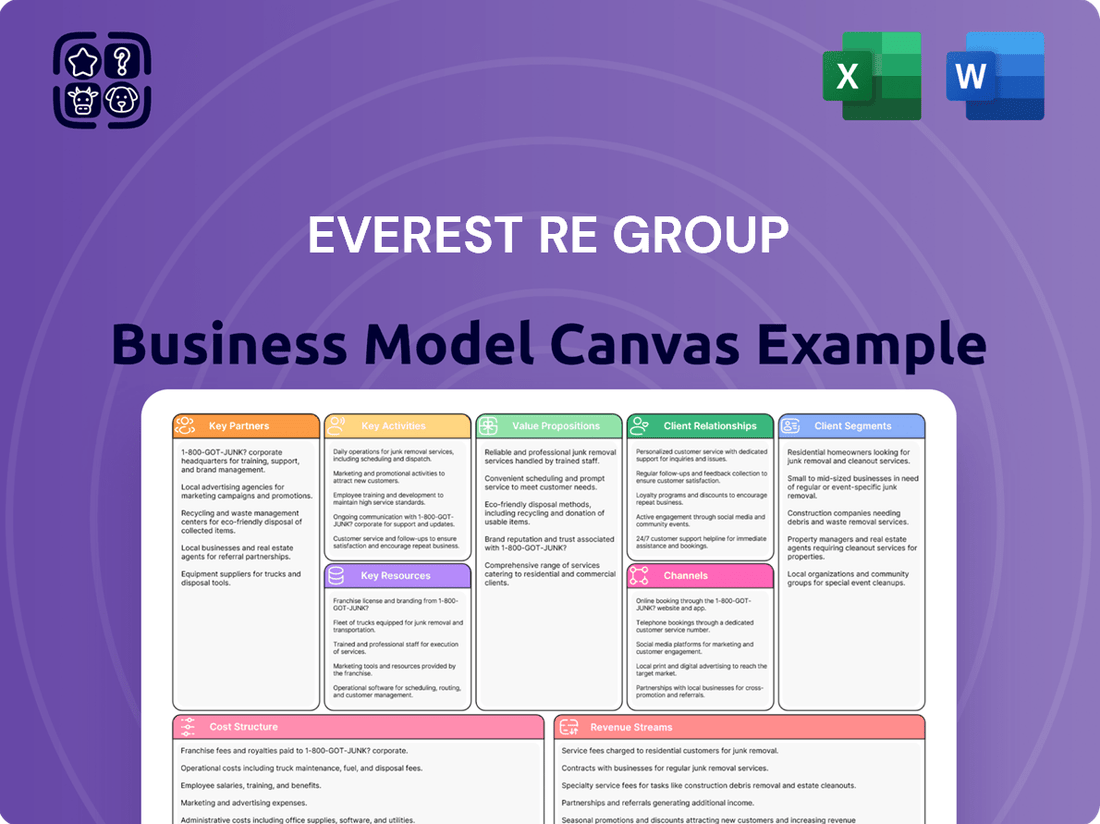

Everest Re Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everest Re Group Bundle

Everest Re Group's Business Model Canvas showcases a robust reinsurance strategy focused on underwriting excellence and diversified risk appetites. It details how they leverage strategic partnerships and a strong capital base to deliver tailored solutions to clients.

Unlock the full strategic blueprint behind Everest Re Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Everest Re Group's success is deeply intertwined with its relationships with reinsurance brokers, notably giants like Marsh McLennan and Aon. In 2024, these intermediaries were instrumental, facilitating a substantial flow of gross written premiums for Everest Re, underscoring their critical role in the group's distribution strategy.

These partnerships are vital for Everest Re to tap into a broad spectrum of ceding companies and ensure its reinsurance solutions reach a global client base. The brokers serve as essential conduits, bridging the gap between Everest Re and businesses looking to offload risk, thereby expanding Everest Re's market reach and operational efficiency.

Everest Re Group's Insurance division heavily relies on wholesale and retail brokers to get its primary insurance coverage into the market. This is a critical part of their distribution strategy, allowing them to connect with a wide array of commercial property and casualty clients.

These broker partnerships are vital for Everest Insurance to gain broad market access and effectively serve the varied needs of their client base, whether on an admitted or non-admitted basis. In 2024, the insurance brokerage industry continued to be a significant channel for specialty insurance providers like Everest, with many brokers reporting strong growth in commercial lines.

Everest Re Group leverages program administrators as a crucial distribution channel for its insurance offerings, tapping into specialized market segments. These partnerships are vital for reaching niche audiences with tailored insurance products.

While no single program administrator held a dominant market share in 2024, their collective contribution underscored Everest Insurance's commitment to a diversified distribution strategy. This approach allows Everest to effectively serve a broad range of specialized insurance needs across various industries.

Third-Party Capital Providers (e.g., Mt. Logan Capital Management)

Everest Re Group strategically partners with third-party capital providers, notably through its Mt. Logan Capital Management subsidiary. This collaboration is crucial for optimizing Everest's exposure to catastrophe risks and expanding its overall capacity in the reinsurance market.

By channeling third-party capital, Everest gains enhanced flexibility in managing its risk portfolio. This approach allows the company to participate more robustly in the property catastrophe reinsurance sector, a key area of its business.

- Capital Optimization: Mt. Logan Capital Management acts as a conduit for external capital, enabling Everest to fine-tune its risk appetite and capital allocation.

- Enhanced Capacity: Access to third-party funds directly increases Everest's underwriting capacity, particularly for large-scale property catastrophe events.

- Market Participation: These partnerships provide additional financial leverage, allowing Everest to pursue greater market share and more significant opportunities in the property catastrophe reinsurance space.

