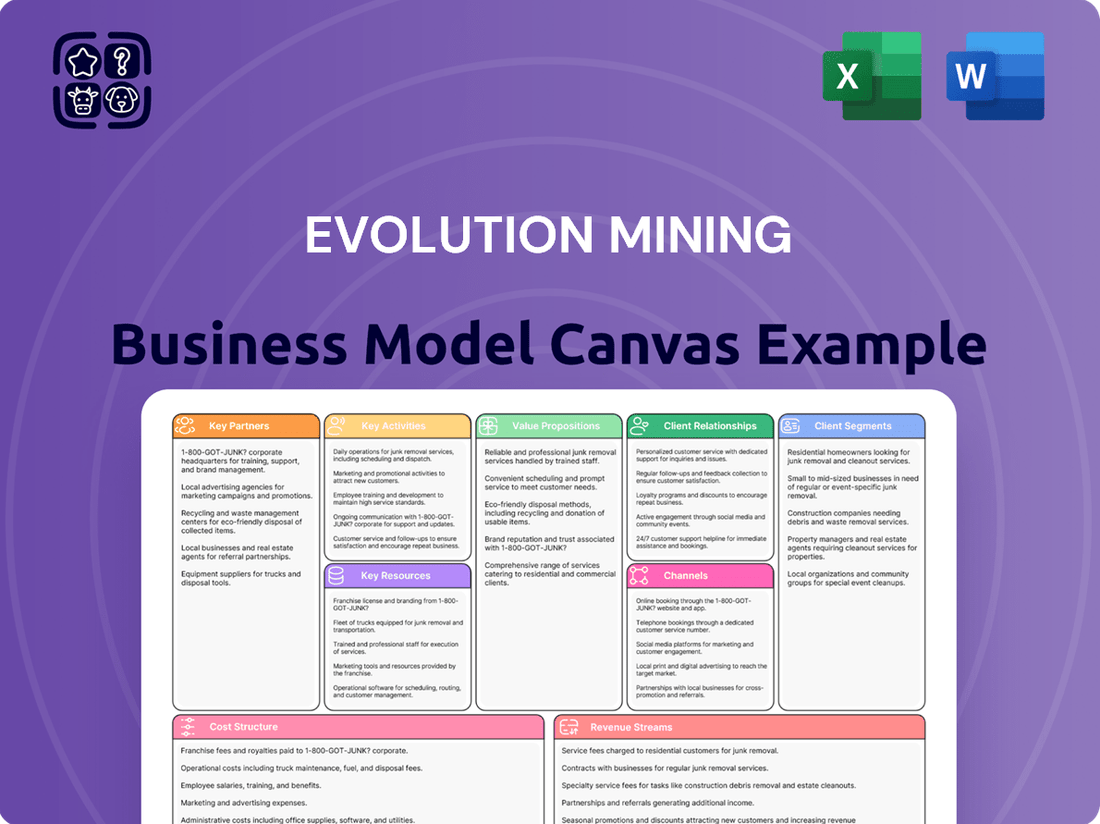

Evolution Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evolution Mining Bundle

Unlock the strategic blueprint behind Evolution Mining's success with our comprehensive Business Model Canvas. This detailed analysis dissects how they create, deliver, and capture value in the competitive mining sector, offering a clear view of their customer relationships, key resources, and revenue streams.

Dive deeper into Evolution Mining’s operational genius with the complete Business Model Canvas. This professionally crafted document provides an in-depth look at their value propositions, cost structures, and key partnerships, making it an invaluable resource for anyone seeking to understand their market dominance.

Ready to gain actionable insights from Evolution Mining’s proven strategy? Download the full Business Model Canvas to explore their customer segments, revenue streams, and competitive advantages, empowering your own strategic planning and decision-making.

Partnerships

Evolution Mining fosters crucial partnerships with mining equipment and technology providers. These alliances are essential for securing access to advanced machinery and innovative solutions that drive operational efficiency and safety across their sites.

In 2024, Evolution Mining continued to leverage these relationships to integrate new technologies. For instance, their focus on automation and data analytics relies heavily on the expertise and equipment supplied by these key partners, aiming to improve resource recovery and reduce operational costs.

Evolution Mining actively partners with specialized geological and exploration consultants. These collaborations are vital for gaining deep insights into potential mineral deposits and refining resource models, directly influencing target generation for new exploration ventures.

These expert partnerships are crucial for Evolution Mining to identify promising new mining opportunities and effectively expand their existing ore reserves. This strategic reliance on external geological expertise underpins the company’s commitment to long-term operational sustainability and growth.

For instance, in 2024, Evolution Mining continued to leverage these partnerships across its portfolio, with exploration expenditure playing a significant role in their capital allocation strategy, aiming to bolster future resource bases.

Evolution Mining relies on robust relationships with logistics and supply chain partners to keep its operations running smoothly. These alliances are crucial for the efficient transportation of everything from raw materials and essential equipment to the finished gold products. In 2024, managing these complex movements across Australia and Canada, where Evolution has significant operations, is key to controlling costs and ensuring timely delivery.

Local Communities & Indigenous Groups

Evolution Mining prioritizes strong relationships with local communities and Indigenous groups, recognizing their crucial role in securing a social license to operate and fostering sustainable development. These partnerships are built through consistent engagement, local employment programs, and shared value initiatives designed to deliver mutual benefits and mitigate social impacts.

In 2024, Evolution Mining continued its commitment to these vital partnerships. For instance, at the Cowal mine in New South Wales, the company actively engaged with the Wiradjuri people, a key Indigenous group, through various cultural heritage management programs and employment opportunities. This focus on shared value aims to ensure that mining operations contribute positively to the economic and social well-being of the surrounding regions.

- Community Engagement: Regular consultations and feedback mechanisms are in place to address community concerns and aspirations.

