Evolution Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evolution Mining Bundle

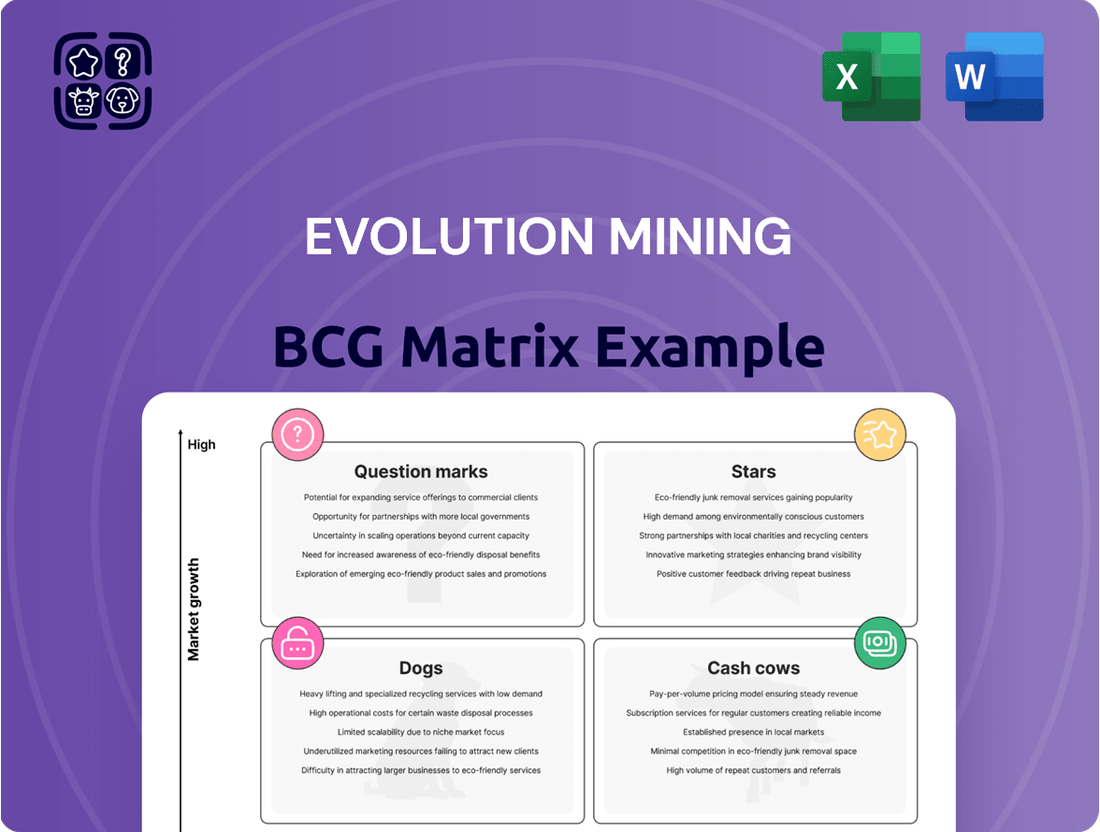

Unlock the strategic potential of Evolution Mining with a comprehensive look at its BCG Matrix. Understand which of their operations are market leaders, generating substantial cash, or require careful consideration. This preview offers a glimpse into their portfolio's dynamics, but the full report provides the detailed quadrant placements and actionable insights you need to make informed investment decisions.

Dive deeper into Evolution Mining's strategic positioning by purchasing the complete BCG Matrix. Gain clarity on their Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with data-backed recommendations for optimal capital allocation. This report is your key to navigating the complexities of the mining sector with confidence and foresight.

Stars

The Cowal Open Pit Continuation (OPC) project represents a significant growth driver for Evolution Mining, with a board-approved A$430 million investment. This expansion is projected to add 2 million ounces of gold production, extending the mine's operational life to 2042.

This substantial development solidifies Cowal's position as a Star in Evolution's portfolio. It leverages the asset's existing high market share and capitalizes on its considerable future growth potential, making it a key contributor to the company's future success.

The Mungari Expansion Project is a significant undertaking for Evolution Mining, representing a substantial investment of A$250 million. This project is currently progressing exceptionally well, being ahead of schedule and under budget, which is a strong indicator of efficient management and execution.

Upon completion, the expansion will boost Mungari's processing capacity to an impressive 4.2 million tonnes per annum (Mtpa). This aggressive growth strategy at an existing, proven asset highlights its high potential for increased production and revenue generation.

