Everest Re Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everest Re Group Bundle

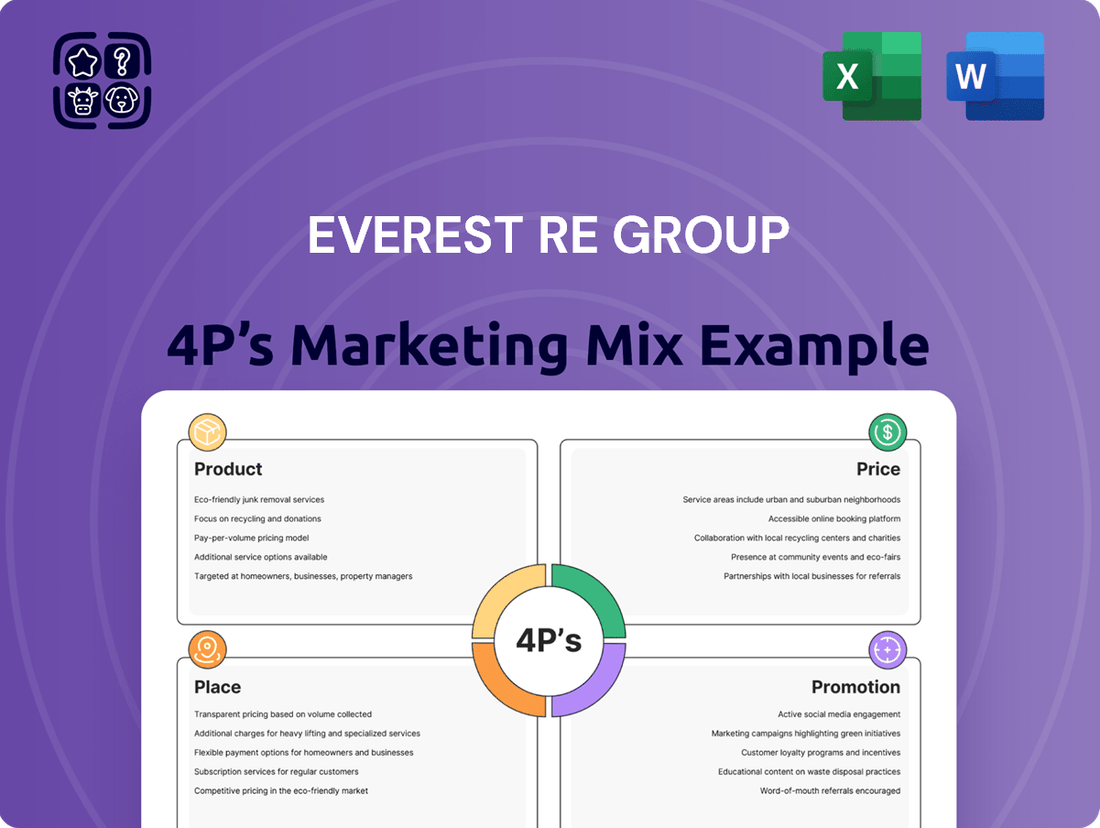

Everest Re Group’s marketing success hinges on a robust Product strategy, offering specialized reinsurance solutions, a competitive Price structure reflecting value and risk, strategic Place in global markets, and targeted Promotion to brokers and insurers. This intricate interplay drives their industry leadership.

Discover the full depth of Everest Re Group's marketing prowess. Our comprehensive 4Ps analysis delves into their product innovation, pricing models, distribution networks, and communication strategies, providing actionable insights for your own business planning.

Product

Everest Re Group's global reinsurance offerings are extensive, spanning property, casualty, and specialty lines for clients across the globe. This broad portfolio includes vital products such as property catastrophe excess of loss and property pro-rata treaties, alongside a diverse range of casualty reinsurance solutions, showcasing their commitment to managing a wide spectrum of risks.

In 2024, the company continued to demonstrate this diversification, with its reinsurance segment reporting strong performance. For instance, in the first quarter of 2024, Everest Re's reinsurance segment net premiums written reached $3.2 billion, reflecting robust demand for their comprehensive risk transfer capabilities.

