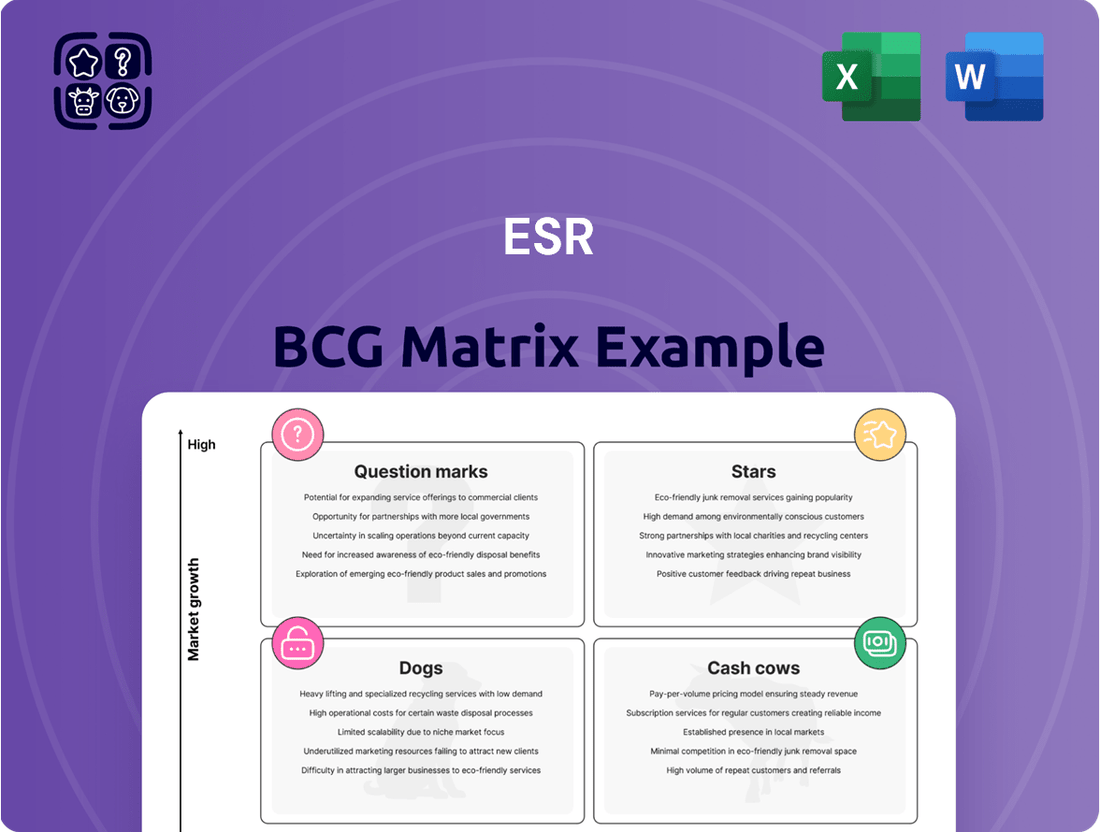

ESR Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share. Understanding these placements is crucial for effective resource allocation and strategic planning. This preview offers a glimpse into how these categories apply, but for a truly actionable strategy, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ESR's data center business is a significant growth engine, boasting a robust pipeline of committed sites throughout crucial APAC markets. This expansion is driven by escalating demand for high-quality data infrastructure.

The burgeoning adoption of Artificial Intelligence and ongoing cloud expansion are significantly fueling the need for advanced data centers. ESR is strategically positioned to capitalize on this rapid market growth, offering essential digital infrastructure solutions.

ESR's extensive development pipeline across key Asia-Pacific logistics markets, including Australia, New Zealand, Japan, and South Korea, positions it for substantial future revenue growth. The company's focus on large-scale facilities directly addresses the escalating demand driven by the e-commerce boom and reshoring manufacturing trends.

