ESR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESR Bundle

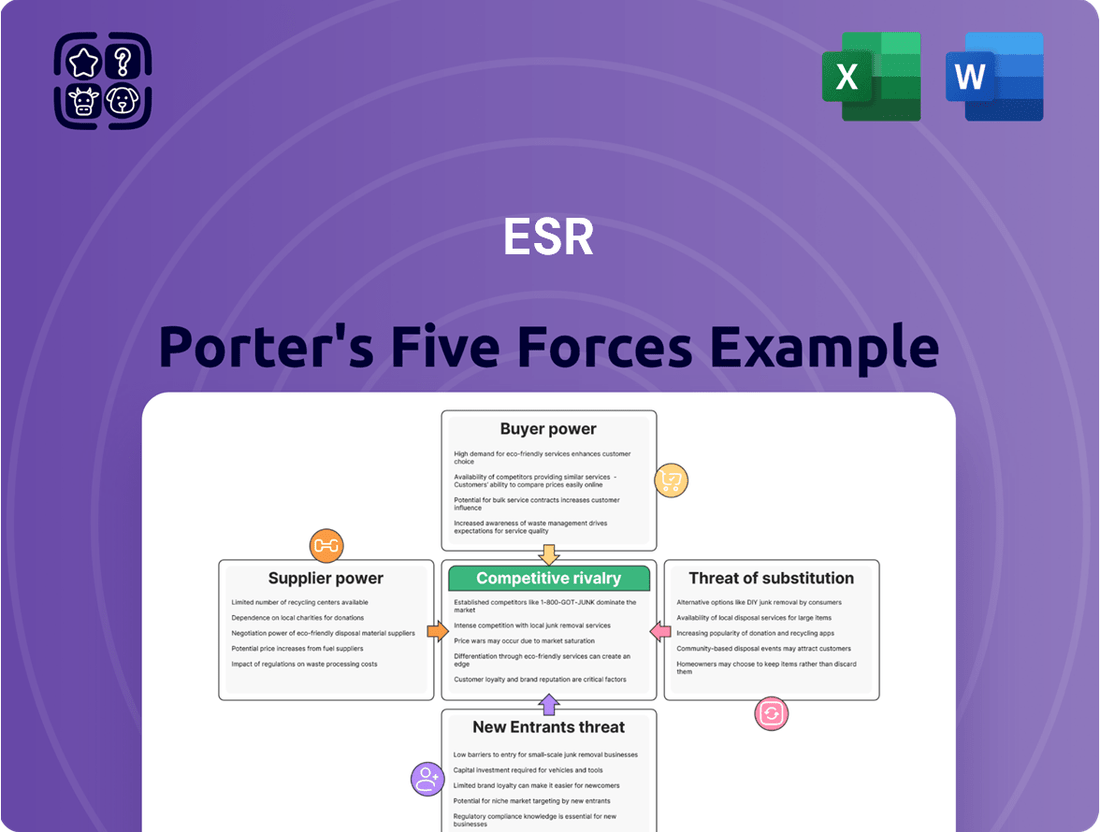

Understanding the competitive landscape is crucial for any business, and Porter's Five Forces Analysis provides a powerful framework to dissect ESR's industry. This analysis reveals the underlying forces that shape competition, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes, and the intensity of rivalry among existing players.

The complete report reveals the real forces shaping ESR’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of prime land in strategic locations is a significant factor influencing ESR's bargaining power with suppliers, especially for large-scale logistics hubs and data centers. Limited prime land in major Asia Pacific markets, such as Singapore and Japan where space is highly constrained, can significantly increase the bargaining power of landowners and developers controlling these parcels. This scarcity can drive up land acquisition costs, directly impacting ESR's operational expenses and development strategies.

Suppliers of essential construction materials like steel, concrete, and specialized data center equipment wield considerable bargaining power. This leverage is amplified by potential supply chain disruptions or significant fluctuations in commodity prices, as seen in the volatile steel market throughout 2024, which experienced price swings of up to 15% based on global demand and production levels.