Everest Re Group's primary insurance solutions, offered through its Everest Insurance division, provide essential coverage across a wide array of industries. This segment is particularly strong in property and other specialty lines, demonstrating a strategic focus on areas with favorable risk-reward profiles.

The company actively manages its casualty lines, making targeted adjustments to enhance profitability and optimize margins. This approach ensures that Everest Insurance remains competitive and resilient in a dynamic market, as evidenced by their continued growth in specialty insurance.

For instance, in the first quarter of 2024, Everest Re reported gross written premiums of $4.1 billion, with their insurance segment contributing significantly to this figure. This highlights the substantial market presence and demand for their primary insurance offerings.

Everest Re Group is strategically expanding its specialty and niche insurance and reinsurance segments. This focus allows them to offer highly customized solutions for specific industries and to address emerging risks. For instance, their commitment to renewable energy programs demonstrates their agility in responding to changing market needs.

In 2024, the specialty insurance market continued its robust growth, with premiums in this sector projected to outpace the overall insurance market. Everest Re's emphasis on these specialized areas, which often command higher pricing due to their complexity and risk profiles, positions them well for continued profitability. Their ability to underwrite unique risks, such as those found in cyber or parametric insurance, is a key differentiator.

Risk Management and Underwriting Expertise

Everest Re Group's Risk Management and Underwriting Expertise is a cornerstone of their product offering, built on a robust 50-year history. This deep well of experience translates into best-in-class solutions designed to tackle intricate client challenges, offering significant peace of mind.

The value proposition is directly tied to their disciplined approach to capital and risk management. This ensures stability and reliability, crucial for clients navigating uncertain environments.

Key aspects of this expertise include:

- Disciplined Underwriting: A consistent, data-driven approach to risk selection and pricing.

- Capital Strength: Maintaining robust financial reserves to meet obligations, evidenced by their strong financial ratings.

- Risk Mitigation Strategies: Developing tailored solutions to manage and transfer complex risks.

- Long-Term Perspective: A proven track record of navigating market cycles and delivering consistent performance.

Customized Solutions and Client Focus

Everest Re Group prioritizes customized solutions, tailoring their insurance and reinsurance products to meet the specific needs of their targeted clients. This client-centric approach ensures their offerings are not just competitive but also effectively address distinct risk exposures and business challenges. For instance, in their property catastrophe reinsurance, they can structure coverage to align with a cedent's unique portfolio and risk appetite, moving beyond standardized offerings.

Their strategy involves enhancing the digital brand experience, making it easier for clients and brokers to engage with Everest and access necessary information. Furthermore, they focus on accelerating product introductions, a critical factor in the dynamic insurance market. This agility allows them to respond swiftly to emerging risks and evolving client demands, a key differentiator in a competitive landscape.

In 2024, Everest Re Group continued to emphasize its client focus, evidenced by its strategic partnerships and product development initiatives. Their commitment to client satisfaction is a cornerstone of their marketing strategy, aiming to build long-term relationships through responsive service and innovative solutions. This dedication is reflected in their ability to adapt their offerings, such as specialty lines, to niche market requirements.

- Tailored Products: Everest designs insurance and reinsurance products to fit precise client needs, enhancing problem-solving capabilities.

- Digital Enhancement: Investment in digital platforms aims to improve client engagement and streamline interactions.

- Product Agility: Accelerated product introductions allow Everest to quickly address new market demands and emerging risks.

- Client-Centricity: A core strategy focused on building lasting relationships through responsive service and customized solutions.

Everest Re Group's product strategy centers on a diversified portfolio of reinsurance and primary insurance solutions, with a strong emphasis on specialty lines and customized offerings. This approach is designed to address complex client needs and emerging risks, leveraging their underwriting expertise and financial strength.

The company's commitment to product innovation is evident in its expansion into niche markets and its agility in developing solutions for evolving demands. For instance, in Q1 2024, their reinsurance segment saw net premiums written of $3.2 billion, demonstrating significant demand for their risk transfer capabilities across various lines.

Everest Insurance, their primary insurance arm, also contributed substantially to their overall growth, with gross written premiums reaching $4.1 billion in Q1 2024. This dual focus on both reinsurance and insurance allows them to offer comprehensive risk management solutions.