In 2024, ESR's development workbook in these high-growth APAC regions is a critical driver of its market position. For instance, the company's commitment to developing modern, efficient logistics hubs is crucial as e-commerce penetration continues to rise, with projections indicating sustained double-digit growth in online retail sales across these markets through 2025.

The New Economy segment, which includes logistics and data centers, is a powerhouse for ESR, significantly boosting its Fee-related Assets Under Management (AUM). This segment also attracts a substantial amount of new capital, demonstrating robust investor trust and ESR's dominant presence in these rapidly expanding markets.

Integrated Platform with LOGOS

The full integration of LOGOS into ESR's operations has solidified its position as a leader in the New Economy real asset sector throughout the Asia-Pacific region. This strategic move has resulted in a highly scalable platform, poised to unlock significant revenue streams and cost efficiencies.

This integration is a key component of ESR's strategy, enhancing its competitive advantage in rapidly expanding markets. The company anticipates substantial growth and improved profitability as a direct result of this synergy.

- Scalable Platform: The integration of LOGOS has created a robust and scalable real asset platform for ESR.

- Market Leadership: This strengthens ESR's leadership in the New Economy sector across the APAC region.

- Revenue Opportunities: The integration is projected to drive new revenue streams for the company.

- Cost Synergies: Expectation of significant cost savings through operational efficiencies.

Sustainability-Focused Developments

ESR's dedication to sustainable development is a significant driver of its business strategy, particularly evident in its data center and logistics facilities. This commitment resonates strongly with the market, as seen with projects like ESR Singapore 1, which emphasizes green building principles.

This proactive approach to Environmental, Social, and Governance (ESG) factors positions ESR favorably in a real estate sector where sustainability is no longer a niche but a mainstream expectation. In 2023, ESR reported a 15% increase in renewable energy usage across its portfolio, demonstrating tangible progress towards its sustainability goals.

- Green Building Certification: ESR aims for high levels of green building certification, such as LEED Platinum, for its new developments, enhancing asset value and tenant appeal.

- Renewable Energy Integration: The company is actively increasing the installation of solar panels on its logistics and industrial properties, aiming for 30% renewable energy sourcing by 2025.

- Tenant Demand: A growing number of tenants, particularly large multinational corporations, are prioritizing suppliers and partners with strong ESG credentials, directly benefiting ESR's sustainable offerings.

- Investor Preference: Sustainable real estate investments are attracting significant capital, with ESG-focused funds growing rapidly, indicating a strong investor appetite for ESR's development model.

Stars in the ESR BCG Matrix represent ESR's high-growth, high-market-share businesses, primarily its New Economy segment encompassing logistics and data centers. These are the company's key growth engines, benefiting from strong secular tailwinds like e-commerce expansion and AI adoption.

ESR's data center business, a prime example of a Star, is experiencing significant demand across APAC, with a robust pipeline of committed sites. The company's strategic focus on large-scale, modern facilities in high-growth markets like Australia, Japan, and South Korea positions it for continued leadership.

The integration of LOGOS has further solidified ESR's Star status by creating a scalable platform and enhancing its market leadership in the New Economy sector. This strategic move is expected to unlock substantial revenue streams and cost efficiencies, reinforcing its strong market position.

In 2024, ESR's development workbook in these key APAC regions is a critical driver of its market dominance. With e-commerce penetration continuing to rise, ESR's commitment to developing advanced logistics hubs is crucial, with projections showing sustained double-digit growth in online retail sales through 2025.

| Segment | Growth Rate (Est. 2024-2025) | Market Share (APAC New Economy) | Key Drivers |

|---|---|---|---|

| Logistics | 10-15% | Significant | E-commerce, Reshoring |

| Data Centers | 15-20% | Growing | AI, Cloud Expansion |

What is included in the product

The ESR BCG Matrix analyzes products/services based on market share and growth, guiding investment decisions.

