ESR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

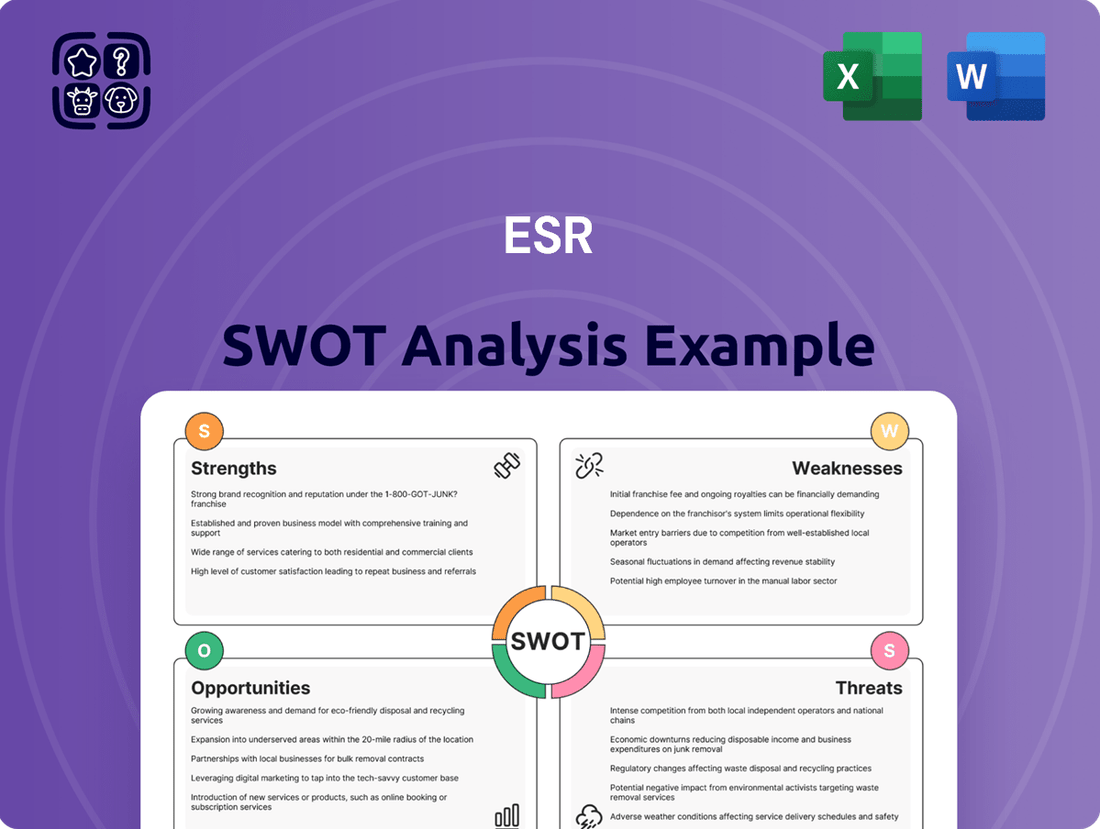

Curious about ESR's competitive edge and potential challenges? Our comprehensive SWOT analysis delves deep into their unique strengths, potential weaknesses, exciting opportunities, and critical threats.

Want the full story behind ESR's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

ESR Group Limited stands as the dominant force in Asia Pacific's real asset management sector, holding its title as the largest manager for the second consecutive year, according to the 2025 Fund Manager Survey. This impressive market leadership is built upon a foundation of significant Assets Under Management (AUM), which reached an impressive US$71.4 billion by the end of 2024. The company's strategic concentration on rapidly expanding industries, particularly logistics and data centers, fuels this ongoing success and solidifies its preeminent position in the region.

ESR's strategic focus on new economy assets, particularly logistics real estate and data centers, positions it well to capitalize on the burgeoning e-commerce and digital transformation trends. This deliberate concentration demonstrates a keen understanding of evolving market demands.

The company's capital allocation strategy underscores this strength, with over 75% of the US$5.4 billion raised in fiscal year 2024 directed towards industrial logistics and data center projects. This significant investment highlights investor confidence in these high-growth sectors and ESR's ability to execute its strategy.

ESR's integrated business model is a significant strength, encompassing the entire real asset value chain. This end-to-end capability, from land sourcing and development to leasing and asset management, allows for streamlined operations and enhanced value creation across the property lifecycle. This integrated approach underpins their scalable, asset-light strategy.