Similarly, the availability of skilled labor, particularly for intricate data center construction projects, presents a significant factor. A shortage of specialized electricians, HVAC technicians, and project managers in high-demand regions can drive up labor costs, directly impacting development expenses for companies like ESR. In 2024, the average cost for specialized construction labor in major data center hubs saw an increase of approximately 8-10% year-over-year.

These elevated construction costs remain a persistent challenge for data center development, directly affecting project timelines and overall profitability. The combined impact of material price volatility and labor scarcity means that ESR, like other developers, must carefully manage supplier relationships and anticipate cost increases to maintain competitive project bids and ensure timely delivery of facilities.

For data centers like ESR, the necessity of cutting-edge and highly specialized hardware, including advanced servers, sophisticated cooling solutions, and robust power systems, grants technology and specialized equipment providers considerable leverage. This dependence is amplified by the swift evolution of technology, compelling ESR to consistently invest in modernization and thus deepening its reliance on these key suppliers.

Utility Providers (Power and Water)

Data centers are massive consumers of electricity, making access to reliable and affordable power a critical operational factor for companies like ESR. The concentration of power generation and distribution in the hands of a limited number of utility providers can significantly amplify their bargaining power.

This concentration means that data center operators often have few alternatives for securing their essential power needs. In 2024, the increasing demand for electricity, driven by AI and cloud computing growth, has put further strain on power grids. For instance, regions experiencing a data center boom often face challenges with insufficient power supply, a situation that can be exacerbated by utility providers’ ability to dictate terms.

- High Power Demand: Data centers can consume megawatt-hours of electricity, making power a dominant cost factor.

- Limited Supplier Options: In many geographic locations, there are only one or two primary utility providers.

- Infrastructure Constraints: The capital expenditure required to build new power infrastructure to support data centers can be substantial, limiting the speed at which supply can increase to meet demand.

- Regulatory Influence: Utility pricing and availability are often subject to regulatory approvals, which can affect the bargaining dynamics.

Financing and Capital Providers

As a real asset manager, ESR's ability to secure funding is crucial for its growth. The company depends on institutional investors and lenders for capital. In a competitive fundraising landscape, these capital providers hold considerable sway over the terms and conditions of financing.

The fundraising environment for real estate, including for companies like ESR, was notably subdued in 2024. Despite these market conditions, ESR demonstrated resilience by successfully raising US$5.4 billion in capital. This capital is essential for funding new developments and acquiring existing properties.

- Investor Influence: Capital providers, particularly large institutional investors, can dictate investment mandates and influence the types of projects ESR undertakes.

- Lender Leverage: Banks and other lenders can impact development timelines and project feasibility through their lending terms and interest rates.

- Market Sensitivity: The bargaining power of capital providers often increases during periods of economic uncertainty or when the real estate sector faces headwinds, as seen in 2024.

- Capital Raising Success: ESR's ability to raise significant capital, such as the US$5.4 billion in 2024, indicates a degree of success in navigating these supplier dynamics.

Suppliers of specialized construction materials and skilled labor can exert significant influence over ESR's development projects. Fluctuations in commodity prices, like the 15% swing in steel prices during 2024, and rising labor costs, up 8-10% for specialized data center roles in 2024, directly impact project expenses. Furthermore, providers of cutting-edge data center hardware and essential utility services hold considerable leverage due to high demand and limited alternatives, particularly in power supply where grid constraints were evident in 2024.

| Supplier Type | Bargaining Power Factors | Impact on ESR (2024 Data) |

|---|---|---|

| Landowners/Developers | Scarcity of prime locations | Increased land acquisition costs in constrained markets |

| Material Suppliers | Commodity price volatility (e.g., steel) | Up to 15% price swings impacting construction budgets |

| Skilled Labor | Shortage of specialized workers | 8-10% year-over-year increase in labor costs for data centers |

| Technology Providers | Need for cutting-edge hardware | Dependence on suppliers for advanced servers and cooling solutions |

| Utility Providers | Concentration of supply, high demand | Potential for dictated terms due to power grid strain from AI growth |

What is included in the product

Analyzes the five forces shaping ESR's competitive environment: threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry.