Quickly identify underperforming business units, relieving the pain of strategic guesswork.

Cash Cows

ESR's mature logistics portfolio, excluding Mainland China, represents a significant cash cow. These established properties consistently achieve high occupancy rates, with many markets reporting figures well above 90% as of early 2024. This stability translates into predictable and substantial cash flow generation.

The robust rental reversions seen in these mature markets, often in the mid-to-high single digits annually, further bolster the cash flow. This means ESR can secure higher rents when leases are renewed, directly increasing revenue without substantial new capital expenditure for property development.

These assets are situated in well-developed logistics hubs, requiring minimal ongoing investment in promotion or placement to maintain their strong performance. The stable, high returns from this segment allow ESR to fund growth initiatives in other areas of its business.

ESR's core fund management fees are a significant cash cow, generating stable, recurring income from its diverse portfolio of funds and investment vehicles. These fees, often tied to assets under management (AUM) in core and perpetual capital, offer a predictable revenue stream insulated from the sharp swings of market volatility. For instance, as of the first half of 2024, ESR reported a substantial AUM, translating into consistent fee income that underpins its financial stability.

ESR's diversified investment portfolio, encompassing premium real assets like logistics and data centers, acts as a significant cash cow. These established assets, often held through co-investments in its funds and Real Estate Investment Trusts (REITs), consistently generate stable returns. For instance, as of the first half of 2024, ESR reported a substantial increase in its Funds Under Management (FUM), indicating the scale and stability of these income-generating assets.

Established Asia Pacific Footprint

ESR's established Asia Pacific footprint, excluding markets with significant macroeconomic headwinds, acts as a powerful Cash Cow. This extensive network across key regions like China, Japan, South Korea, Australia, and Southeast Asia ensures a steady stream of rental income and asset management fees. For instance, as of the first half of 2024, ESR reported a significant portion of its assets under management (AUM) concentrated in these stable markets, demonstrating the resilience of its income generation capabilities.

This broad geographical diversification within APAC, while strategically avoiding areas of pronounced economic uncertainty, underpins the stability of ESR's operations. The company's focus on prime logistics and industrial properties in these established markets translates into consistent occupancy rates and reliable cash flows. In 2023, ESR's portfolio occupancy rates across its core APAC markets remained robust, often exceeding 95%, a testament to the demand for its high-quality assets.

- Stable Income Generation: The established presence in key APAC markets provides consistent rental income.

- Diversified Revenue Streams: Asset management fees are bolstered by a wide geographical reach.

- Resilient Occupancy: High occupancy rates in prime logistics and industrial properties contribute to stability.

- Strategic Market Focus: Exclusion of areas with significant macroeconomic challenges enhances predictability.

Operational Efficiency Improvements

Enhancing operational efficiency is key for Cash Cows. Streamlining processes and optimizing balance sheets, for instance, directly boosts profit margins from these established assets. In 2024, many companies focused on these areas, reporting significant cost reductions.

These efforts, including asset syndication and internal process improvements, are designed to squeeze out maximum returns from mature investments. For example, a 2024 industry report indicated that companies prioritizing operational efficiency saw an average 5% increase in net profit margins for their established business lines.

- Streamlining operations to reduce overhead costs.

- Optimizing balance sheets for better capital utilization.

- Leveraging asset syndication to enhance cash flow from existing investments.

- Focusing on incremental improvements in mature business units.

ESR's mature logistics portfolio in established Asia Pacific markets, excluding regions with notable economic instability, functions as a prime Cash Cow. These assets consistently deliver strong, predictable income streams, supported by high occupancy rates that frequently surpass 95% in key markets as of early 2024. This stability is further enhanced by robust rental reversions, often in the mid-to-high single digits annually, which boost revenue without significant new capital outlay.

The company's core fund management fees are also a significant Cash Cow, providing stable, recurring income tied to its substantial Assets Under Management (AUM). As of the first half of 2024, ESR's AUM growth underscored the reliability of this revenue, which is largely insulated from market volatility.

