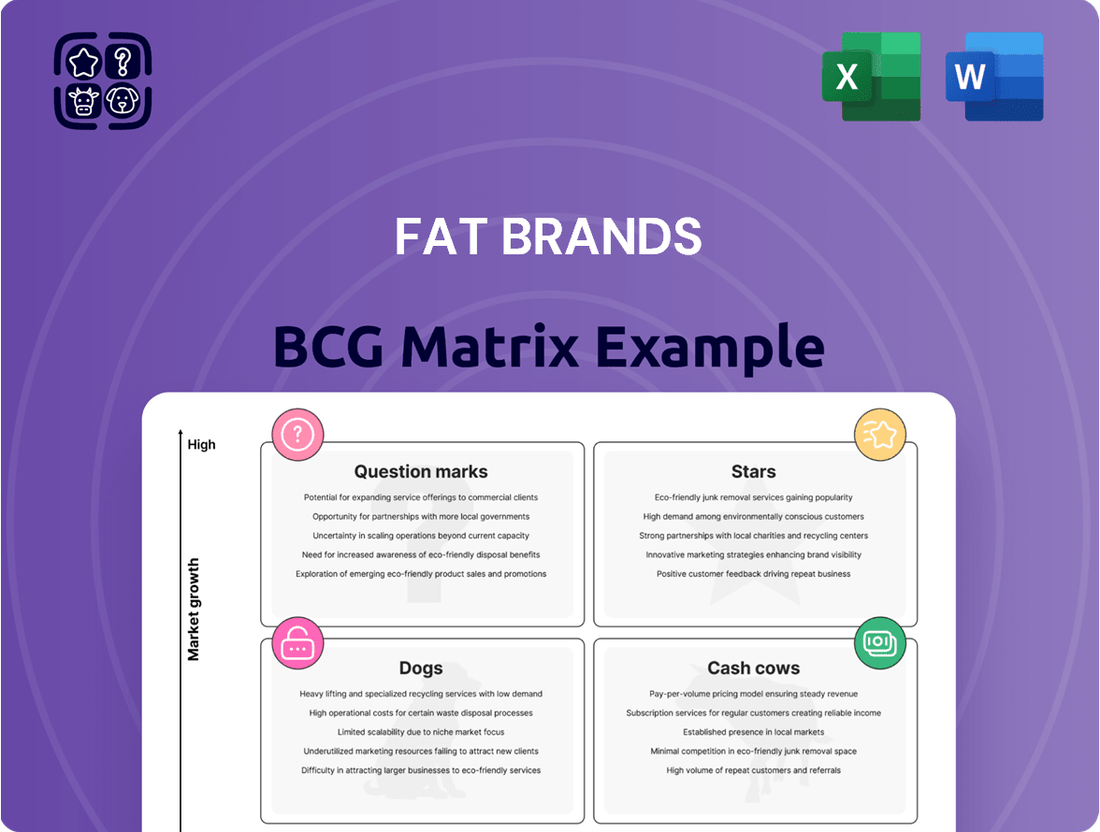

FAT Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

FAT Brands' portfolio is a dynamic mix, with some brands shining as Stars and others operating as Cash Cows. Understand which brands are fueling growth and which might need a strategic rethink.

This glimpse into FAT Brands' BCG Matrix highlights key opportunities and potential challenges. Purchase the full report for a comprehensive quadrant analysis, actionable strategies, and a clear roadmap to optimize your investment in their diverse brand portfolio.

Stars

Twin Peaks is a clear star in FAT Brands' portfolio, showing impressive growth and high average unit volumes. It's the fastest-growing concept, with ambitious expansion plans, including converting former Smokey Bones sites. This brand's spin-off into Twin Hospitality Group Inc. underscores its significant value and independent growth potential.

Fatburger is a key player in FAT Brands' portfolio, currently positioned as a star due to its robust growth trajectory. This growth is fueled by strategic international expansion, with recent agreements to open 40 new locations across France, signaling a strong push into promising European markets.

Furthermore, Fatburger benefits from co-branding strategies, such as its integration with Buffalo's Cafe. This approach allows for broader market penetration and taps into diverse customer preferences, enhancing its overall market share and brand visibility in various segments.

Round Table Pizza is positioned as a Star within FAT Brands' portfolio. The brand experienced a 5% increase in outlets in 2025, driven by a strategic expansion focus, particularly in its core market of California. This growth is supported by its reputation for quality ingredients and community engagement, which fosters strong customer loyalty and consistent revenue.

