Evolution Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evolution Mining Bundle

Navigate the complex external forces shaping Evolution Mining's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expertly curated insights to inform your investment or business decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Changes in government policies, particularly regarding mining taxation and royalties, significantly influence Evolution Mining's financial performance and operational flexibility. For instance, shifts in Australia's Minerals Resource Rent Tax (MRRT) or proposed changes to royalty rates in Canadian provinces can directly affect the company's bottom line.

Navigating diverse regulatory landscapes in Australia and Canada presents ongoing challenges. Evolution Mining must adhere to stringent environmental protection laws and increasingly complex Indigenous land rights frameworks, which are often shaped by political discourse and international advocacy, impacting project approvals and operational continuity.

Evolution Mining's primary operating jurisdictions, Australia and Canada, consistently rank high in global political stability indices. For instance, Canada has maintained a strong position in various governance and stability reports throughout 2024, reflecting its robust democratic institutions and rule of law. Australia also demonstrates significant political resilience, though like any nation, it is subject to the ebb and flow of electoral cycles and policy shifts.

However, potential disruptions can arise from changes in government policy, particularly concerning mining regulations, taxation, and environmental standards. For example, upcoming Australian federal elections in 2025 could potentially lead to policy adjustments that impact the mining sector. Furthermore, escalating geopolitical tensions globally, as observed in various regions throughout 2024, could indirectly affect trade agreements, currency exchange rates, and the cost of capital for international mining operations.

Evolution Mining's social license to operate is deeply intertwined with its Indigenous relations, particularly concerning land rights in Australia and Canada. The company actively cultivates partnerships with First Nations groups, recognizing the critical importance of respecting their ancestral lands and resource rights.

In 2023, Evolution Mining reported progress in its Indigenous engagement initiatives, including increased Indigenous employment figures and procurement from Indigenous-owned businesses. For instance, at its Cowal mine in New South Wales, the company has established a strong partnership with the Wiradjuri people, focusing on cultural heritage management and employment pathways.

The company's commitment extends to fostering economic opportunities for Indigenous communities through training programs and direct business partnerships. This approach aims to build mutual trust and ensure that mining operations contribute positively to the social and economic well-being of Indigenous peoples, thereby strengthening its operational sustainability.

Trade Agreements and International Relations

Global trade dynamics, including potential protectionist policies and shifts in major trading partners' industrial strategies, can influence demand for gold and copper, impacting Evolution Mining's market access and pricing. For instance, the US, a significant trading partner for Australia, saw its trade surplus with Australia widen to A$30.9 billion in 2023, highlighting evolving trade patterns that could affect commodity demand.

Australia's strengthened ties with countries like the US and Japan may lead to new trade opportunities, but also expose the company to broader global rivalries. In 2024, Australia continued to pursue bilateral trade agreements, aiming to diversify export markets beyond traditional partners, which could present both opportunities and challenges for Evolution Mining's supply chain and sales.

- Protectionist Policies: Increased tariffs or trade barriers in key markets could raise costs for Evolution Mining or reduce demand for its products.

- Shifting Industrial Strategies: Major economies re-evaluating their industrial bases might alter global demand for metals like copper, a key component in many advanced technologies.

- Bilateral Agreements: New trade pacts, such as those strengthening Australia's relationship with the US, could open new avenues for exports or investment.

- Geopolitical Rivalries: Heightened global competition can create volatility in commodity markets and impact international operational strategies.

Energy Policy and Decarbonization Goals

Government policies and incentives for renewable energy and decarbonization directly impact Evolution Mining's operational costs and its investments in sustainable practices. These policies can create both opportunities and challenges for the company's transition to lower-emission operations.

Evolution Mining has set ambitious targets, aiming for Net Zero emissions by 2050 and an interim goal of reducing emissions by 30% by 2030. These commitments are in line with global climate action, and their progress will be significantly shaped by evolving government regulations and support mechanisms.

- Government Support: Federal and state governments in Australia, where Evolution Mining primarily operates, are increasingly implementing policies to encourage the adoption of renewable energy sources and the reduction of greenhouse gas emissions across industries.

- Carbon Pricing Mechanisms: The potential for future carbon pricing or emissions trading schemes could directly affect the cost of energy for Evolution Mining, incentivizing further investment in cleaner technologies.

- Regulatory Frameworks: Changes in environmental regulations, permitting processes for new projects, and reporting requirements related to climate change can influence project timelines and capital expenditure.

- Incentives for Innovation: Government grants and tax incentives for research and development in areas like carbon capture, energy efficiency, and renewable energy integration can accelerate Evolution Mining's decarbonization efforts.

