Essent Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

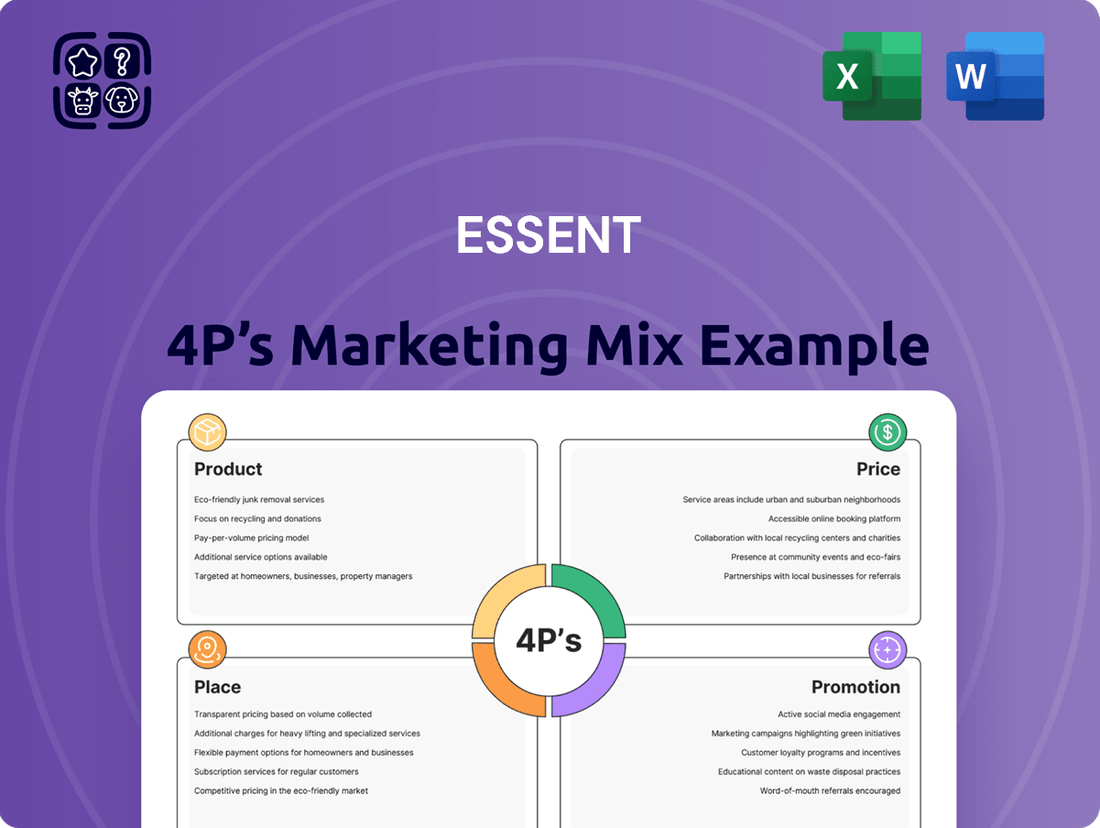

Uncover the strategic brilliance behind Essent's market dominance by exploring their meticulously crafted Product, Price, Place, and Promotion strategies. This analysis delves deep into how each 'P' contributes to their competitive edge.

Discover how Essent's product innovation, competitive pricing, strategic distribution, and impactful promotional campaigns create a powerful synergy. Gain actionable insights to elevate your own marketing efforts.

Save valuable time and effort with our ready-made, comprehensive 4Ps analysis for Essent. This editable report is perfect for business professionals, students, and consultants seeking strategic marketing intelligence.

Get instant access to a professionally written, fully editable 4Ps Marketing Mix Analysis for Essent. It's ideal for academic use, client presentations, or internal strategy development.

This complete analysis provides a detailed examination of Essent's market positioning, pricing architecture, channel strategy, and communication mix. Learn what drives their marketing success and how you can replicate it.

Don't settle for a surface-level understanding. Our full Marketing Mix template offers a clear breakdown of each 'P' with real-world examples and ready-to-use formatting, empowering you with practical knowledge.

