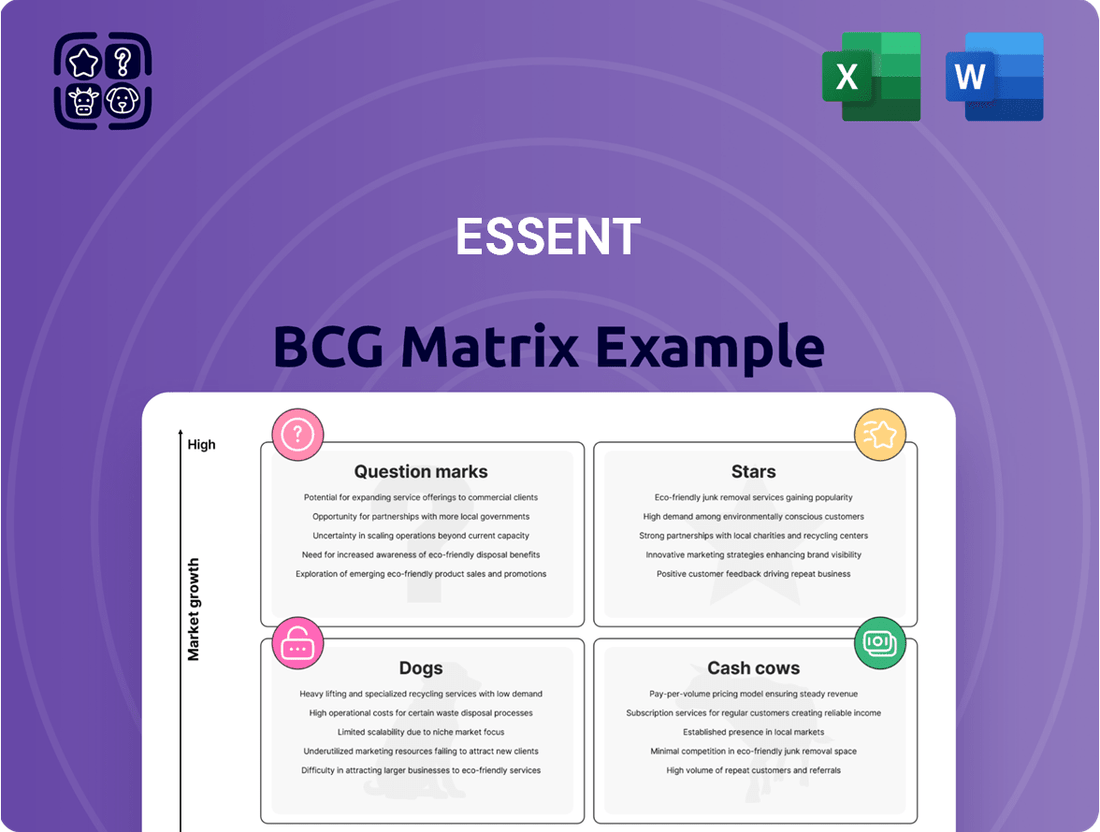

Essent Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

Uncover the strategic positioning of this company's product portfolio with the BCG Matrix. Understand which products are Stars, Cash Cows, Dogs, or Question Marks, and how they contribute to overall market share and growth. This preview offers a glimpse into the power of strategic analysis. Purchase the full BCG Matrix for a comprehensive breakdown of each quadrant, actionable insights, and a clear roadmap for optimizing your investments and product development.

Stars

Essent's New Insurance Written (NIW) showed impressive growth in the fourth quarter of 2024, climbing notably year-over-year. This upward trend points to strong customer interest in their primary private mortgage insurance. This performance suggests Essent is effectively securing more of the new mortgage business, especially as the overall market is anticipated to expand in 2025, solidifying these new policies as Stars within the BCG framework.

Essent strategically utilizes reinsurance to manage its risk portfolio, with significant transactions planned for 2025 and 2026. These include excess of loss and quota share agreements designed to protect against catastrophic events and smooth earnings.