Identify and neutralize competitive threats before they impact profitability, offering a strategic roadmap to mitigate market pressures.

Customers Bargaining Power

ESR's customer base is heavily concentrated with large e-commerce, logistics, and technology firms. These significant tenants, by virtue of their size and the substantial space they occupy, possess considerable bargaining power. They can leverage their scale to negotiate favorable lease terms, including competitive rental rates and customized facility solutions, directly impacting ESR's profitability.

The sheer volume of real estate these major players require means they are critical to ESR's portfolio performance. In fiscal year 2024, ESR demonstrated its ability to attract and retain these key clients by leasing approximately 8 million square meters of space, marking a significant 50% increase year-on-year. This robust leasing activity underscores ESR's success in solidifying relationships with its most important customers.

Data center clients, a key customer segment in the new economy, demand modern, high-specification facilities. These clients require advanced infrastructure, robust cooling systems, and significant power capacity, often exceeding standard commercial property offerings. For instance, hyperscale data center providers are increasingly seeking facilities built to Tier IV standards, necessitating substantial capital expenditure from developers like ESR.

This elevated demand for specialized features grants these customers significant bargaining power. They can negotiate for tailored solutions, favorable lease terms, and even influence the design and build-out of properties. In 2024, the global data center market continued its rapid expansion, with demand for colocation space growing by an estimated 10-15% year-over-year, underscoring the leverage held by major clients in securing prime, high-spec locations.

ESR's customers, often large multinational corporations with extensive operations throughout the Asia Pacific region, possess significant bargaining power. Their ability to redirect demand to alternative markets or suppliers based on unfavorable terms in any single location directly impacts ESR's pricing and service negotiations. This geographic spread means a localized issue for ESR could be mitigated by a customer elsewhere.

Colocation and Hyperscale Operators

For colocation and hyperscale operators, the bargaining power of customers is a significant factor. Hyperscale cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, along with major colocation providers, represent substantial demand. Their sheer volume of required capacity and the potential for long-term contracts grant them considerable leverage. This often translates into favorable pricing and customized build-to-suit data center arrangements.

The market for these services is experiencing robust expansion. For instance, the global data center market was valued at approximately $240 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 10-15% over the next five years, reaching over $350 billion by 2028. This continued growth trajectory for hyperscale and colocation clients reinforces their strong bargaining position.

- Significant Customer Base: Major hyperscale cloud providers and large colocation clients are key customers for data center operators.

- Negotiating Leverage: Their substantial demand and long-term commitments empower them to negotiate favorable terms, including build-to-suit options.

- Market Growth: The ongoing expansion of hyperscale and colocation services, with the global market projected to exceed $350 billion by 2028, ensures these customers will retain strong bargaining power.

Economic and Industry Downturns

During economic downturns or when there's an oversupply in certain real estate sectors, customers gain more leverage. This is because they have a wider selection of properties to choose from and feel less pressure to commit quickly. Consequently, this can drive down rental prices and occupancy rates, directly affecting ESR's income.

For instance, in the first half of 2025, logistics rents across the Asia-Pacific region experienced a slight dip, showing a year-on-year decrease of 0.4%. This data point illustrates the sensitivity of rental markets to broader economic conditions and highlights the increased bargaining power of tenants during such periods.

- Increased Tenant Options: Economic slowdowns often lead to higher vacancy rates, giving tenants more choices and reducing their reliance on any single landlord.

- Downward Pressure on Rents: With more available space and reduced demand, customers can negotiate lower rental rates, impacting ESR's revenue streams.