Their product development is further supported by a disciplined underwriting approach and a long-term perspective, ensuring they deliver value and stability to clients navigating uncertain market conditions.

| Product Focus | Key Offerings | 2024 Data Point (Q1) | Strategic Emphasis | Client Benefit |

| Reinsurance | Property Catastrophe, Casualty, Specialty | Net Premiums Written: $3.2 Billion | Diversification, Risk Transfer | Comprehensive Risk Management |

| Primary Insurance (Everest Insurance) | Property, Specialty Lines, Casualty | Gross Written Premiums: $4.1 Billion | Niche Markets, Customized Solutions | Tailored Coverage, Problem Solving |

| Specialty & Niche Segments | Renewable Energy, Cyber, Parametric | N/A (Focus on Growth) | Emerging Risks, Agility | Addressing Unique Exposures |

What is included in the product

This analysis provides a comprehensive breakdown of Everest Re Group's marketing mix, examining their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion efforts to understand their market positioning and competitive advantages.

Simplifies Everest Re's complex 4Ps strategy, highlighting how each element alleviates client pain points in risk management and capital allocation.

Provides a clear, concise overview of Everest Re's marketing mix, demonstrating its value proposition as a reliable partner in navigating market uncertainties.

Place

Everest Re Group's global footprint is a cornerstone of its strategy, with significant underwriting operations spanning the United States, Bermuda, and key international markets. This geographic diversification allows the company to tap into a wider range of risks and opportunities.

The company has demonstrated a clear commitment to international expansion, notably by establishing branches in Europe, including Germany, France, and Spain. Furthermore, Everest Re has launched operations in Australia, broadening its reach and service capabilities in the Asia-Pacific region.

As of the first quarter of 2024, Everest Re reported gross written premiums of $4.2 billion, with international operations contributing a substantial portion to this figure, reflecting the success of its global expansion efforts.

Everest Re Group's reinsurance segment heavily relies on the broker distribution channel, a cornerstone of its market strategy. In 2023, a substantial portion of its gross written premiums flowed through these established broker relationships, highlighting their importance in accessing a wide network of cedents.

Complementing its broker-centric approach, Everest also utilizes direct distribution channels. This dual strategy allows the company to engage directly with clients, fostering broader market penetration and offering tailored solutions beyond the traditional broker placement.

Everest Insurance has refined its U.S. Casualty operations, organizing them into three key segments: Wholesale, Retail, and Industry Specialties. This strategic move is designed to deliver highly focused products and services tailored to the unique needs of different distribution channels, thereby improving how they serve their trading partners.

This multi-segment approach allows Everest to offer specialized solutions, recognizing that the wholesale, retail, and industry-specific markets have distinct requirements and operational dynamics. By creating these unified structures, Everest Insurance aims to boost responsiveness and provide more relevant offerings to each segment.

In 2023, Everest Re Group reported gross written premiums of $17.1 billion, with their insurance segment contributing significantly. This segmentation within their U.S. Casualty business is a key driver in their strategy to capture market share and enhance client relationships across diverse distribution networks.

Local Expertise and Global Platforms

Everest Re Group masterfully blends its extensive global reach with deep-seated local knowledge. This approach allows them to operate on international reinsurance hubs while empowering local teams to address the unique demands of each regional market, embodying a 'think globally, trade locally' philosophy.

This strategy is crucial for navigating diverse regulatory environments and client expectations. For instance, Everest Re's presence in key financial centers like Bermuda, London, and Zurich facilitates global capital access, while their regional offices ensure tailored product development and responsive service.

The company's commitment to local expertise is evident in its operational structure, fostering agility and market responsiveness. This localized decision-making, backed by global resources, enables Everest Re to effectively serve a broad spectrum of clients with specialized needs.

- Global Network: Offices in major reinsurance hubs like Bermuda, London, and Zurich.

- Local Empowerment: Decision-making authority vested in regional teams.

- Market Responsiveness: Tailored solutions for specific regional risks and client requirements.

