FAT Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

Unlock the strategic blueprint of FAT Brands's thriving franchise empire. This comprehensive Business Model Canvas dissects how they leverage diverse restaurant brands, manage franchise relationships, and generate revenue streams. Discover the key partnerships and cost structures that fuel their growth.

Partnerships

Franchisees are the backbone of FAT Brands' strategy, driving the majority of its revenue through royalty fees and initial franchise payments. In 2023, FAT Brands operated over 2,300 franchised locations across its diverse brand portfolio, highlighting the critical role these partners play in the company's expansion and operational footprint.

FAT Brands supports its franchisees by offering comprehensive training programs, robust marketing initiatives, and ongoing operational assistance. This partnership model allows FAT Brands to scale rapidly while enabling entrepreneurs to own and operate successful restaurant businesses under established brand names.

FAT Brands relies heavily on a robust network of food and beverage suppliers to maintain the quality and consistency across its diverse portfolio of restaurant brands. These partnerships are fundamental to ensuring operational efficiency and cost-effectiveness, directly impacting profitability for both franchised and company-owned establishments. For instance, in 2023, FAT Brands continued to solidify these relationships, understanding that a reliable supply chain is paramount to meeting customer expectations.

The company's manufacturing facility also depends on strategic supplier relationships for everything from raw ingredients to packaging materials. By fostering strong ties with these key partners, FAT Brands secures a steady flow of essential products, which is critical for upholding brand standards and managing inventory effectively. This collaborative approach helps mitigate supply chain disruptions and allows for competitive pricing, benefiting the entire franchise system.

FAT Brands actively cultivates relationships with real estate developers and landlords to pinpoint and acquire optimal sites for new restaurant establishments and conversions. This strategic collaboration is paramount for extending the market presence of its established brands and effectively integrating newly acquired concepts, such as the ongoing conversion of Smokey Bones restaurants into Twin Peaks locations.

In 2024, FAT Brands continued to leverage these partnerships to fuel its expansion. For instance, the company's strategy includes identifying high-traffic retail centers and urban hubs, often through direct engagement with developers who manage these properties. This approach ensures access to prime real estate, a critical factor in the success of quick-service and casual-dining concepts.

Acquired Brand Management Teams

FAT Brands strategically leverages acquired brand management teams as crucial partners. This allows for the seamless integration of new restaurant concepts by tapping into their existing expertise and established customer loyalty. For instance, following acquisitions like that of Johnny Rockets in 2020, FAT Brands retained key leadership to maintain brand integrity and operational efficiency.

These partnerships are vital for aligning the acquired brand's unique strengths with FAT Brands' overarching expansion goals. By retaining experienced management, FAT Brands can more effectively harness the acquired brand's market position and operational know-how. This approach was evident in the 2021 acquisition of Twin Peaks, where experienced management was retained to guide its continued growth within the FAT Brands portfolio.

Key benefits of these acquired brand management teams include:

- Preservation of Brand Identity: Maintaining the unique culture and customer experience of each acquired brand.

- Operational Continuity: Ensuring smooth day-to-day operations and minimizing disruption post-acquisition.

- Market Expertise: Utilizing the deep understanding of specific customer segments and market dynamics held by the acquired teams.

- Accelerated Integration: Speeding up the process of incorporating new brands into the FAT Brands ecosystem.

Technology and Digital Marketing Partners

FAT Brands leverages key partnerships with technology and digital marketing firms to elevate customer experiences and boost sales. These collaborations are crucial for implementing advanced loyalty programs and user-friendly online ordering systems that cater to a diverse customer base. For instance, in 2024, FAT Brands continued to invest in digital infrastructure to support its growing portfolio of brands, aiming to create seamless omnichannel engagement.

These strategic alliances enable FAT Brands to execute highly targeted marketing campaigns across digital platforms. By partnering with specialized agencies, the company can refine its customer outreach, driving traffic and increasing order frequency for its various restaurant concepts. This focus on digital engagement is a cornerstone of their growth strategy, ensuring brand visibility and customer loyalty in a competitive market.

Key aspects of these partnerships include:

- Development and implementation of innovative loyalty programs to reward repeat customers and encourage frequent visits.

- Enhancement of online ordering platforms to ensure a smooth and efficient customer experience across all brands.

- Execution of data-driven digital marketing campaigns targeting specific customer segments to maximize engagement and conversion rates.

- Integration of new technologies to streamline operational efficiencies and improve overall service delivery.

FAT Brands' success is intrinsically linked to its franchisees, who operate the vast majority of its locations. In 2023, the company boasted over 2,300 franchised units, underscoring the critical role these entrepreneurs play in revenue generation and brand expansion. These partnerships are further strengthened by FAT Brands' provision of extensive training, marketing support, and operational guidance, fostering a mutually beneficial growth environment.

Strategic supplier relationships are also paramount, ensuring consistent quality and cost-effectiveness across FAT Brands' diverse portfolio. These partnerships are vital for maintaining brand standards and managing inventory efficiently, as demonstrated by ongoing efforts in 2023 to solidify these essential supply chain connections. Reliable access to ingredients and packaging materials directly impacts profitability for all operating locations.

FAT Brands actively collaborates with real estate developers and landlords to secure prime locations for new and existing brands. This is crucial for market penetration and the integration of acquired concepts, such as the conversion of Smokey Bones to Twin Peaks in 2024, which relies on identifying high-traffic areas through developer engagement.

The company also leverages acquired brand management teams, retaining key leadership post-acquisition to preserve brand identity and ensure operational continuity. This strategy was employed with brands like Johnny Rockets (acquired 2020) and Twin Peaks (acquired 2021), utilizing their market expertise to accelerate integration and drive growth within the FAT Brands ecosystem.

