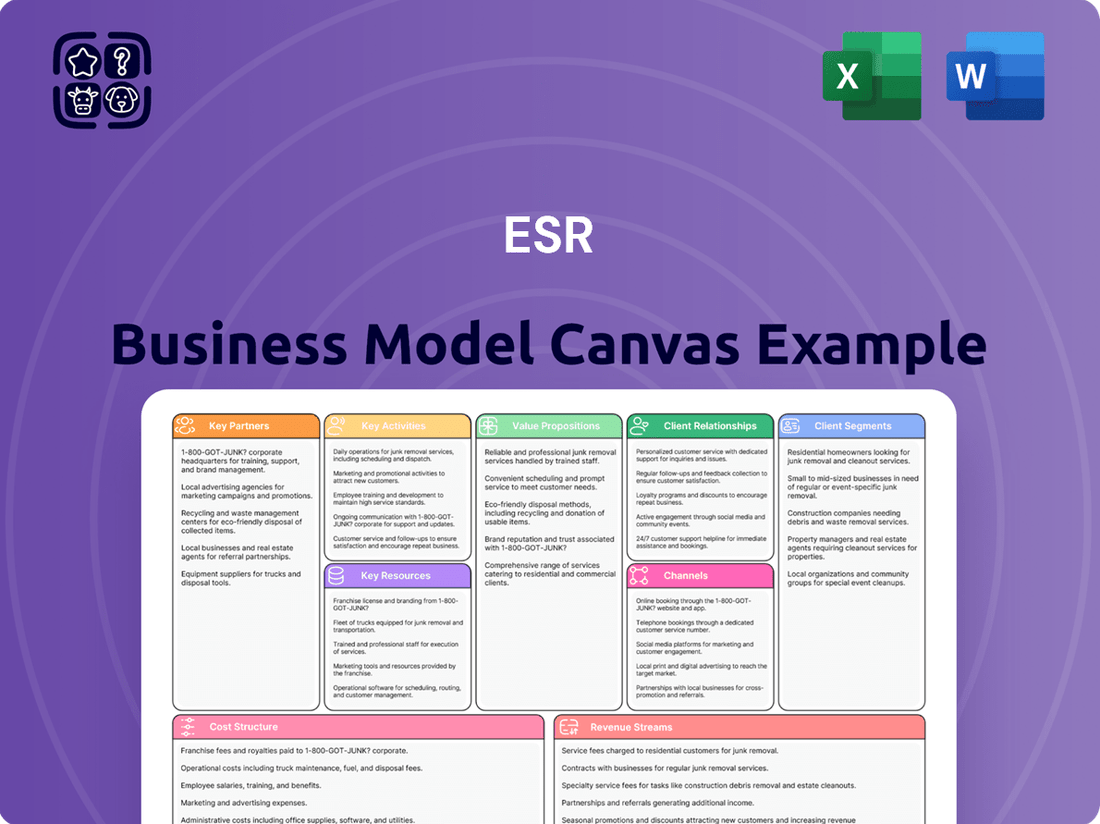

ESR Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

Curious about ESR's strategic framework? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover how they achieve operational excellence and market dominance.

Ready to unlock the secrets behind ESR's success? The full Business Model Canvas provides a comprehensive, section-by-section analysis of their value proposition, cost structure, and competitive advantages. Download it now to gain a competitive edge.

Partnerships

ESR actively cultivates relationships with a broad spectrum of institutional investors, such as pension funds and sovereign wealth funds. These collaborations are fundamental to securing the necessary capital for ambitious real estate projects, particularly in the logistics and data center sectors throughout the Asia Pacific.

In fiscal year 2024, ESR achieved a significant milestone by raising US$5.4 billion in capital. A substantial portion of this capital was specifically allocated to New Economy mandates, underscoring the robust investor confidence in ESR's strategic direction and development pipeline.

ESR cultivates key partnerships with major e-commerce and logistics players, positioning itself as their go-to real estate solutions provider. These collaborations focus on creating and overseeing specialized logistics properties designed to adapt to the dynamic needs of contemporary supply chains.

The company's strong leasing activity in fiscal year 2024, which saw around 8 million square meters of space leased, underscores the success and importance of these strategic alliances.

ESR collaborates with leading technology and cloud service providers, including hyperscalers, to build and manage advanced data centers. These partnerships are crucial for addressing the surging demand for digital infrastructure, fueled by the growth of AI and cloud computing. For instance, ESR's joint venture with CloudHQ for the Cosmosquare Data Centre campus in Japan highlights this strategic alliance.

Local Development and Construction Partners

ESR actively collaborates with local development and construction firms throughout its Asia-Pacific footprint. This strategy allows ESR to tap into invaluable regional knowledge, ensuring smoother project execution from land acquisition to final build. For instance, in 2023, ESR continued to rely on these partnerships to manage its substantial development pipeline, which encompasses millions of square meters of logistics and industrial space across key markets.

- Leveraging Regional Expertise: Local partners bring in-depth understanding of specific market regulations, zoning laws, and construction practices, crucial for efficient project development.

- Streamlined Project Execution: These collaborations facilitate faster land sourcing, optimized design processes, and reliable construction, leading to quicker project completion and delivery.

- Extensive Development Pipeline: ESR's significant development workbook, with projects spanning numerous APAC countries, is heavily dependent on the capabilities and local presence of these key partners.