Strong Capital Partnerships and Fundraising

ESR benefits from strong capital partnerships, attracting significant uncalled capital from global institutional investors like sovereign wealth and pension funds for its development pipeline. This deep investor base provides a stable foundation for future growth and project execution.

The company demonstrated its fundraising prowess in FY2024 by securing US$5.4 billion in capital. Notably, this included US$2.3 billion from new investors, highlighting ESR's continued appeal to a broadening investor base even amidst a challenging economic climate.

- Robust Investor Relationships: Cultivated strong ties with global institutional investors, ensuring access to substantial uncalled capital.

- FY2024 Fundraising Success: Raised US$5.4 billion, with US$2.3 billion coming from new investors, demonstrating strong market confidence.

Commitment to Sustainability and ESG

ESR's unwavering dedication to Environmental, Social, and Governance (ESG) principles is a significant strength, underscored by its comprehensive ESG 2030 Roadmap. This commitment translates into tangible actions, such as substantial investments in rooftop solar power and the installation of EV charging stations across its properties. The company's pursuit of green building certifications and the development of decarbonization roadmaps for its extensive portfolios further solidify its appeal to a growing segment of ESG-conscious investors and tenants.

This focus on sustainability is not merely aspirational; it's backed by concrete achievements. For instance, by the end of 2023, ESR had achieved over 110 MW of rooftop solar capacity installed, with a target to reach 250 MW by 2025. Furthermore, the company aims to have 100% of its new developments certified under leading green building standards by 2025.

- Strong ESG 2030 Roadmap: Provides a clear strategic direction for sustainability initiatives.

- Renewable Energy Integration: Significant rooftop solar capacity (over 110 MW by end of 2023) and EV charging infrastructure development.

- Green Building Focus: Aiming for 100% of new developments to meet green building certifications by 2025.

- Decarbonization Strategy: Developing roadmaps to reduce carbon emissions across its property portfolios.

ESR's market leadership in Asia Pacific real asset management is a key strength, managing US$71.4 billion in AUM by the end of 2024. This dominance is fueled by a strategic focus on high-growth sectors like logistics and data centers, aligning with e-commerce and digital transformation trends. The company's integrated business model, covering the entire real asset value chain, allows for efficient operations and value creation.

Strong capital partnerships are a significant advantage, with ESR attracting substantial uncalled capital from global institutional investors. This was evident in FY2024, where US$5.4 billion was raised, including US$2.3 billion from new investors, showcasing broad market confidence. The company's commitment to ESG is also a differentiator, with a clear roadmap and concrete actions like significant rooftop solar installations (over 110 MW by end of 2023) and a target for 100% of new developments to meet green building certifications by 2025.

| Metric | Value (as of end 2024/FY2024) | Significance |

|---|---|---|

| Assets Under Management (AUM) | US$71.4 billion | Demonstrates market leadership and scale. |

| FY2024 Capital Raised | US$5.4 billion | Highlights fundraising success and investor confidence. |

| New Investor Capital in FY2024 | US$2.3 billion | Indicates broadening investor appeal. |

| Rooftop Solar Capacity (end 2023) | Over 110 MW | Shows commitment to renewable energy. |

| New Developments Green Certification Target | 100% by 2025 | Emphasizes focus on sustainable development. |

What is included in the product

Analyzes ESR’s competitive position through key internal and external factors.

Offers a clear, organized framework to identify and address strategic weaknesses, thereby alleviating the pain of uncertainty and indecision.

Weaknesses

ESR Group faced a significant financial setback in fiscal year 2024, reporting a net loss of US$699.81 million. This marks a stark contrast to the profitability recorded in the prior year. The substantial loss stemmed largely from non-cash charges related to marked-to-market adjustments on its asset and project valuations.

Further contributing to the downturn were decreased promote fees and transaction-based income. These revenue streams, crucial for the group's performance, experienced a notable decline during the reporting period, impacting the overall financial results.

ESR's financial health is closely tied to the real estate market's ups and downs. For instance, in the first half of 2024, the company reported revaluation losses on its investment properties, particularly in Mainland China. This was driven by a tougher economic climate and a slowdown in leasing demand, leading to longer periods for properties to stabilize and achieve their full rental potential.