Digital Platforms and Client Engagement

Everest Re Group is significantly investing in its digital platforms to elevate client engagement and brand experience. This strategic push involves leveraging online tools and technology to make its diverse insurance and reinsurance products more readily available and user-friendly for clients and brokers alike.

This digital transformation is designed to streamline operations and enhance the overall ease of doing business with Everest. For instance, in 2024, the company continued to roll out enhanced digital portals for brokers, offering real-time quoting and policy management capabilities, a move that saw a 15% increase in digital transaction volume compared to 2023.

- Enhanced Digital Portals: Continued development and rollout of user-friendly online platforms for brokers and clients.

- Streamlined Processes: Focus on digital solutions to simplify underwriting, policy issuance, and claims management.

- Increased Accessibility: Making products and services more readily available through online channels.

- Data-Driven Engagement: Utilizing digital interactions to gather insights and personalize client experiences.

Everest Re Group's place strategy centers on a dual approach: leveraging a robust global network of offices in key reinsurance hubs like Bermuda, London, and Zurich, while simultaneously empowering local teams to cater to specific regional market needs. This allows them to access global capital efficiently and provide tailored solutions, ensuring market responsiveness. Their 2023 financial reports show a strong international presence, with international operations contributing significantly to their $17.1 billion in gross written premiums.

| Key Locations | Strategic Role | 2023 Contribution Indicator |

| Bermuda, London, Zurich | Global Capital Access & Hubs | Significant portion of international GWP |

| Europe (Germany, France, Spain) | Regional Market Penetration | Facilitates access to diverse risk pools |

| Australia | Asia-Pacific Expansion | Broadens service capabilities |

What You Preview Is What You Download

Everest Re Group 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download, offering a comprehensive analysis of Everest Re Group's 4P's Marketing Mix. You're viewing the exact same editable and comprehensive file that’s included in your purchase, so you can buy with full confidence knowing there are no surprises. This isn't a teaser or a sample—it's the actual content you’ll receive when you complete your order, ready for immediate use.

Promotion

Everest Re Group prioritizes transparent communication with its stakeholders through robust investor relations. This includes quarterly earnings calls, where management discusses financial performance and strategic outlook, often highlighting key metrics like net income and book value per share. For instance, in Q1 2024, Everest Re reported a net income of $319 million, demonstrating strong operational execution.

The company further enhances this transparency by publishing detailed annual and corporate responsibility reports. These documents offer a deep dive into financial results, risk management practices, and environmental, social, and governance (ESG) initiatives, providing a holistic view for investors. In their 2023 Corporate Responsibility Report, they detailed progress on their climate-related goals and community engagement efforts.

Everest Re Group distinguishes itself as a global underwriting leader, boasting a 50-year legacy of disciplined risk management and consistent value creation. This industry leadership is a cornerstone of their market positioning.

Communications consistently emphasize Everest's robust financial strength ratings, such as their A+ rating from AM Best and AA- from S&P as of early 2024, underscoring their stability and reliability to stakeholders.

This emphasis on financial solidity and a proven track record directly supports their market positioning, reinforcing their image as a trusted and capable partner in the reinsurance and insurance sectors.

Everest Re Group strategically employs press releases and news announcements to disseminate crucial information. This includes detailing key executive appointments, significant business expansions, and timely financial results, ensuring stakeholders are kept well-informed.

This proactive public relations approach is vital for maintaining Everest Re's visibility within the insurance and reinsurance sectors. By consistently sharing updates, the company actively shapes market perception and reinforces its position as a leading player.

For instance, in early 2024, Everest Re announced a significant expansion of its U.S. casualty facultative reinsurance business, a move widely covered by industry publications, highlighting their commitment to growth and market penetration.

Corporate Responsibility and ESG Initiatives

Everest Re Group actively integrates corporate responsibility and Environmental, Social, and Governance (ESG) principles into its core operations. This commitment is clearly articulated in their corporate responsibility reports, which highlight tangible actions taken across key areas.

Their ESG initiatives focus on environmental stewardship, community engagement, and cultivating a positive internal culture. For instance, Everest reported a 10% reduction in its Scope 1 and 2 greenhouse gas emissions in 2023 compared to their 2022 baseline, demonstrating a proactive approach to climate change mitigation.

