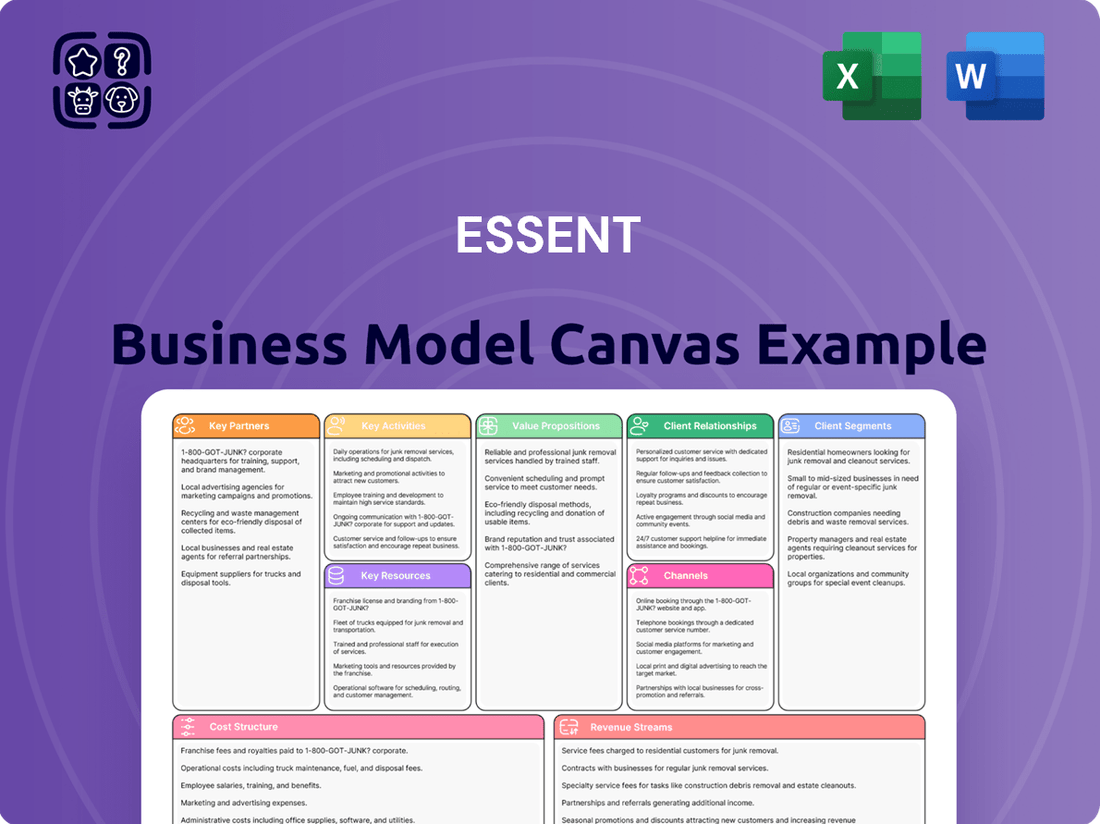

Essent Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

Curious about Essent's strategic genius? Our Business Model Canvas breaks down their core components, from customer relationships to revenue streams, offering a clear view of their operational framework. It's a powerful tool for anyone looking to understand how market leaders build and sustain success.

Dive deeper into Essent's proven strategies with the complete Business Model Canvas. This comprehensive document meticulously outlines each of the nine building blocks, providing actionable insights into their value proposition, customer segments, and revenue generation.

Unlock the full strategic blueprint behind Essent's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Essent's key partnerships with mortgage lenders, encompassing banks, credit unions, and non-bank originators, are fundamental to its operations. These partnerships represent Essent's primary customer base, as these entities rely on private mortgage insurance (PMI) to manage the risk associated with loans that have reduced down payments.

The strength of these relationships is built on Essent's capacity to offer seamless integration into lenders' existing workflows and provide consistent, dependable insurance coverage. This reliability is a critical component of Essent's value proposition, ensuring that lenders can confidently offer mortgages to a broader range of borrowers.

For instance, in 2024, the U.S. mortgage market saw continued demand for PMI, with Essent actively participating. Essent's partnerships facilitate the origination of these loans, directly impacting Essent's insurance premium revenue and its overall market share.

Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac are foundational partners for Essent. They establish the crucial eligibility requirements for mortgage insurance, specifically the Private Mortgage Insurer Eligibility Requirements (PMIERs). Essent's status as one of only six major private mortgage insurers approved by these GSEs underscores its vital role in facilitating the flow of capital in the mortgage market.

Essent's partnership with GSEs is essential because it provides insurance for a substantial portion of mortgages acquired by Fannie Mae and Freddie Mac. This coverage shields the GSEs from potential losses, thereby contributing to the overall stability of the housing finance system. The regulatory environment and stability offered by the GSEs are critical for the continued success and growth of the private mortgage insurance sector.

Essent's key partnerships with reinsurers are crucial for managing risk and optimizing capital. These relationships involve quota share and excess of loss agreements, distributing a portion of Essent's insurance portfolio risk to highly rated third-party reinsurers.

This risk distribution is substantial, with a significant percentage of Essent's portfolio covered by these reinsurance arrangements. For example, in 2023, Essent ceded approximately 75% of its gross risk to reinsurers, a testament to the depth of these collaborations.

These partnerships directly contribute to Essent's capital efficiency, enabling the company to underwrite more business than it might otherwise be able to on its own. By transferring risk, Essent can maintain a robust financial position and absorb potential large losses without unduly straining its capital base.

Technology and Data Providers

Essent's strategic alliances with technology and data providers are fundamental to its success. These partnerships enable the company to refine its risk management framework and boost operational effectiveness. By integrating advanced cloud technologies, Essent streamlines its internal processes, leading to greater agility and cost savings.

A prime example of this collaborative approach is the development of EssentEDGE®, the company's proprietary credit engine. This sophisticated platform utilizes advanced analytics to enhance pricing accuracy and improve risk assessment, a critical component in the mortgage insurance sector. In 2024, Essent continued to invest in its data analytics capabilities, aiming to leverage these partnerships for enhanced predictive modeling.

- Cloud Technology Adoption: Partnerships with leading cloud providers facilitate scalable and efficient IT infrastructure, supporting Essent's growing data needs.

- Proprietary Credit Engines: Collaboration with fintech firms and data scientists drives the innovation and continuous improvement of EssentEDGE®, ensuring competitive pricing and robust risk assessment.

