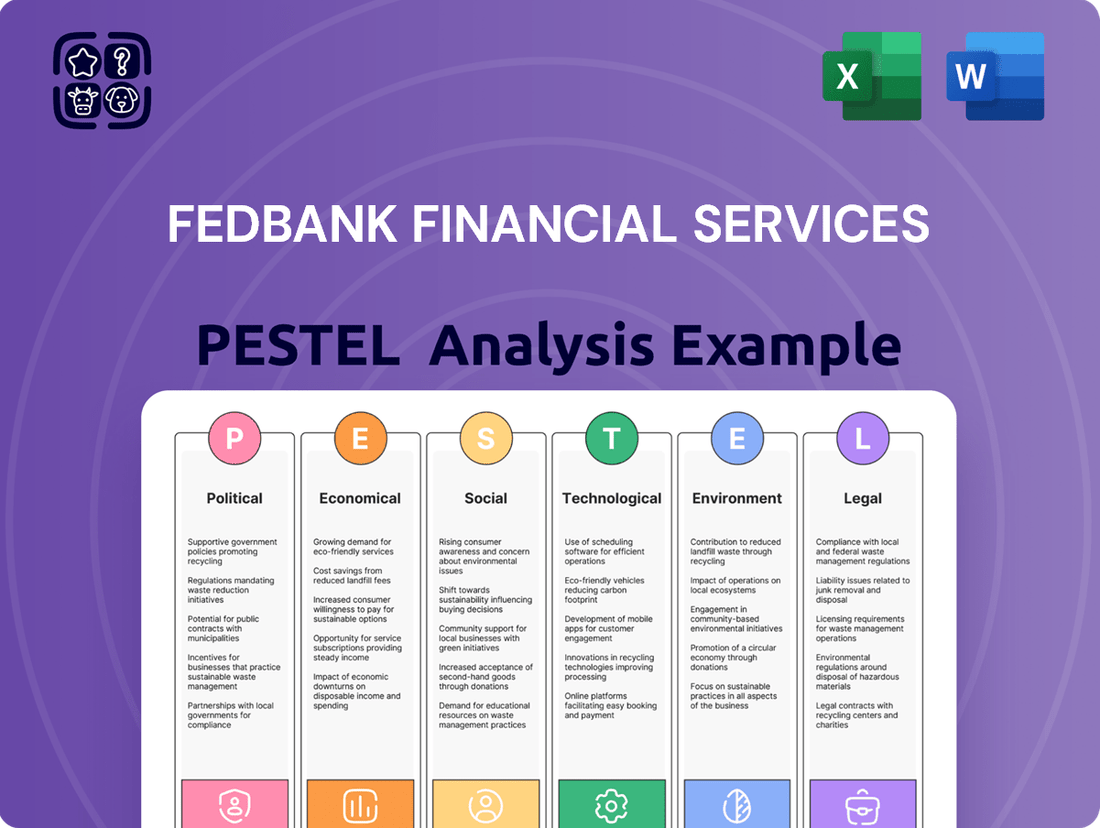

This PESTLE analysis provides a comprehensive overview of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal forces, specifically impact Fedbank Financial Services.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats stemming from these influential forces.

The Fedbank Financial Services PESTLE analysis offers a streamlined, easily digestible overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for quick referencing in strategic discussions.

Economic factors

Fluctuations in the Reserve Bank of India's (RBI) policy rates directly impact Fedbank Financial Services' cost of borrowing and the pricing of its loan products. For instance, if the repo rate were to increase, Fedbank's funding costs would likely rise, potentially leading to higher lending rates for its customers.

Looking ahead, projections suggest a potential easing of interest rates in the latter half of 2025. This anticipated decline could stimulate greater demand for credit across various sectors, providing a supportive environment for the growth of non-banking financial companies (NBFCs) like Fedbank.

