Essent Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

Porter's Five Forces Analysis offers a powerful lens to dissect Essent's competitive landscape. It illuminates how supplier and buyer power, the threat of new entrants and substitutes, and the intensity of existing rivalries shape Essent's strategic environment. Understanding these forces is crucial for identifying opportunities and mitigating risks within the mortgage insurance sector. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Essent’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Essent heavily depends on specialized data providers for crucial functions like risk assessment, underwriting, and predictive analytics. This data includes credit bureau information, property records, and macroeconomic outlooks. The leverage these suppliers hold is directly tied to the distinctiveness and proprietary nature of their data and technological offerings.

When a limited number of companies control essential data streams or software platforms, their bargaining power naturally escalates. For instance, in 2024, the market for specialized mortgage insurance analytics saw a consolidation trend, with a few key players offering integrated solutions that significantly reduced the number of viable alternative providers for Essent.

While not typical suppliers, regulatory bodies like the Federal Housing Finance Agency (FHFA) wield significant influence over Essent's operational costs and capital needs. Mandates such as the Private Mortgage Insurer Eligibility Requirements (PMIERs) directly shape how much capital Essent must maintain.

With updated PMIERs set to phase in starting March 2025, these requirements will necessitate adjustments in Essent's capital allocation strategies. This indirect control over capital expenditure grants regulators a form of supplier power, impacting Essent's financial flexibility and operational expenditure planning.

Essent relies heavily on the reinsurance market to effectively manage its risk and optimize its capital structure. The terms and cost of reinsurance directly impact Essent's operational expenses and its capacity to absorb significant risk events. In the first quarter of 2025, Essent secured new forward quota share transactions, underscoring its continued dependence on these arrangements.

The bargaining power of suppliers in the reinsurance market is a critical factor for Essent. When a few highly-rated reinsurers dominate the market, they can command higher prices and impose more stringent terms. This can directly increase Essent's cost of doing business, as reinsurance premiums represent a substantial expense. For instance, in 2024, the global reinsurance market experienced price increases across various lines of business due to increased claims activity and a focus on profitability by reinsurers, a trend that would likely impact Essent's sourcing costs.

Capital Markets

Essent's bargaining power with capital markets is shaped by its ability to secure financing. The cost and availability of debt and equity directly affect its financial flexibility and growth potential.

Conditions in the capital markets significantly influence Essent's capacity to raise funds, whether through senior notes or revolving credit facilities. For instance, in July 2024, Essent successfully completed a $500 million senior notes offering, a move aimed at optimizing its capital structure and demonstrating its access to funding.

The cost of capital is a critical factor. Higher interest rates or a lower stock valuation can increase Essent's borrowing costs and dilute existing equity, thereby reducing its bargaining power.

- Capital Market Access Essent's ability to raise capital through instruments like senior notes and revolving credit facilities is directly tied to the prevailing conditions in the capital markets.

- Cost of Capital Impact The expense of debt and equity financing directly influences Essent's financial maneuverability and its capacity for expansion.

- Recent Financing Activity In July 2024, Essent executed a $500 million senior notes offering, a strategic move to enhance its capital structure and signal its financial health.

Skilled Labor Market

The availability of highly specialized professionals like actuaries, data scientists, and experienced underwriters is critical for Essent's core functions. A scarcity of these in-demand skills, or a surge in demand, directly translates to higher labor expenses, amplifying the bargaining power of this skilled workforce. For instance, in 2024, the demand for data scientists in financial services saw a significant increase, with average salaries in the US for experienced professionals often exceeding $150,000 annually.

This trend is not unique to Essent but is a broader industry challenge within financial services, impacting recruitment and retention costs. The ability of these specialized workers to command higher wages or better benefits due to their unique expertise can significantly influence Essent's operational costs and profitability.

- High demand for actuaries and data scientists in 2024.

- Potential for increased labor costs due to talent shortages.

- Skilled workforce can leverage expertise for better compensation.