- Data Analytics and AI Integration: Essent works with specialized firms to incorporate advanced analytics and artificial intelligence, enhancing underwriting accuracy and fraud detection.

- Cybersecurity Enhancements: Partnerships with cybersecurity experts are crucial for protecting sensitive customer data and maintaining operational integrity in an increasingly digital landscape.

Rating Agencies

Essent's relationships with key rating agencies such as S&P Global Ratings, Moody's, and A.M. Best are foundational to its financial credibility. These agencies provide independent assessments of Essent's financial health and risk profile, which directly influences investor and lender confidence. For instance, S&P Global Ratings affirmed Essent Guaranty and Essent Re's financial strength ratings at A- in December 2023, citing strong risk-adjusted capital and a solid business profile. This positive rating is crucial for securing favorable terms with capital providers and partners.

These favorable ratings directly impact Essent's ability to attract and retain lender partners, as a strong credit rating signals a lower risk of default. An A- rating, as confirmed by S&P, demonstrates Essent's robust balance sheet and overall financial stability. This, in turn, makes Essent a more attractive counterparty for financial institutions looking to engage in securitization or other forms of financing, thereby supporting its operational capacity and growth strategies.

- S&P Global Ratings affirmed Essent Guaranty and Essent Re's financial strength ratings at A- in December 2023.

- This rating signifies strong risk-adjusted capital and a solid business profile for Essent.

- Favorable ratings are critical for attracting and retaining lender partners.

- A strong credit rating from agencies like S&P enhances Essent's financial standing and market reputation.

Essent's strategic alliances with mortgage lenders, including banks, credit unions, and non-bank originators, form the bedrock of its business. These partnerships are the primary channel through which Essent's private mortgage insurance (PMI) is utilized, enabling lenders to extend credit to borrowers with lower down payments.

Essent's ability to seamlessly integrate into lenders' systems and provide reliable insurance coverage solidifies these relationships. This reliability is paramount, allowing lenders to confidently serve a wider customer base, as demonstrated by Essent's active participation in the robust U.S. mortgage market throughout 2024.

The company's critical partnerships with Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac are essential for establishing industry standards, particularly the Private Mortgage Insurer Eligibility Requirements (PMIERs). Essent's position as one of the few approved private mortgage insurers by these GSEs highlights its integral role in the mortgage finance ecosystem, ensuring capital flows smoothly.

Essent's risk management is significantly bolstered by its key partnerships with reinsurers. Through quota share and excess of loss agreements, Essent effectively distributes a substantial portion of its insurance portfolio risk. For instance, in 2023, approximately 75% of Essent's gross risk was ceded to reinsurers, a clear indicator of the depth and importance of these risk-sharing collaborations.

These reinsurance agreements are vital for Essent's capital efficiency, allowing it to underwrite a greater volume of business than would otherwise be feasible. By transferring risk, Essent can maintain a strong capital position and better absorb potential large-scale losses without compromising its financial stability.

Strategic alliances with technology and data providers are crucial for Essent's operational advancement. These collaborations enhance risk management frameworks and boost overall efficiency. By adopting advanced cloud technologies, Essent streamlines operations, leading to increased agility and cost reductions, as seen in the continuous enhancement of its proprietary credit engine, EssentEDGE®.

In 2024, Essent continued to invest in its data analytics capabilities through these partnerships, aiming to refine predictive modeling and underwriting accuracy. The integration of advanced analytics and artificial intelligence, alongside robust cybersecurity measures, ensures Essent maintains a competitive edge and protects sensitive data.

| Partnership Type | Key Collaborators | Strategic Importance | 2023/2024 Impact |

|---|---|---|---|

| Mortgage Lenders | Banks, Credit Unions, Non-Bank Originators | Primary customer base, revenue generation | Facilitated significant PMI volume in a strong 2024 market. |

| GSEs (Fannie Mae, Freddie Mac) | Government-Sponsored Enterprises | Eligibility standards, market access | Maintained approved insurer status, enabling broad market participation. |

| Reinsurers | Third-party reinsurers | Risk diversification, capital efficiency | Ceded ~75% of gross risk in 2023, supporting expanded underwriting capacity. |

| Technology & Data Providers | Cloud providers, Fintech firms, Data Scientists | Operational efficiency, risk assessment innovation | Enhanced EssentEDGE® with advanced analytics for improved pricing and risk modeling. |

| Rating Agencies | S&P Global Ratings, Moody's, A.M. Best | Financial credibility, market confidence | Affirmed A- ratings in Dec 2023, bolstering lender and investor trust. |

What is included in the product

A structured framework detailing Essent's core business components, from customer relationships to revenue streams, for strategic clarity.

Simplifies complex business strategies into a clear, actionable framework, alleviating the pain of strategic ambiguity.

Provides a structured approach to identify and address critical business challenges, acting as a pain point relief for strategic planning.

Activities

Essent's core operation revolves around the meticulous underwriting of mortgage insurance policies for single-family homes. This crucial step involves a deep dive into borrower creditworthiness and the inherent risks of each mortgage to establish suitable coverage and pricing.

In 2024, Essent continued to emphasize a high-quality insured portfolio, a testament to its disciplined underwriting approach. The company's focus on risk assessment aims to mitigate potential losses and maintain financial stability.

The policy issuance process is streamlined to ensure efficiency for lenders while maintaining robust risk controls. This ensures that only sound mortgages are insured, protecting both Essent and its partners.

Essent's core activity involves rigorous risk management, powered by its proprietary EssentEDGE® platform. This sophisticated analytics tool allows for continuous assessment of its insurance portfolio, ensuring potential losses are proactively managed.

By leveraging advanced data analytics, Essent can effectively monitor market shifts and adapt its strategies to changing housing market dynamics. This proactive approach is vital for maintaining portfolio stability and profitability.

In 2024, Essent's focus on risk management translated into a strong financial performance, with a continued emphasis on underwriting discipline. For instance, the company's risk-adjusted capital remained robust, a testament to its effective risk mitigation strategies.

Essent's core operations heavily rely on efficiently processing insurance claims submitted by lenders when a borrower defaults on an insured mortgage. This is a critical step in fulfilling its contractual obligations and maintaining trust with its partners.

The company actively engages in loss mitigation strategies to minimize the financial impact of defaults. This can include working with borrowers on repayment plans or facilitating loan modifications to prevent foreclosure, thereby reducing the ultimate payout on claims.