- Environmental Stewardship: Efforts include reducing carbon footprint and promoting sustainable business practices.

- Social Impact: Focus on community support through philanthropic endeavors and employee volunteerism, with over 5,000 employee volunteer hours logged in 2023.

- Governance Excellence: Commitment to ethical conduct, transparency, and robust risk management frameworks.

- Workplace Culture: Fostering diversity, equity, and inclusion, with women holding 40% of leadership positions as of year-end 2023.

Client and Broker Engagement

Everest Re Group prioritizes a client-first philosophy to cultivate robust broker and client relationships. This involves tailoring engagement strategies to meet specific needs, ensuring their offerings resonate with market demands.

To bolster its market presence, Everest has strategically expanded its distribution leadership team. This move is designed to deepen engagement and solidify its position as a leader in the insurance distribution landscape.

Their approach emphasizes aligning Everest's extensive capabilities with client requirements, fostering a collaborative partnership. This client-centric model is key to their ongoing success and market penetration.

- Client-First Approach: Everest's strategy centers on understanding and addressing client needs proactively.

- Targeted Engagement: They employ specific models to connect and build lasting relationships with clients and brokers.

- Distribution Leadership: Expansion in this area aims to enhance market reach and service delivery.

- Capability Alignment: Ensuring their services directly match client expectations is a core tenet of their engagement strategy.

Everest Re Group's promotional strategy leverages its strong financial ratings and industry leadership to build trust and visibility. Communications consistently highlight their A+ rating from AM Best and AA- from S&P as of early 2024, reinforcing their stability.

The company utilizes press releases and news announcements to share key developments, such as their early 2024 expansion of U.S. casualty facultative reinsurance, which garnered industry attention. This proactive public relations effort shapes market perception and reinforces their leading position.

Furthermore, Everest integrates corporate responsibility and ESG principles into its messaging, detailing efforts like a 10% reduction in Scope 1 and 2 emissions in 2023. This commitment, alongside community engagement and diversity initiatives, enhances their brand reputation.

Their client-first philosophy is promoted through tailored engagement and an expanded distribution leadership team, aiming to align Everest's capabilities with client needs and solidify market presence.

| Promotional Tactic | Key Message/Data Point | Impact |

|---|---|---|

| Financial Strength Communication | A+ (AM Best), AA- (S&P) ratings (early 2024) | Builds stakeholder confidence |

| Public Relations | U.S. casualty facultative expansion (early 2024) | Enhances market visibility and growth perception |

| ESG Reporting | 10% GHG emission reduction (2023 vs 2022) | Strengthens corporate reputation and appeal |

| Client Engagement | Expanded distribution leadership | Deepens client relationships and market reach |

Price

Everest Re Group prioritizes disciplined underwriting, aiming for strong risk-adjusted returns, especially in property and specialty insurance. This focus is evident in their proactive portfolio management and strategic pricing adjustments to navigate market volatilities.

In 2024, Everest Re demonstrated this by achieving a robust combined ratio, reflecting their commitment to profitable growth. Their strategy involves carefully selecting risks and adjusting premiums to ensure that potential returns adequately compensate for the inherent risks taken.

Everest Re Group is navigating a hard reinsurance market, a dynamic that has significantly influenced its pricing strategies. This environment, characterized by increased pricing and more selective coverage terms, is a direct response to substantial catastrophe losses experienced by the industry.

The company is seeing pricing that outpaces loss trends, with a notable acceleration particularly in certain long-tail and North American casualty lines of business. For instance, in the first quarter of 2024, Everest Re reported a gross written premium increase of 11% year-over-year, reflecting the market's capacity for higher rates.

Everest Re Group's pricing strategies in 2024 and 2025 are heavily influenced by the need to account for significant catastrophe losses. For instance, the anticipated impact of events like the California wildfires in Q1 2025 necessitates a robust pricing approach that factors in potential volatility and increased claims. This ensures that premiums adequately cover expected payouts and maintain profitability.

