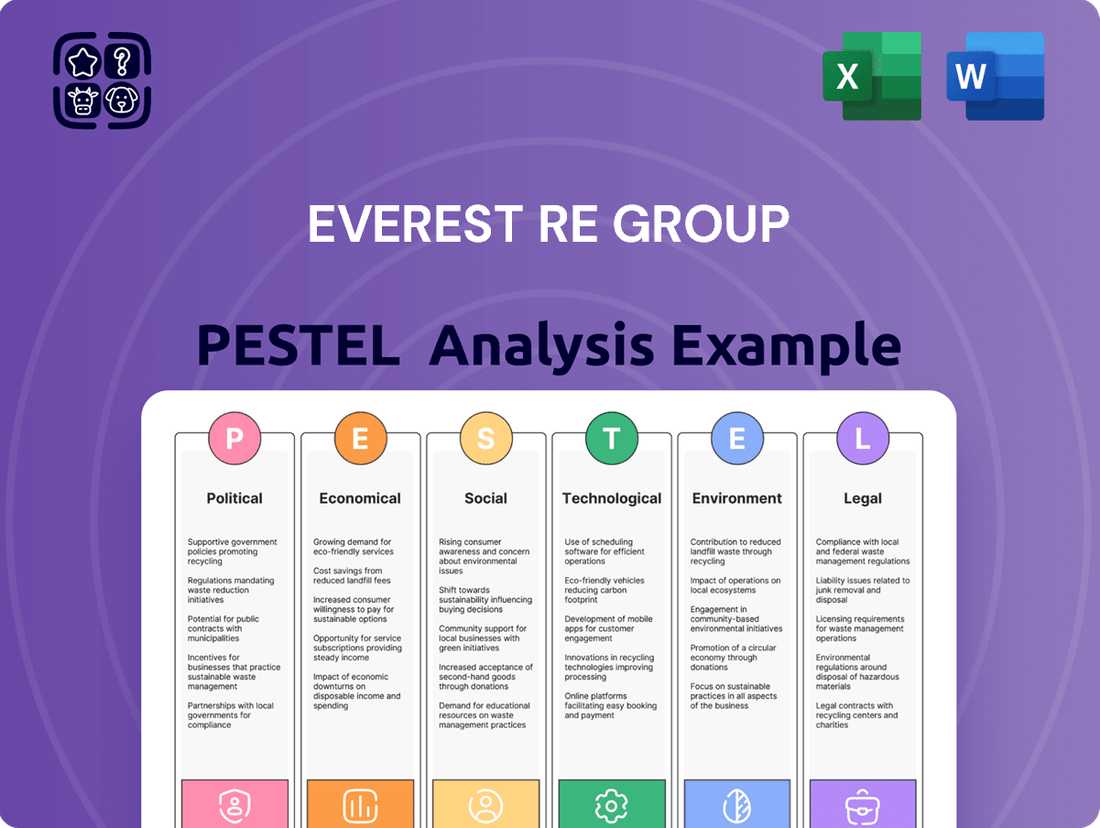

Everest Re Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everest Re Group Bundle

Unlock the critical external factors shaping Everest Re Group's strategic landscape with our comprehensive PESTLE analysis. From evolving political regulations to emerging technological advancements and socio-economic shifts, understand the forces that will define their future. Equip yourself with actionable intelligence to navigate this complex environment and identify opportunities for growth.

Don't get left behind in the dynamic reinsurance market. Our PESTLE analysis provides the deep-dive insights you need to anticipate challenges and capitalize on trends impacting Everest Re Group. Invest in clarity and foresight – download the full report now to gain a decisive market advantage.

Political factors

Ongoing geopolitical tensions, such as the protracted conflict in Ukraine and escalating trade disputes between major economies, continue to create significant headwinds for global financial markets. These disruptions directly impact Everest Re Group's investment portfolios and capital allocation strategies, requiring constant vigilance and adaptability. For instance, the World Bank's latest projections for 2024 indicate a slowdown in global growth, partly attributed to these geopolitical uncertainties, which can affect demand for insurance and reinsurance services.

The upcoming US presidential election in late 2024 is particularly crucial, as the outcome will shape the regulatory landscape for the insurance sector. Shifts in trade policies and potential tariffs could introduce new complexities for cross-border reinsurance operations, influencing pricing and the availability of coverage. This necessitates robust legal and compliance frameworks to navigate evolving international trade agreements and manage potential disputes effectively.

The insurance regulatory landscape is a dynamic area, with significant shifts anticipated in 2025 across key markets such as the UK and the US. Regulators are increasingly prioritizing consumer protection, robust data privacy, and overall financial system stability.