Credit growth in India, especially in retail lending, is a crucial driver for Fedbank Financial Services. The Reserve Bank of India reported that bank credit grew by 16.3% year-on-year as of October 2024, indicating a robust demand for credit across the economy.

While overall consumer lending growth might moderate in 2025, Fedbank's focus on gold loans, home loans, and loans against property positions it well. Gold loan portfolios, for instance, have shown resilience, with industry estimates suggesting continued strong demand driven by both rural and urban consumers seeking liquidity in 2024 and projected into 2025.

Fedbank Financial Services focuses on emerging middle-income and lower-middle-income families, a segment poised for significant growth. As disposable incomes rise, these households gain greater capacity to invest in financial products like home loans and business loans, directly benefiting Fedbank's core offerings.

In India, the middle class is projected to expand significantly, with estimates suggesting it could reach over 475 million people by 2030, a substantial increase from current figures. This demographic expansion, coupled with anticipated increases in per capita income, suggests a robust market for financial services tailored to this growing segment.

Gold Price Volatility

Gold price volatility is a critical economic factor for Fedbank Financial Services, given its core business in gold loans. Fluctuations directly affect the value of collateral and loan book health.

In 2024, gold prices have shown considerable movement, with the yellow metal reaching record highs, driven by geopolitical uncertainties and central bank buying. For instance, the price of gold per 10 grams in India, a key market for Fedbank, has seen significant upward trends throughout the year. This rise in gold prices can bolster the value of Fedbank's collateral, potentially increasing the attractiveness and volume of gold-backed loans.

However, sharp downturns in gold prices present a risk. A sudden drop could diminish the value of existing collateral, potentially leading to higher loan-to-value ratios and increased risk for the lender. This necessitates careful risk management and dynamic appraisal strategies.

- 2024 Gold Price Trends: Gold prices have experienced significant appreciation, with benchmarks like the MCX Gold futures touching new peaks, impacting collateral valuations.

- Impact on Loan Demand: Higher gold prices can stimulate demand for gold loans as individuals can borrow more against the same quantum of gold.

- Risk Management: Fedbank must monitor price volatility closely to manage the risk of collateral value depreciation and its effect on loan recovery.

- Collateral Value: The inherent value of gold as collateral is directly tied to market prices, making price stability or predictable trends beneficial for the financial institution.

Inflationary Pressures

Inflationary pressures remain a significant consideration for Fedbank Financial Services. Persistent inflation erodes the purchasing power of consumers, potentially impacting their ability to service existing loans and their capacity for new borrowing. This dynamic directly affects the loan portfolio quality and the overall demand for financial products.

While headline retail inflation saw a decline, core inflation, which excludes volatile food and energy prices, has shown more resilience. For instance, in early 2024, core inflation figures indicated underlying price pressures. This stubbornness, partly influenced by factors like rising gold prices which can signal economic uncertainty and impact consumer sentiment, could lead to more cautious borrower behavior and a more challenging lending environment.

- Erosion of Purchasing Power: Higher inflation reduces the real value of savings and income, making it harder for individuals to meet their financial obligations.

- Impact on Loan Repayment: Customers with fixed incomes or those whose incomes do not keep pace with inflation may struggle with loan repayments, increasing default risk.

- Core Inflation Trends: Observing core inflation provides a clearer picture of underlying price stability, crucial for assessing long-term economic health and borrower resilience.

- Gold Price Influence: Increases in gold prices, often seen as a safe-haven asset, can reflect heightened economic uncertainty and may correlate with reduced consumer confidence and borrowing appetite.

The Indian economy's growth trajectory is a primary economic driver for Fedbank Financial Services. Robust GDP expansion fuels demand for credit, benefiting the company's lending operations. Projections for India's GDP growth in FY2025 remain strong, with various institutions forecasting rates around 6.5% to 7.0%, indicating a conducive environment for financial services.