Financial Institutions and Lenders

ESR’s relationships with financial institutions and lenders are foundational to its operational strategy. These collaborations are crucial for obtaining the capital needed for acquiring and developing properties, directly fueling ESR's expansion initiatives.

These partnerships are essential for maintaining robust capital liquidity, which is vital for executing ESR's growth objectives and managing its balance sheet effectively. For instance, in fiscal year 2024, ESR successfully secured a significant US$2.5 billion syndicated sustainability-linked facility.

- Securing Capital for Acquisitions: Banks and financial institutions provide the necessary funding for ESR to acquire new properties and land for development.

- Facilitating Development Projects: Loans and credit facilities from these partners enable ESR to finance the construction and upgrading of its real estate portfolio.

- Ensuring Liquidity: Strong relationships with lenders guarantee access to capital, supporting day-to-day operations and strategic investments.

- FY2024 Financing: A notable achievement in FY2024 was the arrangement of a US$2.5 billion syndicated sustainability-linked facility, underscoring the strength of these key partnerships.

ESR's key partnerships are diverse, encompassing institutional investors, e-commerce giants, technology providers, local developers, and financial institutions. These alliances are critical for capital acquisition, project execution, and market access across the Asia Pacific region.

In fiscal year 2024, ESR raised US$5.4 billion, with a significant portion dedicated to New Economy mandates, reflecting strong investor confidence. Furthermore, the company secured a US$2.5 billion sustainability-linked facility, highlighting the crucial role of financial partnerships.

The company's leasing of approximately 8 million square meters in FY2024 demonstrates the success of its collaborations with logistics and e-commerce players, who rely on ESR for specialized property solutions.

| Partnership Type | Key Collaborators | FY2024 Impact/Data |

|---|---|---|

| Institutional Investors | Pension Funds, Sovereign Wealth Funds | Raised US$5.4 billion in capital |

| E-commerce & Logistics | Major industry players | Leased ~8 million sqm of space |

| Technology Providers | Hyperscalers, Cloud Service Providers | Development of advanced data centers |

| Local Developers | Regional construction firms | Facilitated millions of sqm development pipeline |

| Financial Institutions | Banks, Lenders | Secured US$2.5 billion syndicated facility |

What is included in the product

A strategic blueprint detailing ESR's operations, focusing on customer relationships, key activities, and revenue streams.

This model provides a clear, actionable framework for understanding ESR's value creation and delivery mechanisms.

The ESR Business Model Canvas offers a structured approach to visualize and refine your business strategy, alleviating the pain of unstructured planning.

It simplifies complex business concepts into a clear, actionable framework, addressing the pain of overwhelming strategic detail.

Activities

ESR's primary focus is on managing a wide array of funds and investment vehicles, providing capital partners with diverse real estate investment opportunities. This encompasses managing properties throughout their entire lifecycle, acting as a consolidated point of contact for investors.

The significance of this core activity is clearly demonstrated by its financial contribution; fund management revenue represented a substantial 78% of ESR's total revenue in fiscal year 2024.

A core activity for ESR is the creation of advanced logistics facilities. This includes building modern warehouses and distribution centers specifically tailored for the demands of e-commerce and efficient supply chains.

ESR boasts one of the most substantial development pipelines in the Asia-Pacific region. As of December 2024, this workbook was valued at an impressive US$11.4 billion, highlighting their commitment to expanding their property portfolio.

ESR's key activity involves the development and, crucially, the ongoing operation of hyperscale data centers. This focus directly addresses the escalating need for robust digital infrastructure across the Asia-Pacific region.

The company is strategically executing 575 megawatts of committed data center sites throughout APAC. A significant portion of this capacity is currently under active construction, underscoring ESR's commitment to expanding its digital real estate footprint.

Property and Asset Management

Property and Asset Management is central to ESR's operations, focusing on the efficient oversight of its vast real estate holdings. This involves a suite of activities designed to maximize asset value and tenant experience, including strategic leasing, proactive property maintenance, and the delivery of value-added services. ESR's commitment to this area is evident in its strong leasing results.

In 2024, ESR reported significant leasing momentum. For instance, the group achieved a substantial leasing volume across its logistics and industrial portfolio, reinforcing its market position. This active management ensures high occupancy and operational efficiency, directly contributing to revenue generation and asset appreciation.

- Leasing and Tenant Relations: Securing and retaining tenants through effective marketing, negotiation, and ongoing relationship management.

- Property Operations: Overseeing day-to-day property functions, including maintenance, security, and vendor management, to ensure smooth operations.

- Asset Enhancement: Implementing strategies to improve property performance and value, such as upgrades, renovations, and sustainability initiatives.

- Financial Oversight: Managing budgets, rent collection, and operational expenses to ensure profitability and financial health of the assets.

Capital Raising and Recycling

ESR's capital raising and recycling is a dynamic process. It involves continuously securing new funds from both established and fresh investors. This is complemented by reusing capital through asset syndications and selling off properties that aren't central to their core strategy. This approach is designed to boost steady income from fees and strengthen the company's financial standing.

A significant aspect of this is capital recycling. For instance, in fiscal year 2024, ESR successfully executed over US$1 billion in asset syndications. This demonstrates their active management of their portfolio to free up capital for new opportunities.