Furthermore, FAT Brands partners with technology and digital marketing firms to enhance customer experience and drive sales. These collaborations focus on advanced loyalty programs and streamlined online ordering, with continued investment in digital infrastructure throughout 2024 to foster seamless omnichannel engagement and targeted marketing campaigns.

| Partnership Type | Key Role | 2023/2024 Impact |

|---|---|---|

| Franchisees | Operational execution, revenue generation | Over 2,300 locations in 2023; driving royalty fees and expansion |

| Suppliers | Ensuring quality ingredients and materials | Critical for operational efficiency, cost-effectiveness, and brand consistency |

| Real Estate Developers | Site acquisition and expansion | Facilitating new location openings and brand integration (e.g., Twin Peaks conversions) |

| Acquired Brand Management | Brand integrity, operational expertise | Retained leadership for smooth integration and market knowledge utilization |

| Technology/Marketing Firms | Customer engagement, sales growth | Enhancing loyalty programs, online ordering, and digital marketing efforts |

What is included in the product

A comprehensive, pre-written business model tailored to FAT Brands' strategy of acquiring and growing a portfolio of restaurant brands, focusing on franchise operations and leveraging shared resources.

This model details FAT Brands' diverse customer segments, multi-channel distribution, and value propositions across its various restaurant concepts, reflecting real-world operations and growth plans.

FAT Brands' Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of their diverse franchise portfolio, allowing for quick identification of core components and strategic synergies.

Activities

FAT Brands' key activity centers on the strategic acquisition of new restaurant concepts, a process that fuels its portfolio expansion. This involves meticulous due diligence to identify promising brands, followed by careful negotiation to secure favorable terms.

Once a brand is acquired, FAT Brands focuses on its seamless integration. This encompasses merging operations, aligning supply chains, and incorporating the new brand's franchising system into the existing FAT Brands infrastructure, ensuring operational efficiency and brand synergy.

For instance, in 2023, FAT Brands completed the acquisition of Great American Cookies and Wetzel's Pretzels, adding significant value and expanding its reach within the mall-based food court segment. This strategic move highlights their commitment to growing through acquisition.

A core activity for FAT Brands is the continuous expansion of its franchise system. This includes actively seeking out and onboarding new franchisees, meticulously crafting franchise agreements, and delivering thorough training programs. This focus is crucial for maintaining uniform brand quality and operational efficiency across its diverse global portfolio.

FAT Brands also dedicates significant resources to ongoing support for its existing franchisees. This support encompasses providing operational guidance, marketing assistance, and access to supply chain efficiencies. For instance, in 2024, the company continued to refine its franchisee onboarding process, aiming to shorten the time to opening for new locations.

FAT Brands actively markets its diverse portfolio of restaurant brands, including Fatburger and Johnny Rockets, to build strong brand recognition and attract a broad customer base. This involves crafting national and local marketing campaigns, meticulously managing each brand's unique identity, and executing targeted digital marketing strategies to boost system-wide sales.

In 2024, the company continued to invest in marketing efforts to support its franchisees and drive traffic. For instance, strategic digital advertising and social media engagement are key components of their approach to reaching consumers in today's competitive landscape.

Supply Chain Management and Manufacturing

FAT Brands actively manages its supply chain to ensure efficient sourcing of ingredients and products across its diverse portfolio of restaurant brands. This involves strategic partnerships and robust logistics to maintain quality and availability.

The company is also investing in expanding its manufacturing infrastructure. A notable example is the facility in Georgia, which focuses on producing cookie dough and dry mixes. This expansion aims to enhance operational efficiency and explore opportunities to serve external clients.

- Supply Chain Efficiency: FAT Brands prioritizes an efficient supply chain for all its brands, covering ingredient sourcing and product distribution.

- Manufacturing Expansion: The company is increasing its manufacturing capabilities, exemplified by its Georgia facility for cookie dough and dry mix production.

- Operational Enhancement: This expansion is designed to boost efficiency and potentially open avenues for third-party manufacturing services.

Company-Owned Restaurant Operations

FAT Brands' key activities for its company-owned restaurant operations revolve around the direct management of these locations. This includes overseeing daily service, maintaining food quality, and ensuring a positive customer experience to drive profitability. These owned sites also function as crucial innovation hubs, allowing the company to test new menu items, operational efficiencies, and marketing strategies before introducing them to the broader franchise network.

For instance, in 2023, FAT Brands reported that its company-owned locations played a vital role in refining operational models. While the majority of revenue comes from franchising, these direct operations are essential for validating business concepts. The company's focus remains on leveraging these owned assets to enhance the overall value proposition for its franchisees, ultimately supporting system-wide growth and brand consistency.

- Direct Management: Ensuring smooth daily operations, staff training, and customer satisfaction at owned restaurants.

- Profitability Focus: Implementing strategies to maximize revenue and control costs within these specific locations.

- Innovation Hub: Testing new menu items, operational procedures, and marketing campaigns for potential franchise adoption.

- Brand Consistency: Maintaining high standards that serve as a benchmark for the entire franchise system.

FAT Brands' key activities are multifaceted, encompassing brand acquisition, franchise system development and support, marketing, and supply chain management. These activities are designed to grow and strengthen its portfolio of restaurant brands.

The company actively pursues strategic acquisitions to expand its brand portfolio, as seen with the 2023 additions of Great American Cookies and Wetzel's Pretzels. Simultaneously, FAT Brands focuses on growing its franchise network through franchisee recruitment, training, and ongoing support, ensuring brand consistency and operational excellence across its global presence. In 2024, efforts continued to streamline franchisee onboarding.