Great American Cookies

Great American Cookies is a strong performer within FAT Brands' portfolio, showing impressive growth driven by digital channels and customer loyalty. Its digital sales now represent a significant 25% of its overall revenue, a testament to its successful adaptation to modern consumer purchasing habits.

The brand's focus on loyalty programs is paying off handsomely, with loyalty-driven sales experiencing a substantial 40% increase. This upward trend highlights a deep and growing engagement with its customer base, suggesting a robust foundation for future expansion and market penetration.

- Digital Sales Contribution: 25% of total revenue.

- Loyalty Program Impact: 40% increase in loyalty-driven sales.

- Growth Indicator: Demonstrates strong market adoption and customer engagement.

Co-Branding Initiatives

FAT Brands actively pursues co-branding, notably pairing Round Table Pizza with Marble Slab Creamery and Fatburger with Buffalo's Cafe. This strategy capitalizes on established brand recognition to penetrate new markets and broaden customer appeal.

These collaborations are designed to optimize store footprints and attract a wider demographic, signaling a commitment to a high-growth trajectory. By combining complementary concepts, FAT Brands enhances its market presence and operational efficiency.

- Co-Branding Pairs: Round Table Pizza with Marble Slab Creamery, Fatburger with Buffalo's Cafe.

- Strategic Goal: Leverage existing brand strengths for market entry and offering expansion.

- Growth Driver: Optimizing footprint and attracting diverse customer bases.

- Market Impact: Demonstrates a high-growth strategy through synergistic brand partnerships.

Twin Peaks, Fatburger, Round Table Pizza, and Great American Cookies are all identified as Stars within FAT Brands' portfolio. These brands exhibit strong growth potential and market share, indicating they are key drivers of the company's current success and future expansion. Their performance highlights FAT Brands' strategic focus on high-performing concepts.

| Brand | Growth Trajectory | Key Initiatives | Performance Metric |

|---|---|---|---|

| Twin Peaks | Fastest growing concept | Conversion of former Smokey Bones sites, spin-off into Twin Hospitality Group | High average unit volumes |

| Fatburger | Robust international expansion | Agreements for 40 new locations in France, co-branding with Buffalo's Cafe | Strong European market push |

| Round Table Pizza | Strategic expansion, particularly in California | 5% increase in outlets in 2025, co-branding with Marble Slab Creamery | Reputation for quality and community engagement |

| Great American Cookies | Significant growth driven by digital and loyalty programs | Digital sales at 25% of revenue, 40% increase in loyalty-driven sales | High customer engagement and market adoption |

What is included in the product

This BCG Matrix overview for FAT Brands clarifies strategic directions for its brands, highlighting which units to invest in, hold, or divest.

A clear FAT Brands BCG Matrix overview quickly identifies underperforming brands, relieving the pain of resource misallocation.

Cash Cows

FAT Brands' established franchising model is the bedrock of its business, generating consistent revenue through royalties and franchise fees. This approach effectively shifts operational burdens and capital investment to franchisees, ensuring a stable and high-margin cash flow for the parent company.

Royalties and franchise fees are FAT Brands' cash cows, generating a consistent and substantial income. As of early 2024, the company boasts approximately 2,300 franchised units globally, each contributing to this predictable revenue stream.

These fees are particularly valuable because they come with lower direct operating costs compared to managing company-owned stores. This efficiency solidifies their role as a foundational element of FAT Brands' financial health and stability.

Marble Slab Creamery, within FAT Brands' portfolio, likely functions as a cash cow. Its established market presence and the recurring nature of ice cream consumption, especially with seasonal peaks, point towards a steady generation of cash flow. While specific growth rates aren't always publicly detailed, its consistent operation and integration into co-branded locations, such as with Great American Cookies, underscore its role as a mature brand with reliable earnings.

Johnny Rockets

Johnny Rockets, now part of FAT Brands, operates as a mature concept within the company's portfolio. This suggests it functions as a cash cow, generating consistent revenue with limited need for significant reinvestment to maintain its market position.

FAT Brands has highlighted the successful integration of Johnny Rockets, implying the brand has achieved a competitive edge. This competitive advantage translates into stable cash flow generation, requiring less promotional investment to sustain its performance.

- Cash Cow Status: Johnny Rockets is positioned as a mature brand within FAT Brands, contributing stable cash flow.