- Occupancy Level Impact: Tenants may delay leasing decisions or opt for shorter lease terms, leading to lower overall occupancy and potentially higher costs for ESR in finding new tenants.

ESR's customer base, particularly in the data center segment, includes major hyperscale cloud providers and large colocation operators. These clients possess substantial bargaining power due to their significant demand and the specialized nature of their facility requirements. Their ability to secure long-term contracts and influence property design means they can negotiate favorable lease terms, impacting ESR's revenue and profitability.

| Customer Segment | Key Players | Bargaining Power Factors | Market Context (2024-2025) |

|---|---|---|---|

| Data Centers (Hyperscale/Colocation) | AWS, Microsoft Azure, Google Cloud, Major Colocation Providers | High volume demand, long-term contracts, specialized facility needs (Tier IV standards), potential to influence design. | Global data center market valued ~ $240 billion in 2023, projected 10-15% CAGR. Demand for high-spec facilities remains strong. |

| Logistics & E-commerce | Large E-commerce Platforms, Major Logistics Companies | Significant space requirements, ability to shift to alternative markets, impact of economic conditions on rental rates. | Asia-Pacific logistics rents saw a slight dip of 0.4% in H1 2025, indicating increased tenant leverage during economic slowdowns. |

Preview the Actual Deliverable

ESR Porter's Five Forces Analysis

This preview showcases the complete ESR Porter's Five Forces analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally formatted analysis you'll receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The Asia Pacific logistics and data center real estate market is a bustling arena, featuring formidable global giants like Prologis and Goodman, alongside robust regional developers and asset managers. These entities fiercely compete for prime land, essential capital, and lucrative tenant contracts, creating a highly charged competitive environment.

ESR's primary rivals in this space include Prologis, Goodman, and Realterm, each possessing significant market share and operational expertise. For instance, Prologis reported a global portfolio of approximately 1.2 billion square feet as of Q1 2024, highlighting its extensive reach and scale.

While global players like Prologis and Goodman are significant forces in the logistics real estate sector, certain local markets or specialized property types, such as last-mile delivery hubs or cold storage facilities, can exhibit a more fragmented competitive environment. This fragmentation means numerous smaller, regional developers may vie for the same projects or tenants, potentially driving down rental rates and increasing acquisition costs for larger entities in those specific niches.

Competitors in the real estate sector are intensely vying for the same pool of institutional capital. Success hinges on a firm's capacity to not only attract but also efficiently deploy this capital to gain or maintain market share. This competitive pressure is evident across the industry.

ESR's performance in FY2024 highlights this dynamic, as the company successfully raised US$5.4 billion in capital. This achievement is particularly noteworthy given the challenging fundraising landscape, demonstrating strong investor confidence in ESR's strategies and operational capabilities amidst a competitive environment.

Development Pipeline and New Supply

A robust development pipeline from competitors can indeed create oversupply in specific markets. This, in turn, puts downward pressure on occupancy rates and limits the potential for rental growth, directly impacting profitability for existing players.

The Asia Pacific region, a key growth area, exemplifies this. The data center market there has an impressive 14.4GW in its development pipeline, indicating a sustained period of rapid expansion extending into 2025 and beyond. This substantial new supply will likely intensify competition.

- Significant Development Pipeline: Asia Pacific data center market has an additional 14.4GW in development.

- Market Oversupply Risk: Competitors' pipelines can lead to excess capacity.

- Impact on Occupancy: Increased supply can drive down occupancy rates.

- Pressure on Rental Growth: Oversupply may limit opportunities for rent increases.

Innovation and Service Differentiation

Competitive rivalry in the real estate sector, particularly for firms like ESR, extends beyond mere price and location. Companies are increasingly differentiating themselves through the quality of their facilities, offering integrated solutions, and providing value-added services. This includes advancements like smart logistics solutions and sustainable data center designs, which cater to evolving market demands.

