Evolution Mining Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evolution Mining Bundle

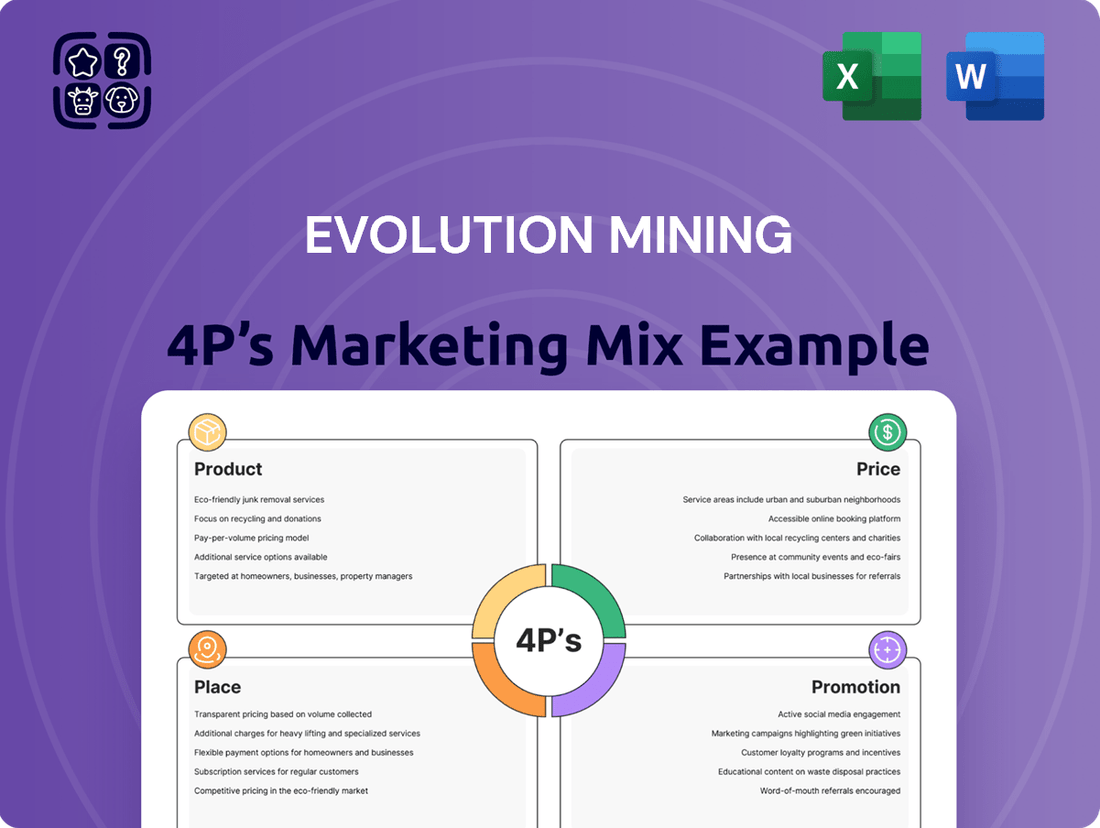

Evolution Mining's marketing prowess lies in its strategic approach to its core 4Ps. From the quality and diversity of its gold and silver products to its competitive pricing, efficient distribution networks, and targeted promotional campaigns, every element is meticulously crafted to resonate with investors and stakeholders.

Unlock the full picture of Evolution Mining's marketing success. Our comprehensive 4Ps analysis provides an in-depth look at their product offerings, pricing strategies, distribution channels, and promotional activities, offering actionable insights for your own business planning or academic research.

Product

Evolution Mining's primary product is high-quality gold, extracted from its diverse asset base. This forms the cornerstone of their offering to the market.

Beyond gold, Evolution Mining also produces copper, a significant revenue contributor. For instance, in the fiscal year 2023, copper sales represented a notable portion of their overall revenue, providing valuable diversification. This dual commodity focus enhances product value and revenue stability.

Evolution Mining's product offering is built upon a robust strategic asset portfolio. This includes key operating mines situated in Australia, such as Cowal, Ernest Henry, Mt Rawdon, Mungari, and Northparkes, alongside the significant Red Lake operation in Canada. This geographical spread across tier-one jurisdictions is a cornerstone of their strategy, aiming to mitigate operational risks and ensure a consistent production stream.