Marketing is another crucial activity, with FAT Brands investing in campaigns to enhance brand recognition and drive customer traffic for brands like Fatburger and Johnny Rockets, utilizing digital strategies. Furthermore, the company optimizes its supply chain for efficient ingredient sourcing and product distribution, alongside expanding manufacturing capabilities, such as its Georgia facility, to improve operational efficiency and explore external service opportunities.

| Key Activity | Description | Recent Focus/Data Point |

|---|---|---|

| Brand Acquisition | Strategic acquisition of new restaurant concepts. | Acquisition of Great American Cookies and Wetzel's Pretzels in 2023. |

| Franchise System Development & Support | Seeking, onboarding, training, and supporting franchisees. | Refining franchisee onboarding in 2024; focus on brand consistency. |

| Marketing & Brand Building | Promoting brands to attract customers and support franchisees. | Investing in digital advertising and social media engagement in 2024. |

| Supply Chain & Manufacturing | Ensuring efficient sourcing and expanding manufacturing capacity. | Expanding Georgia facility for cookie dough and dry mix production. |

What You See Is What You Get

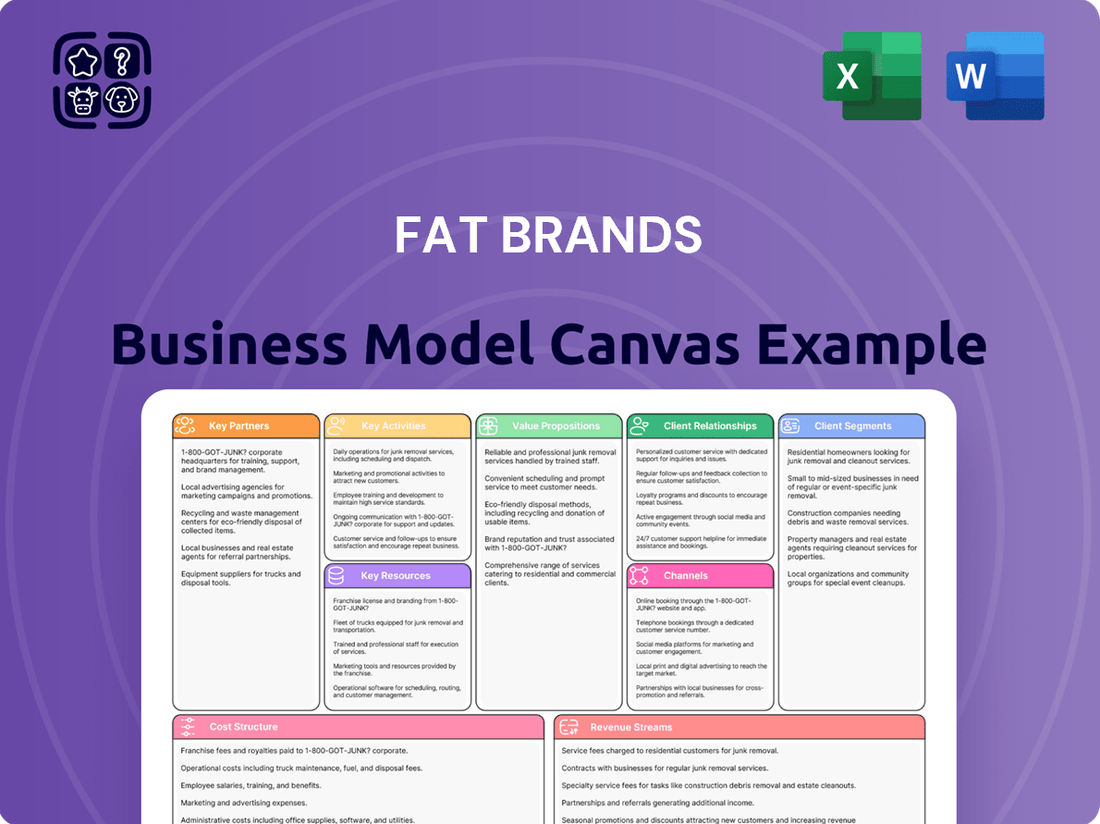

Business Model Canvas

The FAT Brands Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This means you're seeing the complete, unedited structure and content that will be delivered to you. Once your order is processed, you'll gain full access to this exact Business Model Canvas, ready for your strategic analysis and planning.

Resources

FAT Brands' most critical asset is its diverse portfolio of restaurant brands, which spans various dining segments like fast casual, quick-service, and casual dining. This variety allows them to tap into different customer preferences and market trends, creating multiple avenues for revenue generation.

As of late 2023 and early 2024, FAT Brands boasts a significant number of locations globally, with brands like Fatburger, Johnny Rockets, and Great American Cookies contributing to its expansive footprint. This extensive network is a key resource for brand recognition and operational efficiency.

The company's ability to acquire and integrate new brands, while also nurturing existing ones, represents a core competency. This strategic growth through acquisition, coupled with organic expansion, ensures a dynamic and resilient business model, as evidenced by their continued expansion efforts throughout 2024.

Franchise agreements are the bedrock of FAT Brands' operations, creating a predictable income stream from royalties and initial franchise fees. These legal frameworks are essential for managing their extensive global network of franchisees.

The sheer scale and robustness of FAT Brands' franchise network is a core asset, underpinning its asset-light strategy. As of the first quarter of 2024, FAT Brands operated over 2,300 total restaurants across its portfolio of brands.

FAT Brands' intellectual property, encompassing its portfolio of distinct restaurant brands like Fatburger and Johnny Rockets, is a cornerstone of its business model. This proprietary asset includes recognizable brand names, distinctive logos, and the unique recipes that define each concept's culinary appeal.

These valuable intellectual assets are not just for show; they are the core of what FAT Brands licenses to its franchisees. This licensing model ensures brand consistency across all locations, a critical factor for customer trust and repeat business. For instance, the specific preparation methods for a Fatburger patty or the signature milkshake recipes are protected intellectual property.

