Essent PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Essent's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and identify hidden opportunities. Equip yourself with the insights needed to make informed decisions and gain a competitive advantage.

This expertly crafted PESTLE analysis is your key to understanding the external factors influencing Essent's future. Whether you're an investor, strategist, or industry analyst, this report offers deep-dive insights for robust planning. Download the full version now to unlock a complete understanding of Essent's operating environment and drive impactful strategies.

Political factors

Government housing policies play a crucial role in shaping the landscape for private mortgage insurers like Essent. Initiatives designed to boost affordable homeownership, such as enhanced down payment assistance programs or adjustments to Federal Housing Administration (FHA) loan parameters, directly influence the demand for private mortgage insurance. These programs broaden access to home financing, thereby expanding the potential customer base for Essent.

For instance, in 2024, many regions saw continued efforts to address housing affordability. Some states introduced or expanded mortgage credit certificate programs, effectively lowering the tax burden for first-time homebuyers and making homeownership more attainable. This directly benefits Essent by increasing the volume of insured mortgages.

Conversely, any policy shifts that tighten lending standards or diminish incentives for home purchases could present headwinds for Essent. For example, a broad increase in interest rates, even if not a direct policy, can be influenced by central bank actions which are policy-driven, leading to reduced mortgage origination volumes and, consequently, lower demand for private mortgage insurance.

The health of the housing market, heavily influenced by government policy, is paramount. In 2024, while interest rates remained a factor, the underlying demand for housing, supported by a generally stable job market, continued to create opportunities. Essent's success is intrinsically linked to policies that foster a robust and accessible housing market.

The regulatory landscape for Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac directly impacts Essent's operations. As a provider of private mortgage insurance (MI), Essent's business is intertwined with the GSEs' purchasing of mortgages, where MI often acts as a credit enhancement. Changes to GSE charters or their reliance on private MI could reshape Essent's market position.

The Federal Housing Finance Agency (FHFA) plays a key role in overseeing the GSEs and, by extension, the private MI companies that serve them. This oversight aims to ensure the financial stability and adequate capitalization of these MI providers, including Essent, which is vital for maintaining market confidence and the smooth functioning of the housing finance system.

In 2024, the FHFA continued its efforts to strengthen the GSEs' financial footing, which indirectly benefits Essent by fostering a more stable secondary mortgage market. For instance, the FHFA's capital requirements for Fannie Mae and Freddie Mac, while focused on the GSEs themselves, signal a broader emphasis on financial resilience across the housing ecosystem.

Government fiscal policies, such as changes in spending and taxation, can influence economic growth and consumer confidence, thereby impacting housing demand and the need for mortgage insurance. For example, tax cuts might stimulate the economy, leading to increased home purchases and higher demand for Essent's services.

Monetary policy decisions, particularly those concerning interest rates, directly affect mortgage affordability. As of late 2024, the Federal Reserve's target for the federal funds rate has remained a key indicator. Higher rates can dampen housing market activity, potentially reducing the volume of new mortgage insurance written by companies like Essent.

The interplay between fiscal stimulus and monetary tightening, or vice versa, creates a dynamic environment for the housing sector. If the Fed continues to hold rates steady or begins a gradual reduction in 2025, it could support housing affordability and benefit Essent's business volume. Conversely, unexpected policy shifts could create headwinds.

In 2024, the housing market experienced fluctuations influenced by these policies. For instance, mortgage rates, closely tied to Federal Reserve actions, averaged around 7% for a 30-year fixed mortgage for much of the year, impacting affordability and transaction volumes. This environment directly influences Essent's market penetration and financial performance.

Consumer Protection Regulations

Increased political attention to consumer protection can translate into new regulations for mortgage lenders and insurers. These could include more stringent disclosure mandates or caps on certain fees, directly impacting the mortgage ecosystem Essent operates within.

The Consumer Financial Protection Bureau (CFPB) has been actively scrutinizing areas like mortgage servicing and so-called 'junk fees'. Proposed changes, such as those targeting late fees or other charges, could alter the operational costs and revenue streams for Essent's client lenders. This, in turn, might affect their demand for private mortgage insurance (PMI) as they adapt to new compliance landscapes. For example, the CFPB's focus on fair lending practices and transparency continues to shape how financial products are offered and serviced.

- Enhanced Disclosure Requirements: Lenders may need to provide more detailed information to borrowers regarding PMI costs and benefits.

- Fee Limitations: Regulations could restrict certain fees charged by lenders, potentially impacting their profitability and reliance on secondary market products.

- CFPB Scrutiny: Ongoing CFPB actions, like those on servicing rules, signal a proactive stance on consumer financial well-being in the mortgage sector.

- Impact on Lender Partners: Changes in operational costs and regulatory burdens for lenders could indirectly influence their demand for PMI services.

Political Stability and Election Cycles

Political stability and the outcomes of election cycles significantly influence the financial services sector, particularly for companies like Essent that operate within mortgage insurance. Shifts in government or legislative priorities can directly impact housing finance regulations and the overall economic climate. For instance, a change in administration could lead to altered approaches to housing finance, potentially affecting the demand for private mortgage insurance or the compliance burdens faced by Essent. In the lead-up to the 2024 US presidential election, for example, market participants closely watched for potential policy shifts that could impact interest rates, housing affordability, and the regulatory landscape for mortgage lenders and insurers. A more favorable regulatory environment, perhaps one with reduced compliance requirements, could directly benefit Essent by lowering operational costs and potentially increasing market participation.