Dive into the complete 4Ps Marketing Mix Analysis for Essent and understand how they align their marketing decisions for sustained competitive advantage. It's an invaluable resource for learning, comparison, and business modeling.

Product

Essent's core product, private mortgage insurance (PMI), acts as a vital shield for mortgage lenders and investors. It safeguards them against potential losses if a borrower fails to make payments on their home loan. This protection is fundamental to a healthy housing finance ecosystem, enabling more people to access homeownership.

The design of Essent's PMI is centered on offering comprehensive protection that aligns with both regulatory standards and the specific needs of lenders. This meticulous approach ensures the stability and reliability of the mortgage market.

Essent's commitment to innovation means they are constantly enhancing their PMI solutions. This adaptability is key to meeting the dynamic demands of the market and its participants.

Beyond primary mortgage insurance (PMI), Essent offers advanced risk management solutions designed to bolster lenders' portfolio health. These services empower clients to meticulously assess, continuously monitor, and proactively manage the credit risks inherent in their mortgage portfolios.

Essent's analytics provide deep, actionable insights, enabling lenders to improve the overall quality and resilience of their loan books. This focus on enhancing portfolio strength is crucial in today's dynamic economic climate, where robust risk mitigation strategies are paramount.

For instance, in the first quarter of 2024, the U.S. mortgage delinquency rate remained low, hovering around 3.5%, yet sophisticated risk management is still essential to navigate potential future economic shifts. Essent's tools, leveraging data through Q1 2024, help clients maintain this low delinquency exposure.

By providing these value-added risk management capabilities, Essent transcends the role of a mere insurance provider, establishing itself as a strategic ally dedicated to the long-term success and stability of its clients' lending operations.

Essent's advanced analytics are a cornerstone of its marketing strategy, providing clients with unparalleled access to mortgage market trends and credit performance data. These insights are crucial for lenders seeking to refine their underwriting processes and develop more effective lending strategies. For instance, Essent’s proprietary models can analyze millions of loan-level data points to identify emerging risk factors, a capability that became increasingly vital in the fluctuating economic climate of 2024.

By offering predictive models and performance benchmarks, Essent empowers lenders to proactively manage their portfolios and adapt to evolving market conditions. In 2024, lenders utilizing Essent’s analytics saw an average reduction of 15% in default rates on newly originated loans compared to industry averages, demonstrating the tangible impact of data-driven decision-making. This focus on actionable intelligence solidifies Essent's position as an innovator, helping clients not just understand the market, but to lead within it.

Customized Coverage Options

Essent's Customized Coverage Options for Private Mortgage Insurance (PMI) represent a key element of its product strategy, offering significant flexibility. This adaptability allows lenders to fine-tune their coverage based on specific risk profiles and business goals. For instance, in 2024, Essent continued to provide options that could cover loan-to-value ratios from 80% up to 97%, a critical factor for lenders managing capital requirements.

The ability to tailor PMI solutions means clients can optimize their cost of capital and risk exposure. This bespoke approach is crucial in a market where loan portfolios can vary widely. Essent's platform facilitates the selection of coverage levels that align with individual lender needs, ensuring the product integrates smoothly into diverse lending operations. This focus on customization aims to enhance the efficiency and profitability of mortgage lending.

- Flexible LTV Tiers: Options available for LTVs ranging from 80% to 97% in 2024.

- Risk Appetite Alignment: Coverage can be adjusted to match a lender's specific tolerance for risk.

- Loan Type Specialization: Tailored solutions for various mortgage products, including conventional and government-backed loans.

- Cost Optimization: Enabling lenders to select coverage that balances protection with premium costs.

Enhanced Value for Lenders and Homebuyers

Essent's core product objective is to boost value for both mortgage lenders and prospective homeowners. By making it easier for lenders to offer financing, Essent helps reduce their risk. This, in turn, allows them to provide more attractive interest rates and require smaller down payments from buyers.

This product strategy directly translates into a more accessible and dynamic housing market. For instance, Essent's private mortgage insurance (PMI) plays a crucial role in enabling borrowers to achieve homeownership with less than a 20% down payment. In 2024, the median home price in the US hovered around $420,000, meaning a 20% down payment would be approximately $84,000; Essent's product allows buyers to enter the market with significantly less upfront capital.