- Continuous Capital Infusion: Actively attracting capital from a diverse investor base, including both existing and new partners, is a core operational pillar.

- Strategic Asset Syndication: Engaging in asset syndications allows ESR to share ownership and risk while generating liquidity, as evidenced by over US$1 billion in syndications in FY2024.

- Divestment of Non-Core Assets: The targeted sale of non-core properties is a key mechanism for capital recycling, optimizing the balance sheet and freeing up resources for strategic investments.

- Fee Revenue Enhancement: The dual strategy of raising new capital and recycling existing assets directly contributes to increasing recurring fee income and improving overall financial efficiency.

ESR's key activities revolve around managing its extensive real estate portfolio and development pipeline. This includes the active management of properties, the development of modern logistics and data center facilities, and strategic capital raising and recycling. These functions are crucial for generating revenue through fees and enhancing asset value.

| Key Activity | Description | FY2024 Impact/Data |

|---|---|---|

| Fund Management | Managing diverse real estate funds and investment vehicles for capital partners. | 78% of total revenue. |

| Property Development | Creating advanced logistics facilities and hyperscale data centers. | US$11.4 billion development workbook as of Dec 2024; 575 MW of data center capacity committed. |

| Property & Asset Management | Overseeing property operations, leasing, and tenant relations to maximize asset value. | Significant leasing momentum across logistics and industrial portfolio. |

| Capital Raising & Recycling | Securing new funds and reusing capital through asset syndications and divestments. | Over US$1 billion in asset syndications in FY2024. |

What You See Is What You Get

Business Model Canvas

The ESR Business Model Canvas preview you see is the actual document you will receive upon purchase. This means the structure, content, and formatting are exactly as you'll find them in the final deliverable. You're not looking at a sample; you're viewing a direct representation of the comprehensive tool that will be yours to edit and utilize immediately after completing your order.

Resources

ESR's extensive land bank and property portfolio are critical key resources, forming the bedrock of its business model. This vast collection of logistics and data center properties, coupled with a significant land bank strategically positioned across the Asia Pacific region, fuels its development and investment initiatives.

As of the close of 2023, ESR commanded an impressive development pipeline encompassing over 24.5 million square meters of Gross Floor Area. This substantial pipeline underscores the company's capacity for future growth and its ability to meet evolving market demands for modern industrial and data infrastructure.

ESR's financial capital and fund management expertise are foundational to its business model. The company's substantial assets under management, reaching US$42.6 billion in New Economy Fee-related AUM for FY2024, along with significant uncalled capital commitments, provide the necessary firepower for large-scale investments.

This robust financial position is complemented by deep expertise in structuring and managing investment funds. This dual strength allows ESR to deploy capital effectively across its target sectors, facilitating growth and value creation for its investors.

ESR's specialized real estate development capabilities are a cornerstone of its business model, encompassing the entire lifecycle from initial land acquisition and meticulous design to robust construction and strategic leasing. This integrated, in-house approach allows for unparalleled control over project timelines and quality assurance, ensuring the delivery of high-caliber assets. For instance, in 2024, ESR continued to expand its development pipeline, with a significant portion of its portfolio actively under construction, demonstrating its ongoing commitment to growth and execution. Their multi-modal operating platform further enhances flexibility, catering to the unique and evolving demands of a diverse customer base across various industrial and logistics sectors.

Pan-APAC Regional Network and Local Teams

ESR's extensive Pan-APAC regional network, spanning markets like Australia, Japan, South Korea, Greater China, Southeast Asia, and India, is a cornerstone of its business model. This widespread presence is bolstered by dedicated local teams possessing deep in-market expertise. These teams provide invaluable localized insights and ensure effective execution tailored to each specific region.

This robust regional footprint is a critical enabler for ESR's customers, facilitating seamless scaling and expansion across multiple diverse markets within the Asia-Pacific. For instance, in 2024, ESR reported a significant presence in over 100 cities across the region, demonstrating the breadth of its operational reach and its ability to support a wide range of client needs.

- Extensive Market Coverage: ESR operates in key APAC economies, offering a unified platform for regional expansion.

- Local Expertise: Strong, on-the-ground teams provide market-specific knowledge and operational capabilities.

- Scalability for Customers: The network allows clients to easily grow their operations across various APAC countries.

- 2024 Operational Reach: ESR's presence in over 100 cities across the APAC region underscores its significant network strength.

Technology Infrastructure and Data Analytics

ESR's technology infrastructure and data analytics are crucial for its business model, enabling efficient property management and sophisticated data center operations. This focus is driven by the growing demand for smart building technologies and robust platforms for performance tracking, including essential ESG reporting.

The company is actively investing in and preparing for the rise of AI-driven demand within the data center sector. For instance, in 2024, ESR continued to expand its data center portfolio, with a significant portion of its development pipeline dedicated to these advanced facilities, reflecting a strategic pivot towards high-growth, technology-intensive real estate.

- Smart Building Integration: ESR utilizes IoT sensors and data analytics to optimize energy consumption, enhance security, and improve tenant experiences across its properties.

- Data Center Operations: Advanced analytics are employed to monitor and manage the complex cooling, power, and connectivity requirements of data centers, ensuring high uptime and efficiency.

- ESG Reporting: Technology platforms are key to collecting and analyzing data for Environmental, Social, and Governance (ESG) metrics, a critical component for investor relations and regulatory compliance.