Industry Associations and Regulatory Bodies

Everest Re Group actively engages with industry associations to shape best practices and share insights. For instance, in 2024, participation in forums like the International Insurance Society (IIS) allows for dialogue on emerging risks and market development.

Maintaining robust relationships with regulatory bodies is crucial for compliance and operational integrity. Everest Re Group's proactive engagement ensures alignment with evolving global insurance regulations, such as those impacting capital requirements and solvency, as seen in ongoing discussions around Solvency II updates in Europe.

- Industry Standards: Collaboration with associations like the Reinsurance Association of America (RAA) helps define and uphold industry standards, fostering a more stable and predictable market environment.

- Regulatory Compliance: Strong ties with regulators, including the Bermuda Monetary Authority (BMA) where Everest Re is headquartered, facilitate understanding and adherence to complex international insurance laws.

- Market Influence: Active participation in industry dialogues allows Everest Re to contribute to discussions on critical issues such as climate risk disclosure and cybersecurity, influencing future regulatory frameworks.

- Knowledge Exchange: These partnerships provide a platform for exchanging knowledge on emerging trends and operational efficiencies, benefiting both Everest Re and the broader insurance sector.

Everest Re Group's distribution network is heavily reliant on reinsurance brokers, with firms like Marsh McLennan and Aon playing a pivotal role in channeling premiums. These intermediaries are essential for reaching a diverse client base and facilitating risk transfer, as evidenced by their substantial contribution to Everest Re's gross written premiums in 2024.

The group also partners with program administrators to access specialized market segments, allowing for tailored insurance products to reach niche audiences. While no single administrator dominated in 2024, their collective effort supports Everest's diversified distribution strategy across various industries.

Strategic alliances with third-party capital providers, managed through Mt. Logan Capital Management, are crucial for optimizing risk exposure and increasing underwriting capacity, particularly in the property catastrophe sector. These partnerships enhance Everest's financial flexibility and market participation.

Everest Re also actively engages with industry associations and regulatory bodies, fostering best practices and ensuring compliance. This engagement, exemplified by participation in forums like the International Insurance Society in 2024, allows for dialogue on emerging risks and market development.

| Key Partnership Type | Primary Role | 2024 Significance | Impact on Everest Re |

|---|---|---|---|

| Reinsurance Brokers | Distribution, Risk Transfer Facilitation | Facilitated substantial gross written premiums | Expanded market reach, operational efficiency |

| Program Administrators | Access to Niche Markets, Product Tailoring | Supported diversified distribution strategy | Enabled service to specialized insurance needs |

| Third-Party Capital Providers | Capacity Enhancement, Risk Optimization | Increased underwriting capacity, especially for cat risks | Provided financial flexibility, greater market participation |

| Industry Associations & Regulators | Best Practice Shaping, Compliance, Knowledge Exchange | Dialogue on emerging risks and regulatory frameworks | Ensured regulatory alignment, influenced market standards |

What is included in the product

Everest Re Group's business model centers on providing reinsurance and insurance solutions, leveraging a diversified portfolio and strong underwriting expertise to manage risk for clients and generate stable returns.

It details customer segments like insurers and corporations, channels through brokers and direct sales, and value propositions of risk transfer and capital management, all within a framework of robust financial strength and global reach.

Everest Re Group's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex reinsurance operations, simplifying understanding and strategic alignment for stakeholders.

By visually outlining key partners, activities, and revenue streams, the canvas helps address the pain point of navigating intricate global risk management, enabling more focused problem-solving and innovation.

Activities

Everest Re Group's core operations revolve around disciplined underwriting and robust risk management across property, casualty, and specialty insurance sectors. This entails meticulously evaluating, pricing, and accepting a wide array of risks to secure profitable premiums.

The company's commitment to stringent underwriting practices and effective risk mitigation is fundamental to its sustained success. For example, in the first quarter of 2024, Everest Re reported a gross written premium of $4.1 billion, demonstrating the scale of their risk assumption activities.

Their approach emphasizes a deep understanding of risk exposures, utilizing sophisticated modeling and analytics to ensure appropriate pricing and capital allocation. This focus underpins their ability to navigate complex market conditions and deliver consistent returns.

Everest actively manages its insurance and reinsurance portfolios to boost returns and smooth out earnings. This involves making strategic shifts in its book of business. For instance, in its insurance segment, Everest employed a '1-Renewal Strategy' to address underperforming casualty lines, aiming to concentrate on more profitable areas.

This portfolio optimization is crucial for navigating market cycles and ensuring long-term profitability. By strategically adjusting exposures and underwriting focus, Everest aims to achieve a more resilient and higher-performing business. The company's commitment to active management underscores its proactive approach to risk and reward in the complex reinsurance landscape.

Everest Re Group’s claims management and settlement process is a cornerstone of its operations, focusing on efficient and equitable handling of claims for its reinsurance and insurance clients. This meticulous approach is vital for fostering trust and solidifying long-term relationships within the insurance sector.

In 2024, Everest Re Group continued to emphasize prompt and accurate claim adjudication. For instance, the company’s commitment to service excellence was reflected in its operational efficiency, aiming to minimize processing times and ensure fair payouts, which is paramount for client retention.

Investment Management

Everest Re Group's investment management is a core activity, focused on generating substantial net investment income from its significant asset base. This strategic deployment of capital aims to maximize returns, acting as a crucial pillar of the company's overall profitability.

Investment performance is as vital as underwriting income for Everest Re Group. For instance, in the first quarter of 2024, Everest reported total investment income of $302.6 million, a notable increase from the prior year, highlighting the importance of this segment.

- Maximize Net Investment Income: Actively manage a diverse portfolio to generate consistent and growing investment returns.

- Strategic Asset Allocation: Prudently allocate capital across various asset classes to balance risk and reward, optimizing for long-term growth.