Essent's reliance on specialized data providers and reinsurance markets significantly shapes supplier bargaining power. When fewer providers offer unique data or comprehensive reinsurance, their ability to dictate terms and prices increases, impacting Essent's operational costs. The increased demand for data scientists in 2024, with average salaries exceeding $150,000 for experienced professionals, also highlights the leverage skilled labor possesses.

| Supplier Type | Key Dependency | Bargaining Power Factors | Impact on Essent (2024/2025) |

|---|---|---|---|

| Data Providers | Risk Assessment, Analytics | Data distinctiveness, few alternatives | Potential for higher data acquisition costs |

| Reinsurers | Risk Management, Capital Optimization | Market concentration, reinsurer profitability focus | Increased reinsurance premiums observed in 2024 |

| Skilled Workforce | Underwriting, Data Science | Talent scarcity, industry-wide demand | Higher labor costs, recruitment challenges |

What is included in the product

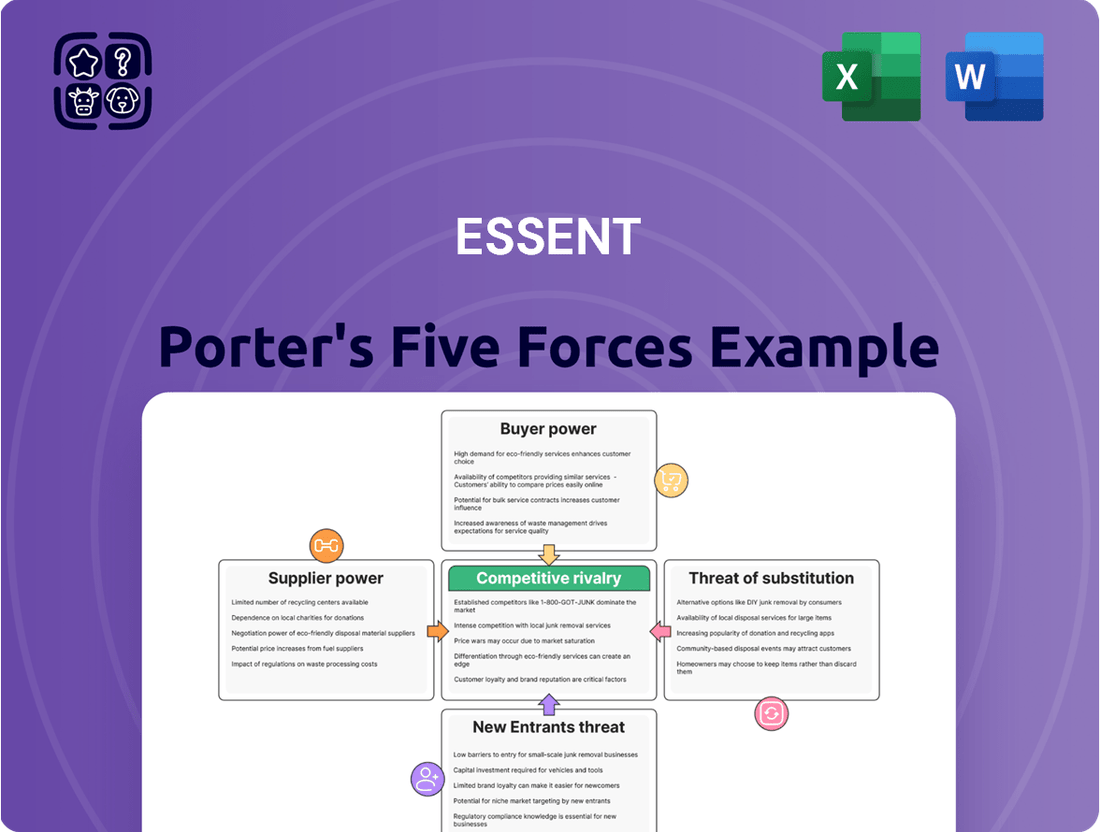

Essent's Porter's Five Forces analysis delves into the competitive intensity of its industry by examining threats of new entrants, buyer and supplier power, the threat of substitutes, and the rivalry among existing competitors.

Effortlessly identify and address competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

Essent's main customers are mortgage lenders and investors. The mortgage market includes big national banks, smaller regional banks, and independent mortgage companies. These different types of lenders can influence Essent.

Large mortgage originators, due to their substantial business volume, often possess more bargaining power. They can negotiate better pricing and service agreements with Essent because they represent significant revenue streams. For example, in 2024, the US mortgage origination market saw trillions of dollars in volume, making large players key partners.

Lenders face some switching costs when changing private mortgage insurance (PMI) providers. These can include the expense of integrating new underwriting systems, training personnel on new processes, and establishing different operational workflows. For instance, a lender might need to invest in new software licenses or dedicate staff hours to learning a new online portal.