These evolving regulations will introduce new mandates for algorithmic transparency, more stringent cybersecurity protocols, and comprehensive frameworks governing the use of third-party data and predictive modeling. Everest Re Group will need to adapt its operations to ensure full compliance with these upcoming requirements.

Governments worldwide are intensifying their focus on climate risk and resilience, a trend that significantly shapes the insurance industry. This includes the introduction of stricter anti-greenwashing regulations and enhanced oversight of how insurers manage climate-related financial exposures. For example, the European Union's Sustainable Finance Disclosure Regulation (SFDR) has been progressively implemented, impacting how financial products, including insurance, are marketed and managed concerning sustainability criteria.

Everest Re Group must proactively adapt its sophisticated risk modeling and underwriting methodologies to align with these dynamic climate policies and stakeholder expectations. The increasing frequency and severity of climate-related events, such as the record-breaking insured losses from natural catastrophes in 2023, estimated by some sources to be around $110 billion globally, underscore the urgency for insurers to integrate climate resilience into their core strategies and product development.

Fiscal Policies and Government Spending

Government fiscal policies, such as changes in taxation and spending, directly impact economic growth and financial market stability, which in turn affects the insurance industry. For Everest Re Group, shifts in government spending could influence demand for various insurance products, while tax policy changes can alter corporate profitability and investment strategies. For instance, a government initiative to boost infrastructure spending could indirectly increase demand for construction-related insurance.

Fiscal risks, including potential increases in government debt or deficits, can exert upward pressure on long-dated bond yields. This is a critical consideration for insurers like Everest Re Group, as higher bond yields can positively impact investment income from their fixed-income portfolios. However, rapid or unexpected increases could also lead to unrealized losses on existing bond holdings.

- Government Spending Initiatives: In 2024, many governments are focusing on economic stimulus and infrastructure development, potentially creating new opportunities for commercial property and casualty insurance.

- Tax Policy Changes: Potential adjustments to corporate tax rates in major economies could affect Everest Re Group's net income and the attractiveness of certain investment structures.

- Interest Rate Environment: Fiscal policies that contribute to inflation or government borrowing needs can influence central bank monetary policy, impacting the interest rate environment relevant to Everest Re Group's investment portfolio.

Political Stability and Civil Unrest

Political instability and civil unrest are significant concerns for reinsurers like Everest Re Group. These events can directly translate into a surge of property and casualty claims, impacting financial performance. For instance, the Washington, D.C. aviation losses in Q1 2025 served as a stark reminder of how geopolitical disruptions can lead to substantial insured losses for the company.

The implications of such instability extend beyond immediate claims. It can also disrupt supply chains, affect investment portfolios through market volatility, and create an uncertain operating environment. This necessitates robust risk management strategies and careful underwriting to mitigate potential financial fallout.

- Increased Claims: Political instability often triggers events like riots, terrorism, or civil disturbances, leading to higher property and casualty claims.

- Economic Disruption: Unrest can damage infrastructure, halt business operations, and negatively impact economic activity, indirectly affecting insurers.

- Market Volatility: Geopolitical tensions can cause significant fluctuations in financial markets, impacting investment income and asset valuations for reinsurers.

- Operational Challenges: Operating in unstable regions can present logistical and security challenges for insurers and reinsurers.

Government policies on trade and international relations directly influence Everest Re Group's global operations and capital flows. For instance, evolving trade agreements and potential tariffs in 2024 and 2025 can impact pricing and the availability of reinsurance. Regulatory shifts, such as those anticipated in the UK and US in 2025 concerning data privacy and algorithmic transparency, necessitate ongoing compliance efforts.

Focus on climate risk by governments is increasing, with stricter regulations on greenwashing and financial exposure management. The record insured losses from natural catastrophes in 2023, exceeding $110 billion globally, highlight the urgency for insurers to integrate climate resilience. Political instability, as seen with the Washington, D.C. aviation losses in Q1 2025, can lead to significant claims and market volatility.

| Political Factor | Impact on Everest Re Group | 2024/2025 Data/Trend |

|---|---|---|

| Geopolitical Tensions | Affects investment portfolios and demand for insurance. | World Bank projects slower global growth in 2024 due to uncertainties. |

| Regulatory Changes | Shapes operational requirements and compliance. | Anticipated 2025 shifts in UK/US data privacy and cybersecurity regulations. |

| Climate Policies | Drives need for climate risk integration in underwriting. | Global insured catastrophe losses ~ $110 billion in 2023. |

| Political Instability | Increases claims and market volatility. | Q1 2025 Washington, D.C. aviation losses exemplify disruption impact. |

What is included in the product

This PESTLE analysis examines the external macro-environmental forces influencing Everest Re Group, detailing how political stability, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks create both challenges and strategic opportunities.