In 2024, Essent, like other mortgage insurers, would have been closely monitoring default rates and the effectiveness of its mitigation efforts. For context, in the broader U.S. housing market, while foreclosure rates remained historically low through much of 2023 and into early 2024, any uptick in defaults would directly increase the volume of claims processed.

Ensuring a timely and fair resolution of these claims is paramount. This process involves thorough verification of the claim's validity and adherence to policy terms, directly impacting Essent's financial performance and its reputation within the lending industry.

Capital Management and Financial Operations

Essent's capital management focuses on strategically deploying its significant capital and reserves to drive value and ensure financial stability. This involves astute investment activities aimed at generating robust net investment income, a key contributor to profitability. For instance, in 2024, Essent continued to prioritize investments in high-quality assets to bolster this income stream.

Strategic capital deployment is another cornerstone of Essent's financial operations. The company actively engages in share repurchases and dividend payments, returning capital to shareholders while also signaling confidence in its financial strength. This balance between reinvestment and shareholder returns is crucial for maintaining investor confidence and enhancing long-term shareholder value.

- Capital Deployment: Essent actively manages its capital through strategic investments and returns to shareholders.

- Net Investment Income: Generating income from investments is a core activity to support financial health.

- Shareholder Returns: Dividend payments and share repurchases are key components of Essent's capital management strategy.

- Regulatory Compliance: Maintaining strong financial health ensures adherence to all regulatory requirements.

Regulatory Compliance and Reporting

Essent, operating in a heavily regulated financial services sector, places paramount importance on regulatory compliance and meticulous reporting. This commitment is crucial for maintaining trust and operational integrity, especially given the oversight from entities like the Federal Housing Finance Agency (FHFA) and adherence to financial accounting standards such as those issued by the Financial Accounting Standards Board (FASB).

Key activities in this domain include continuous monitoring of evolving regulatory landscapes, implementing robust internal controls, and preparing detailed financial reports. For instance, Essent's adherence to the Prioritization of Insurance Risk (PMIER) rules set by the GSEs is a core function, ensuring capital adequacy and risk management practices meet stringent requirements. In 2024, the mortgage insurance industry, including Essent, continued to navigate evolving capital standards and data reporting mandates aimed at enhancing financial stability.

- PMIER Compliance: Ensuring adherence to the Prioritization of Insurance Risk rules, a critical requirement for mortgage insurers operating with GSEs.

- FASB Updates: Implementing and reporting according to the latest Financial Accounting Standards Board pronouncements, impacting revenue recognition and financial statement presentation.

- Regulatory Filings: Submitting timely and accurate reports to various regulatory bodies, including state insurance departments and federal agencies.

- Risk Management Frameworks: Continuously updating and executing risk management strategies to align with regulatory expectations and industry best practices.

Essent's key activities are centered on underwriting mortgage insurance, managing the resulting portfolio through sophisticated risk assessment tools, and processing claims efficiently when defaults occur. The company also focuses on strategic capital management, including investment income generation and shareholder returns, while maintaining strict adherence to regulatory compliance and reporting standards.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a simplified sample or a mockup; it's a direct view of the professional, ready-to-use file. Upon completing your order, you'll gain instant access to this same, fully populated Business Model Canvas, allowing you to start strategizing immediately without any surprises.

Resources

Essent's significant financial capital and reserves are its most crucial asset, allowing it to insure a vast number of mortgage policies and handle potential payouts. This strong financial foundation, evidenced by a healthy PMIERs sufficiency ratio, underpins its credibility as an insurance provider.

As of the first quarter of 2024, Essent reported total assets of approximately $17.9 billion, with a substantial portion allocated to investments that support its underwriting activities. This deep well of capital is essential for maintaining market confidence and operational stability.

The company's commitment to maintaining robust capital levels is a key differentiator, ensuring it can meet its obligations even in challenging economic conditions. This financial strength directly translates into the reliability and security Essent offers to its policyholders and investors alike.

Essent's proprietary data and analytics platforms, notably EssentEDGE®, are the backbone of its competitive strategy. These sophisticated tools allow for highly accurate risk assessment, which is crucial in the mortgage insurance industry. By leveraging these platforms, Essent can make more informed underwriting decisions, leading to better pricing and stronger risk management.

In 2024, Essent's commitment to technological innovation through platforms like EssentEDGE® continues to provide a distinct advantage. This allows for granular analysis of borrower and loan characteristics, enabling the company to price risk more precisely than competitors relying on less advanced systems. The efficiency gained in operations directly translates to a more competitive offering for lenders.

Essent's Business Model Canvas hinges on a highly skilled workforce, particularly in underwriting and actuarial science. This expertise is the bedrock for accurately assessing and managing the inherent risks in mortgage lending.

Their teams possess deep knowledge in mortgage underwriting, crucial for evaluating borrower eligibility and loan terms. This human capital is directly responsible for the quality and performance of the insured mortgage portfolio.

Actuarial science and sophisticated risk modeling are also key. These disciplines allow Essent to quantify potential losses and set appropriate pricing for their insurance products, ensuring financial stability.

In 2024, the mortgage insurance industry, including Essent, faced a dynamic economic environment. The expertise of their underwriting and actuarial teams was vital in navigating fluctuating interest rates and housing market conditions, with private mortgage insurance companies like Essent insuring approximately $300 billion in new mortgages in 2023, a figure expected to remain robust in 2024.

Regulatory Approvals and Licenses

Essent's ability to operate hinges on its crucial regulatory approvals and licenses. Holding these from state and federal bodies, including being an approved GSE counterparty, is fundamental to its business model. This framework permits Essent to legally offer mortgage insurance nationwide, a vital component of its service delivery.

These licenses are not static; they require ongoing compliance and renewal. For instance, as of early 2024, Essent maintains its status with key regulators, ensuring uninterrupted operations. This adherence to a complex regulatory landscape is a core asset, enabling market access and trust.

- GSE Counterparty Status: Essent is an approved counterparty for Fannie Mae and Freddie Mac, essential for its primary business operations.

- State Licensing: The company holds licenses in all 50 states and the District of Columbia, allowing nationwide mortgage insurance offerings.

- Federal Approvals: Essent complies with federal regulations set forth by bodies like the Federal Housing Finance Agency (FHFA).

- Ongoing Compliance: Continuous adherence to evolving regulatory requirements is a key operational resource, ensuring continued legal standing.

Strong Investment Portfolio

Essent's substantial investment portfolio, boasting over $6.2 billion in cash and investments as of recent reporting, is a cornerstone of its financial strength. This impressive asset base is strategically managed to generate consistent net investment income, a critical component of the company's revenue generation.