The 2024 US election cycle, like others, presented potential for both stability and disruption. Policy discussions around housing affordability, interest rate management, and the role of government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac are critical. Changes in these areas could indirectly affect Essent's business by altering the competitive landscape or the overall volume of mortgages requiring private mortgage insurance. For example, if new policies are introduced to stimulate the housing market through lower down payment requirements, this could increase the need for PMI. Conversely, a tightening of lending standards could reduce demand.

- Potential for regulatory changes: Election outcomes can lead to shifts in housing finance regulations, impacting Essent's operating environment.

- Impact on demand for PMI: Policy changes affecting mortgage accessibility or lending standards could alter the demand for private mortgage insurance.

- Economic policy influence: Broader economic policies enacted by elected officials can affect interest rates, inflation, and consumer confidence, all of which influence the housing market.

- Uncertainty and market reactions: Election periods often introduce a degree of uncertainty, leading to market volatility that can affect investor sentiment towards companies like Essent.

Government housing policies directly influence Essent's market by either promoting or hindering homeownership, which in turn affects the demand for private mortgage insurance. For instance, initiatives aimed at boosting affordability, such as expanded down payment assistance programs in various states during 2024, broaden Essent's customer base.

Regulatory oversight from bodies like the FHFA ensures Essent's financial stability, crucial for its role in the secondary mortgage market. The FHFA's continued focus on GSE capital requirements in 2024 underpins a stable environment for Essent's partnerships.

Monetary policy, particularly interest rate decisions by the Federal Reserve, significantly impacts mortgage affordability and Essent's business volume. With mortgage rates hovering around 7% for a 30-year fixed mortgage in late 2024, these policy-driven costs shape market activity.

Consumer protection efforts by agencies like the CFPB can lead to new regulations affecting lenders, potentially influencing their demand for mortgage insurance. The CFPB's scrutiny of fees in 2024 highlights a trend toward greater transparency, impacting the broader mortgage ecosystem.

What is included in the product

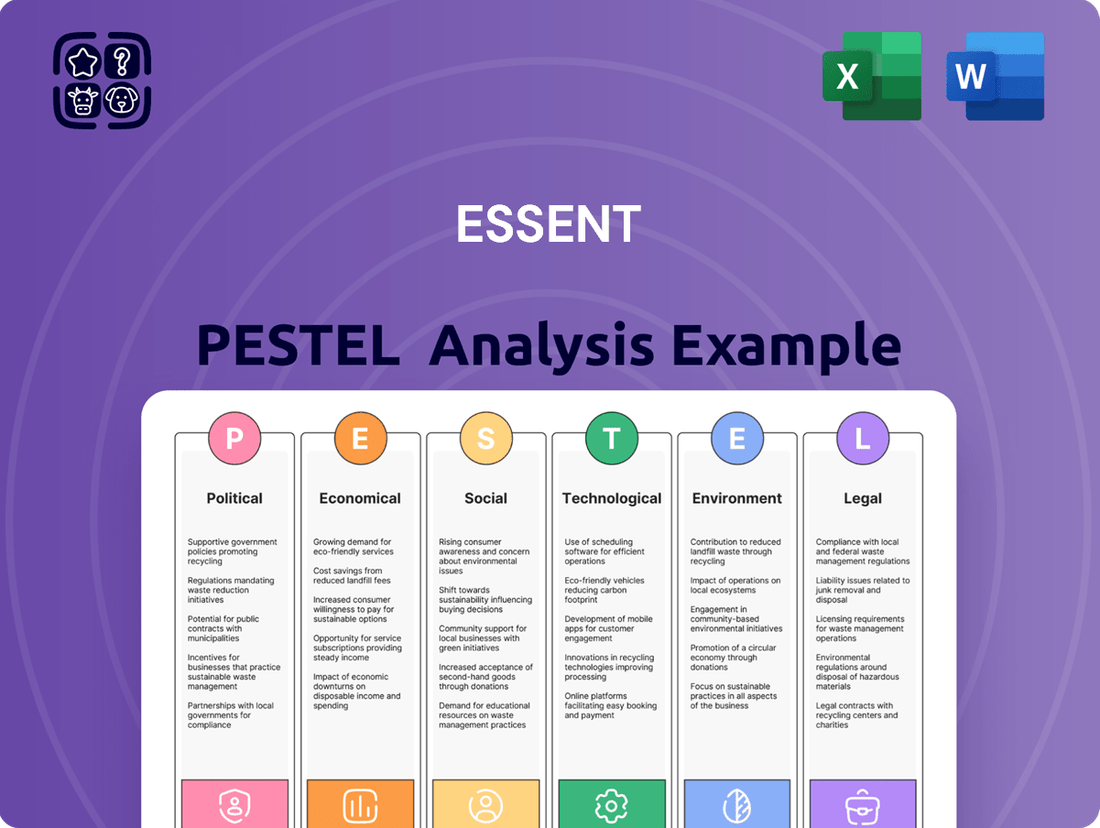

The Essent PESTLE Analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company.

This comprehensive evaluation provides actionable insights for strategic decision-making and identifying emerging market opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, unmanageable data dumps.

Economic factors

The prevailing interest rate environment significantly impacts Essent's core business. Fluctuations in mortgage interest rates, for instance, directly influence the volume of new mortgages originated. When rates climb, as they did throughout much of 2022 and 2023, reaching 30-year fixed rates over 7%, this typically dampens home sales and mortgage origination, consequently reducing the new insurance written for Essent.

