FAT Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

FAT Brands operates in a dynamic environment shaped by political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks. Understanding these external forces is crucial for strategic planning and identifying both opportunities and threats. Gain an edge with our in-depth PESTEL Analysis—crafted specifically for FAT Brands. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government regulations significantly shape the restaurant industry, influencing everything from food sourcing to employee treatment. For FAT Brands, this means navigating a complex web of rules. For instance, in 2024, several states and cities saw increases in minimum wage, with some reaching $15-$17 per hour, directly impacting labor costs for its franchisees.

Changes in food safety standards, such as stricter temperature controls or new allergen labeling requirements, necessitate operational adjustments and potential investments in equipment or training. Furthermore, evolving labor laws concerning benefits, overtime, and scheduling can add to operational expenses. FAT Brands must ensure all its brands, operating across numerous jurisdictions, remain compliant to avoid fines and maintain their operating licenses.

FAT Brands, as a global franchisor, is significantly influenced by international trade policies and geopolitical stability. For instance, changes in tariffs or trade agreements can directly impact the cost of goods and the profitability of its franchisees in various markets. The company's reliance on a global supply chain means that trade disputes, such as those seen between major economic blocs in recent years, can disrupt ingredient sourcing and increase operational expenses.

Political instability in key operating regions poses a direct threat to FAT Brands' expansion and sustained growth. For example, unrest or significant policy shifts in countries where the company has a presence or is considering market entry can deter new franchisee investment and negatively affect existing operations. The company's ability to navigate these political landscapes is crucial for maintaining franchisee confidence and achieving its long-term strategic objectives.

FAT Brands must navigate a complex web of tax policies globally. For instance, corporate tax rates vary widely; in 2024, the US federal corporate tax rate stands at 21%, while countries like Ireland offer significantly lower rates, potentially influencing where FAT Brands chooses to reinvest profits or establish new operations.

Sales taxes and value-added taxes (VAT) also impact consumer spending and operational costs. A shift in VAT rates, such as the recent increase in some European nations, can affect the affordability of FAT Brands' offerings and necessitate pricing adjustments.

Furthermore, franchise-specific taxes or fees can add another layer of complexity. Understanding these fiscal impositions is crucial for accurate financial forecasting and for identifying markets where tax incentives might support expansion initiatives, such as potential tax credits for job creation in emerging markets.

Food Labeling and Dietary Guidelines

Government-mandated food labeling requirements, such as calorie counts on menus, directly impact FAT Brands' operational costs and marketing strategies. For instance, the FDA's menu labeling rule, effective since May 2018, requires chain restaurants with 20 or more locations to display calorie information. This necessitates careful menu engineering and potential ingredient adjustments across FAT Brands' portfolio, influencing consumer purchasing decisions by providing clearer nutritional insights.

Evolving dietary guidelines promoted by governmental bodies, like the USDA's Dietary Guidelines for Americans, shape public health trends and can influence consumer preferences. FAT Brands needs to monitor these evolving recommendations, which in 2024-2025 will likely continue to emphasize reduced sodium, added sugars, and saturated fats. Adapting menu offerings to align with these trends is crucial for maintaining relevance and attracting health-conscious consumers.

- Menu Labeling Compliance: FAT Brands must ensure all its franchised locations adhere to national and local menu labeling laws, which mandate the disclosure of nutritional information.

- Dietary Trend Alignment: Staying abreast of government-promoted dietary guidelines, such as those focusing on plant-based options or reduced processed ingredients, is vital for product innovation.

- Marketing Impact: Changes in labeling or dietary recommendations can necessitate revisions to marketing campaigns and product positioning to resonate with consumer health perceptions.

- Operational Adjustments: Compliance may require adjustments in sourcing, preparation methods, and ingredient formulations across FAT Brands' diverse restaurant concepts.

Franchising Regulatory Environment

The franchising regulatory environment presents a dynamic challenge for FAT Brands, as rules governing disclosure and franchisee relationships differ considerably across jurisdictions. For instance, in the United States, the Federal Trade Commission (FTC) Franchise Rule mandates specific pre-sale disclosures, while individual states may impose additional requirements. Changes to these regulations, such as stricter disclosure mandates or new franchisee protection laws enacted in key markets like California or new international territories FAT Brands may enter, could necessitate adjustments to their franchise agreements and recruitment strategies.

FAT Brands must navigate this complex web of regulations to ensure compliance and foster strong franchisee relationships. In 2024, ongoing discussions around franchise fairness and transparency in various legislative bodies could lead to new compliance burdens or opportunities. For example, a proposed bill in a significant market could alter termination clauses or renewal rights, directly impacting FAT Brands' operational model and its ability to expand efficiently.