ESR, for instance, actively competes by offering a comprehensive suite of services that go beyond traditional property development. Their focus on integrated solutions, encompassing both investment management and fund management, allows them to capture greater value and build stronger client relationships. This strategic approach helps them stand out in a crowded market.

- Facility Quality: Companies compete on the modernity, efficiency, and sustainability of their physical assets, such as state-of-the-art warehouses or advanced data centers.

- Integrated Solutions: Offering a bundled approach, combining development, leasing, and property management, provides a competitive edge.

- Value-Added Services: This includes specialized offerings like smart logistics technology, cold storage capabilities, or ESG (Environmental, Social, and Governance) compliant infrastructure.

- ESR's Strategy: ESR's emphasis on investment and fund management alongside property operations creates a synergistic model, enhancing its competitive position.

The competitive landscape for ESR is intense, with global players like Prologis and Goodman holding substantial market share. For example, Prologis managed 1.2 billion square feet globally as of Q1 2024, demonstrating significant scale. This rivalry extends to securing capital, with ESR raising US$5.4 billion in FY2024, underscoring the constant need to attract and deploy funds effectively in a competitive market.

| Competitor | Global Portfolio (Approx. sq ft) | Key Differentiators |

|---|---|---|

| Prologis | 1.2 billion (Q1 2024) | Scale, global reach, integrated logistics solutions |

| Goodman | Significant global presence | Development expertise, focus on key gateway cities |

| Realterm | Specialized focus on transportation-intensive logistics real estate | Niche market expertise, active asset management |

SSubstitutes Threaten

The increasing migration of businesses to public cloud services like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud presents a significant substitute threat for traditional data center providers. As companies increasingly leverage these hyperscale platforms, their need for dedicated physical data center space, whether owned or leased, can diminish, potentially impacting demand for colocation services. For instance, in 2024, the global cloud computing market was projected to reach over $1 trillion, indicating a substantial shift in IT infrastructure spending away from on-premises solutions.

However, this trend also paradoxically fuels demand for the very hyperscale data centers that companies like ESR develop. These massive facilities are essential to the functioning of public cloud providers, who require vast amounts of space and power to house their server farms. The Asia-Pacific data center market, a key focus for ESR, is experiencing robust growth, with cloud adoption identified as a primary driver. Estimates from 2024 suggested the APAC data center market could grow at a compound annual growth rate (CAGR) exceeding 7%, largely propelled by cloud service expansion.

Companies may choose to retain or grow their own on-premise data centers, particularly for highly sensitive information or unique legacy systems, rather than relying on third-party providers like ESR. This can be driven by stringent security requirements or the need for specialized, deeply integrated infrastructure.

Despite this, the overarching industry trend strongly favors outsourcing data center operations. Factors like enhanced scalability, reduced capital expenditure, and improved operational efficiency are pushing many organizations towards third-party solutions. For instance, the global cloud computing market, which encompasses outsourced data center services, was projected to reach over $1.3 trillion in 2024, indicating a significant shift away from on-premise investments for many.

While more efficient inventory management and localized production can theoretically reduce the need for traditional logistics properties, the reality is that these substitutes often complement rather than replace the core function of warehousing. For instance, advanced supply chain technologies, like real-time tracking and predictive analytics, enhance the efficiency of goods movement but still require physical hubs for storage and distribution. The burgeoning e-commerce sector, projected to reach over $7 trillion globally by 2025, continues to be a powerful counterforce, directly fueling demand for modern logistics facilities. In 2024, the industrial and logistics real estate sector saw significant investment, with transaction volumes remaining robust, underscoring the sustained need for these physical assets despite technological advancements.

Relocation to Lower-Cost Regions

The threat of relocation to lower-cost regions presents a significant challenge for ESR. Tenants, particularly those in the logistics and manufacturing sectors, are constantly evaluating operational expenses. If the cost of real estate in ESR's key markets, such as Australia and New Zealand where average industrial rents have seen increases, becomes too high, businesses may seek out more affordable locations. This geographical shift acts as a direct substitute for the warehousing and industrial space ESR provides.