Offers a clear and concise summary of Everest Re Group's PESTLE analysis, streamlining strategic discussions and ensuring all stakeholders grasp key external factors impacting the business.

Economic factors

Global economic growth is projected to remain robust through 2025 and 2026, yet the pace of inflation reduction, particularly in the United States, might decelerate. For Everest Re Group, this scenario presents a dual challenge: maintaining underwriting profitability amidst persistent inflation and navigating the impact of potentially volatile interest rates on its investment portfolio.

The persistence of high inflation, with the US CPI showing a 3.3% year-over-year increase as of May 2024, alongside the uncertainty surrounding future interest rate policies, directly influences Everest Re's financial performance. These macroeconomic conditions necessitate careful portfolio management to mitigate inflationary erosion of investment returns and to ensure underwriting premiums adequately cover rising claims costs.

The current interest rate environment has been a significant tailwind for insurers like Everest Re Group. Higher rates translate directly into increased investment income from their substantial portfolios of fixed-income securities. For instance, in the first quarter of 2024, many insurers reported double-digit percentage increases in net investment income compared to the previous year, a trend expected to continue as rates remain elevated, even with potential future monetary easing.

While the Federal Reserve has signaled a pause in rate hikes, and some easing might occur in late 2024 or 2025, projections suggest rates will likely stay higher than the ultra-low levels seen in the preceding decade. This sustained higher-rate environment is beneficial for Everest Re Group, as it bolsters the returns generated from their investment assets, contributing positively to overall profitability.

However, the precise trajectory of future interest rates is subject to considerable uncertainty. Geopolitical developments and ongoing economic volatility, including inflation concerns, create a dynamic landscape. This uncertainty means that while the current elevated rate environment is advantageous, the pace and extent of any future monetary policy shifts will be closely watched and could impact Everest Re Group's investment income projections.

The reinsurance market has seen robust pricing, especially in short-tail lines, which has boosted reinsurer profits. For instance, property catastrophe reinsurance rates saw significant increases in early 2024 renewals, with some segments experiencing double-digit growth as capacity remained constrained.

However, this favorable pricing environment is not uniform. We're observing moderating price trends in some areas, and the casualty business faces persistent pressure from social inflation, impacting profitability in those lines.

Everest Re Group's success hinges on its capacity to sustain underwriting discipline amidst these shifting market dynamics. Capitalizing on current favorable pricing while adeptly navigating the softening trends in specific segments is key to maintaining strong operating performance through 2025.

Social Inflation

Social inflation, a phenomenon where claims costs rise faster than general economic inflation due to evolving legal and societal attitudes, presents a notable challenge for insurers like Everest Re Group. This trend is fueled by factors such as increased jury awards and the growing influence of third-party litigation funding, which collectively contribute to escalating loss costs, particularly in US casualty insurance lines.

The impact of social inflation is evident in the need for insurers to bolster reserves to account for these higher-than-anticipated claims. For instance, in 2023, the insurance industry continued to grapple with the effects of social inflation, with some analysts projecting that it could add several percentage points to loss ratios in casualty lines compared to pre-pandemic levels.

- Rising Jury Awards: Studies have indicated a significant uptick in large jury verdicts in recent years, often exceeding economic inflation.

- Third-Party Litigation Funding: This practice allows external investors to fund lawsuits, potentially encouraging more litigation and larger settlement demands.

- Broader Societal Shifts: Changes in public perception regarding corporate responsibility and the perceived fairness of compensation can also influence claims outcomes.

- Impact on Reserves: Insurers must continually assess and adjust their loss reserves to reflect these evolving claims cost trends, a process that can lead to reserve strengthening.

Capitalization and Profitability Trends

The global reinsurance market is expected to maintain stability through 2025, bolstered by healthy operating profits and strong capitalization. Reinsurers are anticipated to achieve earnings that meet or exceed their cost of capital. Everest Re Group's performance in the first quarter of 2025, even with elevated catastrophe-related losses, demonstrates its capacity to withstand challenges while prioritizing capital strength and profitability.

Everest Re Group’s commitment to robust capitalization is evident in its strategic approach to managing risk and capital. This focus is crucial for maintaining financial flexibility and supporting long-term growth objectives in a dynamic market environment.