- Varying State and Country Regulations: Franchise disclosure documents and relationship laws differ significantly, requiring FAT Brands to maintain country-specific compliance.

- Impact of Regulatory Changes: New or revised laws can affect franchise agreement structures, franchisee recruitment, and ongoing relationship management.

- Importance of Legal Adherence: Strict compliance with franchise laws is fundamental to FAT Brands' business model and long-term sustainability.

- Potential for New Compliance Burdens: Evolving legislation in 2024 and 2025 may introduce additional requirements for franchisors.

Government policies on minimum wage and labor laws directly impact FAT Brands' operational costs, with many US states and cities raising minimum wages to $15-$17 per hour in 2024, affecting franchisee labor expenses.

Stricter food safety standards and evolving labor regulations necessitate ongoing compliance and potential investments across FAT Brands' diverse portfolio, impacting operational expenses and licensing.

International trade policies and geopolitical stability influence FAT Brands' global supply chain and profitability, as seen with recent trade disputes impacting ingredient sourcing costs.

Political instability in key markets poses risks to expansion and operations, potentially deterring investment and affecting franchisee confidence, making political navigation crucial for growth.

What is included in the product

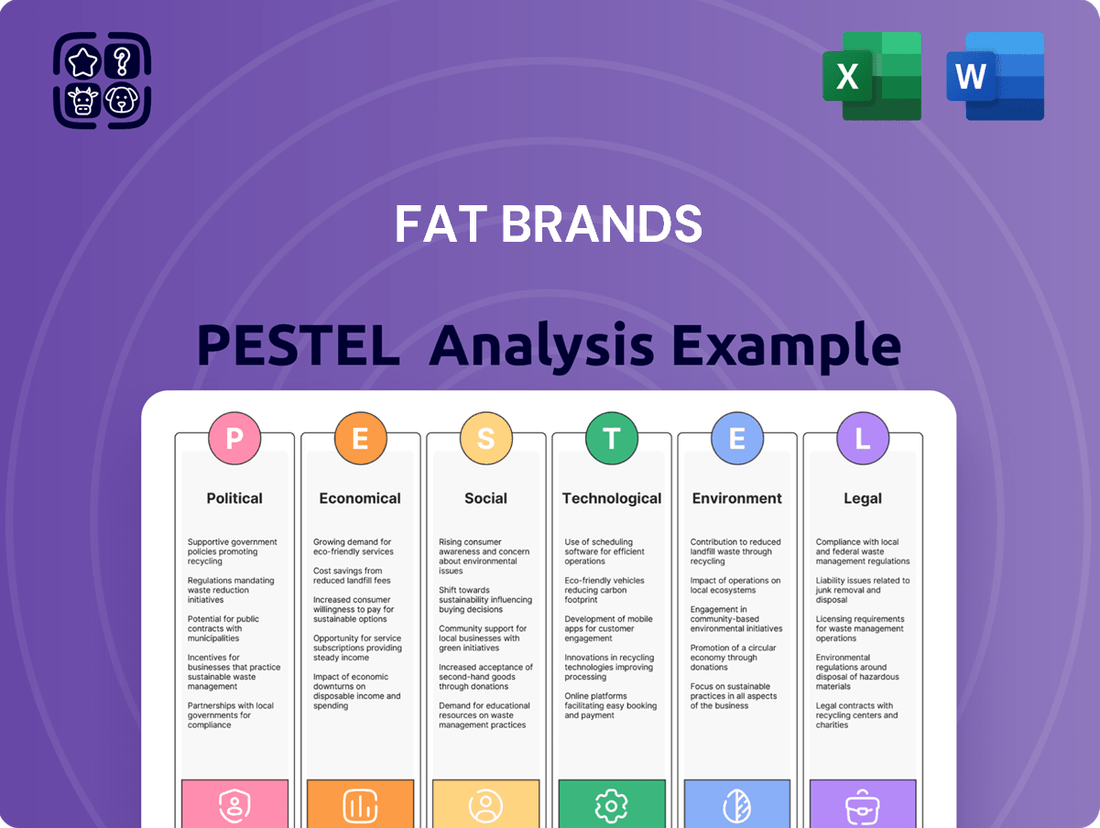

This PESTLE analysis provides a comprehensive examination of the external forces impacting FAT Brands, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It identifies key opportunities and threats stemming from these macro-environmental influences, offering strategic insights for FAT Brands's business planning.

A concise FAT Brands PESTLE analysis provides actionable insights, acting as a pain point reliever by highlighting external factors that can be proactively managed to mitigate risks and capitalize on opportunities.

Economic factors

Consumer discretionary spending is a key driver for FAT Brands, as dining out is often one of the first expenses consumers cut during economic slowdowns. In early 2024, inflation remained a concern, with the Consumer Price Index (CPI) showing persistent price increases, which can squeeze household budgets and reduce spending on non-essential items like restaurant meals.

