FAT Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

FAT Brands leverages its diverse portfolio of popular restaurant concepts, offering a compelling blend of familiar favorites and emerging trends to a broad customer base. However, navigating the competitive restaurant landscape and managing a rapidly expanding franchise network presents significant challenges.

Want the full story behind FAT Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FAT Brands' strength lies in its extensive and varied collection of 17 restaurant brands. This broad selection spans different dining styles, from quick service to more upscale casual experiences, ensuring they can cater to a wide range of consumer preferences and dining occasions.

This multi-brand strategy significantly reduces the company's vulnerability to downturns in any single market segment or brand. For instance, if the fast-casual market experiences a slowdown, the performance of their quick-service or casual dining brands can help offset those losses, providing a more stable revenue stream.

By operating across diverse segments, FAT Brands taps into a larger customer pool. This diversification is a key advantage, allowing them to capture market share from various consumer groups and adapt more readily to evolving tastes and economic conditions, a strategy that proved beneficial in the post-pandemic recovery where consumer habits shifted.

FAT Brands' asset-light franchising model is a significant strength, allowing the company to grow its restaurant portfolio with minimal capital investment. This strategy focuses on generating revenue through royalty fees and franchise fees, which contributed to approximately 99% of their restaurant network operating under this model as of recent reports. This minimizes direct operational risks and ensures a steady income stream.

FAT Brands demonstrates a significant strength in strategic acquisitions, evidenced by its impressive history of integrating new brands. Since 2009, the company has successfully acquired 17 distinct brands, marking a substantial expansion of its portfolio and market presence.

This acquisition strategy has been financially robust, with a cumulative investment of $375 million poured into these brand integrations. Furthermore, the total acquisition value since 2017 alone has reached $842 million, underscoring FAT Brands' commitment and capability in growing through strategic purchases.

Robust Development Pipeline and Expansion

FAT Brands demonstrates a powerful growth trajectory, evidenced by a substantial development pipeline. The company has secured approximately 1,000 signed franchise agreements, signaling robust confidence from potential franchisees in its brand portfolio and expansion strategy.

This commitment to growth is further solidified by ambitious opening plans. FAT Brands aims to debut over 100 new restaurants in 2025, building on the 92 new locations opened throughout 2024. This consistent pace of expansion points to strong underlying consumer demand across its various restaurant concepts and presents significant opportunities for new and existing franchisees.

- Development Pipeline: Approximately 1,000 signed franchise agreements.

- 2025 Expansion Target: Over 100 new restaurant openings planned.

- 2024 Performance: Successfully opened 92 new restaurants.

- Market Indicator: Strong consumer demand and franchise interest in FAT Brands' portfolio.

Global Presence and International Growth

FAT Brands boasts a substantial global reach, with over 2,300 locations spread across more than 40 countries and 49 U.S. states or territories. This extensive international and domestic presence is a key strength, allowing for diversified revenue streams and brand recognition in varied markets.

The company is strategically prioritizing international expansion, evidenced by recent agreements to launch new locations in several countries. This proactive approach to global growth is designed to capitalize on emerging market opportunities and further solidify its worldwide footprint.

- Global Footprint: Over 2,300 locations in 40+ countries and 49 U.S. states/territories.

- International Expansion: Active new agreements in various countries signal a strong growth strategy.

- Market Diversification: Presence across numerous international markets mitigates reliance on any single region.

FAT Brands' diversified brand portfolio, encompassing 17 distinct restaurant concepts, provides resilience against sector-specific downturns and broad market appeal. This multi-brand approach, coupled with an asset-light franchising model that generated approximately 99% of their restaurant network revenue from royalties and franchise fees, minimizes capital expenditure and operational risk.

The company's aggressive acquisition strategy has been a significant growth driver, with $375 million invested in 17 brands since 2009, including $842 million in acquisitions since 2017. This expansion is further supported by a robust development pipeline of 1,000 signed franchise agreements and a target of over 100 new openings in 2025, building on 92 openings in 2024.