Political stability in Australia and Canada, Evolution Mining's core operating regions, remains a key strength, with both nations demonstrating robust governance. However, the upcoming Australian federal election in 2025 presents a potential for policy shifts impacting the mining sector, including taxation and environmental regulations.

Geopolitical tensions globally, as observed in 2024, can indirectly influence Evolution Mining through trade agreements and capital costs. The company's social license to operate is also politically influenced, particularly through evolving Indigenous land rights frameworks in Australia and Canada, with progress noted in Indigenous employment and partnerships in 2023.

Government incentives for renewable energy and decarbonization efforts directly affect Evolution Mining's operational costs and investment strategies. These policies, alongside potential carbon pricing mechanisms, are crucial for the company's Net Zero by 2050 target, with a 30% emissions reduction goal by 2030.

What is included in the product

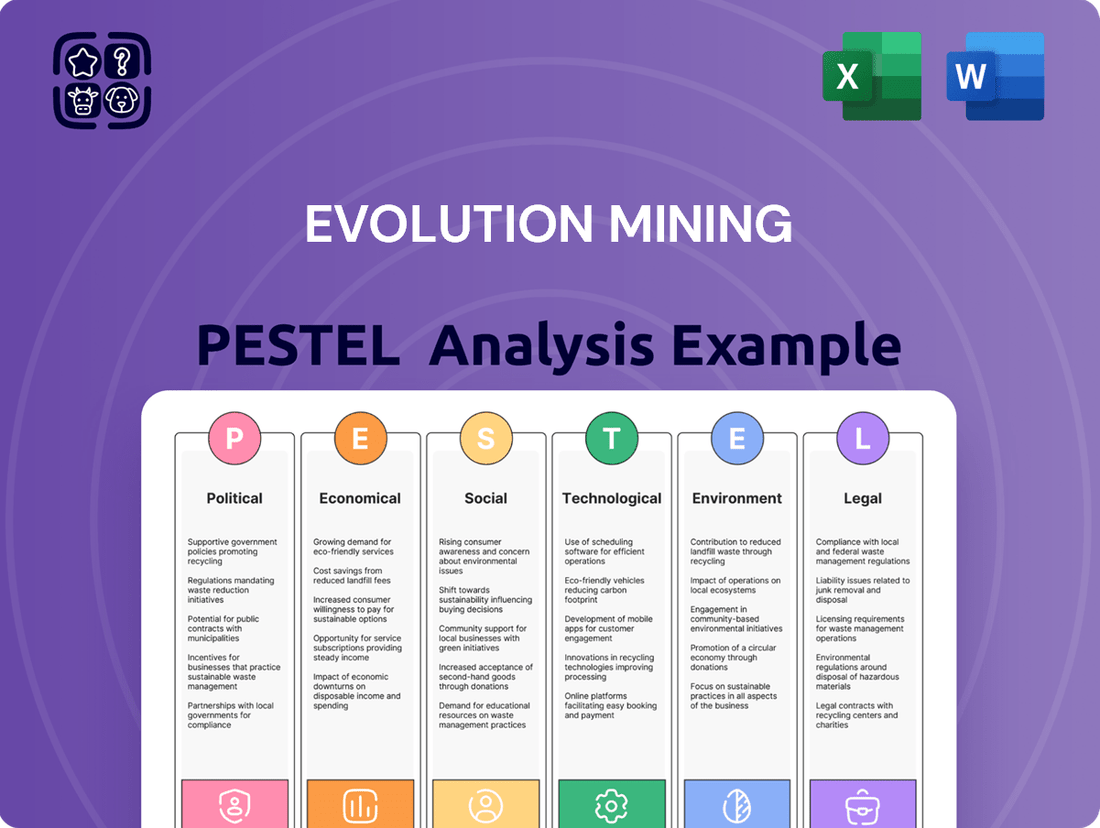

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Evolution Mining, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying key opportunities and threats shaped by current market and regulatory dynamics.

The Evolution Mining PESTLE Analysis provides a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning sessions.

This analysis offers a concise, easily shareable format ideal for quick alignment across teams, ensuring everyone understands the key external risks and opportunities impacting Evolution Mining.

Economic factors

Evolution Mining's profitability is directly tied to the global prices of gold and copper. These commodity markets are notoriously volatile, meaning even small shifts can significantly impact the company's revenue and earnings.

The outlook for gold prices in 2025 appears positive, with Evolution Mining's executive chair anticipating an upward trend. This optimism is echoed by several financial institutions, which point to sustained demand from central banks as a key driver for higher gold prices in the coming year.

Operational costs are a significant factor for Evolution Mining, especially with current inflationary trends. For instance, the Australian Consumer Price Index (CPI) saw a substantial increase, reaching 6.0% in the year ending December 2023, impacting everything from fuel to wages.