- Local Employment: Initiatives focus on creating job opportunities and providing training for local residents, including Indigenous individuals. In 2023, approximately 20% of the Cowal workforce identified as Indigenous.

- Shared Value Programs: Investments in local infrastructure, education, and health services are undertaken to create lasting benefits beyond the mine's operational life.

Financial Institutions & Investors

Evolution Mining’s key partnerships with financial institutions and investors are fundamental to its operational and strategic success. These relationships provide the necessary capital for everything from initial exploration to the development of new mines and the day-to-day running of existing operations.

Securing diverse funding sources is paramount. For instance, in the fiscal year 2023, Evolution Mining reported a net debt of approximately A$535 million, highlighting the reliance on financial partners for managing its capital structure and funding future endeavors. These financial entities, including major banks and investment funds, are critical for providing loans, credit facilities, and equity, thereby enabling the company to pursue its ambitious growth plans and maintain a robust balance sheet.

- Banks: Provide essential debt financing through syndicated loans and credit facilities, crucial for large-scale projects.

- Investment Funds: Offer equity capital and long-term investment, supporting strategic initiatives and shareholder value.

- Financial Institutions: Facilitate risk management through hedging instruments and provide advisory services for financial strategy.

- Shareholders: As a publicly traded company, ongoing support from a broad base of individual and institutional shareholders is vital for market confidence and capital raising.

Evolution Mining's key partnerships extend to government and regulatory bodies. These relationships are vital for navigating the complex legal and environmental frameworks governing mining operations, ensuring compliance and maintaining operational licenses.

In 2024, Evolution Mining continued to work closely with these authorities to manage environmental standards and permitting processes. For example, securing approvals for expansions or new projects in 2024, such as potential developments at their Canadian assets, would heavily rely on positive engagement and adherence to government guidelines.

What is included in the product

A detailed, strategy-aligned business model for Evolution Mining, outlining key customer segments, value propositions, and operational channels.

This model is designed for strategic planning and investor engagement, reflecting the company's real-world operations and competitive advantages.

The Evolution Mining Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operational strategy, enabling rapid identification of inefficiencies and areas for optimization.

Activities

Evolution Mining’s key activity in gold exploration and resource definition is fundamental to its long-term success. The company invests heavily in geological programs aimed at discovering new gold deposits and growing its existing resource base. This proactive approach ensures a pipeline of future production opportunities.

Detailed geological mapping and extensive drilling campaigns are core components of this activity. These efforts allow Evolution Mining to precisely define and quantify its gold reserves. For instance, as of December 31, 2023, the company reported a total attributable gold mineral reserve of 8.7 million ounces, highlighting the tangible outcomes of these exploration efforts.

Once Evolution Mining identifies viable gold deposits, it moves into the crucial development and construction phase. This involves building the necessary infrastructure, such as open pits or underground shafts, along with processing plants and all supporting facilities.

This stage is a substantial undertaking, demanding significant capital investment and intricate project management to ensure efficient and safe construction. For instance, the Mungari expansion project, a key development for Evolution Mining, was projected to cost around A$174 million in capital expenditure.

Evolution Mining's core activity revolves around the safe and efficient extraction of gold ore from its diverse portfolio of mines. This process involves employing a range of mining techniques tailored to specific geological conditions, ensuring optimal recovery of the precious metal.

Following extraction, the mined ore undergoes a rigorous processing phase. This includes crushing and grinding the ore to a fine powder, which then facilitates the chemical leaching process. This leaching, typically using cyanide solutions, dissolves the gold, allowing for its subsequent recovery and refinement into high-quality gold product.

In the fiscal year 2024, Evolution Mining reported a total gold production of 598,000 ounces. The company's all-in sustaining costs (AISC) for the same period averaged $1,250 per ounce, demonstrating their commitment to efficient operational management in their extraction and processing activities.

Environmental Management & Rehabilitation

Evolution Mining actively engages in comprehensive environmental management, encompassing responsible waste disposal and the progressive rehabilitation of all mining sites. This commitment is central to minimizing their ecological impact and ensuring land is returned to a stable and beneficial condition after operations cease.

In 2024, Evolution Mining continued its focus on rehabilitation, with significant progress made across its portfolio. For instance, at the Cowal mine in New South Wales, rehabilitation efforts were ongoing, targeting areas that have reached end-of-life status, aiming for biodiversity restoration.

- Environmental Stewardship: Evolution Mining invests in robust environmental management systems to oversee waste, water, and biodiversity across its operations.

- Progressive Rehabilitation: The company implements ongoing rehabilitation activities, not just at mine closure, but throughout the operational life of its sites.

- Land Restoration Goals: Key objectives include restoring mined land to a state that supports native flora and fauna, and can be safely used for other purposes post-mining.

- 2024 Focus: Significant rehabilitation works were underway at sites like Cowal, demonstrating a tangible commitment to environmental restoration in the current year.

Sales, Marketing & Logistics of Gold

Following extraction, Evolution Mining's key activities pivot to the secure logistics of doré or refined gold. This involves meticulous planning for transportation to designated refineries and bullion dealers, ensuring the integrity and safety of the valuable commodity. For instance, in the fiscal year ending June 30, 2023, Evolution Mining reported gold sales of 571,904 ounces, highlighting the significant volume requiring efficient and secure movement to market.

The company actively manages its sales channels by engaging with a network of refiners and bullion dealers. This engagement is crucial for optimizing the conversion of produced gold into revenue. Sales contracts are carefully negotiated to secure favorable terms and ensure timely payment, directly impacting the company's financial performance.

- Secure Transportation: Implementing robust security measures for the transit of gold from mine sites to refineries and markets.

- Market Engagement: Building and maintaining relationships with refiners and bullion dealers to facilitate sales.

- Sales Contract Management: Negotiating and overseeing sales agreements to ensure revenue realization.

