Everest Re Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everest Re Group Bundle

Everest Re Group's BCG Matrix offers a strategic snapshot of its diverse portfolio, highlighting which business units are driving growth and which require careful consideration. Understanding these dynamics is crucial for informed capital allocation and future planning.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Everest Re Group.

Stars

The Reinsurance Property Catastrophe XOL segment at Everest Re Group is a clear star. In Q4 2024, this area saw a remarkable 54.4% surge in gross written premiums. This robust growth highlights Everest Re's dominant standing in a dynamic and expanding reinsurance market.

Everest's International Insurance business is a significant growth engine, demonstrating a robust upward trend. This performance indicates strong market positions in expanding global territories, with Everest effectively increasing its presence and customer base.

The company's strategic focus and investments in this segment are pivotal for capturing emerging worldwide opportunities. It holds the potential to evolve into a substantial contributor to future earnings, mirroring the characteristics of a star in the BCG matrix.

Everest Re Group's Property/Short Tail Insurance segment demonstrates impressive performance, showcasing significant growth. In the fourth quarter of 2024, this line saw a substantial increase of 32.3%, followed by a continued strong showing of 19.0% in the first quarter of 2025. This consistent double-digit expansion highlights a dynamic market where Everest is successfully gaining traction.

This robust growth indicates that Everest is capitalizing on opportunities within the property and short tail insurance sector. The company's strategic underwriting practices and ongoing expansion efforts are key drivers behind this momentum. Maintaining this leadership position will require continued focus and investment in this high-performing area.

Other Specialty Lines Insurance

Everest Insurance's Other Specialty lines demonstrated robust expansion, with a notable 37.2% surge in the fourth quarter of 2024 and a 16.1% increase in the first quarter of 2025. This performance highlights effective entry and growth within specialized, high-potential insurance sectors. Continued investment in innovation and strategic market development within these niche areas is crucial for maintaining this upward trajectory.

- Growth Driver: Q4 2024 saw a 37.2% increase in Other Specialty lines.

- Sustained Momentum: Q1 2025 continued this trend with 16.1% growth.

- Market Penetration: Success in high-growth, niche insurance markets.

- Future Strategy: Innovation and market development are key for sustained success.

Global Facultative Reinsurance

Everest Re Group's Global Facultative reinsurance segment is a key growth driver within its tier-1 lead market strategy. This division is actively expanding its footprint and market share.

As a high-growth opportunity, Everest is strategically allocating capital and expertise to bolster its leadership in facultative reinsurance. The company sees substantial return potential in this specialized area.

- Global Facultative Reinsurance Growth: Everest is focused on expanding its market leadership in this segment.

- Strategic Capital Deployment: Capital is being strategically deployed to capitalize on growth opportunities.

- Talent Investment: Investment in talent is crucial for driving success in facultative reinsurance.

- High Return Potential: The segment offers significant prospects for substantial financial returns.

The Reinsurance Property Catastrophe XOL segment is a star performer, exhibiting exceptional growth. This segment's strong market position and the dynamic nature of the catastrophe reinsurance market indicate continued dominance. Everest Re's strategic focus on this area is likely to yield significant returns.

Everest's International Insurance business is another star, demonstrating a robust upward trend and strong market positions in expanding global territories. The company's strategic investments here are pivotal for capturing emerging worldwide opportunities, positioning it as a substantial contributor to future earnings.

The Property/Short Tail Insurance segment, with its consistent double-digit expansion, clearly fits the star profile. Everest is effectively capitalizing on opportunities in this sector, driven by strategic underwriting and ongoing expansion efforts.

Everest Insurance's Other Specialty lines are also stars, showing robust expansion in niche, high-potential sectors. Continued investment in innovation and strategic market development within these areas is crucial for maintaining this upward trajectory.

The Global Facultative reinsurance segment is a star, with Everest actively expanding its footprint and market share. Strategic capital and talent allocation are driving leadership in this specialized area with high return potential.

| Segment | Q4 2024 Growth | Q1 2025 Growth | BCG Category | Key Driver |

|---|---|---|---|---|

| Reinsurance Property Catastrophe XOL | 54.4% | N/A | Star | Market dominance, dynamic market |

| International Insurance | N/A | N/A | Star | Global expansion, customer base growth |

| Property/Short Tail Insurance | 32.3% | 19.0% | Star | Strategic underwriting, market traction |

| Other Specialty | 37.2% | 16.1% | Star | Niche market entry, innovation |

| Global Facultative Reinsurance | N/A | N/A | Star | Market leadership, strategic investment |