FAT Brands possesses a substantial global presence with over 2,300 locations across more than 40 countries and 49 U.S. states, indicating strong brand recognition and diversified revenue streams. Recent international expansion efforts further bolster this global reach, tapping into new market opportunities.

| Metric | 2024 (Opened) | 2025 (Target) | Total Franchise Agreements | Total Brands |

|---|---|---|---|---|

| New Restaurants | 92 | Over 100 | ~1,000 | 17 |

| Global Locations | 2,300+ | Expanding | N/A | N/A |

| Countries | 40+ | Expanding | N/A | N/A |

What is included in the product

Analyzes FAT Brands’s competitive position through key internal and external factors, detailing its strengths in brand portfolio and market presence, weaknesses in debt and integration, opportunities in franchising and international expansion, and threats from competition and economic downturns.

FAT Brands' SWOT analysis offers a clear framework to identify and address strategic vulnerabilities, acting as a pain point reliever by highlighting areas needing improvement for sustainable growth.

Weaknesses

FAT Brands carries a substantial amount of debt, with total debt reported at $1.48 billion USD as of March 2025. This significant financial burden, coupled with a debt-to-equity ratio of 7.2, highlights the company's high financial leverage.

The aggressive acquisition strategy employed by FAT Brands has resulted in this considerable debt load. Such high leverage can amplify financial risks, particularly in scenarios of tightening liquidity or rising interest rates, potentially hindering future operational flexibility and profitability.

FAT Brands has recently faced headwinds with a noticeable dip in both overall revenue and sales at its established locations. For the second quarter of 2025, total revenue saw a 3.4% drop compared to the same period in 2024. This trend is mirrored in same-store sales, which declined by 3.9%, impacting overall system-wide sales negatively.

These figures highlight a significant challenge for the company: its existing restaurants are not performing as strongly as they have in the past. This decline in same-store sales suggests potential issues with customer traffic, average check size, or competitive pressures affecting the core business of its brands.

FAT Brands has been grappling with widening net losses, a significant concern for its financial health. In the second quarter of 2025, the company reported a net loss of $54.2 million, a notable jump from the $39.4 million loss experienced in the same period of the prior year.

Further illustrating this trend, the net loss attributable specifically to FAT Brands reached $54.188 million in Q2 2025, a substantial increase compared to the first quarter of 2025. This deterioration in profitability indicates ongoing challenges in the company's operational performance.

Operational Disruptions and Store Closures

FAT Brands has grappled with significant operational disruptions, notably the closure and conversion of underperforming Smokey Bones locations. This strategic shift, aimed at optimizing the portfolio, has directly impacted revenue streams. For instance, the company reported a net loss of $7.5 million in the first quarter of 2024, partly attributed to these ongoing restructuring efforts.

These closures and conversions, such as transforming Smokey Bones sites into Twin Peaks lodges, incur substantial costs. These expenses, coupled with the temporary loss of revenue from the closed locations, place a strain on the company's financial performance. The process itself requires investment and can lead to short-term dips in overall sales figures as the transition takes place.

- Operational Challenges: FAT Brands has experienced disruptions due to the closure of underperforming Smokey Bones units.

- Revenue Impact: These closures and conversions, including the shift to Twin Peaks, have contributed to lower reported revenues.

- Financial Costs: The process of closing and converting locations incurs significant expenses, affecting profitability.

- Restructuring Efforts: The company's Q1 2024 results showed a net loss of $7.5 million, partly due to these ongoing strategic adjustments.

Increased General and Administrative Expenses

FAT Brands has experienced a rise in its general and administrative (G&A) expenses, which is a notable weakness. This increase is partly attributable to higher professional fees stemming from ongoing litigation.

These escalating G&A costs directly affect the company's profitability. For instance, during the first quarter of 2024, FAT Brands reported G&A expenses of $12.9 million, up from $10.5 million in the same period of 2023. This 22.8% increase puts pressure on operating margins.

- Rising G&A Costs: General and administrative expenses have increased, impacting financial performance.

- Litigation Impact: A portion of the G&A increase is linked to higher professional fees for pending legal matters.

- Profitability Squeeze: The higher operating costs can reduce the company's net income and earnings per share.

- Q1 2024 G&A: G&A expenses were $12.9 million in Q1 2024, a 22.8% rise from $10.5 million in Q1 2023.

FAT Brands' significant debt load, reaching $1.48 billion USD by March 2025 with a debt-to-equity ratio of 7.2, presents a considerable financial risk. This high leverage, a consequence of its acquisition strategy, could limit future flexibility, especially if interest rates rise or liquidity tightens.