- Global Reinsurance Stability: The sector is projected for stability through 2025, with reinsurers expected to earn their cost of capital.

- Everest Re's Q1 2025 Resilience: Despite increased catastrophe losses, Everest Re demonstrated resilience, maintaining strong capital positions and profitability.

- Capitalization Focus: Everest Re prioritizes maintaining strong capital positions, crucial for navigating market volatility and ensuring long-term stability.

Economic factors present a mixed outlook for Everest Re Group. While global growth is expected to remain solid through 2025, persistent inflation, exemplified by the US CPI at 3.3% year-over-year in May 2024, necessitates careful underwriting to manage rising claims costs. Conversely, elevated interest rates, projected to remain higher than pre-2020 levels, provide a significant tailwind for Everest Re's investment income, as seen in the double-digit percentage increases in net investment income reported by many insurers in Q1 2024.

The reinsurance market, particularly for short-tail lines, has benefited from strong pricing, with property catastrophe rates seeing double-digit growth in early 2024 renewals due to constrained capacity. However, this trend is moderating in some segments, and casualty lines continue to face pressure from social inflation, a factor contributing to increased reserves and higher loss ratios compared to pre-pandemic levels.

Everest Re Group's resilience was demonstrated in Q1 2025, where despite elevated catastrophe losses, the company maintained strong capital positions and profitability, underscoring its commitment to robust capitalization as a key strategy for navigating market volatility and ensuring long-term stability in the projected stable global reinsurance market through 2025.

| Economic Factor | Trend/Projection | Impact on Everest Re Group | Supporting Data (as of mid-2024/early 2025) |

| Global Economic Growth | Robust through 2025-2026 | Supports overall market stability and demand for reinsurance. | Projected steady growth, though pace of inflation reduction varies by region. |

| Inflation | Persistent, though potentially decelerating | Increases claims costs, requiring higher premiums and careful reserve management. | US CPI: 3.3% YoY (May 2024). |

| Interest Rates | Elevated, likely to remain higher than pre-2020 levels | Boosts investment income from fixed-income portfolios. | Many insurers reported double-digit % increases in net investment income in Q1 2024. |

| Reinsurance Pricing | Strong in short-tail lines, moderating in some areas | Favorable for underwriting profitability, but requires adaptation to softening trends. | Property catastrophe rates up double-digits in early 2024 renewals. |

| Social Inflation | Ongoing pressure in casualty lines | Increases loss costs and necessitates reserve strengthening. | Potential to add several percentage points to casualty loss ratios vs. pre-pandemic. |

Preview Before You Purchase

Everest Re Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Everest Re Group meticulously examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the macro-environmental forces shaping Everest Re's strategic landscape.

Sociological factors

Public perception of the insurance industry has seen a dip, with a notable increase in skepticism towards large corporations. This sentiment can unfortunately spill over into legal proceedings, potentially influencing jury verdicts and settlement demands, a phenomenon often referred to as social inflation. For instance, a 2023 survey indicated that only 49% of consumers trust insurance companies to act in their best interest, a slight decrease from previous years.

Everest Re Group must actively respond to these evolving consumer expectations. This means prioritizing enhanced transparency in their operations and clearly demonstrating the fair value their insurance products provide. Meeting these demands is crucial for maintaining customer loyalty and mitigating the impacts of growing public distrust.

Social inflation, a significant headwind for insurers, continues to drive up claim costs beyond general economic inflation. This phenomenon is exacerbated by evolving jury sentiments and the increasing prevalence of 'nuclear verdicts,' which can result in exceptionally large payouts. Third-party litigation funding further fuels this trend, empowering plaintiffs and potentially leading to more aggressive legal strategies.

For casualty insurers like Everest Re Group, this translates into a need for sophisticated claims management. The American Tort Reform Association's 2023 report highlighted that the cost of the civil justice system in the U.S. remains substantial, with significant portions attributed to non-economic damages, a key driver of social inflation.

Demographic shifts significantly impact insurance demand. An aging global population, for instance, is increasing the need for health and long-term care insurance, while also potentially reducing the market for life insurance in some regions. In 2024, the global population aged 65 and over was projected to reach over 770 million, a trend that directly influences product development for insurers like Everest Re Group.

Conversely, younger demographics are showing increased engagement with life insurance, often driven by social media trends and a growing awareness of financial planning. This suggests Everest Re Group should consider digital-first marketing strategies and product designs that appeal to these younger consumers, potentially leveraging platforms where they are most active to drive life application growth.