However, the PMI market is largely commoditized, meaning that the products offered by different providers are quite similar. This similarity significantly lowers the perceived differentiation between providers. Consequently, the switching costs for lenders are not prohibitively high, which inherently increases the bargaining power of these customers.

In 2024, the PMI market continued to see robust activity, with lenders actively seeking competitive rates and efficient service. The ease with which a lender can switch providers, due to the standardized nature of PMI products and available technology, means that lenders can exert considerable pressure on PMI companies to offer favorable terms. This dynamic is crucial for lenders aiming to optimize their operational costs.

Private mortgage insurance (MI) is essential for lenders, especially for loans with low down payments. It acts as a risk mitigator, protecting lenders from potential losses if a borrower defaults. In 2024, MI remains a key component in enabling a broader range of individuals to access homeownership.

Without MI, lenders would typically demand higher down payments, effectively shutting out many potential homebuyers. Alternatively, lenders would need to absorb significantly more capital risk, which could lead to tighter lending standards and higher interest rates for everyone. This inherent need for MI grants providers a degree of leverage with lenders.

However, this reliance also makes lenders acutely aware of the cost and dependability of MI services. They are constantly evaluating pricing structures and the reliability of MI providers to ensure they are getting the best value and security for their mortgage portfolios.

Price Sensitivity and Comparison

Lenders exhibit significant price sensitivity regarding mortgage insurance (MI). This is because MI costs directly influence the total expense for borrowers, impacting a lender's ability to offer competitive mortgage rates. In 2024, the average cost of private mortgage insurance can range from 0.5% to 1.5% of the loan amount annually, a substantial factor in a borrower's monthly payment.

The largely homogenous nature of the core mortgage insurance product allows lenders to easily shop around and compare pricing from various insurers. This ease of comparison fuels intense price competition within the MI market, as lenders seek the most cost-effective solutions to maintain their own competitive edge in the mortgage origination business.

- Price Sensitivity: Lenders are highly attuned to MI costs, as these fees are passed on to borrowers and affect mortgage competitiveness.

- Product Differentiation: The core MI product is largely undifferentiated, enabling lenders to readily compare pricing across providers.

- Competitive Landscape: This lack of differentiation drives price competition among MI providers, as they vie for lender business.

- Impact on Borrowers: Higher MI costs can deter potential borrowers, forcing lenders to seek more affordable MI options.

Access to Government-Backed Alternatives

The bargaining power of customers can be significantly amplified when they have access to government-backed alternatives, particularly in the mortgage insurance sector. Lenders, for instance, can turn to programs like the Federal Housing Administration (FHA) or Department of Veterans Affairs (VA) loans, which offer mortgage insurance as part of their structure. This directly competes with private mortgage insurance (MI) providers.

The presence and attractiveness of these government programs give lenders more leverage. If private MI providers raise their prices or tighten their terms, lenders can simply shift their business to FHA or VA loans, especially for eligible borrowers. This is a critical factor, as in 2023, FHA loans accounted for approximately 13% of all single-family home originations, demonstrating their substantial market share and influence.

- Government-backed programs like FHA and VA loans provide alternative mortgage insurance solutions.

- This availability reduces lenders' reliance on private MI providers.

- Lenders can leverage these alternatives to negotiate better terms or switch providers.

- The significant market share of FHA loans (around 13% of single-family originations in 2023) underscores their impact on the private MI market.

The bargaining power of Essent's customers, primarily mortgage lenders, is substantial due to a combination of factors. Lenders can switch to government-backed alternatives like FHA or VA loans, which offer similar risk mitigation. In 2023, FHA loans represented about 13% of single-family home originations, showcasing the significant market presence of these alternatives. This availability provides lenders with a strong negotiating position against private mortgage insurers.

Furthermore, the commoditized nature of private mortgage insurance (MI) means that products are largely interchangeable, reducing differentiation. This lack of unique features makes lenders highly sensitive to pricing, as seen in 2024 when MI costs, often ranging from 0.5% to 1.5% annually, directly impact borrower affordability and lender competitiveness. The ease of comparing prices amplifies this pressure.

| Factor | Impact on Customer Bargaining Power | 2024/2023 Data Point |

|---|---|---|

| Availability of Alternatives | High; Lenders can shift to FHA/VA loans. | FHA loans accounted for ~13% of 2023 single-family originations. |

| Product Differentiation | High; MI products are largely undifferentiated. | Standardized nature allows easy comparison. |

| Price Sensitivity | High; MI costs affect borrower affordability and lender competitiveness. | MI costs can range from 0.5%-1.5% annually. |

Full Version Awaits

Essent Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Essent Porter's Five Forces Analysis, a comprehensive breakdown of the competitive forces shaping Essent's industry. Once you complete your purchase, you’ll get instant access to this exact file, allowing you to immediately leverage its insights into market attractiveness and strategic positioning. This detailed analysis covers buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, providing a complete picture for informed decision-making.