By elevating Mungari's operational scale, Evolution Mining aims to significantly enhance its overall contribution to the company's production profile and expand its market share. This strategic development positions Mungari as a key Star asset within Evolution's portfolio, poised for substantial future growth and profitability.

The Ernest Henry Mine Extension Project is a prime example of a Star in the BCG matrix for Evolution Mining. With a Feasibility Study slated for completion in FY25 and encouraging exploration results, this project aims to substantially increase mineral resources and prolong the mine's operational lifespan.

This strategic development of a high-performing copper-gold asset is set to be a significant growth driver, capitalizing on its already impressive negative All-in Sustaining Costs (ASCs). In FY23, Ernest Henry's ASCs were a remarkable negative $1,122/oz, showcasing its exceptional profitability and potential for future expansion.

Red Lake Operations Transformation

Evolution Mining is actively transforming its Red Lake operations, aiming to re-establish it as a leading Canadian gold mine. This strategic overhaul is designed to boost annual production significantly by 2026 and extend the mine's lifespan by over 15 years.

- Red Lake Transformation: Evolution is investing heavily to enhance consistency and reliability.

- Production Growth: Targets are set for a substantial increase in annual gold production by 2026.

- Extended Mine Life: The project aims to add more than 15 years to Red Lake's operational future.

- Star Potential: Despite historical challenges, the significant investment and growth prospects position Red Lake as a potential Star in the BCG matrix.

Northparkes Integration & Optimisation

The acquisition of an 80% stake in Northparkes, a significant copper-gold mine, has immediately boosted Evolution Mining's copper presence and cash generation. This operation is notably achieving a negative All-in Sustaining Cost, a strong indicator of its efficiency and profitability.

Evolution Mining is prioritizing the integration of Northparkes and enhancing its block caving operations. This strategic move aims to ensure consistent, profitable output, positioning Northparkes as a critical asset for future growth and a Star in the company's portfolio due to its substantial potential contribution.

- Northparkes' 80% acquisition significantly increases Evolution Mining's copper exposure.

- The mine operates at a negative All-in Sustaining Cost, highlighting its cost-effectiveness.

- Integration and optimization of block caving are key strategic priorities for sustained profitability.

- Northparkes is identified as a Star due to its high potential for future value creation.

Stars in Evolution Mining's portfolio represent assets with high market share and high growth potential, requiring significant investment to maintain their leading position. These are the company's current or future growth engines.

The Cowal OPC project, with its A$430 million investment and extension to 2042, solidifies Cowal's Star status. Similarly, the Mungari Expansion, a A$250 million project ahead of schedule and under budget, is poised to significantly boost production, marking it as a key Star. Ernest Henry's ongoing extension project, coupled with its impressive negative ASCs of -$1,122/oz in FY23, also positions it firmly as a Star.

Red Lake's transformation, targeting increased production by 2026 and an extended mine life, signals its potential Star status despite historical challenges. The acquisition of Northparkes, with its negative ASCs and strategic focus on block caving optimization, immediately elevates it to Star status due to its strong profitability and growth prospects.

| Asset | Project/Status | Investment (A$) | FY23 ASCs (USD/oz) | Projected Impact |

|---|---|---|---|---|

| Cowal | OPC Project | 430 million | N/A | Extend life to 2042, +2 Moz production |

| Mungari | Expansion Project | 250 million | N/A | Increase processing to 4.2 Mtpa |

| Ernest Henry | Extension Project | N/A (Feasibility in FY25) | -1,122 | Increase resources, prolong life |

| Red Lake | Transformation | Significant Investment | N/A | Boost production by 2026, +15 years life |

| Northparkes (80%) | Integration & Optimization | N/A (Acquisition) | Negative | Enhance copper presence, cash generation |

What is included in the product

The Evolution Mining BCG Matrix categorizes its assets into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment and divestment decisions.

The Evolution Mining BCG Matrix offers a clear, one-page overview, instantly clarifying which business units require more investment and which are self-sustaining, thus relieving the pain of strategic uncertainty.

Cash Cows

The Cowal Gold Operations stands as a cornerstone for Evolution Mining, consistently delivering robust production and significant cash flow. In the first nine months of fiscal year 2025, it generated an impressive A$479 million, underscoring its role as a stable, high-performing asset.

With a history of proven profitability, Cowal is a mature operation that reliably contributes to the company's financial strength. This established performance makes it a dependable source of returns, a true cash cow within Evolution Mining's portfolio.

Ernest Henry is a prime example of a cash cow for Evolution Mining, consistently churning out significant cash flow. This copper-gold operation has not only repaid all its acquisition and capital costs but also boasts a negative All-in Sustaining Cost, a testament to its remarkable efficiency and profitability.