Conversely, a strengthening economy, characterized by job growth and rising wages, directly benefits FAT Brands. For instance, if disposable income increases, consumers are more likely to patronize brands like Fatburger and Johnny Rockets, boosting the company's royalty streams and sales from its company-owned restaurants.

Inflationary pressures continue to impact the restaurant industry, with FAT Brands potentially facing increased costs for food, labor, and energy. For instance, the U.S. Consumer Price Index for food away from home saw an increase of 5.5% in the 12 months ending April 2024, a notable figure for businesses reliant on these inputs. This rise in operational expenses can directly squeeze profit margins for both the parent company and its franchisees.

Managing these higher input costs requires a delicate balancing act. FAT Brands must implement astute pricing strategies to offset these expenses without deterring its customer base, which is often price-sensitive. Simultaneously, optimizing supply chain efficiency becomes paramount to mitigate the impact of rising costs and maintain profitability.

The core economic challenge for FAT Brands lies in its capacity to either successfully pass these increased costs onto consumers or absorb them internally. For the fiscal year 2023, FAT Brands reported total revenues of $249.1 million, and any significant increase in cost of goods sold or operating expenses without corresponding revenue growth could impact its bottom line.

Fluctuations in interest rates directly impact FAT Brands' cost of borrowing for corporate acquisitions and the financing expenses for its franchisees looking to open new locations. For instance, if the Federal Reserve raises its benchmark interest rate, the cost of loans for both the parent company and its franchisees will likely increase.

Higher interest rates can act as a brake on expansion. When borrowing becomes more expensive, companies and individuals may be less inclined to take on new debt, which can slow down the pace of new franchise development for FAT Brands. This is a critical consideration for a company focused on growth.

Access to affordable capital is the lifeblood of FAT Brands' growth strategy. In 2023, the company continued to manage its debt, and access to favorable lending terms remains paramount. For example, the Federal Reserve kept its target for the federal funds rate in the 5.25%-5.50% range through early 2024, reflecting a sustained period of higher borrowing costs.

Labor Market Conditions

The labor market significantly influences FAT Brands' operational costs and efficiency. In the U.S., the unemployment rate hovered around 3.9% in early 2024, indicating a relatively tight labor market. This can translate to increased competition for workers, potentially driving up wages and impacting franchisee profitability.

Minimum wage increases also present a direct cost factor. For instance, several U.S. states and cities have implemented or are phasing in higher minimum wages, with some reaching $15 per hour or more by 2024-2025. This escalates payroll expenses for FAT Brands' locations.

- Labor Availability: A tight labor market in 2024-2025 means finding and retaining staff can be challenging for FAT Brands' franchisees.

- Wage Pressures: Rising minimum wages and competition for skilled workers directly increase operating expenses.

- Skilled Worker Competition: The demand for experienced restaurant managers and kitchen staff intensifies competition, potentially raising compensation expectations.

- Operational Impact: Higher labor costs can affect profit margins for both corporate-owned and franchised FAT Brands restaurants.

Exchange Rate Fluctuations

For a global entity like FAT Brands, fluctuations in exchange rates directly influence how its international sales and costs are reported in its primary currency. A strengthening US dollar, for instance, can diminish the reported value of profits earned in foreign markets. Conversely, a weaker dollar can make overseas ventures more appealing and cost-effective for expansion.

Managing these currency volatilities is crucial for maintaining FAT Brands' financial health and predictability. For example, in the first quarter of 2024, the US dollar saw mixed performance against major currencies, impacting companies with significant international operations. FAT Brands' diverse portfolio, including brands like Fatburger and Johnny Rockets, operates in numerous countries, making currency risk a constant consideration.

- Impact on Revenue: A stronger USD can decrease the reported USD value of international sales.

- Impact on Expenses: Conversely, a weaker USD can increase the USD cost of imported goods or services.

- Strategic Implications: Exchange rate movements can influence pricing strategies and the attractiveness of new market entries.

- Risk Management: Companies like FAT Brands often employ hedging strategies to mitigate the adverse effects of currency fluctuations.

Economic conditions significantly shape FAT Brands' performance, with consumer discretionary spending being a primary driver. Inflationary pressures, evident in rising food away from home costs, directly impact operational expenses, as seen with a 5.5% increase in the 12 months ending April 2024. Conversely, a robust economy with growing disposable income boosts sales and royalty streams.

Interest rates affect borrowing costs for both the company and its franchisees, potentially slowing expansion. The Federal Reserve's sustained federal funds rate target of 5.25%-5.50% through early 2024 highlights this challenge. A tight labor market, with a U.S. unemployment rate around 3.9% in early 2024, also drives up wage costs, impacting profit margins.