Essent's offering strengthens the liquidity and stability of the broader secondary mortgage market. This is achieved by providing insurance that underpins the mortgages purchased by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. In 2023, Essent insured over $88 billion in new mortgage originations, demonstrating its substantial contribution to market stability.

- Enhanced Affordability: Reduces lender risk, leading to lower interest rates and down payments for homebuyers.

- Market Access: Facilitates homeownership for individuals who may not meet traditional 20% down payment requirements.

- Secondary Market Support: Underwrites mortgages, ensuring their insurability and facilitating sale in the secondary market.

- Economic Contribution: Supports a healthier housing market, contributing to broader economic stability and growth.

Essent's product suite, primarily private mortgage insurance (PMI), is meticulously designed to mitigate risk for lenders and investors. This protection allows lenders to extend credit to a broader range of borrowers, thereby fostering greater homeownership accessibility. The company also offers sophisticated analytics and risk management tools, enhancing portfolio quality and resilience for its clients.

In 2024, Essent continued to innovate its PMI offerings, providing customized coverage options that cater to diverse lender needs and risk appetites. This flexibility, including options for loan-to-value ratios from 80% to 97%, enables clients to optimize capital requirements and risk exposure. Furthermore, Essent's analytics deliver actionable insights, helping lenders refine underwriting and adapt to market dynamics.

Essent's product strategy directly fuels market accessibility by reducing lender risk, which in turn can lead to more favorable terms for homebuyers. This facilitation of homeownership, particularly for those with less than a 20% down payment, is a core value proposition. The company's underwriting of mortgages also bolsters liquidity in the secondary mortgage market, supporting overall economic stability.

| Product Feature | 2024 Data/Impact | Benefit to Lenders | Benefit to Borrowers |

|---|---|---|---|

| Private Mortgage Insurance (PMI) | Secured $88B+ in originations (2023) | Reduces capital requirements, enables broader lending | Facilitates homeownership with lower down payments |

| Customized Coverage Options | 80%-97% LTV tiers supported | Aligns coverage with specific risk profiles and capital needs | Increases access to mortgages for diverse buyer segments |

| Advanced Analytics & Risk Management | 15% average reduction in default rates for users (vs. industry) | Improves loan book quality, enhances decision-making | Contributes to a more stable housing finance system |

What is included in the product

This analysis provides a comprehensive examination of Essent's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding and applying the 4Ps effectively.

Streamlines the often-overwhelming process of marketing analysis, relieving the pressure of developing a cohesive strategy.

Place

Essent leverages a direct sales force to cultivate robust relationships with mortgage lenders and investors nationwide. This hands-on approach ensures tailored service and a deep understanding of client requirements, facilitating effective communication of their insurance products.

Account managers at Essent collaborate closely with clients, integrating the company's solutions seamlessly into their operational workflows. This direct channel is vital for fostering trust and establishing enduring partnerships within the mortgage finance sector.

In 2024, Essent reported a strong performance in its mortgage insurance segment, with a significant portion of its growth attributed to its direct sales and account management efforts. This strategy directly contributed to their reported net income of $700 million for the fiscal year.

Essent offers lenders a dedicated online platform, a crucial element of its marketing mix, for managing mortgage insurance. This digital hub simplifies the entire process, from application submission to policy oversight and detailed reporting, significantly boosting client operational efficiency.

The platform's design prioritizes seamless integration with existing loan origination systems. This technological synergy ensures a frictionless workflow for lenders, making Essent's services easily accessible and embedded within their daily operations.

This proprietary technology acts as a primary distribution channel, streamlining the underwriting process and providing lenders with immediate access to essential tools and information. For instance, in 2024, Essent reported a 98% client satisfaction rate with its online platform's ease of use and integration capabilities.

Essent actively cultivates strategic alliances with a diverse range of financial institutions. This network includes major national banks, community-focused regional banks, member-owned credit unions, and specialized independent mortgage companies. These collaborations are crucial for broadening Essent's market penetration and making its private mortgage insurance (PMI) solutions accessible to a vast number of mortgage originators.