Conversely, elevated interest rates can also positively affect Essent by improving the persistency of its existing mortgage insurance policies. Higher rates tend to curb mortgage refinancing activity, meaning homeowners are less likely to pay off their existing mortgages early. This extends the duration for which Essent collects premiums on its policies, providing a stable revenue stream.

Looking ahead to 2024 and 2025, forecasts suggest a potential moderation in interest rates, possibly settling in the 5.5% to 6.5% range for 30-year fixed mortgages. While this could spur greater origination volumes, it might also lead to increased refinancing, potentially impacting policy persistency, creating a balancing act for Essent's revenue streams.

The health of the U.S. housing market is a crucial factor for Essent, influencing both its risk and business volume. In late 2024 and early 2025, we're seeing continued, albeit moderating, home price appreciation across many regions. For instance, the S&P CoreLogic Case-Shiller Home Price Index reported year-over-year gains in the mid-single digits throughout 2024, though the pace has slowed from previous years.

Sustained home price growth generally benefits Essent by reducing the likelihood of borrower default, thereby improving credit performance for the company. When home values rise, borrowers have more equity, making them less likely to walk away from their mortgages. This trend supports Essent's core business of insuring mortgage defaults.

However, a significant challenge emerges when high home prices are coupled with elevated interest rates, as has been the case in 2024. This combination severely impacts housing affordability, dampening demand for new mortgages. For example, average 30-year fixed mortgage rates hovering in the 6-7% range in 2024, combined with already high prices, strain household budgets and can lead to fewer new loan originations, directly affecting Essent's potential business volume.

Inventory levels also play a key role. While inventory has shown some improvement from historic lows in 2023, it remained relatively tight in many markets through early 2025. This limited supply can continue to support price growth but also contributes to affordability challenges, creating a complex environment for Essent.

Strong employment and wage growth are key drivers for Essent's mortgage insurance business, directly impacting borrowers' capacity to meet their payment obligations. For instance, the U.S. unemployment rate stood at a historically low 3.7% in April 2024, reflecting a resilient labor market that underpins mortgage repayment stability.

A healthy job market translates to fewer defaults, which is beneficial for Essent's claims experience and overall financial health. When people have jobs and earn more, they are better positioned to pay their mortgages, reducing the likelihood of Essent having to pay out on claims.

Conversely, economic downturns characterized by rising unemployment or sluggish wage increases can put pressure on borrowers. This often leads to an uptick in mortgage delinquencies, as individuals struggle to manage their finances and meet their loan commitments.

Looking ahead, the Bureau of Labor Statistics projects continued job growth through 2024 and into 2025, albeit at a more moderate pace. Wage growth, while showing signs of slowing from its post-pandemic peaks, is still expected to outpace inflation in many sectors, offering continued support for mortgage performance.

Consumer Confidence and Spending

Consumer confidence significantly impacts major purchasing decisions, particularly homeownership. High confidence levels encourage more people to enter the housing market, boosting demand for mortgage financing and, by extension, private mortgage insurance (PMI). For instance, the Conference Board's Consumer Confidence Index in May 2024 showed a slight dip to 102.0, down from 104.7 in April, indicating a cautious consumer sentiment that could temper housing demand.

When consumers feel secure about their financial future and the economy's stability, they are more inclined to make substantial investments like buying a home. This increased propensity to buy, driven by optimism, directly translates into higher mortgage originations. Conversely, a decline in confidence, often linked to inflation concerns or job market uncertainty, can lead to a pullback in spending and a slowdown in housing market activity.

Consumer spending patterns are a key indicator of economic health and directly influence sectors reliant on discretionary income, such as real estate.

- Consumer Confidence Index: The Conference Board reported the index at 102.0 in May 2024, a slight decrease from April's 104.7, reflecting evolving consumer sentiment.

- Impact on Housing: Higher consumer confidence generally correlates with increased home sales and mortgage applications, driving demand for PMI.

- Economic Sensitivity: Consumer spending, a major economic driver, is closely tied to confidence levels, influencing broader market trends.

- Future Outlook: Persistent inflation or economic uncertainty can dampen confidence, potentially leading to reduced consumer spending and a cooling housing market.

Inflation and Economic Growth

Inflationary pressures significantly impact Essent's operational landscape. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, a figure that directly contributes to rising construction costs for new housing and affects the affordability of homes for potential buyers. This, in turn, influences the demand for mortgage insurance, Essent's core business.

The broader economic growth trajectory is equally critical. A robust economy typically translates to higher disposable incomes, enabling more consumers to enter the housing market. In 2024, the US economy was projected to grow by approximately 2.5%, supporting consumer spending and mortgage origination volumes. Conversely, slower growth can dampen demand and increase the risk of mortgage defaults, impacting Essent's financial stability.

Interest rates, often a response to inflation, play a pivotal role. As of May 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25%-5.50%. Higher interest rates can cool the housing market by making mortgages more expensive, thus potentially reducing the volume of new insurance policies written by Essent. This dynamic highlights the delicate balance Essent must navigate.

- Inflationary Impact: Rising inflation (e.g., US CPI at 3.4% in April 2024) increases construction costs and reduces housing affordability, directly affecting Essent's market.

- Economic Growth Correlation: Strong economic growth (e.g., projected US GDP growth of 2.5% in 2024) boosts disposable income and housing demand, benefiting Essent.