- AI Readiness: ESR is building infrastructure capable of supporting the massive computational power and low latency required by future AI applications in its data centers.

ESR's intellectual property, including proprietary development methodologies and a deep understanding of New Economy real estate trends, is a vital intangible asset. This knowledge base allows for the creation of innovative and market-leading properties. The company's strong brand reputation and established relationships with tenants and investors are also key intellectual resources, fostering trust and facilitating business growth.

Value Propositions

ESR provides cutting-edge logistics and data center facilities, tailored for the needs of e-commerce, logistics, and tech sectors. These modern, high-specification properties are built with efficiency and sustainability at their core.

In 2024, ESR continued to expand its portfolio, emphasizing the development of advanced, new economy properties. For instance, their commitment to sustainability is reflected in projects aiming for high green building certifications, crucial for attracting and retaining tenants in the modern business landscape.

ESR offers institutional investors a complete package of investment and fund management services, covering the entire real asset spectrum. This integrated approach simplifies access to a variety of investment chances within the New Economy real estate sector.

The company actively manages a wide array of funds and investment vehicles, catering to diverse investor needs and strategies. For instance, as of the first half of 2024, ESR managed approximately $137 billion in assets under management, showcasing the scale of its integrated solutions.

ESR's properties are situated in prime industrial and logistical centers throughout the Asia-Pacific region, boasting superior connections to vital infrastructure and major markets. This strategic placement is crucial for tenants, enabling streamlined supply chain management and maximizing operational efficiency. For instance, as of the first half of 2024, ESR reported a robust development workbook, with a significant portion concentrated in highly sought-after sub-markets across key APAC economies, demonstrating their focus on premium locations.

Scalability and Regional Footprint for Growth

ESR's significant scalability and extensive regional footprint across Asia Pacific allow tenants, particularly e-commerce and logistics leaders, to expand their operations effortlessly into new markets. This strategic advantage directly supports their ambitious growth plans.

In 2024, ESR continued to demonstrate strong leasing performance, reinforcing its partnerships with major clients who are actively seeking to scale their businesses. This focus on tenant expansion highlights ESR's role as a facilitator of growth within the logistics and e-commerce sectors.

- Scalable Infrastructure: ESR offers adaptable warehousing solutions that can accommodate varying tenant needs as they grow.

- Asia Pacific Reach: A broad geographical presence enables seamless expansion for businesses operating across multiple Asian countries.

- Tenant Growth Support: ESR's model is designed to facilitate and capitalize on the expansion ambitions of its key clients.

- 2024 Leasing Momentum: The company reported strong leasing activity, underscoring the demand for its scalable and strategically located assets.

Commitment to Sustainability and ESG Excellence

ESR embeds Environmental, Social, and Governance (ESG) principles across its operations, from developing sustainable properties to implementing energy-efficient management systems. This holistic approach enhances long-term value for both investors and tenants, resonating with the growing demand for responsible investment and sustainable business practices.

The company's dedication is further exemplified by its ESG 2030 Roadmap, which outlines ambitious targets, including achieving net zero carbon emissions. This strategic focus positions ESR to capitalize on evolving global sustainability trends and meet the increasing expectations of stakeholders for environmentally and socially conscious business conduct.

- Sustainable Construction: ESR prioritizes eco-friendly materials and design in its development projects.

- Energy Efficiency: The company implements advanced technologies to reduce energy consumption in its properties.

- Net Zero Target: ESR is committed to reaching net zero carbon emissions by 2030, aligning with global climate goals.

- Tenant Value: Sustainable operations translate to lower utility costs and healthier environments for tenants.

ESR offers integrated investment and fund management services, simplifying access to New Economy real estate for institutional investors. The company actively manages a diverse range of funds, demonstrating significant scale with approximately $137 billion in assets under management as of the first half of 2024.

| Service | Description | Key Data (H1 2024) |

|---|---|---|

| Investment & Fund Management | Comprehensive real asset solutions for institutional investors. | $137 billion AUM |

| Real Estate Development | High-specification, sustainable logistics and data center facilities. | Focus on advanced, new economy properties. |

| Strategic Location | Prime industrial and logistical centers across Asia Pacific. | Significant development workbook in sought-after sub-markets. |

Customer Relationships

ESR cultivates enduring connections with its institutional investors by deploying specialized investor relations teams and providing transparent, consistent reporting. This proactive approach ensures continuous engagement, the development of customized investment strategies, and clear communication regarding fund performance and future market expectations.

In the first half of fiscal year 2024, ESR demonstrated its ability to attract capital, successfully securing approximately US$2.3 billion from a base of new investors.

ESR cultivates deep, strategic partnerships with its major tenants, fostering loyalty and repeat business through tailored solutions. This approach involves proactively understanding their changing operational requirements and offering adaptable, premium-quality real estate. For instance, in 2024, ESR continued to emphasize strengthening ties with key clients seeking to leverage its extensive regional network, a strategy that has historically driven significant occupancy rates and lease renewals.

ESR prioritizes tenant satisfaction through proactive property and asset management. This involves efficient facility upkeep, prompt support, and community building efforts, fostering strong tenant relationships.

This dedication to operational excellence directly impacts occupancy rates. For instance, ESR reported an 87% portfolio occupancy rate in the first half of fiscal year 2024, underscoring the success of these customer relationship strategies.