Beyond recipes and brand names, FAT Brands also possesses comprehensive operational manuals. These manuals are crucial for maintaining the quality and efficiency of each restaurant, detailing everything from food preparation and customer service standards to inventory management and marketing. This standardized approach is fundamental to scaling the business and ensuring a predictable customer experience, a key driver for franchise recruitment and investor confidence.

Experienced Management Team and Industry Expertise

FAT Brands' experienced management team is a cornerstone of its business model, bringing a wealth of knowledge in restaurant operations, brand acquisition, and franchising. This deep industry expertise is crucial for the company's strategy of acquiring and growing a diverse portfolio of restaurant brands.

The executive leadership's strategic vision and hands-on operational understanding are vital for identifying promising acquisition opportunities, seamlessly integrating new brands into the existing structure, and propelling overall company expansion. For instance, the team's proficiency was evident in the successful integration of brands like Great American Cookies and Pretzelmaker, contributing to FAT Brands' revenue growth.

- Deep industry knowledge in restaurant operations, acquisition, and franchising.

- Strategic vision for identifying and integrating new brands.

- Operational expertise driving company growth and efficiency.

- Proven track record in managing and expanding a multi-brand portfolio.

Manufacturing Facilities and Supply Chain Infrastructure

FAT Brands leverages its manufacturing facilities, like the Georgia plant, to produce key ingredients such as cookie dough and dry mixes. This direct control over production is a significant asset, enabling robust cost management and ensuring consistent product quality across its diverse brand portfolio.

The company's supply chain infrastructure is critical for efficiently serving both its corporate-owned restaurants and its extensive network of franchised locations. This includes managing the flow of goods from manufacturing to distribution points, ensuring timely availability of necessary supplies.

- Strategic Manufacturing: Ownership of facilities like the Georgia plant allows FAT Brands to directly control the production of essential components, impacting both cost efficiency and product integrity.

- Supply Chain Integration: Established relationships and infrastructure within the supply chain are vital for the seamless operation and support of all FAT Brands' franchised and company-owned units.

- Operational Efficiency: This vertically integrated approach, from manufacturing to distribution, underpins the operational backbone of the company, facilitating scalability and consistent brand experience.

FAT Brands' Key Resources are multifaceted, encompassing its extensive brand portfolio, a vast franchise network, intellectual property, and its experienced management team. The company's manufacturing capabilities and supply chain infrastructure also play a crucial role in its operational efficiency and product consistency.

The company's intellectual property, including brand names, logos, and proprietary recipes, forms the basis of its licensing agreements with franchisees. Operational manuals further standardize quality and customer experience across all locations, reinforcing brand integrity.

FAT Brands' manufacturing facilities, such as the Georgia plant, are vital for producing key ingredients, offering cost control and quality assurance. This, combined with a robust supply chain, ensures the efficient delivery of goods to its widespread network of restaurants.

| Key Resource | Description | Impact |

| Brand Portfolio | Diverse collection of 17 restaurant brands (as of early 2024) across various dining segments. | Market reach, revenue diversification, customer appeal. |

| Franchise Network | Over 2,300 total restaurants globally (Q1 2024). | Asset-light growth, predictable revenue streams, brand visibility. |

| Intellectual Property | Brand names, logos, recipes, operational manuals. | Brand consistency, licensing revenue, operational standardization. |

| Management Team | Experienced leadership in restaurant operations, acquisitions, and franchising. | Strategic growth, brand integration, operational efficiency. |

| Manufacturing & Supply Chain | In-house production facilities (e.g., Georgia plant) and distribution infrastructure. | Cost management, quality control, operational scalability. |

Value Propositions

FAT Brands provides franchisees with a broad selection of restaurant brands, spanning from quick-service to casual dining. This variety allows franchisees to tap into different market segments and consumer preferences, mitigating the risk often associated with single-brand ventures. For example, as of the first quarter of 2024, FAT Brands operated over 2,300 franchised locations globally, showcasing the breadth of its portfolio and franchisee success.

FAT Brands offers extensive operational support and training, equipping franchisees with the tools to manage their restaurants efficiently and profitably. This commitment ensures brand consistency and helps franchisees navigate the complexities of the food service industry.

In 2023, FAT Brands continued to refine its franchisee support systems, aiming to boost unit-level economics. The company's focus on providing ongoing guidance, from site selection to daily operations, underpins its strategy for franchisee success and brand growth.

Franchisees of FAT Brands gain a significant advantage through the company's robust brand recognition and extensive marketing power. This established presence across multiple popular restaurant concepts, such as Fatburger and Johnny Rockets, directly translates into higher customer traffic and increased sales for individual franchise locations. In 2023, FAT Brands reported a 14% increase in systemwide sales, a testament to the strength of their brands and marketing initiatives.

The company's strategic investment in marketing campaigns, including digital advertising and promotional events, creates a powerful competitive edge for its franchisees. These efforts build brand loyalty and attract new customers, ultimately driving revenue growth. For instance, a successful national campaign for one of their brands in late 2023 saw a measurable uplift in same-store sales across the franchise network.

Consistent Quality and Customer Experience

For consumers, FAT Brands’ core value proposition centers on dependable quality and a predictable customer experience, no matter which of its diverse restaurant concepts they visit. This uniformity across brands like Fatburger, Johnny Rockets, and Great American Cookies fosters a sense of trust, driving customer loyalty and repeat visits.

This commitment to consistency is a significant draw for patrons seeking a familiar and satisfying dining experience. In 2023, FAT Brands continued to focus on operational excellence, aiming to ensure that each customer interaction reflects the high standards associated with its portfolio. For instance, their franchise support systems are designed to reinforce brand standards, contributing to the consistent quality consumers expect.

- Consistent Quality: Consumers can rely on a familiar taste and preparation standard across all locations of a specific FAT Brands restaurant.

- Reliable Customer Experience: From ordering to service, the aim is to provide a predictable and pleasant interaction, building confidence.