The company is also facing declining performance in its existing restaurants. For Q2 2025, total revenue dropped 3.4% year-over-year, and same-store sales fell by 3.9%, indicating potential issues with customer traffic or competitive pressures affecting its core brands.

Profitability remains a concern, with net losses widening. The second quarter of 2025 saw a net loss of $54.2 million, an increase from the $39.4 million loss in the same period of 2024, signaling ongoing operational challenges.

Operational disruptions, such as the closure and conversion of Smokey Bones locations, have impacted revenue and incurred significant costs. These restructuring efforts, while strategic, contribute to short-term financial strain and revenue dips.

Escalating general and administrative (G&A) expenses, driven partly by litigation-related professional fees, are further pressuring profitability. Q1 2024 G&A expenses rose 22.8% to $12.9 million compared to the prior year.

| Financial Metric | Q2 2025 (USD) | Q2 2024 (USD) | Change |

|---|---|---|---|

| Total Debt | $1.48 billion | N/A | N/A |

| Debt-to-Equity Ratio | 7.2 | N/A | N/A |

| Total Revenue | N/A | N/A | -3.4% |

| Same-Store Sales | N/A | N/A | -3.9% |

| Net Loss | $54.2 million | $39.4 million | +37.6% |

| Q1 2024 G&A Expenses | $12.9 million | $10.5 million | +22.8% |

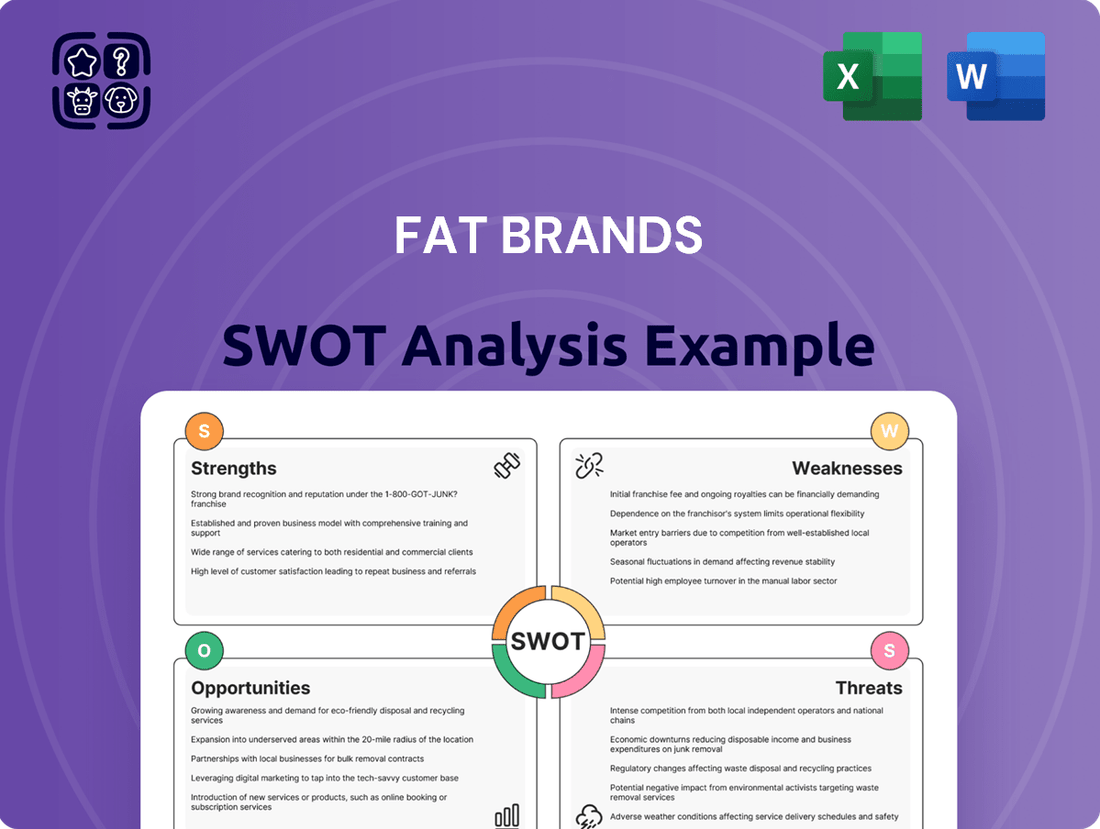

Preview Before You Purchase

FAT Brands SWOT Analysis

This is the actual FAT Brands SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, offering a comprehensive overview of the company's strategic position.