Despite ESR's efforts towards an asset-light model, its substantial development pipeline, especially in high-growth sectors like data centers and logistics, still demands considerable capital outlay. For instance, ESR's 2024 guidance indicated ongoing significant investment in its development projects to meet projected demand.

While the company has demonstrated robust capital raising abilities, the fundamental capital intensity of large-scale real estate development inherently poses a financial pressure. This can strain resources, particularly if market conditions shift or development costs escalate beyond initial projections.

Dependency on Specific Regional Performance

ESR's significant presence across the Asia-Pacific region, while a strength, also presents a weakness if certain markets underperform. For instance, in fiscal year 2024, the company observed a considerable dip in revenue originating from South Korea. This regional dependency exposes ESR to the risks associated with localized economic slowdowns or specific market challenges that can disproportionately impact overall financial results.

This reliance on individual regional economies can create volatility. The South Korean market's revenue decline in FY2024, for example, highlights how localized issues can ripple through the company's performance. This underscores a vulnerability to economic or regulatory shifts within any single, key operating territory.

- FY2024 South Korean Revenue Decline: A notable drop in revenue from South Korea in FY2024.

- Regional Economic Sensitivity: Vulnerability to downturns in specific APAC economies.

- Market-Specific Challenges: Potential impact from localized market dynamics or regulatory changes.

Impact of Reduced Promote and Transaction-Based Fees

ESR experienced a notable downturn in its financial performance during FY2024, primarily due to a significant drop in both promote and transaction-based fees. This decline directly affected the company's revenue streams and overall profitability.

Promote fees, which are contingent upon the successful realization or recapitalization of managed funds, proved to be particularly vulnerable. Their volatility is intrinsically linked to the broader real estate market cycles and prevailing economic conditions, making them an unpredictable component of ESR's income.

The impact of these reduced fees is evident in ESR's financial reporting:

- FY2024 Revenue Decline: ESR's total revenue saw a decrease, with a substantial portion attributed to lower fee income.

- Profitability Squeeze: Margins were compressed as the company navigated lower fee generation from its core activities.

- Market Sensitivity: The reliance on promote fees highlights ESR's exposure to market fluctuations and the timing of asset sales or restructurings.

- Strategic Adjustments: This weakness necessitates a review of fee structures and a potential diversification of revenue sources to mitigate future impacts.

ESR's financial performance in fiscal year 2024 was significantly impacted by substantial non-cash charges, primarily from marked-to-market adjustments on asset and project valuations. This led to a reported net loss of US$699.81 million, a stark reversal from the previous year's profitability.

The company also experienced a decline in crucial revenue streams, including promote fees and transaction-based income. These fluctuations are closely tied to the cyclical nature of the real estate market and the timing of asset sales or restructurings, directly affecting the group's earnings capacity.

Furthermore, ESR's substantial development pipeline, while strategic, requires significant ongoing capital investment. This inherent capital intensity can strain financial resources, especially if market conditions deteriorate or development costs escalate, as seen with revaluation losses on investment properties in Mainland China during the first half of 2024 due to economic headwinds and slower leasing demand.

| Financial Metric | FY2024 (US$) | FY2023 (US$) |

|---|---|---|

| Net Loss/(Profit) | (699.81 million) | [Profit figure not provided, but stated as profitable] |

| Promote Fees | [Specific figure not provided, but stated as decreased] | [Specific figure not provided] |

| Transaction-Based Income | [Specific figure not provided, but stated as decreased] | [Specific figure not provided] |

Preview the Actual Deliverable

ESR SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The burgeoning digital economy, fueled by e-commerce expansion and widespread AI adoption, is creating a powerful demand for modern logistics and data center facilities throughout the Asia Pacific region. This surge presents a prime opportunity for ESR to significantly grow its real estate holdings and benefit from the anticipated increases in data center build-outs and e-commerce fulfillment infrastructure.

Asia Pacific's e-commerce market, projected to reach over $2 trillion by 2025, underscores the critical need for advanced logistics spaces. ESR's strategic focus on these new economy assets positions it to capture a substantial share of this expanding market, leveraging the ongoing digital transformation to drive rental income and property value appreciation.

ESR possesses a significant opportunity to deepen its presence in rapidly expanding emerging markets across the Asia Pacific region, notably in Southeast Asia and India. These areas present substantial demand for modern logistics and warehousing facilities, a core strength of ESR. The region's growing middle class and increasing e-commerce penetration are key drivers for this expansion.