In the 2024 financial year, Ernest Henry demonstrated its 'cash cow' status by contributing substantially to Evolution Mining's financial performance. Its mature and streamlined operations ensure a reliable and substantial cash generation, solidifying its position as a cornerstone of the company's portfolio.

Northparkes, following its acquisition by Evolution Mining, has quickly established itself as a significant cash cow. Its copper-gold operations are not only stable but also profitable, evidenced by a negative All-in Sustaining Cost (AISC) in recent reporting periods, a strong indicator of efficient production.

This consistent cash generation, stemming from established block caving methods, provides a reliable financial backbone for Evolution Mining. Despite potential for future growth, its current role as a dependable source of funds is paramount to the company's overall financial strength.

Evolution's Diversified Commodity Exposure

Evolution Mining's strategic positioning with exposure to both gold and copper significantly diversifies its revenue streams. This dual commodity focus acts as a natural hedge against the volatility inherent in individual commodity prices, bolstering the company's financial stability. Established operations like Ernest Henry, a significant copper-gold mine, and Northparkes contribute substantially to this robust cash flow, solidifying their role as cash cows within the company's portfolio.

- Diversified Revenue: Gold and copper exposure reduces reliance on a single commodity.

- Hedging Against Volatility: Dual commodity presence mitigates price fluctuation risks.

- Established Assets: Ernest Henry and Northparkes are key drivers of stable cash flow.

- Financial Resilience: Diversification underpins the company's overall financial strength.

Strong Balance Sheet & Shareholder Returns

Evolution Mining's strong balance sheet and commitment to shareholder returns firmly place its mature assets within the cash cow quadrant of the BCG matrix. The company achieved significant material deleveraging, a testament to its efficient operations and robust free cash flow generation.

Record financial performance in FY25, including increased liquidity, underscores this cash cow status. This financial strength allows for consistent dividend payments, directly benefiting shareholders.

- Material Deleveraging: Evolution Mining has successfully reduced its debt levels, strengthening its financial foundation.

- Consistent Dividend Payments: The company demonstrates a commitment to returning capital to shareholders through regular dividend distributions.

- Increased Liquidity: FY25 results showed enhanced liquidity, providing financial flexibility and stability.

- Record Financial Performance: The company's latest financial results highlight its ability to generate substantial free cash flow from its mature, efficient operations.

Evolution Mining's established gold and copper operations, such as Cowal, Ernest Henry, and Northparkes, function as its primary cash cows. These mature assets consistently generate substantial free cash flow, contributing significantly to the company's financial stability and enabling shareholder returns.

In the first nine months of fiscal year 2025, Cowal alone generated A$479 million, highlighting its dependable cash-generating capabilities. Ernest Henry and Northparkes also exhibit strong performance, with Ernest Henry notably achieving a negative All-in Sustaining Cost (AISC) in FY24, a clear indicator of its highly efficient and profitable nature.

This consistent cash generation from mature, low-cost operations allows Evolution Mining to pursue material deleveraging and maintain consistent dividend payments, reinforcing their role as vital cash cows within the company's portfolio.

| Operation | Commodity | FY24 Contribution (Illustrative) | FY25 (9M) Contribution | BCG Status |

|---|---|---|---|---|

| Cowal | Gold | Significant Cash Flow | A$479 million | Cash Cow |

| Ernest Henry | Copper-Gold | Substantial Cash Flow, Negative AISC | Not Specified | Cash Cow |

| Northparkes | Copper-Gold | Stable & Profitable, Negative AISC | Not Specified | Cash Cow |

What You See Is What You Get

Evolution Mining BCG Matrix

The Evolution Mining BCG Matrix preview you are seeing is the complete, unwatermarked document you will receive immediately after purchase, offering a comprehensive strategic overview of their asset portfolio. This preview accurately represents the final, professionally formatted report, ready for immediate integration into your business planning and analysis. You will gain access to the full, editable BCG Matrix, providing actionable insights without any hidden surprises or demo content. This is the exact, analysis-ready file designed for strategic clarity, which you can download and utilize directly for your business needs.

Dogs

The Mt Rawdon mine is a mature open-pit gold operation that is currently in the process of winding down. Evolution Mining has stated that operations are expected to cease by 2028, with a planned transition towards closure occurring in FY25.

With its declining production and a clear strategy for exiting the asset, Mt Rawdon fits the profile of a 'Dog' in the BCG matrix. This classification reflects its low growth prospects and diminishing market share within the company's portfolio, as it is being responsibly managed towards the end of its life cycle.