Interest rate policies set by the Reserve Bank of India (RBI) directly influence Fedbank's cost of funds and lending rates. While rates have been stable, any future adjustments will impact profitability and loan demand. The RBI's stance, closely watched by financial institutions, aims to balance inflation control with economic growth, a dynamic that Fedbank must navigate.

Inflationary pressures, particularly core inflation, can affect consumer spending power and loan repayment capacity. While headline inflation has moderated, underlying price pressures, as seen in early 2024, necessitate careful monitoring of borrower affordability and potential impacts on asset quality for Fedbank.

The resilience of gold prices is paramount for Fedbank's gold loan portfolio. Continued strength in gold prices, observed throughout 2024 with MCX Gold futures reaching record highs, supports collateral valuations and can boost loan origination volumes, though price volatility remains a key risk factor.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on Fedbank | Mitigation/Opportunity |

|---|---|---|---|---|

| GDP Growth | Strong growth, e.g., ~7% in FY2024 | Projected ~6.5%-7.0% in FY2025 | Increased demand for credit, higher loan volumes | Expand product offerings to capture growth |

| Interest Rates (Repo Rate) | Maintained at 6.50% (as of early 2024) | Potential for easing in H2 2025 | Cost of funds, lending rates, profitability | Optimize funding mix, manage interest rate risk |

| Inflation (CPI) | Moderating headline, resilient core inflation | Continued monitoring of core inflation | Consumer spending power, loan repayment capacity | Focus on resilient customer segments, prudent underwriting |

| Gold Prices | Record highs in 2024, significant appreciation | Continued volatility expected, but generally supported | Collateral value, loan origination for gold loans | Dynamic loan-to-value ratios, robust risk assessment |

Full Version Awaits

Fedbank Financial Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fedbank Financial Services delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Fedbank Financial Services' success hinges on the financial literacy of its target demographic: emerging middle and lower-middle-income families. A significant portion of these households may have limited exposure to formal financial products. For instance, in India, where Fedbank operates, a 2022 report indicated that only around 27% of the population had formal financial education, highlighting a substantial opportunity for growth.

As awareness of services like savings accounts, insurance, and investment products increases, demand for Fedbank's offerings is likely to rise. This growing financial acumen, spurred by government initiatives and accessible information, directly translates into a larger customer base receptive to structured financial planning and wealth creation tools.

India's accelerating urbanization, with a significant portion of its population migrating to cities, creates a dual dynamic for financial services. While urban centers offer concentrated demand for sophisticated financial products, the rural outreach strategy remains critical. Fedbank Financial Services' established branch network is strategically positioned to tap into the growing financial needs of these rural populations.

The increasing penetration of financial services into rural and semi-urban areas is a significant trend. As of December 2023, the financial inclusion initiatives have seen a substantial rise in bank account ownership, with over 50 crore Jan Dhan accounts active, indicating a receptive market for further financial product adoption. This expansion presents a direct opportunity for Fedbank to leverage its distribution strength.

The demand for diverse financial products, including credit, insurance, and investment solutions, is on the rise in rural markets. This surge is fueled by increased economic activity and a growing awareness of financial planning. Fedbank's ability to cater to these evolving needs through its localized branch approach will be key to its growth in these segments.

Consumers increasingly favor digital platforms for banking, with mobile banking adoption expected to reach over 70% of the adult population in India by 2025, according to industry reports. This shift demands that non-banking financial companies (NBFCs) like Fedbank Financial Services invest in robust digital infrastructure and user-friendly interfaces to meet evolving expectations.

The demand for personalized financial products, such as tailored loan offerings and investment advice, is also on the rise. Fedbank Financial Services must leverage data analytics to understand individual customer needs and deliver customized solutions, enhancing customer loyalty and attracting new clients in a competitive market.

Demographic Shifts

India's demographic landscape is characterized by a substantial and youthful population, coupled with a burgeoning middle class. This presents a vast and expanding market for financial services, offering significant growth potential. As of 2024, India's median age hovers around 28 years, underscoring its young demographic profile. The expanding middle class, projected to reach over 475 million by 2030, signifies increasing disposable income and a greater demand for sophisticated financial products.

