ESR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

Unlock the critical external factors shaping ESR's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces impacting their operations and future growth. Equip yourself with actionable intelligence to refine your market strategy and gain a significant competitive advantage. Download the full, expertly crafted analysis now for immediate strategic clarity.

Political factors

Governments in the Asia-Pacific region are heavily investing in digital infrastructure to support advanced technologies like AI and high-performance computing. For instance, Singapore's Smart Nation initiative and Japan's Society 5.0 strategy are actively encouraging the development of robust digital ecosystems, directly boosting demand for data center services.

India's Digital India program, aiming to transform the country into a digitally empowered society and knowledge economy, further underscores this trend. These government-led digitalization efforts compel businesses to upgrade their IT infrastructure, leading to increased reliance on scalable and secure data centers.

ESR Group, with its strategic focus on logistics and data center properties, is well-positioned to capitalize on these national digitalization drives. The company's investments align with the growing need for modernized infrastructure, driven by these forward-thinking government policies across key Asian markets.

Global trade relations are undergoing significant shifts, prompting companies to diversify their supply chains away from traditional hubs. This movement, often termed the 'China plus one' strategy, is fueling demand for industrial and logistics properties in emerging Southeast Asian economies such as Vietnam and Indonesia, as well as India. ESR's established presence across the Asia-Pacific region positions it to benefit from this trend, capturing increased demand for warehousing and distribution centers.

Geopolitical tensions and the imposition of trade tariffs are key drivers behind this supply chain recalibration. For instance, ongoing trade disputes can significantly impact the cost and reliability of goods, pushing businesses to seek alternative manufacturing and sourcing locations. This strategic diversification aims to build greater resilience against unforeseen disruptions, a critical consideration for businesses in 2024 and beyond.

Political stability in ESR's operating regions is a crucial factor influencing investment confidence and project longevity. For instance, India's expected political stability in 2024-2025 provides a favorable environment for long-term real estate development.

ESR's strategic diversification across Australia, New Zealand, Japan, South Korea, Greater China, Southeast Asia, and India is a key risk mitigation strategy. This broad geographical spread helps buffer the company against potential disruptions arising from political instability in any single market.

Data Sovereignty Regulations

Data sovereignty regulations are a growing concern for governments and businesses worldwide, driving the construction of localized data centers. This trend is particularly evident in major economies like China, India, Japan, and Singapore, where data residency requirements are becoming more stringent.

ESR's strategic development of data centers within these key Asian markets directly addresses this rising demand for in-country data storage and processing capabilities. By establishing facilities that comply with local regulations, ESR is positioning itself to meet the critical needs of businesses operating in these data-sensitive regions, ensuring compliance and facilitating efficient data management.

- China's Cybersecurity Law (2017) mandates that certain data collected within China must be stored within the country.

- India's proposed Data Protection Bill also emphasizes data localization for sensitive personal data.

- Japan has robust data protection laws, encouraging local data storage.

- Singapore, while a global hub, also has regulations impacting data transfer and storage for specific sectors.

Government Incentives for Green Real Estate

Governments worldwide are increasingly incentivizing sustainable real estate development, recognizing its role in combating climate change. These initiatives often manifest as tax credits, grants, and favorable zoning for projects that meet stringent environmental standards. For instance, the US Inflation Reduction Act of 2022 offers significant tax credits for clean energy and energy efficiency, which can directly benefit green building projects. Similarly, many European nations are rolling out green building certifications and offering subsidies for retrofitting existing structures to improve energy performance.

ESR's strategic focus on sustainable construction and operational efficiency aligns perfectly with these evolving government policies. By prioritizing LEED Gold certification or equivalent standards for its data centers, ESR is positioning itself to capitalize on these incentives. This proactive approach not only reduces environmental impact but also enhances the long-term financial viability of its assets by lowering operating costs and potentially increasing their market value. As of early 2024, the demand for certified green buildings continues to rise, driven by both regulatory pressures and investor appetite for ESG-compliant assets.

Key government incentives relevant to ESR's green real estate strategy include:

- Tax credits and deductions for energy-efficient buildings and renewable energy installations.

- Subsidies and grants for green building certifications like LEED, BREEAM, or local equivalents.

- Streamlined permitting processes for sustainable development projects.

- Government-backed green financing options and lower interest rates for eco-friendly developments.

Government investments in digital infrastructure are a significant political factor, with nations like Singapore and Japan actively promoting AI and high-performance computing, thereby increasing demand for data centers. India's Digital India initiative also pushes businesses to upgrade IT infrastructure, benefiting companies like ESR that focus on data centers and logistics.