Currency exchange rates introduce another layer of complexity for FAT Brands' global operations. Fluctuations can alter the reported value of international profits and the cost of imported goods. For instance, the mixed performance of the US dollar against major currencies in Q1 2024 necessitates careful currency risk management strategies.

| Economic Factor | Impact on FAT Brands | Relevant Data (2024/2025) |

|---|---|---|

| Consumer Spending | Directly affects sales volume and royalty income. | Inflation concerns in early 2024 impacting discretionary budgets. |

| Inflation | Increases operating costs (food, labor, energy). | Food away from home CPI up 5.5% (12 months ending April 2024). |

| Interest Rates | Influences cost of debt for company and franchisees. | Federal Funds Rate target: 5.25%-5.50% (early 2024). |

| Labor Market | Affects labor availability and wage costs. | U.S. Unemployment Rate: ~3.9% (early 2024). |

| Exchange Rates | Impacts reported international revenue and expenses. | Mixed USD performance against major currencies (Q1 2024). |

Same Document Delivered

FAT Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This FAT Brands PESTLE analysis offers a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental aspects.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain valuable insights into how global trends and industry shifts influence FAT Brands' strategic decisions and operational landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It’s designed to provide a clear and actionable understanding of the opportunities and threats facing FAT Brands in the current market environment.

Sociological factors

Consumers are increasingly seeking healthier and more specialized food options, with plant-based diets gaining significant traction. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $160.5 billion by 2030, demonstrating a strong growth trend.

FAT Brands faces the challenge of integrating these evolving preferences across its varied restaurant concepts, which include casual dining and fast-food chains. Adapting menus to include more plant-based alternatives or catering to specific dietary needs like gluten-free or organic ingredients could attract a broader customer base.

Failure to innovate and respond to these shifts in consumer demand could impact brand relevance and market share. For example, a 2024 survey indicated that over 60% of consumers consider health and wellness when choosing where to eat, highlighting the importance of menu innovation.

Consumers increasingly expect seamless and quick dining experiences, a trend amplified by busy schedules and widespread digital integration. FAT Brands is responding by focusing on improving its online ordering platforms and delivery services. For instance, in 2024, digital sales for the restaurant industry continued their upward trajectory, with many consumers prioritizing brands offering efficient mobile ordering and curbside pickup options.

The digital lifestyle means that convenience is no longer a bonus but a necessity for restaurant brands. FAT Brands' investment in enhancing its drive-thru efficiency and app-based ordering directly addresses this societal shift. Reports from late 2024 indicated that over 60% of quick-service restaurant orders were placed digitally, highlighting the critical need for robust technological infrastructure to maintain customer engagement and loyalty.

Demographic shifts, like the growing aging population and increasing ethnic diversity, directly influence consumer preferences and dining habits. For instance, in the US, the 65+ population is projected to reach 73 million by 2030, a significant increase that may favor more health-conscious or comfort-food oriented concepts. Urbanization continues to concentrate populations in cities, creating demand for convenient, quick-service options, which aligns well with FAT Brands' portfolio, but also intensifies competition. Analyzing these trends allows FAT Brands to pinpoint high-growth urban areas and tailor offerings to the evolving tastes of diverse local communities, ensuring brand relevance and market penetration.

Brand Perception and Social Responsibility

Consumers increasingly scrutinize a brand's commitment to social responsibility. For FAT Brands, this means how ethically its ingredients are sourced, its engagement with local communities, and how its employees are treated. A recent survey in early 2024 indicated that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions.

Maintaining a positive public image is crucial for FAT Brands. Demonstrating genuine commitment to corporate social responsibility across its diverse portfolio of brands, from Johnny Rockets to Great American Cookies, can foster trust and build lasting customer loyalty. For instance, a strong community involvement program for one of its flagship brands could resonate with local patrons.

- Consumer Prioritization: A 2024 Nielsen report found that 55% of global consumers are willing to pay more for sustainable brands.

- Brand Equity Impact: Negative press regarding labor practices or supply chain ethics can lead to immediate sales declines, as seen with other restaurant chains facing similar scrutiny.

- Competitive Advantage: Brands that proactively highlight their ethical practices, such as fair wages or sustainable sourcing, can differentiate themselves in a crowded market.

- Investor Relations: Environmental, Social, and Governance (ESG) factors are becoming more important for investors, influencing capital allocation and company valuations.

Dining Out Culture and Experience Economy

The enduring cultural importance of dining out continues to fuel consumer spending, with a significant portion of discretionary income allocated to restaurant visits. This trend is amplified by the growing 'experience economy,' where consumers prioritize memorable outings over mere consumption. For instance, in 2024, the US restaurant industry was projected to reach over $1 trillion in sales, underscoring the substantial market for dining experiences.