The preview below is taken directly from the full SWOT report you'll get, highlighting key internal strengths and weaknesses alongside external opportunities and threats facing FAT Brands.

Purchase unlocks the entire in-depth version of this FAT Brands SWOT analysis, providing actionable insights for strategic planning and decision-making.

Opportunities

FAT Brands is actively pursuing an expansion of its manufacturing capabilities, notably at its Georgia facility. This strategic move is designed to leverage existing, underutilized capacity, which currently stands at 40%.

The company plans to fill this excess capacity through both its own organic growth initiatives and by engaging in third-party dough and mix manufacturing. This dual approach is expected to unlock new revenue streams and significantly boost operational efficiencies.

FAT Brands is actively pursuing strategic refranchising initiatives, notably planning to convert its company-owned Fazoli's locations back to a franchised model. This move is designed to push the company closer to its target of a nearly 100% franchised portfolio.

This strategic pivot is expected to significantly bolster FAT Brands' cash flow and trim operational expenses. By shedding company-owned assets, the company further strengthens its commitment to an asset-light business structure, which is often favored for its scalability and reduced capital intensity.

FAT Brands is capitalizing on a significant surge in digital sales, with brands like Great American Cookies seeing 25% of their total revenue generated online. This digital push is further amplified by a remarkable 40% growth in loyalty-driven sales, indicating strong customer engagement through digital channels.

The company is also strategically accelerating co-branding initiatives. These partnerships are proving to be a powerful growth engine, consistently delivering 10% to 20% higher incremental sales compared to standalone locations, thereby driving overall expansion and revenue.

Potential from Twin Hospitality Group Spin-off

FAT Brands' spin-off of Twin Hospitality Group Inc., encompassing brands like Twin Peaks and Smokey Bones, creates a distinct publicly traded entity. This strategic maneuver is designed to unlock significant capital resources for FAT Brands. It also offers FAT Brands stockholders a direct avenue to invest in and benefit from the anticipated growth trajectory of the Twin Peaks brand.

This separation allows Twin Peaks to pursue its own strategic initiatives and capital allocation, potentially accelerating its expansion. For FAT Brands, the capital infusion from the spin-off can be reinvested into its core portfolio or used to strengthen its balance sheet. This move is particularly timely given the projected growth in the casual dining sector, with industry reports indicating a continued recovery and expansion in consumer spending on dining out through 2025.

- Capital Infusion: The spin-off is expected to provide FAT Brands with valuable capital to reinvest in its other brands or reduce debt.

- Stockholder Value: FAT Brands shareholders gain direct exposure to the performance and growth potential of the Twin Peaks brand.

- Brand Focus: Twin Peaks can now operate with a dedicated management team and capital structure, optimizing its growth strategy in the competitive casual dining market.

Debt Restructuring and Cost Reduction Initiatives

FAT Brands is strategically addressing its financial structure through significant debt restructuring. A key initiative involves a bondholder agreement to convert amortizing bonds into interest-only payments, a move projected to yield substantial annual cash flow savings, estimated between $30 million and $40 million. This financial maneuver is crucial for enhancing liquidity and operational flexibility.

Beyond debt restructuring, the company is actively implementing cost reduction measures across its operations. Over $5 million in annual general and administrative (G&A) expense reductions have already been realized. Furthermore, FAT Brands is engaged in refinancing its securitization silos, aiming to optimize its capital structure and reduce borrowing costs.

- Debt Restructuring: Agreement to convert amortizing bonds to interest-only, targeting $30-40 million in annual cash flow savings.

- Cost Reduction: Implemented over $5 million in annual G&A reductions.

- Capital Optimization: Actively working on refinancing securitization silos.