These rising input costs, including energy, labor, and essential equipment, directly affect Evolution Mining's profitability. The company is actively pursuing operational efficiencies and adopting new technologies to combat these pressures and maintain a competitive cost base.

Foreign exchange fluctuations present a significant economic factor for Evolution Mining. As gold is primarily priced in US dollars, a stronger Australian dollar (AUD) against the USD can reduce the AUD-denominated revenue received by the company. For instance, in the fiscal year 2023, Evolution Mining reported that a 10% change in the AUD/USD exchange rate could impact its EBITDA by approximately AUD 40 million, highlighting the sensitivity of its financial performance to currency movements.

Furthermore, the company's operational costs, often incurred in local currencies like the AUD, can become more expensive in USD terms when the AUD strengthens. Conversely, a weaker AUD can boost its revenue and improve cost competitiveness when translated back into Australian dollars. This dynamic interplay between currency values directly influences Evolution Mining's profitability and the overall cost structure of its mining operations, particularly those located in Australia.

Access to Capital and Investment Climate

Evolution Mining's ability to secure capital for exploration and project development is paramount to its expansion plans. The cost of this capital, influenced by global economic conditions and investor sentiment, directly impacts project feasibility and profitability. In 2024, the Australian mining sector, where Evolution operates, has seen a slight increase in the cost of capital due to rising interest rates globally, though this is partially offset by strong commodity prices.

A positive investment climate is essential for attracting the necessary funding. This climate is shaped by political stability, clear regulatory frameworks, and robust commodity markets. For instance, Australia's consistent ranking as a top destination for mining investment, bolstered by its stable governance and resource-rich geology, continues to be a significant advantage. However, concerns regarding environmental regulations and Indigenous land rights can introduce complexities that affect investment decisions.

- Capital Availability: Access to debt and equity financing remains a key determinant of Evolution Mining's growth trajectory.

- Cost of Capital: Global interest rate trends and market risk premiums directly influence the cost of funding for new projects.

- Investment Climate: Political stability, regulatory certainty, and commodity price outlook are critical for attracting foreign and domestic investment.

- Commodity Prices: Strong gold prices, for example, can improve the investment climate by enhancing project economics and attracting capital.

Economic Growth and Demand for Minerals

Global economic growth directly impacts mineral demand. For instance, a robust global economy in 2024 and projected for 2025 typically translates to increased industrial activity, boosting the need for metals like copper, essential for infrastructure and manufacturing. Conversely, during economic downturns, demand can soften.

Gold's role as a safe-haven asset means its demand can fluctuate with economic uncertainty. In times of geopolitical tension or high inflation, investors often turn to gold, driving up its price and demand, even if broader economic growth is sluggish. This was observed in early 2024, with gold prices reaching new highs amid persistent inflation concerns.

The electrification trend is a significant driver for critical minerals. The ongoing transition to electric vehicles and renewable energy sources is creating substantial demand for metals like copper, nickel, and lithium. Projections suggest this demand will continue to grow, offering a strong long-term outlook for producers of these materials. For example, the International Energy Agency (IEA) forecast in its 2024 reports that demand for critical minerals in clean energy technologies could increase by a factor of four to six by 2040 compared to 2020 levels.

- Global GDP Growth: The IMF’s April 2024 World Economic Outlook projected global GDP growth at 3.2% for both 2024 and 2025, indicating a stable environment for industrial mineral demand.

- Copper Demand: Copper prices in early 2024 averaged around $8,500 per tonne, reflecting strong demand from the construction and automotive sectors, particularly with the acceleration of EV production.

- Gold as a Safe Haven: Gold prices surged to over $2,300 per ounce in April 2024, driven by geopolitical risks and central bank buying, highlighting its continued appeal during uncertain economic periods.

- Critical Minerals for Electrification: The IEA estimates that the energy sector's demand for critical minerals will triple by 2040, underscoring the long-term growth potential for companies supplying these essential materials.

Evolution Mining's financial performance is intrinsically linked to global commodity prices, with gold and copper being key drivers. The company's executive chair anticipates a positive trend for gold prices in 2025, supported by sustained central bank demand, while copper demand remains robust due to electrification trends and industrial activity. However, inflationary pressures, as evidenced by Australia's 6.0% CPI in the year ending December 2023, increase operational costs, impacting profitability. Furthermore, currency fluctuations, particularly the AUD/USD exchange rate, significantly influence revenue and costs, with a 10% change potentially impacting EBITDA by approximately AUD 40 million in FY23.

| Economic Factor | 2024/2025 Outlook | Impact on Evolution Mining |

|---|---|---|

| Gold Prices | Positive outlook, driven by central bank demand | Increased revenue and profitability |

| Copper Prices | Strong demand from electrification and industry | Potential for increased revenue if copper production is significant |

| Inflation (Australia CPI) | 6.0% (Year ending Dec 2023) | Higher operational costs (labor, energy, materials) |

| AUD/USD Exchange Rate | Volatile, impacting USD-denominated revenues | A weaker AUD boosts revenue; a stronger AUD reduces it |

| Global GDP Growth | Projected 3.2% for 2024 & 2025 (IMF) | Stable demand for industrial minerals; potential for gold as safe haven |

Preview the Actual Deliverable

Evolution Mining PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Evolution Mining details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this professionally structured report upon completing your purchase.