For the fiscal year 2024, Evolution Mining reported a significant increase in gold production, with total group gold production reaching 681,783 ounces. The Cowal operation, in particular, delivered 350,630 ounces, showcasing its importance within the portfolio. This performance highlights the stability and productivity of their strategically located assets.

Evolution Mining is committed to extending the operational life of its existing mines and expanding its resource base. This focus ensures a consistent and growing supply of valuable minerals for the market.

Notable initiatives include the development of the Cowal underground mine and the expansion of the Mungari 4.2 processing plant, both crucial for sustained production. Furthermore, continuous exploration and drilling at Ernest Henry are designed to uncover and define new ore reserves, bolstering future output and market presence.

Sustainable Mining Practices

Evolution Mining's product extends beyond gold itself, incorporating a strong commitment to sustainable mining. This focus on responsible environmental stewardship and community engagement adds significant value. The company has set ambitious targets, aiming for a 30% reduction in emissions by 2030 and achieving Net Zero by 2050, demonstrating a clear product differentiator.

This dedication to sustainability is reflected in tangible actions and future plans. Their approach enhances the product's appeal to increasingly environmentally conscious investors and stakeholders.

- Emissions Reduction: Targeting a 30% decrease by 2030 and Net Zero by 2050.

- Community Relations: Actively fostering strong relationships with local communities.

- Environmental Stewardship: Prioritizing responsible management of natural resources.

- Social Value: Creating positive social impact alongside economic returns.

Focus on Operational Efficiency and Quality

Evolution Mining places a strong emphasis on operational efficiency, aiming to keep its production costs low. This strategy is crucial for maintaining a competitive edge and indirectly bolsters the perceived quality of its gold and copper products. By streamlining operations, the company ensures that its output is not only of high purity but also produced in a financially sustainable way.

This dedication to efficiency translates directly into tangible benefits for the company and its stakeholders. For instance, in the fiscal year 2023, Evolution Mining reported a significant reduction in its all-in sustaining costs (AISC) across its key operations.

- All-in Sustaining Costs (AISC) Reduction: For FY23, Evolution Mining achieved an AISC of AUD 1,317 per ounce, a notable decrease from the previous year, underscoring their focus on cost management.

- Production Volume: The company produced 570,304 ounces of gold in FY23, demonstrating consistent output driven by efficient mining practices.

- Copper Production: At the Northparkes mine, copper production for FY23 reached 21,783 tonnes, with operational efficiencies contributing to this output.

- Exploration and Development Investment: Continued investment in exploration and resource development, totaling AUD 192 million in FY23, supports future operational efficiency and quality improvements.

Evolution Mining's core product is high-quality gold, supplemented by copper, sourced from a strategically diversified portfolio of tier-one assets in Australia and Canada.

The company actively enhances its product offering through life-of-mine extensions and resource growth initiatives, such as the Cowal underground development and ongoing exploration at Ernest Henry.

A key differentiator is Evolution's commitment to sustainable mining practices, targeting a 30% emissions reduction by 2030 and Net Zero by 2050, appealing to environmentally conscious stakeholders.

Operational efficiency is paramount, evidenced by a focus on reducing all-in sustaining costs (AISC), which stood at AUD 1,317 per ounce in FY23, ensuring competitive and sustainable production.

| Product Focus | Key Assets | FY23 Production (Gold) | FY23 AISC (Gold) | Sustainability Target |

|---|---|---|---|---|

| Gold and Copper | Cowal, Ernest Henry, Mungari, Northparkes, Red Lake | 570,304 ounces | AUD 1,317 per ounce | 30% emissions reduction by 2030 |

What is included in the product

This analysis delves into Evolution Mining's marketing strategies, examining their Product offerings, Pricing models, Place (distribution) and Promotion tactics to understand their market positioning.

It provides a comprehensive overview of how Evolution Mining leverages the 4Ps to engage stakeholders and achieve its business objectives.

Provides a clear, actionable framework to address the complexities of Evolution Mining's marketing strategy, simplifying decision-making and fostering alignment across departments.

Place

Evolution Mining's 'place' strategy for its gold and copper commodities centers on direct sales to established international refineries and reputable bullion dealers. This approach is crucial for the efficient and secure integration of its mined products into the global marketplace.

For instance, in the fiscal year 2023, Evolution Mining reported gold sales of 619,000 ounces. These sales were predominantly channeled through direct agreements, bypassing intermediaries and ensuring a streamlined distribution for this high-value commodity.