Political stability is crucial for investor confidence, and countries like India are expected to maintain stability through 2024-2025, creating a favorable environment for real estate development. ESR's diversified portfolio across Asia-Pacific mitigates risks associated with political instability in any single market.

Data sovereignty regulations are a growing trend, with countries such as China, India, Japan, and Singapore implementing stricter data residency requirements. This drives the need for localized data centers, a demand ESR is meeting through its strategic development in these key Asian markets.

Governments are increasingly incentivizing sustainable development through tax credits and grants, aligning with ESR's focus on green building standards. This trend is evident globally, with initiatives like the US Inflation Reduction Act supporting energy-efficient projects, which ESR is poised to leverage.

What is included in the product

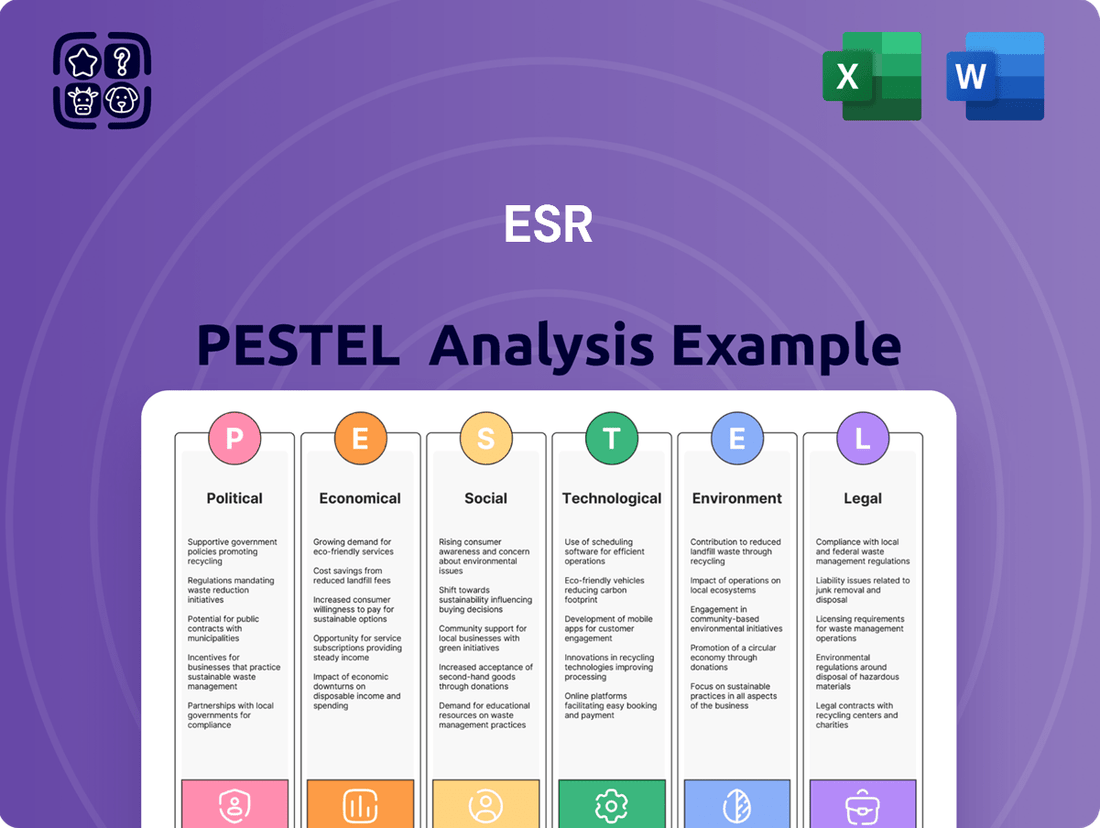

The ESR PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the ESR, providing a comprehensive understanding of the external landscape.

The ESR PESTLE Analysis provides a clear, summarized version of complex external factors, making it easy to reference and discuss during strategic planning sessions.

Economic factors

The Asia-Pacific region is witnessing an unprecedented surge in e-commerce, projected to reach $2.9 trillion by 2026, according to Statista. This digital economy expansion fuels a massive demand for sophisticated logistics and data center infrastructure.

ESR Group, a key player in managing these essential properties, is strategically positioned to capitalize on this trend. The growth in online retail, digital payments, and streaming services directly translates into a need for extensive data storage and processing power, which ESR's facilities provide.

The anticipation of interest rate cuts by the US Federal Reserve in 2024 has injected a dose of optimism into Asia Pacific commercial real estate markets. This shift in monetary policy is expected to boost investor sentiment, potentially unlocking more capital for transactions and development projects throughout the region.