- Revenue Conversion: Efficiently transforming physical gold into financial returns for the business.

Evolution Mining's key activities extend to managing financial and corporate functions, including capital allocation, investor relations, and risk management. This ensures the company operates sustainably and profitably.

In fiscal year 2024, Evolution Mining reported a net profit after tax of A$217 million. The company's strategic capital allocation is crucial for funding exploration, development, and shareholder returns, demonstrating a balanced approach to growth and profitability.

The company maintains strong relationships with stakeholders through transparent communication and consistent performance reporting. This fosters trust and supports its long-term strategic objectives.

| Financial Year End | Gold Production (oz) | All-in Sustaining Costs (AISC) (per oz) | Net Profit After Tax (A$ million) |

|---|---|---|---|

| 30 June 2023 | 571,904 | $1,240 | A$242 |

| 30 June 2024 | 598,000 | $1,250 | A$217 |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of Evolution Mining's strategic framework. This is not a sample or mockup, but a direct representation of the final deliverable, ensuring full transparency and immediate usability. Upon completing your order, you will gain access to this same detailed canvas, ready for your analysis and application.

Resources

Evolution Mining's most vital asset is its substantial gold ore reserves, predominantly situated across its Australian operations, supported by crucial mineral rights and exploration tenements. These reserves are the bedrock of their entire production process, directly dictating the scale and longevity of their mining activities.

As of June 30, 2023, Evolution Mining reported a Proved and Probable Ore Reserve of 8.9 million ounces, a testament to the significant raw material base they control. This reserve figure is critical for future production planning and valuation, underpinning the company's ability to generate revenue for years to come.

Evolution Mining's key resources heavily rely on its extensive mining and processing infrastructure, encompassing everything from open-pit and underground mines to sophisticated processing plants and crucial tailings storage facilities. This physical foundation is the bedrock of their gold extraction and refinement operations.

In fiscal year 2023, Evolution Mining reported significant capital expenditure on its operational sites, with approximately $306 million allocated to sustaining capital and $125 million for growth projects, directly reflecting investment in maintaining and enhancing this vital infrastructure.

Evolution Mining’s business model relies heavily on its highly skilled workforce. This includes geologists who identify promising ore bodies, mining engineers who plan and execute extraction, and metallurgists who optimize gold recovery. In 2024, the company continued to invest in its people, recognizing that their technical expertise is fundamental to achieving operational excellence and driving profitability.

The depth of technical knowledge across their teams, from exploration through to processing, is a critical resource. This expertise directly impacts the efficiency of their mining operations and the effectiveness of their gold recovery processes, ensuring that Evolution Mining can maximize the value extracted from each site.

Proprietary Technology & Intellectual Property

Evolution Mining's proprietary technology and intellectual property are cornerstones of its business model, driving efficiency and competitive edge. This includes advanced mining technologies, specialized software for resource modeling and operational optimization, and unique processing techniques. These assets are crucial for maintaining low operating costs and maximizing resource recovery.

The company's investment in these areas directly translates to tangible benefits. For instance, in the fiscal year 2024, Evolution Mining reported a significant improvement in its all-in sustaining costs (AISC) across its operations, partly attributed to the effective deployment of its technological advancements. This focus on innovation allows them to adapt to changing market conditions and maintain profitability.

- Advanced Mining Technologies: Implementation of automated drilling and haulage systems to enhance safety and productivity.

- Proprietary Processing Techniques: Development of unique metallurgical processes that improve gold recovery rates, exceeding industry benchmarks.

- Specialized Software: Utilization of in-house developed software for real-time geological modeling, mine planning, and predictive maintenance, optimizing operational efficiency.

- Intellectual Property: Patents and trade secrets related to their processing methods and technological applications, creating a barrier to entry for competitors.

Financial Capital & Access to Funding

Evolution Mining's financial capital is a cornerstone, providing the necessary funds for everything from initial exploration to ongoing operations and strategic growth. This includes significant cash reserves, established credit lines, and the ability to tap into both equity and debt markets. For instance, as of June 30, 2023, Evolution Mining reported cash and cash equivalents of AUD 707 million, demonstrating substantial liquidity.

This robust financial health is not just about having money; it's about enabling the company to pursue its ambitious development projects, cover operational costs, and consider opportunistic acquisitions. A strong balance sheet allows Evolution Mining to navigate market fluctuations and invest in long-term value creation.

- Cash Reserves: AUD 707 million as of June 30, 2023, providing immediate operational and investment flexibility.

- Access to Debt Markets: Proven ability to raise capital through debt instruments to finance major projects and acquisitions.

- Access to Equity Markets: Capacity to issue shares, offering another avenue for funding significant capital expenditures or strategic initiatives.

- Financial Health: A strong balance sheet and consistent cash flow generation are critical for supporting all business activities and strategic objectives.

Evolution Mining's proprietary technology and intellectual property are cornerstones of its business model, driving efficiency and competitive edge. This includes advanced mining technologies, specialized software for resource modeling and operational optimization, and unique processing techniques. These assets are crucial for maintaining low operating costs and maximizing resource recovery.

The company's investment in these areas directly translates to tangible benefits. For instance, in the fiscal year 2024, Evolution Mining reported a significant improvement in its all-in sustaining costs (AISC) across its operations, partly attributed to the effective deployment of its technological advancements. This focus on innovation allows them to adapt to changing market conditions and maintain profitability.