This direct engagement with key players in the refining and bullion sectors underscores a commitment to market access and optimized logistics, facilitating the smooth flow of precious metals and base metals to their end-users.

Evolution Mining's operational footprint is anchored in Australia and Canada, jurisdictions renowned for their political stability and supportive mining regulatory environments. This strategic placement, encompassing key regions like New South Wales, Queensland, and Western Australia, alongside Ontario in Canada, ensures consistent access to vital resources and well-developed infrastructure.

Evolution Mining prioritizes efficient logistics and supply chain management, ensuring ore moves smoothly from mine to processing and then to customers. This focus is crucial for cost control and timely delivery in the competitive gold market. For instance, in the fiscal year 2023, the company reported a group-wide all-in sustaining cost (AISC) of A$1,296 per ounce, demonstrating the impact of operational efficiencies.

Global Market Access

While Evolution Mining's physical operations are rooted in specific Australian locations, the gold and copper it extracts are commodities traded on a global stage. The company's strategic advantage lies in its ability to efficiently produce high-quality metals that meet international market demands.

This global market access is crucial for realizing the value of its mineral resources. Evolution Mining's competitive positioning is further strengthened by its focus on low-cost production, enabling it to compete effectively against producers worldwide.

- Global Gold Market: In 2024, the global gold market is expected to see continued demand driven by safe-haven assets and central bank purchases, with prices fluctuating based on geopolitical events and inflation expectations.

- Copper Demand: The demand for copper, essential for electrification and renewable energy infrastructure, remains robust. Projections for 2025 indicate a sustained need for copper, supporting its market value.

- Evolution's Output: Evolution Mining consistently aims to deliver gold and copper that meets stringent international purity standards, facilitating seamless integration into global supply chains.

- Cost Competitiveness: By maintaining a low all-in sustaining cost (AISC) profile, Evolution Mining enhances its ability to compete profitably in the volatile international commodity markets.

Continuous Infrastructure Development

Evolution Mining's commitment to continuous infrastructure development is a cornerstone of its 'Place' strategy. Investments in key projects, like the Mungari 4.2 plant expansion, are designed to boost processing capabilities. This directly enhances the company's ability to prepare its gold products efficiently for market.

The development at Cowal underground also exemplifies this focus. By improving extraction methods, Evolution ensures a consistent and optimized supply of its product. These infrastructure upgrades are crucial for maintaining competitive positioning and meeting market demand effectively.

- Mungari 4.2 Plant Expansion: Increased processing capacity to handle higher throughput.

- Cowal Underground Development: Enhanced ore extraction efficiency and access to deeper reserves.

- Infrastructure Investment: Directly supports product readiness and distribution logistics.

- Strategic Focus: Ensures Evolution Mining can meet market demand and maintain a competitive edge in product placement.

Evolution Mining's 'Place' strategy leverages its Australian and Canadian operational base, ensuring access to stable jurisdictions and robust infrastructure. This geographic advantage facilitates efficient extraction and processing, crucial for meeting global demand for gold and copper.

The company's direct sales model to international refineries and bullion dealers streamlines distribution. This approach, as seen in its 619,000 ounces of gold sold in FY2023, minimizes intermediaries and ensures efficient market integration.

Investments in infrastructure, such as the Mungari 4.2 plant expansion and Cowal underground development, bolster processing capabilities and ore extraction efficiency, directly supporting product readiness for market.

| Metric | FY2023 Value | Significance for Place Strategy |

|---|---|---|

| Gold Sales (oz) | 619,000 | Demonstrates direct market access and sales volume. |

| All-in Sustaining Cost (AISC) (A$/oz) | 1,296 | Highlights cost competitiveness for global market positioning. |

| Operational Footprint | Australia & Canada | Ensures stable jurisdictions and resource access. |

What You See Is What You Get

Evolution Mining 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Evolution Mining's 4P's Marketing Mix is fully prepared and ready for your immediate use.

Promotion

Evolution Mining prioritizes clear communication with its stakeholders through strong investor relations and detailed financial reporting. This includes readily available annual and sustainability reports, quarterly earnings updates, and investor presentations, all designed to offer a transparent view of the company's operational and financial health.

This approach directly appeals to financially literate decision-makers by furnishing them with the comprehensive data and strategic insights necessary to understand Evolution Mining's performance and future trajectory. For instance, their FY23 results highlighted a statutory profit of $369 million and EBITDA of $1.1 billion, demonstrating solid operational outcomes.