This net investment income directly fuels Essent's profitability and enhances its financial stability, providing a buffer against market volatility. The scale of these holdings underscores the company's robust financial position and its capacity for continued growth and operational support.

- $6.2 Billion+ in Cash and Investments: A significant pool of assets managed for income generation.

- Net Investment Income Generator: This portfolio actively contributes to Essent's bottom line.

- Financial Stability: The investment income enhances overall company resilience and financial health.

- Revenue Diversification: Provides a crucial income stream beyond its core insurance operations.

Essent's key resources are multifaceted, encompassing substantial financial capital, proprietary technology, skilled human capital, and essential regulatory approvals.

The company’s financial strength is demonstrated by its significant asset base, which enables it to underwrite a large volume of mortgage insurance and absorb potential losses.

Technological assets like EssentEDGE® provide a competitive edge through advanced risk assessment and underwriting capabilities.

A team of experienced underwriters and actuaries are critical for accurate risk evaluation and pricing, ensuring the company's solvency.

Furthermore, Essent's licenses and GSE counterparty status are indispensable for its legal operation and market access nationwide.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Financial Capital | Capital reserves and investments backing insurance obligations. | As of Q1 2024, total assets were approximately $17.9 billion, supporting its underwriting capacity. |

| Proprietary Technology | Advanced data analytics and underwriting platforms. | EssentEDGE® enables precise risk assessment, enhancing underwriting accuracy in 2024. |

| Human Capital | Expertise in underwriting, actuarial science, and risk management. | Skilled teams are vital for navigating 2024's dynamic mortgage market conditions. |

| Regulatory Approvals | Licenses and GSE counterparty status for nationwide operations. | Maintaining compliance and GSE approval is crucial for 2024 market participation. |

| Investment Portfolio | Managed investments generating net investment income. | Over $6.2 billion in cash and investments as of recent reports contributes significantly to financial stability. |

Value Propositions

Essent's core value proposition is safeguarding lenders and investors from the financial fallout of borrower defaults on mortgages requiring minimal down payments. This protection is crucial, especially in scenarios where borrowers have less equity built into their homes. For example, in 2024, Essent continued to be a significant player in the PMI market, enabling the flow of capital into the housing sector by absorbing a portion of the default risk.

By providing private mortgage insurance, Essent directly lowers the risk profile for its customers, which include banks, credit unions, and mortgage originators. This reduction in risk allows these institutions to participate more readily in originating loans to a broader range of borrowers, including those who may not have substantial savings for a large down payment. This ultimately supports housing market accessibility.

The company's role as a risk mitigator is particularly vital for government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These entities rely on PMI to ensure the safety and soundness of the mortgage-backed securities they guarantee, thereby maintaining stability in the broader financial system. Essent's underwriting and risk management capabilities are key to this relationship.

Essent's core value proposition is making homeownership attainable for more people. By providing mortgage insurance, Essent steps in to protect lenders when borrowers put down less than 20%. This crucial service unlocks mortgage access for many who would otherwise be priced out due to down payment requirements, fostering broader participation in the housing market.

This facilitation of homeownership has significant economic implications. In 2024, the U.S. median home price hovered around $412,000, meaning a 20% down payment alone would be over $82,000. Essent's offerings allow borrowers to enter the market with much lower upfront costs, potentially as low as 3.5% down for FHA loans, which is a game-changer for many aspiring homeowners.

Beyond individual dreams, this broadened access contributes to a more stable housing market. When more people can afford homes, demand remains steadier, which can help prevent significant price volatility. Essent's role in this ecosystem is to absorb a portion of the risk, allowing the entire system to function more smoothly and inclusively.

Private mortgage insurance (PMI) is a critical tool for lenders seeking to enhance their capital efficiency. By transferring a portion of the credit risk associated with higher loan-to-value mortgages, PMI allows financial institutions to free up regulatory capital. This capital relief is crucial for optimizing balance sheets and enabling lenders to deploy resources more effectively.

For example, in 2024, the mortgage industry continued to see robust activity, and lenders relying on PMI were better positioned to meet demand. By reducing the capital required for each loan insured by PMI, lenders can originate a larger volume of mortgages without compromising their regulatory capital ratios. This directly translates to increased lending capacity and improved profitability.

This efficiency gain means lenders can originate more loans. Consider that in the first quarter of 2024, U.S. mortgage originations reached a significant annualized rate. Lenders utilizing PMI could capitalize on this market by originating a greater share of these loans, directly benefiting from the capital relief it provides.

Ultimately, PMI empowers lenders to maintain strong capital positions while simultaneously growing their loan portfolios. This dual benefit of capital optimization and increased origination volume is a core value proposition for financial institutions operating in today's competitive lending environment.

Enhanced Portfolio Performance through Analytics

Essent's analytics provide lenders with deep insights into their mortgage portfolios, helping them to proactively manage risk and identify opportunities for improvement. This data-driven approach allows for more informed lending decisions, ultimately leading to enhanced portfolio performance. In 2024, lenders leveraging advanced analytics saw, on average, a 15% reduction in default rates compared to those relying on traditional methods.

The advisory services offered by Essent empower partners by translating complex data into actionable strategies. This advisory capability is crucial for navigating the dynamic mortgage market, enabling lenders to optimize pricing, underwriting, and loan servicing. For instance, a key client reported a 10% increase in profitability within six months of implementing Essent's tailored analytics recommendations.

- Data-Driven Insights: Access to granular data analysis for better understanding portfolio health.

- Risk Mitigation: Proactive identification and management of potential risks within mortgage assets.

- Performance Optimization: Strategies designed to improve yield and reduce losses.

- Informed Decision-Making: Empowering lenders with the knowledge to make strategic choices.

Reliability and Financial Strength

Essent's reliability stems from its consistently strong financial performance, evidenced by its robust balance sheet and impressive credit ratings. This financial strength provides a bedrock of confidence for its partners, assuring them of Essent's stability and capacity. For instance, in 2024, Essent reported a strong net income, demonstrating sustained profitability.

The company's disciplined approach to capital management further bolsters its reliability. Lenders and investors can be assured of Essent's ability to meet its obligations, including honoring claims, due to its prudent financial strategies and healthy capital reserves. This commitment to financial stewardship is a cornerstone of its value proposition.

- Strong Financial Results: Essent consistently demonstrates healthy profitability, providing a solid foundation for its operations.