FAT Brands must therefore focus on developing restaurant concepts that offer more than just food. This involves creating appealing ambiances, delivering exceptional service, and crafting unique dining experiences that resonate with consumers seeking engagement and entertainment. This strategic imperative is especially critical for FAT Brands' casual and polished casual dining segments, where differentiation through experience is key to capturing market share.

- Consumer Spending Shift: In 2024, US consumers continued to allocate a substantial portion of their discretionary income to dining out, reflecting its cultural significance.

- Experience Economy Dominance: The rise of the experience economy means consumers are actively seeking memorable dining occasions, not just meals.

- FAT Brands' Strategic Focus: FAT Brands needs to ensure its brands, particularly in the casual and polished casual dining sectors, provide attractive ambiances and unique experiences to remain competitive.

Societal shifts toward health and convenience significantly impact FAT Brands' diverse portfolio. Growing consumer demand for plant-based and specialized dietary options, evidenced by the global plant-based food market's projected growth to $160.5 billion by 2030, necessitates menu adaptation across brands like Johnny Rockets and Great American Cookies. Simultaneously, the emphasis on digital integration and seamless experiences, with over 60% of quick-service restaurant orders placed digitally in late 2024, highlights FAT Brands' strategic focus on enhancing its online ordering and delivery platforms to meet evolving consumer expectations for speed and accessibility.

Technological factors

The widespread adoption of digital ordering through mobile apps, websites, and third-party delivery services is a critical technological factor for FAT Brands. This trend directly impacts accessibility and revenue streams, as consumers increasingly expect seamless online ordering experiences. In 2024, the global online food delivery market was projected to reach over $200 billion, highlighting the significant opportunity for brands that can effectively leverage these platforms.

FAT Brands must continue to invest in developing and maintaining intuitive digital ordering platforms. Equally important is the strategic management of partnerships with third-party delivery services, which are vital for expanding reach and fulfilling customer demand for convenience. By streamlining the entire process from initial order to final delivery, these technologies are key to capturing market share and meeting evolving consumer expectations in the competitive restaurant landscape.

Technological advancements are revolutionizing kitchen operations. Automated cooking systems, smart inventory management, and robotics are enhancing efficiency and consistency across FAT Brands' various restaurant concepts. For instance, the adoption of AI-powered inventory tracking can reduce food waste by up to 15%, a significant cost saving for franchisees.

Implementing these technologies directly impacts profitability. Reduced labor costs, minimized waste, and consistent food quality contribute to better margins. In 2024, QSR Magazine reported that restaurants leveraging advanced kitchen tech saw an average 10% increase in operational efficiency, directly boosting their bottom line.

FAT Brands is increasingly leveraging data analytics to gain a deeper understanding of its diverse customer base. By analyzing purchasing patterns and preferences across its portfolio of brands like Fatburger and Johnny Rockets, the company can identify key demographic segments and their evolving tastes. This granular insight is crucial for tailoring marketing efforts and optimizing menu development, ensuring offerings resonate with specific customer needs.

The strategic application of data analytics provides a significant competitive advantage. For instance, understanding which menu items perform best in different regions or during specific times of the day allows FAT Brands to refine its product mix and operational strategies. This data-driven approach supports more informed decision-making, benefiting both corporate management and individual franchisees in their day-to-day operations and long-term planning.

Supply Chain Technology and Logistics

Innovations in supply chain technology, such as real-time tracking and predictive analytics, are crucial for FAT Brands. These advancements can significantly boost the efficiency and resilience of sourcing ingredients and distributing products across their global operations. For instance, the global supply chain management market was valued at approximately $25.8 billion in 2023 and is projected to reach $48.1 billion by 2030, indicating substantial investment in these technologies.

Implementing technologies like blockchain for ingredient traceability can enhance transparency and food safety, which are paramount in the restaurant industry. This technology not only builds consumer trust but also helps in quickly identifying and rectifying any issues within the supply chain. The blockchain in supply chain market is expected to grow from $1.1 billion in 2023 to $10.5 billion by 2028, showcasing a strong trend towards adoption.

Improved logistics, driven by technology, directly translate to reduced operational costs and minimized waste for FAT Brands. Efficient logistics ensure a consistent supply of high-quality ingredients, preventing stockouts and maintaining the brand's reputation for product consistency. In 2024, companies are increasingly leveraging AI-powered logistics platforms to optimize delivery routes and inventory management, leading to potential cost savings of up to 15-20%.

- Real-time tracking provides immediate visibility into ingredient location and status.

- Predictive analytics helps forecast demand and optimize inventory levels, reducing waste.