Evolution Mining emphasizes its dedication to sustainability and robust Environmental, Social, and Governance (ESG) performance. This commitment is clearly communicated through their annual sustainability reports and investor briefings, showcasing their proactive approach to responsible mining operations.

This focus on ESG resonates strongly with a growing segment of investors and stakeholders who increasingly prioritize companies demonstrating ethical conduct and long-term value creation. For instance, in FY23, Evolution Mining reported a 12% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to FY20, highlighting tangible progress in their environmental stewardship.

Evolution Mining actively participates in key industry conferences and delivers corporate presentations. This strategy allows them to directly communicate their strategic direction, operational successes, and future growth plans to a diverse audience, including financial analysts and potential investors.

These engagements are crucial for persuasively highlighting the company's value proposition. For instance, at the 2023 Diggers & Dealers Forum, Evolution Mining showcased its robust production figures and strategic advancements, reinforcing investor confidence.

News Releases and Media Engagement

Evolution Mining actively engages with media through regular news releases, keeping stakeholders informed about production figures and financial results. For instance, their FY24 guidance anticipated gold production between 740,000 to 800,000 ounces, with a focus on cost management.

This proactive communication strategy ensures broad awareness of the company's operational milestones and strategic advancements within the mining and financial sectors.

Key media engagement points include:

- Dissemination of Production: Timely updates on gold output and operational efficiency.

- Financial Performance Reporting: Clear communication of revenue, costs, and profitability.

- Key Development Announcements: Information on exploration success, mine expansions, and strategic partnerships.

- Investor Relations: Direct engagement with financial analysts and media to clarify company performance and outlook.

Digital Presence and Shareholder Communication

Evolution Mining prioritizes a robust digital presence, ensuring shareholders have easy access to crucial information. Their website serves as a central hub for reports, presentations, and company news, fostering transparency and informed decision-making.

Direct communication channels are actively maintained, allowing for timely engagement with the investor community. This approach is vital for building trust and keeping stakeholders updated on company performance and strategic direction.

For instance, as of the first half of FY24, Evolution Mining reported a 4% increase in production to 330.1koz gold. Their investor relations section on the website provides detailed financial results, ASX announcements, and presentations, demonstrating a commitment to accessible shareholder communication.

- Website Accessibility: Comprehensive repository of financial reports, presentations, and news updates.

- Shareholder Engagement: Direct communication channels for inquiries and feedback.

- Transparency: Facilitates informed investment decisions through readily available data.

- Information Dissemination: Timely updates on production, financial performance, and strategic initiatives.

Evolution Mining leverages industry conferences and direct corporate presentations to communicate its strategic vision and operational achievements. These platforms are vital for engaging with financial professionals and investors, providing them with the insights needed to assess the company's value proposition. For example, their participation in events like the 2023 Diggers & Dealers Forum allowed them to highlight strong production figures and strategic progress.

The company also maintains a strong media presence through regular news releases, ensuring stakeholders are informed about key developments. This includes updates on production volumes, financial results, and significant operational milestones, such as their FY24 guidance anticipating 740,000 to 800,000 ounces of gold production.

A robust digital strategy, centered on an accessible website, serves as a primary channel for disseminating essential information. This includes financial reports, investor presentations, and company news, promoting transparency and facilitating informed decision-making for all stakeholders. Their commitment to accessible communication is evident in the detailed financial results and ASX announcements readily available on their investor relations portal.

Evolution Mining's promotional efforts focus on clear, data-driven communication across multiple channels to build investor confidence and awareness. This multifaceted approach ensures that key financial and operational metrics, such as their H1 FY24 gold production increase of 4% to 330.1koz, are effectively communicated to a diverse audience of financially literate decision-makers.

Price

Evolution Mining places significant emphasis on managing its All-in Sustaining Cost (AISC) as a critical factor influencing both pricing and overall profitability. The company's strategic objective is to rank among the world's lowest-cost gold producers.

This focus on cost efficiency allows Evolution Mining to maintain robust profit margins, even when gold prices experience volatility. It also ensures their gold output remains competitive in the global market.

For the December 2023 half-year, Evolution Mining reported an AISC of $1,220 per ounce, a notable decrease from $1,286 per ounce in the prior corresponding period, underscoring their successful cost management efforts.

Evolution Mining's revenue is heavily influenced by global commodity prices for gold and copper. The company's largely unhedged copper position and limited gold hedging mean its earnings directly reflect market spot prices, making it highly sensitive to fluctuations in these key metals.