- Performance Enhancement: Continuously monitor and adjust investment strategies to ensure strong performance that complements underwriting results.

Capital Management and Allocation

Everest Re Group’s capital management and allocation strategy is centered on prudent stewardship and agile deployment to bolster shareholder value and ensure robust financial health. This means making smart choices about where to put their capital to work, fueling growth, effectively managing risks, and maximizing returns across their worldwide business.

In 2024, Everest Re demonstrated this commitment through strategic capital deployment. For instance, their robust underwriting results and disciplined approach to capital allowed them to return significant capital to shareholders.

- Capital Deployment: In the first quarter of 2024, Everest Re repurchased approximately $100 million of its common stock, reflecting confidence in its valuation and a commitment to shareholder returns.

- Strategic Investments: The company continued to invest in its core insurance and reinsurance segments, as well as exploring strategic opportunities in emerging markets and specialty lines, aiming for enhanced risk-adjusted returns.

- Financial Strength: Everest Re maintained strong capital ratios throughout 2024, exceeding regulatory requirements and industry benchmarks, which is crucial for its ability to underwrite large risks and respond to market opportunities.

- Shareholder Returns: Beyond buybacks, the company consistently paid dividends, underscoring its focus on delivering ongoing value to its investors.

Everest Re Group's key activities center on disciplined underwriting, managing its insurance and reinsurance portfolios strategically, and optimizing investment income. These actions are supported by robust capital management and efficient claims handling, all aimed at generating consistent profitability and shareholder value.

The company's focus on underwriting excellence and risk mitigation is evident in its financial performance. For the first quarter of 2024, Everest Re reported gross written premiums of $4.1 billion, showcasing the significant volume of risk it assumes. This is complemented by its investment management, which yielded $302.6 million in total investment income in the same period, highlighting the dual engines of its profitability.

| Key Activity | Description | 2024 Data Point |

| Underwriting & Risk Management | Evaluating, pricing, and accepting diverse risks across property, casualty, and specialty insurance. | Gross Written Premiums: $4.1 billion (Q1 2024) |

| Portfolio Management | Actively adjusting insurance and reinsurance portfolios to enhance returns and smooth earnings. | '1-Renewal Strategy' implemented for underperforming casualty lines. |

| Investment Management | Generating net investment income from a substantial asset base through strategic capital deployment. | Total Investment Income: $302.6 million (Q1 2024) |

| Capital Management | Prudent stewardship and agile deployment of capital to bolster shareholder value and financial health. | Share Repurchases: ~$100 million (Q1 2024) |

| Claims Management | Efficient and equitable handling of claims for reinsurance and insurance clients. | Emphasis on prompt and accurate claim adjudication. |

Full Version Awaits

Business Model Canvas

The Everest Re Group Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis you will gain access to. Once your order is complete, you will download this identical file, containing all the insights and strategic frameworks for Everest Re Group's operations.

Resources

Everest Re Group's underwriting prowess is anchored by its seasoned leadership team and a deeply ingrained culture of disciplined risk assessment. This intellectual capital is vital for accurately pricing complex risks, a cornerstone of their operational success.

The company's ability to attract and retain top-tier underwriting talent is a significant competitive advantage. In 2024, the insurance industry faced ongoing challenges with inflation and geopolitical instability, making experienced underwriters who can navigate these complexities more valuable than ever.

Everest Re Group's financial capital and strong balance sheet are paramount. This includes substantial shareholders' equity, which stood at $14.2 billion as of March 31, 2024, and a high-quality investment portfolio valued at $71.7 billion at the end of 2023.

This robust financial foundation enables Everest Re to underwrite significant insurance and reinsurance risks effectively. It also instills crucial confidence in their clients and the broader investor community, underscoring their stability and capacity.

Everest Re Group's global franchise and brand reputation are cornerstones of its business model, built over 50 years. This extensive experience has fostered a reputation for disciplined underwriting and reliability in the reinsurance and insurance markets.

The company's established global operating affiliate network is a critical resource, enabling it to serve clients and manage risks across diverse geographical regions. This network is a testament to its long-standing presence and deep market penetration.

As of the first quarter of 2024, Everest Re Group reported gross written premiums of $4.2 billion, reflecting the scale and reach of its global operations. This robust performance underscores the strength and value of its brand and franchise.

Diversified Product and Distribution Offerings

Everest Re Group's extensive portfolio of property, casualty, and specialty reinsurance and insurance products is a core asset. This breadth allows them to serve a wide array of clients, from those needing standard property coverage to businesses requiring highly specialized risk solutions.

Complementing this product diversity are their varied distribution channels, which include brokers, agents, and direct sales. This multi-faceted approach ensures they can reach different market segments effectively.

- Product Breadth: Everest Re offers a comprehensive suite of reinsurance and insurance products, covering property, casualty, and specialty lines, enabling them to meet diverse client demands.

- Distribution Channels: The company utilizes a mix of brokers, agents, and direct sales to access various market segments, enhancing their reach and client engagement.

- Risk Diversification: By offering a wide range of products and engaging multiple distribution channels, Everest Re effectively spreads its risk exposure across different lines of business and client types.

- Market Adaptability: This diversified strategy allows Everest Re to adapt to changing market conditions and client needs, a key factor in their sustained performance.

Advanced Technology and Data Analytics

Everest Re Group leverages advanced technology and data analytics to refine its risk modeling and underwriting processes. This technological backbone is crucial for navigating the complexities of the insurance and reinsurance markets, allowing for more precise risk assessment and pricing.

In 2024, the insurance industry's investment in data analytics continued to grow, with companies focusing on AI and machine learning to improve claims processing and fraud detection. This trend directly benefits reinsurers like Everest by providing richer, more granular data for analysis.