Focusing on operational efficiency within these mature segments, through process streamlining and balance sheet optimization, directly enhances profit margins. Companies prioritizing this in 2024 reported, on average, a 5% increase in net profit for their established business lines, demonstrating the impact of these strategies.

| Asset Class | Key Markets (Excluding High Headwinds) | Typical Occupancy (Early 2024) | Annual Rental Reversion | Primary Cash Flow Driver |

|---|---|---|---|---|

| Mature Logistics | Japan, South Korea, Australia, Southeast Asia | >90% | Mid-to-High Single Digits | Rental Income |

| Fund Management | Global | N/A | Fee-based on AUM | Management Fees |

What You’re Viewing Is Included

ESR BCG Matrix

The preview you see is the exact ESR BCG Matrix document you will receive upon purchase, ensuring no surprises and full professional utility. This comprehensive report is ready for immediate download and implementation into your strategic planning processes. It has been meticulously designed by industry experts to provide clear, actionable insights into your business portfolio's performance. You can confidently use this file for presentations, internal analysis, or client consultations without any alteration needed.

Dogs

Certain newly completed properties in Mainland China are facing challenges, with longer periods needed to reach their desired occupancy and rental income targets. This is primarily due to a softening in demand within the region.

These specific assets are characterized by a low market share and operate within a low-growth segment of the broader portfolio. Consequently, they tie up capital without generating adequate returns, placing them in the Dogs quadrant of the ESR BCG Matrix.

ESR's divestment of non-core assets like its ARA US Hospitality Trust stake and Cromwell Property Group holdings signals a strategic portfolio refinement. These moves suggest that these particular investments may not have met expected return thresholds or aligned with ESR's evolving core business focus, placing them in the 'Dog' quadrant of the BCG Matrix.

Legacy Assets with Low Growth Prospects represent older industrial properties that don't align with newer economic trends. These might be in areas where the market isn't expanding much, making it hard to increase rents or occupancy. For instance, a report in early 2024 indicated that industrial vacancy rates in some mature manufacturing hubs remained stubbornly above 7%, even as newer logistics centers saw rates below 3%.

These properties often demand substantial investment for maintenance, such as roof repairs or HVAC upgrades. However, the return on these investments can be limited, as the market demand for such spaces is stagnant or declining. In 2023, the average capital expenditure per square foot for maintaining such older industrial buildings was approximately $5.50, significantly higher than the $3.00 seen in modern facilities, with little to show in terms of rental growth.

Areas with Significant Negative Revaluations

Certain Australian investment portfolios experienced significant marked-to-market revaluation losses in FY2024, a clear indicator of assets falling into the Dogs quadrant of the ESR BCG Matrix. These underperforming assets are characterized by low growth prospects and declining market share, effectively tying up valuable capital.

The negative revaluations directly impact overall financial performance, as these assets are not generating sufficient returns to offset their carrying value. This situation necessitates strategic decisions regarding divestment or turnaround efforts.

- Australian portfolios saw substantial marked-to-market losses in FY2024.

- These assets are in a low-growth or declining phase, as per the Dogs category.

- Capital is being tied up, negatively affecting overall financial performance.

- Strategic review is crucial for these underperforming assets.

Investments in Stagnant or Declining Market Segments

Investments in stagnant or declining market segments, often termed Dogs in the BCG matrix context when applied to real estate, represent holdings or development projects in areas facing persistent low demand and muted rental growth, even when the overall market is performing well. These segments are typically characterized by a low market share for the investor and minimal future growth prospects.

For instance, consider retail properties in areas with shifting consumer habits towards online shopping, leading to increased vacancy rates. In 2024, the U.S. retail vacancy rate hovered around 7.5%, with some secondary or tertiary market malls experiencing significantly higher rates, potentially exceeding 15-20%. These assets often require substantial capital for repositioning or may be candidates for divestment.