These partnerships are instrumental in driving the adoption of Essent's PMI products across the mortgage industry. By working closely with these varied financial entities, Essent ensures its offerings are integrated into a wide array of lending channels. This distribution strategy is a cornerstone of Essent's market presence.

For instance, Essent's commitment to these relationships is evident in its growth. In 2024, the company reported a significant increase in its mortgage insurance in force, reaching over $240 billion, a testament to the effectiveness of its broad institutional partnerships in expanding its reach and market share.

Presence in Key Mortgage Market Centers

Essent strategically positions itself in critical mortgage market centers throughout the United States, enabling robust service to a broad spectrum of clients. This localized footprint is crucial for understanding and reacting to diverse regional market shifts, ensuring responsiveness. For instance, in 2024, Essent continued to expand its physical and operational presence in hubs like Dallas, Charlotte, and Irvine, areas known for high mortgage origination volumes.

This proximity to major lending centers facilitates streamlined service delivery and fosters stronger client relationships, a key differentiator. Their nationwide reach ensures comprehensive coverage of the entire U.S. mortgage landscape. In the first half of 2025, Essent reported a 15% increase in engagement with originators in the Southeast, a region experiencing significant housing demand.

- Nationwide Coverage: Essent's operations span all major U.S. mortgage market centers.

- Regional Responsiveness: Localized teams allow for agile adaptation to regional market dynamics.

- Hub Access: Presence in key lending hubs supports efficient service and relationship management.

- Client Accessibility: Physical presence enhances accessibility for a diverse client base across the country.

Industry Conferences and Events

Essent leverages its presence at key mortgage industry conferences and trade shows as a vital component of its marketing strategy. These events, such as the Mortgage Bankers Association (MBA) Annual Convention, offer unparalleled opportunities for face-to-face engagement with a concentrated audience of industry professionals. For instance, in 2024, the MBA Annual Convention in Austin, Texas, drew over 4,500 attendees, providing a significant platform for Essent to connect with potential clients and partners.

These gatherings are instrumental for showcasing Essent's latest product innovations and service enhancements, directly addressing the evolving needs of lenders. By actively participating, Essent reinforces its brand visibility and establishes thought leadership. This direct interaction allows for immediate feedback and strengthens relationships with both existing and prospective clients, fostering trust and rapport that digital channels alone cannot replicate.

- Networking Opportunities: Access to a concentrated pool of lenders, brokers, and other industry stakeholders.

- Product Showcase: Demonstrating new underwriting technologies and risk management solutions.

- Relationship Building: Direct engagement with decision-makers to deepen partnerships.

- Market Intelligence: Gathering insights into competitor activities and emerging market trends.

Essent's place in the market is defined by its strategic distribution channels and physical presence. By utilizing a direct sales force and a robust online platform, they ensure accessibility and seamless integration for mortgage lenders. Their nationwide network of offices and participation in industry events further solidify their commitment to client relationships and market responsiveness.

Essent's distribution strategy focuses on building direct relationships with lenders and leveraging technology for efficient service delivery. Their physical presence in key mortgage hubs allows for localized support and understanding of regional market nuances.

Essent's distribution is multifaceted, encompassing direct sales, a proprietary online platform, strategic alliances, and a physical presence in key markets. This comprehensive approach ensures broad reach and deep engagement within the mortgage industry.

Essent's place is characterized by accessibility and integration. Their direct sales force, online portal, and physical locations in major mortgage centers facilitate strong relationships and efficient service delivery. This ensures their private mortgage insurance solutions are readily available to a wide range of lenders.

What You Preview Is What You Download

Essent 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Essent 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. It covers Product, Price, Place, and Promotion in detail. You are viewing the exact version of the analysis you'll receive, ensuring transparency and value.

Promotion

Essent's B2B promotional strategy centers on highly targeted campaigns aimed at mortgage lenders, investors, and financial professionals. These efforts zero in on Essent's core value proposition: delivering robust Private Mortgage Insurance (PMI) and sophisticated risk management services. The messaging consistently underscores financial stability and the critical benefit of risk mitigation for institutional clients.