Rivalry Among Competitors

The U.S. private mortgage insurance (PMI) sector is a prime example of an oligopoly, featuring a concentrated landscape with a handful of dominant companies. Essent operates within this environment alongside key competitors such as Arch MI, MGIC, Radian, and NMI Holdings.

This limited competitive set intensifies rivalry, as each of these major players actively pursues market share. For instance, in the first quarter of 2024, Essent reported a strong performance with total new insurance written of $15.4 billion, demonstrating its significant presence and ongoing efforts to capture business within this concentrated market.

Competitive rivalry in the insurance sector is intense, frequently playing out through aggressive pricing tactics and a continuous battle for market share. This dynamic can lead to significant shifts in where customers place their business.

In 2024, the industry experienced growth in new insurance written (NIW), yet pricing remained a key competitive lever. Leading insurers saw their market shares fluctuate, underscoring the ongoing nature of this competition.

Competitive rivalry in the mortgage insurance (MI) sector is intense, with providers primarily differentiating themselves on service quality rather than the fundamental insurance product. This includes the speed of their underwriting processes, how well they integrate technology for ease of use, and their financial strength ratings, which instill confidence in lenders.

Companies actively compete to offer enhanced lender support and streamlined processes, recognizing these as key drivers for attracting and retaining business. For instance, in 2024, many MI providers continued to invest heavily in digital platforms to expedite loan approvals and improve communication with lenders, aiming to shave days off the typical underwriting cycle.

The focus on service quality is crucial because the core mortgage insurance product itself offers limited inherent differences between providers. Therefore, the customer experience, particularly for mortgage originators and servicers, becomes a significant competitive battleground, influencing market share and profitability.

Industry Growth and Economic Headwinds

The mortgage origination market’s overall growth directly impacts how intensely competitors vie for business. Even with interest rates hovering around 7% in early 2024, the private mortgage insurance (MI) sector remained crucial, facilitating substantial mortgage activity. A market that isn't expanding can force companies to aggressively pursue market share.

This intensified competition can manifest in several ways:

- Pricing pressures: Companies may lower their prices to attract more borrowers, impacting profit margins.

- Increased marketing spend: To stand out, firms might invest more in advertising and promotional activities.

- Focus on niche markets: Some players might concentrate on specific borrower segments or loan types to reduce direct competition.

- Innovation in service: Offering unique customer experiences or streamlined processes can become a key differentiator.

Regulatory Environment and Capital Strength

The mortgage insurance industry is heavily regulated, with stringent capital requirements like the Private Mortgage Insurer Eligibility Requirements (PMIERs) playing a significant role in competition. These regulations ensure that insurers have sufficient financial backing to cover potential losses, making capital strength a critical differentiator.

Companies demonstrating robust financial health and high credit ratings are better equipped to navigate economic downturns and maintain market trust. For instance, as of the first quarter of 2024, Essent Group Ltd. reported a strong risk-to-capital ratio, indicating its capacity to absorb potential shocks and meet its obligations.

- Regulatory Compliance as a Barrier: Strict capital rules act as a barrier to entry, favoring established players with proven financial stability.

- Financial Strength Advantage: Companies like Essent, with strong balance sheets and high credit ratings, can offer more competitive pricing and product terms.

- Resilience in Economic Cycles: Greater capital allows insurers to withstand periods of increased claims, ensuring business continuity and investor confidence.

- Impact on Market Share: Financial strength directly influences a company's ability to underwrite new business and maintain its market position, especially during volatile economic periods.

Competitive rivalry in the U.S. private mortgage insurance (PMI) sector is intense, characterized by a few dominant players like Essent, Arch MI, MGIC, Radian, and NMI Holdings. This rivalry plays out through aggressive pricing, a strong emphasis on service quality, and continuous efforts to capture market share, especially as the mortgage origination market fluctuates.