These reinsurance arrangements are vital for Essent's capital management, enabling the company to support higher volumes of new insurance written. For instance, in 2024, Essent reported a significant increase in new business, which these reinsurance structures help to underwrite more efficiently.

By ceding a portion of its risk, Essent can pursue aggressive growth in a favorable market while preserving a robust financial position. This approach allows for greater market penetration and operational flexibility.

Essent's commitment to innovation in underwriting is a clear Star in its BCG Matrix. Their proprietary credit engine, EssentEDGE®, utilizes machine learning to refine mortgage insurance pricing and manage risk. This technological advantage allows for quicker and more precise credit evaluations and underwriting, benefiting lenders by streamlining operations.

This focus on advanced platforms is crucial for maintaining a strong market position in a rapidly changing industry. Essent's investment in technologies like EssentEDGE® directly contributes to their competitive edge and ability to capture market share, solidifying its Star status.

PMI for First-Time Homebuyers

Private mortgage insurance (PMI) is a critical component for many first-time homebuyers, allowing them to purchase a home with less than a 20% down payment. Essent, as a significant player in this industry, directly facilitates this by mitigating lender risk. This market segment is poised for continued growth, driven by demographic shifts as younger generations reach prime homebuying age. In 2024, the demand for housing from millennials and Gen Z continues to be robust, making this a key area for mortgage insurers.

Essent's focus on supporting first-time homebuyers positions its PMI offerings as a Star product within a business portfolio, akin to the BCG Matrix. This is because the company is leveraging a high-growth market where it holds a strong competitive position. The continued influx of first-time buyers, often requiring PMI, ensures a sustained demand for Essent's services. For example, in the first quarter of 2024, Essent reported a significant increase in its new insurance written, largely attributable to this demographic.

- Market Growth: Demographic trends indicate a sustained demand for homeownership from younger cohorts entering the market, a key driver for PMI.

- Essent's Position: Essent's established presence and focus on this segment allow it to capitalize on this growing demand effectively.

- Financial Performance: Essent's first-quarter 2024 results, showing an increase in new insurance written, underscore the strength of its first-time homebuyer business.

- Enabling Homeownership: PMI, particularly from companies like Essent, remains vital in making homeownership accessible for individuals with lower initial down payments.

Expansion of Mortgage-Related Services

Essent's strategic expansion beyond its core Private Mortgage Insurance (PMI) offerings into mortgage-related services like risk management and analytics positions it for growth. The company is actively developing its capabilities in title insurance, targeting high-volume states. This move into adjacent markets, particularly with a focus on building production and specialty value-added services, signals a clear intent to diversify revenue streams and leverage existing market knowledge.

This diversification into title insurance represents a significant opportunity for Essent. The title insurance market is substantial; for instance, the U.S. title insurance market was valued at approximately $16.5 billion in 2023 and is projected to grow. Essent's strategy to focus on high-volume states means it's entering markets with proven demand, aiming to capture a share of this lucrative sector.

- Diversification into Title Insurance: Essent is broadening its service portfolio to include title insurance, a move that leverages its existing relationships within the mortgage industry.

- Focus on High-Volume States: The initial rollout of title insurance services is concentrated in states with substantial real estate transaction volumes, maximizing potential market penetration.

- Value-Added Services: Essent aims to differentiate itself by offering specialty and value-added services within the title insurance space, moving beyond basic offerings.

- Market Potential: The expansion taps into a growing adjacent market, with the U.S. title insurance industry showing consistent revenue generation and growth prospects.

Essent's successful growth in new insurance written (NIW) during 2024, particularly in private mortgage insurance, firmly establishes this segment as a Star. The company's ability to secure a larger share of new mortgage business, fueled by demographic trends favoring younger homebuyers, indicates strong market demand and Essent's competitive edge. This is further supported by Essent's 2024 first-quarter results, which showed a notable increase in NIW, directly attributable to this core offering.

What is included in the product

Strategic guidance for product portfolio management, categorizing units by market share and growth.

Provides a clear visual roadmap for resource allocation, easing the pain of strategic uncertainty.