Non-core or underperforming assets within Evolution Mining's portfolio would represent mining operations or exploration projects that consistently fail to meet profitability benchmarks or have been identified as no longer aligning with the company's long-term strategic direction. These assets, while not always explicitly detailed in public disclosures, would likely be characterized by high operating costs, low ore grades, or significant geological challenges that hinder efficient extraction. For instance, if a particular mine in 2024 reported an all-in sustaining cost significantly above the industry average or its peers within Evolution's own portfolio, it could be considered a candidate for this category.

Within Evolution Mining's extensive exploration endeavors, some early-stage projects may initially reveal limited geological promise or economic feasibility, leading to their classification as marginal prospects. These areas are typically allocated minimal capital, acknowledging their constrained potential for future growth or market share expansion. Consequently, they occupy a position of low priority within the company's exploration pipeline.

Sub-economic Ore Zones

Sub-economic ore zones are essentially pockets within a mine that aren't profitable to extract at current market prices. Think of them as areas that, on their own, wouldn't justify the cost of mining. Even if the main mine is doing well, these specific sections might be a drain on resources.

For instance, Evolution Mining's Mungari operation in Western Australia has faced challenges with lower-grade zones. In the first half of 2024, the company reported that the overall cash cost per ounce for Mungari was AUD 1,553. However, within this, certain zones might have had significantly higher costs, pushing them into sub-economic territory.

- Definition: Ore zones with grades or mining conditions that make extraction unprofitable at current commodity prices.

- Impact: These zones can operate at a loss, even within a profitable larger mining operation.

- Example: Evolution Mining's Mungari operation has encountered lower-grade zones that increase overall cash costs.

- Financial Implication: Sub-economic zones require careful management to avoid negatively impacting the mine's overall profitability.

Inefficient Legacy Infrastructure

Inefficient legacy infrastructure in mining operations can represent a significant challenge, often falling into the 'Dog' category of the BCG Matrix. As mines age, the original equipment and processing facilities may no longer be cost-effective to operate or maintain. For instance, older processing plants might have lower recovery rates compared to modern technologies, meaning more ore is processed for less valuable output.

This inefficiency translates directly into higher operating costs per ounce of gold produced. In 2024, as the industry faces fluctuating commodity prices and increasing environmental regulations, such legacy assets become a liability. Evolution Mining, like many established players, must continually assess whether to invest in modernizing these older facilities or divest them.

- High Operating Costs: Legacy infrastructure often incurs higher energy consumption and maintenance expenses compared to newer, more efficient systems.

- Lower Recovery Rates: Older processing technologies may not extract as much valuable mineral from the ore, reducing overall profitability.

- Capital Drain: Continued investment in maintaining outdated assets diverts capital that could be used for growth opportunities or more productive ventures.

- Reduced Competitiveness: Inefficient operations can make a mine less competitive against those utilizing state-of-the-art technology.

Evolution Mining's 'Dogs' are assets with low growth potential and market share, often characterized by declining production or high costs. Mt Rawdon, slated for closure by 2028, exemplifies this, as its operations are winding down. Similarly, sub-economic ore zones, like those potentially within Mungari, represent areas where extraction is unprofitable, even within a larger, viable mine. Inefficient legacy infrastructure also falls into this category, as older equipment leads to higher operating costs and lower recovery rates, making these assets a financial drain.

| Asset Type | Characteristics | Example (Evolution Mining) | 2024 Data Point |

|---|---|---|---|

| Winding Down Operations | Low growth, declining production, planned closure | Mt Rawdon | Expected cessation of operations by 2028 |

| Sub-economic Ore Zones | Unprofitable extraction at current prices, high cost per ounce | Certain zones within Mungari | Mungari's H1 2024 cash cost per ounce AUD 1,553 (indicating potential for higher costs in specific zones) |

| Inefficient Legacy Infrastructure | High operating costs, lower recovery rates, capital drain | Older processing plants | Lower recovery rates compared to modern technologies |

Question Marks

Red Lake is in the midst of a significant operational overhaul, aiming to establish itself as a leading Canadian gold producer. The target is a substantial production boost by 2026, reflecting its high growth potential.

While Red Lake has shown recent operational gains and positive cash flow, it demands considerable ongoing capital to fully unlock its capabilities and capture greater market share. This positions it as a classic Question Mark in the BCG matrix, characterized by high growth prospects but also requiring significant investment.

Evolution Mining's commitment to early-stage exploration is evident in its strategic acquisition of 15 new tenements near the Ernest Henry operation. This initiative is specifically designed to unearth new copper-gold orebodies, a classic 'Question Mark' in the BCG matrix due to its high growth potential coupled with significant inherent risk and an uncertain future market share.