In 2024, despite a growing market for new insurance written (NIW), pricing remained a crucial competitive tool, leading to shifts in market share among key insurers. Companies actively differentiate themselves through technology, underwriting speed, and financial strength ratings, rather than significant product differences, making customer experience a key battleground.

The concentration of the market means that each player's actions significantly impact the others, intensifying the drive for differentiation in service and digital offerings. For instance, Essent's first-quarter 2024 performance with $15.4 billion in new insurance written highlights the scale of competition and the importance of securing new business.

The regulatory environment, particularly PMIERs, also shapes competition by favoring financially stable companies. Essent's strong risk-to-capital ratio in early 2024 underscores how capital strength allows insurers to offer competitive terms and maintain market trust, especially during economic uncertainty.

| Competitor | New Insurance Written (Q1 2024, est. $B) | Key Differentiators |

|---|---|---|

| Essent | 15.4 | Financial strength, digital platform |

| Arch MI | N/A | Service quality, lender support |

| MGIC | N/A | Technology integration, underwriting speed |

| Radian | N/A | Customer experience, streamlined processes |

| NMI Holdings | N/A | Pricing, niche market focus |

SSubstitutes Threaten

The most significant substitute for private mortgage insurance (MI) comes from government-backed programs, particularly those from the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA).

These government programs offer mortgage insurance directly to borrowers, often at competitive rates and with more lenient down payment requirements compared to conventional loans requiring private MI. For instance, FHA loans typically require as little as 3.5% down, while VA loans can require no down payment at all for eligible veterans.

This accessibility can directly siphon demand away from private MI providers like Essent, as borrowers opt for the government-insured route to secure their home loans, especially those with lower credit scores or smaller down payments.

In 2024, the FHA insured approximately 8.1 million mortgages, a substantial portion of the overall mortgage market, illustrating the significant presence and impact of these government-backed alternatives on the demand for private MI.

Borrowers who can comfortably afford a down payment of 20% or more on a home purchase effectively bypass the need for private mortgage insurance (PMI). This ability to self-insure by contributing a larger upfront sum acts as a direct substitute for the services offered by PMI providers like Essent. As housing affordability continues to be a significant hurdle, the capacity for potential homebuyers to save and deploy a substantial down payment directly influences the size of the market for PMI.

Large financial institutions with significant capital reserves, like major banks, might opt to self-insure or retain the credit risk associated with low down payment mortgages directly within their own balance sheets. This approach bypasses the need for private mortgage insurance (PMI), effectively acting as a form of internal insurance. For example, in 2024, some of the largest mortgage originators continued to hold a substantial portion of their originated loans, particularly those with stronger borrower profiles, rather than selling them or insuring them through third parties. This strategy is more feasible for entities with ample liquidity and a high tolerance for risk, allowing them to capture the full premium income that would otherwise go to an insurer.

Alternative Credit Risk Transfer Mechanisms

While traditional private mortgage insurance (MI) is a primary credit enhancement, alternative credit risk transfer (CRT) mechanisms are emerging as potential substitutes. Fannie Mae and Freddie Mac, government-sponsored enterprises (GSEs), are actively involved in various CRT transactions that share risk with the private sector, moving beyond just MI.

These evolving CRT methods could indirectly impact the demand for traditional MI. For instance, the GSEs' efforts to transfer risk through securitization structures or other forms of insurance can offer alternative ways to mitigate credit exposure on mortgage portfolios. In 2023, the GSEs completed over $1.1 trillion in CRT transactions, indicating a growing appetite for private sector risk participation.

The increasing sophistication and volume of these CRT transactions present a notable threat. As more private capital engages in mortgage credit risk, the necessity and pricing power of traditional MI might be influenced. This trend suggests a dynamic market where alternative risk-sharing models are gaining traction.

- Growing CRT Market: The GSEs' CRT market has expanded significantly, with billions of dollars in risk transferred annually, providing alternatives to traditional MI.

- Diversification of Risk Transfer: Beyond MI, CRT includes credit-linked notes, reinsurance treaties, and other structured products that share mortgage credit risk.

- Potential Impact on MI Premiums: Increased availability of alternative risk transfer methods could lead to competitive pressure on MI pricing and market share.

- Investor Appetite for Mortgage Risk: A strong investor demand for mortgage-backed securities and associated credit protection fuels the growth of CRT.