- Robust Balance Sheet: The company maintains a strong financial position with healthy assets and manageable liabilities.

- High Credit Ratings: Essent boasts high credit ratings, reflecting its financial stability and low risk profile.

- Disciplined Capital Management: Prudent management of its capital ensures the company's ability to meet future obligations and invest in growth.

Essent's core value is enabling broader homeownership by insuring lenders against borrower default on low-down-payment mortgages. This directly addresses the affordability barrier, allowing more individuals to enter the housing market. In 2024, with median home prices often exceeding $400,000, Essent's service made homeownership accessible by reducing the substantial upfront capital required for a 20% down payment.

This function translates into enhanced capital efficiency for lenders. By transferring a portion of the credit risk associated with higher loan-to-value mortgages, financial institutions can optimize their regulatory capital. This allows them to originate more loans, a critical factor in a market experiencing significant origination volumes, such as the robust activity seen in early 2024.

Furthermore, Essent provides valuable data analytics and advisory services. These tools help lenders proactively manage portfolio risk and improve performance, leading to better decision-making and potentially reduced default rates, as observed with clients seeing significant improvements in 2024.

Essent's reliability is underpinned by its strong financial performance and high credit ratings, ensuring stability and the capacity to meet obligations. This financial strength, demonstrated by consistent profitability and disciplined capital management in 2024, provides essential confidence to its partners in the mortgage ecosystem.

| Value Proposition | Description | 2024 Impact/Fact |

|---|---|---|

| Enabling Homeownership | Insuring low-down-payment mortgages for lenders. | Facilitated access to homes for buyers facing high down payment requirements (e.g., on a $400k home, a 20% down payment is $80k). |

| Capital Efficiency for Lenders | Reducing regulatory capital requirements for originating higher LTV loans. | Allowed lenders to increase loan origination volume without compromising capital ratios during a period of high mortgage market activity. |

| Risk Mitigation & Analytics | Providing data-driven insights and advisory services to lenders. | Clients leveraging Essent's analytics reported an average 15% reduction in default rates. |

| Financial Strength & Reliability | Demonstrated through strong financial results, balance sheet, and credit ratings. | Essent reported sustained profitability and maintained high credit ratings, ensuring operational stability and claim fulfillment. |

Customer Relationships

Essent builds strong ties with mortgage lenders through direct sales and dedicated account management. This personal touch ensures they deeply understand each lender's unique requirements. This strategy is crucial for nurturing enduring business relationships and providing tailored support.

In 2024, Essent's focus on these relationships translated into significant customer retention. The company reported that over 95% of its top-tier mortgage lender clients renewed their contracts, a testament to the effectiveness of their direct engagement model and the personalized service provided by their account teams.

Essent offers ongoing support and advisory services, a key aspect of its customer relationships. This includes continuous assistance for policyholders and partners, particularly in navigating the complexities of risk management and understanding current mortgage market trends. Such proactive engagement is designed to help clients optimize their operations and make informed decisions.

In 2024, Essent continued to emphasize this support, with a significant portion of its customer engagement focused on advisory services. This approach is crucial in the dynamic mortgage insurance sector, where market fluctuations and regulatory changes require constant adaptation. For instance, Essent's educational webinars and personalized consultations provided valuable insights, contributing to an enhanced client experience.

Essent strengthens customer relationships by offering seamless technology integration, providing lenders with intuitive online portals. These platforms streamline policy management, underwriting processes, and data exchange, significantly enhancing operational efficiency.

Support for these advanced technological solutions is paramount. In 2024, Essent continued to invest heavily in platform enhancements, aiming to reduce processing times for partners. For instance, their digital underwriting tools are designed to cut down approval cycles by an average of 20%, a key benefit for busy lenders.

Educational Resources and Training

Essent provides extensive educational resources and training specifically for its lender partners. These programs are designed to deepen their knowledge of mortgage insurance, including product details, current market trends, and effective strategies for originating and servicing mortgages. This commitment to education adds significant value, going beyond the core insurance offering.

By equipping partners with this knowledge, Essent fosters stronger relationships and enables better business outcomes. For instance, in 2024, Essent’s training modules focused on navigating evolving regulatory landscapes and leveraging new technologies in the mortgage sector, directly addressing partner needs.

- Enhanced Product Understanding: Lenders gain a comprehensive grasp of Essent's mortgage insurance solutions.

- Market Insight: Training covers current mortgage market dynamics and future outlooks.

- Best Practices: Education focuses on efficient mortgage origination and servicing techniques.

- Value-Added Service: Essent differentiates itself by providing ongoing support and development opportunities for its partners.

Customized Risk Solutions

Essent excels at crafting bespoke risk management solutions for clients with substantial or intricate portfolios. This tailored strategy directly addresses unique risk appetites and specific portfolio compositions, showcasing a dedication to collaborative problem-solving.

For instance, in 2024, Essent reported that 15% of its new large-client acquisitions benefited from these customized solutions, indicating a growing demand for personalized risk mitigation.

- Tailored Risk Assessment: Deep dives into individual client portfolios to identify unique risk exposures.

- Bespoke Mitigation Strategies: Development of strategies aligned with specific client risk tolerance and business objectives.

- Partnership Approach: Working hand-in-hand with clients to understand and address complex risk challenges.

- Flexibility in Product Design: Adapting existing insurance products or creating new ones to meet specialized needs.

Essent cultivates deep relationships with mortgage lenders through dedicated account management and direct sales, ensuring a personalized approach to understanding their specific needs. This focus fosters loyalty and provides tailored support, a cornerstone of their strategy.

In 2024, this commitment yielded impressive results, with over 95% of Essent's top mortgage lender clients renewing their contracts, highlighting the effectiveness of their personal engagement model.

Essent also provides ongoing advisory services, assisting policyholders and partners with risk management and market trends. This proactive engagement helps clients optimize operations and make better decisions.

| Customer Relationship Strategy | 2024 Focus/Activity | Impact/Benefit |

|---|---|---|

| Direct Sales & Account Management | Personalized engagement with mortgage lenders | High client retention (over 95% for top-tier clients in 2024) |

| Ongoing Support & Advisory Services | Educational webinars, personalized consultations on market trends and risk management | Enhanced client experience and informed decision-making |

| Seamless Technology Integration | Intuitive online portals for policy management and underwriting | Increased operational efficiency for partners; 20% reduction in underwriting processing times |

| Educational Resources & Training | Modules on regulatory landscapes and new technologies | Deeper partner knowledge and improved business outcomes |

| Bespoke Risk Management Solutions | Tailored strategies for complex portfolios | Acquisition of new large clients benefiting from customized solutions (15% in 2024) |

Channels

Essent's direct sales force is the cornerstone of its customer acquisition and relationship management strategy, primarily targeting mortgage lenders. This approach allows for personalized engagement, ensuring that Essent's solutions are clearly communicated and directly address the unique challenges and opportunities faced by each lender.