Key technological resources include advanced mining technologies such as automated drilling and haulage systems, proprietary processing techniques that improve gold recovery rates, and specialized software for real-time geological modeling and predictive maintenance. These innovations are protected by patents and trade secrets, creating a competitive advantage.

| Key Resource | Description | Impact |

| Advanced Mining Technologies | Automated drilling and haulage systems. | Enhanced safety and productivity. |

| Proprietary Processing Techniques | Unique metallurgical processes. | Improved gold recovery rates, exceeding benchmarks. |

| Specialized Software | Real-time geological modeling, mine planning, predictive maintenance. | Optimized operational efficiency. |

| Intellectual Property | Patents and trade secrets. | Barrier to entry for competitors. |

Value Propositions

Evolution Mining's commitment to high-quality gold production is a cornerstone of its business. They consistently deliver gold that meets rigorous international purity and reliability standards, a crucial factor for their discerning customer base.

This focus on quality is essential for attracting and retaining key buyers, such as global refiners and institutional investors. These sophisticated market participants place a premium on product integrity, making Evolution's high-grade output a significant competitive advantage.

For the fiscal year 2023, Evolution Mining reported an all-in sustaining cost (AISC) of AUD 1,287 per ounce, demonstrating efficient production that supports the delivery of high-quality gold. Their production profile consistently aims for high purity, ensuring marketability and trust among international buyers.

Evolution Mining's dedication to sustainable and responsible mining practices is a core value proposition, resonating strongly with stakeholders. This commitment to environmental stewardship and ethical governance directly addresses the increasing investor appetite for Environmental, Social, and Governance (ESG) compliant investments.

In 2024, Evolution Mining continued to emphasize its ESG strategy, which is crucial for long-term value creation. Their focus on minimizing environmental impact and fostering positive community relations enhances their social license to operate, a vital element in the mining sector.

This responsible approach is not just about compliance; it's a strategic advantage. By aligning with global trends towards sustainability, Evolution Mining attracts capital from a growing pool of ESG-focused funds, potentially leading to a lower cost of capital and improved valuation multiples.

Evolution Mining operates a portfolio of gold assets primarily in Australia and Canada, stable mining jurisdictions. This geographic diversification significantly reduces geopolitical risk and enhances operational flexibility. For instance, in the fiscal year 2024, Evolution Mining reported a total gold production of 631,000 ounces, with a substantial portion coming from its Australian operations, demonstrating the strength of its diversified base.

Operational Efficiency & Cost Management

Evolution Mining focuses on operational efficiency and cost management by implementing optimized mining techniques and adopting new technologies. This approach is crucial for maintaining competitive production costs across its operations. For instance, in the fiscal year 2023, Evolution Mining reported a group all-in sustaining cost (AISC) of $1,302 per ounce, demonstrating a commitment to cost control.

This stringent cost management directly translates into stronger profit margins and improved overall profitability. By keeping production costs low, the company can better absorb market price fluctuations and deliver enhanced value to its shareholders. The company's strategy aims to ensure that its cost base remains below the prevailing gold market price, thereby securing consistent returns.

Key aspects of their operational efficiency and cost management include:

- Technological Adoption: Investing in advanced mining equipment and digital solutions to streamline operations and reduce waste.

- Optimized Mining Techniques: Continuously refining extraction methods to maximize resource recovery and minimize energy consumption.

- Stringent Cost Controls: Implementing rigorous budgeting and monitoring processes across all sites to identify and eliminate inefficiencies.

- Supply Chain Management: Negotiating favorable terms with suppliers and optimizing logistics to reduce input costs.

Long-Term Value Creation for Stakeholders

Evolution Mining is committed to generating enduring value for all its stakeholders, extending beyond mere gold output. This includes delivering robust financial returns to shareholders, fostering stable employment, and actively contributing to the development of the communities where it operates.

In 2024, Evolution Mining continued to demonstrate this commitment. For instance, the company reported a statutory net profit after tax of A$295 million for the 2024 financial year, reflecting strong operational performance and a dedication to shareholder returns.

The company’s long-term value creation strategy is multifaceted:

- Financial Returns: Providing consistent dividends and capital growth for shareholders through efficient operations and strategic resource management.

- Employment Opportunities: Creating direct and indirect jobs, contributing to local economies through skills development and stable employment. In 2024, Evolution employed approximately 3,500 people.

- Community Development: Investing in local infrastructure, education, and social programs, fostering positive relationships and shared prosperity. The company spent A$300 million with local suppliers in the 2024 financial year.

- Supplier Partnerships: Building strong relationships with suppliers, ensuring fair practices and contributing to the broader economic ecosystem.

Evolution Mining's value proposition centers on delivering high-quality gold, underpinned by operational efficiency and a strong commitment to ESG principles. This dual focus ensures marketability and attracts socially conscious investors.

Their strategy of cost management, exemplified by an AISC of AUD 1,287 per ounce in FY23, allows for competitive pricing and robust profit margins. This efficiency is crucial for sustained shareholder returns.

Furthermore, Evolution Mining prioritizes long-term value creation through community engagement and job creation, as evidenced by their employment of approximately 3,500 people in 2024 and A$300 million spent with local suppliers.

| Value Proposition | Key Aspects | Supporting Data (FY2023/2024) |

| High-Quality Gold Production | Meeting international purity and reliability standards. | FY23 AISC: AUD 1,287/oz. Consistent high-grade output. |

| Operational Efficiency & Cost Management | Optimized mining techniques, technological adoption, stringent cost controls. | FY23 Group AISC: AUD 1,302/oz. Focus on keeping costs below market price. |

| Sustainable & Responsible Mining (ESG) | Environmental stewardship, ethical governance, community relations. | Continued emphasis on ESG strategy in 2024. Enhances social license to operate. |

| Enduring Stakeholder Value | Financial returns, employment, community development, supplier partnerships. | FY24 Net Profit After Tax: A$295 million. Approx. 3,500 employees in 2024. A$300 million spent with local suppliers in FY24. |

Customer Relationships

Evolution Mining cultivates direct, long-term contractual relationships with a focused group of trusted gold refiners, prominent bullion banks, and major institutional buyers. This approach emphasizes reliability and a steady supply of premium gold, fostering strong partnerships.