For instance, in the fiscal year 2023, Evolution Mining's average realized gold price was approximately A$2,826 per ounce, while its copper price averaged around A$4.74 per pound, showcasing the direct link between their sales and market dynamics.

Evolution Mining's approach to capital discipline directly supports its pricing strategy by ensuring that investments are made only in projects with robust returns. This focus on efficiency means the company is well-positioned to generate strong cash flow, even when metal prices fluctuate. For instance, during the 2023 financial year, Evolution reported underlying EBITDA of A$1.2 billion, demonstrating its ability to convert operational success into tangible cash.

By banking cash from favorable market conditions, such as the higher gold prices seen in late 2023 and early 2024, Evolution enhances its financial flexibility. This allows the company to maintain profitability and stability, indirectly influencing its ability to operate effectively and competitively at current market prices. Their commitment to returning capital to shareholders, with A$400 million in dividends and buybacks in FY23, underscores this cash-generative strength.

Operational Efficiency and Cost Reduction

Evolution Mining consistently pursues operational efficiency and cost reduction, which is a cornerstone of its strategy. This focus directly impacts its cost of production and overall profitability. For instance, the Mungari plant expansion is a prime example of investing in infrastructure to drive down per-unit costs.

Technological advancements are also key. The adoption of autonomous drilling, for example, not only improves safety but also reduces labor costs and increases operational uptime, thereby lowering the all-in sustaining cost (AISC). These efforts are crucial for maintaining competitiveness in a fluctuating gold price environment.

The company's commitment to efficiency is reflected in its financial performance. For the fiscal year ended June 30, 2024, Evolution Mining reported a significant improvement in its AISC, aiming to keep it within the lower end of its guidance range, demonstrating the tangible benefits of these initiatives.

- Mungari Plant Expansion: Directly contributes to economies of scale and improved cost per ounce.

- Autonomous Drilling: Enhances productivity and reduces labor-related expenses.

- All-In Sustaining Cost (AISC): Targeted reduction in AISC for FY24 to bolster profitability.

- Technological Investment: Ongoing commitment to innovation for long-term cost competitiveness.

Dividend Policy and Shareholder Returns

Evolution Mining's commitment to a consistent dividend policy underscores its robust financial performance and its ability to generate significant value from its gold and copper production. This focus on shareholder returns is a clear signal to the market that the company's pricing and cost management strategies are not only effective but are actively contributing to stakeholder prosperity.

The company's dividend history reflects its financial discipline and its confidence in its operational and pricing strategies. For instance, Evolution Mining declared a final dividend of AUD 3.00 cents per share for the fiscal year 2023, demonstrating its ongoing commitment to returning capital to shareholders. This consistent payout, alongside other capital management initiatives, highlights the tangible value derived from its effective market positioning.

- Consistent Dividend Payouts: Evolution Mining has a track record of delivering dividends, reinforcing its financial stability.

- Shareholder Value Creation: The dividend policy directly translates the company's operational success and pricing power into tangible returns for investors.

- Market Confidence: A reliable dividend payout signals to the market the effectiveness of the company's pricing and cost strategies, fostering investor confidence.

Evolution Mining's pricing strategy is intrinsically linked to its cost management, aiming for industry-leading low All-in Sustaining Costs (AISC). This focus allows them to remain profitable even with fluctuating gold prices. For the December 2023 half-year, AISC was $1,220 per ounce, down from $1,286 per ounce in the prior period.

The company's revenue directly reflects global gold and copper spot prices due to limited hedging. In FY23, the average realized gold price was A$2,826 per ounce, and copper averaged A$4.74 per pound.

Capital discipline, ensuring investments yield strong returns, supports their pricing. This efficiency is evident in the FY23 underlying EBITDA of A$1.2 billion and a commitment to returning capital, with A$400 million in dividends and buybacks during FY23.

| Metric | FY23 (June 30) | H1 FY24 (Dec 31) |

| AISC (per ounce) | A$1,286 | A$1,220 |

| Average Realized Gold Price (per ounce) | A$2,826 | - |

| Underlying EBITDA (A$ billion) | A$1.2 | - |

| Dividends & Buybacks (A$ million) | A$400 | - |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Evolution Mining is grounded in a comprehensive review of company disclosures, including annual reports, investor presentations, and sustainability reports. We supplement this with industry-specific data and market intelligence to capture their product offerings, pricing strategies, distribution networks, and promotional activities.