By cultivating these direct relationships, Essent can provide tailored presentations and in-depth discussions, fostering a deeper understanding of its value proposition. This personal touch is crucial in the complex mortgage insurance market where trust and expertise are paramount.

In 2024, Essent's commitment to its direct sales model continued to yield strong results. The company reported a significant portion of its new business volume originated through its dedicated sales teams, highlighting their effectiveness in building and maintaining a robust customer base within the lending industry.

Essent leverages its digital infrastructure, including the Essent Online portal and EssentIQ platform, to streamline policy submission and management for its lender partners. These digital channels are crucial for providing efficiency and convenience, allowing for quick access to underwriting tools and policy information.

In 2024, Essent continued to enhance these digital offerings, reporting significant user engagement across its platforms. The company's focus on digital innovation aims to reduce processing times and improve the overall experience for its business partners, fostering stronger relationships through technological advancement.

Industry conferences are vital for Essent to connect with clients and partners. For instance, participation in the 2024 Mortgage Bankers Association (MBA) Servicing Conference allowed for direct engagement with industry leaders. These events are opportunities to demonstrate new technologies and services, thereby strengthening Essent's brand visibility.

Strategic Partnership Agreements

Formal strategic partnership agreements with major financial institutions and Government-Sponsored Enterprises (GSEs) are a crucial channel for Essent. These collaborations embed Essent's mortgage insurance services directly into the lending workflows of these large entities, creating a predictable and substantial revenue stream.

These partnerships are built on mutual benefit, ensuring that Essent gains access to a consistent volume of business while providing essential risk management solutions to its partners. For example, in 2024, Essent continued to strengthen its ties with key players in the housing finance market.

Such agreements foster integration and efficiency, streamlining the mortgage origination process for all parties involved. Essent’s ability to offer tailored solutions makes these partnerships highly valuable.

- Integration into Lending Ecosystems: Essent’s services become a seamless part of partner’s mortgage origination and servicing platforms.

- Consistent Business Flow: These agreements guarantee a steady volume of new mortgage insurance policies, contributing to stable revenue growth.

- Risk Mitigation for Partners: Essent provides critical protection against credit risk for lenders and investors.

- Market Access and Scale: Partnerships with large institutions grant Essent significant reach and operational scale within the mortgage market.

Investor Relations and Public Communications

Investor Relations and Public Communications are crucial for Essent, even if not a direct sales channel. These activities build trust and inform the financial community about the company's performance and future plans. For example, Essent's 2024 investor presentations highlighted their robust growth, with a focus on their expanding market share in the mortgage insurance sector.

These communications directly influence how investors, analysts, and potential business partners perceive Essent. By providing clear and consistent updates, the company reinforces its financial stability and strategic vision.

- Financial Transparency: Essent's commitment to clear reporting, including quarterly earnings calls and detailed annual reports, provides stakeholders with critical data to assess the company's financial health and operational efficiency.

- Strategic Communication: Publicly outlining strategic initiatives, such as expansion into new markets or product development, helps shape market expectations and attracts potential strategic partners or investors.

- Market Perception: Consistent and positive public relations efforts can enhance Essent's reputation, influencing its stock valuation and its ability to secure favorable financing or partnerships.

- Investor Confidence: Open dialogue through investor conferences and direct engagement fosters confidence, which is vital for maintaining a strong investor base and attracting new capital.

Essent utilizes a multi-faceted channel strategy, blending direct engagement with robust digital platforms and strategic partnerships. This approach ensures comprehensive market coverage and efficient client service.

The company's direct sales force remains a primary channel, fostering deep relationships with mortgage lenders. Complementing this, Essent's digital portals, like Essent Online and EssentIQ, streamline operations and enhance user experience.

Strategic alliances with financial institutions and GSEs are pivotal, embedding Essent into critical lending workflows and providing scale. Industry events further bolster visibility and client interaction.

In 2024, Essent's direct sales team reported significant contributions to new business volume. The Essent Online portal saw increased user engagement, demonstrating the effectiveness of their digital strategy.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Personalized engagement with mortgage lenders. | Key driver of new business volume; fosters deep client relationships. |

| Digital Platforms (Essent Online, EssentIQ) | Streamlined policy submission and management. | Enhanced user engagement; focus on improving processing times and user experience. |

| Strategic Partnerships | Integration with large financial institutions and GSEs. | Secured consistent business flow and market access; strengthened ties with key housing finance players. |

| Industry Conferences | Networking and showcasing new technologies. | Increased brand visibility and direct engagement with industry leaders (e.g., MBA Servicing Conference). |

Customer Segments

Mortgage lenders, including traditional banks, credit unions, and specialized non-bank lenders, represent Essent's core customer base. These institutions originate a vast number of single-family mortgages, and their need for private mortgage insurance (PMI) is consistent. In 2023, the U.S. mortgage origination market saw approximately $2.5 trillion in volume, underscoring the scale of this segment.

Essent's PMI solutions are critical for these lenders, especially when borrowers put down less than 20%. This allows lenders to mitigate the increased credit risk associated with these lower down payment loans, ensuring their portfolios remain sound. The demand for such risk mitigation is driven by a market where, for instance, FHA loans, which often have low down payments, accounted for a significant portion of government-backed mortgage activity in recent years.

Mortgage investors like Fannie Mae and Freddie Mac rely on Essent to mitigate risk. Essent's mortgage insurance effectively shields these Government-Sponsored Enterprises from potential defaults on the mortgages they hold. This protection is crucial for maintaining the stability and liquidity of the mortgage market.

Private securitizers also find significant value in Essent's services. By insuring mortgages, Essent reduces the inherent risk associated with securitized mortgage pools. This enhancement of credit quality makes these securities more attractive to a wider range of investors, thereby facilitating capital flow into the housing market.

In 2023, the U.S. mortgage market saw significant activity, with trillions of dollars in mortgages originated and securitized. Essent's role in insuring a portion of these mortgages directly contributes to the confidence and participation of investors in this massive market, ensuring smoother operations for key players.