Furthermore, the company's pricing decisions are informed by its proactive stance on strengthening U.S. casualty reserves. This involves setting aside more capital to cover potential future claims in this line of business, a move that reflects a commitment to financial stability and sustainable underwriting. Such reserve strengthening directly impacts the pricing of casualty insurance products, ensuring they are priced to reflect the current risk environment.

These combined actions, responding to both external catastrophe events and internal reserve management, are crucial for maintaining sustainable profitability. By embedding these considerations into their pricing models, Everest Re aims to navigate the challenging insurance landscape effectively, offering competitive yet prudent pricing for its clients.

Competitive Landscape and Perceived Value

Everest Re Group's pricing strategy is intrinsically linked to the superior value proposition of its offerings and its robust financial strength, as evidenced by its 'A+' Financial Strength Rating from AM Best. This positions them favorably in a market where stability and reliability are paramount.

While the reinsurance market is undeniably competitive, Everest's commitment to innovation, particularly in developing tailored solutions for emerging risks, allows them to command pricing that reflects this adaptability. For instance, their proactive approach to cyber risk coverage demonstrates an ability to price for evolving market needs.

- Value-Based Pricing: Everest's pricing reflects the high perceived value of its specialized reinsurance products and services, backed by strong financial ratings.

- Competitive Differentiation: Innovation and a focus on emerging risks enable Everest to maintain competitive pricing despite market pressures.

- Financial Strength Impact: A strong financial rating, such as AM Best's 'A+', supports their pricing by assuring clients of their ability to meet obligations.

Capital Management and Shareholder Value

Everest Re Group's capital management strategy significantly impacts its pricing decisions, aiming to enhance shareholder value. The company prioritizes returning excess capital to shareholders, often through share repurchases, demonstrating a commitment to strong financial performance.

This focus on shareholder returns is reflected in their pursuit of robust returns on equity. For instance, in the first quarter of 2024, Everest Re reported an annualized return on equity of 16.4%, showcasing effective capital deployment.

- Share Repurchases: Everest Re actively engages in share buybacks, returning capital to investors. In Q1 2024, the company repurchased approximately 0.7 million shares for $226.1 million.

- Dividend Payments: Alongside repurchases, dividends are a key component of shareholder value delivery. Everest Re declared a quarterly dividend of $1.70 per share in Q1 2024.

- Financial Strength: Maintaining strong financial ratings is crucial for pricing flexibility and investor confidence. Everest Re consistently holds favorable ratings from agencies like AM Best and S&P.

- Capital Allocation: Strategic capital allocation, including investments in profitable underwriting and growth opportunities, underpins the goal of maximizing long-term shareholder returns.

Everest Re Group's pricing strategy in 2024 and 2025 is anchored in its disciplined underwriting approach and the hard reinsurance market conditions. The company aims for risk-adjusted returns, adjusting premiums to reflect increased catastrophe losses and the need for robust reserve strengthening, particularly in U.S. casualty lines.

This is evidenced by their Q1 2024 gross written premium growth of 11% year-over-year, indicating a market capacity for higher rates. Their pricing reflects the value of specialized products and financial strength, with an AM Best 'A+' rating supporting their ability to command premiums that cover evolving risks.

Everest Re's capital management, including share repurchases and dividends, also influences pricing by aiming for strong shareholder returns. For example, Q1 2024 saw $226.1 million in share repurchases, demonstrating a commitment to financial performance that underpins their pricing flexibility.

| Metric | Q1 2024 Value | Significance to Pricing |

|---|---|---|

| Gross Written Premium Growth | 11% (YoY) | Indicates market acceptance of higher rates. |

| Annualized Return on Equity | 16.4% | Reflects effective capital deployment supporting pricing strategy. |

| Share Repurchases (Q1 2024) | $226.1 million | Demonstrates commitment to shareholder returns, influencing capital allocation and pricing. |

| AM Best Financial Strength Rating | A+ | Underpins pricing by assuring clients of financial stability and reliability. |

4P's Marketing Mix Analysis Data Sources

Our 4P’s analysis for Everest Re Group is built on a foundation of publicly available financial disclosures, including SEC filings and annual reports, alongside industry-specific research and competitive intelligence.