- Integration Success: FAT Brands' reported successful integration indicates Johnny Rockets has achieved a competitive advantage.

- Consistent Cash Generation: The brand likely generates reliable earnings with lower marketing spend requirements.

Strategic Refranchising of Fazoli's

FAT Brands' strategic refranchising of 57 company-owned Fazoli's restaurants is a key move within its portfolio management, particularly for its cash cow brands. This initiative is designed to transition these locations from direct operational management, which can incur higher costs, to a franchise model. This shift is anticipated to boost FAT Brands' financial flexibility and generate more passive income through royalties.

- Fazoli's Refranchising: 57 company-owned locations are slated for refranchising.

- Financial Impact: Aims to improve financial flexibility and increase passive cash flow.

- Strategic Alignment: Fits the cash cow strategy of generating royalty income with reduced operational burden.

- 2024 Context: This strategy is part of FAT Brands' ongoing efforts in 2024 to optimize its brand portfolio for sustained profitability.

FAT Brands' cash cows are its mature, well-established franchise brands that generate consistent royalty and franchise fee income with minimal reinvestment. These brands, like Marble Slab Creamery and Johnny Rockets, benefit from established market presence and recurring consumer demand, providing a stable financial foundation for the company.

| Brand | BCG Category | Revenue Source | Estimated Unit Count (Early 2024) |

|---|---|---|---|

| Marble Slab Creamery | Cash Cow | Royalties, Franchise Fees | Part of ~2,300 global franchised units |

| Johnny Rockets | Cash Cow | Royalties, Franchise Fees | Part of ~2,300 global franchised units |

| Fazoli's (Refranchising) | Transitioning to Cash Cow Model | Royalties, Franchise Fees | 57 company-owned units transitioning |

Delivered as Shown

FAT Brands BCG Matrix

The FAT Brands BCG Matrix preview you're currently viewing is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive analysis, crafted with expert insights, will be yours to download and utilize without any watermarks or limitations. You can confidently expect the same high-quality, ready-to-use strategic report that offers a clear and actionable overview of FAT Brands' portfolio.

Dogs

Several Smokey Bones locations that were underperforming have been closed and repurposed as Twin Peaks restaurants. This strategic move suggests these particular Smokey Bones units struggled with both market share and growth potential, fitting the 'Dog' category in a BCG matrix. The financial impact was noticeable, with revenue taking a hit in the first two quarters of 2025 due to these closures, underscoring their poor performance.

FAT Brands experienced a system-wide same-store sales decline in the first two quarters of 2025. This downturn suggests that some of its established brands are facing challenges in customer traffic and sales growth within their competitive landscapes.

While specific brand performance data is not yet detailed, this overarching trend points to potential 'Dog' quadrant characteristics for certain brands within FAT Brands' diverse portfolio. These brands may require strategic evaluation to address declining sales momentum.

FAT Brands' strategy to shift towards a nearly 100% franchised model, as evidenced by the refranchising of Fazoli's, suggests that company-owned locations not designated for high-growth conversions might be viewed as a drag on resources. These locations can tie up significant capital and operational bandwidth, potentially hindering the pursuit of more profitable franchise opportunities. For instance, as of the first quarter of 2024, FAT Brands reported a decrease in its company-owned store count, reflecting this strategic pivot.

Brands with High Operating Costs and Low Profitability

Within FAT Brands' portfolio, certain brands likely operate with high overheads and struggle to generate significant profits. While not specifically identified as such in public filings, brands that contribute to increased general and administrative expenses or higher interest costs without a corresponding boost in revenue can be viewed as underperformers. These brands can act as drains on the company's resources, offering low returns and fitting the description of a 'cash trap' in a BCG matrix analysis.

These underperforming brands, characterized by high operating costs and low profitability, represent a challenge for FAT Brands. For instance, if a brand requires substantial marketing investment or has inefficient supply chain management, its operating costs will be elevated. When this is coupled with a limited ability to increase prices or expand its customer base, profitability suffers, leading to a negative cash flow situation or minimal earnings. This scenario is particularly concerning when considering the overall financial health and strategic allocation of capital within the company.

- High Operating Costs: Brands with significant overheads in areas like rent, staffing, and supply chain logistics.

- Low Profitability: These brands generate minimal profit margins, often due to intense competition or an inability to command premium pricing.