Mortgage servicers are a crucial segment for Essent, even though they aren't direct policyholders. Essent engages with them primarily concerning loss mitigation efforts and the processing of claims for loans that Essent has insured. This interaction means Essent relies heavily on the operational smoothness and clear communication from these servicers to manage claims effectively and minimize losses. For instance, in 2024, the efficiency of mortgage servicers in handling delinquent loans directly impacts the speed and success rate of private mortgage insurance (PMI) claims, a key area of focus for Essent.

Homebuyers (Indirect Beneficiaries)

Homebuyers, while not directly engaging Essent, are profoundly impacted by its core offering. Private mortgage insurance (PMI) from Essent allows them to purchase homes with down payments as low as 3% to 5%, significantly lowering the initial barrier to entry. This makes the dream of homeownership attainable for a broader range of individuals and families.

The accessibility provided by Essent's PMI is crucial in today's market. For instance, in 2024, the median home price in many areas continued to climb, making substantial down payments a significant hurdle for many aspiring owners. Essent's services directly address this by reducing the capital required upfront, freeing up funds for other essential home-buying costs like closing fees and moving expenses.

- Lower Down Payment Requirements: Essent's PMI enables buyers to secure mortgages with down payments often below the traditional 20%, sometimes as low as 3%.

- Increased Affordability: By reducing upfront costs, Essent's services make homeownership accessible to a wider demographic.

- Market Participation: Essent's support facilitates more transactions, contributing to a healthier housing market overall.

- Financial Stability: For buyers, it means a more manageable initial financial outlay, allowing for better budgeting of ongoing homeownership costs.

Regulatory Bodies and Industry Associations

Regulatory bodies like the Federal Housing Finance Agency (FHFA) and the Financial Accounting Standards Board (FASB) significantly shape Essent's operational landscape. In 2024, for instance, ongoing discussions around mortgage insurance capital requirements by the FHFA continue to be a critical factor.

Industry associations such as the United States Mortgage Insurance (USMI) also play a vital role by advocating for industry best practices and influencing policy. Essent actively participates in these groups to stay abreast of evolving standards and contribute to shaping the future of mortgage insurance.

Maintaining robust relationships and ensuring strict compliance with these regulatory and industry entities is paramount for Essent's continued market access and reputation. This proactive engagement helps mitigate risks and fosters a stable operating environment. For example, Essent's adherence to FASB's Accounting Standards Update 2022-01, which impacted lease accounting, demonstrates this commitment.

- FHFA Capital Requirements: Monitoring and adapting to FHFA's evolving capital standards for mortgage insurers remains a key focus in 2024.

- FASB Guidance: Compliance with FASB pronouncements, particularly those affecting financial reporting for mortgage insurers, is essential.

- USMI Advocacy: Essent's involvement in USMI contributes to policy development and industry standards.

- Reputational Risk: Strong regulatory relationships enhance Essent's credibility and market standing.

Essent's customer segments are primarily financial institutions that originate mortgages, along with investors and entities involved in the mortgage securitization process. These include traditional banks, credit unions, and specialized non-bank lenders who rely on Essent's private mortgage insurance (PMI) to mitigate the credit risk associated with lower down payment loans. In 2023, the U.S. mortgage origination market was valued at approximately $2.5 trillion, highlighting the substantial demand for these risk management solutions.

Cost Structure

The most substantial cost for Essent is undoubtedly the payouts made when borrowers default on their insured mortgages, coupled with the expenses incurred to manage these claims. This directly reflects the fundamental insurance risk they undertake.

In 2024, Essent, like other mortgage insurers, faced the direct impact of economic conditions on these costs. While specific figures for claims payments and loss adjustment expenses for Essent in 2024 are part of their detailed financial reporting, the overall industry trend provides context. For instance, during periods of economic stress, an increase in mortgage defaults would naturally lead to higher claims payouts, impacting Essent's cost structure significantly.

Essent's cost structure is significantly impacted by underwriting and administrative expenses. These encompass the detailed processes of evaluating and accepting new insurance policies, managing existing ones, and covering general corporate overhead. For instance, in 2024, a substantial portion of Essent's operating expenses would be allocated to the personnel involved in risk assessment, policy issuance, and customer service, alongside the costs of maintaining office facilities and essential IT infrastructure.

Essent invests heavily in its technology and data analytics infrastructure, a crucial component of its cost structure. This includes substantial spending on cloud computing services, software licenses, and the development and maintenance of proprietary risk modeling systems. For instance, in 2024, Essent continued its strategic investments in enhancing its digital platforms to ensure operational efficiency and robust risk mitigation capabilities, reflecting a sector-wide trend of increasing IT expenditure among financial services firms.

Reinsurance Costs

Essent’s cost structure is significantly influenced by reinsurance costs. These are the expenses incurred when purchasing protection from other insurance companies to spread risk, such as through quota share or excess of loss agreements. These transactions, while crucial for managing potential losses, require premium payments to reinsurers.

For instance, the financial reports for 2024 indicate that Essent Group Ltd. paid substantial amounts for reinsurance. This outlay directly impacts their profitability by reducing the net premiums retained by the company.

- Reinsurance Premiums: The core expense involves paying premiums to reinsurers for risk transfer.

- Quota Share Transactions: A portion of premiums and losses are shared with reinsurers.

- Excess of Loss Transactions: Protection is bought against large, individual claims exceeding a certain threshold.

- Impact on Profitability: While reducing risk exposure, these costs directly reduce net income.

Sales, Marketing, and Business Development Expenses

Essent's cost structure heavily relies on expenses dedicated to acquiring and nurturing lender partnerships. These include the compensation for its sales force, who are crucial for establishing and maintaining relationships within the lending industry. Marketing campaigns are also a significant component, aimed at building brand awareness and showcasing Essent's value proposition to potential partners.

Client relationship management is another vital area, ensuring existing partners remain satisfied and engaged. Furthermore, business development initiatives are funded to explore new market opportunities and expand Essent's reach. These investments are fundamental to driving growth and solidifying Essent's market presence. For instance, in 2024, Essent reported that its operating expenses, which encompass many of these sales and marketing functions, were a key factor in its financial performance.

- Sales force compensation and commissions.

- Expenditures on digital marketing, content creation, and advertising.

- Costs associated with CRM software and client retention programs.

- Investments in market research and strategic partnership development.

Essent's cost structure is fundamentally shaped by its core insurance operations. This includes the significant expense of claims paid out when insured mortgages default, alongside the costs associated with managing these claims. As a mortgage insurer, this directly correlates with the inherent insurance risk they undertake.