Fedbank Financial Services is strategically positioned to capitalize on these demographic trends. Their business model and product offerings are designed to cater to the needs of this growing segment, from first-time investors to those seeking wealth management solutions. This alignment ensures a strong market fit and a receptive customer base for the company's services.

- Young Population: India's median age is approximately 28 years, indicating a large pool of potential customers for long-term financial planning.

- Growing Middle Class: The middle class is expected to exceed 475 million by 2030, driving demand for financial products and services.

- Market Opportunity: These demographic shifts create a substantial market for financial services, including savings, investments, and insurance.

- Strategic Alignment: Fedbank Financial Services' focus on these demographics directly taps into India's evolving socioeconomic structure.

Social Mobility and Aspirations

The aspirations of emerging middle-income and lower middle-income families are a significant driver for financial services like those offered by Fedbank. These families are increasingly focused on achieving milestones such as homeownership, expanding existing businesses, or launching new ventures, all of which require access to capital. This upward mobility fuels demand for essential financial products.

This desire for improved living standards directly translates into a robust demand for loans against property, home loans, and business loans. Fedbank Financial Services, with its core offerings in these areas, is well-positioned to cater to this growing segment. For instance, in 2024, the Indian housing market saw a notable increase in demand for home loans, particularly from first-time buyers in Tier 2 and Tier 3 cities, reflecting this trend.

- Homeownership Goals: A significant portion of the Indian population, especially in the burgeoning middle class, views owning a home as a primary life goal, driving demand for mortgage products.

- Entrepreneurial Spirit: The desire to start or expand small and medium-sized enterprises (SMEs) is strong, creating a consistent need for business loans and working capital solutions.

- Improved Living Standards: Aspirations for better education, healthcare, and overall quality of life necessitate financial planning and often involve leveraging assets through loans.

- Digital Adoption: Growing digital literacy among these demographics is also influencing how they access and utilize financial services, favoring convenient online application processes.

Societal shifts towards increased financial literacy and digital adoption are key for Fedbank Financial Services. As of late 2024, financial inclusion initiatives in India have significantly boosted bank account ownership, with over 50 crore Jan Dhan accounts active, indicating a receptive market for further financial product penetration. This trend, coupled with an anticipated 70% mobile banking adoption by 2025, underscores the need for robust digital platforms and user-friendly interfaces to meet evolving customer expectations.

The growing aspirations of India's emerging middle and lower-middle-income families, particularly their focus on homeownership and business expansion, directly fuels demand for Fedbank's core offerings like home and business loans. The Indian housing market, for instance, saw a notable increase in demand for home loans from first-time buyers in Tier 2 and Tier 3 cities in 2024, reflecting this upward mobility and need for capital.

India's youthful demographic, with a median age around 28 years in 2024, presents a substantial pool of potential long-term customers for financial planning. This, combined with a middle class projected to exceed 475 million by 2030, signifies increasing disposable income and a growing appetite for diverse financial products and wealth management solutions, directly aligning with Fedbank's strategic focus.

| Sociological Factor | Description | Relevance to Fedbank | Data Point (2023-2025) |

|---|---|---|---|

| Financial Literacy | Increasing awareness and understanding of financial products and services. | Drives demand for Fedbank's savings, investment, and insurance offerings. | ~27% of Indian population had formal financial education (2022). |

| Digital Adoption | Growing preference for online and mobile platforms for banking and financial transactions. | Necessitates investment in digital infrastructure and user-friendly interfaces. | Mobile banking adoption expected to reach >70% of Indian adults by 2025. |

| Aspirations & Mobility | Desire for homeownership, business growth, and improved living standards. | Creates demand for loans (home, business, property) and financial planning. | Notable increase in home loan demand from first-time buyers in Tier 2/3 cities (2024). |

| Demographics | Young population and expanding middle class. | Provides a large, growing customer base for long-term financial products. | India's median age ~28 years (2024); Middle class projected to exceed 475 million by 2030. |

Technological factors

The Indian NBFC sector is deeply immersed in digital transformation, a trend Fedbank Financial Services must actively embrace. Leveraging AI-driven and data-rich platforms is essential for enhancing financial inclusion, accelerating lending processes, and delivering superior customer experiences. This digital shift is not just about efficiency; it's about competitive survival and growth in a rapidly evolving financial landscape.