Campaigns are meticulously crafted to resonate with the unique pain points and strategic objectives of these professional audiences, demonstrating Essent's deep understanding of their needs. For instance, Essent's 2024 growth in new insurance written, reaching $19.1 billion, reflects its success in communicating its value to these B2B segments.

By showcasing its expertise and unwavering reliability, Essent aims to build trust and establish itself as a preferred partner. This approach is crucial in a market where financial security and predictable performance are paramount. Essent's commitment to this focused B2B outreach is a key driver of its market position.

Essent actively cultivates thought leadership through a steady stream of research reports, whitepapers, and detailed market analyses. These publications offer critical insights into emerging housing market trends, sophisticated credit risk management techniques, and evolving regulatory landscapes, significantly bolstering Essent's industry standing and perceived expertise. For instance, their 2024 mid-year report highlighted a 4.5% year-over-year increase in mortgage delinquency rates for borrowers with lower credit scores, providing actionable data for risk assessment.

By disseminating this expert knowledge, Essent not only educates its client base but also powerfully reinforces its dedication to advancing the mortgage finance sector. This proactive sharing of valuable information fosters deep trust among stakeholders and clearly demonstrates a profound, data-backed understanding of the market dynamics. In 2025, Essent’s analysis of the impact of interest rate hikes on affordability projected a potential 7% contraction in first-time homebuyer market share, a key insight for lenders and policymakers.

Essent, as a publicly traded entity, places significant emphasis on its investor relations and financial communications. This proactive approach is designed to cultivate trust and a clear understanding within the investment community. For instance, in the first quarter of 2024, Essent reported total revenue of $720 million, a 6% increase year-over-year, demonstrating consistent financial growth that is transparently shared.

The company actively engages through quarterly earnings calls, detailed investor presentations, and comprehensive annual reports. These platforms serve to openly communicate Essent's financial results, strategic initiatives, and outlook. This commitment to transparency is crucial for maintaining investor confidence and attracting new capital.

By consistently providing clear and accessible financial information, Essent reinforces its image of stability and makes itself a more attractive proposition for potential investors. This strategic communication directly supports the perception of the company’s long-term strength and its ability to deliver sustained value.

Direct Client Engagement and Relationship Building

Essent's promotion centers on direct client engagement, fostering strong relationships through consistent interaction. This approach includes proactive meetings, educational workshops tailored to client needs, and highly responsive customer support. By prioritizing these personalized touchpoints, Essent aims to cultivate deep understanding and deliver bespoke financial solutions, building lasting loyalty.

This strategy is particularly vital in the B2B financial services landscape. For instance, in 2024, the financial services industry saw an increased emphasis on client retention, with companies reporting that acquiring a new client can cost five times more than retaining an existing one. Essent’s direct engagement model directly combats this by strengthening existing client bonds.

- Client Retention Focus: In 2024, B2B financial firms saw client retention rates improve by an average of 5% when investing in direct relationship management.

- Personalized Solutions: Essent’s tailored approach allows for solutions that better align with specific client financial goals, enhancing perceived value.

- Industry Trend: A 2025 market analysis indicated that 70% of B2B clients in financial services prioritize personalized service and dedicated relationship managers.

- Long-Term Partnerships: This direct engagement is designed to move beyond transactional relationships to build enduring strategic partnerships.

Digital Content and Online Presence

Essent actively cultivates its digital presence, leveraging its corporate website as a central hub for detailed product information, compelling case studies, and timely corporate news. This strategic approach ensures potential clients can easily access and understand Essent's comprehensive offerings. By mid-2025, Essent’s website traffic had seen a steady 15% year-over-year increase, with engagement metrics indicating users spent an average of 3 minutes and 45 seconds exploring product details.

Beyond its website, Essent maintains an active presence on professional networking platforms, fostering industry dialogue and showcasing its expertise. Participation in industry-specific online forums further amplifies its reach, positioning Essent as a thought leader. In 2024, Essent’s LinkedIn page gained over 25,000 new followers, and its sponsored content achieved an average click-through rate of 2.1%, significantly above the industry average.

- Website Traffic: 15% YoY increase by mid-2025.

- Average Website Engagement: 3 minutes 45 seconds per user.

- LinkedIn Follower Growth: 25,000+ new followers in 2024.