Sociological factors

Evolution Mining's social license to operate is crucial, and they actively foster positive community relationships. In FY23, they invested $11.5 million in community contributions, demonstrating a commitment to local well-being.

The company's focus on local employment and procurement significantly benefits regional economies. For instance, in FY23, 84% of their workforce was Australian-based, and a substantial portion of their procurement spend was directed to local suppliers.

Evolution Mining is actively working to enhance workforce diversity, with a particular emphasis on increasing Indigenous participation. This commitment is formalized through dedicated employment, apprentice, trainee, and graduate programs designed to build a more inclusive and skilled workforce.

The company's strategic focus for FY25 includes comprehensive Inclusion and Diversity Plans, underpinned by a broader Reconciliation Plan. These initiatives aim to foster a culturally rich environment and integrate diverse skill sets, reflecting a growing societal expectation for businesses to champion diversity and inclusion.

Evolution Mining places a strong emphasis on the health, safety, and overall wellbeing of its employees, recognizing it as a cornerstone of sustainable operations. This commitment is directly reflected in their efforts to minimize injury frequency rates across all sites. For instance, in the fiscal year 2023, Evolution Mining reported a Total Recordable Injury Frequency Rate (TRIFR) of 3.0, demonstrating a focus on creating a secure workplace.

Ensuring a safe working environment is not just a regulatory requirement but a critical component of their sustainability performance. By actively working to reduce incidents, the company aims to foster a culture where employee wellbeing is paramount, contributing to both operational efficiency and employee morale. This proactive approach to safety is a key indicator of their responsible business practices.

Cultural Heritage Protection

Evolution Mining actively partners with First Nations communities to safeguard cultural heritage, a key sociological consideration. This commitment involves extensive consultation and formal agreements, ensuring the preservation of significant sites within their operational footprints.

In 2023, Evolution Mining reported ongoing engagement with over 30 First Nations groups across its Australian operations, underscoring the importance of these collaborations. These partnerships are crucial for maintaining social license to operate and respecting Indigenous cultural practices.

- Collaborative Site Identification: Working with Traditional Owners to pinpoint and document heritage locations.

- Formalized Agreements: Establishing clear protocols and responsibilities for heritage protection.

- Capacity Building: Supporting First Nations groups in managing and monitoring cultural heritage.

- Ongoing Consultation: Maintaining open communication channels for continuous feedback and input.

Changing Community Expectations and ESG Focus

Societal expectations are increasingly shaping business practices, with a strong emphasis on environmental, social, and governance (ESG) performance. This trend directly influences how companies like Evolution Mining operate and are perceived by stakeholders. The demand for responsible mining practices, fair labor, and robust governance is no longer a niche concern but a mainstream expectation.

Evolution Mining is actively integrating sustainability into its core business strategy to meet these evolving community expectations. This includes a commitment to transparent disclosure of its ESG performance and aligning with external assurance requirements. For instance, in its 2023 Sustainability Report, Evolution Mining highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2020 baseline, demonstrating tangible progress in environmental stewardship.

- Community Engagement: Evolution Mining invested over $14 million in community programs and contributions across its operating regions in FY23, fostering positive relationships and addressing local needs.

- Indigenous Partnerships: The company continues to strengthen its partnerships with Indigenous communities, with over 15% of its workforce identifying as Indigenous in FY23, reflecting a commitment to social inclusion.

- Governance Transparency: Evolution Mining maintains a strong governance framework, with its Board of Directors comprising 40% independent directors, ensuring robust oversight and accountability.

- Environmental Performance: The company is investing in water management technologies, with 95% of its operational water usage recycled or reused in FY23, minimizing its environmental footprint.

Societal expectations for responsible mining are increasingly prominent, influencing Evolution Mining's operational and strategic decisions. The company's commitment to community well-being is evident through its FY23 investments of $11.5 million in community contributions, alongside a focus on local employment, with 84% of its workforce being Australian-based in the same year.

Enhancing workforce diversity, particularly Indigenous participation, is a key sociological driver for Evolution Mining. The company's FY25 strategic focus includes comprehensive Inclusion and Diversity Plans and a broader Reconciliation Plan to foster a culturally rich and inclusive workforce.