- Blockchain technology enhances traceability, ensuring food safety and transparency.

- AI-driven logistics optimize delivery routes and reduce transportation costs.

Customer Relationship Management (CRM) Systems

Advanced Customer Relationship Management (CRM) systems are crucial for FAT Brands to cultivate deeper connections with its customer base. These platforms facilitate the implementation of effective loyalty programs, the delivery of precisely targeted promotions, and personalized communication strategies. By understanding and proactively addressing customer needs, FAT Brands can enhance customer retention and attract new patrons.

The strategic use of CRM technology is instrumental in building and sustaining brand loyalty across FAT Brands' diverse portfolio of restaurant concepts. For instance, in 2024, many quick-service restaurant (QSR) chains reported significant improvements in repeat business, with some seeing a 15-20% uplift attributed directly to enhanced loyalty programs managed through sophisticated CRM systems. This technology allows for granular analysis of purchasing behavior, enabling tailored offers that resonate with individual preferences.

- Enhanced Customer Engagement: CRM systems allow FAT Brands to segment customers and deliver personalized marketing messages, boosting engagement.

- Improved Customer Retention: By tracking customer interactions and preferences, FAT Brands can proactively address issues and foster loyalty, reducing churn.

- Data-Driven Marketing: CRM data provides insights into customer behavior, enabling more effective and efficient marketing campaigns.

- Operational Efficiency: Streamlined customer service and sales processes through CRM contribute to overall operational improvements.

Technological advancements in digital ordering and delivery platforms are paramount for FAT Brands' growth. The global online food delivery market is expected to surpass $200 billion in 2024, underscoring the importance of robust mobile apps and third-party partnerships for reaching consumers. Investing in user-friendly interfaces and efficient delivery logistics is key to capturing market share.

Legal factors

FAT Brands' reliance on franchising means it must navigate a complex web of federal and state franchise laws. These regulations, such as the Franchise Disclosure Document (FDD) requirements, dictate how FAT Brands must present information to potential franchisees, ensuring transparency and fairness. Failure to comply can lead to significant legal penalties and operational disruptions.

Staying current with evolving franchise laws is critical for FAT Brands. For instance, in 2024, several states are reviewing or have proposed changes to franchise relationship laws, which could impact contract renewals and termination clauses. FAT Brands’ ability to adapt its franchise agreements and operational guidelines to these legal shifts directly affects its growth and stability.

FAT Brands must navigate a complex web of labor and employment laws, including minimum wage, overtime, and anti-discrimination statutes. For instance, the U.S. federal minimum wage remains $7.25 per hour, but many states and cities have enacted higher rates, impacting franchisee labor costs. Non-compliance can result in substantial penalties, such as the $1.5 million settlement reached by Chipotle in 2023 over child labor law violations, underscoring the financial and reputational risks.

Worker classification, distinguishing between employees and independent contractors, is another critical legal area. Misclassification can lead to back taxes, penalties, and benefits claims. The ongoing debate and legal challenges surrounding gig economy workers, for example, highlight the evolving landscape and the need for FAT Brands and its franchisees to ensure proper classification to avoid costly litigation and regulatory scrutiny.

Health and safety regulations, such as those enforced by OSHA in the United States, are paramount in the food service industry. FAT Brands' restaurants must adhere to strict food safety standards and maintain safe working environments. In 2024, the U.S. Bureau of Labor Statistics reported that the food service industry continues to face higher rates of nonfatal workplace injuries compared to other sectors, emphasizing the persistent need for vigilance and investment in safety protocols.

FAT Brands, like all restaurant operators, must meticulously follow stringent food safety and public health regulations. This encompasses everything from maintaining high sanitation standards and proper food handling procedures to accurate allergen labeling and passing regular health inspections.

Failure to comply can lead to immediate business interruptions, significant fines, and irreparable damage to consumer confidence and brand image across FAT Brands' diverse portfolio of restaurants. For instance, in 2023, the FDA issued over 10,000 citations for food safety violations, highlighting the critical nature of these regulations.

Intellectual Property Rights

FAT Brands heavily relies on its intellectual property, including brand names like Fatburger and Johnny Rockets, logos, and proprietary recipes, which are protected through trademarks and copyrights. This legal framework is crucial for maintaining the distinctiveness and value of its extensive brand portfolio. In 2023, the company continued its focus on brand protection, a key element in its strategy to prevent dilution and ensure consistent customer experience across its diverse restaurant concepts.

The enforcement of these intellectual property rights is paramount for FAT Brands to safeguard its competitive edge. Legal action against infringement is a necessary measure to protect brand integrity and prevent unauthorized use of its valuable assets by competitors or former business partners. This vigilance is essential in the fast-paced restaurant industry.