- Brand Trust and Loyalty: This predictability cultivates strong customer relationships, encouraging repeat business and positive word-of-mouth.

- Portfolio Diversity: While maintaining consistency within each brand, FAT Brands offers a range of dining experiences to cater to different preferences.

Strategic Growth Opportunities through Acquisitions

FAT Brands’ strategic growth is significantly fueled by its acquisition strategy, presenting a compelling value proposition for investors. The company actively pursues and integrates new restaurant concepts, expanding its portfolio and market presence. This approach is designed to enhance overall market share and, consequently, drive increased shareholder value.

The company's commitment to growth through acquisition is evident in its ongoing efforts to identify and onboard new brands. This dynamic expansion strategy aims to capitalize on market opportunities and diversify revenue streams. For instance, in 2023, FAT Brands continued its acquisition trajectory, integrating brands that align with its growth objectives and operational synergies.

FAT Brands’ acquisition-driven growth model offers a clear path to scalability and profitability. By strategically acquiring and developing brands, the company positions itself for sustained expansion. This focus on inorganic growth complements its organic efforts, creating a robust framework for long-term success and value creation for its stakeholders.

- Acquisition-driven growth: FAT Brands actively acquires new restaurant concepts to expand its portfolio.

- Market share expansion: The strategy aims to increase the company's footprint and competitive standing.

- Shareholder value enhancement: Acquisitions are pursued with the objective of boosting returns for investors.

- Brand diversification: The company broadens its offerings by integrating various culinary experiences.

FAT Brands offers franchisees a diverse portfolio of restaurant brands, reducing single-brand risk and allowing access to various market segments. This breadth, exemplified by over 2,300 franchised locations globally as of Q1 2024, provides a robust platform for franchisee success.

Customer Relationships

FAT Brands fosters strong franchisee relationships through dedicated support teams and consistent communication. These teams provide crucial guidance and resources, ensuring franchisees have the tools needed for successful operations.

In 2024, FAT Brands continued to invest in training programs designed to equip franchisees with the latest operational knowledge and marketing strategies. This commitment to ongoing education is a cornerstone of their partnership approach.

FAT Brands cultivates customer connections via digital channels, featuring brand-specific mobile apps and overarching loyalty programs. These digital touchpoints are designed to streamline the customer experience and foster brand advocacy.

In 2024, the company continued to invest in these digital platforms, recognizing their role in driving repeat business and gathering valuable customer data. For instance, the push for app downloads and loyalty program sign-ups directly correlates with increased customer lifetime value.

These digital engagement strategies are crucial for building lasting relationships, offering personalized promotions and rewards that incentivize continued patronage and enhance overall customer satisfaction across the FAT Brands portfolio.

FAT Brands actively manages customer relationships through multiple touchpoints, aiming to enhance satisfaction and gather insights. This includes direct in-store interactions, online feedback platforms, and dedicated customer service channels to efficiently address inquiries and resolve any issues that arise.

The company leverages customer feedback to drive continuous improvement across its brands. For instance, in 2023, FAT Brands reported a net income of $7.6 million, demonstrating a commitment to operational efficiency that is often informed by customer input on their dining experiences.

Brand Community Building

FAT Brands actively cultivates brand communities, aiming to create a loyal following and encourage customer advocacy. This strategy is evident in their approach to engaging consumers through platforms like social media, local store events, and targeted promotions designed to appeal to the unique customer base of each restaurant concept.

For instance, the company's focus on community building can translate into initiatives that deepen customer connection. This approach is crucial for fostering repeat business and positive word-of-mouth marketing.

- Social Media Engagement: Regular interaction on platforms like Instagram and Facebook to share brand stories, promotions, and user-generated content.

- Local Store Events: Hosting community-focused events at individual restaurant locations to drive foot traffic and local loyalty.

- Loyalty Programs: Implementing rewards programs that incentivize repeat visits and make customers feel valued.

- Brand-Specific Content: Creating content tailored to the unique appeal of each brand, such as highlighting the heritage of Johnny Rockets or the family-friendly atmosphere of Great American Cookies.

Strategic Partnerships with Acquired Brands

FAT Brands actively cultivates strategic partnerships with the brands it acquires, focusing on integrating existing teams and operational frameworks. This approach ensures a seamless transition and capitalizes on the established customer loyalty and brand equity of these newly incorporated concepts.

- Leveraging Existing Customer Bases: FAT Brands aims to retain and grow the customer relationships inherent in acquired brands, recognizing their value in driving continued revenue.

- Operational Integration: The company works to blend the operational structures of acquired businesses with its own to create efficiencies while respecting the unique identity of each brand.

- Brand Equity Preservation: A key strategy involves maintaining and enhancing the brand equity of acquired companies, ensuring their distinct appeal to their target markets remains intact.

FAT Brands actively nurtures its franchisee network through comprehensive support systems and continuous communication. This dedication ensures that franchisees are well-equipped with the necessary resources and knowledge to thrive. In 2024, the company reinforced this commitment by enhancing training modules, focusing on the latest operational advancements and marketing techniques crucial for success in the competitive QSR landscape.

Customer relationships are further strengthened through robust digital engagement strategies, including brand-specific mobile applications and unified loyalty programs. These platforms are designed to offer a seamless customer journey and foster brand loyalty. The company's 2024 initiatives prioritized the growth of these digital touchpoints, recognizing their impact on increasing customer lifetime value and driving repeat business.