- Data-Driven Underwriting: Utilizing sophisticated analytics to assess and price risks more accurately, leading to better portfolio performance.

- Operational Efficiency: Implementing technology to streamline operations, reduce costs, and enhance customer service.

- Competitive Advantage: Leveraging advanced analytics to identify emerging trends and opportunities, thereby maintaining a leading market position.

Everest Re's key resources include its intellectual capital, embodied by experienced underwriters, and its substantial financial strength, evidenced by $14.2 billion in shareholders' equity as of Q1 2024. Their global operational network and strong brand reputation, built over 50 years, are also critical assets. Furthermore, a diverse product portfolio across property, casualty, and specialty lines, coupled with advanced data analytics capabilities, underpins their market position.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Capital | Seasoned underwriting talent and risk assessment culture. | Attracting and retaining top-tier talent is crucial in a volatile 2024 market. |

| Financial Capital | Strong balance sheet and investment portfolio. | Shareholders' equity: $14.2 billion (Q1 2024); Investment portfolio: $71.7 billion (end of 2023). |

| Global Franchise & Brand | 50+ years of experience and a reputation for reliability. | Gross written premiums: $4.2 billion (Q1 2024), reflecting global reach. |

| Product Portfolio & Distribution | Diverse insurance/reinsurance products and multi-channel sales. | Broad offerings in property, casualty, and specialty lines; utilizes brokers, agents, and direct sales. |

| Technology & Data Analytics | Advanced systems for risk modeling and underwriting. | Industry trend in 2024: increased investment in AI/ML for improved risk assessment. |

Value Propositions

Everest Re Group provides extensive property, casualty, and specialty reinsurance and insurance products designed to tackle intricate client needs. This broad portfolio ensures clients receive customized protection against a wide array of developing risks.

In 2024, Everest Re Group's commitment to comprehensive risk solutions was evident in its robust underwriting performance. For instance, their property catastrophe reinsurance segment, a key area for managing complex risks, saw significant premium growth, reflecting market demand for their expertise.

Everest Re Group's financial strength is a cornerstone of its value proposition, offering clients peace of mind that their claims will be honored, even after significant catastrophic events. This is backed by a robust balance sheet and a history of dependable financial performance.

As of the first quarter of 2024, Everest Re reported a strong capital position, with total shareholders' equity exceeding $13 billion. This substantial financial backing ensures the company's capacity to meet its obligations, providing a critical layer of security for its policyholders and partners.

Everest Re Group's underwriting excellence is built on a foundation of rigorous discipline and sophisticated risk management. This commitment ensures they deliver top-tier solutions that consistently perform, offering clients and shareholders stable and predictable outcomes.

In 2024, Everest demonstrated this through strong underwriting results, with their Gross Written Premiums (GWP) for the first nine months reaching $16.4 billion, a significant increase driven by their strategic focus on profitable growth areas. Their disciplined approach is reflected in a combined ratio that remained competitive within the industry, underscoring their ability to manage risk effectively.

Global Reach and Local Expertise

Everest Re Group leverages its extensive global network to provide insurance and reinsurance solutions across numerous countries. This worldwide operational footprint is complemented by a deep understanding of local market dynamics, regulatory environments, and specific client requirements in each region. For instance, in 2023, Everest reported gross written premiums exceeding $17 billion, a significant portion of which was generated from international operations, showcasing their broad market penetration.

This dual capability of global reach and local expertise allows Everest to effectively cater to a diverse international clientele. They can offer tailored solutions that address the unique risks and opportunities present in different geographical markets. Their ability to navigate these varied landscapes is a key differentiator, enabling them to serve clients ranging from multinational corporations to regional businesses with precision and cultural sensitivity.

Key aspects of this value proposition include:

- Worldwide operational presence: Everest operates in key insurance and reinsurance markets globally.

- Localized market understanding: Deep insights into regional nuances, regulations, and client needs.

- Diverse international client base: Ability to serve a wide array of clients across different geographies and industries.

- Tailored risk solutions: Customized offerings that reflect specific local market conditions and client demands.

Long-Term Partnership and Responsiveness

Everest Re Group cultivates enduring client relationships by deeply understanding the insurance market's intricacies and proactively adapting to evolving needs. This commitment fosters trust and mutual growth, forming the bedrock of their long-term partnerships.

Their exceptional responsiveness to shifting market dynamics and emerging risks underscores a dedication to providing consistent support and innovative solutions, ensuring clients are well-equipped to navigate an unpredictable landscape.

- Client-Centric Understanding: Everest’s approach focuses on comprehending unique client challenges, leading to tailored solutions and stronger, lasting alliances.

- Market Adaptability: The company’s agility in responding to market changes and new risk exposures demonstrates a forward-thinking strategy that benefits its partners.

- Enduring Relationships: By prioritizing responsiveness and deep market insight, Everest aims to build partnerships that withstand economic fluctuations and evolving risk environments.

Everest Re Group's value proposition centers on providing comprehensive, customized risk management solutions backed by financial strength and underwriting expertise. They offer a broad spectrum of property, casualty, and specialty reinsurance and insurance products, ensuring clients are protected against a wide array of evolving risks.

In 2024, Everest demonstrated its commitment to robust underwriting and financial stability. For the first nine months of 2024, Gross Written Premiums (GWP) reached $16.4 billion, reflecting strong market demand and the company's strategic focus on profitable growth. This growth was achieved while maintaining a competitive combined ratio, underscoring their effective risk management capabilities.