Urbanization and Population Growth in High-Risk Areas

Urbanization and population growth are increasingly concentrating people and assets in areas prone to natural disasters. This escalating exposure means that when events like hurricanes or floods occur, the insured losses are significantly higher. For instance, coastal regions, often experiencing rapid development, are particularly vulnerable.

Everest Re Group, like other insurers, must contend with this growing risk. The concentration of higher-valued properties in these vulnerable zones amplifies potential payouts from catastrophic events. This necessitates ongoing refinement of risk assessment tools and underwriting strategies to account for these evolving demographic and environmental pressures.

Key considerations for Everest Re Group include:

- Increased Insured Losses: Growing populations in flood plains and coastal areas directly correlate with higher insured losses from weather-related events.

- Asset Concentration: Higher property values in high-risk zones intensify the financial impact of natural catastrophes on insurers.

- Risk Model Adaptation: Continuous updates to catastrophe risk models are crucial to accurately reflect the changing landscape of urbanization and climate impacts.

- Underwriting Adjustments: Pricing and coverage strategies need to adapt to the heightened exposure presented by population shifts into vulnerable geographies.

Evolving Attitudes Towards Corporations and Accountability

Societal expectations of corporations are shifting, with a growing emphasis on transparency and ethical conduct. This evolving landscape can translate into a greater willingness among the public and legal systems to impose significant penalties, often in the form of punitive damages, when perceived wrongdoing occurs. For a company like Everest Re Group, this means that the severity of claims, particularly those involving corporate responsibility, could potentially increase.

Navigating this environment requires Everest Re Group to proactively demonstrate strong accountability. This involves not only robust risk management frameworks but also transparent communication and responsive claims handling. The company may need to adapt its strategies to reflect these heightened societal expectations, ensuring that its operations and responses align with a commitment to corporate citizenship.

Consider the impact of public perception on insurance claims. For instance, in 2024, there's been a notable increase in class-action lawsuits targeting companies for alleged environmental negligence or data breaches, often seeking substantial damages. This trend suggests that corporate accountability is becoming a more significant factor in the financial and legal outcomes for businesses across industries.

- Increased Litigation Risk: Evolving societal attitudes often fuel a greater propensity for litigation, potentially leading to more frequent and higher-value claims against corporations.

- Demand for Transparency: Stakeholders, including customers and investors, increasingly expect corporations to operate with a high degree of transparency, impacting reputation and potential liabilities.

- Punitive Damages Trend: A growing societal preference for punitive damages in legal cases can significantly escalate the financial impact of adverse judgments for companies.

- Adaptation of Risk Management: Everest Re Group must continually refine its risk management and claims handling practices to address these shifting societal expectations and mitigate potential financial exposures.

Societal shifts are profoundly influencing the insurance landscape, with growing public skepticism towards large corporations potentially impacting legal outcomes, a trend known as social inflation. This is evidenced by a 2023 survey where only 49% of consumers trusted insurance companies, highlighting a need for greater transparency from entities like Everest Re Group.

Demographic changes, such as an aging global population projected to exceed 770 million aged 65+ in 2024, are reshaping insurance demand, increasing the need for health and long-term care products. Simultaneously, younger demographics are showing increased interest in life insurance, suggesting a need for digital-first engagement strategies.

Urbanization concentrates populations and assets in disaster-prone areas, leading to escalating insured losses from natural catastrophes, a challenge for insurers like Everest Re Group. For example, coastal development amplifies potential payouts, necessitating continuous refinement of risk assessment tools.

Societal expectations are also demanding greater corporate accountability and transparency, potentially increasing the risk of significant penalties and punitive damages, as seen in the rise of class-action lawsuits in 2024 targeting alleged corporate negligence.

Technological factors

Artificial Intelligence and Machine Learning are rapidly transforming the Insurtech landscape, presenting significant opportunities for efficiency gains and enhanced capabilities. These technologies are instrumental in automating repetitive tasks, bolstering fraud detection mechanisms, and refining the accuracy of claims processing and risk prediction models. For Everest Re Group, adopting AI-driven solutions can lead to substantial improvements in operational efficiency, more robust risk management strategies, and ultimately, superior customer service experiences.

Data analytics and big data are transforming the insurance landscape, enabling companies like Everest Re Group to gain a competitive edge. The sheer volume of data generated by the insurance industry offers immense potential for uncovering trends and improving decision-making.

Everest Re Group can harness these capabilities to refine risk assessment and pricing, especially for complex and volatile events like severe weather. For instance, advanced analytics can process historical weather patterns and real-time data to more accurately predict the frequency and severity of such events, leading to more precise premium calculations. This data-driven approach also extends to enhancing operational efficiency by identifying areas for cost reduction and process optimization.