What is included in the product

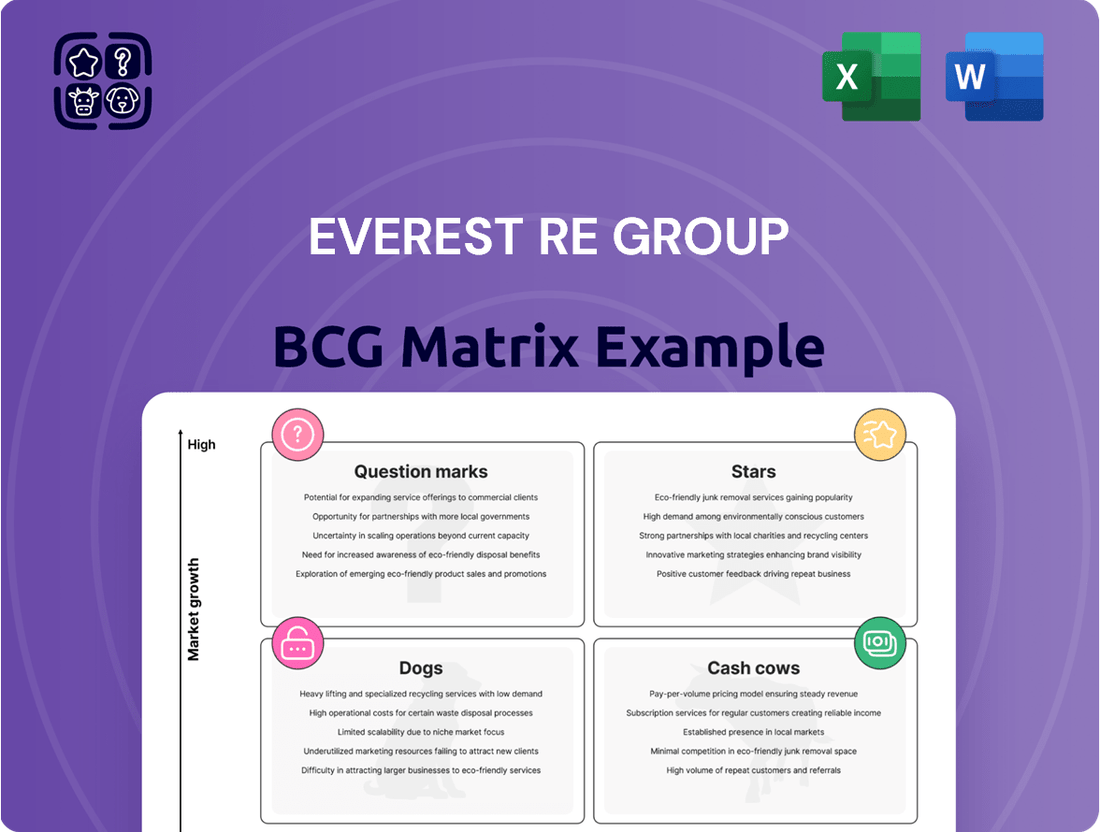

The Everest Re Group BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

The Everest Re Group BCG Matrix simplifies complex portfolio analysis, alleviating the pain of strategic decision-making.

Cash Cows

Everest Re Group's overall reinsurance business is a clear cash cow, boasting a 50-year history of disciplined underwriting. In 2024, this segment delivered an impressive underwriting profit of $1.2 billion.

Despite significant industry-wide catastrophe losses, Everest maintained a robust combined ratio of 89.7% for the entirety of 2024. This performance highlights its consistent ability to generate strong financial results and reliable cash flow.

Looking ahead, the reinsurance market is anticipated to remain favorable through 2025, further solidifying this segment's position as a consistent cash generator for the group.

Everest Re Group's Net Investment Income is a prime example of a Cash Cow within its business portfolio. For the full year 2024, the company achieved a record net investment income of approximately $2 billion. This figure represents a substantial 36% increase compared to 2023, highlighting its robust growth.

This impressive income stream is fueled by a growing asset base and favorable returns in the fixed income markets. The consistency and magnitude of this income provide Everest Re Group with a reliable financial bedrock, capable of absorbing potential headwinds in other areas of its operations.

Everest Re Group's operating cash flow reached a remarkable $5.0 billion for the full year 2024, underscoring the strength of its core business. This significant cash generation is a testament to the company's operational efficiency and profitability.

This strong performance in operating cash flow provides Everest Re Group with substantial financial flexibility. It enables the company to self-fund growth initiatives, service its debt obligations, and reward its shareholders through dividends and buybacks, all without needing to seek external capital.