Safeguarding cultural heritage through active partnerships with First Nations communities is a critical sociological factor for Evolution Mining. In 2023, the company engaged with over 30 First Nations groups, formalizing agreements and supporting capacity building for heritage protection.

The growing emphasis on ESG performance shapes how Evolution Mining operates and is perceived. The company reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity by FY23 compared to its 2020 baseline, reflecting a response to societal demands for environmental stewardship.

| Sociological Factor | FY23 Data Point | FY25 Focus |

|---|---|---|

| Community Investment | $11.5 million | Continued investment and program development |

| Local Employment | 84% Australian-based workforce | Maintaining and enhancing local employment |

| Indigenous Participation | Over 15% Indigenous workforce (FY23) | Strengthening employment, apprentice, trainee, and graduate programs |

| Cultural Heritage Protection | Engagement with over 30 First Nations groups | Formalized agreements and capacity building |

Technological factors

Evolution Mining is increasingly integrating automation and artificial intelligence (AI) across its operations to boost efficiency and safety. For instance, the company is deploying autonomous haulage systems and drill rigs, which are designed to operate with greater precision and less human intervention, directly contributing to enhanced productivity.

These advanced technologies, including predictive maintenance, are crucial for minimizing equipment downtime. By anticipating potential failures, Evolution Mining can schedule maintenance proactively, leading to more consistent operational output and reduced costly interruptions, a key factor in optimizing mining economics.

Evolution Mining is leveraging advanced data analytics and digital transformation to sharpen its operational edge. The integration of real-time geospatial analytics, machine learning, and digital twins is proving crucial for smarter decision-making, optimizing processing circuits, and refining exploration accuracy. This data-driven strategy directly contributes to enhanced ore recovery rates, a key performance indicator for mining companies.

For instance, by implementing these technologies, Evolution Mining aims to boost its ore recovery, which can significantly impact profitability. While specific 2024 or 2025 recovery rate figures are still emerging, the company's ongoing investment in digital infrastructure underscores a commitment to improving efficiency. This approach also plays a vital role in minimizing the environmental footprint of mining operations through more precise resource management and waste reduction.

Technological advancements, especially in artificial intelligence and machine learning, are revolutionizing how companies like Evolution Mining find new mineral deposits. These tools can sift through massive geological datasets far faster than humans, pinpointing promising areas for drilling and significantly reducing the time and cost of exploration. For instance, by mid-2024, AI-powered geological modeling has been shown to improve drill target identification accuracy by up to 30% in some pilot projects.

These innovations not only speed up discovery but also contribute to a smaller environmental footprint. By focusing exploration efforts on higher-probability targets identified through advanced analytics, companies can minimize the need for widespread, less efficient surveying and drilling. This smarter approach to resource discovery is becoming increasingly crucial as easily accessible deposits become scarcer, with the global mining sector investing heavily in digital transformation initiatives throughout 2024 and into 2025.

Renewable Energy and Low-Emission Technologies

Evolution Mining is actively exploring and integrating renewable energy sources, energy storage, and low-emission technologies across its operations. This strategic pivot aims to reduce operational costs and environmental impact. For instance, the company is investigating hybrid and battery-electric vehicle options for its mining fleet, signaling a significant shift towards cleaner transportation solutions.

Key initiatives include partnerships focused on advancing emissions-reduction technologies within the mining sector. In 2023, the global mining industry saw significant investment in green technologies, with renewable energy projects in mining operations increasing by an estimated 15% year-on-year. Evolution Mining's commitment aligns with this broader industry trend, positioning it to leverage these advancements.

- Investment in Battery-Electric Vehicles: Evolution Mining is evaluating the feasibility and deployment of battery-electric vehicles (BEVs) for its underground and surface fleets, aiming to cut diesel consumption and associated emissions.

- Renewable Energy Integration: The company is exploring solar and wind power generation opportunities to supplement grid electricity at its mine sites, with a target to increase the proportion of renewable energy in its power mix.

- Energy Storage Solutions: Investigating the use of battery energy storage systems (BESS) to improve grid stability, manage peak demand, and maximize the utilization of intermittent renewable energy sources.

- Partnerships for Innovation: Collaborating with technology providers and research institutions to develop and implement novel low-emission technologies tailored for the unique demands of mining environments.

Mining Methods and Operational Efficiency

Evolution Mining's commitment to technological advancement is evident in its adoption of innovative mining methods. For instance, the implementation of block caving technology at its Northparkes operations has been a key driver for cost efficiency and enhanced production. This approach optimizes resource extraction, directly contributing to improved operational performance and the potential to extend the mine's lifespan.