FAT Brands is poised to capitalize on the growing demand for its brands through strategic expansion and operational enhancements. The company's focus on increasing manufacturing capacity, particularly at its Georgia facility which currently operates at 40% underutilization, presents a significant opportunity for revenue growth through both internal demand and third-party contracts.

The acceleration of co-branding initiatives is a key growth driver, with these partnerships consistently delivering 10% to 20% higher incremental sales compared to standalone units. Furthermore, the substantial surge in digital sales, with brands like Great American Cookies deriving 25% of revenue online, and a 40% increase in loyalty-driven sales, highlights strong customer engagement and future potential in digital channels.

Threats

The restaurant franchise market is incredibly crowded, with many well-known brands and emerging concepts vying for customer attention. This intense competition means FAT Brands must constantly innovate and adapt to stand out. For instance, the quick-service restaurant (QSR) segment, where many FAT Brands concepts operate, saw significant growth in 2024, but also an increase in new openings from competitors.

FAT Brands directly competes with larger, more established franchise conglomerates that possess greater brand recognition and marketing resources. This can make it challenging to capture market share and expand effectively, especially in key demographic areas. In 2023, the top 500 franchise brands in the U.S. reported substantial revenue growth, highlighting the scale of the competitive landscape FAT Brands navigates.

The restaurant sector, including FAT Brands, is inherently sensitive to economic downturns and changes in how much consumers are willing or able to spend. When the economy falters, discretionary spending on dining out often decreases, directly impacting sales.

FAT Brands' financial results demonstrate this vulnerability. For instance, the company reported a decline in same-store sales for some of its brands during periods of economic stress. This trend highlights how shifts in consumer confidence and disposable income can significantly affect the company's revenue streams across its varied portfolio.

FAT Brands faces a significant challenge with its high interest expenses, directly stemming from its substantial debt obligations. In the first quarter of 2024, the company reported interest expenses of $18.7 million, a notable increase that directly contributes to its net loss. This ongoing need to service its debt, particularly in an environment of elevated interest rates, places a continuous and considerable strain on the company's financial health, impacting profitability and cash flow.

Litigation and Reputational Risk

FAT Brands has experienced a rise in litigation expenses, which have put a strain on its financial performance. For instance, the company reported increased legal and professional fees in its filings, impacting profitability.

While certain legal actions have been resolved or dismissed, the ongoing nature of some disputes presents a lingering reputational risk. This can erode investor confidence and negatively affect how consumers perceive its brands.

- Increased Litigation Costs: Legal expenses have demonstrably risen, impacting the company's bottom line.

- Reputational Damage: Past and ongoing legal challenges can tarnish brand image and investor sentiment.

- Investor Confidence: Persistent legal issues may deter potential investors and affect stock valuation.

Challenges in Raising Equity

FAT Brands has encountered significant hurdles in its efforts to raise equity, a critical step intended to bolster its financial standing and trim its debt load. These delays, stemming from unfavorable market conditions throughout 2024 and into early 2025, have impeded the company's progress. This situation directly impacts its capacity to secure the vital capital needed for executing strategic growth plans and addressing its outstanding debt obligations.

The company's ability to attract equity investors has been tested by a volatile economic climate. For instance, as of the first quarter of 2025, the broader market has shown increased caution towards restaurant sector investments, potentially impacting FAT Brands' valuation and the attractiveness of its equity offerings.

- Market Volatility: Equity markets in 2024 and early 2025 have presented a challenging environment for capital raises, particularly for companies with existing debt concerns.

- Investor Sentiment: A more risk-averse investor sentiment has made it harder for FAT Brands to secure the desired equity financing at favorable terms.

- Impact on Strategy: Delays in equity raises directly threaten the execution of strategic initiatives and the company's ability to deleverage its balance sheet effectively.

FAT Brands faces intense competition from established players and new entrants, requiring constant innovation to differentiate its brands. The company's reliance on debt, evidenced by $18.7 million in interest expenses in Q1 2024, poses a significant financial strain, particularly with rising interest rates. Furthermore, increased litigation costs and potential reputational damage from ongoing legal matters could deter investors and negatively impact brand perception.

SWOT Analysis Data Sources

This analysis is built on a foundation of credible data, including FAT Brands' official financial filings, comprehensive market research reports, and expert commentary from industry analysts, ensuring a robust and informed strategic assessment.