Changes in Loan Product Offerings

Lenders are developing new mortgage products that reduce risk without requiring private mortgage insurance (PMI). These can include certain adjustable-rate mortgages or innovative loan structures that act as substitutes for traditional loans requiring PMI. For instance, some lenders are offering limited cash-out refinance options on existing loans that have already built equity, effectively reducing the need for new insurance.

However, the market segment focused on low down payment loans still generally requires a form of credit enhancement, making direct substitution challenging. As of early 2024, the demand for low-down-payment mortgages remained robust, with government-backed loans like FHA and VA loans continuing to be significant players, often providing alternatives to PMI but with their own associated costs or requirements.

- New Mortgage Products: Adjustable-rate mortgages and unique loan structures designed to inherently mitigate risk.

- Risk Mitigation: These products aim to reduce or eliminate the need for external mortgage insurance.

- Low Down Payment Loans: This segment typically still requires credit enhancement, limiting direct substitution.

- Market Dynamics (2024): Continued demand for low-down-payment options, with government-backed loans serving as alternatives, albeit with different structures.

The threat of substitutes for private mortgage insurance (MI) is significant, primarily stemming from government-backed loan programs like FHA and VA, which offer direct insurance often with more accessible terms. Additionally, borrowers with substantial down payments, typically 20% or more, can bypass the need for MI altogether by self-insuring.

Large financial institutions may also choose to absorb credit risk internally, acting as a substitute for external MI. Emerging alternative credit risk transfer (CRT) mechanisms, involving GSEs and private capital, are further diversifying risk-sharing avenues and potentially impacting the traditional MI market.

| Substitute | Key Features | Impact on Private MI | 2024 Data/Context |

| Government-Backed Loans (FHA, VA) | Lower down payment requirements, direct insurance | Siphons demand from private MI | FHA insured ~8.1 million mortgages |

| Large Down Payment (20%+) | Self-insurance, no MI needed | Reduces the addressable market for MI | Housing affordability remains a key factor |

| Institutional Self-Insurance | Retaining credit risk on balance sheets | Bypasses third-party MI providers | Major originators continue to hold loans |

| Alternative Credit Risk Transfer (CRT) | GSEs and private sector risk sharing | Offers alternative credit enhancement | GSEs completed over $1.1 trillion in CRT (2023) |

Entrants Threaten

The private mortgage insurance (PMI) sector presents a formidable barrier to entry due to exceptionally high capital requirements. New companies must possess substantial financial resources to comply with regulations like the Federal Housing Finance Agency's (FHFA) Private Mortgage Insurer Eligibility Requirements (PMIERs). These rules are in place to guarantee the financial health and stability of PMI providers.

Meeting these stringent PMIERs, which dictate minimum capital reserves and risk-based capital levels, necessitates significant upfront investment. For instance, as of early 2024, a prospective PMI provider would need to demonstrate robust capitalization well into the hundreds of millions of dollars to even be considered eligible to insure mortgages for Fannie Mae and Freddie Mac. This capital intensity effectively deters many potential new entrants.

New entrants into the mortgage insurance sector confront substantial regulatory barriers. Obtaining the necessary licenses and adhering to a maze of federal and state compliance requirements, such as those mandated by the Protecting Our Most Essential Retirement Savings (PMIERs) regulations, presents a significant challenge. These rules, which were subject to updates in 2024 and are expected to see further evolution through 2025, demand considerable investment in legal, compliance, and operational infrastructure, thereby raising the cost and complexity of market entry.

Success in the mortgage insurance (MI) market hinges significantly on cultivating and maintaining strong, established relationships with a wide array of mortgage lenders. These partnerships are the bedrock of a lender's willingness to offer MI to their borrowers.

Developing these crucial lender relationships and achieving widespread market acceptance is a time-consuming and resource-intensive endeavor, presenting a formidable hurdle for any new entrant aiming to break into the sector. For instance, in 2024, the top three MI providers continued to leverage their decades-old lender networks to maintain their market share.

New companies entering the MI space face the challenge of not only proving their financial stability and product competitiveness but also of demonstrating reliability and building trust with lenders who are often risk-averse and prefer to work with proven entities.

The established players often benefit from long-standing contracts and preferred vendor status, making it difficult for newcomers to gain traction and secure a significant volume of business without substantial incentives or a truly disruptive offering.