Cash Cows

Essent's established mortgage insurance-in-force (IIF) portfolio is a prime example of a Cash Cow within the BCG matrix. Its substantial and consistently growing nature provides a reliable stream of recurring premium revenue, underpinning financial stability.

As of March 31, 2025, Essent's U.S. mortgage insurance portfolio reached an impressive $244.7 billion. This significant market presence highlights the scale and maturity of its operations.

This large, mature portfolio generates consistent cash flow with relatively low new investment requirements. Such characteristics are the hallmark of a Cash Cow, offering dependable returns without demanding significant capital infusion.

Essent's investment portfolio demonstrated robust performance, generating a substantial net investment income of $6.3 billion in 2024. This significant income stream serves as a cornerstone of the company's financial strength and contributes reliably to its bottom line. The consistent upward trend in this income, supported by the stability of its investment assets, firmly positions this segment as a Cash Cow within the BCG framework.

Essent's commitment to customer satisfaction is reflected in its impressive persistency rate, which stood at a robust 85.7% as of March 31, 2025. This metric, representing the percentage of insurance policies that remain active, is a crucial indicator of customer loyalty and product satisfaction.

A high persistency rate like Essent's is a hallmark of a Cash Cow. It directly translates into a predictable and steady income stream from policyholders who continue to pay their premiums. This stability is invaluable, especially when compared to the often volatile revenue generated by new business acquisition.

This consistent revenue flow allows Essent to generate substantial profits with minimal ongoing investment. The mature nature of these products, coupled with strong customer retention, means that the resources required to maintain them are relatively low, further enhancing their Cash Cow status.

The ability to maintain such a high persistency rate, even during challenging economic periods, underscores the enduring value and reliability that Essent's offerings provide to its customers.

Consistent Profitability and Return on Equity

Essent's consistent financial performance positions it firmly as a Cash Cow. In 2024, the company achieved a net income of $729 million, demonstrating significant profitability. Furthermore, its return on average equity stood at an impressive 14%, indicating efficient use of shareholder capital.

Despite a slight dip in net income during Q1 2025, Essent continues to exhibit strong financial health. The company maintains robust gross profit margins and showcases effective financial management practices. These factors collectively suggest that Essent generates substantial cash flows, exceeding its operational and investment needs.

- Consistent Profitability: Essent reported $729 million in net income for 2024.

- Strong Return on Equity: The company achieved a 14% return on average equity in 2024.

- Efficient Capital Utilization: Essent's financial management allows it to generate more cash than it consumes.

- Resilient Margins: Despite minor Q1 2025 fluctuations, gross profit margins remain robust.

Long-Standing Lender Relationships

Essent's extensive network of long-standing lender relationships across the U.S. is a significant driver of its Cash Cow status. These established partnerships ensure a steady flow of business for its primary Private Mortgage Insurance (PMI) operations, minimizing the need for costly outreach to new clients.

This stable and predictable revenue stream, fueled by mature lender connections, underpins Essent's position as a Cash Cow. For instance, Essent reported a substantial number of lender relationships in its 2023 filings, underscoring the depth of its market penetration.

- Deep Lender Network: Essent maintains relationships with hundreds of mortgage lenders nationwide.

- Reduced Acquisition Costs: Mature relationships lower the expense of securing new business.

- Predictable Revenue: These long-term partnerships create a reliable and consistent income source.

- Core Business Support: The lender network directly fuels Essent's core PMI offerings.

Essent's mortgage insurance portfolio acts as a strong Cash Cow, generating consistent cash flow with minimal new investment needs. The company's substantial U.S. mortgage insurance in force, reaching $244.7 billion as of March 31, 2025, highlights its mature market position.

This stability is further reinforced by a robust net investment income of $6.3 billion in 2024. High policy persistency, demonstrated by an 85.7% rate as of March 31, 2025, ensures a predictable revenue stream from loyal customers.