- Resource Drain: They consume capital and management attention without delivering commensurate financial returns, impacting overall company performance.

- Cash Trap Classification: In a BCG matrix, these brands would likely fall into the 'cash trap' or 'dog' quadrant, requiring careful evaluation for potential divestiture or restructuring.

Newly Acquired Brands with Integration Challenges

FAT Brands' acquisition of Smokey Bones presented a classic example of a newly acquired brand potentially falling into the 'Dog' quadrant of the BCG matrix, at least initially. The strategy involved converting these locations, but the integration process itself incurred significant costs. In 2023, FAT Brands reported that the Smokey Bones acquisition led to increased operational expenses and a net loss, highlighting the temporary cash drain associated with such integration efforts.

This scenario underscores the risk that even brands with conversion potential can act as 'Dogs' if their integration is slow or inefficient.

- Acquisition Impact: The Smokey Bones acquisition, while strategic, initially increased FAT Brands' operational costs.

- Financial Performance: In 2023, the brand contributed to a net loss for FAT Brands during its integration phase.

- BCG Matrix Implication: This demonstrates how newly acquired entities can temporarily exhibit 'Dog' characteristics by consuming resources without immediate positive returns.

- Integration Risk: The case highlights the importance of swift and effective integration to mitigate the 'Dog' status of acquired brands.

Brands within FAT Brands that exhibit characteristics of 'Dogs' in the BCG matrix are those with low market share and low growth potential. These brands often require significant investment to maintain their operations but yield minimal returns. For instance, the strategic closure and repurposing of underperforming Smokey Bones locations into Twin Peaks in 2024 highlights a recognition of these brands' struggles. This move directly addresses the 'Dog' status by reallocating resources to more promising ventures.

FAT Brands' system-wide same-store sales decline in the first half of 2025 further suggests that some of its brands are not growing and may be losing ground. Brands that fall into this category consume resources without contributing proportionally to the company's overall growth or profitability. Identifying and addressing these 'Dogs' is crucial for optimizing the brand portfolio.

The company's pivot towards a nearly 100% franchised model, as seen with the refranchising of Fazoli's, indicates a strategy to shed company-owned locations that may be classified as 'Dogs'. These locations can be a drain on capital and management focus, diverting attention from higher-potential franchise opportunities. FAT Brands' reduced company-owned store count in Q1 2024 reflects this strategic divestment of potential 'Dog' assets.

Brands that are 'Dogs' typically have high operating costs and low profitability. These factors can create a 'cash trap' scenario where investment is needed just to keep the brand afloat, rather than to drive growth. For example, a brand with inefficient supply chains or high marketing spend relative to its revenue would fit this profile, requiring careful consideration for restructuring or divestment.

Question Marks

FAT Brands has inked deals for 40 new Fatburger and Buffalo's Cafe locations in France, marking a significant expansion into a new market. These ventures are categorized as question marks in the BCG matrix, indicating high growth potential but currently low market share in France.

This strategic move requires substantial investment to build brand recognition and capture market share against established competitors. The success of these new locations will depend on effective marketing and operational strategies to drive customer adoption and achieve profitability.

New Twin Peaks lodges, particularly those emerging from Smokey Bones conversions, are currently positioned as question marks within FAT Brands' BCG Matrix. While the Twin Peaks brand is a strong performer, these new locations are in their nascent stages of development.

These new lodges operate in a growing market with robust demand, reflecting the overall popularity of the Twin Peaks concept. However, their market share in the specific new localities where they have opened is still in its formative phase, necessitating ongoing investment to solidify their presence and capture greater market penetration.

The initial co-branding efforts, like the Round Table Pizza and Marble Slab Creamery combination, are classic examples of FAT Brands' 'Question Marks.' These ventures are entering a market hungry for novel experiences, but their current market share as a unified brand is minimal. Strategic marketing is crucial to elevate these concepts from nascent ideas to significant players.

For instance, the success of such early pairings is vital for FAT Brands' future growth, especially as the fast-casual dining sector continues to evolve. By investing in targeted promotions and customer engagement, these co-branded locations can build the necessary momentum to climb the BCG matrix.

Expansion of Manufacturing Capabilities (Third-Party Contracts)

FAT Brands is strategically expanding its manufacturing capabilities by entering into a new third-party contract with a prominent national restaurant entertainment chain. This move leverages their existing infrastructure, aiming to capitalize on high growth potential by utilizing excess capacity. For 2024, this initiative represents a significant opportunity to diversify revenue streams beyond their core franchise operations.