Cybersecurity threats pose a significant and escalating risk to the insurance industry, directly impacting business continuity and the ability to serve customers effectively. For a company like Everest Re Group, maintaining uninterrupted operations and safeguarding client information is paramount. The increasing sophistication of cyberattacks means that robust defenses are no longer optional but a core operational necessity.

Everest Re Group must implement and continuously update stringent cybersecurity protocols to defend against evolving threats. This includes investing in advanced threat detection, data encryption, and employee training. Furthermore, establishing clear and mandatory notification processes for any cyber incidents is crucial for transparency and maintaining stakeholder trust, especially when dealing with sensitive policyholder data.

Blockchain Technology

Blockchain technology is increasingly seen as a game-changer for the insurance sector, offering unparalleled security and transparency in data sharing. This can significantly bolster fraud protection, a persistent challenge for companies like Everest Re Group. For instance, a 2024 report by InsurTech Analytics highlighted that blockchain solutions could reduce insurance fraud by up to 20% globally.

The integration of smart contracts, powered by blockchain, presents a compelling opportunity for Everest Re Group to streamline complex processes like claim settlements. These self-executing contracts automatically trigger actions when predefined conditions are met, leading to faster payouts and reduced administrative overhead. By 2025, it's projected that smart contracts could automate over 30% of insurance claims processing.

Furthermore, blockchain's inherent transparency can enhance policy management, providing customers with a clear and immutable record of their coverage and transactions. This could foster greater customer trust and loyalty. Everest Re Group's exploration of these blockchain applications could unlock significant operational efficiencies and a competitive edge in the evolving insurance landscape.

- Enhanced Security: Blockchain provides a decentralized and immutable ledger, making data tampering extremely difficult, thus improving data integrity for Everest Re Group.

- Fraud Reduction: By creating a transparent and auditable trail of transactions, blockchain significantly hinders fraudulent activities within the insurance value chain.

- Streamlined Operations: Smart contracts automate claim processing and policy management, reducing manual intervention and accelerating service delivery.

- Increased Transparency: Policyholders gain clearer visibility into their policy details and claims status, fostering improved customer relationships.

Digital Claims Management Platforms

Digital claims management platforms are increasingly vital for insurers aiming to manage expenses and lessen the impact of claims, particularly with the rise of social inflation. These systems enhance operational efficiency, offer deeper analytical insights, and improve communication between policyholders and insurers, presenting a significant opportunity for Everest Re Group to adopt for risk mitigation.

By leveraging these platforms, Everest Re Group can expect to see tangible benefits. For instance, a report by McKinsey in early 2024 indicated that insurers adopting advanced digital claims processing can achieve a 15-20% reduction in claims handling costs. Furthermore, these platforms facilitate faster claims resolution, which can improve customer satisfaction and reduce the potential for litigation, a key concern in the current market environment.

- Cost Reduction: Digital platforms can automate manual tasks, leading to a projected 15-20% decrease in claims handling expenses as per industry analyses.

- Improved Efficiency: Streamlined workflows and data integration accelerate claims processing times.

- Enhanced Insights: Advanced analytics provide better visibility into claims trends, aiding in proactive risk management.

- Policyholder Experience: Real-time updates and easier communication channels improve engagement and satisfaction.

The ongoing digital transformation is reshaping the insurance industry, with technologies like AI and big data analytics offering significant advantages. Everest Re Group can leverage these advancements for more accurate risk assessment, efficient claims processing, and improved customer engagement. For instance, by early 2025, the adoption of AI in underwriting is projected to increase by 25% across the sector, leading to faster and more precise risk evaluations.

Legal factors

Everest Re Group navigates a complex web of global regulations, with requirements constantly shifting across its operating jurisdictions. For instance, the ongoing development and potential adoption of Insurance Capital Standards (ICS) by bodies like the International Association of Insurance Supervisors (IAIS) aim to harmonize capital requirements internationally. This convergence, while potentially streamlining operations, also necessitates significant adaptation and investment to ensure compliance across diverse markets.

New and evolving data privacy laws, like the UK's Data Reform Bill and the NAIC Insurance Data Security Model Law in the US, are significantly impacting insurers. These frameworks demand strict adherence to data collection, usage transparency, and robust security measures. Everest Re Group must navigate these regulations to prevent substantial penalties, which could affect financial performance.

The rollback of tort reform in various jurisdictions, coupled with the increasing adoption of aggressive litigation tactics like the 'reptile theory,' is fueling social inflation and contributing to larger jury awards. This trend directly impacts casualty insurers, including Everest Re Group, by increasing the cost of claims and the unpredictability of legal outcomes.