FAT Brands also emphasizes building strong customer communities via active social media engagement, local store events, and tailored promotions. For example, in 2023, the company reported a net income of $7.6 million, reflecting successful operational strategies that often incorporate customer feedback to enhance dining experiences and build lasting connections.

| Customer Relationship Strategy | Key Initiatives | 2024 Focus |

| Franchisee Support | Dedicated support teams, operational guidance, training programs | Enhanced training modules for latest techniques |

| Digital Engagement | Mobile apps, loyalty programs, personalized promotions | Growth of digital platforms for repeat business |

| Community Building | Social media, local events, brand-specific content | Deepening customer connection through community initiatives |

Channels

The primary channel for delivering FAT Brands' value propositions to end-consumers is its extensive network of franchised restaurant locations. These physical storefronts act as the direct point of sale for food and beverages across all its diverse brands, reaching customers globally.

As of the first quarter of 2024, FAT Brands operated approximately 2,300 franchised locations across its portfolio, demonstrating a significant physical presence. This widespread distribution is key to making their brands accessible to a broad customer base.

These franchised locations are crucial for customer interaction, providing the tangible experience of enjoying the food and beverages offered by brands like Fatburger, Johnny Rockets, and Great American Cookies. They are the embodiment of the brand experience for the end-user.

Company-owned restaurants, though a smaller segment of FAT Brands' overall footprint, act as vital direct touchpoints with consumers, providing essential food and beverage services. These locations also offer a valuable opportunity to pilot new menu offerings and test innovative operational approaches before broader implementation across the franchise network.

FAT Brands actively utilizes its digital presence, encompassing dedicated websites for each brand and user-friendly mobile apps, to connect with a broad customer base. These platforms are crucial for streamlining the ordering process and fostering customer loyalty.

In 2023, FAT Brands continued to invest in its digital infrastructure, recognizing the growing importance of online ordering and delivery. The company's focus on enhancing these channels aims to capture a larger share of the digital food service market, which saw significant growth in the preceding years.

Through these digital avenues, customers can easily place orders, engage with brand promotions, and participate in loyalty programs, thereby deepening their connection with FAT Brands' portfolio of restaurants.

Marketing and Advertising Campaigns

FAT Brands leverages a multi-channel marketing approach to boost its portfolio of restaurant concepts. This includes traditional avenues like television and radio, alongside robust digital strategies encompassing social media engagement and targeted online advertising. The primary goal is to cultivate strong brand recognition and encourage customer visits to their numerous franchised and company-owned establishments.

These campaigns are crucial for driving foot traffic and online orders. For instance, in 2024, FAT Brands continued to invest in digital marketing, with a significant portion of their advertising spend allocated to platforms like Facebook, Instagram, and Google Ads to reach a wider audience and promote specific menu items or limited-time offers.

- Brand Awareness: Campaigns focus on increasing recognition for each of FAT Brands' distinct restaurant concepts.

- Customer Acquisition: Efforts are geared towards attracting new customers to both dine-in and takeout experiences.

- Digital Presence: A strong emphasis is placed on social media engagement and online advertising to connect with modern consumers.

- Promotional Activities: Marketing initiatives often highlight special deals, new menu items, and seasonal offerings to drive immediate sales.

Franchise Sales and Development Teams

FAT Brands relies on its specialized franchise sales and development teams to identify and onboard new franchisees. These teams are crucial for the company's expansion strategy, actively seeking out individuals and groups interested in operating FAT Brands' various restaurant concepts.

These dedicated teams actively participate in major franchise expos and industry trade shows, providing direct engagement opportunities for potential franchisees. They also leverage digital marketing channels and direct outreach programs to connect with a wider audience, aiming to secure new locations and drive brand growth. In 2023, FAT Brands continued to expand its portfolio, with its development pipeline reflecting ongoing interest in its brands.

- Franchise Sales Teams: Actively recruit and vet potential franchisees.

- Development Efforts: Focus on identifying strategic markets for new unit openings.

- Industry Engagement: Utilize trade shows and online platforms to attract qualified candidates.

- Global Expansion: Drive the company's international growth through franchisee partnerships.

FAT Brands utilizes a dual-channel approach for customer engagement: its extensive network of franchised restaurants, comprising approximately 2,300 locations as of Q1 2024, serves as the primary physical touchpoint for sales and brand experience. Complementing this, robust digital platforms, including brand-specific websites and mobile apps, facilitate online ordering and loyalty programs, reflecting a strategic investment in the growing digital food service market throughout 2023 and into 2024.

Customer Segments

Franchisees are the backbone of FAT Brands' expansion, encompassing both aspiring entrepreneurs and seasoned multi-unit operators. These individuals are drawn to the opportunity to own and operate established, recognizable restaurant concepts, leveraging FAT Brands' proven business models for success.

For instance, in 2023, FAT Brands continued to grow its franchise network, with a significant portion of its revenue derived from franchise fees and royalties. This segment is crucial for driving brand visibility and market penetration across diverse geographic locations.

Casual diners and families represent a core customer base for FAT Brands, seeking accessible and enjoyable dining experiences. This segment prioritizes value, a welcoming atmosphere, and a menu that caters to diverse tastes, making them frequent visitors to quick-service and casual dining establishments for everyday meals and special occasions.

In 2024, the casual dining sector continued to see robust demand from families and individuals looking for affordable yet satisfying meal options. For FAT Brands, this translates into a significant opportunity to leverage its portfolio of brands, such as Fatburger and Johnny Rockets, which are well-positioned to meet the needs of this broad demographic by offering familiar favorites and a comfortable, family-friendly environment.

Specific Brand Enthusiasts are deeply loyal customers who actively seek out particular FAT Brands concepts. Think of the devoted fans of Fatburger, the regulars at Twin Peaks, or the families who consistently choose Round Table Pizza. These customers are driven by a specific craving for the unique menu items, the distinct atmosphere, or the overall dining experience each brand offers.

This loyalty translates into consistent patronage. For instance, FAT Brands reported in their 2024 investor updates that same-store sales for their established brands like Fatburger and Round Table Pizza have shown resilience, indicating a strong base of these dedicated enthusiasts. These customers aren't just looking for a meal; they're looking for *their* Fatburger, *their* Twin Peaks, or *their* Round Table Pizza.