- Interest Rate Sensitivity: Higher interest rates (e.g., Fed funds rate at 5.25%-5.50% in May 2024) can slow the housing market, impacting Essent's policy volumes.

- Mortgage Market Stability: The overall health of the mortgage market, influenced by both inflation and growth, is fundamental to Essent's performance and risk assessment.

Economic factors significantly shape Essent's operating environment, influencing mortgage origination and default rates. Inflation, for instance, impacts housing affordability and construction costs, while economic growth affects consumer spending and employment. Interest rate policies by central banks directly influence mortgage affordability and refinancing activity, creating a dynamic interplay for Essent's business model.

The U.S. economy in 2024 and early 2025 is navigating a period of moderating inflation and steady, though slowing, growth. For example, the U.S. CPI was 3.4% year-over-year in April 2024, and projected GDP growth for 2024 was around 2.5%. These figures suggest a generally stable, yet sensitive, economic backdrop for the mortgage insurance sector.

Interest rates remain a key consideration, with the Federal Reserve maintaining its benchmark rate between 5.25%-5.50% as of May 2024. Forecasts for 30-year fixed mortgage rates in 2024-2025 hover around 5.5% to 6.5%, a level that could support origination volumes while also potentially increasing refinancing.

| Economic Factor | Data Point (2024-2025) | Impact on Essent |

|---|---|---|

| Inflation (US CPI) | 3.4% (April 2024) | Increases construction costs, affects housing affordability. |

| Economic Growth (US GDP Projection) | ~2.5% (2024) | Supports consumer spending and mortgage demand. |

| Interest Rates (Fed Funds Rate) | 5.25%-5.50% (May 2024) | Influences mortgage affordability and refinancing activity. |

| 30-Year Fixed Mortgage Rate Forecast | 5.5%-6.5% (2024-2025) | Balances origination volume with refinancing potential. |

Preview Before You Purchase

Essent PESTLE Analysis

The preview shown here is the exact Essent PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, showcasing the comprehensive PESTLE framework for Essent. It’s fully formatted and professionally structured.

No placeholders, no teasers—this is the real, ready-to-use Essent PESTLE Analysis file you’ll get upon purchase, ensuring you have all the insights immediately.

The content and structure shown in the preview is the same Essent PESTLE Analysis document you’ll download after payment, providing a complete and actionable report.

Sociological factors

Demographic shifts are a major force shaping the housing market. As the population ages, demand for certain types of housing, like smaller, more accessible homes, may increase. Conversely, the growing number of millennials and Gen Z entering their prime homebuying years is fueling demand, particularly for starter homes. This influx is a key driver for low down payment mortgage options.

Homeownership rates showed a modest uptick in 2024, reaching an estimated 66.1% according to the U.S. Census Bureau, up from 65.9% in 2023. However, affordability remains a significant hurdle, especially for first-time buyers. Many of these younger buyers are turning to Private Mortgage Insurance (PMI) to bridge the gap, with FICO reporting that the average credit score for borrowers with PMI in 2024 was around 725.

Housing affordability remains a significant hurdle, with persistent challenges stemming from high home prices and elevated mortgage rates. These factors directly impede the ability of potential homebuyers, particularly first-time buyers, from entering the market. For instance, in early 2024, the median home price in the US hovered around $420,000, while average mortgage rates approached 7%.

This market dynamic can directly influence the volume of new mortgage insurance written. When fewer individuals can afford to purchase homes due to these affordability pressures, the demand for mortgage insurance naturally declines, impacting insurers like Essent.

The average financial literacy rate among U.S. adults has shown persistent gaps, with many struggling to grasp complex financial concepts essential for homeownership. For instance, a 2023 FINRA study indicated that a significant portion of Americans still find it challenging to manage their finances effectively. This directly impacts their ability to save for a substantial down payment.

The hurdle of accumulating a traditional 20% down payment remains a major barrier for many aspiring homeowners. In 2024, median home prices, while fluctuating, continue to represent a substantial financial commitment, making a 20% down payment out of reach for a large segment of the population. This is particularly true for first-time buyers and those in higher cost-of-living areas.

Essent's role in providing private mortgage insurance (PMI) is crucial in addressing these financial literacy and down payment challenges. PMI allows borrowers to qualify for mortgages with down payments as low as 3% to 5%, thereby unlocking homeownership for individuals who might otherwise be excluded from the market due to savings limitations.

Urbanization and Suburbanization Trends

Shifts in population distribution significantly impact Essent's portfolio. For instance, the U.S. saw a slight de-urbanization trend post-2020, with some growth in suburban and rural areas. This redistribution can alter regional housing demand and property values, directly affecting the geographic concentration of Essent's insured assets and its exposure to specific market dynamics.

The ongoing suburbanization trend, particularly in Sun Belt states, continues to reshape housing markets. Areas like Florida and Texas have experienced substantial population growth, leading to increased demand for housing and, consequently, higher property values. This influx impacts Essent's exposure in these regions, potentially increasing its insured portfolio value but also its risk if underwriting doesn't keep pace with these changes.

- Population shifts: Over 80% of the U.S. population now lives in urban areas, but recent trends show a migration towards smaller cities and suburban communities.

- Regional impact: States like North Carolina, South Carolina, and Tennessee are seeing significant in-migration, driving up housing demand and property values.

- Essent's exposure: These demographic movements can lead to a higher concentration of Essent's insured properties in rapidly appreciating, but potentially more volatile, suburban markets.