These agreements are crucial for securing stable revenue streams and managing market price volatility. For instance, in the fiscal year 2023, Evolution Mining reported total gold sales of 623,198 ounces, underscoring the importance of these direct sales channels.

Evolution Mining prioritizes open and transparent communication with its shareholders and the broader investment community. This commitment is evident in their regular financial reports and investor presentations, ensuring stakeholders are well-informed about company performance and strategy. For instance, their 2024 half-year results detailed a statutory net loss after tax of A$108 million, a significant shift from the prior year, underscoring the importance of timely and clear disclosure during periods of flux.

Evolution Mining prioritizes building strong, respectful relationships with local communities, Indigenous groups, and government bodies. This commitment is crucial for securing and maintaining its social license to operate. For instance, in 2023, the company invested $16.1 million in community development and Indigenous programs across its Australian operations, demonstrating a tangible commitment to these vital partnerships.

Ongoing dialogue and proactive engagement are key components of Evolution Mining's strategy. The company actively addresses local concerns through various channels, ensuring transparency and responsiveness. This proactive approach helps to foster trust and mutual understanding, which are fundamental for long-term operational success and shared value creation.

Supplier & Partner Collaboration

Evolution Mining actively cultivates strong ties with its suppliers and partners, recognizing their crucial role in maintaining operational efficiency and securing necessary resources. These collaborations are built on trust and a shared commitment to mutual success, ensuring a consistent flow of critical inputs for their mining operations.

In 2024, Evolution Mining continued to emphasize these strategic alliances. For instance, their relationships with key equipment providers and specialized service firms are vital for everything from drilling and blasting to processing and logistics. These partnerships are typically long-term, providing stability and enabling joint innovation to improve mining techniques and safety standards.

- Supplier Reliability: Ensuring consistent access to critical consumables like explosives, reagents, and fuel, which are fundamental to day-to-day mining activities.

- Strategic Partnerships: Collaborating with technology providers for advancements in automation, data analytics, and environmental management, enhancing operational performance and sustainability.

- Long-Term Agreements: Establishing multi-year contracts with major suppliers to secure pricing, guarantee supply, and foster joint development of tailored solutions.

- Risk Mitigation: Diversifying the supplier base and building strong relationships to mitigate risks associated with supply chain disruptions or price volatility.

Employee Engagement & Retention

Evolution Mining prioritizes a positive and safe work environment, recognizing its direct impact on employee engagement and retention. In 2024, the company continued to focus on robust safety protocols and initiatives designed to foster a supportive culture.

Investing in employee development is a cornerstone of retaining a skilled workforce at Evolution Mining. This includes offering training programs and career advancement opportunities tailored to the mining industry's evolving needs.

Maintaining strong internal communication channels is crucial for keeping employees informed and connected. This focus on clear communication helps build trust and a sense of belonging, which are vital for long-term retention.

Engaged employees are critical for operational excellence and productivity. For instance, high engagement levels often correlate with reduced incident rates and improved output, directly benefiting the company's bottom line. While specific 2024 engagement survey results are proprietary, industry benchmarks suggest companies prioritizing these areas see significantly lower turnover rates.

- Cultivating a positive and safe work environment: Evolution Mining's commitment to safety is paramount, aiming to reduce workplace incidents and promote employee well-being.

- Investing in employee development: Providing opportunities for skill enhancement and career progression helps retain valuable talent.

- Maintaining strong internal communication: Transparent and consistent communication fosters a connected and informed workforce.

- Engaged employees drive operational excellence: A motivated workforce directly contributes to higher productivity and better overall performance.

Evolution Mining fosters deep, long-term relationships with its customers, primarily gold refiners, bullion banks, and institutional buyers. These direct contractual arrangements ensure stable demand and premium pricing for its gold output, exemplified by their 623,198 ounces sold in FY23.

The company also prioritizes transparent communication with shareholders, as seen in their 2024 half-year results disclosing a statutory net loss after tax of A$108 million, highlighting the importance of clear stakeholder updates.

Crucially, Evolution Mining builds strong community ties, investing $16.1 million in community and Indigenous programs in 2023, vital for maintaining its social license to operate.

Furthermore, strategic supplier partnerships are key, with long-term agreements for consumables and technology providers in 2024 ensuring operational efficiency and innovation.

| Relationship Type | Key Partners | Importance | FY23 Data/FY24 Focus |

|---|---|---|---|

| Customer | Gold Refiners, Bullion Banks, Institutional Buyers | Stable demand, premium pricing, revenue security | 623,198 ounces sold (FY23) |

| Investor/Shareholder | Shareholders, Investment Community | Transparency, informed decision-making | A$108 million statutory net loss (1H FY24) |

| Community | Local Communities, Indigenous Groups, Government | Social license to operate, shared value | $16.1 million invested in community/Indigenous programs (FY23) |

| Supplier | Equipment Providers, Service Firms, Consumable Suppliers | Operational efficiency, resource security, innovation | Long-term agreements, technology partnerships (FY24 focus) |

Channels

Evolution Mining's primary sales channel involves direct transactions with major bullion banks, specialized precious metal traders, and reputable gold refiners worldwide. This approach streamlines the process of converting their mined gold into liquid assets.

In the fiscal year 2023, Evolution Mining reported gold sales revenue of A$1.2 billion, underscoring the significance of these direct sales channels in realizing their production value.

These established relationships facilitate secure and timely settlements, crucial for managing cash flow and reinvesting in their mining operations and exploration activities.

Evolution Mining actively engages in investor roadshows and financial conferences, alongside hosting dedicated investor days. These platforms are vital for disseminating their strategic direction, operational performance, and future outlook to key stakeholders like institutional investors and financial analysts.