For instance, in 2024, while demand for industrial space remained robust in many Asia-Pacific markets, rising construction costs and land prices in prime locations could push some occupiers to consider secondary or even tertiary markets offering lower rental yields. This is especially true for businesses where real estate costs are a substantial portion of their overall expenditure.

- Geographical Substitution: Businesses can opt for operations in lower-cost countries or regions, bypassing the need for ESR's premium facilities in high-cost areas.

- Cost Sensitivity: Tenants in cost-sensitive industries like manufacturing and logistics are more prone to relocate if rental expenses escalate beyond acceptable thresholds.

- Market Dynamics: Fluctuations in global economic conditions and supply chain strategies can influence decisions to shift operations, making geographical relocation a viable alternative.

Technological Advancements in Logistics Automation

Technological advancements in logistics automation present a significant threat of substitutes by potentially altering the fundamental requirements for logistics operations. Innovations in robotics and automated systems are enabling more compact and efficient storage solutions, such as vertical farming or automated storage and retrieval systems (AS/RS). This could lessen the reliance on traditional, large-footprint warehouses.

For instance, companies are investing heavily in these technologies. In 2023, the global warehouse automation market was valued at approximately $25 billion and is projected to grow substantially. This growth indicates a rising availability and adoption of technologies that can perform logistics functions with less physical space than conventional methods.

- Reduced Space Needs: Automation can allow for denser storage and faster throughput, potentially decreasing the square footage required per unit of inventory.

- Increased Efficiency: Automated systems can operate 24/7 with higher precision, substituting for labor and traditional workflows that might require more extensive facilities.

- Shifting Infrastructure Demand: As automation becomes more sophisticated, the demand for specialized, tech-enabled logistics hubs might grow, while demand for older, less adaptable warehouse spaces could decline.

The threat of substitutes for ESR's logistics properties arises from alternative ways businesses can manage their supply chains. Companies might opt for smaller, more distributed fulfillment centers closer to end consumers, reducing the need for large, centralized warehouses. Additionally, advancements in inventory management and direct-to-consumer shipping models could lessen overall warehousing requirements.

In 2024, the e-commerce sector continued its strong growth trajectory, with projections indicating a significant portion of retail sales occurring online. This trend, while boosting demand for logistics space, also encourages innovation in last-mile delivery and smaller, localized distribution points, which can act as substitutes for traditional large-scale warehousing.

Furthermore, the increasing adoption of automation within warehouses can lead to greater storage density and faster inventory turnover. This efficiency gain means that less physical space may be required to handle the same volume of goods, presenting a substitute for the extensive floor space ESR typically provides.

The rise of urban logistics and micro-fulfillment centers, often situated in densely populated areas, offers a direct substitute for larger, out-of-town logistics parks. These smaller facilities cater to immediate delivery needs, potentially reducing the reliance on ESR's larger-scale assets for certain distribution strategies.

Entrants Threaten

Entering the new economy real estate sector, especially in developing and managing large-scale logistics and data centers, demands substantial capital. For instance, a single modern logistics facility can cost tens of millions of dollars, and data centers can run into hundreds of millions, creating a significant hurdle for newcomers.

These high capital requirements act as a formidable barrier, discouraging potential competitors. Investors need access to vast sums for land acquisition, construction, technology integration, and ongoing operational expenses, making entry exceptionally challenging.

The threat of new entrants is significantly influenced by the difficulty in securing prime land and the specialized development expertise required for high-specification logistics and data center facilities. Established companies like ESR benefit from decades of experience and a robust network of relationships, making it hard for newcomers to replicate their advantage. In 2024, the ongoing challenges of insufficient power supply, elevated construction costs, and supply chain constraints further erect barriers for potential entrants aiming to develop these complex assets.