- Market dynamics: Changes in where people live influence local economic conditions, job growth, and infrastructure development, all of which are critical factors for property valuation and insurance risk.

Changing Lifestyles and Household Formations

Shifting lifestyle preferences significantly shape housing demand. We're seeing trends like delayed marriage, with the average age of first marriage in the US reaching around 30 for men and 28 for women in recent years, leading to smaller household sizes and a different approach to homeownership. Conversely, there's a growing interest in multi-generational living, perhaps driven by economic factors or a desire for closer family ties, impacting the demand for larger homes or accessory dwelling units.

These evolving household formations directly influence the pool of potential homebuyers and the types of mortgages they seek. Smaller, younger households might prioritize starter homes or renting, while those opting for multi-generational setups could require larger loans for more substantial properties. For instance, the National Association of Realtors reported that in 2023, the median age of first-time homebuyers continued to rise, highlighting the impact of delayed life stages on the housing market.

- Delayed Marriage: Increased average age at first marriage impacts household formation timing and size.

- Smaller Families: Trends towards fewer children influence demand for different housing types.

- Multi-Generational Homes: Growing preference for shared living spaces affects demand for larger properties.

- Mortgage Demand: Lifestyle shifts alter the nature and volume of mortgage applications.

Sociological factors significantly influence housing demand and mortgage markets. Shifts in household composition, such as delayed marriage and smaller family sizes, alter the types of homes people seek. The growing trend towards multi-generational living, for example, can increase demand for larger properties. These lifestyle changes directly impact the mortgage products needed and the pool of eligible borrowers, affecting companies like Essent.

Technological factors

The mortgage industry's rapid shift towards digital origination and processing is a significant technological factor for Essent. Platforms that streamline applications, underwriting, and closing are becoming standard, directly impacting the speed and efficiency Essent's partners can offer. For instance, in 2024, many lenders reported that digital mortgage applications could reduce processing times by up to 20% compared to traditional methods.

Essent's ability to integrate seamlessly with these evolving digital ecosystems is crucial for maintaining its competitive edge. This integration ensures Essent can support a smooth, efficient borrower experience, which is increasingly a deciding factor for both lenders and consumers. By Q1 2025, over 70% of new mortgage applications in the US are expected to be initiated through digital channels, highlighting the imperative for adaptable technological partnerships.

Advanced data analytics and AI are revolutionizing risk assessment in the financial sector. Essent utilizes these technologies to more accurately evaluate borrower creditworthiness and property risk, leading to better underwriting decisions. This is particularly crucial as the volume and complexity of data continue to grow, making traditional methods less effective.

By leveraging its internal analytics capabilities, Essent can identify subtle patterns and correlations that might be missed by human analysts. For instance, AI algorithms can process vast datasets, including economic indicators, market trends, and borrower behavior, to predict default probabilities with greater precision. This proactive approach helps in managing portfolio risk more effectively.

The adoption of AI and machine learning by lenders also benefits Essent. When lenders employ sophisticated tools to improve loan quality, it directly translates to a reduced likelihood of defaults within the insured portfolios. This collaborative enhancement of loan origination and servicing processes is key to maintaining the stability and profitability of the mortgage insurance market.

In 2024 and looking into 2025, the demand for AI-driven risk assessment is expected to surge. Financial institutions are investing heavily in these technologies, with global spending on AI in financial services projected to reach tens of billions of dollars. Essent's commitment to these advanced analytics positions it well to navigate this evolving landscape and provide superior risk management solutions.

As mortgage processes increasingly move online, cybersecurity and data privacy are paramount for Essent. The company handles vast amounts of sensitive financial and personal information, making it a target for cyber threats. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the substantial financial risks associated with data breaches.

Essent must therefore maintain continuous investment in advanced security measures to safeguard against these threats. Compliance with evolving data protection regulations, such as GDPR and CCPA, is also critical, with significant fines for non-compliance. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the regulatory imperative for robust data privacy protocols.

Automation in Mortgage Services

Automation is significantly reshaping mortgage services. Technologies like AI and machine learning are streamlining everything from loan origination and underwriting to customer service and collections. This means less manual work, fewer mistakes, and faster processing times for lenders, which ultimately benefits Essent by improving efficiency and reducing operational overhead.

The drive for efficiency through automation is evident. For instance, in 2024, reports indicated that lenders adopting advanced automation platforms saw a reduction in loan processing times by as much as 40%. This acceleration not only improves the customer experience but also allows companies like Essent to handle a higher volume of business with existing resources, boosting profitability.

Key areas of automation impacting mortgage services include:

- Loan Origination: Automated underwriting systems and digital application portals speed up the initial stages of the mortgage process.

- Risk Management: AI-powered tools can more effectively identify and mitigate fraud, as well as assess credit risk with greater accuracy.

- Loan Servicing: Automated payment processing, customer inquiries via chatbots, and digital document management enhance post-closing operations.

- Compliance: Automation helps ensure adherence to ever-changing regulatory requirements, reducing the risk of penalties.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) offer a glimpse into a more secure and efficient future for mortgage transactions. Essent should monitor its development closely, as it could fundamentally change how property titles are verified and loans are transferred. The immutability of blockchain records promises enhanced transparency and reduced fraud potential across the entire mortgage ecosystem.