Further enhancing its growth trajectory, ESR is strategically expanding its infrastructure and energy transition platforms. This diversification leverages existing operational synergies and capitalizes on the global shift towards sustainable energy solutions and resilient infrastructure development. For instance, investments in renewable energy projects are becoming increasingly attractive as governments prioritize decarbonization efforts.

ESR can significantly boost its market position by strategically acquiring or partnering with companies that complement its existing business. This approach allows for enhanced operational efficiencies and deeper market penetration. For instance, the successful integration of LOGOS in 2024, which saw ESR acquire a majority stake, streamlined operations and unlocked substantial revenue opportunities and cost synergies, demonstrating the power of such strategic moves.

Leveraging AI and Technology in Operations

The rapid advancement of artificial intelligence is significantly boosting the need for robust data centers, a trend ESR is poised to capitalize on. By focusing on AI-ready developments and incorporating cutting-edge technologies into its portfolio, ESR can effectively address this escalating demand.

Integrating smart building management systems and optimizing operational efficiency through technology are key strategies for ESR to solidify its competitive edge. This technological adoption not only improves facility performance but also aligns with the growing market expectation for sustainable and intelligent infrastructure.

- AI-Driven Demand: The global AI market is projected to reach $1.5 trillion by 2030, directly fueling data center expansion.

- ESR's Position: ESR's strategic investments in modern, scalable data center facilities across Asia Pacific position it to capture a significant share of this growth.

- Operational Efficiencies: Implementing AI in building management can reduce energy consumption by up to 20%, enhancing sustainability and cost-effectiveness.

- Technological Integration: ESR's focus on advanced cooling systems and automated management platforms ensures its facilities are future-proofed for AI workloads.

Capital Recycling and Balance Sheet Optimization

ESR's strategic focus on an asset-light model and capital recycling is a significant opportunity. By injecting seed assets into newly listed Real Estate Investment Trusts (REITs), such as the ESR China REIT, the company effectively optimizes its balance sheet. This approach liberates capital, which can then be strategically reinvested into promising New Economy assets, ensuring sustained growth and enhancing shareholder value.

This strategy allows ESR to maintain financial flexibility and pursue new development opportunities. For instance, the successful listing of ESR China REIT in early 2024, which raised approximately $300 million, exemplifies this capital recycling in action. This allows ESR to continue its expansion in high-demand sectors.

- Asset-Light Strategy: Reduces capital intensity and improves return on equity.

- Capital Recycling: Frees up capital for reinvestment in growth areas.

- REIT Listings: Provides liquidity and access to a broader investor base.

- Balance Sheet Optimization: Enhances financial flexibility and reduces leverage.

ESR's strategic expansion into emerging Asia Pacific markets, particularly Southeast Asia and India, presents a significant growth avenue. These regions exhibit robust demand for modern logistics facilities, driven by a growing middle class and increasing e-commerce penetration. The company's focus on these high-growth areas is well-aligned with demographic and economic trends.

The company's diversification into infrastructure and energy transition platforms offers further opportunities. By investing in renewable energy and resilient infrastructure, ESR can capitalize on the global shift towards sustainability and decarbonization. This strategic move taps into a growing market segment with strong governmental support.

ESR's asset-light model and capital recycling strategy, exemplified by the successful listing of ESR China REIT in early 2024, allows for efficient balance sheet management and reinvestment in high-demand New Economy assets. This approach enhances financial flexibility and supports sustained growth.

| Opportunity Area | Market Driver | ESR's Advantage | 2024/2025 Data Point |

|---|---|---|---|

| Emerging Asia Pacific Markets | E-commerce growth, rising middle class | Core logistics expertise, strategic presence | Asia Pacific e-commerce market projected to exceed $2 trillion by 2025 |

| Infrastructure & Energy Transition | Global sustainability push, decarbonization | Diversification, operational synergies | Increasing government incentives for renewable energy projects |

| Capital Recycling & REITs | Balance sheet optimization, growth funding | Asset-light model, access to capital markets | ESR China REIT listing raised approx. $300 million in early 2024 |

Threats

Persistent macroeconomic headwinds, such as elevated interest rates, are significantly impacting the real estate sector, including ESR's financial performance. For instance, the US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a level that increases borrowing costs for developers and investors alike.

This challenging fundraising environment can dampen transaction activity and slow market stabilization. In 2023, global real estate investment volumes saw a notable decline, with many markets experiencing reduced deal flow due to pricing disconnects and higher financing expenses, directly affecting companies like ESR.