For instance, studies indicate a significant rise in nuclear verdicts, often exceeding $10 million, particularly in product liability and catastrophic injury cases. Everest Re Group must therefore closely monitor these evolving litigation trends and proactively adapt its underwriting guidelines and claims management processes to mitigate the escalating risks associated with higher jury awards and prolonged legal battles.

Anti-Greenwashing Regulations

The increasing focus on environmental, social, and governance (ESG) factors has led to a surge in anti-greenwashing regulations globally. For instance, the UK’s Financial Conduct Authority (FCA) has implemented rules requiring firms to ensure sustainability-related claims accurately reflect product characteristics. Everest Re Group, like other insurers, must navigate these evolving legal landscapes to maintain credibility and avoid penalties associated with misleading environmental marketing.

These regulations are designed to protect investors and consumers from unsubstantiated or exaggerated claims about the environmental benefits of financial products and services. Failure to comply can result in significant fines and reputational damage. For example, the EU’s Sustainable Finance Disclosure Regulation (SFDR) aims to bring greater transparency to sustainable investments, impacting how companies like Everest Re Group market their ESG-aligned offerings.

- Regulatory Scrutiny: Increased governmental oversight on ESG claims, particularly in major markets like the EU and UK.

- Compliance Costs: Investment in robust systems and processes to verify and substantiate all sustainability-related marketing.

- Reputational Risk: Potential for significant damage to brand image and investor confidence if greenwashing accusations arise.

- Market Access: Adherence to these regulations is becoming a prerequisite for accessing certain investor pools and markets.

Third-Party Risk Management Guidelines

Regulatory bodies are increasingly focusing on third-party risk management, with new guidelines taking effect in 2024 and continuing into 2025. These updates mandate stricter oversight for companies like Everest Re Group when handling consumer data and managing relationships with external vendors. This heightened scrutiny aims to bolster data security and operational resilience. For instance, the European Union's Digital Operational Resilience Act (DORA), fully applicable from January 2025, places significant emphasis on the ICT third-party risk of financial entities.

Everest Re Group must therefore ensure its third-party risk management framework is robust and fully compliant with these evolving regulations. This involves implementing comprehensive due diligence processes for all partners, continuous monitoring of their security practices, and clear contractual obligations regarding data protection and incident response. Failure to comply could result in significant fines and reputational damage, impacting client trust and market standing. In 2024, the financial services sector saw a notable increase in regulatory enforcement actions related to data privacy and third-party risks.

- Enhanced Due Diligence: Implementing rigorous vetting procedures for all new and existing third-party partners, especially those handling sensitive customer information.

- Continuous Monitoring: Establishing ongoing assessment of third-party compliance, security posture, and performance against contractual agreements.

- Data Protection Clauses: Ensuring all contracts include explicit terms regarding data privacy, breach notification, and data handling responsibilities.

- Incident Response Planning: Developing and testing coordinated response plans for security incidents involving third-party vendors.

Global regulatory frameworks continue to evolve, impacting Everest Re Group's operations. For example, the International Association of Insurance Supervisors (IAIS) is working on Insurance Capital Standards (ICS), aiming for global harmonization, which requires significant investment for compliance. Furthermore, data privacy laws like the UK's Data Reform Bill and the NAIC Insurance Data Security Model Law in the US impose strict data handling and security requirements, with non-compliance leading to substantial penalties.

Environmental factors

The escalating frequency and intensity of extreme weather events, such as hurricanes, severe thunderstorms, and wildfires, are driving a significant rise in insured losses from natural catastrophes globally. This trend directly impacts reinsurers like Everest Re Group, potentially increasing their catastrophe budgets and affecting underwriting profitability.

Climate change is significantly reshaping weather risk patterns, compelling reinsurers like Everest Re Group to constantly refine and broaden their risk models. This necessitates a deeper comprehension of how present and future risks are affected by a shifting climate, which in turn informs adjustments to pricing and risk management strategies.

For instance, the increasing frequency and intensity of extreme weather events, such as the record-breaking hurricane season in 2020 which caused an estimated $115 billion in insured losses in the US alone, highlight the inadequacy of historical data alone for accurate modeling. Everest Re, like its peers, must integrate forward-looking climate projections into its underwriting processes to maintain solvency and profitability.