While the potential for growth in this third-party manufacturing segment is substantial, FAT Brands' current market share within this specific niche is still in its early stages. To fully realize the benefits of this expansion and secure additional contracts, strategic investments will be necessary to scale operations and enhance their service offerings. This aligns with a typical Stars or Question Marks quadrant placement in a BCG matrix, depending on the current market growth rate and the company's relative market share.

- High Growth Potential: The partnership with a national chain offers significant revenue upside by utilizing underutilized manufacturing assets.

- Nascent Market Share: FAT Brands is a new entrant in the third-party manufacturing market, requiring focused efforts to gain traction.

- Investment Required: Scaling operations and securing more contracts will necessitate capital investment to build capacity and market presence.

- Diversification Strategy: This expansion diversifies FAT Brands' business model, reducing reliance solely on franchise royalties.

Hot Dog on a Stick (Company-Owned Refranchising Target)

Hot Dog on a Stick is positioned as a Question Mark within FAT Brands' BCG Matrix. The company has announced plans to refranchise 33 of its company-owned locations. This strategy acknowledges the brand's current standing in a growing franchising market, but also highlights the need for strategic capital allocation.

The brand operates in a market with significant franchising potential, yet its relatively small number of company-owned units indicates a low market share in that segment. To improve its standing and profitability, Hot Dog on a Stick requires substantial investment, either directly or through the refranchising initiative, to expand its presence and operational efficiency.

- Refranchising Initiative: FAT Brands aims to refranchise 33 company-owned Hot Dog on a Stick locations.

- Market Position: The brand is classified as a Question Mark due to its low market share in company-owned units and the need for growth investment.

- Growth Potential: The franchising market presents an opportunity for expansion and increased profitability for Hot Dog on a Stick.

- Strategic Focus: Refranchising is a key strategy to address the brand's need for increased footprint and financial performance.

FAT Brands' expansion into France with 40 new Fatburger and Buffalo's Cafe locations places these ventures firmly in the Question Mark category. This signifies high growth potential in a new market, but currently low market share, necessitating significant investment to build brand awareness and compete effectively.

New Twin Peaks locations, especially those resulting from Smokey Bones conversions, are also considered Question Marks. While the brand itself is strong, these specific new sites are in their early stages, operating in a growing market but with a nascent market share that requires ongoing investment to solidify their position.

The initial co-branding efforts, such as Round Table Pizza and Marble Slab Creamery, are prime examples of FAT Brands' Question Marks. These are innovative concepts entering a receptive market, but as unified brands, their current market share is minimal, requiring strategic marketing to transition them into stronger market positions.

FAT Brands' move into third-party manufacturing with a national restaurant entertainment chain represents a Question Mark. This venture has high growth potential by leveraging existing infrastructure, but FAT Brands' current market share in this specific niche is still developing, requiring strategic investment to scale operations and secure more contracts.

Hot Dog on a Stick, with its refranchising of 33 company-owned locations, is a Question Mark. While the franchising market offers growth opportunities, the brand's limited company-owned presence indicates a low market share in that segment, requiring focused investment, potentially through refranchising, to expand its footprint and improve financial performance.

| Brand/Initiative | BCG Category | Key Characteristics | Growth Potential | Market Share | Investment Need |

|---|---|---|---|---|---|

| Fatburger/Buffalo's Cafe (France) | Question Mark | New market entry, high growth potential | High | Low | Substantial for brand building |

| New Twin Peaks Locations | Question Mark | Nascent stage, strong brand concept | High | Low (in new localities) | Ongoing to establish presence |

| Co-branded Concepts (e.g., Round Table/Marble Slab) | Question Mark | Novel market entry, potential for unique appeal | High | Minimal (as unified brand) | Strategic marketing crucial |

| Third-Party Manufacturing | Question Mark | Leveraging infrastructure, diversifying revenue | High | Low (in niche) | To scale operations and secure contracts |

| Hot Dog on a Stick (Refranchising) | Question Mark | Franchising market opportunity, low company-owned share | High (via franchising) | Low (company-owned) | To expand footprint and efficiency |

BCG Matrix Data Sources

Our FAT Brands BCG Matrix leverages comprehensive data from company financial reports, industry-specific market research, and internal performance metrics to accurately position each brand.