Continuous operational improvements, supported by technology, are central to Evolution Mining's strategy. These efforts focus on streamlining processes and increasing output. By leveraging technology, the company aims to maximize the value derived from its mineral assets, ensuring a more sustainable and profitable future for its mining ventures.

- Block Caving Technology: Implemented at Northparkes, this method improves ore recovery and reduces operational costs.

- Operational Efficiency: Continuous improvements driven by technology lead to better cost management and increased production volumes.

- Resource Optimization: Technology plays a vital role in extracting more value from existing ore bodies and extending mine life.

- Cost Reduction: Innovations in mining techniques directly impact the cost per ounce, boosting profitability.

Technological factors are fundamentally reshaping Evolution Mining's operational landscape, driving efficiency and safety through automation and AI. The company's investment in autonomous haulage systems and AI-powered geological modeling, which has shown up to a 30% improvement in drill target identification accuracy in pilot projects by mid-2024, underscores this commitment. Furthermore, the integration of advanced data analytics and digital twins is optimizing processing circuits and enhancing ore recovery rates.

Evolution Mining is also at the forefront of adopting cleaner technologies, exploring battery-electric vehicles and renewable energy sources to reduce its environmental footprint and operational costs. This aligns with a broader industry trend, as global mining sector investment in digital transformation initiatives surged throughout 2024 and is expected to continue into 2025.

The company's strategic implementation of technologies like block caving at Northparkes exemplifies its focus on cost efficiency and enhanced production, aiming to maximize resource value and extend mine life. These technological advancements are crucial for maintaining a competitive edge in the evolving mining sector.

| Technology Area | Impact | Evolution Mining Initiatives | Industry Trend (2024-2025 Focus) |

|---|---|---|---|

| Automation & AI | Increased efficiency, safety, precision | Autonomous haulage, AI geological modeling | Widespread adoption for exploration and operations |

| Data Analytics & Digitalization | Optimized processing, improved recovery | Digital twins, real-time geospatial analytics | Enhanced decision-making and predictive maintenance |

| Electrification & Renewables | Reduced emissions, lower costs | Battery-electric vehicles, solar/wind exploration | Significant investment in green technologies |

| Innovative Mining Methods | Cost efficiency, extended mine life | Block caving (Northparkes) | Focus on resource optimization and cost reduction |

Legal factors

Evolution Mining navigates a complex web of mining and environmental regulations across its Australian and Canadian operations. These rules are not static; they are constantly evolving, demanding continuous adaptation from the company to maintain compliance.

Staying on top of these regulations, which cover everything from pollution control and waste disposal to the crucial task of land rehabilitation, is paramount. For instance, in 2023, Australian federal and state governments continued to emphasize environmental stewardship, with significant fines levied for non-compliance in the resources sector, underscoring the financial risks involved.

The increasing regulatory focus means that Evolution Mining must invest heavily in environmental management systems and technologies. Failure to do so not only risks penalties but also impacts the company's social license to operate, a critical factor in the mining industry.

Legal frameworks recognizing Indigenous land and resource rights, like Australia's native title legislation, mandate formal consultation and collaboration agreements with First Nations groups. Evolution Mining, operating within Australia, must navigate these obligations, ensuring its projects respect established rights and interests. This often involves detailed impact assessments and benefit-sharing arrangements.

Evolution Mining operates under stringent work health and safety (WHS) laws in Australia and Canada, requiring adherence to regulations covering everything from site conditions to emergency preparedness. For instance, in 2023, Australian workplaces reported over 150,000 serious injury claims, highlighting the critical nature of these WHS frameworks.

Compliance extends to robust training programs and meticulous incident reporting mechanisms, ensuring accountability and continuous improvement in safety practices. In 2024, Canadian provinces continued to update their WHS regulations, with a focus on mental health in the workplace, a trend likely to impact mining operations.

Corporate Governance and Reporting Standards

Evolution Mining operates under strict corporate governance regulations and reporting standards, crucial for maintaining investor confidence and regulatory compliance. These include rigorous requirements for financial disclosure and an increasing emphasis on sustainability performance, reflecting global trends in responsible business practices. For instance, in their 2023 reporting, Evolution Mining highlighted their adherence to the Global Reporting Initiative (GRI) standards, demonstrating a commitment to transparent communication on environmental, social, and governance (ESG) matters.

The company's annual and sustainability reports are key instruments for this transparency. These documents detail financial performance, operational updates, and their approach to ESG challenges, aligning with frameworks like the GRI. This commitment ensures stakeholders have a clear understanding of the company's operations and its impact. For example, their 2023 Sustainability Report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline.

- Financial Reporting: Adherence to Australian Securities Exchange (ASX) listing rules and Australian Accounting Standards Board (AASB) ensures accurate financial disclosures.