Well-Seasoned Property and Mortgage Lines Reserves

Everest Re Group's well-seasoned property and mortgage lines are performing as cash cows, showing favorable reserve development in 2024. This positive trend fully counteracted reserve strengthening in other business segments, signaling that these mature lines are now releasing capital and contributing positively to the company's overall financial performance.

These segments are characterized by stability and low growth, but their primary value lies in their consistent ability to generate cash through reserve releases. For instance, in 2024, the favorable development in these seasoned reserves provided a significant buffer against other reserve adjustments.

- Stable Cash Generation: Mature property and mortgage lines consistently generate predictable cash flows.

- Capital Release: Favorable reserve development in 2024 allowed for capital release from these segments.

- Offsetting Other Segments: The positive impact from these cash cows helped offset reserve strengthening elsewhere in the business.

- Low Growth, High Reliability: While not growth engines, their reliability in cash generation makes them valuable.

Traditional Property Pro-Rata Reinsurance

While Property Catastrophe XOL is a star, the broader Property Pro-Rata reinsurance business, with a 19.9% increase in Q4 2024, represents a mature, established line that consistently contributes to premium growth and profitability.

This segment benefits from stable client relationships and a disciplined underwriting approach, making it a reliable source of cash flow for Everest.

- Mature Business Line: Property Pro-Rata reinsurance is a well-established segment within Everest Re Group.

- Consistent Growth: It demonstrated a notable 19.9% increase in Q4 2024, highlighting its ongoing contribution.

- Stable Cash Flow: The business is a reliable generator of cash due to its mature nature and disciplined underwriting.

- Client Relationships: Strong, long-standing client relationships underpin its stability and consistent performance.

Everest Re Group's overall reinsurance business, a bedrock of its operations, continues to perform as a cash cow. In 2024, this segment achieved an underwriting profit of $1.2 billion, demonstrating sustained profitability. The group maintained a robust combined ratio of 89.7% for the year, even amidst industry-wide catastrophe events, underscoring its consistent ability to generate reliable cash flow.

The Net Investment Income stream is another significant cash cow for Everest Re. For the full year 2024, net investment income reached approximately $2 billion, a substantial 36% increase from 2023. This growth is attributed to an expanding asset base and favorable fixed income market returns, providing a stable financial foundation.

Mature lines such as Property and Mortgage reinsurance are also acting as cash cows, evidenced by favorable reserve development in 2024. This positive trend effectively offset reserve strengthening in other areas, signaling that these established segments are releasing capital and contributing positively to the group's financial health.

| Segment | 2024 Underwriting Profit | 2024 Combined Ratio | 2024 Net Investment Income | Key Characteristic |

| Reinsurance Business | $1.2 Billion | 89.7% | N/A | Disciplined underwriting, consistent cash generation |

| Net Investment Income | N/A | N/A | ~$2.0 Billion | Record income, driven by asset growth and market returns |

| Property & Mortgage Reserves | N/A | N/A | N/A | Favorable reserve development, capital release |

Full Transparency, Always

Everest Re Group BCG Matrix

The Everest Re Group BCG Matrix preview you're examining is the identical, fully-unlocked document you'll receive immediately after purchase. This comprehensive report, meticulously crafted with industry-leading analysis, will be delivered without any watermarks or demo content, ensuring you have a professional, ready-to-use strategic tool.

Dogs

Everest Re Group's U.S. casualty lines are currently positioned as a Question Mark in the BCG matrix. The company made a significant move in 2024, strengthening these reserves by $1.5 billion. This action, while necessary for long-term stability, resulted in a net loss for Q4 2024 and a notably higher combined ratio for the insurance segment.

These casualty lines operate in a challenging market characterized by low growth, further exacerbated by factors like social inflation and issues within the legal system. This environment suggests a relatively low market share for Everest in this particular segment. The substantial capital consumption by these lines makes them prime candidates for strategic review, potentially leading to significant restructuring or a reduction in their overall footprint.

Everest Re Group is strategically exiting its Accident and Health (A&H) medical stop loss business. This decision, which contributed to a significant 36.9% drop in A&H gross written premiums for Q4 2024, indicates that this particular product line was not meeting performance expectations or fitting with the company's overall growth objectives.

The divestment of the medical stop loss business aligns with the characteristics of a 'Dog' in the BCG matrix, signifying a low market share and low growth potential. Such exits are typical when a company reallocates resources to more promising ventures, aiming to improve overall profitability and strategic focus.