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing credit management, underwriting, and risk assessment in the lending sector. Fedbank Financial Services can harness these technologies to create more personalized financial products and significantly improve the accuracy of credit scoring models.

By integrating AI, Fedbank can streamline the loan approval process, reducing turnaround times and enhancing operational efficiency. For instance, AI-powered platforms can analyze vast datasets to identify subtle risk patterns, leading to better-informed lending decisions. The global AI in fintech market was valued at approximately $10.7 billion in 2023 and is projected to grow substantially, indicating a significant opportunity for early adopters like Fedbank.

The increasing prevalence of mobile banking and digital payment systems, such as Unified Payments Interface (UPI), presents a significant opportunity for Fedbank Financial Services. These platforms allow for more direct and cost-effective customer engagement, enabling the company to offer a wider array of convenient financial services. For instance, by the end of 2023, UPI transactions in India had already surpassed 113 billion, highlighting the massive shift towards digital payments.

Further advancements in digital payment infrastructure, including the rollout of features like UPI Lite for smaller transactions and the integration of credit facilities directly into UPI (Credit on UPI), can streamline and expand the volume of digital transactions. This evolution in payment technology allows Fedbank Financial Services to tap into a broader customer base and cater to diverse transaction needs, potentially boosting service uptake and customer loyalty.

Data Analytics and Real-time Insights

Advanced data analytics is transforming the NBFC sector. Fedbank Financial Services can leverage these capabilities to gain real-time insights into customer preferences and evolving market dynamics. This allows for the creation of highly personalized financial products and services, directly addressing specific customer needs.

The ability to analyze vast datasets in real-time empowers Fedbank Financial Services to make more informed, agile decisions. For instance, by tracking loan application patterns and repayment behaviors, the company can refine its risk assessment models. In 2024, the Indian NBFC sector saw a significant increase in digital lending, with data analytics playing a crucial role in managing this growth and associated risks.

- Enhanced Customer Segmentation: Utilizing analytics to identify distinct customer groups for targeted product offerings.

- Predictive Risk Management: Employing data to forecast potential defaults and proactively mitigate risks.

- Operational Efficiency: Streamlining processes through data-driven insights into customer interactions and internal workflows.

- Market Trend Identification: Spotting emerging opportunities and adapting strategies based on real-time market signals.

Cybersecurity and Data Protection Technologies

Cybersecurity and data protection are critical as Fedbank Financial Services continues its digital transformation. The increasing volume of sensitive financial data necessitates advanced security measures. In 2024, global cybercrime costs were projected to reach $10.5 trillion annually, highlighting the immense financial risk.

Fedbank must prioritize investments in robust technologies like end-to-end encryption, advanced data masking techniques, and stringent multi-factor authentication to protect customer information. Compliance with evolving data privacy regulations, such as the Digital Personal Data Protection Act in India, is also a key driver for these technological investments.

- Encryption: Implementing strong encryption protocols for data both in transit and at rest to prevent unauthorized access.

- Data Masking: Utilizing techniques to obscure sensitive data fields while still allowing for testing and development.

- Access Control: Deploying granular access control systems to ensure only authorized personnel can access specific data.

- Threat Detection: Investing in AI-powered threat detection and response systems to proactively identify and neutralize cyber threats.