Despite escalating losses from natural catastrophes, a substantial protection gap persists, with numerous assets remaining uninsured or underinsured. For Everest Re Group, this gap represents a dual challenge and a significant opportunity to broaden its insurance offerings, especially in areas frequently impacted by climate change events. For instance, the insurance industry's global insured losses from natural catastrophes reached $110 billion in 2023, according to Swiss Re, highlighting the vast unmet need.

ESG (Environmental, Social, Governance) Considerations

Environmental, Social, and Governance (ESG) factors are increasingly shaping investment and business strategies. Everest Re Group, like many in the insurance sector, faces growing stakeholder expectations to integrate sustainable practices. This pressure can impact investment portfolios and underwriting decisions, pushing for greater environmental responsibility. For instance, in 2023, the global sustainable investment market reached an estimated $37.7 trillion, indicating a significant shift in capital allocation towards ESG-aligned companies.

Everest Re Group may experience heightened scrutiny regarding its carbon footprint and the environmental impact of its operations and insured activities. Demonstrating a commitment to climate resilience and reducing emissions is becoming a key differentiator. The company's 2024 sustainability report highlighted a 15% reduction in its operational greenhouse gas emissions compared to a 2020 baseline, a step towards meeting its 2030 reduction targets.

- Growing ESG Investment: The global sustainable investment market surpassed $37.7 trillion in 2023, reflecting increased investor focus on ESG criteria.

- Stakeholder Pressure: Insurers like Everest Re are under pressure to adopt sustainable practices, influencing investment and underwriting.

- Climate Risk Management: Demonstrating commitment to climate resilience and emission reduction is crucial for long-term viability and stakeholder confidence.

- Operational Improvements: Everest Re reported a 15% reduction in operational GHG emissions by 2024 from its 2020 baseline.

Transition Risk from Climate Change

Everest Re Group, like many insurers, navigates significant transition risks stemming from the global move towards a low-carbon economy. These risks are multifaceted, encompassing potential policy shifts, rapid technological innovation, and evolving market preferences that can impact asset values and business models.

The insurance industry, in particular, must adapt to regulatory changes aimed at mitigating climate change, which can affect underwriting practices and investment portfolios. For instance, governments worldwide are implementing carbon pricing mechanisms and stricter emissions standards, creating new compliance burdens and potentially devaluing carbon-intensive assets held by insurers.

Managing these transition risks is a critical strategic imperative for Everest Re. This involves:

- Assessing and pricing climate-related transition risks in underwriting: This includes understanding how new regulations and market shifts will affect the insurability of certain industries and assets.

- Integrating climate transition considerations into investment strategies: This means evaluating the long-term viability of investments in a decarbonizing world, potentially divesting from high-carbon sectors.

- Developing new insurance products: There's an opportunity to create innovative solutions that support the transition, such as coverage for renewable energy projects or carbon capture technologies.

By proactively addressing these transition risks, Everest Re can not only safeguard its financial stability but also position itself as a leader in supporting the global transition to a sustainable future.

The increasing frequency and severity of natural catastrophes, such as the record-breaking insured losses of $110 billion in 2023 from natural catastrophes globally, directly impact reinsurers like Everest Re Group, necessitating robust risk modeling and potentially higher catastrophe budgets.

Climate change necessitates a strategic adaptation for Everest Re, requiring updated risk models that incorporate forward-looking climate projections to accurately price and manage evolving weather patterns, a critical step given that historical data alone is proving insufficient, as evidenced by the $115 billion in US insured losses from the 2020 hurricane season.

The substantial protection gap, where numerous assets remain uninsured or underinsured despite escalating losses, presents both a challenge and an opportunity for Everest Re to expand its offerings, particularly in regions susceptible to climate-related events.

Growing stakeholder pressure for Environmental, Social, and Governance (ESG) integration, reflected in the $37.7 trillion global sustainable investment market in 2023, is pushing companies like Everest Re to adopt sustainable practices, impacting investment and underwriting decisions and demanding greater environmental responsibility.

| Environmental Factor | Impact on Everest Re Group | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Extreme Weather Events | Increased insured losses, higher catastrophe budgets, need for advanced modeling | $110 billion in global insured losses from natural catastrophes in 2023 |

| Climate Change Adaptation | Refinement of risk models, integration of forward-looking climate data | Inadequacy of historical data highlighted by 2020 hurricane season losses ($115 billion in US) |

| Protection Gap | Opportunity for product expansion in high-risk areas | Persistent gap indicates significant unmet insurance needs globally |

| ESG Integration & Stakeholder Pressure | Influence on investment and underwriting, demand for sustainability | $37.7 trillion in global sustainable investment market (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Everest Re Group is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading industry-specific research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the reinsurance sector.