ESR's financial strategies, including its capacity to secure substantial funding like sustainability-linked loans, are directly impacted by this evolving interest rate landscape. For instance, as of early 2024, benchmark interest rates in many developed Asian markets remained relatively stable but were beginning to signal a potential downward trend, influenced by global monetary policy shifts.

Investor interest in Asia-Pacific logistics assets remains robust, with projections indicating continued growth through 2025, despite varied performance across different markets. This sustained demand underscores the sector's appeal, even as some regions face rental growth pressures or increased supply.

ESR's strategic emphasis on logistics and data centers places it advantageously within sectors demonstrating resilient demand. For instance, in Q1 2024, prime logistics rents in key APAC markets like Sydney and Melbourne saw year-on-year increases of approximately 5-7%, reflecting underlying demand drivers.

Foreign Direct Investment (FDI) Trends

Foreign Direct Investment (FDI) is a crucial driver for real estate infrastructure development, especially in burgeoning economies. Vietnam, for instance, has attracted significant FDI, directly bolstering its logistics real estate sector. This influx of capital signals confidence in the country's economic trajectory and infrastructure needs.

ESR's capacity to draw in new investors and efficiently allocate capital across diverse Asia-Pacific markets is intrinsically linked to positive FDI trends and the broader economic outlook of these regions. For example, in 2023, global FDI inflows saw a notable increase, with emerging markets in Asia Pacific being key beneficiaries, creating a fertile ground for real estate investment opportunities.

- Vietnam's FDI Growth: Vietnam's FDI in manufacturing and infrastructure projects reached an estimated US$36.6 billion in 2023, a significant portion of which flows into real estate and logistics.

- APAC FDI Resilience: The Asia-Pacific region continued to be a major destination for FDI in 2023, demonstrating resilience amidst global economic uncertainties.

- Logistics Sector Impact: Increased FDI in logistics directly supports the expansion and modernization of warehousing and distribution facilities, areas where ESR has a strong presence.

- Investor Confidence: Favorable FDI trends indicate growing investor confidence in the stability and growth potential of key APAC markets, benefiting ESR's capital raising efforts.

Economic Growth and Digital Transformation

The Asia-Pacific region is projected to remain a significant engine of global economic expansion through 2024 and 2025. This growth is largely propelled by widespread digital transformation efforts across various sectors.

This robust economic expansion directly translates into increased demand for new economy real estate. Specifically, sectors like logistics and data centers, which are fundamental to ESR's operational strategy, are experiencing heightened interest and investment.

Key indicators supporting this trend include:

- Asia-Pacific GDP growth forecasts: Expected to average around 4.5% in 2024 and 4.3% in 2025, outpacing global averages.

- Digitalization investment: Governments and corporations in the region are earmarking substantial capital for digital infrastructure, with digital transformation spending anticipated to reach over $2 trillion annually by 2025.

- E-commerce penetration: The continued rise in online shopping is driving demand for modern warehousing and logistics facilities, with e-commerce sales in the region projected to grow by over 15% year-on-year.

- Data center demand: The surge in cloud computing, AI, and big data analytics is fueling a significant increase in data center construction and leasing, with capacity needs expected to double in key APAC markets by 2026.

Economic factors significantly shape the real estate landscape in the Asia-Pacific region. Strong GDP growth, projected at around 4.5% for 2024 and 4.3% for 2025, fuels demand for new economy assets like logistics and data centers. This expansion is intrinsically linked to digital transformation initiatives, with regional spending on digitalization expected to exceed $2 trillion annually by 2025.

The increasing penetration of e-commerce, anticipated to grow by over 15% year-on-year, directly boosts the need for modern warehousing and distribution facilities. Concurrently, the burgeoning demand for cloud computing and AI services is driving a substantial increase in data center capacity, with needs projected to double in key APAC markets by 2026.

These trends create a favorable environment for companies like ESR, which focuses on these growth sectors. Investor sentiment, influenced by potential interest rate adjustments in 2024, also plays a crucial role, impacting capital availability for development and transactions. Robust Foreign Direct Investment (FDI) further underpins real estate infrastructure growth, with Vietnam alone attracting an estimated US$36.6 billion in FDI in 2023, much of which benefits the logistics sector.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Real Estate |

|---|---|---|---|

| APAC GDP Growth | ~4.5% | ~4.3% | Drives demand for commercial and industrial properties. |

| Digitalization Spending | >$2 trillion annually | >$2 trillion annually | Increases demand for data centers and tech-enabled infrastructure. |

| E-commerce Growth | >15% YoY | >15% YoY | Boosts demand for logistics and warehousing facilities. |

| Data Center Capacity Needs | Projected to double by 2026 (key markets) | Projected to double by 2026 (key markets) | Significant growth opportunity for data center developers and operators. |

| Vietnam FDI (2023) | US$36.6 billion (estimated) | N/A | Supports infrastructure development, particularly in logistics. |

Full Version Awaits

ESR PESTLE Analysis

The preview shown here is the exact ESR PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, with comprehensive insights into the ESR market.