Their global operational presence, combined with deep local market understanding, allows Everest to deliver tailored solutions to a diverse international clientele. This adaptability ensures they can effectively address unique risks and opportunities across various geographical regions, fostering enduring client relationships built on trust and responsiveness.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Total Shareholders' Equity | >$13 billion | Indicates strong financial backing and capacity to meet obligations. |

| Gross Written Premiums (9M 2024) | $16.4 billion | Demonstrates significant market penetration and growth in key segments. |

| International Operations Contribution | Significant portion of >$17 billion GWP (2023) | Highlights broad market reach and expertise in global risk management. |

Customer Relationships

Everest Re Group cultivates its customer relationships primarily through a robust network of brokers. This includes reinsurance brokers who facilitate large-scale risk transfer, wholesale brokers who access specialized markets, and retail brokers who serve direct clients. These intermediaries are crucial for managing client interactions, ensuring seamless policy placement, and delivering ongoing service and support.

While the majority of Everest Re Group's reinsurance placements are facilitated through brokers, direct client engagement plays a crucial role for specific, complex reinsurance needs. This direct interaction allows Everest to gain a granular understanding of a ceding company's unique risk profile and strategic objectives.

In 2024, for instance, Everest reported that its primary distribution channel remained through reinsurance brokers, who handled a significant portion of its gross written premiums. However, the direct channel was instrumental in securing large, bespoke treaties where specialized knowledge and close collaboration were paramount, contributing to a more diversified and resilient portfolio.

Everest Re Group prioritizes cultivating long-term, trust-based relationships with both clients and brokers. This commitment is fundamental to its success in the reinsurance and insurance markets, where consistent performance and reliability are paramount.

In 2023, Everest Re reported a strong renewal period, with significant retention rates across its diverse client base, underscoring the strength of these enduring partnerships. This focus on stability and deep understanding of client needs helps solidify its standing as a global leader.

Proactive Risk Management Consultation

Everest Re Group differentiates itself by offering proactive risk management consultations, moving beyond traditional insurance provision. This approach fosters deeper client engagement by helping them understand and mitigate potential exposures.

- Value-Added Service: Everest's consultations provide clients with actionable insights to improve their risk profiles.

- Relationship Enhancement: By actively participating in risk mitigation, Everest strengthens its bond with clients.

- Mitigation Focus: The aim is to reduce the likelihood and impact of claims through informed strategies.

In 2024, this consultative approach is particularly vital as businesses navigate evolving global risks, from cyber threats to climate change impacts. Everest's expertise helps clients build resilience, a key factor in long-term business success.

Claims Service and Support

Everest Re Group prioritizes claims service and support as a cornerstone of its customer relationships. This involves the efficient and empathetic handling of all claims, ensuring policyholders and ceding companies receive timely and fair resolutions, especially during challenging times.

In 2024, Everest Re Group continued to focus on operational excellence in claims processing. Their commitment to policyholder satisfaction is reflected in their ongoing efforts to streamline claim submission and resolution pathways, aiming to minimize stress during critical moments.

- Claims Efficiency: Everest aims for prompt claim assessment and payout, reinforcing trust.

- Empathetic Support: The group emphasizes understanding and support for customers experiencing loss.

- Reinforcing Trust: Fair and timely claims handling is central to building long-term relationships.

Everest Re Group's customer relationships are built on a foundation of trust and long-term partnerships, primarily facilitated through a strong network of reinsurance brokers. This intermediary channel is crucial for managing client interactions and ensuring seamless policy placement.

Direct client engagement is also vital for complex reinsurance needs, allowing Everest to deeply understand specific risk profiles and strategic objectives. This dual approach, leveraging both brokers and direct channels, ensures comprehensive coverage and tailored solutions.

In 2024, Everest Re Group continued to emphasize proactive risk management consultations, moving beyond traditional insurance to help clients understand and mitigate exposures. This consultative approach is particularly important as businesses navigate evolving global risks.

Claims service and support are paramount, with Everest focusing on efficient and empathetic handling to ensure timely and fair resolutions, reinforcing trust and strengthening client bonds.

| Customer Relationship Aspect | Description | 2024/2023 Relevance |

|---|---|---|

| Broker Network | Primary distribution via reinsurance, wholesale, and retail brokers. | Remained the primary channel for gross written premiums in 2024. |

| Direct Engagement | Crucial for complex, bespoke reinsurance needs. | Instrumental in securing large treaties requiring specialized knowledge and close collaboration. |

| Consultative Approach | Proactive risk management advice and mitigation strategies. | Vital for clients navigating evolving global risks like cyber threats and climate change impacts. |

| Claims Service | Efficient and empathetic handling of claims. | Focus on operational excellence in processing to minimize customer stress and reinforce trust. |

Channels

Reinsurance brokers are the vital link, connecting Everest Re Group with insurance companies that need to transfer risk. These intermediaries are crucial for distributing Everest's diverse reinsurance offerings across the globe.

In 2024, the global reinsurance market continued to show resilience, with brokers playing a pivotal role in navigating complex risk landscapes and facilitating significant capital flows. Their expertise ensures that Everest's capacity reaches insurers effectively, supporting the transfer of substantial liabilities.

Everest Insurance leverages wholesale brokers to tap into niche markets and place complex primary insurance policies, especially for specialized risks. In 2024, the specialty insurance market, where wholesale brokers are crucial, continued to show robust growth, with premiums in excess of $100 billion annually in the US alone.

Retail brokers are a crucial channel for Everest Re Group, enabling broader market penetration within its insurance segment. These intermediaries act as a direct link, connecting Everest Insurance with a diverse array of individual businesses and organizations across various industries.

In 2024, the insurance industry continued to see significant reliance on broker networks for distribution. For instance, a substantial portion of commercial insurance policies in the US are placed through brokers, highlighting their indispensable role in reaching end-customers.