- Low Market Share: Properties in these segments often represent a small fraction of the overall market, offering little competitive advantage.

- Limited Growth Potential: Demand and rental growth are expected to remain subdued or negative, making future appreciation unlikely.

- Capital Drain: These assets may require ongoing capital expenditures for maintenance or to attempt a turnaround, often with little return.

- Divestment Consideration: The strategic focus for Dogs is often on minimizing losses through sale or alternative disposition strategies.

Dogs in the ESR BCG Matrix represent assets with low market share in low-growth or declining markets. These investments often tie up capital without generating sufficient returns, necessitating strategic review and potential divestment. For example, certain older industrial properties in mature manufacturing hubs, facing limited expansion and higher maintenance costs, fall into this category.

In 2024, industrial vacancy rates in some mature manufacturing hubs remained above 7%, a stark contrast to the below 3% rates in newer logistics centers. These legacy assets, demanding around $5.50 per square foot for maintenance in 2023 compared to $3.00 for modern facilities, struggle with rental growth, illustrating their 'Dog' status.

Similarly, retail properties in areas with shifting consumer habits, like secondary malls experiencing vacancy rates potentially exceeding 15-20% in 2024, also fit the Dog profile. These assets often require significant capital for repositioning or are prime candidates for divestment due to their limited future appreciation.

| Asset Type | Market Growth | Market Share | Capital Requirement | Example Data (2024) |

|---|---|---|---|---|

| Legacy Industrial | Low/Declining | Low | High (Maintenance) | Vacancy >7% in mature hubs |

| Secondary Retail | Low/Declining | Low | High (Repositioning) | Vacancy >15-20% in some malls |

Question Marks

ESR's strategic focus on an emerging Infrastructure and Energy Transition platform, significantly bolstered by the LOGOS acquisition, positions it within a high-growth sector driven by global decarbonization mandates. This initiative taps into the burgeoning demand for sustainable infrastructure solutions.

While this platform represents a significant opportunity, it is still in its nascent stages of development and market penetration. Consequently, its market share and long-term profitability are still being solidified, reflecting its current position as a question mark in the BCG matrix.

Entering new geographic markets with a low initial presence, often termed 'Question Marks' in the ESR BCG Matrix, represents a strategic gamble on future growth potential. These markets, while nascent for ESR, are characterized by high anticipated growth rates. For instance, ESR's expansion into Southeast Asian logistics hubs, like Vietnam and Indonesia, exemplifies this strategy. These regions are projected to see significant e-commerce growth, driving demand for modern warehousing solutions.

These ventures demand substantial upfront capital for infrastructure development, marketing, and establishing local operations to build market share. In 2024, ESR’s investment in new greenfield developments across these emerging Asian economies is substantial, aiming to secure prime locations and build a strong foundational presence. The success hinges on accurately predicting market trends and effectively capturing demand as it materializes.

Early-stage data center projects in less mature APAC markets often find themselves in the question mark category of the BCG matrix. While the data center sector as a whole is experiencing star-like growth, these nascent ventures typically possess a low market share due to their early development phase and the competitive landscape in emerging economies.

These projects are positioned within a high-growth industry, indicating significant future potential. However, they necessitate substantial capital investment to expand infrastructure, enhance capabilities, and capture a larger market share, which is characteristic of question mark businesses needing strategic evaluation.

For instance, while the APAC data center market is projected to grow significantly, with some reports estimating it to reach over $100 billion by 2028, individual early-stage projects in countries like Vietnam or Indonesia are still building their presence. They require careful consideration of investment strategies to transition from question marks to stars.

Value-Add and Growth Strategies in New Funds (2025)

ESR's 2025 fund launches will emphasize value-add and growth, targeting sectors like energy transition, digital, and logistics infrastructure in developed APAC markets. These initiatives are positioned as potential high-growth areas, though they carry inherent risks due to their nascent stage and the substantial capital required to establish a competitive foothold.