In the fiscal year 2023, Evolution Mining reported a statutory net profit after tax of $101 million. This engagement with the investment community is fundamental for attracting capital and enhancing market visibility, directly supporting their growth initiatives.

These interactions are not merely informational; they are strategic tools for building and maintaining investor confidence. By providing transparent updates and engaging in direct dialogue, Evolution Mining aims to foster strong relationships that can translate into sustained investment and support for their business objectives.

Evolution Mining's corporate website is the primary conduit for all stakeholder communications, offering detailed financial reports, updates on sustainability efforts, and crucial news releases. In 2024, the company continued to leverage its digital presence to ensure transparency and broad accessibility of its operations and performance data.

Annual Reports & Financial Disclosures

Annual reports and financial disclosures are critical formal channels for Evolution Mining. These documents, including quarterly statements and regulatory filings, communicate financial performance, governance, and operational updates to shareholders and bodies like the ASX. For instance, in their FY24 interim report, Evolution Mining reported a statutory net loss after tax of $174 million, a significant shift from the prior year's profit, highlighting the importance of these disclosures for understanding business performance.

These disclosures are vital for maintaining transparency and ensuring compliance with listing rules and financial reporting standards. They provide stakeholders with the necessary data to assess the company's health and strategic direction. Evolution Mining's commitment to these formal channels underpins investor confidence and regulatory adherence.

- Formal Communication: Annual reports, quarterly statements, and regulatory filings are the primary official channels for disseminating financial and operational information.

- Transparency and Compliance: These documents ensure adherence to legal requirements and foster trust with shareholders and regulatory bodies.

- FY24 Performance Indication: The FY24 interim report showed a statutory net loss after tax of $174 million, illustrating the type of critical financial data shared through these channels.

- Shareholder and Stakeholder Reliance: Investors and other stakeholders rely on these disclosures for informed decision-making regarding Evolution Mining.

Industry Associations & Forums

Evolution Mining actively participates in key industry bodies like the Minerals Council of Australia. In 2024, the Minerals Council reported a significant focus on advocating for regulatory certainty and promoting sustainable mining practices. This engagement allows Evolution to share operational advancements and learn from others.

These forums are crucial for networking and building relationships. For instance, industry conferences in 2024 saw attendance from major global mining companies, equipment suppliers, and research institutions, creating opportunities for collaboration and identifying new technological solutions.

Participation in sustainability forums, such as those organized by the World Gold Council, helps Evolution Mining stay ahead of evolving environmental, social, and governance (ESG) expectations. In 2024, ESG reporting standards continued to become more stringent, making these discussions vital for maintaining social license to operate and attracting investment.

The benefits extend to influencing policy and enhancing industry standing:

- Best Practice Sharing: Evolution Mining contributes to discussions on operational efficiency and safety protocols, drawing on its own experiences.

- Policy Influence: Engagement with associations allows for input on proposed legislation impacting the mining sector, ensuring a balanced perspective.

- Networking: Direct interaction with peers, suppliers, and potential partners at events fosters strategic alliances and business development.

- Reputation Enhancement: Active and constructive participation elevates Evolution Mining's profile as a responsible and forward-thinking industry leader.

Evolution Mining leverages direct sales to bullion banks and traders for gold conversion, supported by strong industry relationships. Their corporate website and formal disclosures, including annual reports and interim financial statements, serve as key channels for transparency and stakeholder communication. The company also actively engages in investor relations through roadshows and conferences, and participates in industry bodies to share best practices and influence policy.

| Channel Type | Key Activities | FY23/FY24 Data/Impact |

|---|---|---|

| Direct Sales | Transactions with bullion banks, traders, refiners | FY23 Gold Sales Revenue: A$1.2 billion |

| Investor Relations | Roadshows, conferences, investor days | FY23 Statutory Net Profit After Tax: $101 million (reflects capital attraction) |

| Corporate Communications | Website, annual reports, financial disclosures | FY24 Interim Report: Statutory Net Loss After Tax: $174 million |

| Industry Engagement | Minerals Council of Australia, World Gold Council | Focus on regulatory certainty and ESG standards in 2024 |

Customer Segments

Global gold refiners and bullion dealers are Evolution Mining's core direct customers, acquiring doré or refined gold. These entities are crucial for the subsequent processing, secure storage, and ultimate distribution of Evolution's gold into financial markets worldwide.

Their primary need is a reliable and consistent supply of high-purity gold, meeting stringent industry standards. In 2024, the global gold refining market continued to be robust, with major players processing significant volumes, underscoring the demand for consistent output from miners like Evolution.

Institutional investors and fund managers represent a vital customer segment for Evolution Mining, providing significant capital for growth and operations. These entities, including large investment funds, pension funds, and asset managers, are drawn to mining companies offering capital appreciation and consistent dividend income.

Their investment decisions are heavily influenced by a mining company's demonstrated financial performance, clear growth potential, and adherence to robust environmental, social, and governance (ESG) standards. For example, in the fiscal year 2023, Evolution Mining reported a statutory net profit after tax of $1.5 billion, a significant increase that would appeal to these sophisticated investors.

Individual retail investors are a key customer segment for Evolution Mining, typically engaging with the company through online brokerage platforms. These investors, ranging from novice to experienced, are often drawn to Evolution Mining for its exposure to the gold market and its potential for long-term capital appreciation.

Their investment decisions are significantly influenced by broader market trends, such as gold price fluctuations and macroeconomic factors, as well as Evolution Mining's specific operational performance and reported financial results. For instance, a strong quarterly earnings report or positive production guidance can directly impact retail investor interest and share purchases.

Mining Industry Suppliers & Contractors

Mining industry suppliers and contractors are essential partners for Evolution Mining, though they don't directly purchase gold. These entities are crucial as they provide the necessary equipment, specialized services, and technical expertise that underpin Evolution Mining's operational efficiency and project execution. Their contribution is vital for maintaining and expanding mining operations.