- Sustainability Reporting: Adoption of frameworks like the Global Reporting Initiative (GRI) for transparent reporting on environmental, social, and governance (ESG) performance.

- Corporate Governance Codes: Compliance with the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations.

- Shareholder Rights: Mechanisms in place to protect shareholder rights and promote equitable treatment of all shareholders.

Permitting and Licensing Requirements

Evolution Mining, like all mining companies, navigates a complex web of legal requirements for its operations. Obtaining and maintaining the necessary licenses and permits for exploration, development, and the ongoing operation of mines is a significant undertaking. These approvals are critical for legal compliance and operational continuity.

Changes in regulatory frameworks, such as the introduction of more stringent environmental standards or a streamlining of approval processes, can directly influence project timelines and overall feasibility. For instance, delays in securing environmental permits can push back development schedules, impacting projected revenues and capital expenditure plans. In 2023, the Australian government continued to emphasize environmental, social, and governance (ESG) factors in resource project approvals, potentially leading to longer assessment periods for new developments.

Key legal factors impacting Evolution Mining include:

- Exploration Permits: Securing rights to explore for mineral resources in designated areas.

- Mining Leases: Obtaining legal title to extract minerals from a specific site.

- Environmental Approvals: Meeting stringent environmental impact assessment and management requirements.

- Workplace Health and Safety Regulations: Adhering to laws designed to protect mine workers.

Legal factors are critical for Evolution Mining, encompassing everything from securing exploration permits to adhering to stringent environmental and safety regulations. The company must navigate a dynamic legal landscape, ensuring compliance with Australian and Canadian laws that govern mining operations, Indigenous rights, and corporate conduct. For example, in 2023, the Australian federal government continued to prioritize ESG considerations in resource project approvals, potentially extending assessment timelines.

Compliance with work health and safety (WHS) laws is paramount, with ongoing updates in 2024, such as those in Canadian provinces focusing on workplace mental health, directly impacting mining safety protocols. Evolution Mining's commitment to corporate governance and transparent financial and sustainability reporting, often aligned with frameworks like the Global Reporting Initiative (GRI), builds investor trust and meets regulatory expectations. Their 2023 Sustainability Report noted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity against a 2019 baseline.

| Legal Area | Key Compliance Aspects | 2023/2024 Relevance/Data |

| Environmental Regulations | Pollution control, waste disposal, land rehabilitation, ESG approvals | Increased focus on ESG in Australian project approvals; fines for non-compliance in resources sector. |

| Indigenous Rights | Consultation, collaboration agreements, impact assessments | Ongoing navigation of native title legislation and benefit-sharing arrangements. |

| Work Health & Safety (WHS) | Site safety, emergency preparedness, training, incident reporting | Over 150,000 serious injury claims in Australian workplaces (2023); Canadian provinces updating WHS regulations with mental health focus (2024). |

| Corporate Governance & Reporting | Financial disclosure, sustainability reporting (GRI), shareholder rights | Adherence to ASX listing rules, AASB standards, ASX Corporate Governance Council recommendations; 2023 Sustainability Report showed 15% GHG emissions intensity reduction. |

Environmental factors

Evolution Mining views climate change as a significant strategic risk, driving its commitment to a 30% reduction in Scope 1 and 2 emissions by 2030 and aiming for Net Zero by 2050. This ambitious target necessitates a shift towards renewable energy sources and enhanced energy efficiency across operations. For instance, in FY23, Evolution Mining reported total Scope 1 and 2 emissions of approximately 1.1 million tonnes of CO2 equivalent, with a clear roadmap to decrease this figure significantly.

Key initiatives include the adoption of renewable energy, such as solar power, to supplement existing diesel generation, and ongoing efforts to optimize energy consumption at its mine sites. The company is also actively evaluating the electrification of its mining fleet, a crucial step in decarbonizing its heavy machinery operations. These actions are not only environmentally responsible but also position Evolution Mining to navigate evolving regulatory landscapes and investor expectations regarding climate action.

Evolution Mining places significant emphasis on responsible water management, a critical factor given the increasing global awareness of water scarcity. This commitment is particularly relevant as many mining operations are situated in arid or semi-arid environments where water is a precious resource.

The company actively pursues strategies to minimize its overall water footprint. This includes innovative mine design and ongoing process optimization aimed at reducing total water demand. For instance, Evolution Mining prioritizes the reuse of mine-affected water and lower-quality water sources, thereby decreasing its dependence on fresh, external water supplies.

In the 2023 financial year, Evolution Mining reported a total water withdrawal of 13,569 megalitres. The company's focus on water conservation and reuse is a key component of its environmental, social, and governance (ESG) strategy, aiming to ensure sustainable operations and minimize impact on local communities and ecosystems.