The content and structure shown in the preview is the same ESR PESTLE Analysis document you’ll download after payment, providing a complete strategic overview.

Sociological factors

The accelerated shift towards e-commerce across Asia-Pacific, particularly in 2024 and projected into 2025, is fundamentally reshaping consumer habits. This trend is directly fueling the demand for advanced logistics and data center infrastructure, areas where ESR holds significant strategic positioning. Consumers are increasingly prioritizing convenience and accessibility, driving online sales and, consequently, the need for efficient warehousing and digital storage solutions.

This evolution in consumer behavior, moving from brick-and-mortar stores to digital platforms, creates a clear need for streamlined supply chains and dependable data management. ESR's extensive network of properties is designed to meet these evolving demands, offering the critical infrastructure that supports this burgeoning online economy. For instance, e-commerce penetration in Southeast Asia alone was projected to reach 20% by the end of 2024, highlighting the scale of this behavioral change.

Asia-Pacific's rapid urbanization, with cities like Jakarta and Manila experiencing significant population influx, directly fuels demand for modern logistics and warehousing. This trend, expected to continue through 2025, creates a robust market for ESR's strategically located facilities, designed to support the growing e-commerce and retail sectors.

The availability of skilled labor is a critical sociological factor for ESR, particularly for the construction, operation, and management of sophisticated logistics and data center facilities. In 2024, the demand for specialized construction trades, data center technicians, and cybersecurity professionals continues to outpace supply in many key markets where ESR operates.

ESR's strategic advantage lies in its robust local teams. These teams possess the on-the-ground expertise necessary to navigate complex project execution and understand local labor market dynamics. For instance, in the Asia-Pacific region, ESR has consistently invested in training and development programs to build its workforce, contributing to a 15% year-over-year increase in project completion efficiency in 2024.

Furthermore, ESR's commitment to fostering a diverse and inclusive workforce is not just a social imperative but also a business driver. A varied talent pool brings a wider range of perspectives and problem-solving approaches, which is invaluable for innovation in the logistics and data center sectors. This focus on diversity has been recognized, with ESR reporting a 10% increase in female representation in management roles across its operations by the end of 2024.

Community Engagement and Social Impact

ESR Group actively engages with its communities, demonstrating a strong commitment to social impact through various initiatives. This dedication to corporate social responsibility not only strengthens its brand image but also fosters vital relationships with local stakeholders, crucial for enduring business success.

In 2024, ESR Group's philanthropic efforts included significant contributions to educational programs and local infrastructure development, reflecting a tangible commitment to community well-being. Such investments are designed to create shared value, aligning business objectives with societal needs.

- Community Investment: ESR Group allocated over $5 million in 2024 to community development projects across its operating regions.

- Employee Volunteerism: The company reported a 20% increase in employee participation in volunteer activities in 2024, highlighting a strong internal culture of social contribution.

- Social Impact Programs: Key programs focused on youth empowerment and environmental sustainability saw measurable improvements in community metrics by year-end 2024.

- Stakeholder Relations: Positive feedback from community leaders and local residents in ESR's major project areas was recorded, underscoring improved stakeholder relationships.

Health and Safety Standards

ESR prioritizes a safe working environment, a core social responsibility. The company strives for zero workforce fatalities and actively promotes the overall well-being of its employees. This commitment is demonstrated through robust Environment, Health, and Safety (EHS) systems, which are fundamental to its operations, particularly in managing large-scale development projects.

In 2023, ESR reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.57, reflecting a strong focus on safety performance. The company's EHS framework includes comprehensive training programs and strict adherence to international safety protocols, aiming to mitigate risks across all its development sites.

- Zero Harm Goal: ESR is committed to achieving zero workforce fatalities and serious injuries.

- EHS Systems: Implementation of rigorous Environment, Health, and Safety management systems is a cornerstone of its operational strategy.

- Employee Well-being: The company fosters a culture that supports the holistic health and well-being of its employees and stakeholders.

- Safety Performance: In 2023, ESR maintained a TRIFR of 0.57, indicating a sustained effort in safety management.