These exploration projects represent a substantial investment in future growth, requiring considerable capital for discovery and development. While their success could lead to significant market share gains, their current status is one of low or no market presence, aligning them perfectly with the 'Question Mark' classification where potential rewards are high, but so are the uncertainties and capital demands.

New mine development studies, like the Ernest Henry Mine Extension Project, are crucial for Evolution Mining's future growth. These projects are in the detailed feasibility stage, meaning they require significant capital investment for evaluation and development but haven't yet committed to full production or begun generating substantial returns. Their ultimate success and contribution to market share and profitability are still uncertain, placing them in a category with high potential upside but also inherent risk.

Technological Innovation and Pilot Programs

Evolution Mining is actively exploring technological innovations to enhance its operations. For instance, the company has implemented autonomous drilling technology at its Ernest Henry mine, a significant step towards increasing efficiency and safety. Similarly, the use of muon-powered subsurface modeling at Northparkes demonstrates a commitment to cutting-edge exploration techniques.

These pilot programs, while promising, represent investments in future capabilities rather than immediate, proven returns. The initial phases of deploying such advanced technologies inherently involve considerable capital expenditure and rigorous testing to validate their effectiveness and scalability across the broader portfolio. For example, the capital expenditure on technology and innovation is a key component of Evolution Mining's overall investment strategy.

- Autonomous Drilling at Ernest Henry: Aims to improve operational efficiency and safety, representing a significant technological leap.

- Muon-Powered Subsurface Modeling at Northparkes: Explores advanced geological understanding for potential resource discovery and optimization.

- Investment in Pilot Programs: These initiatives require substantial initial investment and testing periods before demonstrating widespread impact or market share gains.

Strategic Growth Opportunities (Unannounced)

Evolution Mining, as a forward-thinking entity, continuously explores unannounced strategic growth avenues. These might involve venturing into new mineral exploration frontiers or considering strategic acquisitions that align with its long-term vision. These emerging opportunities are classified as Question Marks within the BCG framework.

These nascent ventures represent Question Marks because they possess significant growth potential, akin to a burgeoning resource play or a carefully selected acquisition target. However, at this early stage, they command a low market share and necessitate rigorous evaluation and substantial capital investment to mature into potential future Stars in Evolution's portfolio.

- Exploration Ventures: Evolution Mining's 2024 exploration budget was approximately AUD 120 million, a portion of which is allocated to identifying and assessing new, unproven resource plays that could become future growth drivers.

- Acquisition Pipeline: While specific targets are unannounced, the company has historically demonstrated a strategic approach to acquisitions, with past successful integration of assets contributing significantly to its growth trajectory.

- Early-Stage Assessment: These opportunities require extensive geological surveying, feasibility studies, and market analysis, mirroring the intensive due diligence process for any potential acquisition, before significant capital is committed.

- High Risk, High Reward: The inherent nature of these unannounced projects means they carry a higher risk profile due to geological uncertainty and market volatility, but they also offer the potential for substantial returns if successful.

Question Marks in Evolution Mining's portfolio represent opportunities with high growth potential but currently low market share, demanding significant investment. These are typically new exploration projects or early-stage developments where the outcome is uncertain.

Examples include the ongoing exploration near Ernest Henry and the evaluation of new mine development studies, all requiring substantial capital for feasibility and potential future expansion. The company's 2024 exploration budget of approximately AUD 120 million underscores this commitment to identifying and nurturing these high-potential, high-risk ventures.

These ventures, while not yet contributing significantly to revenue, are crucial for future growth and market positioning, aligning with the core characteristics of a Question Mark in the BCG matrix.

| Project/Initiative | BCG Category | Growth Potential | Market Share | Investment Required |

|---|---|---|---|---|

| Red Lake Operational Overhaul | Question Mark | High | Low (Targeting significant boost) | Considerable ongoing capital |

| New Tenements near Ernest Henry | Question Mark | High | Negligible (New exploration) | Substantial for discovery and development |

| Ernest Henry Mine Extension Project | Question Mark | High | Uncertain | Significant for evaluation and development |

| Autonomous Drilling Pilot | Question Mark | High (Efficiency gains) | Low (Pilot phase) | Substantial initial investment |

| Muon-Powered Subsurface Modeling | Question Mark | High (Advanced understanding) | Low (Pilot phase) | Substantial initial investment |

BCG Matrix Data Sources

Our BCG Matrix is built on Evolution Mining's official financial statements, annual reports, and market analysis, supplemented by industry research and expert commentary for a comprehensive view.