Navigating the complex web of regulations and licensing requirements across different Asia Pacific markets presents a substantial barrier for potential new entrants into the logistics and industrial real estate sector. ESR's extensive presence, spanning Australia and New Zealand, Japan, South Korea, Greater China, Southeast Asia, and India, highlights the diverse regulatory landscapes that newcomers must contend with. For instance, obtaining specific permits and understanding the localized operational nuances in each of these distinct economies demands significant investment in expertise and time, effectively deterring many from entering.

Established Relationships with Institutional Investors and Tenants

ESR's deep-rooted connections with institutional investors and a robust base of key tenants, including major players in e-commerce, logistics, and technology, present a significant barrier to new entrants. Building these trust-based relationships from the ground up requires substantial time and capital investment. For instance, as of the first half of 2024, ESR managed a substantial global portfolio, underscoring the breadth of its investor and tenant network.

Newcomers would face the arduous task of replicating ESR's established network, a process that typically involves years of consistent performance and relationship nurturing. This existing ecosystem provides ESR with a competitive advantage, making it difficult for new firms to gain immediate traction and secure the necessary capital or tenant commitments.

- Established Investor Base: ESR's long-standing relationships with global institutional investors provide a consistent and deep pool of capital.

- Key Tenant Lock-in: Major e-commerce and logistics firms, often bound by long-term leases and operational integration, create sticky demand for ESR's properties.

- Time and Trust Deficit: New entrants must overcome the significant hurdle of building credibility and trust with both capital providers and end-users in a competitive market.

- Global Diversification: ESR's presence across multiple geographies and tenant sectors diversifies risk and enhances its appeal to a wider range of investors, a feat difficult for new, localized players to match.

Economies of Scale and Operational Efficiency

The threat of new entrants in the logistics real estate sector, particularly concerning ESR's competitive landscape, is significantly mitigated by the substantial economies of scale enjoyed by established players. ESR, for instance, leverages its vast portfolio and operational footprint to achieve cost advantages in development, property management, and capital raising. In 2023, ESR's global assets under management reached approximately $132 billion, a scale that allows for considerable efficiencies not easily replicated by newcomers.

New entrants would face considerable hurdles in matching ESR's operational efficiency. The ability to negotiate better terms with suppliers, secure favorable financing, and optimize logistics operations across a large network provides a distinct cost advantage. For example, a new entrant would likely incur higher per-unit development costs and administrative overhead compared to ESR, making it difficult to compete on price or profitability from the outset.

- Economies of Scale: ESR's extensive global presence and large-scale operations enable cost efficiencies in development, property management, and fund management that are challenging for new entrants to match.

- Operational Efficiency: Established players benefit from optimized supply chains, bulk purchasing power, and streamlined processes, leading to lower operating costs per square foot compared to nascent competitors.

- Capital Access: The sheer size of ESR's operations facilitates access to capital markets at more favorable terms, a crucial advantage for funding large-scale development projects, which new entrants may struggle to secure.

- Market Penetration: Achieving the same level of market penetration and tenant relationships as ESR would require significant time and investment for any new competitor.

The threat of new entrants in the logistics and industrial real estate sector, particularly for companies like ESR, is significantly low due to immense capital requirements. Developing modern logistics facilities or data centers demands tens to hundreds of millions of dollars, a substantial barrier for any newcomer. For example, the ongoing high costs of construction and supply chain disruptions in 2024 further escalate these entry barriers.

Established players like ESR benefit from deep-rooted relationships with institutional investors and key tenants, creating a formidable moat. Building this trust and network takes years, a challenge new entrants face in securing capital and tenant commitments. ESR's global portfolio, as of mid-2024, showcases the breadth of these established relationships.

Economies of scale also heavily deter new entrants. ESR's 2023 assets under management of approximately $132 billion allow for significant cost efficiencies in development and operations that are difficult for smaller, newer firms to match. This scale translates to better negotiation power with suppliers and more favorable capital access.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data sources, including company annual reports, industry-specific market research, and government economic data, to provide a robust understanding of industry structure.