Everest Re Group's discontinued insurance programs, primarily from before 2012, are now housed in an 'Other' segment. These are run-off businesses, meaning they no longer write new policies but still incur claims management and administrative expenses, representing a drain on resources without new income.

These legacy portfolios are classic examples of 'Dogs' in a BCG matrix context. They consume capital and management attention while offering little to no growth or future potential. For instance, in 2023, Everest Re reported that its 'Other' segment, which includes these run-off lines, had a net unfavorable prior year reserve development of $20 million, highlighting the ongoing cost associated with these discontinued lines.

Sports and Leisure Business (Sold)

Everest Re Group divested its Sports and Leisure business in October 2024, signaling a strategic move away from this segment. The financial results for this unit predominantly reflect policies in force before the sale. This divestiture clearly categorizes the Sports and Leisure business as a 'Dog' within the BCG Matrix, indicating it was an underperforming or non-core asset that the company chose to exit.

The sale of the Sports and Leisure business is a definitive action, marking its removal from Everest Re Group's ongoing operations. Although a limited amount of renewal and new business might continue for a short period post-transaction, the core strategic decision to sell underscores its classification as a 'Dog'. This action aligns with typical business strategies to shed non-essential or low-growth units to focus on more profitable areas.

- Divestiture Date: October 2024

- BCG Classification: Dog

- Reason for Sale: Non-core or underperforming asset

- Impact on Everest Re: Strategic focus on core operations

Asbestos & Environmental (A&E) Exposures

Asbestos & Environmental (A&E) exposures within Everest Re Group's portfolio are categorized as 'Dogs' in the BCG Matrix. These are legacy run-off portfolios within the 'Other' segment, meaning they no longer generate new premiums but continue to demand significant management attention and capital reserves for their long-tail liabilities.

These A&E exposures are classic examples of problematic legacy portfolios that consume resources without contributing to growth. Their inherent nature of being difficult to resolve and their low growth prospects firmly place them in the 'Dog' quadrant, representing a drain on capital and management focus.

- Legacy Liabilities: A&E exposures represent historical liabilities that require ongoing financial and operational management.

- Resource Drain: These portfolios consume capital and management bandwidth without generating new revenue streams.

- Low Growth, High Management: They exhibit minimal growth potential while demanding continuous oversight and reserve allocations.

- BCG Classification: Due to these characteristics, they are classified as 'Dogs' within the BCG Matrix framework.

Everest Re Group's discontinued operations, such as the Sports and Leisure business divested in October 2024, and legacy portfolios like Asbestos & Environmental exposures, are classified as Dogs in the BCG matrix. These segments exhibit low market share and low growth potential, consuming resources without significant future returns.

The company's strategic exit from its Accident and Health medical stop loss business also aligns with the 'Dog' classification, reflecting a decision to shed underperforming or non-core assets. In 2023, the 'Other' segment, which includes many of these run-off lines, reported a net unfavorable prior year reserve development of $20 million, underscoring the ongoing costs associated with these legacy 'Dogs'.

These 'Dog' segments require careful management to minimize resource drain and capital consumption, allowing Everest Re to reallocate capital towards its more promising 'Stars' and 'Question Marks'. The divestiture of the Sports and Leisure business in 2024 is a clear example of shedding such an asset.

| Segment | BCG Classification | Key Characteristics | Recent Action/Data |

| Sports and Leisure | Dog | Low growth, non-core | Divested October 2024 |

| A&E Exposures | Dog | Legacy liabilities, resource drain | Part of 'Other' segment |

| Medical Stop Loss | Dog | Low growth, underperforming | Exited |

| Legacy Run-off Portfolios | Dog | No new premiums, ongoing costs | Contributed to $20M unfavorable reserve development in 'Other' segment (2023) |

Question Marks

Everest Re Group is actively cultivating emerging specialty lines, recognizing their potential for future growth even as some existing lines are established Stars. These nascent areas, while potentially in high-growth markets, currently possess a low market share, necessitating substantial investment to build a strong foothold.

For instance, in the burgeoning field of cyber insurance, a sector projected to see significant expansion, Everest is making strategic investments. While market penetration is still developing, the group is focused on building capabilities and partnerships to capture future opportunities. This mirrors the early stages of other specialty lines where initial investment is crucial for long-term success.

Everest Re Group's cyber insurance initiatives are positioned within a dynamic market described as having 'growing pains' but moving towards maturity, signaling a high-growth opportunity. The company's active participation and collaboration suggest strategic investments aimed at capturing market share in this rapidly evolving sector.