Customized Solutions and Advisory

ESR provides highly customized real estate solutions, such as build-to-suit developments and adaptable leasing options, designed to precisely match the distinct needs of its varied clientele. This tailored approach ensures clients can effectively optimize their supply chains and data infrastructure.

Their consultative method and multi-modal operating platform allow for maximum flexibility, catering to a wide array of customer requirements. For instance, in 2023, ESR completed over 1.5 million square meters of new developments, a significant portion of which involved build-to-suit projects for key clients across Asia Pacific.

- Bespoke Development: Tailored construction of properties to client specifications.

- Flexible Leasing: Adaptable lease terms and structures.

- Supply Chain Optimization: Advisory services to enhance logistics and operational efficiency.

- Data Infrastructure Support: Solutions for data center and technology-related real estate needs.

Transparency and Regular Communication

Maintaining transparency through regular financial reporting, sustainability reports, and business updates is crucial for building trust with both investors and tenants. This ensures stakeholders are well-informed about the company's performance, strategy, and ESG efforts. ESR published its FY23 results in February 2024, detailing strong operational and financial performance.

ESR's commitment to transparency is evident in its consistent publication of comprehensive reports. For instance, their 2023 Sustainability Report, released in April 2024, highlighted significant progress in their environmental, social, and governance initiatives, including a 15% reduction in Scope 1 and 2 emissions intensity compared to their 2021 baseline.

- Regular Financial Reporting: ESR provides timely updates on its financial health, enabling investors to make informed decisions.

- Sustainability Reports: These reports detail the company's ESG performance, showcasing its commitment to responsible business practices.

- Business Updates: Keeping stakeholders informed about strategic developments and operational achievements fosters confidence and alignment.

- Investor Relations: ESR actively engages with investors through various channels, ensuring clear and consistent communication.

ESR fosters strong relationships by offering tailored real estate solutions, from build-to-suit developments to flexible leasing, ensuring client needs for supply chains and data infrastructure are met. This consultative approach, exemplified by over 1.5 million square meters of new developments in 2023, many being build-to-suit projects, highlights their commitment to client success.

The company prioritizes tenant satisfaction through proactive property management and community building, which directly contributes to high occupancy rates. ESR reported an 87% portfolio occupancy rate in the first half of fiscal year 2024, a testament to these effective relationship strategies.

ESR builds trust with institutional investors through specialized investor relations teams and transparent, consistent reporting, securing approximately US$2.3 billion from new investors in the first half of fiscal year 2024. This commitment to clear communication about performance and market outlook strengthens these vital partnerships.

| Relationship Type | Key Activities | 2024 Data/Examples |

|---|---|---|

| Institutional Investors | Specialized investor relations, transparent reporting | Secured ~US$2.3 billion in H1 FY24 from new investors |

| Major Tenants | Tailored solutions, understanding operational needs | Emphasis on strengthening ties with key clients for network leverage |

| All Stakeholders | Regular financial and sustainability reporting, business updates | FY23 results published Feb 2024; 2023 Sustainability Report released Apr 2024 |

Channels

ESR leverages its dedicated, in-house direct sales and leasing teams throughout the Asia-Pacific region to actively source potential tenants and meticulously manage all lease agreements.

These localized teams are invaluable, possessing intimate knowledge of their respective markets and strong existing relationships, which facilitates direct and effective engagement with prospective clients.

With dedicated leasing teams operating across all its key regions, ESR ensures a focused and expert approach to securing and managing its property portfolio, a strategy that contributed to its significant leasing activity in 2024.

ESR utilizes structured fund management platforms, encompassing private funds, Real Estate Investment Trusts (REITs), and various other investment vehicles, to access institutional capital. These platforms are the core conduits for drawing in and allocating investor funds into real assets.

In fiscal year 2024, ESR demonstrated significant success by raising US$2 billion across two dedicated data center funds. This capital infusion highlights the effectiveness of their fund management approach in attracting substantial investment for specific real asset classes.

ESR's online presence is a cornerstone of its stakeholder engagement strategy. Its corporate website serves as a central hub, offering detailed insights into its extensive portfolio of logistics and industrial properties. In 2024, the company continued to enhance its digital communication channels, ensuring global stakeholders have access to timely updates on its performance and strategic initiatives.

Investor portals and digital communication platforms are crucial for disseminating financial reports and operational data. These channels facilitate transparency and provide a comprehensive overview of ESR's market position and growth trajectory. The company's commitment to digital accessibility ensures that information is readily available to a diverse range of investors and partners.

Industry Conferences and Investor Roadshows

Industry conferences and investor roadshows are crucial channels for real estate investment trusts (REITs) and other asset managers to connect with capital providers and showcase their portfolios. These events facilitate direct engagement with a broad spectrum of investors, from institutional funds to high-net-worth individuals, fostering relationships and generating interest in investment opportunities.

Participation in major events like MIPIM, EXPO REAL, and NAREIT’s conventions provides unparalleled access to global real estate trends and key decision-makers. In 2024, attendance at these conferences remained robust, with many firms reporting significant lead generation and pipeline development directly attributable to these gatherings. For instance, a significant portion of capital raised by publicly traded REITs in 2024 was facilitated through investor meetings arranged at these industry functions.

- Networking: Direct interaction with potential investors, analysts, and industry peers.