Continuous monitoring and defense of its intellectual property are ongoing requirements for FAT Brands. This proactive approach helps to deter potential infringers and ensures that the company's unique brand identity and operational standards are not compromised. The company's commitment to IP protection underpins its franchise model and long-term growth strategy.

Key aspects of FAT Brands' intellectual property protection include:

- Trademarks: Safeguarding brand names, logos, and slogans associated with its various restaurant chains.

- Copyrights: Protecting original works, such as unique menu item descriptions, marketing materials, and operational manuals.

- Trade Secrets: Maintaining the confidentiality of proprietary recipes and operational processes that provide a competitive advantage.

- Enforcement Actions: Actively pursuing legal remedies against any unauthorized use or infringement of its intellectual property rights.

Consumer Protection and Data Privacy Laws

FAT Brands must navigate a complex web of consumer protection laws that govern everything from how they advertise their menus and pricing to the quality of service provided at their franchised locations. In 2024, regulators continue to focus on transparency and fair practices, with potential penalties for misleading advertising or unfair pricing structures.

The increasing reliance on digital platforms for ordering and customer engagement means FAT Brands must also adhere to evolving data privacy regulations. Laws like the GDPR in Europe and the CCPA in California, which came into full effect in recent years, impose strict requirements on how customer data is collected, stored, and used. Non-compliance can result in substantial fines; for instance, GDPR violations can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Ensuring secure data handling practices is not just a legal necessity but also crucial for maintaining customer trust. A data breach could severely damage FAT Brands' reputation and lead to a significant loss of business.

- Advertising Standards: Ensuring all promotional materials are truthful and not misleading.

- Pricing Transparency: Clearly communicating all costs associated with menu items and promotions.

- Data Privacy Compliance: Adhering to regulations like GDPR and CCPA for customer data protection.

- Service Quality Standards: Maintaining consistent service quality across all franchised locations as per agreements.

FAT Brands' franchise model necessitates strict adherence to franchise disclosure laws, ensuring transparency for potential franchisees. In 2024, regulatory bodies continue to scrutinize franchise agreements for fairness and clarity, with potential implications for contract terms and renewal processes.

Navigating labor laws is paramount, especially with varying state minimum wage laws impacting operational costs for franchisees. Furthermore, the ongoing debate around worker classification underscores the need for FAT Brands to ensure compliance to avoid costly litigation and penalties.

Food safety and health regulations remain critical; the U.S. food service sector, as of 2024, still reports higher workplace injury rates, highlighting FAT Brands' need for robust safety protocols. Non-compliance with food safety standards, as evidenced by over 10,000 FDA citations in 2023, can lead to severe business disruptions and reputational damage.

Protecting its intellectual property, including brand names and recipes, is vital for FAT Brands' competitive edge. The company's vigilance in enforcing trademarks and copyrights, as seen in its 2023 brand protection efforts, is essential for maintaining brand integrity and its franchise system's value.

Environmental factors

Growing consumer and investor demand for sustainability is increasingly pressuring restaurant chains like FAT Brands to adopt more environmentally friendly practices. This includes a heightened focus on ethical and sustainable sourcing of ingredients, with a significant portion of consumers in 2024 indicating a preference for brands demonstrating clear commitments to these areas. For instance, a recent industry survey revealed that over 60% of diners consider a restaurant's sustainability practices when choosing where to eat.

Implementing robust programs for responsible sourcing, actively reducing food waste, and prioritizing support for local producers can significantly enhance FAT Brands' brand image. This strategic approach appeals directly to the growing segment of environmentally conscious consumers, potentially boosting customer loyalty and market share. Evaluating the environmental impact across the entire supply chain, from farm to fork, is becoming a critical component of operational strategy.

The restaurant sector, including chains like FAT Brands, is a major contributor to waste, with food scraps, single-use packaging, and disposable items forming a substantial portion. This reality places increasing pressure on FAT Brands to adopt robust waste management strategies, focusing on reduction, recycling, and potentially composting initiatives across its diverse portfolio of brands.

In 2024, the U.S. restaurant industry's waste generation remains a significant environmental concern. For instance, the National Restaurant Association reported that food waste alone accounts for a substantial percentage of overall waste. FAT Brands, like its peers, is therefore incentivized to explore and implement innovations in sustainable packaging solutions and waste diversion programs to meet evolving environmental regulations and enhance its corporate social responsibility image.

Restaurant operations, including cooking and climate control, are significant energy users. FAT Brands, like many in the industry, faces growing pressure to track and lower its energy use and carbon emissions. For instance, the restaurant sector's energy consumption contributes notably to overall emissions, with HVAC systems alone accounting for a substantial portion of a restaurant's energy bill.