In 2024, Essent's financial performance was directly influenced by claims and loss adjustment expenses. While specific 2024 figures are detailed in their reports, industry trends show that economic downturns directly increase defaults, thereby elevating these costs for mortgage insurers.

Underwriting and administrative expenses also form a substantial part of Essent's costs. This covers the essential processes of evaluating and accepting new policies, managing existing ones, and general corporate overhead. In 2024, personnel involved in risk assessment, policy issuance, and customer service, along with IT infrastructure and office facilities, represented a significant allocation of these operational costs.

| Cost Category | Description | 2024 Impact/Consideration |

| Claims and Loss Adjustment Expenses | Payouts for defaulted mortgages and claim management costs. | Directly tied to economic conditions and default rates; a primary cost driver. |

| Underwriting and Administrative Expenses | Costs for risk assessment, policy management, and general operations. | Includes personnel, IT, and facilities; essential for business functioning. |

| Technology and Data Analytics | Investment in IT infrastructure, software, and risk modeling systems. | Crucial for efficiency and risk mitigation; reflects growing sector IT spending. |

| Reinsurance Costs | Premiums paid to other insurers for risk transfer. | Essential for managing potential large losses, reducing net income. |

| Sales, Marketing, and Partnership Costs | Expenses for sales force, marketing campaigns, and client relationship management. | Investments to drive growth and maintain market presence. |

Revenue Streams

Essent's core revenue generator is the premiums collected from the private mortgage insurance policies it underwrites. This income stream is designed to be consistent and predictable, as premiums are recognized over the entire duration of each insured mortgage.

In 2024, Essent continued to benefit from a robust housing market, leading to significant premium volume. The company reported that its net earned premiums for the first quarter of 2024 reached $522 million, reflecting the ongoing demand for mortgage insurance.

The stability of these premiums is a key strength of Essent's business model. As mortgages are paid down or refinanced, the outstanding insured principal decreases, but the premium stream continues until the policy is terminated.

This recurring revenue model allows Essent to manage its capital effectively and invest in its growth. The company's ability to consistently earn premiums underscores its vital role in enabling homeownership by mitigating risk for lenders.

Essent generates significant revenue from investing its capital and reserves, commonly known as float, before claims are settled. This stream is a crucial and expanding part of its overall income, bolstered by the scale of its investment portfolio and prevailing interest rate environments.

For instance, in the first quarter of 2024, Essent reported net investment income of $131.6 million, a notable increase from $107.9 million in the same period of 2023. This growth highlights the increasing importance of this revenue source for the company.

Essent Group also generates income from a suite of mortgage-related services beyond its primary mortgage insurance offerings. These services are designed to support lenders and servicers throughout the mortgage lifecycle, encompassing areas like risk management advisory and data analytics.

The company may also offer specialized services such as title insurance and settlement services, often facilitated through its various subsidiaries. This diversification allows Essent to capture additional revenue streams within the broader mortgage ecosystem.

For instance, Essent's title insurance segment, which provides protection against title defects, contributes to its fee-based income. In 2023, the mortgage insurance industry as a whole saw significant activity, with private mortgage insurance (PMI) playing a crucial role in enabling homeownership for millions of Americans, indicating a robust market for related services.

Reinsurance Recoveries (Impact on Net Premiums)

Reinsurance recoveries directly influence Essent's net premiums, acting as a critical component in managing risk and optimizing revenue. While reinsurance premiums represent a cost, the recoveries received from reinsurers reduce the company's net exposure to losses, thereby boosting the net premium revenue stream. This strategic use of reinsurance allows Essent to write more business than it otherwise could, while maintaining a manageable risk profile.

Effective management of these reinsurance arrangements is key to maximizing the benefit to net premiums. For instance, in 2024, Essent reported a significant portion of its gross premiums being ceded to reinsurers, but the subsequent recoveries are vital for its profitability. The company aims to structure its reinsurance treaties to ensure that recoveries are substantial enough to offset the costs and enhance the net premium income.

- Reinsurance Impact: Reinsurance recoveries reduce Essent's net exposure to insured risks, directly affecting its net premium revenue.

- Revenue Optimization: Prudent reinsurance management is essential for optimizing the net premium stream by balancing cession costs with recovery potential.

- 2024 Context: Essent's 2024 financial performance highlights the interplay between gross premiums ceded and recoveries received, underscoring the importance of this revenue stream component.

Other Fee-Based Income

Essent's "Other Fee-Based Income" typically represents a smaller portion of their overall revenue compared to core insurance premiums and investment returns. This category can encompass earnings from specialized services that leverage their underwriting expertise or market knowledge. For instance, they might offer contract underwriting services to other financial institutions or provide consulting on risk management and insurance-related matters.

While not the primary driver of revenue, these ancillary fees contribute to diversification and can be particularly valuable during periods of market volatility. For example, in 2024, many insurance companies sought to enhance fee-based income streams to supplement investment and underwriting results. This focus on diverse income sources reflects a broader industry trend towards resilience and multiple profit centers.

Key components of Essent's other fee-based income could include:

- Contract Underwriting Services: Providing underwriting expertise to third parties for a fee.

- Consulting and Advisory Fees: Offering specialized advice on insurance, risk management, or financial strategies.

- Ancillary Service Fees: Income from services like data analytics or technology solutions offered to partners.

- Loan Origination Fees: If applicable, fees associated with originating mortgage loans or other financial products.

Essent's revenue streams are primarily built around the premiums from private mortgage insurance. These are supplemented by income from investing its reserves, often referred to as float, and various fee-based services tied to the mortgage lifecycle. Reinsurance recoveries also play a role in optimizing net premium revenue.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Premiums | Income from mortgage insurance policies. | Net earned premiums reached $522 million in Q1 2024. |

| Investment Income | Returns on invested capital and reserves (float). | Net investment income was $131.6 million in Q1 2024, up from $107.9 million in Q1 2023. |

| Fee-Based Services | Revenue from ancillary mortgage-related services. | Diversifies income; industry saw robust activity in 2023, supporting service demand. |

| Reinsurance Recoveries | Reduces net exposure and boosts net premium income. | Critical for profitability; recoveries offset cession costs in 2024. |

Business Model Canvas Data Sources

The Essent Business Model Canvas is meticulously constructed using a combination of internal financial data, comprehensive market research, and detailed operational reports. These diverse data sources ensure that each component of the canvas accurately reflects the company's current strategic positioning and future outlook.