Proprietary Risk Models and Data Analytics

Existing players, such as Essent, have invested heavily in developing advanced proprietary risk models and extensive data analytics. These capabilities are fundamental to accurately assessing and pricing mortgage risk, a core function in the industry. The sheer depth of historical data and the continuous refinement of these models create a significant barrier for newcomers.

Replicating Essent's established expertise and the infrastructure supporting its data analytics would demand substantial capital and time. This makes it exceptionally challenging for new entrants to compete on a level playing field, particularly in terms of underwriting precision and risk management efficiency. For instance, companies in the mortgage insurance sector often spend millions annually on data science and modeling to maintain a competitive edge.

- Proprietary Models: Essent's in-house developed risk models are a key differentiator, allowing for nuanced pricing and risk selection.

- Data Analytics Infrastructure: Significant investment in data warehousing, processing power, and analytical talent is required to match Essent's capabilities.

- Competitive Hurdle: The cost and complexity of building comparable data and modeling expertise represent a high barrier to entry.

- Market Entry Cost: New entrants face substantial upfront costs for technology, talent, and data acquisition to even begin competing on risk assessment.

Brand Reputation and Financial Strength Ratings

For new entrants in financial services, establishing a strong brand reputation is a significant hurdle. In 2024, consumer trust in financial institutions remains a key differentiator, and building this takes considerable time and investment in marketing and customer service. Without a proven track record, new players face skepticism.

Furthermore, securing favorable financial strength ratings is essential. Companies like Moody's, S&P, and Fitch assign these ratings, which directly impact a firm's ability to attract capital and conduct business, especially with government-sponsored enterprises (GSEs). For instance, a strong A rating from S&P is often a prerequisite for many partnerships and large-scale transactions in the mortgage sector.

- Brand Reputation: New entrants must invest heavily to build trust and recognition, a process that can take years.

- Financial Strength Ratings: High credit ratings are crucial for accessing funding and partnering with regulated entities.

- GSE Requirements: Agencies like Fannie Mae and Freddie Mac often mandate specific minimum credit ratings for counterparties.

- Claims-Paying Ability: Demonstrating a robust ability to meet financial obligations is vital for long-term viability and customer confidence.

The threat of new entrants into the private mortgage insurance (PMI) sector is significantly low. This is primarily due to extremely high capital requirements, stringent regulatory compliance, and the necessity of establishing strong lender relationships. Building a reputable brand and securing favorable financial strength ratings also present substantial barriers.

For instance, as of early 2024, prospective PMI providers need hundreds of millions in capitalization to be eligible to insure mortgages for Fannie Mae and Freddie Mac. Furthermore, new entrants must replicate the sophisticated proprietary risk models and extensive data analytics that established players like Essent have developed over years, a costly and time-consuming undertaking. The market dominance of existing entities, often bolstered by long-standing contracts and preferred vendor status, further solidifies these entry barriers.

The sheer investment required for technology, talent, and data acquisition to compete on risk assessment alone makes market entry exceptionally challenging. For example, companies in the mortgage insurance sector often allocate millions annually to data science and modeling to maintain their competitive edge, a cost that can be prohibitive for newcomers.

| Barrier Type | Description | Impact on New Entrants (as of 2024) | Example Data/Fact |

|---|---|---|---|

| Capital Requirements | High minimum capital reserves and risk-based capital levels mandated by regulators. | Deters entry due to significant upfront investment needs. | Hundreds of millions of dollars required for eligibility with GSEs. |

| Regulatory Compliance | Navigating federal and state licensing, and evolving regulations (e.g., PMIERs). | Increases costs and complexity of market entry. | Substantial investment in legal, compliance, and operational infrastructure. |

| Lender Relationships | Need to build trust and secure partnerships with mortgage lenders. | Time-consuming and resource-intensive to establish. | Top 3 MI providers leverage decades-old lender networks for market share. |

| Proprietary Models & Data Analytics | Developing advanced risk assessment and pricing capabilities. | Requires substantial capital and time to replicate existing expertise. | Millions spent annually on data science and modeling by established firms. |

| Brand Reputation & Ratings | Building trust and achieving strong financial strength ratings (e.g., S&P, Moody's). | Crucial for accessing capital and partnering with regulated entities. | A strong A rating from S&P often a prerequisite for GSE partnerships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built on a foundation of robust data, drawing from company annual reports, industry-specific market research, and competitive intelligence platforms.