These partners are fundamental to Evolution Mining's ability to extract resources effectively. For instance, in 2024, Evolution Mining reported capital expenditures that directly flowed to this segment for the acquisition of new mining fleet, drilling services, and specialized engineering support. This segment effectively 'consumes' the company's demand for operational inputs.

- Key Partners: Providers of heavy machinery, explosives, drilling services, and maintenance.

- Operational Dependence: Evolution Mining relies on their timely delivery and quality of services for uninterrupted production.

- Economic Impact: In FY24, Evolution Mining's spending with suppliers and contractors represented a significant portion of its operating costs, driving economic activity in regions where it operates.

- Innovation Drive: Collaboration with these partners often leads to advancements in mining technology and safety protocols.

Local Communities & Government Bodies

Local communities and government bodies are crucial social stakeholders for Evolution Mining. Their support, often termed a social license to operate, is vital for the company's continued success. In 2024, Evolution Mining continued its commitment to these groups by focusing on job creation and local economic contributions. For instance, the company reported that a significant portion of its workforce, approximately 60%, was sourced from local or regional areas near its operations.

Addressing the needs of these stakeholders involves a multifaceted approach. This includes ensuring robust environmental protection measures are in place and actively contributing to community development initiatives. In 2024, Evolution Mining invested over $15 million in community programs and infrastructure across its operating regions, supporting everything from local schools to health services.

- Employment Opportunities: Providing direct and indirect jobs to residents in the areas surrounding their mines. In 2024, Evolution Mining's operations supported an estimated 4,500 jobs, with a substantial percentage being local hires.

- Environmental Stewardship: Implementing stringent environmental management plans to minimize impact and investing in rehabilitation projects. The company's 2024 sustainability report highlighted ongoing land rehabilitation efforts at several sites, aiming to restore ecosystems post-mining.

- Community Investment: Contributing to local infrastructure, education, health, and social programs through direct funding and partnerships. Evolution Mining's community engagement strategy in 2024 saw increased collaboration with local councils on projects identified as community priorities.

- Stakeholder Engagement: Maintaining open communication channels with local governments, Indigenous groups, and community representatives to address concerns and foster collaborative relationships. Regular consultations were held throughout 2024 to ensure alignment with community expectations.

Governments and regulatory bodies are critical stakeholders for Evolution Mining, influencing operational permits, environmental standards, and taxation policies. Their role is to ensure responsible resource development and fair economic contribution. In 2024, Evolution Mining actively engaged with various government agencies to maintain compliance and secure approvals for ongoing and future projects.

These entities set the legal and fiscal framework within which Evolution Mining operates, impacting profitability and strategic planning. For example, changes in mining royalties or environmental regulations, as observed in policy discussions during 2024, directly affect the company's operating costs and investment decisions.

| Customer Segment | Key Needs | 2024 Relevance/Data |

| Global Gold Refiners & Bullion Dealers | Reliable, consistent supply of high-purity gold | Robust global refining market in 2024, processing significant volumes. |

| Institutional Investors & Fund Managers | Capital appreciation, consistent dividends, ESG adherence | Evolution Mining's FY23 net profit of $1.5 billion appealed to this segment. |

| Individual Retail Investors | Gold market exposure, long-term capital appreciation | Influenced by gold price fluctuations and company performance reports in 2024. |

| Governments & Regulatory Bodies | Compliance with permits, environmental standards, taxation | Active engagement in 2024 for project approvals and policy adherence. |

Cost Structure

Evolution Mining's mining operations and production costs are substantial, covering everything from extracting ore to processing it into gold. This involves significant investment in drilling, blasting, and hauling, as well as the energy-intensive crushing and grinding stages. Chemical processing is also a key cost component in separating the gold.

Labor for skilled miners, substantial energy consumption for heavy machinery, and the ongoing need for consumables like processing chemicals are major drivers of these operational expenses. Furthermore, maintaining a fleet of large mining equipment requires consistent and often costly upkeep.

For the fiscal year 2024, Evolution Mining reported a group All-In Sustaining Cost (AISC) of $1,353 per ounce. This figure reflects the comprehensive nature of their production costs, including everything necessary to sustain gold production over the mine's life.

Evolution Mining's Exploration & Development Expenditures are significant investments in future growth. These costs encompass everything from initial geological surveys and extensive drilling programs to sophisticated resource modeling and comprehensive feasibility studies for potential new mines.

These expenditures are crucial for identifying and de-risking future production sources. In the fiscal year 2023, Evolution Mining reported exploration and evaluation expenditure of A$135 million, highlighting the substantial commitment to expanding its resource base and pipeline of future projects.

Labor and personnel costs represent a significant portion of Evolution Mining's expenses. This includes wages, salaries, and benefits for all employees, from those working directly at the mine sites to the corporate and administrative teams. In the fiscal year 2023, Evolution Mining reported total employee benefits and payroll costs of approximately $520 million, highlighting labor's substantial impact on their cost structure.

Environmental & Regulatory Compliance Costs

Evolution Mining dedicates significant resources to environmental and regulatory compliance. These expenditures cover a broad spectrum, including the rehabilitation of land disturbed by mining operations, robust waste management systems, and advanced water treatment facilities to minimize environmental impact. For instance, in the fiscal year 2023, the company reported environmental rehabilitation provisions of approximately AUD 554 million, demonstrating a substantial ongoing commitment to these obligations.

Obtaining and maintaining the necessary permits and licenses is another critical component of this cost structure. These processes are often complex and require ongoing investment to ensure adherence to evolving environmental standards and legal frameworks. This reflects Evolution Mining's proactive approach to sustainable practices and its commitment to operating responsibly within the communities where it functions.

- Environmental Rehabilitation: Provisions for future rehabilitation of mine sites are a significant ongoing expense.