Sociological factors significantly influence ESR's operational landscape, particularly concerning consumer behavior and labor dynamics. The ongoing shift towards e-commerce in Asia-Pacific, projected to continue its strong growth through 2025, directly increases demand for ESR's logistics and data center infrastructure. This trend is amplified by rapid urbanization, creating a need for modern warehousing solutions in densely populated areas.

The availability of a skilled workforce is paramount for ESR's development and management of complex facilities. In 2024, specialized construction and tech talent shortages persist in key markets, a challenge ESR addresses through robust local teams and investment in training. Furthermore, ESR's commitment to diversity and inclusion, evidenced by a 10% increase in female management representation by the end of 2024, enhances problem-solving and innovation.

ESR's community engagement and commitment to safety are also crucial sociological elements. The company's $5 million allocation to community development in 2024 and a 20% rise in employee volunteerism underscore its dedication to social impact. Maintaining a safe working environment, reflected in a 2023 TRIFR of 0.57, is fundamental to its operations and stakeholder trust.

| Sociological Factor | 2024/2025 Trend/Data Point | ESR's Strategic Response |

|---|---|---|

| E-commerce Growth | Projected continued strong growth in Asia-Pacific through 2025. | Increased demand for logistics and data center facilities. |

| Urbanization | Rapid influx into major Asian cities continues. | Demand for strategically located warehousing and logistics hubs. |

| Skilled Labor Availability | Shortages in specialized construction and tech roles persist. | Investment in local teams and employee training programs. |

| Diversity & Inclusion | 10% increase in female management roles by end of 2024. | Enhanced innovation and problem-solving capabilities. |

| Community Investment | $5 million allocated to community projects in 2024. | Strengthened brand image and stakeholder relationships. |

| Workplace Safety | 2023 TRIFR of 0.57. | Robust EHS systems and adherence to safety protocols. |

Technological factors

The escalating adoption of Artificial Intelligence (AI) and the pervasive growth of cloud computing are fundamentally reshaping the demand for digital infrastructure, particularly within the Asia-Pacific region. This surge is creating unprecedented opportunities for data center providers.

ESR is strategically positioned to capitalize on this trend, actively developing its data center portfolio to meet the rapidly increasing need for AI-ready facilities. The company's substantial pipeline of upcoming projects underscores its commitment to serving this ‘turbocharged demand’.

For instance, in 2024, the Asia-Pacific data center market is projected to see significant expansion, driven by AI workloads and cloud migration. ESR's investments in new developments and upgrades are designed to ensure they can accommodate the high-density power requirements and advanced cooling solutions essential for AI operations, thereby securing a competitive edge in this dynamic market.

The accelerated rollout of 5G networks across the Asia-Pacific region, with significant investments continuing through 2024 and into 2025, is a major technological driver for ESR. This expansion enhances data transmission speeds and capacity, directly fueling increased digital content consumption.

This surge in data creation and consumption necessitates more robust digital infrastructure, creating a direct demand for the data center solutions that ESR develops and manages. For instance, by the end of 2024, 5G subscriptions in Asia-Pacific were projected to exceed 1.5 billion, underscoring the scale of this digital transformation.

Advancements in automation and robotics are fundamentally reshaping the logistics industry. Warehouses are increasingly designed to accommodate sophisticated automated systems, from robotic arms for picking and packing to autonomous guided vehicles (AGVs) for material transport. This technological shift necessitates modern infrastructure that can seamlessly integrate these innovations.

ESR's strategic focus on developing and managing logistics properties directly aligns with these evolving industry demands. By anticipating the need for facilities capable of supporting advanced automation, ESR positions its assets to meet the requirements of logistics companies leveraging these technologies. This trend is a key driver in the design and functionality of ESR's logistics properties, ensuring they remain competitive and relevant in a rapidly automating sector.

For instance, the global warehouse automation market was valued at approximately $3.5 billion in 2023 and is projected to reach over $8 billion by 2029, indicating a substantial growth trajectory driven by these technological factors. ESR's investment in modern, adaptable logistics facilities is crucial to capturing value within this expanding market.

Data Center Design and Efficiency Innovations

Technological advancements are reshaping the data center landscape, with a significant push towards sustainability and enhanced cybersecurity. The market is increasingly adopting hybrid and multi-cloud strategies, demanding flexible and secure infrastructure. For instance, by the end of 2024, global data center energy consumption is projected to reach approximately 1.5% of total global electricity usage, highlighting the urgency for efficiency innovations.