Convenience-Seeking Consumers

Convenience-seeking consumers represent a significant portion of the market, valuing speed and ease above all else. They are drawn to brands that offer efficient ordering processes, whether through mobile apps, online platforms, or streamlined in-store experiences. This preference is evident in the continued growth of the quick-service restaurant (QSR) sector, which saw global sales reach approximately $310 billion in 2024.

For FAT Brands, this segment translates to a demand for accessible locations and robust digital ordering and delivery infrastructure. Brands like Fatburger and Johnny Rockets cater to this by focusing on drive-thru efficiency and partnerships with major third-party delivery services. In 2023, digital sales accounted for over 70% of revenue for many QSR chains, highlighting the importance of these channels.

- Prioritization of Speed: These consumers expect minimal wait times for their food.

- Digital Integration: Easy online and app-based ordering, along with delivery options, are crucial.

- Brand Choice: Fast casual and quick-service brands are often the go-to for their efficiency.

- Accessibility: Convenient locations and operating hours further appeal to this segment.

Value-Conscious Consumers

Value-conscious consumers are a core customer segment for FAT Brands, prioritizing affordability and good deals. These individuals are often drawn to promotions, limited-time offers, and competitive pricing that ensures they receive a satisfying meal without overspending. For instance, during 2024, many quick-service restaurant chains, including those within FAT Brands' portfolio, continued to leverage value menus and combo deals to attract this demographic. This segment is crucial for driving consistent, high-volume traffic.

- Price Sensitivity: This group actively seeks out discounts and promotions.

- Value Proposition: They look for satisfying meal experiences at the lowest possible cost.

- Brand Loyalty Drivers: Consistent value and affordable offerings foster loyalty.

- Promotional Responsiveness: Highly likely to engage with deals and special offers.

FAT Brands' customer segments are diverse, ranging from the franchisees who operate their restaurants to the everyday diners who frequent them. The company also caters to brand loyalists who specifically seek out particular restaurant concepts within its portfolio, as well as convenience-driven consumers and those prioritizing value. These segments collectively represent the broad market reach and appeal of FAT Brands' various restaurant concepts.

In 2024, FAT Brands continued to focus on these key customer groups. Franchisees remain vital for expansion, while casual diners and families represent a consistent revenue stream. The company also observed strong engagement from specific brand enthusiasts and a growing demand from convenience-seeking and value-conscious consumers, particularly within the quick-service sector.

| Customer Segment | Key Characteristics | 2024 Relevance for FAT Brands |

|---|---|---|

| Franchisees | Entrepreneurs, multi-unit operators seeking proven models | Drive brand expansion and market penetration |

| Casual Diners & Families | Seek accessible, enjoyable dining; prioritize value and atmosphere | Core demographic for brands like Fatburger and Johnny Rockets |

| Specific Brand Enthusiasts | Loyal customers seeking unique menu items and brand experience | Contribute to resilient same-store sales for established brands |

| Convenience-Seeking Consumers | Value speed, ease, digital ordering, and delivery | Demand focus on QSR efficiency and digital infrastructure |

| Value-Conscious Consumers | Prioritize affordability, deals, and competitive pricing | Attracted by value menus and promotions, driving high traffic |

Cost Structure

FAT Brands faces significant expenses when acquiring new restaurant brands. These costs include thorough legal reviews, due diligence processes to assess financial health and operational viability, and the expenses tied to integrating the acquired brand into FAT Brands' existing operational and marketing infrastructure. For instance, in 2023, the company reported acquisition-related costs that contributed to their overall expenditure as they continued their expansion strategy.

General and Administrative (G&A) expenses at FAT Brands cover essential corporate functions like executive compensation, support staff, office upkeep, and professional services such as legal and accounting. These costs are fundamental to operating the business at a corporate level.

In 2023, FAT Brands reported G&A expenses of $26.3 million. This figure reflects an increase driven by factors including share-based compensation, which is a common incentive for leadership, and costs associated with ongoing litigation, impacting the overall administrative overhead.

For FAT Brands' company-owned restaurants and its manufacturing facility, operating costs are a significant factor. These include the essential expenses like food and beverage ingredients, which are directly tied to sales volume. Labor wages for staff at these locations also form a substantial part of the cost structure.

Beyond direct product and labor costs, FAT Brands incurs expenses related to the physical operation of its sites. Rent for both restaurant locations and the manufacturing plant, along with utilities such as electricity and water, are ongoing operational necessities. Furthermore, regular maintenance to ensure facilities are in good working order contributes to these operating costs, directly influencing the profitability of each company-owned unit.

Marketing and Advertising Expenses

FAT Brands dedicates significant resources to marketing and advertising across its portfolio of restaurant concepts. These outlays are crucial for building brand awareness and driving customer traffic to its franchised locations. In 2023, FAT Brands reported advertising and marketing expenses of $14.7 million, a notable increase from $12.2 million in 2022, reflecting a strategic push to enhance brand visibility and support franchisee sales efforts.

These marketing expenditures are often funded, in part, by advertising fees collected from franchisees. This symbiotic relationship ensures that marketing initiatives are aligned with the needs of the individual restaurant operators while simultaneously working to boost system-wide sales and overall brand equity.

- Marketing and Advertising Expenses: FAT Brands incurred $14.7 million in marketing and advertising costs in 2023.

- Purpose: Expenses are aimed at increasing brand visibility and driving system-wide sales for its restaurant brands.

- Funding Mechanism: A portion of these costs is supported by advertising revenues collected from franchisees.

- Trend: Marketing expenses saw an increase from $12.2 million in 2022 to $14.7 million in 2023.