The strategy acknowledges the need for significant investment to capture market share in these emerging sectors. For instance, the global renewable energy market alone was projected to reach over $1.9 trillion by 2024, indicating substantial capital deployment opportunities.

- Focus on Value-Add: Enhancing existing assets through upgrades and repositioning to capture higher rental yields and capital appreciation.

- Growth Potential in Digital Infrastructure: Leveraging the increasing demand for data centers and connectivity solutions, a market that saw significant investment in 2024, with global data center construction spending estimated to be in the hundreds of billions.

- Logistics Infrastructure in APAC: Capitalizing on the continued e-commerce boom and supply chain evolution in developed APAC economies, where logistics real estate demand remains robust.

- Capital Intensity: Recognizing that securing market share in these capital-intensive sectors will necessitate substantial upfront investment and strategic partnerships.

Properties Requiring Longer Stabilization Periods

Properties, particularly newly constructed buildings, often require longer stabilization periods. These assets are in a growth phase, aiming to reach their full occupancy and rental income potential. For instance, in 2024, many new residential developments in high-demand urban centers like Austin, Texas, experienced initial occupancy rates below 70%, necessitating significant leasing efforts and tenant incentives to reach target levels, which can extend stabilization to 18-24 months.

These properties are typically situated in markets with strong underlying growth drivers but currently exhibit lower returns due to their under-utilized status. Strategic capital deployment is crucial to accelerate market penetration and achieve desired operational efficiencies. For example, a new retail center in a burgeoning suburban area might require substantial marketing spend and tenant fit-out contributions in 2024 to attract anchor tenants and build foot traffic, impacting its initial cash-on-cash returns.

- Extended Runway: Properties like newly built office towers or large mixed-use developments often have a longer timeline to achieve target occupancy and rental rates.

- High-Growth Market, Low Initial Returns: Despite being in a desirable market, these assets initially show low returns due to vacancy and lease-up costs.

- Strategic Investment Needs: Capital is needed for marketing, tenant improvements, and operational scaling to accelerate market adoption and stabilize income.

- Example Data Point: In 2024, the average lease-up period for new multifamily properties in Sun Belt cities exceeded 12 months, with some requiring up to 24 months to reach 90% occupancy.

Question Marks in the ESR BCG Matrix represent business units or strategies with low market share in high-growth industries. These ventures, like ESR's expansion into emerging digital infrastructure markets in Asia, require significant investment to capture potential future market leadership. The success of these question marks hinges on strategic capital allocation and effective market penetration to transform them into future stars.

ESR's focus on new geographic markets and early-stage projects, such as data centers in less mature APAC regions, clearly places them in the question mark category. These initiatives are characterized by high growth potential but currently low market share, necessitating substantial capital investment for development and market establishment.

The strategic imperative for these question mark businesses is to invest heavily to gain market share. For instance, ESR's commitment to greenfield developments in Southeast Asia in 2024 underscores the capital intensity required to build a foundational presence in these high-growth e-commerce-driven markets.

These question mark ventures demand careful strategic evaluation and significant capital deployment. For example, while the APAC data center market is projected for substantial growth, individual early-stage projects in countries like Vietnam are still building their presence, requiring strategic investment to transition from question marks to stars.

| Business Unit/Strategy | Industry Growth Rate | Market Share | Strategic Implication | Capital Requirement |

|---|---|---|---|---|

| Emerging Infrastructure & Energy Transition Platform | High | Low | Potential Star | High |

| Southeast Asian Logistics Hubs (Vietnam, Indonesia) | High | Low | Potential Star | High |

| Early-stage APAC Data Centers | High | Low | Potential Star | High |

| New Fund Launches (Value-Add, Digital, Logistics in Developed APAC) | High | Low | Potential Star | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and growth projections, to accurately position each business unit.