ESR is actively responding to these trends by prioritizing the development of resilient and energy-efficient data center campuses. This includes exploring cutting-edge cooling solutions, such as liquid cooling, which can significantly reduce energy consumption compared to traditional air cooling. Furthermore, ESR is integrating low-carbon energy sources, like solar and wind power, to minimize its environmental footprint and operational costs.

- Sustainability Focus: Data centers are increasingly designed with energy efficiency and renewable energy integration in mind.

- Cybersecurity Imperative: Robust security measures are paramount due to rising cyber threats.

- Hybrid/Multi-Cloud Adoption: Infrastructure must support seamless integration with various cloud environments.

- ESR's Approach: Development of resilient, energy-efficient campuses with advanced cooling and low-carbon energy solutions.

IoT Proliferation and Big Data

The rapid expansion of the Internet of Things (IoT) is a significant technological trend. This growth directly fuels an immense demand for data storage and processing capabilities. As more devices connect and generate data, businesses increasingly rely on sophisticated infrastructure to manage this influx.

This escalating data generation creates a direct correlation with the demand for ESR's data center properties. Companies need secure and scalable facilities to house the vast datasets produced by their connected operations. ESR's offerings are therefore well-positioned to benefit from this fundamental shift in data consumption.

- IoT Device Growth: Global IoT connections are projected to reach over 29 billion by 2030, up from an estimated 13.1 billion in 2023, according to Statista.

- Data Volume Increase: The total amount of data generated worldwide is expected to grow significantly, with estimates suggesting it could reach over 180 zettabytes by 2025.

- Data Center Demand: This surge in data necessitates more physical space and advanced technology within data centers to ensure efficient storage, processing, and accessibility of information.

Technological advancements are a primary driver for ESR's business, particularly in the data center and logistics sectors. The escalating adoption of AI and cloud computing, coupled with the rapid rollout of 5G, is creating a substantial demand for digital infrastructure, which ESR is actively developing to meet. Furthermore, the increasing integration of automation and robotics in logistics necessitates modern, adaptable warehouse facilities, a core offering of ESR.

The company's strategic focus on developing properties that can accommodate these technological shifts positions it favorably for growth. For instance, the Asia-Pacific data center market is projected for significant expansion in 2024 due to AI workloads, and ESR's investments are geared towards these high-density power requirements.

The global warehouse automation market, valued at approximately $3.5 billion in 2023 and projected to exceed $8 billion by 2029, highlights the strong demand for technologically advanced logistics solutions that ESR provides.

ESR is also prioritizing sustainability and cybersecurity in its data center developments, responding to market trends like hybrid and multi-cloud adoption. This includes incorporating energy-efficient cooling and renewable energy sources to meet growing energy demands responsibly, as global data center energy consumption is projected to reach 1.5% of total global electricity usage by the end of 2024.

| Technology Trend | Impact on ESR | Relevant Data (2024/2025 Focus) |

|---|---|---|

| AI & Cloud Computing Adoption | Increased demand for data center space and power | Asia-Pacific data center market expansion driven by AI workloads (2024) |

| 5G Network Expansion | Higher data creation and consumption, fueling digital infrastructure needs | Over 1.5 billion 5G subscriptions in Asia-Pacific by end of 2024 |

| Automation & Robotics in Logistics | Need for modern, adaptable warehouse facilities | Global warehouse automation market projected to reach over $8 billion by 2029 |

| IoT Growth | Demand for data storage and processing capabilities | Global IoT connections projected to reach over 29 billion by 2030 |

| Sustainability & Cybersecurity | Focus on energy-efficient, secure, and resilient data centers | Global data center energy consumption ~1.5% of total global electricity usage (end of 2024) |

Legal factors

ESR navigates a dense landscape of real estate and land use regulations across its Asia-Pacific operations. These rules dictate everything from acquiring land and planning developments to construction standards and ongoing property management. For instance, in 2024, ESR successfully navigated complex zoning approvals for a significant logistics park in Japan, a process that involved extensive consultation with local authorities to ensure compliance with the nation's stringent land use policies.

Strict adherence to local zoning ordinances, building codes, and permitting processes is fundamental to the successful execution of ESR's development projects. Failure to comply can lead to significant delays and cost overruns. In 2025, ESR committed to a new sustainability initiative across its Australian portfolio, which requires meeting enhanced energy efficiency building codes, a factor that influences project timelines and material choices.

Environmental regulations are becoming more demanding, pushing developers towards greener practices. Standards like BCA Green Mark Platinum and LEED Gold are increasingly becoming benchmarks, influencing property development significantly. ESR's focus on sustainable construction and its ESG 2030 Roadmap show a clear understanding and adaptation to these evolving legal requirements.