- Capital Raising: Presenting investment opportunities and securing funding for new projects or acquisitions.

- Market Intelligence: Gaining insights into market trends, competitor strategies, and investor sentiment.

- Brand Visibility: Enhancing the company's profile and reputation within the investment community.

Strategic Partnerships and Joint Ventures

ESR leverages strategic partnerships and joint ventures as key channels to broaden its operational scope and tap into specialized knowledge. These collaborations are instrumental in facilitating market entry and undertaking complex, large-scale projects.

A prime example is ESR's joint venture with CloudHQ, specifically targeting the development of data centers. This partnership allows ESR to access CloudHQ's expertise in the data center sector, proving vital for significant development initiatives and gaining deeper market penetration.

These strategic alliances enable ESR to share risks and rewards, thereby optimizing resource allocation and accelerating growth in new or challenging markets. By combining complementary strengths, ESR can achieve greater efficiency and impact than it might alone.

- Strategic Partnerships: Enable market expansion and access to specialized expertise for specific projects.

- Joint Ventures: Facilitate large-scale developments and market penetration, as seen with CloudHQ for data centers.

- Risk Sharing: Collaborations allow for the distribution of investment risks and operational burdens.

- Synergistic Growth: Combining complementary capabilities accelerates development and market reach.

ESR utilizes a multi-faceted approach to its Channels, blending direct engagement with broader outreach.

Its in-house sales and leasing teams are critical for direct tenant acquisition and relationship management, a strategy that proved effective in 2024.

Furthermore, the company leverages digital platforms and industry events to connect with investors and stakeholders, ensuring broad visibility and access to capital.

Strategic partnerships and joint ventures are also key, enabling market expansion and access to specialized expertise, as demonstrated by its data center developments.

| Channel Type | Key Activities | 2024 Impact/Examples | Strategic Benefit |

|---|---|---|---|

| Direct Sales & Leasing | Tenant sourcing, lease management | Active engagement across APAC, significant leasing activity | Market knowledge, strong client relationships |

| Digital Platforms | Website, investor portals | Enhanced global stakeholder communication, timely updates | Transparency, accessibility of information |

| Industry Events | Conferences, roadshows | Lead generation, pipeline development, capital raising facilitation | Investor access, market intelligence, brand visibility |

| Strategic Partnerships/JVs | Collaborations on projects | Data center development with CloudHQ, risk sharing | Market entry, specialized expertise, synergistic growth |

Customer Segments

Institutional investors, a crucial customer segment for ESR, include entities like pension funds, sovereign wealth funds, insurance companies, and private equity firms. These sophisticated players are drawn to real asset investments, particularly those in the New Economy sector, for their potential to deliver stable, long-term returns.

ESR’s ability to attract significant capital underscores its appeal to this segment. For instance, in the first half of fiscal year 2024, ESR successfully raised approximately US$2.3 billion from new investors, demonstrating strong confidence from these major financial institutions in ESR’s strategy and asset portfolio.

E-commerce giants and third-party logistics (3PL) providers represent a critical customer segment for ESR, demanding extensive, high-quality warehousing and distribution infrastructure. Their need for modern facilities is directly fueled by the booming online retail sector and the increasing complexity of global supply chains. In FY2024 alone, ESR successfully leased approximately 8 million square meters of space to these key players, highlighting their significant reliance on ESR's strategic locations and efficient operational capabilities.

Hyperscale cloud and technology giants are a core customer segment, demanding vast, dependable data center capacity. These companies, including major cloud providers, are fueling significant growth in AI, requiring advanced infrastructure. For instance, in 2023, global data center construction spending reached over $200 billion, with hyperscale projects representing a substantial portion of this investment, driven by AI workloads.

Manufacturers and Industrial Users

ESR serves a vital segment of traditional manufacturers and industrial businesses that require contemporary facilities for their production, warehousing, and logistics operations. These companies, while not always directly tied to the New Economy, represent a significant portion of the industrial real estate market.

This customer base relies on ESR for modern industrial spaces that enhance efficiency and facilitate seamless distribution. For instance, in 2024, industrial property demand remained robust, with vacancy rates for prime industrial spaces in key Asian markets like Greater Tokyo and Singapore hovering below 3%, underscoring the need for high-quality facilities.

- Traditional Manufacturing Needs: Companies in sectors like automotive parts, consumer goods, and heavy machinery require specialized industrial spaces for assembly, processing, and inventory management.

- Logistics and Distribution Hubs: Many manufacturers utilize ESR's facilities as crucial nodes in their supply chains, enabling efficient storage and timely delivery of finished products to market.

- Modernization Drive: The ongoing trend of upgrading older, less efficient industrial sites to modern, technologically advanced facilities drives demand from this segment.

- Economic Contribution: This customer group contributes significantly to the overall industrial output and employment, making their real estate needs a consistent market driver.

Real Estate Investment Trusts (REITs)

ESR's customer segments for its REITs include a broad range of investors, from large institutional players like pension funds and sovereign wealth funds to individual retail investors seeking exposure to real estate. These REITs act as crucial investment vehicles, allowing a wider audience to participate in ESR's extensive portfolio of income-generating properties.

These REITs are designed to acquire, develop, and manage a diverse array of real estate assets, primarily focusing on logistics and industrial properties, but also encompassing data centers and other sectors. This strategy provides investors with a liquid and publicly traded avenue to invest in ESR's strategically located and high-quality real estate holdings.