Mining operations inherently affect biodiversity and land use, necessitating careful management. Evolution Mining addresses this by integrating biodiversity conservation into its operational strategies, conducting thorough impact assessments, and developing specific management plans to mitigate ecological disruption.

The company's commitment extends to post-closure rehabilitation, aiming to restore affected land and support the recovery of local ecosystems. For example, Evolution Mining's Cowal operation in New South Wales has ongoing rehabilitation programs targeting native flora and fauna, with significant progress reported in restoring disturbed areas by late 2024.

Waste Management and Circular Economy

Evolution Mining is actively integrating circular economy principles by prioritizing waste minimization through robust recycling and beneficial reuse initiatives. This commitment extends to responsible tailings management, a critical environmental aspect of mining operations. In 2023, the company reported a 10% reduction in waste sent to landfill across its operations compared to the previous year.

The company's focus on a circular economy means exploring innovative ways to repurpose by-products and reduce the overall environmental footprint. This includes initiatives aimed at extending the life of mine sites and rehabilitating land post-operation. For instance, their Mungari operation in Western Australia implemented a new tailings reprocessing project in late 2023, which is projected to recover an additional 50,000 ounces of gold and significantly reduce the volume of tailings requiring long-term storage.

- Waste Minimization: Evolution Mining aims to reduce waste generation by 15% by 2025 through enhanced recycling programs.

- Circular Economy Focus: Initiatives include beneficial reuse of materials and exploring opportunities for reprocessing tailings.

- Tailings Management: Responsible management of tailings is a core environmental priority, with ongoing investment in advanced technologies.

- 2023 Performance: Achieved a 10% reduction in waste to landfill, demonstrating progress in their environmental stewardship.

Environmental Impact Assessments and Monitoring

Evolution Mining places significant emphasis on Environmental Impact Assessments (EIAs), incorporating explicit biodiversity metrics to gauge and mitigate its operational footprint. This commitment extends to real-time environmental monitoring, a crucial component of responsible mining practices.

The company leverages advanced technologies, such as satellite-based remote sensing, to meticulously track and manage environmental impacts. For instance, in the 2023 financial year, Evolution Mining reported a 20% reduction in water intensity across its operations, demonstrating a proactive approach to resource management.

- Biodiversity Metrics: Evolution Mining integrates specific biodiversity targets into its EIAs, aiming to protect and enhance local ecosystems.

- Real-time Monitoring: Utilizing technologies like satellite imagery and on-site sensors, the company continuously monitors air quality, water, and land.

- Technological Integration: Satellite-based remote sensing is a key tool for ensuring compliance and managing environmental performance effectively.

- Water Intensity Reduction: A 20% decrease in water intensity in FY23 highlights the company's focus on sustainable water management.

Evolution Mining's environmental strategy centers on climate action, with a target to cut Scope 1 and 2 emissions by 30% by 2030 and achieve Net Zero by 2050. This involves transitioning to renewables and improving energy efficiency. In FY23, the company's emissions were approximately 1.1 million tonnes of CO2 equivalent, a figure they are actively working to reduce.

Water management is also a priority, with the company focused on minimizing its water footprint through reuse and process optimization, particularly in arid regions. In FY23, Evolution Mining withdrew 13,569 megalitres of water, emphasizing conservation efforts.

The company actively manages biodiversity and land use, integrating conservation into its operations and planning for post-closure rehabilitation, as seen at its Cowal operation. Furthermore, Evolution Mining embraces circular economy principles, aiming to reduce waste by 15% by 2025 and reprocessing tailings to minimize environmental impact.

| Environmental Focus | Target/Metric | FY23 Data | Key Initiatives |

|---|---|---|---|

| Emissions Reduction | 30% Scope 1 & 2 reduction by 2030; Net Zero by 2050 | 1.1 million tonnes CO2e (Scope 1 & 2) | Renewable energy adoption, energy efficiency improvements, fleet electrification |

| Water Management | Minimize water footprint | 13,569 megalitres withdrawn | Water reuse, process optimization, reduced reliance on fresh water |

| Waste Minimization | 15% reduction by 2025 | 10% reduction in waste to landfill | Recycling programs, beneficial reuse of materials, tailings reprocessing |

| Biodiversity & Land Use | Mitigate ecological disruption | Ongoing rehabilitation programs (e.g., Cowal) | Environmental Impact Assessments with biodiversity metrics, post-closure rehabilitation |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Evolution Mining is built on comprehensive data from reputable sources, including government geological surveys, global commodity market reports, and leading financial news outlets. This ensures a thorough understanding of political stability, economic trends, and technological advancements impacting the mining sector.