Interest Expense and Debt Servicing

FAT Brands' growth-through-acquisition strategy means interest expense and debt servicing are major cost components. For example, as of the first quarter of 2024, FAT Brands reported total debt of approximately $376.8 million. This significant debt load directly translates into substantial interest payments, impacting profitability and cash flow available for reinvestment or shareholder returns.

Managing this debt effectively is crucial. The company's financial strategy likely involves exploring opportunities to refinance existing debt at more favorable interest rates when market conditions permit. This proactive approach aims to reduce the overall cost of borrowing and improve the company's financial flexibility.

- Interest Expense: A significant outlay due to the company's acquisition-driven growth model.

- Debt Servicing: Regular payments of principal and interest on its substantial debt portfolio.

- Refinancing Strategy: A key priority to potentially lower borrowing costs and enhance cash flow.

- Financial Priority: Managing debt is essential for improving overall financial health and operational capacity.

FAT Brands' cost structure is heavily influenced by its acquisition strategy, leading to significant interest expenses on its substantial debt. In the first quarter of 2024, the company reported total debt of approximately $376.8 million, underscoring the financial commitment required to fuel its growth. This debt necessitates ongoing interest payments, a critical component of its overall operating expenses.

| Cost Category | 2023 Expense (Millions) | 2022 Expense (Millions) | Key Drivers |

|---|---|---|---|

| General & Administrative (G&A) | $26.3 | N/A | Executive compensation, litigation, share-based compensation |

| Marketing & Advertising | $14.7 | $12.2 | Brand visibility, franchisee support, system-wide sales |

| Total Debt (Q1 2024) | $376.8 (Approx.) | N/A | Acquisition financing |

Revenue Streams

FAT Brands primarily generates revenue through franchise royalties, which are ongoing payments from its franchisees. These royalties are typically calculated as a percentage of the franchisee's gross sales, providing a predictable and scalable income stream.

This asset-light franchising model allows FAT Brands to expand its reach without significant capital investment in physical locations. For instance, in 2023, FAT Brands reported that its franchise segment contributed significantly to its overall revenue, demonstrating the effectiveness of this model.

Franchise fees represent a key revenue source for FAT Brands, comprising initial payments from new franchisees. These upfront fees are crucial for funding the company's ongoing expansion and operational needs as it grows its portfolio of restaurant brands.

For instance, in 2023, FAT Brands reported franchise fees and royalties as a significant component of its revenue, with total revenue reaching $266.2 million. This highlights the direct impact of new franchise agreements on the company's financial health and growth trajectory.

FAT Brands generates revenue directly from sales at its company-owned restaurants. These locations, though fewer in number compared to franchised outlets, still contribute to the company's top line through the sale of food and beverages.

For instance, in the first quarter of 2024, FAT Brands reported that its company-owned comparable restaurant sales increased by 4.2%. This segment, while smaller, demonstrates consistent performance and adds to the overall financial health of the organization.

Advertising Fund Contributions

Franchisees pay a percentage of their sales into a central advertising fund. FAT Brands then uses this pool of money for marketing campaigns and promotions that benefit all its brands.

This advertising contribution is a key revenue source, specifically earmarked for building and strengthening the brand portfolio. For instance, in 2023, FAT Brands reported total revenue of $113.4 million, with franchise royalties and fees forming a significant portion of this income, directly tied to these advertising contributions and other franchise-related revenue.

- Advertising Fund Contributions: Franchisees contribute a percentage of their gross sales to a collective advertising fund managed by FAT Brands.

- Purpose: Funds are utilized for national and local marketing, advertising, and promotional activities aimed at increasing brand awareness and driving customer traffic across the FAT Brands portfolio.

- Revenue Stream: This represents a predictable and dedicated revenue stream for FAT Brands, supporting its brand development and growth initiatives.

Factory Revenue (Dough and Mix Production)

FAT Brands generates revenue from its manufacturing operations, specifically through the production of cookie dough and dry mixes. This factory revenue stream primarily serves its own franchised locations, ensuring consistent product quality and supply across its brands.

Beyond internal sales, there's a significant and expanding opportunity in third-party contract manufacturing. This allows FAT Brands to leverage its production capacity and expertise to produce goods for other businesses, creating an additional revenue channel.

- Factory Sales: Revenue from producing and selling cookie dough and dry mixes to FAT Brands' franchised restaurants.

- Third-Party Manufacturing: Income generated by producing goods for external clients on a contract basis.

- Capacity Utilization: The factory's output contributes to both internal brand needs and external sales, optimizing operational efficiency.

FAT Brands' revenue streams are diverse, heavily leaning on its franchise model. Royalties from franchisees, calculated as a percentage of their sales, provide a consistent income. Initial franchise fees also contribute significantly, funding the company's expansion efforts.

Company-owned locations add to the revenue through direct sales, demonstrating operational performance. Advertising contributions from franchisees form another predictable income source, supporting brand-wide marketing initiatives.

Additionally, FAT Brands generates revenue from its manufacturing operations, selling cookie dough and dry mixes internally and through third-party contract manufacturing, optimizing its production capacity.

| Revenue Stream | Description | 2023 Data (Illustrative) |

|---|---|---|

| Franchise Royalties | Percentage of franchisee gross sales | Significant portion of $113.4M total revenue |

| Franchise Fees | Upfront payments from new franchisees | Contributed to growth |

| Company-Owned Sales | Direct sales from FAT Brands' restaurants | 4.2% comparable sales increase Q1 2024 |

| Advertising Contributions | Percentage of franchisee sales for marketing | Supports brand promotion |

| Manufacturing Sales | Cookie dough/dry mix sales to franchisees and third parties | Optimizes production capacity |

Business Model Canvas Data Sources

The FAT Brands Business Model Canvas is built using a combination of proprietary operational data, franchisee feedback, and comprehensive market research. This ensures each component, from customer segments to cost structures, is grounded in actionable insights and real-world performance.