A prime illustration of this segment is the ESR China REIT, which debuted in 2021. By July 2024, the REIT continued to demonstrate its value proposition, offering investors a direct stake in a portfolio of modern, well-occupied industrial and logistics assets across key Chinese economic hubs. For instance, the ESR-Logos Fund, a significant REIT managed by ESR, reported strong occupancy rates in its Australian portfolio during 2023, underscoring the operational success of these vehicles.

- Institutional Investors: Pension funds, sovereign wealth funds, and large asset managers seeking stable, long-term income streams.

- Retail Investors: Individual investors looking for diversified real estate exposure through publicly traded securities.

- Property Funds: Other real estate funds that may invest in ESR-managed REITs as part of their broader portfolio strategy.

ESR's customer base is diverse, encompassing institutional investors like pension funds and sovereign wealth funds, who are attracted to the stable, long-term returns of New Economy real assets. E-commerce giants and 3PL providers form another key segment, requiring extensive, modern warehousing to support booming online retail and complex supply chains.

Hyperscale cloud and technology companies are critical, demanding vast data center capacity driven by AI growth, with global data center construction spending exceeding $200 billion in 2023. Traditional manufacturers also rely on ESR for contemporary industrial spaces to enhance efficiency and distribution, with demand for prime industrial spaces remaining robust in 2024.

REIT investors, including both institutional and retail participants, gain exposure to ESR's income-generating properties, primarily logistics and industrial assets. The ESR China REIT, for instance, offers a direct stake in modern industrial and logistics properties, with managed funds like ESR-Logos reporting strong occupancy in 2023.

| Customer Segment | Key Needs | 2023-2024 Data Point |

|---|---|---|

| Institutional Investors | Stable, long-term returns, New Economy assets | Raised ~US$2.3 billion from new investors (H1 FY24) |

| E-commerce & 3PL Providers | Modern warehousing, distribution infrastructure | Leased ~8 million sqm of space (FY24) |

| Hyperscale Cloud & Tech Giants | Dependable data center capacity, AI infrastructure | Global data center construction spending >$200 billion (2023) |

| Traditional Manufacturers | Contemporary industrial spaces, efficient logistics | Prime industrial vacancy <3% in key Asian markets (2024) |

| REIT Investors | Diversified real estate exposure, income streams | ESR-Logos Fund reported strong occupancy (2023) |

Cost Structure

A major component of ESR's expenses involves securing land and then building its logistics and data center facilities. These ventures are very capital-intensive, requiring significant outlay for materials, workers, and essential infrastructure.

As of the end of 2024, ESR's development pipeline was valued at roughly US$11.4 billion, highlighting the scale of these property development and construction costs.

ESR's land acquisition and holding costs represent a significant upfront investment, crucial for building its future development pipeline. These expenses cover the purchase of strategically positioned land parcels, essential for expanding its extensive portfolio.

The company maintained a substantial landbank of approximately 7 million square meters as of late 2023, underscoring the scale of these ongoing holding expenses. These costs are vital for securing future growth opportunities in key logistics and industrial markets.

ESR's property operating and maintenance expenses are ongoing costs essential for managing its vast real estate portfolio. These include essential services like utilities, routine repairs, security personnel, and property management fees, all standard for maintaining high-value assets.

In 2024, ESR's commitment to operational excellence ensured its properties remained functional and attractive to tenants. While specific figures vary by property type and location, these costs are critical for preserving asset value and ensuring tenant satisfaction, directly impacting rental income and occupancy rates.

Fund Management and Administrative Expenses

These costs are fundamental to the day-to-day operations of ESR's fund management arm. They encompass everything from the salaries of the team that manages the investments to the office rent and utilities that keep the lights on. Marketing efforts to attract new investors and the necessary expenses for adhering to financial regulations are also included here.

These expenditures are critical for maintaining strong relationships with investors and ensuring the successful performance of the funds under management. In fiscal year 2024, ESR reported a Fund Management EBITDA of US$321 million, indicating the scale of these operational costs relative to earnings.

- Staff Salaries: Compensation for fund managers, analysts, and support staff.

- Administrative Overhead: Costs for office space, utilities, technology, and general operational support.

- Marketing and Business Development: Expenses related to attracting investors and promoting fund offerings.

- Regulatory Compliance: Costs associated with meeting legal and regulatory requirements in the financial industry.

Financing Costs and Interest Expenses

Financing costs and interest expenses represent the money ESR pays to service the debt it uses to acquire and develop properties. This is a significant part of their cost structure.

Effectively managing these expenses is crucial for ESR's profitability, particularly when interest rates change. For fiscal year 2024, ESR demonstrated strong cost management by reducing its weighted average interest cost by 60 basis points, bringing it down to 4.7%.

- Debt Financing Expenses: Costs associated with loans taken for property acquisition and development.

- Interest Rate Sensitivity: Profitability is impacted by fluctuations in interest rates.

- FY2024 Performance: Weighted average interest cost reduced by 60 basis points to 4.7%.

The cost structure for ESR is heavily influenced by its capital-intensive property development and land acquisition activities. These foundational expenses are critical for building its extensive logistics and data center portfolio.

Ongoing operational and maintenance costs are essential for preserving asset value and ensuring tenant satisfaction across its managed properties. Fund management expenses, including staff compensation and regulatory compliance, also form a significant part of its cost base.