The adoption rate of blockchain in financial services is steadily increasing. For instance, by the end of 2023, over 50% of major banks were actively exploring or piloting DLT solutions for various applications, including trade finance and identity verification. This trend suggests that the mortgage sector, a significant part of financial services, will likely see increased integration of such technologies in the coming years. Essent’s strategic planning needs to account for this evolving technological landscape to remain competitive and to leverage potential efficiency gains.

- Potential for Secure Record-Keeping: Blockchain's distributed and immutable nature can enhance the security and integrity of mortgage-related data, reducing risks of tampering or loss.

- Streamlined Processes: DLT could automate and simplify complex processes like title verification, loan origination, and secondary market transactions, leading to faster and cheaper operations.

- Increased Transparency: A shared, transparent ledger can provide all authorized parties with real-time access to verified information, improving trust and reducing disputes.

- Future Investment Considerations: Essent may need to invest in or partner with blockchain solution providers to integrate these capabilities, ensuring it stays at the forefront of technological innovation in the mortgage industry.

Technological advancements are rapidly reshaping Essent's operational landscape, driving efficiency and innovation. The increasing adoption of digital mortgage platforms by lenders in 2024 and projected through 2025 means faster processing times, with some lenders seeing up to a 20% reduction. Essent's ability to integrate with these digital channels is vital, especially as over 70% of US mortgage applications are expected to be digital by Q1 2025.

AI and advanced analytics are revolutionizing risk assessment, enabling more precise underwriting and better portfolio management. Financial institutions are significantly increasing their investment in AI, with global spending expected to reach tens of billions of dollars in 2024-2025. Essent's commitment to these technologies positions it to effectively manage growing data complexity and predict default probabilities with enhanced accuracy.

Cybersecurity and data privacy are critical concerns, given the sensitive nature of financial information handled by Essent. The global cost of cybercrime was projected to exceed $10.5 trillion annually in 2024, making robust security investments essential. Compliance with data protection regulations, which carry significant penalties, such as up to 4% of global annual revenue for GDPR violations, further emphasizes the need for strong data privacy protocols.

Automation, driven by AI and machine learning, is streamlining various aspects of mortgage services, from origination to servicing, leading to fewer errors and faster processing. Lenders utilizing automation platforms saw processing time reductions of up to 40% in 2024. This increased efficiency allows Essent to handle higher business volumes and improve profitability.

| Technology | Impact on Essent | 2024/2025 Data/Projections |

|---|---|---|

| Digital Origination Platforms | Increased efficiency, faster processing times for partners | Processing times reduced by up to 20% (2024); 70%+ of US mortgage apps digital by Q1 2025 |

| AI & Advanced Analytics | Improved risk assessment, more accurate underwriting, better portfolio management | Global AI spending in financial services in tens of billions of dollars (2024-2025) |

| Cybersecurity & Data Privacy | Protection of sensitive data, regulatory compliance | Global cost of cybercrime projected to exceed $10.5 trillion annually (2024); GDPR fines up to 4% of global revenue |

| Automation | Streamlined operations, reduced errors, faster processing | Up to 40% reduction in loan processing times for adopters (2024) |

Legal factors

Essent navigates a complex web of mortgage lending regulations, including federal acts like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), alongside state-specific laws. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued its oversight of lending practices, with enforcement actions often targeting disclosures and fair lending. Failure to adhere to these rules, such as maintaining compliant underwriting standards, can result in significant fines and reputational damage.

Compliance with these stringent requirements is non-negotiable for Essent. In 2025, regulatory bodies are expected to maintain a sharp focus on consumer protection in mortgage origination and servicing. Maintaining robust compliance programs ensures Essent avoids costly penalties, such as those seen in past years where lenders faced millions in fines for disclosure violations, and preserves trust with its wholesale and retail partners.

Regulatory bodies, like state insurance departments in the US, mandate specific capital requirements for mortgage insurers to ensure they can meet their obligations. For instance, a common solvency standard involves maintaining a certain ratio of capital to net written premiums, often around 25% or higher, to absorb unexpected losses.

Essent, as a mortgage insurer, must comply with these solvency regulations, which directly impact its capacity to underwrite new business and its overall financial resilience. Failure to meet these capital adequacy ratios can lead to regulatory intervention, limiting growth or even operational capacity.

These requirements, often benchmarked against industry-wide solvency standards like Solvency II in Europe or state-specific risk-based capital (RBC) formulas in the US, influence how Essent manages its balance sheet and reserves. The 2024 and 2025 regulatory landscape will likely continue to emphasize robust capital buffers, especially in light of potential economic shifts.

Consumer protection laws are a significant factor for Essent, particularly concerning unfair lending practices. For instance, the Consumer Financial Protection Bureau (CFPB) in the United States actively enforces regulations like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA). Failure to adhere to these can lead to substantial fines and legal battles.

The risk of class action lawsuits is a constant concern. If Essent's practices are deemed predatory or violate consumer rights, a group of affected individuals could band together, seeking significant damages. Such actions can erode public trust and lead to costly settlements or judgments, as seen in numerous cases within the financial services industry.

Essent must ensure its operational procedures and contractual agreements are fully compliant with all relevant consumer protection statutes. Any proposed legislative changes, such as bans on specific restrictive contract clauses, could necessitate a revision of standard industry agreements, impacting Essent's business model and revenue streams.