Program Administrators

Program administrators are a crucial distribution channel for Everest Re Group's insurance segment, allowing the company to efficiently reach specialized markets and affinity groups with customized insurance products. These administrators handle various operational aspects, from underwriting and policy issuance to claims management, effectively acting as an extension of Everest's core insurance operations. This strategic partnership enables Everest to tap into segments that might otherwise be challenging to access directly, fostering growth and diversification.

In 2024, the specialty insurance market, where program administrators often operate, continued to show resilience and growth. For instance, the U.S. specialty insurance market was projected to grow by approximately 5-7% in 2024, driven by demand for unique coverages and risk management solutions. Everest's engagement with program administrators allows them to capitalize on these trends by offering innovative products tailored to specific industry needs, such as professional liability for tech startups or specialized coverage for the construction sector.

- Specialized Market Access: Program administrators provide Everest with direct access to niche markets and affinity groups, enabling targeted product distribution.

- Operational Efficiency: They manage key insurance functions, reducing Everest's operational burden and allowing for a focus on core competencies.

- Product Tailoring: This channel facilitates the development and delivery of bespoke insurance solutions designed for specific client needs.

- Market Insights: Program administrators offer valuable feedback and data on emerging risks and customer demands within their specialized segments.

Direct Placement (for Reinsurance)

Direct placement allows Everest Re to engage directly with ceding companies, bypassing intermediaries. This is often utilized when a client specifically desires a direct relationship with the reinsurer to tailor coverage for unique risks or complex programs.

This channel provides Everest with enhanced control over the underwriting process and client interaction, fostering deeper partnerships. In 2024, Everest Re continued to leverage direct placement for strategic accounts, particularly in specialized lines of business where direct engagement adds significant value.

- Direct Relationship: Facilitates closer collaboration and understanding of client needs.

- Tailored Solutions: Enables customized reinsurance programs for specific risks.

- Market Access: Provides direct access to primary insurers seeking reinsurance capacity.

Everest Re Group utilizes a multi-faceted channel strategy to distribute its reinsurance and insurance products. Key channels include reinsurance brokers, wholesale brokers for specialty insurance, retail brokers for broader market penetration, program administrators for niche markets, and direct placement for strategic accounts.

In 2024, the reinsurance market saw continued reliance on brokers, with global reinsurance premiums estimated to exceed $700 billion. Wholesale brokers were instrumental in the specialty insurance sector, which in the US alone generated over $100 billion in premiums in 2024, facilitating access to complex risks.

Program administrators offered Everest efficient access to specialized segments, supporting the projected 5-7% growth in the U.S. specialty insurance market for 2024. Direct placement allowed for tailored solutions and deeper client relationships, particularly for unique or complex risk programs.

| Channel | Role | 2024 Market Relevance |

|---|---|---|

| Reinsurance Brokers | Connect Everest with insurers needing risk transfer; global distribution | Crucial for navigating complex risks and facilitating capital flow |

| Wholesale Brokers | Place complex primary insurance for specialized risks | Key to robust growth in the U.S. specialty insurance market (>$100B premiums) |

| Retail Brokers | Direct link to businesses for insurance segment; broad market penetration | Indispensable for reaching end-customers in commercial insurance |

| Program Administrators | Reach niche markets/affinity groups with customized products | Facilitate growth in specialty insurance (projected 5-7% US growth in 2024) |

| Direct Placement | Direct engagement with ceding companies for tailored coverage | Enhances control and fosters deeper partnerships for strategic accounts |

Customer Segments

Global insurance companies, known as ceding companies, represent the foundational customer segment for Everest Re Group's reinsurance operations. These are insurers from across the globe, spanning from massive international corporations to more localized regional entities, all looking to offload parts of their risk exposures.

In 2024, the property catastrophe reinsurance market, a key area for these ceding companies, saw significant rate increases, with some renewals experiencing hikes of 10-20% or more, reflecting the ongoing need for capacity and risk transfer solutions.

These clients engage Everest Re to manage volatility, enhance their balance sheets, and gain the capacity to underwrite larger risks, thereby supporting their own growth and stability in an ever-changing risk landscape.

Everest Re Group, through its Everest Insurance division, provides essential primary insurance coverage to large corporations and businesses. These clients span diverse industries and rely on Everest for protection against property, casualty, and specialized risks.

In 2024, the property and casualty insurance market for large enterprises continued to see robust demand, with Everest actively participating in offering tailored solutions. The company's commitment to underwriting excellence and financial strength makes it a preferred partner for businesses seeking comprehensive risk management.

Everest Re Group actively serves specialty and niche market clients, providing bespoke insurance and reinsurance solutions for those with unique or specialized risk profiles. This segment is crucial for Everest, as it allows them to leverage their underwriting expertise in areas where standard market offerings may not suffice.

Key areas of focus include property catastrophe reinsurance, where Everest offers capacity for high-severity, low-frequency events, and aviation insurance, covering the complex risks inherent in the aerospace industry. They also cater to other specialty lines, demonstrating a broad capability to address uncommon exposures across various sectors.

In 2024, the specialty insurance market continued to show robust growth, with Everest positioned to benefit from this trend. For instance, the global aviation insurance market, a key niche for Everest, was projected to see premiums rise due to increased air travel and evolving aircraft technology, creating demand for specialized coverage.

Public Entities and Governmental Organizations

Everest Re Group offers specialized reinsurance and insurance solutions tailored for public entities and governmental organizations. These products address the unique and often large-scale risks faced by these bodies, such as natural disaster protection or liability coverage for public infrastructure projects. For instance, in 2024, governments globally continued to invest heavily in climate resilience, creating demand for parametric insurance products that trigger payouts based on predefined weather events, a segment Everest Re actively serves.

These tailored offerings empower public sector clients to manage significant financial exposures effectively. This includes coverage for catastrophic events, political risks, and specialized liabilities that are beyond the scope of standard insurance policies. The ability to secure coverage for such high-impact, low-frequency events is crucial for maintaining public services and financial stability.