Financing costs, particularly interest expenses on debt used for acquisitions and development, are a major consideration, with ESR actively managing these to optimize profitability.

| Cost Category | Description | FY2024 Data/Impact |

|---|---|---|

| Property Development & Land Acquisition | Securing land and constructing facilities. | Development pipeline valued at approx. US$11.4 billion. |

| Land Holding Costs | Expenses for maintaining a substantial landbank. | Approx. 7 million sqm landbank as of late 2023. |

| Property Operations & Maintenance | Ongoing costs for utilities, repairs, security, etc. | Critical for asset value preservation and tenant satisfaction. |

| Fund Management Operations | Staff salaries, admin, marketing, compliance. | Fund Management EBITDA of US$321 million. |

| Financing Costs | Interest paid on debt for property financing. | Weighted average interest cost reduced to 4.7% (60 bps decrease). |

Revenue Streams

Fund management fees are ESR's main money-maker, coming from handling investments for their partners. These fees are a steady income, calculated based on the total value of assets they manage. In fiscal year 2024, this segment brought in a significant 78% of ESR's overall revenue, highlighting its importance.

Development profits represent income generated when ESR successfully develops, constructs, and then sells logistics and data center properties. This profit is realized once a project is finished and divested.

ESR's New Economy Development segment is where these development profits are earned. For instance, in 2023, ESR's development profits contributed significantly to its overall financial performance, reflecting the successful execution of its pipeline of new economy assets.

ESR generates significant revenue through rental income derived from its strategically located logistics and data center properties. This income stream is bolstered by a diverse tenant base, encompassing key sectors like e-commerce, logistics, and technology. In fiscal year 2024, ESR demonstrated strong performance in this area, achieving robust leasing activity, high occupancy rates, and positive rental reversions across its logistics real estate portfolio.

Acquisition and Divestment Fees

Acquisition and divestment fees represent a significant revenue stream for ESR, stemming from their role in managing real estate funds and investment vehicles. These are essentially transactional charges incurred when ESR helps clients buy or sell properties within these managed portfolios. For instance, in 2023, ESR's real estate advisory and transaction services contributed to their overall fee income, reflecting the active management of their extensive property portfolio.

These fees are a core component of ESR's integrated fund management business model. They are directly tied to the successful execution of property transactions, which are crucial for optimizing fund performance and generating returns for investors. The volume and value of these transactions directly impact the revenue generated from this stream.

- Transaction-based income: Fees earned from facilitating the buying and selling of properties within ESR's managed funds.

- Fund management contribution: These fees are a vital part of the overall revenue generated by ESR's integrated fund management operations.

- Impact of market activity: Higher transaction volumes and property values generally lead to increased acquisition and divestment fee revenue.

Promote Fees (Performance Fees)

Promote fees, also known as performance fees, are a key revenue stream for asset managers. These fees are earned when the investment performance of managed funds surpasses specific, pre-determined benchmarks or hurdle rates. While this revenue can be quite variable, it offers substantial upside during periods of robust market growth.

For example, in FY2024, many asset management firms saw a dip in their performance fee revenue compared to the previous fiscal year, FY2023. This trend reflects the market's performance during that period. For instance, some reports indicated that performance fees for certain large fund managers decreased by as much as 15-20% year-over-year in FY2024, directly correlating with market volatility and a less consistent outperformance against benchmarks.

- Performance-based revenue: Tied to exceeding investment benchmarks.

- Volatility: Revenue fluctuates with market conditions and fund manager skill.

- FY2024 trend: Lower promote fees observed compared to FY2023, indicating a challenging market environment for consistent outperformance.

Rental income from ESR's extensive portfolio of logistics and data center properties forms a significant and stable revenue base. This income is bolstered by strong occupancy rates and positive rental reversions, as seen in fiscal year 2024 where leasing activity remained robust across its key assets.

Development profits are realized when ESR successfully completes and divests its New Economy Development projects. These profits are a crucial component of their earnings, reflecting their capability in executing and monetizing their development pipeline.

Fund management fees, driven by the total value of assets under management, represent ESR's primary revenue stream, accounting for a substantial 78% of total revenue in fiscal year 2024. This highlights the core strength of their integrated fund management business.

Acquisition and divestment fees, generated from facilitating property transactions within managed funds, contribute to overall fee income. Promote fees, earned from outperforming investment benchmarks, offer potential upside but are subject to market performance, with FY2024 showing a general decrease in this revenue for many asset managers compared to FY2023.

| Revenue Stream | Description | FY2024 Contribution (Approx.) |

|---|---|---|

| Fund Management Fees | Fees from managing investment portfolios and assets. | 78% of total revenue |

| Rental Income | Revenue from leasing logistics and data center properties. | Significant and stable contributor |

| Development Profits | Profits from developing and selling properties. | Key component from New Economy Developments |

| Acquisition & Divestment Fees | Fees for facilitating property transactions in managed funds. | Part of overall fee income |

| Promote Fees | Performance-based fees for exceeding investment benchmarks. | Variable, trended lower in FY2024 |

Business Model Canvas Data Sources

The ESR Business Model Canvas is built using comprehensive market research, competitive analysis, and internal operational data. These sources ensure each canvas block is filled with actionable and accurate information.