Data Privacy Laws (e.g., CCPA, GDPR-like state laws)

The evolving landscape of data privacy laws, such as California's Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), alongside emerging state-level regulations, demands rigorous data management from Essent. These laws, which increasingly mirror the principles of Europe's General Data Protection Regulation (GDPR), necessitate robust frameworks for collecting, storing, and utilizing customer data. Essent must ensure its practices align with these stringent requirements to avoid penalties.

Non-compliance with these data privacy mandates carries substantial financial risks. For instance, under the CPRA, violations can result in statutory damages of up to $7,500 per intentional violation, and civil penalties of up to $2,500 per unintentional violation, escalating significantly for repeated offenses. Beyond financial penalties, reputational damage can be severe, impacting customer trust and market standing.

- CCPA/CPRA Enforcement: California's Attorney General and the California Privacy Protection Agency (CPPA) are actively enforcing data privacy regulations, issuing guidance and pursuing cases against non-compliant businesses.

- Growing State Legislation: As of early 2024, over a dozen U.S. states have enacted comprehensive data privacy laws, creating a complex patchwork of regulations Essent must navigate.

- Increased Consumer Rights: Laws like the CPRA grant consumers enhanced rights, including the right to opt-out of the sale or sharing of personal information and the right to correct inaccurate personal information, requiring businesses to adapt their data handling processes.

- Data Security Requirements: Many of these laws also impose specific data security obligations, requiring Essent to implement reasonable security measures to protect personal information against unauthorized access or disclosure.

Anti-Discrimination and Fair Lending Laws

Essent, operating within the housing finance sector, is bound by critical anti-discrimination and fair lending statutes. These include the Fair Housing Act and the Equal Credit Opportunity Act, which strictly forbid discriminatory practices in lending and insurance. In 2024, regulators continued to emphasize the importance of these laws, with the Consumer Financial Protection Bureau (CFPB) actively monitoring for compliance.

To adhere to these regulations, Essent must meticulously review its risk assessment models and underwriting policies. The goal is to eliminate any inherent bias that could inadvertently disadvantage protected groups. For instance, the CFPB reported in early 2025 that it had initiated several investigations into potential discriminatory lending patterns across the industry, underscoring the ongoing scrutiny.

- Fair Housing Act Compliance: Ensuring all lending and insurance products are offered without regard to race, color, religion, sex, disability, familial status, or national origin.

- Equal Credit Opportunity Act (ECOA) Adherence: Prohibiting discrimination in any aspect of a credit transaction based on protected characteristics.

- Model Bias Auditing: Regularly assessing underwriting and risk models to identify and rectify any disparate impact on protected classes.

- Regulatory Scrutiny: Responding to increased oversight from bodies like the CFPB and HUD, which actively investigate fair lending practices in the mortgage market.

Essent's operations are heavily influenced by evolving consumer protection laws and the potential for litigation. For instance, in 2024, the CFPB continued to focus on fair lending, with enforcement actions often scrutinizing disclosure accuracy and the prevention of discriminatory practices. Failure to comply, such as issues with underwriting standards, can lead to substantial fines, as seen when lenders faced millions in penalties for disclosure violations in past years.

The legal landscape also demands rigorous adherence to data privacy regulations, with new state laws in 2024 and 2025 creating a complex compliance environment. The CPRA, for example, can levy penalties of up to $7,500 per intentional violation, alongside significant reputational risks from data breaches. Essent must maintain robust data management to avoid these financial and trust-related repercussions.

Anti-discrimination laws like the Fair Housing Act and ECOA are paramount, with regulators like the CFPB and HUD actively monitoring mortgage markets in 2024 and 2025. Essent must continuously audit its risk models to ensure no inherent bias disadvantages protected groups, especially as the CFPB reported initiating investigations into potential discriminatory patterns in early 2025.

Environmental factors

The escalating frequency and intensity of climate-related natural disasters, including wildfires, floods, and hurricanes, present a significant threat to Essent's insured properties. These events directly translate into increased claims payouts, potentially impacting the company's profitability and financial stability.

For instance, the economic toll of natural disasters in the U.S. reached an estimated $150 billion in 2023, a figure that continues to climb year over year. This surge in claims can lead to higher premiums for policyholders and, in extreme cases, make certain properties uninsurable in high-risk zones, affecting their market valuation.

Investor and regulatory scrutiny of Environmental, Social, and Governance (ESG) factors is intensifying, placing pressure on Essent to showcase its environmental stewardship. This means Essent needs to actively assess and report on climate-related risks within its investment portfolio, a trend seen across the financial sector. For instance, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) has pushed many asset managers to classify and disclose the sustainability characteristics of their products, with a significant portion of assets now falling under Article 8 or 9 categories, indicating varying degrees of sustainability integration. Essent will likely face similar demands to integrate ESG principles into its core business strategy, moving beyond mere disclosure to active management of sustainability impacts.

Environmental risks, like increased flooding or wildfire frequency, can significantly depress property values in vulnerable regions. This directly impacts the collateral backing mortgages, potentially raising loan-to-value ratios for Essent's insured properties. For instance, areas prone to severe weather events may see a decline in marketability, making it harder to sell properties and recover losses in case of default.

The devaluation of properties due to recurring environmental damage could heighten the risk of mortgage defaults. If a homeowner's property value falls below their outstanding mortgage balance, they might be more inclined to walk away from the loan. This scenario directly affects Essent's financial exposure, as the value of the collateral used to secure the insured mortgage diminishes.