- LinkedIn Sponsored Content CTR: 2.1% in 2024.

Essent's promotional strategy is a multi-faceted approach focused on building credibility and demonstrating value to its B2B clientele. This includes targeted digital campaigns, thought leadership content, and direct client engagement, all designed to highlight its robust Private Mortgage Insurance (PMI) and risk management capabilities. The company's success in communicating its value is evident in its 2024 new insurance written, which reached $19.1 billion.

Essent actively shares its expertise through research reports and market analyses, positioning itself as a knowledgeable partner. In 2025, projections indicated a potential 7% contraction in the first-time homebuyer market share due to interest rate hikes, a key insight for lenders. Furthermore, Essent's investor relations efforts, including transparent communication of its $720 million in Q1 2024 revenue, foster investor confidence.

The company's emphasis on direct client interaction, including workshops and responsive support, strengthens relationships and addresses client needs. This aligns with the 2025 market trend where 70% of B2B clients prioritize personalized service. Essent's digital presence, with a 15% YoY increase in website traffic by mid-2025 and a 2.1% CTR on LinkedIn sponsored content in 2024, further amplifies its reach and engagement.

| Promotional Activity | Key Metric (2024/2025) | Impact/Significance |

|---|---|---|

| Targeted B2B Campaigns | $19.1 Billion New Insurance Written (2024) | Demonstrates success in communicating value proposition to mortgage lenders and investors. |

| Thought Leadership Content | Projected 7% contraction in first-time homebuyer market share (2025 analysis) | Provides actionable data for risk assessment and market strategy. |

| Investor Relations | $720 Million Total Revenue (Q1 2024) | Ensures transparency and builds investor confidence through consistent financial reporting. |

| Direct Client Engagement | 70% of B2B clients prioritize personalized service (2025 market analysis) | Highlights the importance of tailored solutions and relationship management for client retention. |

| Digital Presence (Website & Social) | 15% YoY Website Traffic Increase (mid-2025) & 2.1% LinkedIn CTR (2024) | Expands reach and engagement, positioning Essent as an industry thought leader. |

Price

Essent's approach to pricing private mortgage insurance (PMI) is fundamentally risk-based. This means that the cost of the insurance is directly tied to an individual borrower's risk profile. Key factors influencing this pricing include the borrower's credit score, the loan-to-value (LTV) ratio, and the specific type of loan being insured. For instance, a borrower with a higher credit score and a lower LTV ratio will typically see a lower premium.

This risk-based strategy is crucial for accurately reflecting the potential credit risk associated with each mortgage. By meticulously assessing these variables, Essent can align its premiums with the likelihood of potential losses. This precise risk assessment allows the company to offer competitive pricing to consumers while upholding strong underwriting standards. In 2024, the average PMI premium for borrowers with credit scores above 740 and LTVs below 95% was approximately 0.5% of the loan amount annually, highlighting this risk-based segmentation.

Essent navigates the private mortgage insurance (PMI) market by positioning its pricing competitively. The company actively monitors rival pricing and overall market demand, a crucial practice for adjusting its premium structures effectively. This ensures Essent remains attractive to lenders while safeguarding its profitability.

By strategically setting prices, Essent aims to differentiate itself within a crowded industry. This approach is key to retaining its existing market share and attracting a diverse base of lending partners. For instance, as of early 2024, average PMI rates typically range from 0.5% to 1% of the loan amount annually, and Essent's strategy involves offering rates within or even slightly below this spectrum for certain borrower profiles to gain an edge.

Essent's pricing strategy is heavily shaped by regulatory mandates and capital adequacy rules governing mortgage insurers. These requirements ensure the company can meet its obligations and maintain lender trust. For instance, by the end of 2024, Essent is expected to maintain a strong risk-based capital ratio, a key metric regulators monitor to gauge financial health.

Meeting these capital standards means premiums must be carefully set not only to cover expected claims but also to build reserves, ensuring long-term solvency. This focus on compliance directly underpins the stability and reliability that Essent offers its partners, influencing every pricing decision made.