Technological advancements, particularly in AI and data analytics, are reshaping the NBFC landscape, offering Fedbank Financial Services significant opportunities for growth and efficiency. The widespread adoption of digital payment systems like UPI, with over 113 billion transactions recorded by the end of 2023, underscores the shift towards digital engagement. Fedbank can leverage these trends to enhance customer segmentation, improve risk management, and streamline operations, as seen in the projected $10.7 billion AI in fintech market value for 2023.

| Key Technology Trend | Impact on Fedbank Financial Services | Supporting Data (2023-2024) |

| AI & Machine Learning | Enhanced credit scoring, personalized products, operational efficiency | AI in Fintech Market: ~$10.7 billion (2023), projected growth |

| Digital Payments (UPI) | Wider customer reach, cost-effective engagement | UPI Transactions: >113 billion (end of 2023) |

| Data Analytics | Real-time market insights, predictive risk management | Increased digital lending in Indian NBFC sector (2024) |

| Cybersecurity | Protection of sensitive data, regulatory compliance | Global Cybercrime Costs: Projected $10.5 trillion annually (2024) |

Legal factors

The Reserve Bank of India (RBI) imposes stringent regulations on Fedbank Financial Services as a Non-Banking Financial Company (NBFC). These rules cover critical areas such as capital adequacy ratios, asset classification standards, and provisioning norms, directly influencing the company's operational framework and financial health.

In line with RBI's prudential framework, Fedbank Financial Services must maintain specific capital to risk-weighted assets ratios. For instance, NBFCs in the investment and lending category, like Fedbank, typically need to adhere to a Capital to Risk-weighted Assets Ratio (CRAR) of at least 15% as of recent guidelines, ensuring a cushion against potential losses.

Furthermore, RBI's directives on fair lending practices and transparent customer dealings are paramount. Fedbank Financial Services must ensure its loan products, interest rates, and recovery processes are equitable and clearly communicated, impacting customer trust and operational compliance.

The Digital Personal Data Protection Act (DPDPA), 2023, along with its anticipated rules in 2025, will fundamentally reshape Fedbank Financial Services' approach to customer data management. This legislation mandates stricter protocols for data handling, including obtaining explicit consent for data processing and adhering to data minimization principles.

Fedbank Financial Services must ensure robust data security measures are in place, alongside a clear process for timely notification in the event of a data breach. Failure to comply with these provisions could lead to significant penalties, impacting operational costs and customer trust.

The Reserve Bank of India (RBI) has introduced revised frameworks and draft guidelines for gold loans, set to take effect in April 2026. These new regulations will impact Fedbank Financial Services by potentially altering Loan-to-Value (LTV) ratios and introducing stricter rules around re-pledging gold collateral. Furthermore, formal borrower requests will be mandatory for loan renewals, adding a layer of procedural requirement to Fedbank's gold loan operations.

Consumer Protection Laws

Consumer protection laws in India significantly impact financial institutions like Fedbank Financial Services. The Reserve Bank of India (RBI) has been proactive in strengthening these regulations, with initiatives like the Banking Ombudsman Scheme and the introduction of a dedicated ombudsman for non-banking financial companies (NBFCs). These frameworks ensure fair treatment of customers and provide avenues for grievance redressal.

The classification of banking and NBFC services as public utility services in certain regions, such as Delhi, is a notable development. This allows consumer disputes to be addressed by permanent lok adalats, emphasizing the government's commitment to swift and accessible dispute resolution mechanisms for financial consumers. This legal framework aims to foster trust and accountability within the financial sector.

Key aspects of consumer protection relevant to Fedbank Financial Services include:

- Fair Practices Code: Adherence to the RBI's Fair Practices Code, which governs lending and recovery practices, ensuring transparency and preventing harassment.

- Grievance Redressal: Establishment of robust internal grievance redressal mechanisms and compliance with the timelines set by the RBI's Ombudsman schemes.

- Data Privacy: Compliance with evolving data protection laws, safeguarding customer information and ensuring its ethical use.