Essent's financial performance in 2024, including $729 million in net income and a 14% return on equity, underscores its ability to generate substantial profits. The company's deep network of lender relationships also contributes to consistent business flow, reducing acquisition costs.

| Metric | Value (as of March 31, 2025, unless noted) | Significance for Cash Cow Status |

| U.S. Mortgage Insurance IIF | $244.7 billion | Indicates a large, established market presence |

| Net Investment Income (2024) | $6.3 billion | Provides a significant, reliable income stream |

| Policy Persistency Rate | 85.7% | Ensures predictable, recurring revenue from existing customers |

| Net Income (2024) | $729 million | Demonstrates strong profitability |

| Return on Average Equity (2024) | 14% | Shows efficient use of shareholder capital |

Preview = Final Product

Essent BCG Matrix

The preview you see is the complete and unaltered Essent BCG Matrix document you will receive upon purchase. This means the file is fully formatted, contains all necessary strategic insights, and is ready for immediate application without any watermarks or demo content.

Dogs

Outdated legacy IT systems, while perhaps once critical, often become Dogs in the Essent BCG Matrix if they aren't integrated with newer, more efficient platforms. These systems typically demand substantial upkeep and lack the agility needed for today's fast-paced digital environment. In 2024, many companies are still grappling with these, with estimates suggesting that over 60% of IT spending in large enterprises is dedicated to maintaining legacy systems, diverting funds from innovation.

These systems can be resource drains, consuming capital and human resources for maintenance rather than driving growth or providing a competitive edge. Their low utility and high operational costs make them prime candidates for divestment or a complete overhaul. For instance, a financial institution might find its decades-old mainframe system, still processing essential but slow transactions, is costing millions annually in maintenance and hindering the adoption of real-time analytics, a clear Dog.

Low-volume, non-core mortgage services represent niche offerings within Essent's portfolio that haven't captured substantial market traction. These could include highly specialized loan products or ancillary services that, despite their existence, contribute minimally to the company's overall revenue and profitability. For instance, if Essent had a specialized product targeting a very small demographic that saw little uptake, it would fall into this category.

These types of services often tie up valuable capital and operational resources without generating a commensurate return. In 2024, for companies in the mortgage sector, focusing resources on high-demand areas like conventional purchase mortgages is critical for growth. Services with very low adoption rates can become a drain, impacting efficiency and potentially hindering investment in more promising ventures.

Pilot programs or exploratory ventures that didn't meet their market acceptance or profitability goals are considered "Dogs" in the BCG Matrix. These are initiatives that were once intended for growth but are now draining resources with little to no future potential. For instance, a company might have launched a new subscription service in 2023 that only garnered 5% of its projected user base by mid-2024, indicating poor market fit.

Continuing to fund such underperforming projects is a drain on a company's financial health. In 2024, many businesses are scrutinizing their portfolios, and projects with consistently low ROI, like a pilot mobile app that saw a mere 2% user engagement rate over six months, are prime candidates for divestment or discontinuation to reallocate capital more effectively.

Mortgage Insurance Segments with Declining Demand

Certain segments within the mortgage insurance market might be showing a consistent drop in demand. This can happen as borrowers change their habits or find other ways to finance their homes. For example, if fewer people are taking out certain types of mortgages that require insurance, that segment will shrink.

If Essent has a small slice of these declining markets, it becomes tough to make money or grow. It’s like trying to sell ice cream in the Arctic; there just aren't many customers. This situation calls for close attention so the company doesn't waste valuable resources in areas that aren't yielding results.

Consider the private mortgage insurance (PMI) market for conventional loans with less than 20% down. While still substantial, some trends might indicate a slowdown in specific sub-segments compared to previous years. For instance, a higher percentage of borrowers opting for FHA loans or jumbo loans with different insurance structures could impact traditional PMI demand.

- Declining Demand Segments: Areas where borrower preferences shift away from traditional mortgage insurance, perhaps due to increased down payments or alternative credit enhancements.

- Low Market Share Impact: If Essent's presence in these shrinking segments is minimal, revenue generation and growth potential become severely limited.

- Resource Trap Risk: Investing further in these "Dog" segments could tie up capital and human resources that would be better allocated to more promising areas of the business.

- Market Monitoring: Continuous analysis of market trends and borrower behavior is crucial to identify and manage these underperforming segments effectively.