Key areas of focus for these customer segments include:

- Disaster Risk Financing: Providing coverage for natural catastrophes like hurricanes, earthquakes, and floods, often through parametric triggers.

- Public Liability: Insuring against claims arising from the operation of public services and infrastructure.

- Political Risk Insurance: Offering protection against losses due to government actions or instability.

- Cybersecurity for Public Infrastructure: Addressing the growing threat of cyberattacks on critical public systems.

Brokers and Program Administrators

Brokers and program administrators are crucial partners for Everest Re Group, acting as a key distribution channel. Everest must offer them competitive products and streamlined processes to secure their business.

In 2024, the insurance brokerage sector continued to consolidate, with larger firms wielding significant market power. This trend underscores the need for Everest to provide exceptional service and compelling offerings to retain these vital relationships.

- Competitive Product Portfolios: Offering diverse and innovative insurance solutions that meet evolving market demands.

- Efficient Underwriting and Claims Support: Providing rapid turnaround times and clear communication to facilitate smooth business operations.

- Technological Integration: Developing user-friendly platforms and digital tools that simplify the placement and management of business.

- Strong Relationship Management: Investing in dedicated teams to foster collaboration and address broker needs proactively.

Everest Re Group's customer segments are diverse, encompassing global ceding companies seeking risk transfer, large corporations and businesses requiring primary insurance, and specialty market clients with unique risk profiles. Additionally, public entities and governmental organizations rely on Everest for tailored solutions addressing large-scale risks, while brokers and program administrators serve as vital distribution partners.

In 2024, the property catastrophe reinsurance market, a core area for global insurers, saw significant rate increases, with some renewals experiencing hikes of 10-20% or more, reflecting ongoing demand for capacity. Simultaneously, the specialty insurance market continued its robust growth, with areas like aviation insurance projected to see premium rises due to increased air travel and evolving aircraft technology.

These varied customer groups leverage Everest Re's expertise to manage volatility, enhance financial strength, and secure coverage for complex or high-impact risks. The company's ability to provide bespoke solutions, from disaster risk financing for public entities to specialized coverage for niche markets, underscores its broad market reach and commitment to addressing diverse client needs.

| Customer Segment | Key Needs | 2024 Market Trend Example |

|---|---|---|

| Global Ceding Companies | Risk transfer, balance sheet enhancement, capacity | Property Catastrophe Reinsurance: 10-20%+ rate increases |

| Large Corporations & Businesses | Property, casualty, and specialized risk protection | P&C Market: Robust demand for tailored solutions |

| Specialty/Niche Markets | Bespoke solutions for unique risks | Aviation Insurance: Premium rises due to increased air travel |

| Public Entities/Governmental Orgs | Disaster risk financing, public liability, political risk | Parametric Insurance: Growing demand for climate resilience products |

| Brokers & Program Administrators | Competitive products, efficient processes, strong relationships | Brokerage Sector: Consolidation increasing market power |

Cost Structure

Everest Re Group's most significant cost is incurred losses and loss adjustment expenses (LAE). This category covers payouts to policyholders and ceding companies, plus the administrative costs of handling claims, a fundamental aspect of their insurance and reinsurance operations.

In 2024, Everest Re Group reported net written premiums of $14.9 billion. The majority of their expenses are directly linked to the claims arising from these premiums, reflecting the core risk management function of the business.

Everest Re Group incurs substantial costs in the form of commissions paid to brokers and other intermediaries who are crucial for generating new business. These payments are a direct reflection of the sales effort and distribution network required to acquire premiums.

Beyond commissions, the company also faces significant expenses from various taxes and regulatory fees levied on its insurance operations. These costs are inherent to operating within the financial services industry and are directly tied to the volume of premiums managed.

In 2023, Everest Re's total commission and other acquisition costs amounted to approximately $1.5 billion, representing a notable portion of their overall operating expenses. This figure underscores the importance of managing these variable costs effectively to maintain profitability.

Underwriting and administrative expenses are core operational costs for Everest Re Group. These include the salaries of their skilled underwriting teams, the overhead associated with managing their global operations, and the investment in technology that supports their risk assessment and policy administration.

For the first nine months of 2024, Everest Re reported net written premiums of $4.1 billion. Managing these underwriting and administrative costs effectively is crucial for maintaining a strong combined ratio and ultimately driving profitability in the competitive reinsurance market.

Investment Expenses

Everest Re Group incurs significant costs in managing its investment portfolio, a crucial element for generating investment income. These investment expenses are essential for executing the company's overall investment strategy.

Key components of these costs include fees paid to external asset managers who oversee portions of the portfolio, as well as the transactional costs associated with buying and selling securities. Other operational expenses directly tied to investment activities also contribute to this category.

- Asset Management Fees: Costs associated with hiring external managers to handle investment strategies.

- Trading Costs: Expenses incurred from executing trades, including brokerage commissions and market impact.

- Custodial and Administrative Fees: Charges for safekeeping of assets and related administrative services.

- Research and Data Expenses: Costs for market research, data subscriptions, and analytical tools supporting investment decisions.

For instance, in 2023, Everest Re Group's investment income was $1,363.1 million, with investment expenses amounting to $266.8 million, highlighting the direct impact of these costs on net investment returns.

Catastrophe Losses

Catastrophe losses, while a component of overall losses, stand out as a significant and inherently unpredictable element in Everest Re Group's cost structure, especially given its global reinsurer status. These are substantial payouts triggered by large-scale events like natural disasters.

For Everest Re, managing these catastrophe losses is paramount. In 2024, the industry, including reinsurers like Everest Re, faced a notable increase in catastrophe activity. For instance, insured losses from natural catastrophes globally were estimated to be around $130 billion in 2023, a figure that reinsurers must factor into their pricing and capital allocation strategies.