To address this, FAT Brands can explore investments in energy-efficient kitchen appliances and HVAC upgrades. Adopting renewable energy sources, such as solar panels on franchise locations, and implementing sustainable building practices can further reduce their environmental impact. These initiatives not only align with environmental expectations but can also lead to cost savings on utilities over time, a trend observed across the broader hospitality sector.

Water Usage and Conservation

Water is fundamental to FAT Brands' restaurant operations, essential for everything from food preparation and cooking to maintaining hygiene and sanitation standards across its diverse portfolio of brands.

The company faces increasing pressure from consumers and regulators to manage its water footprint responsibly. This scrutiny highlights the need for proactive water conservation strategies.

Implementing water-efficient technologies and practices is becoming a key differentiator for environmental stewardship. This is particularly relevant in areas experiencing water stress.

- Water Consumption: Restaurants typically use significant amounts of water daily for dishwashing, cooking, and general cleaning.

- Conservation Measures: FAT Brands can benefit from adopting low-flow faucets, pre-rinse spray valves, and water-efficient dishwashers.

- Regional Impact: In 2024, regions like California and parts of the Southwest continued to face water scarcity, making conservation efforts even more critical for businesses operating there.

- Cost Savings: Reduced water usage not only aids environmental goals but also directly translates into lower utility bills for FAT Brands' franchisees.

Climate Change Impact on Supply Chains

Climate change poses a significant threat to FAT Brands' supply chain by disrupting the availability and pricing of key agricultural ingredients. Extreme weather events like droughts and floods, which are becoming more frequent and intense, can directly impact crop yields and quality. For instance, in 2024, prolonged drought conditions in major agricultural regions led to an average 15% increase in the cost of certain produce commodities used in fast-casual dining.

To mitigate these risks, FAT Brands must focus on building resilient supply chains and diversifying its sourcing strategies. Proactive risk assessment and adaptation measures are essential for ensuring consistent ingredient access and managing price volatility. This includes exploring alternative growing regions and developing stronger relationships with suppliers committed to sustainable practices.

- Increased Volatility: Extreme weather events in 2024 led to a 10-20% price fluctuation for several key agricultural inputs critical to FAT Brands' menu offerings.

- Sourcing Diversification: Exploring new supplier partnerships in regions less susceptible to immediate climate impacts is a strategic imperative.

- Resilience Investment: Investing in supply chain infrastructure that can withstand climate-related disruptions, such as improved storage and transportation, is crucial.

- Adaptation Strategies: Implementing strategies like supporting climate-smart agriculture among suppliers can help secure long-term ingredient availability.

Growing consumer and investor demand for sustainability is increasingly pressuring restaurant chains like FAT Brands to adopt more environmentally friendly practices, with a significant portion of consumers in 2024 indicating a preference for brands demonstrating clear commitments to these areas.

Implementing robust programs for responsible sourcing, actively reducing food waste, and prioritizing support for local producers can significantly enhance FAT Brands' brand image, appealing directly to environmentally conscious consumers and potentially boosting customer loyalty.

The restaurant sector's substantial waste generation, including food scraps and single-use packaging, places increasing pressure on FAT Brands to adopt robust waste management strategies focusing on reduction and recycling.

Restaurant operations are significant energy users, with HVAC systems alone accounting for a substantial portion of a restaurant's energy bill, incentivizing FAT Brands to explore energy-efficient appliances and renewable energy sources.

Water conservation is a key differentiator, particularly in water-stressed regions, making water-efficient technologies and practices crucial for FAT Brands' environmental stewardship and potential cost savings.

Climate change poses a significant threat to FAT Brands' supply chain by disrupting ingredient availability and pricing, with extreme weather events in 2024 leading to an average 15% increase in the cost of certain produce commodities.

| Environmental Factor | Impact on FAT Brands | 2024/2025 Data/Trend |

|---|---|---|

| Sustainability Demand | Pressure for eco-friendly practices, ethical sourcing. | Over 60% of diners consider sustainability when choosing restaurants. |

| Waste Management | Need for reduction, recycling, and diversion programs. | Restaurant sector is a major contributor to landfill waste. |

| Energy Consumption | Focus on reducing energy use and carbon emissions. | HVAC systems are a significant portion of restaurant energy bills. |

| Water Usage | Emphasis on water conservation and efficient technologies. | Water scarcity in regions like California in 2024. |

| Climate Change | Supply chain disruption, ingredient price volatility. | 15% increase in produce costs due to drought in 2024. |

PESTLE Analysis Data Sources

Our FAT Brands PESTLE Analysis is informed by a comprehensive blend of public and proprietary data. We integrate insights from industry-specific market research, financial reports from regulatory bodies, and consumer trend analyses to ensure a holistic view.