Highly Manual or Inefficient Internal Processes

Highly manual or inefficient internal processes represent a significant drag on a company's performance, especially in today's competitive landscape. These are operations that haven't been touched by automation or digital advancements, remaining stuck in older, more labor-intensive ways of working. Think of tasks like paper-based invoicing, manual data entry, or even physical inventory checks that could easily be digitized.

These inefficiencies directly translate into higher operational expenses. For instance, companies still relying heavily on manual data processing can see labor costs increase by as much as 30% compared to those with automated systems. This not only reduces profitability but also makes the company less agile and responsive to market changes. In 2024, businesses that continue to operate with such manual processes are falling behind industry benchmarks, which increasingly emphasize lean operations and digital integration.

The impact of these manual processes is substantial:

- Increased Labor Costs: Manual tasks require more human hours, directly inflating payroll expenses. For example, a recent study indicated that manual accounts payable processing can cost up to $12 per invoice, whereas automated systems can bring this down to under $3.

- Reduced Productivity: Repetitive manual work is often slower and more prone to errors than automated solutions, leading to lower overall output and missed deadlines.

- Higher Error Rates: Human error is inherent in manual processes, leading to costly mistakes in data entry, order fulfillment, and customer service. These errors can result in financial losses and damage to reputation.

- Lack of Scalability: Manual processes are difficult to scale up quickly to meet growing demand, hindering business expansion and potentially leading to lost opportunities.

Investing in modernizing these operational areas is not just an option; it's a necessity for survival and growth. Companies that fail to address these inefficiencies risk becoming a significant drain on resources, unable to compete effectively with more digitally-enabled peers.

Dogs in the Essent BCG Matrix represent business units or products with low market share and low growth potential. These are often resource drains, consuming capital without generating significant returns. Identifying and managing these "Dogs" is crucial for optimizing a company's portfolio. For instance, a legacy software product that has been surpassed by newer technologies and has few active users would be a classic example.

In 2024, many companies are shedding underperforming assets. For example, a significant trend observed across various industries is the divestment of niche product lines that require substantial maintenance but offer minimal revenue. This strategic pruning allows businesses to refocus resources on their stars and cash cows.

Consider a scenario where Essent had a specific type of specialized mortgage insurance product that, by mid-2024, only accounted for 0.5% of its total insured volume, with minimal projected growth. This would clearly classify as a Dog, demanding resources for compliance and administration without contributing meaningfully to overall profitability.

The key takeaway is that "Dogs" represent an opportunity for improvement, whether through divestment, turnaround efforts, or strategic harvesting. Ignoring them can lead to a gradual erosion of profitability and hinder a company's ability to invest in more promising ventures.

Question Marks

Essent's strategic exploration into advanced AI/ML-driven predictive analytics for new products positions these initiatives squarely within the Question Mark quadrant of the BCG Matrix. While the company is already leveraging these technologies for risk management and pricing, applying them to entirely novel product lines or nascent market segments represents a significant, albeit potentially lucrative, frontier.

The potential upside is substantial, with these AI/ML applications promising to unlock new market opportunities and drive considerable efficiency gains. For instance, predictive analytics could identify underserved customer needs, leading to the development of highly targeted and successful new offerings. Early indications suggest that companies investing in AI for market prediction are seeing significant returns; a 2024 report indicated that businesses using AI for market analysis experienced an average revenue increase of 15% compared to their AI-averse counterparts.

However, the current market share for these specific AI/ML-driven new product initiatives is inherently low, as they are in the developmental or early-stage testing phases. This necessitates substantial investment to validate their effectiveness and scale them for wider adoption. The inherent uncertainty means that significant capital and resources must be committed before their viability and market traction can be definitively proven.

Expanding Essent's private mortgage insurance or title insurance into new U.S. geographic markets where its presence is currently minimal fits the Question Mark quadrant of the BCG Matrix. These untapped regions often hold significant growth potential, driven by favorable demographic shifts or emerging housing trends. For instance, states like Idaho and Utah saw substantial housing market growth in 2023, with median home prices increasing by over 5% year-over-year according to Redfin data, presenting potential opportunities for market entry.