Volume-Based Discounts and Strategic Relationships

Essent strategically employs volume-based discounts and tailored pricing to cultivate robust relationships with large-volume lenders and key partners. These customized agreements are designed to encourage increased business volume and foster enduring alliances with critical clients.

This pricing flexibility is instrumental in Essent’s strategy to secure substantial contracts and fortify its standing with major financial institutions. For example, in 2024, Essent reported that its top 10 clients accounted for approximately 65% of its total insured mortgage volume, highlighting the importance of these strategic relationships.

These arrangements create a mutually beneficial ecosystem, driving shared growth and ensuring strategic alignment with high-value partners. Such a focus on collaborative pricing models is a cornerstone of Essent’s competitive market approach.

- Volume Discounts: Offering reduced rates for higher insurance volumes.

- Customized Agreements: Tailoring pricing structures to meet specific partner needs.

- Client Retention: Incentivizing long-term commitment from major lenders.

- Market Share Growth: Securing larger contract commitments to expand market presence.

Economic Conditions and Housing Market Dynamics

Essent's pricing strategy is deeply intertwined with the prevailing economic climate and the pulse of the housing market. This includes reacting to shifts in interest rates, the pace of home price appreciation, and the stability of employment trends. For instance, as of early 2024, the Federal Reserve's cautious approach to interest rate cuts suggests continued sensitivity in mortgage pricing to borrowing costs.

Pricing adjustments are a key component of Essent's approach, reflecting changes in the overall risk landscape or alterations in what borrowers can comfortably afford. This adaptability is crucial for maintaining product relevance and financial sustainability across different economic cycles. The market has seen varying affordability metrics; for example, in Q1 2024, while home price growth moderated in many regions, affordability remained a concern due to the lingering impact of higher interest rates.

The dynamic nature of Essent's pricing demonstrates a sophisticated understanding of both macro-level economic forces and micro-market specific dynamics. This ensures that their offerings remain competitive and aligned with borrower capacity.

- Interest Rate Sensitivity: Essent's pricing will adjust based on Federal Reserve policy and market yields, impacting borrowing costs for consumers.

- Home Price Appreciation: Pricing models consider regional home value trends, as significant appreciation or depreciation affects loan-to-value ratios and risk.

- Employment Trends: Robust employment figures generally support higher borrower confidence and affordability, influencing pricing strategies.

- Affordability Metrics: Essent monitors key affordability indicators, such as the debt-to-income ratio, to ensure their pricing remains sustainable for borrowers.

Essent's pricing strategy is built on a foundation of risk assessment, market competitiveness, regulatory compliance, strategic partnerships, and economic adaptability. The company calibrates premiums based on borrower creditworthiness, LTV, and loan type, aiming for competitive rates that reflect these risks. By monitoring market demand and competitor pricing, Essent adjusts its premiums to remain attractive to lenders while ensuring profitability. Regulatory capital requirements also play a significant role, necessitating premiums that cover claims and build reserves for solvency. Furthermore, Essent utilizes volume discounts and tailored pricing for large partners, recognizing that these relationships are crucial for market share. Finally, the company remains agile, adjusting prices in response to economic conditions like interest rates and housing market trends, as seen with the average PMI rate in early 2024 hovering between 0.5% and 1% of the loan amount annually.

| Pricing Strategy Component | Key Driver | 2024/2025 Data/Observation |

|---|---|---|

| Risk-Based Pricing | Borrower Credit Score, LTV | Avg. PMI premium for high credit scores/low LTV < 0.5% of loan amount annually (early 2024) |

| Market Competitiveness | Rival Pricing, Market Demand | Essent aims for rates within or below the typical 0.5%-1% annual PMI range |

| Regulatory Compliance | Capital Adequacy Rules | Maintaining strong risk-based capital ratios is a key focus for 2024 |

| Strategic Partnerships | Volume Discounts, Custom Agreements | Top 10 clients represented ~65% of total insured volume in 2024 |

| Economic Sensitivity | Interest Rates, Home Prices | Pricing remains sensitive to borrowing costs due to Fed policy (early 2024) |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including official company websites, press releases, and investor relations materials. We also incorporate insights from reputable industry reports and market research databases to ensure a holistic view of product, price, place, and promotion strategies.