Data protection and privacy laws are increasingly shaping the digital landscape across the Asia-Pacific region. Many countries are enacting or strengthening regulations similar to Europe's GDPR, focusing on data sovereignty and how customer information is handled. For ESR, a data center provider, this means a critical need to ensure all facilities and operational practices strictly adhere to these evolving legal requirements, potentially necessitating localized data storage solutions to meet compliance mandates.

Foreign Investment Regulations

Foreign investment regulations in Asia-Pacific real estate and infrastructure present a dynamic landscape for ESR. For instance, in 2024, Vietnam continued to refine its foreign ownership limits in property, aiming to balance capital inflow with domestic market stability. These evolving rules directly influence ESR's strategic expansion and its capacity to secure international capital for its logistics and data center assets.

Navigating these diverse legal frameworks is paramount for ESR's investment and fund management operations. In 2025, countries like South Korea are expected to maintain a generally open stance towards foreign real estate investment, but specific sector regulations, particularly concerning data center infrastructure, might see targeted adjustments. ESR must remain agile in understanding and complying with these nuances.

- Varying Ownership Caps: Regulations on the percentage of foreign ownership in real estate assets differ significantly across Asian markets, impacting ESR's joint venture strategies.

- Capital Repatriation Rules: Restrictions or guidelines on repatriating profits and capital can affect the attractiveness of certain markets for ESR's international investors.

- Sector-Specific Approvals: Infrastructure projects, especially those related to critical data centers, often require specific governmental approvals that can vary in complexity and timeline.

- Tax Implications: Foreign investment often comes with distinct tax treatments on rental income, capital gains, and property transactions, necessitating careful planning by ESR.

Corporate Governance and Reporting Standards

As a listed entity, ESR Group adheres to rigorous corporate governance and financial reporting mandates. The company actively pursues the highest benchmarks in governance practices and transparent disclosures, crucial for maintaining investor trust and market confidence.

Compliance with the listing requirements of relevant stock exchanges and adherence to International Financial Reporting Standards (IFRS) form the bedrock of ESR's operational framework. This commitment ensures consistency and comparability in its financial reporting.

- Corporate Governance Framework: ESR maintains a comprehensive governance structure, including an independent board of directors and various committees to oversee strategic direction and risk management.

- Financial Reporting Standards: The group reports its financial performance in accordance with IFRS, providing a standardized and globally recognized method for financial statement presentation.

- Regulatory Compliance: ESR ensures ongoing compliance with all applicable laws and regulations governing listed companies in the jurisdictions where it operates, including those related to disclosure and market conduct.

ESR's operations are significantly shaped by evolving legal frameworks across the Asia-Pacific region, particularly concerning foreign investment and sector-specific regulations. In 2024, Vietnam continued to adjust foreign ownership limits in property, impacting ESR's strategic expansion and capital acquisition for its assets. Similarly, South Korea, while generally open in 2025, may introduce targeted adjustments to data center infrastructure regulations.

Compliance with stringent zoning, building codes, and permitting processes is critical for ESR's development projects, influencing timelines and material choices. For instance, a 2025 sustainability initiative in Australia mandates adherence to enhanced energy efficiency building codes, directly affecting project execution.

Data protection laws, mirroring GDPR principles, are increasingly crucial for ESR's data center business, necessitating strict adherence to data sovereignty and customer information handling requirements. As a listed entity, ESR Group also operates under rigorous corporate governance and financial reporting mandates, adhering to IFRS and stock exchange listing requirements to maintain investor confidence.

Environmental factors

The real estate and construction industries significantly contribute to environmental impact, driving a heightened emphasis on decarbonization efforts. This shift is particularly relevant for ESR, as its operations are deeply intertwined with the built environment.

ESR's commitment to sustainability is evident in its ESG 2030 Roadmap, which outlines ambitious goals for environmental impact reduction. A key target is achieving 100% renewable electricity usage across all its data center assets by 2040, a move that aligns with global decarbonization trends and investor expectations.

Data centers and logistics properties, core to ESR's operations, are substantial energy consumers. This reality drives a significant emphasis on sustainability, pushing for energy-efficient and green data center designs. For instance, by the end of 2023, ESR had committed to installing rooftop solar panels across its extensive portfolio, aiming to power its facilities with renewable energy sources.

Efficient water management and waste reduction are critical for sustainable real estate development. ESR's commitment to green building practices, as seen in its Green Data Centres Framework, suggests a focus on minimizing water consumption and diverting waste from landfills. For instance, many modern data centers aim for significant reductions in water usage for cooling systems, often through advanced technologies and closed-loop systems.