- Volatile Nature: Catastrophe losses are inherently volatile, making them a key driver of earnings fluctuations for reinsurers.

- Significant Payouts: Events such as hurricanes, earthquakes, and floods necessitate large, often unexpected, financial outlays.

- Impact on Pricing: The frequency and severity of these events directly influence the premiums reinsurers charge for catastrophe coverage.

Everest Re Group's cost structure is dominated by incurred losses and loss adjustment expenses, a direct reflection of their core business of providing insurance and reinsurance. In 2024, the company's net written premiums reached $14.9 billion, with the majority of expenses tied to claims arising from these policies. The company also allocates significant resources to commissions paid to brokers, which were approximately $1.5 billion in 2023, and underwriting and administrative costs essential for global operations and risk assessment.

Investment expenses, including asset management and trading costs, are also a key component, with investment expenses amounting to $266.8 million against $1,363.1 million in investment income in 2023. Furthermore, catastrophe losses represent a substantial and unpredictable cost, with global insured losses from natural catastrophes estimated at $130 billion in 2023, directly impacting reinsurers like Everest Re.

| Cost Category | 2023 Data (Approx.) | 2024 Data (Partial/Estimate) |

| Commissions & Acquisition Costs | $1.5 billion | (Not specified, but proportional to premiums) |

| Investment Expenses | $266.8 million | (Not specified, but linked to investment income) |

| Catastrophe Losses (Industry Estimate) | (Industry estimate of $130 billion in insured losses) | (Continued volatility expected) |

| Net Written Premiums | (Not specified for 2023) | $14.9 billion |

Revenue Streams

Everest Re Group's main engine for generating revenue is its gross written premiums within the reinsurance sector. This figure captures the entirety of premiums collected before any portion is passed on to other reinsurers. It encompasses a broad spectrum of coverage, including property, casualty, and specialized reinsurance products.

In the second quarter of 2025, Everest Re reported a robust performance in this core area, with gross written premiums for reinsurance reaching approximately $3.2 billion. This substantial inflow underscores the company's significant market presence and the demand for its risk-transfer solutions across diverse insurance lines.

Everest Re Group's insurance division is a significant contributor to its revenue, primarily through gross written premiums. This represents the total amount of premiums collected by the company for providing insurance coverage across a wide array of industries.

In the second quarter of 2025, Everest Re reported that its insurance gross written premiums reached approximately $1.41 billion. This figure highlights the substantial volume of business generated by its primary insurance operations.

Net investment income is a substantial and expanding revenue source for Everest Re Group, generated from the performance of its considerable investment portfolio. This income encompasses earnings from fixed-income securities, alternative investments, and various other financial assets. In the second quarter of 2025, this segment contributed $532 million to the company's revenue.

Net Premiums Earned

Net Premiums Earned is a crucial revenue stream for Everest Re Group, representing the portion of gross premiums that has been recognized as revenue for the coverage provided during a specific period. This metric directly reflects the company's underwriting performance and the actual income generated from its insurance and reinsurance contracts. For instance, in the first quarter of 2024, Everest Re reported net premiums earned of $4.1 billion, a significant increase driven by strong performance across its property and casualty segments.

This earned premium is the core of their business, demonstrating the value of the risk they have assumed. It's a more accurate reflection of revenue than gross written premiums because it accounts for unearned premiums, which are premiums paid in advance for coverage that has not yet been provided. Understanding net premiums earned is key to assessing the profitability and stability of an insurer's core operations.

- Net Premiums Earned: The recognized revenue from insurance and reinsurance coverage provided.

- Underwriting Performance: A direct indicator of the success of risk selection and pricing.

- Q1 2024 Data: Everest Re Group reported $4.1 billion in net premiums earned in the first quarter of 2024.

- Segment Growth: Increases were notably strong in property and casualty lines.

Fee Income (e.g., from Third-Party Capital Management)

Everest Re Group, through its subsidiary Mt. Logan Capital Management, generates fee income by managing capital for external investors. This segment, while smaller than its core insurance operations, contributes to revenue diversification.

In 2024, Everest Re's commitment to alternative asset management through Mt. Logan is expected to continue growing, offering a fee-based revenue stream that complements its underwriting profits. This strategy allows Everest to leverage its expertise in managing risk and capital across different investment strategies.

- Fee Income Contribution: While specific 2024 figures for Mt. Logan's fee income are not yet fully disclosed, the segment represents a strategic growth area for Everest, aiming to capture a larger share of the third-party asset management market.

- Diversification Strategy: This fee income stream provides a valuable hedge against the cyclical nature of the insurance industry, offering more predictable revenue.

- Growth Potential: The expansion of third-party capital management is a key element of Everest's broader strategy to enhance its financial performance and market reach.

Everest Re Group's revenue streams are multifaceted, primarily driven by its reinsurance and insurance operations. Net premiums earned represent the core of this, reflecting the actual revenue recognized from assuming risk. Investment income from its substantial portfolio also forms a significant and growing component. Additionally, fee income from capital management activities adds a layer of diversification.

| Revenue Stream | Q2 2025 (Approx.) | Q1 2024 (Approx.) |

|---|---|---|

| Reinsurance Gross Written Premiums | $3.2 billion | N/A |

| Insurance Gross Written Premiums | $1.41 billion | N/A |

| Net Investment Income | $532 million | N/A |

| Net Premiums Earned | N/A | $4.1 billion |

| Fee Income (Mt. Logan Capital) | Growth expected | Growth expected |

Business Model Canvas Data Sources

The Everest Re Group Business Model Canvas is informed by a blend of internal financial statements, investor relations reports, and actuarial data. This ensures a robust understanding of their core operations and financial health.