According to data from the National Association of Realtors in late 2023, homes in flood-prone areas can be valued 10-20% lower than comparable homes outside these zones. Similarly, studies in early 2024 indicated that wildfire-prone regions are experiencing property value stagnation or decline, increasing the likelihood of negative equity for homeowners and posing a greater risk for mortgage insurers.

Availability and Cost of Homeowners Insurance

As climate change escalates, the availability and cost of homeowners insurance are becoming significant environmental factors. In areas facing heightened risks like flooding, wildfires, or severe storms, premiums are rising, and in some cases, coverage is becoming difficult to obtain. For example, in California, the cost of homeowners insurance has seen substantial increases due to wildfire risks, with some insurers withdrawing from high-risk markets altogether.

This trend directly affects mortgage accessibility. Lenders almost universally mandate homeowners insurance to protect their investment. When insurance is scarce or prohibitively expensive, it can hinder a homeowner's ability to secure a mortgage, potentially dampening demand in affected regions. This, in turn, could impact the broader housing market and the demand for mortgage insurance, as lenders may become more cautious.

The financial implications are substantial:

- Rising Premiums: According to industry reports from 2024, homeowners in catastrophe-prone areas have experienced average premium increases of 15-30% year-over-year.

- Reduced Insurer Participation: By early 2025, several major insurance carriers had significantly scaled back or exited markets in states like Florida and Louisiana due to escalating claims from hurricanes and other weather events.

- Impact on Property Values: The inability to secure affordable insurance can lead to a decrease in property values in vulnerable areas, as marketability is compromised.

- Increased Demand for Mitigation: This situation is driving greater interest in property-level mitigation efforts, such as fire-resistant roofing and flood defenses, to make homes more insurable.

Regulatory Scrutiny on Climate Risk in Financial Institutions

Financial regulators worldwide are intensifying their focus on how institutions, including mortgage insurers, evaluate and handle climate-related financial risks. This heightened scrutiny is likely to introduce new mandates for sophisticated risk modeling, strategic capital allocation, and transparent disclosures concerning environmental exposures. For instance, as of late 2024, several major central banks, including the European Central Bank, have been conducting stress tests specifically designed to assess the resilience of financial firms to climate shocks, with preliminary findings in 2024 indicating significant potential capital impacts for those with substantial exposure to carbon-intensive sectors.

These evolving regulatory expectations mean that companies like Essent will need to invest in robust data analytics and scenario planning capabilities. The aim is to quantify the potential impact of physical risks, such as extreme weather events, and transition risks, like shifts to a low-carbon economy, on their underwriting portfolios and overall financial stability. By 2025, it's anticipated that a significant number of jurisdictions will have finalized or implemented specific guidance on climate risk management for the financial sector, potentially aligning with frameworks proposed by the Task Force on Climate-related Financial Disclosures (TCFD).

The implications for Essent include the potential for increased compliance costs associated with enhanced reporting and risk management frameworks. Furthermore, a proactive approach to integrating climate risk into business strategy and capital planning can offer a competitive advantage, positioning Essent as a forward-thinking and resilient player in the mortgage insurance market. The industry is already seeing a trend where investors and rating agencies are beginning to factor climate risk management into their assessments, with a growing number of institutional investors demanding clear climate-related disclosures.

Key areas of focus for regulatory oversight are expected to include:

- Climate Risk Governance: Ensuring that boards and senior management have oversight of climate-related risks.

- Risk Management Processes: Integrating climate considerations into existing enterprise-wide risk management frameworks.

- Capital Adequacy: Assessing whether existing capital buffers are sufficient to absorb potential climate-related losses.

- Disclosure Standards: Adhering to emerging and established standards for reporting climate-related financial information.

The increasing frequency and severity of climate-related events, such as wildfires and floods, are directly impacting Essent's insured properties, leading to higher claims and potentially affecting profitability. The economic cost of natural disasters in the U.S. in 2023 alone was around $150 billion, a figure that continues to rise annually.

This trend of escalating climate impacts is also driving up insurance premiums for homeowners, with reports from 2024 indicating average increases of 15-30% in catastrophe-prone areas. In some high-risk regions, obtaining homeowners insurance is becoming increasingly difficult, impacting property marketability and potentially leading to property value declines. For example, homes in flood-prone areas can be valued 10-20% lower than comparable homes outside these zones, according to late 2023 data from the National Association of Realtors.

Financial regulators are placing greater emphasis on how institutions manage climate-related financial risks, with expectations for enhanced risk modeling and transparent disclosures. By 2025, many jurisdictions are anticipated to implement specific guidance on climate risk management, aligning with frameworks like the TCFD, which could lead to increased compliance costs for companies like Essent.

| Environmental Factor | Impact on Essent | Relevant Data (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased insurance claims, potential for higher premiums, property devaluation. | U.S. natural disaster costs: ~$150 billion (2023). Premium increases: 15-30% in high-risk areas (2024). Property value discounts in flood zones: 10-20% (late 2023). |

| Regulatory Scrutiny (ESG & Climate Risk) | Need for enhanced risk management, reporting, and potential capital adequacy adjustments. | Anticipated implementation of climate risk guidance by many jurisdictions by 2025. Central banks conducting climate stress tests (2024). |

| Availability & Cost of Insurance | Challenges in securing affordable coverage in high-risk areas, impacting mortgage accessibility and demand. | Insurers scaling back or exiting markets like Florida and Louisiana due to escalating weather events (early 2025). |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a robust blend of official government publications, reputable financial institutions, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verifiable, current data.