While the cyber insurance market is projected for robust growth, with the global cyber insurance market expected to reach $34.1 billion by 2026, Everest's specific market share and the ultimate success of its initiatives remain uncertain. The company's commitment to this space reflects a calculated approach to a critical and expanding risk landscape.

Everest Re Group is strategically reshaping its North American casualty insurance operations, a move driven by past reserve strengthening and ongoing challenges within U.S. casualty lines. This significant investment aims to bolster profitability and enhance its market standing in a demanding sector.

A key question mark for Everest is the success of this turnaround effort. The group is focusing on improving underwriting results and operational efficiency to achieve sustainable profitability in this historically challenging segment.

Investments in AI and Digital Transformation

Everest Re Group is strategically allocating resources towards artificial intelligence and digital transformation initiatives. This forward-thinking approach aims to secure the company's future competitiveness and foster stronger connections with clients. These investments are recognized as high-potential growth areas vital for long-term success, though they may not yield immediate, substantial market share gains or direct revenue increases.

The precise return on these investments and their definitive impact on Everest Re's market standing remain subjects of ongoing evaluation. For instance, in 2024, the company continued to emphasize digital underwriting platforms and data analytics, areas critical for efficiency and client service enhancement.

- AI and Digital Transformation: Everest Re views these as essential for future-proofing and deepening client relationships.

- Growth Potential vs. Immediate Returns: These are seen as high-growth, crucial for long-term competitiveness, but without immediate high market share or direct revenue.

- Uncertainty of Impact: The ultimate return on investment and market position impact are still being determined.

- 2024 Focus: Continued investment in digital underwriting and data analytics platforms.

New Geographic Market Entries (Greenfield)

Everest Re Group, as a global insurer, might consider new geographic market entries through greenfield strategies. These are typically markets exhibiting high growth potential where Everest currently has little to no presence. Such ventures demand significant upfront capital for building operations, securing regulatory approvals, and executing market entry plans. For instance, emerging markets in Southeast Asia or certain regions in Africa could present such opportunities, though the long-term viability of these nascent ventures is inherently uncertain.

These greenfield expansions are classified as Stars or Question Marks in the BCG matrix, depending on their growth trajectory and market share. The substantial initial investments required can impact short-term profitability. For example, establishing a new underwriting platform and distribution network in a country like India, which has a growing insurance penetration rate, would necessitate millions in capital expenditure. Everest’s 2024 financial reports will likely reflect investments in such strategic initiatives if pursued.

- High Growth Potential Markets: Everest might target regions with projected GDP growth exceeding 5% and increasing demand for insurance products.

- Substantial Initial Investment: Greenfield entries require significant capital for infrastructure, licensing, and talent acquisition, potentially running into tens or hundreds of millions of dollars for a new country operation.

- Uncertain Success: The ultimate success of these new ventures depends on effective market penetration, competitive response, and regulatory stability.

Everest Re's ventures into areas like AI and digital transformation, alongside potential greenfield market entries, represent significant investments with uncertain future payoffs. These initiatives are characterized by high growth potential but currently low market share, fitting the profile of Question Marks in a BCG matrix. The company is actively investing to build capabilities and market presence in these nascent but promising sectors.

The success of these strategic bets hinges on effective execution and market reception. For example, while the global cyber insurance market is projected for substantial growth, Everest's specific market share and the ultimate profitability of its cyber initiatives remain to be seen. Similarly, the financial impact of its digital transformation efforts, including investments in data analytics and underwriting platforms throughout 2024, will be a key indicator of their success.

These Question Mark areas require ongoing capital allocation and strategic focus to transition into Stars or Cash Cows. The company's commitment to these evolving segments underscores a long-term vision for growth and market leadership in a dynamic insurance landscape.

| BCG Category | Everest Re Example | Market Characteristics | Investment Rationale | Potential Outcome |

|---|---|---|---|---|

| Question Marks | AI & Digital Transformation Initiatives | High growth potential, low current market share | Future-proofing, enhancing efficiency, client relationships | Become Stars or Cash Cows with successful development |

| Question Marks | Emerging Specialty Lines (e.g., Cyber Insurance) | Rapidly growing market, nascent Everest presence | Capturing future market share, addressing evolving risks | Achieve significant market share in a high-growth sector |

| Question Marks | Greenfield Market Entries (e.g., Southeast Asia) | High projected GDP growth, low existing Everest penetration | Establishing early presence in high-potential geographies | Develop into Stars or profitable regional operations |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.