- Transparency in Charges: Clear disclosure of all fees, charges, and interest rates associated with financial products and services.

Companies Act, 2013

The Companies Act, 2013, is a cornerstone for entities like Fedbank Financial Services, dictating the framework for their incorporation and day-to-day operations within India. This legislation mandates strict adherence to corporate governance standards, transparent financial reporting practices, and a host of other statutory obligations essential for maintaining legal standing and operational integrity.

Compliance with the Companies Act, 2013, directly impacts Fedbank Financial Services' ability to raise capital, conduct business, and maintain investor confidence. For instance, the Act's provisions on board composition and director responsibilities are crucial for good governance. In 2023-24, the Reserve Bank of India (RBI) continued to emphasize robust corporate governance for Non-Banking Financial Companies (NBFCs), aligning with the spirit of the Companies Act.

- Corporate Governance: Adherence to the Companies Act, 2013, ensures Fedbank Financial Services maintains proper board structures, audit committees, and internal controls, fostering accountability.

- Financial Reporting: The Act mandates specific accounting standards and disclosure requirements, ensuring Fedbank Financial Services provides clear and accurate financial statements to stakeholders.

- Statutory Compliances: Fulfilling requirements related to filings, annual returns, and adherence to directorial duties is paramount for uninterrupted operation.

- Regulatory Alignment: The Companies Act, 2013, works in conjunction with RBI regulations, creating a comprehensive legal environment for NBFCs like Fedbank Financial Services.

Fedbank Financial Services operates under a robust regulatory framework primarily shaped by the Reserve Bank of India (RBI), which sets stringent capital adequacy, asset classification, and provisioning norms for NBFCs. For instance, the RBI mandates a minimum Capital to Risk-weighted Assets Ratio (CRAR) of 15% for investment and lending NBFCs, a benchmark Fedbank must consistently meet to ensure financial stability.

The Digital Personal Data Protection Act (DPDPA), 2023, and its upcoming rules in 2025, will enforce stricter data handling protocols, requiring explicit consent for data processing and adherence to data minimization principles, impacting Fedbank's customer data management strategies.

Furthermore, evolving RBI guidelines on gold loans, effective April 2026, will introduce changes to Loan-to-Value ratios and re-pledging rules, necessitating adjustments in Fedbank's gold loan operations.

Consumer protection laws, including the RBI's Ombudsman schemes, ensure fair treatment and grievance redressal for Fedbank's customers, reinforcing the importance of transparency in charges and fair lending practices.

Environmental factors

The Reserve Bank of India (RBI) has flagged climate change as a significant threat to financial stability, noting that extreme weather events can impair borrowers' ability to repay loans, thereby affecting the solvency of financial institutions. Fedbank Financial Services must integrate these climate-related risks into its credit assessment processes, particularly for loans secured by physical assets.

India's commitment to net-zero emissions by 2070, as reiterated in recent policy discussions, is driving significant growth in green finance. This national focus creates a fertile ground for financial institutions like Fedbank Financial Services to expand their green lending portfolios, aligning with sustainability objectives and potentially attracting ESG-focused investment.

The Reserve Bank of India (RBI) has been actively promoting sustainable finance, with initiatives like the Sustainable Finance Policy Statement and the recent emphasis on green bonds in the 2024-25 monetary policy framework. These developments encourage NBFCs to innovate in offering financial products that support renewable energy projects and other environmentally friendly ventures, tapping into a growing market demand.

While specific ESG data for Fedbank Financial Services isn't publicly detailed, the broader Indian financial sector is increasingly adopting ESG principles. For instance, as of early 2024, many Indian banks and financial institutions are actively developing their ESG strategies, driven by investor demand and regulatory nudges. This trend suggests that for Fedbank, integrating environmental, social, and governance factors into its operations could significantly boost its public image and appeal to a growing segment of ethically-minded investors.