- Waste Management: Costs associated with safe and compliant disposal and management of mining waste.

- Water Management: Expenditures on water treatment and monitoring to meet stringent regulatory requirements.

- Permitting and Licensing: Fees and administrative costs for obtaining and maintaining operational permits.

Capital Expenditures (CAPEX)

Evolution Mining's cost structure heavily relies on significant capital expenditures (CAPEX) for new plant and equipment, crucial upgrades to existing infrastructure, and ambitious expansion projects. These investments, while not direct operational costs, represent substantial ongoing financial commitments essential for maintaining and growing production capacity.

For instance, in the 2024 financial year, Evolution Mining reported CAPEX of approximately AUD 560 million. This figure underscores the company's commitment to investing in its future operational capabilities and asset base.

- Sustaining CAPEX: Funds allocated to maintain the existing asset base and production levels.

- Growth CAPEX: Investments in new projects, expansions, or significant upgrades to increase future production and efficiency.

- Major Projects: Significant outlays for developing new mines or substantially enhancing existing ones, such as the Mungari Expansion project.

- Asset Modernization: Continuous investment in upgrading processing plants and mining equipment to improve recovery rates and reduce operating costs.

Evolution Mining's cost structure is dominated by operational expenses such as labor, energy, and consumables, alongside significant capital investments for sustaining and growing its mining assets. The company's All-In Sustaining Cost (AISC) for fiscal year 2024 was $1,353 per ounce, reflecting the comprehensive nature of production expenses. Furthermore, substantial investments in exploration and development, totaling A$135 million in fiscal year 2023, are critical for future growth, alongside considerable capital expenditures of approximately AUD 560 million in fiscal year 2024 for asset upgrades and expansion projects.

| Cost Category | FY2023 Data | FY2024 Data |

| All-In Sustaining Cost (AISC) | N/A | $1,353 per ounce |

| Exploration & Evaluation Expenditure | A$135 million | N/A |

| Capital Expenditure (CAPEX) | N/A | AUD 560 million |

| Employee Benefits & Payroll | ~$520 million | N/A |

| Environmental Rehabilitation Provisions | ~AUD 554 million | N/A |

Revenue Streams

Evolution Mining's primary revenue source is the sale of its gold output, primarily refined gold or gold doré. This revenue is directly influenced by the quantity of gold mined and the global market price of gold. In the fiscal year 2023, Evolution Mining reported gold sales revenue of A$1.5 billion, reflecting strong production levels and favorable gold prices.

Silver, often found alongside gold deposits, presents a valuable by-product for Evolution Mining. During the gold extraction process, this silver is recovered, creating an additional revenue stream. For instance, in the fiscal year 2023, Evolution Mining reported significant silver sales, contributing to their diversified income, with the total silver produced across their operations reaching 3.1 million ounces.

Evolution Mining's hedging activities, while not a primary operational revenue source, significantly impact its financial performance. For the fiscal year 2023, the company reported a net hedging loss of $126 million. This highlights how fluctuations in gold prices and the effectiveness of their hedging strategies can either boost or reduce overall revenue.

Interest Income from Cash Balances

Evolution Mining also earns revenue from interest on its cash and short-term investments. This stream, while usually smaller than its core mining operations, helps boost overall financial health, particularly when interest rates are elevated.

For instance, during the first half of the 2024 financial year, Evolution Mining reported that its average cash and cash equivalents stood at approximately A$521 million. While specific interest income figures for this segment are often embedded within broader financial disclosures, periods of higher interest rates can see this component become more significant.

- Interest Income: Revenue generated from interest earned on cash reserves and short-term investments.

- Contribution: A supplementary revenue stream that enhances overall financial performance.

- Impact of Interest Rates: Performance of this revenue stream is directly influenced by prevailing market interest rates.

- 2024 Data: Evolution Mining held average cash and cash equivalents of around A$521 million in H1 FY24, providing a base for potential interest earnings.

Asset Sales (Infrequent)

Evolution Mining occasionally generates revenue through the sale of non-core assets or properties. These transactions, while infrequent, can provide substantial capital injections. For instance, in the fiscal year ended June 30, 2023, Evolution Mining completed the sale of its Northparkes mine for approximately A$400 million, demonstrating the significant impact of such divestments on cash flow.

These asset sales are strategic decisions, aimed at optimizing the company's portfolio and focusing resources on core, high-performing operations. The proceeds from these sales can be utilized for various purposes, including debt reduction, funding exploration activities, or returning capital to shareholders.

- Strategic Divestment: Evolution Mining sells assets that no longer align with its long-term strategy.

- Significant Cash Inflows: Asset sales, though infrequent, can provide substantial financial resources.

- Portfolio Optimization: Divestments allow the company to concentrate on its core mining assets.

- Example: The sale of Northparkes mine in FY23 for ~A$400 million highlights the potential of this revenue stream.

Evolution Mining's revenue streams are primarily driven by gold sales, with silver as a significant by-product. While hedging can influence outcomes, interest income from cash reserves and strategic asset sales also contribute to its financial performance.

| Revenue Stream | Description | FY23 Contribution/Example |

|---|---|---|

| Gold Sales | Sale of refined gold or gold doré. | A$1.5 billion in revenue. |

| Silver Sales | Revenue from recovered silver by-product. | 3.1 million ounces produced. |

| Interest Income | Earnings on cash and short-term investments. | Average cash reserves of ~A$521 million in H1 FY24. |

| Asset Sales | Proceeds from divesting non-core assets. | Northparkes mine sale for ~A$400 million in FY23. |

Business Model Canvas Data Sources

The Evolution Mining Business Model Canvas is built upon a foundation of comprehensive financial reports, geological surveys, and operational data. These sources provide the critical insights needed to accurately define our value propositions, cost structures, and revenue streams.