However, success in these new territories hinges on substantial investment. Essent would need to allocate considerable resources towards market penetration strategies, including localized marketing campaigns and building strong relationships with regional lenders and real estate professionals. The company must also contend with established local competitors who already possess brand recognition and existing market share.

New digital closing and e-notarization integrations represent a significant opportunity for Essent, potentially placing them in the Star quadrant of the BCG matrix. These technologies are rapidly gaining traction, with the e-mortgage market projected to reach $7.6 billion by 2027, indicating substantial growth potential.

Successful integration with these platforms could streamline the mortgage origination process, improving efficiency and customer satisfaction for Essent's lender partners. A key factor in determining their Star status will be the rate of adoption by these partners; if lenders actively embrace these digital solutions, it signals strong market demand and Essent's ability to capitalize on it.

Specialized Title Insurance Offerings for Niche Markets

Essent's foray into specialized title insurance offerings positions it as a Question Mark within the BCG framework. The company is developing value-added services for specific high-growth niches, aiming to capture market share in areas often overlooked by traditional insurers.

While the broader title insurance market is established, these specialized segments, such as those catering to complex real estate transactions or emerging property types, present a growth opportunity. Essent's success hinges on its strategic investments and operational execution in these targeted markets.

- Market Penetration Strategy Essent's ability to gain traction in these niche markets will be measured by its customer acquisition rates and the market share it secures by 2024.

- Investment in Technology and Expertise Significant investments in technology and specialized legal expertise are crucial for Essent to effectively serve these complex segments.

- Profitability of Niche Offerings The profitability of these specialized offerings will be a key indicator of their viability and Essent's strategic alignment.

- Competitive Landscape Analysis Understanding and outmaneuvering competitors in these specialized niches will be critical for Essent's sustained growth.

Exploratory Blockchain-Based Mortgage Solutions

The mortgage industry is actively exploring blockchain technology for its potential to revolutionize document security and transaction processes. Essent's engagement in exploratory or pilot initiatives signifies a strategic move into these nascent, high-growth areas.

Blockchain offers enhanced security and transparency, crucial for mortgage servicing and origination, though these applications currently hold a very small market share. Successful integration necessitates significant investment in research and development, alongside building broader market acceptance.

- Market Potential: The global blockchain in banking market size was valued at USD 1.7 billion in 2023 and is projected to grow significantly, indicating substantial future potential for blockchain-based mortgage solutions.

- Essent's Role: Essent's exploratory initiatives position it to capture early market share in a segment expected to see rapid expansion.

- Challenges: Overcoming regulatory hurdles and achieving widespread industry adoption remain key challenges for blockchain implementation in mortgages.

- Efficiency Gains: Blockchain could streamline mortgage processes, reducing costs and settlement times, a critical advantage in a competitive market.

Question Marks represent business units or products with low market share in high-growth industries. These are often new ventures requiring significant investment to develop their market presence. Essent's exploration into AI for new product development and expansion into new geographic markets for its insurance offerings exemplify this category.

The key challenge for Question Marks is to determine which ones have the potential to become Stars, thereby justifying continued investment. Failure to grow market share or a decline in industry growth can lead to these becoming Dogs.

For Essent, success in these Question Mark areas means strategically investing in market penetration, technology, and expertise to convert potential into market dominance.

| Business Unit/Initiative | Market Growth | Current Market Share | Strategic Implication |

|---|---|---|---|

| AI/ML for New Products | High | Low | Requires significant investment for market validation and scaling. Potential to become a Star. |

| Geographic Expansion (e.g., Idaho, Utah) | High (housing market growth) | Low | Needs substantial investment in localized strategies and partnerships. High risk, high reward. |

| Specialized Title Insurance | High (niche segments) | Low | Success depends on targeted investments and operational excellence in specific high-growth niches. |

| Blockchain in Mortgages (Exploratory) | High | Very Low | Demands R&D investment and market acceptance efforts. Future potential is significant but uncertain. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market research, including sales data, competitor analysis, and customer feedback, to accurately position business units.