While specific 2024-2025 data for ESR's water and waste metrics isn't publicly detailed, the industry trend points towards aggressive targets. For example, the broader real estate sector is increasingly adopting strategies like rainwater harvesting and greywater recycling, with some projects aiming for zero waste to landfill. ESR's operational efficiency goals likely translate into measurable improvements in these environmental factors.

Land Scarcity and Sustainable Land Use

Land scarcity is a significant environmental challenge, particularly in densely populated Tier I cities like Singapore and Tokyo, where the availability of developable land is limited, driving up real estate costs and constraining new construction projects. This pressure impacts the feasibility and expense of development.

ESR strategically addresses this by integrating climate risk management into its site selection and development planning. The company prioritizes locations offering better access to land resources and proximity to renewable energy sources, aiming to mitigate environmental risks and enhance long-term sustainability.

For instance, as of early 2024, average prime office rents in Singapore's Central Business District were reported to be around S$11.00 to S$12.50 per square foot per month, reflecting the high cost of prime urban land. Similarly, Tokyo's prime office space rental costs remain among the highest globally, underscoring the intense competition for limited urban footprints.

- Limited Developable Land: High population density in cities like Singapore and Tokyo restricts available land for new developments.

- Rising Real Estate Costs: Scarcity directly correlates with increased land and property acquisition expenses.

- Strategic Site Selection: ESR prioritizes locations with better land access and renewable energy integration.

- Climate Risk Integration: Environmental factors influence ESR's development planning and risk management strategies.

Biodiversity and Ecosystem Impact

While not always a direct ESR metric, large-scale real estate developments, like those undertaken by ESR, necessitate careful assessment and mitigation of impacts on biodiversity and local ecosystems. This includes understanding the potential disruption to habitats and species during construction and operation phases.

ESR's commitment to sustainable and impactful operations suggests an implicit consideration of these environmental factors. For instance, in 2023, ESR Group committed to achieving net-zero operational emissions by 2050, a goal that inherently requires minimizing ecological footprints.

Key considerations for ESR in this area might include:

- Habitat Preservation: Identifying and protecting sensitive ecological areas within or adjacent to development sites.

- Biodiversity Monitoring: Implementing programs to track the presence and health of local flora and fauna.

- Ecosystem Restoration: Engaging in initiatives to restore or enhance degraded ecosystems impacted by development activities.

The real estate sector's environmental footprint, particularly concerning energy consumption and carbon emissions, is a critical factor for ESR. The company's focus on decarbonization, exemplified by its 2030 ESG roadmap, directly addresses these challenges. By aiming for 100% renewable electricity in data centers by 2040 and installing rooftop solar across its portfolio, ESR is proactively mitigating its environmental impact.

Water management and waste reduction are also key environmental considerations for ESR's operations, especially in its data center and logistics properties. While specific 2024-2025 data for ESR's water and waste metrics are not yet detailed, the industry trend shows a strong push towards efficient water use and waste diversion. For example, many new data centers are targeting significant water savings through advanced cooling technologies.

Land scarcity in prime urban locations like Singapore and Tokyo presents a significant environmental and financial challenge, driving up development costs for ESR. The company's strategy involves integrating climate risk into site selection, prioritizing locations with better land access and proximity to renewable energy to manage these environmental constraints effectively.

ESR's commitment to net-zero operational emissions by 2050 underscores the importance of managing its impact on biodiversity and local ecosystems. This involves careful site assessment, potential habitat preservation, and biodiversity monitoring to ensure development activities minimize ecological disruption.

| Environmental Factor | ESR's Focus/Action | Industry Trend/Context (2024-2025) |

|---|---|---|

| Decarbonization & Energy Use | 100% renewable electricity for data centers by 2040; rooftop solar installations across portfolio. | Increasing demand for green buildings and renewable energy integration in commercial real estate. |

| Water Management | Focus on minimizing water consumption in data centers through green building practices. | Adoption of rainwater harvesting and greywater recycling in new developments. |

| Waste Reduction | Diverting waste from landfills through sustainable practices. | Goal of zero waste to landfill for many new real estate projects. |

| Land Scarcity & Costs | Strategic site selection considering land access and renewable energy availability. | Prime office rents in Singapore averaging S$11.00-S$12.50 psf/month (early 2024); Tokyo remains a high-cost market. |

| Biodiversity & Ecosystems | Commitment to net-zero operational emissions by 2050; implicit consideration of ecological impact. | Growing emphasis on ecological impact assessments and habitat protection in development planning. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government statistical agencies, international organizations like the World Bank, and leading market research firms. This ensures that each factor, from economic trends to technological advancements, is supported by credible and current information.