Resource Scarcity and Impact on Borrowers

Environmental factors like water scarcity and agricultural disruptions due to climate change pose significant risks to the economic stability of borrowers, particularly those in rural and agricultural sectors. This can directly impact their ability to repay loans. For instance, a severe drought in 2024 could drastically reduce crop yields, affecting the income streams of farmers who are clients of Fedbank Financial Services.

The increasing frequency of extreme weather events, a consequence of climate change, further exacerbates these risks. These events can lead to crop failures, damage to livestock, and destruction of property, all of which can impair a borrower's financial health and their capacity to service debt obligations. This necessitates careful risk assessment and potential product adjustments by financial institutions like Fedbank.

Consider the following impacts:

- Agricultural Sector Vulnerability: In 2023, India's agricultural sector, a key area for many rural lenders, experienced mixed weather patterns, with some regions facing monsoon deficits. This directly affects the repayment capacity of farmers.

- Water Stress: Regions facing acute water stress, as highlighted by various environmental reports in 2024, will see reduced agricultural productivity, increasing the default risk for loans tied to farming activities.

- Insurance and Mitigation: The rising cost of crop insurance and the effectiveness of climate change mitigation strategies will be crucial factors in borrower resilience and, consequently, Fedbank's loan portfolio performance.

- Supply Chain Disruptions: Climate-related events can disrupt agricultural supply chains, impacting commodity prices and the overall profitability of farming businesses, thereby influencing loan repayment.

Regulatory Push for Sustainable Practices

Regulators, including the Reserve Bank of India (RBI), are actively pushing for the 'greening' of debt capital and are focused on financial stability amidst climate-related risks. This regulatory environment means Fedbank Financial Services can expect growing pressure to embed sustainable practices throughout its operations and lending activities.

For instance, the RBI's recent emphasis on climate risk management for financial institutions highlights a clear direction. Fedbank Financial Services will likely need to demonstrate robust environmental, social, and governance (ESG) integration to comply with evolving guidelines and attract sustainable finance. This could involve enhanced reporting and potentially new product offerings aligned with green principles.

- RBI's focus on green finance: The central bank is increasingly scrutinizing the climate-related financial risks faced by regulated entities.

- Growing ESG integration demand: Investors and stakeholders are demanding greater transparency and commitment to sustainable practices from financial service providers.

- Potential for new regulatory requirements: Expect further guidelines on climate risk disclosure and sustainable lending practices in the coming years.

Environmental factors present significant risks and opportunities for Fedbank Financial Services. Climate change impacts, such as extreme weather events and water scarcity, directly affect borrower repayment capacity, particularly in agriculture. India's commitment to net-zero emissions by 2070 is driving green finance growth, creating avenues for Fedbank to expand its sustainable lending portfolios and align with regulatory pushes for greener debt capital.

The RBI's focus on climate risk management and sustainable finance, evident in its 2024-25 monetary policy, signals a growing expectation for financial institutions to integrate ESG principles. This trend, coupled with increasing investor demand for ESG-aligned investments, suggests that Fedbank's adoption of environmental stewardship could enhance its market appeal and operational resilience.

| Environmental Factor | Impact on Fedbank | Opportunity for Fedbank |

|---|---|---|

| Extreme Weather Events | Increased loan defaults from affected borrowers (e.g., crop failure) | Develop climate-resilient loan products and insurance tie-ups |

| Water Scarcity | Reduced agricultural productivity, impacting farmer loan repayments | Finance water-efficient technologies and sustainable farming practices |

| Net-Zero by 2070 Policy | Potential regulatory shifts favouring green finance | Expand green bond issuances and finance renewable energy projects |

| Growing ESG Demand | Pressure to improve ESG reporting and practices | Attract ESG-focused investors and enhance corporate reputation |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fedbank Financial Services is meticulously constructed using data from reputable financial institutions, government regulatory bodies, and leading market research firms. We incorporate insights from economic forecasts, technological advancements, and socio-political trends to provide a comprehensive overview.