The ongoing market uncertainty, characterized by fluctuating inflation and geopolitical risks, further exacerbates these issues. Such conditions can lead to slower rent growth and increased vacancy rates in certain property segments, posing a direct threat to ESR's revenue streams and asset valuations.

ESR faces heightened competition in its core logistics and data center real estate segments. Both seasoned industry giants and agile newcomers are actively pursuing opportunities, which could translate into price wars and difficulties in acquiring prime development land. This intensified rivalry poses a direct threat to ESR's market positioning and financial performance.

ESR's reliance on capital partnerships, while a strength, faces a threat from fluctuating capital markets. A prolonged period of subdued fundraising or a sharp decline in investor confidence, potentially triggered by global economic instability, could limit the capital available for ESR's ambitious development pipeline. This is a critical concern given the substantial investment required for large-scale real estate projects.

For instance, the global real estate investment market experienced a slowdown in 2023, with transaction volumes declining significantly compared to previous years. Investor appetite for riskier assets, including development projects, can wane rapidly during economic downturns. ESR's ability to secure new funding for its expansion plans in 2024 and 2025 will therefore be heavily influenced by these broader market conditions and investor sentiment shifts.

Geopolitical Risks and Regional Economic Instability

ESR's extensive operations across the Asia-Pacific region mean it's susceptible to geopolitical tensions and localized economic downturns. These factors can significantly impact property demand, alter regulatory landscapes, and disrupt day-to-day business activities. For instance, the varied performance observed across different APAC markets in FY2024 underscores this inherent vulnerability.

The company's exposure to these risks is a significant concern, as shifts in regional stability can directly influence investment sentiment and capital flows into real estate. ESR's diversified portfolio, while generally a strength, also means it must navigate a complex web of potentially conflicting regional economic policies and political climates.

- Geopolitical Tensions: Ongoing trade disputes and political realignments in key APAC markets can create uncertainty, impacting foreign investment and development projects.

- Regional Economic Fluctuations: Differing inflation rates, currency volatility, and varying GDP growth across APAC nations can lead to uneven demand for logistics and industrial properties.

- Regulatory Divergence: Changes in local zoning laws, foreign ownership restrictions, or environmental regulations in different countries can create operational hurdles and affect project timelines.

- Supply Chain Disruptions: Geopolitical events can interrupt global and regional supply chains, indirectly affecting the demand for warehousing and logistics space that ESR provides.

Rising Operational Costs and Development Delays

Escalating operational costs, particularly for land acquisition, construction materials, and labor, present a significant threat to ESR's development pipeline. For instance, global construction material prices saw substantial increases in 2023 and early 2024, impacting project budgets.

Potential development delays stemming from complex regulatory approval processes or persistent supply chain volatility, as experienced in recent years, could further erode project profitability and extend delivery timelines. These factors are inherent risks in large-scale real estate ventures.

ESR may face challenges such as:

- Increased raw material expenses: For example, steel prices, a key component in logistics facilities, have shown volatility, impacting construction budgets.

- Labor shortages and wage inflation: The demand for skilled construction labor continues to outstrip supply in many key markets, driving up labor costs.

- Extended permitting and approval timelines: Navigating diverse and sometimes evolving regulatory landscapes can lead to unforeseen delays.

- Supply chain disruptions: Geopolitical events or unexpected demand surges can still impact the availability and cost of essential building components.

Intensified competition in logistics and data centers poses a significant threat, potentially leading to pricing pressures and difficulties in securing prime development sites. ESR must contend with both established players and emerging firms vying for market share.

Geopolitical tensions and regional economic fluctuations across the Asia-Pacific present considerable risks, impacting demand, regulatory environments, and investment flows. Navigating diverse economic policies and political climates is crucial for ESR's operational stability.

Escalating operational costs, including materials and labor, along with potential development delays due to regulatory hurdles or supply chain issues, directly threaten project profitability and timelines. For instance, global construction material prices saw significant increases in 2023 and early 2024.

ESR's reliance on capital partnerships is vulnerable to shifts in capital markets and investor sentiment, especially during periods of economic instability. A prolonged fundraising slowdown could impede the company's expansion plans, a critical concern for its development pipeline.

SWOT Analysis Data Sources

This ESR SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and validated industry research to ensure a thorough and accurate assessment.