Eris Lifesciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eris Lifesciences Bundle

Navigate the complex external environment impacting Eris Lifesciences with our meticulously crafted PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the pharmaceutical landscape, and how Eris is poised to respond. Gain a competitive edge by leveraging these critical insights. Download the full version now for actionable intelligence to inform your strategic decisions.

Political factors

Government initiatives and increased spending on healthcare significantly influence the pharmaceutical sector. Policies like the Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) aim to reduce out-of-pocket expenses for citizens, potentially increasing demand for affordable medicines.

Eris Lifesciences, as a domestic branded generics company, can benefit from such schemes that expand access to healthcare. India's health expenditure nearly doubled from Rs 3.2 lakh crore in 2020-2021 to Rs 6.1 lakh crore in 2024-2025, with government spending increasing to 48% of total health expenditure.

Drug pricing regulations are a significant political consideration for Eris Lifesciences, directly influencing its financial performance. The Indian government's commitment to affordable healthcare often translates into price controls on essential medicines.

While Eris Lifesciences has managed this risk effectively, with only 14% of its domestic product portfolio subject to price controls compared to the Indian Pharmaceutical Market average of 19%, any shifts in government policy could still impact its revenue streams.

India's pharmaceutical regulatory framework is dynamic, with ongoing updates to Good Manufacturing Practices (GMP) and the Uniform Code of Pharmaceutical Marketing Practices (UCPMP) significantly impacting Eris Lifesciences. These changes are driven by a government focus on improving drug safety, fostering innovation, and boosting global competitiveness.

Adherence to these evolving standards necessitates continuous investment in facility upgrades and robust quality assurance systems, particularly for Eris Lifesciences aiming for international markets. For instance, the Central Drugs Standard Control Organisation (CDSCO) regularly revises guidelines, and companies must demonstrate compliance to maintain manufacturing licenses and export approvals.

Promotion of Domestic Manufacturing (PLI Schemes)

The Indian government's Production-Linked Incentive (PLI) schemes are a significant political factor, directly impacting the pharmaceutical sector. These initiatives are designed to bolster domestic manufacturing of critical Active Pharmaceutical Ingredients (APIs) and finished formulations, aiming to decrease reliance on imports, particularly from China. For Eris Lifesciences, this translates into a strategic advantage by fostering stronger local supply chains and potentially leading to cost efficiencies in its manufacturing processes.

The PLI scheme for pharmaceuticals, with an outlay of ₹6,940 crore (approximately $830 million) approved in March 2021, specifically targets increasing the domestic production of key starting materials, drug intermediates, and APIs. This focus on self-reliance creates a more stable and predictable operating environment for companies like Eris Lifesciences, reducing vulnerability to global supply chain disruptions.

- PLI Scheme for Pharmaceuticals: An outlay of ₹6,940 crore approved in March 2021 to boost domestic manufacturing of APIs and key starting materials.

- Reduced Import Dependency: Aims to lessen India's reliance on imported APIs, which stood at approximately 80% for certain categories before the scheme's implementation.

- Opportunity for Eris Lifesciences: Potential to leverage government incentives for backward integration and cost reduction in API sourcing.

- Strengthening Domestic Industry: The policy fosters a more robust and self-sufficient Indian pharmaceutical manufacturing base.

Intellectual Property and Patent Laws

Changes in patent rules significantly impact Eris Lifesciences' innovation pipeline. The establishment of bodies like the Indian Council of Pharmaceuticals and Med-tech Research and Development (ICPMRD) aims to streamline the R&D process. These evolving regulations can influence the speed and success of new drug development and market entry.

Stricter timelines for patent applications necessitate a more agile approach to R&D. Furthermore, initiatives promoting collaboration between research institutes, academia, and industry, a trend observed in India's pharmaceutical sector, can foster knowledge sharing and accelerate product development for companies like Eris Lifesciences. In 2023, India saw a notable increase in patent filings across various sectors, reflecting a growing emphasis on intellectual property protection.

- Increased Patent Filings: India's patent office reported a significant rise in filings, indicating a more robust IP ecosystem.

- Focus on R&D Collaboration: Government initiatives are actively encouraging partnerships to drive innovation in the life sciences.

- Impact on Market Strategy: Evolving patent laws directly shape Eris Lifesciences' strategies for product lifecycle management and competitive positioning.

Government healthcare initiatives, like the expansion of the Ayushman Bharat scheme, are designed to increase access to medicines, benefiting companies like Eris Lifesciences that focus on affordable branded generics. India's total health expenditure reached approximately ₹6.1 lakh crore in 2024-2025, with government spending forming a larger portion, signaling a supportive environment for the pharmaceutical sector.

Drug pricing regulations remain a key political factor, though Eris Lifesciences has strategically managed its exposure, with only 14% of its domestic portfolio subject to price controls, below the market average of 19%. This demonstrates a proactive approach to navigating government price interventions.

The government's Production-Linked Incentive (PLI) scheme for pharmaceuticals, with an outlay of ₹6,940 crore approved in March 2021, is crucial for bolstering domestic API manufacturing and reducing import dependency, presenting a significant opportunity for Eris Lifesciences to strengthen its supply chain and potentially lower costs.

Evolving pharmaceutical regulations, including updated Good Manufacturing Practices (GMP) and marketing codes, necessitate continuous investment in quality and compliance, a factor Eris Lifesciences must manage to maintain its competitive edge and market access, especially for international operations.

What is included in the product

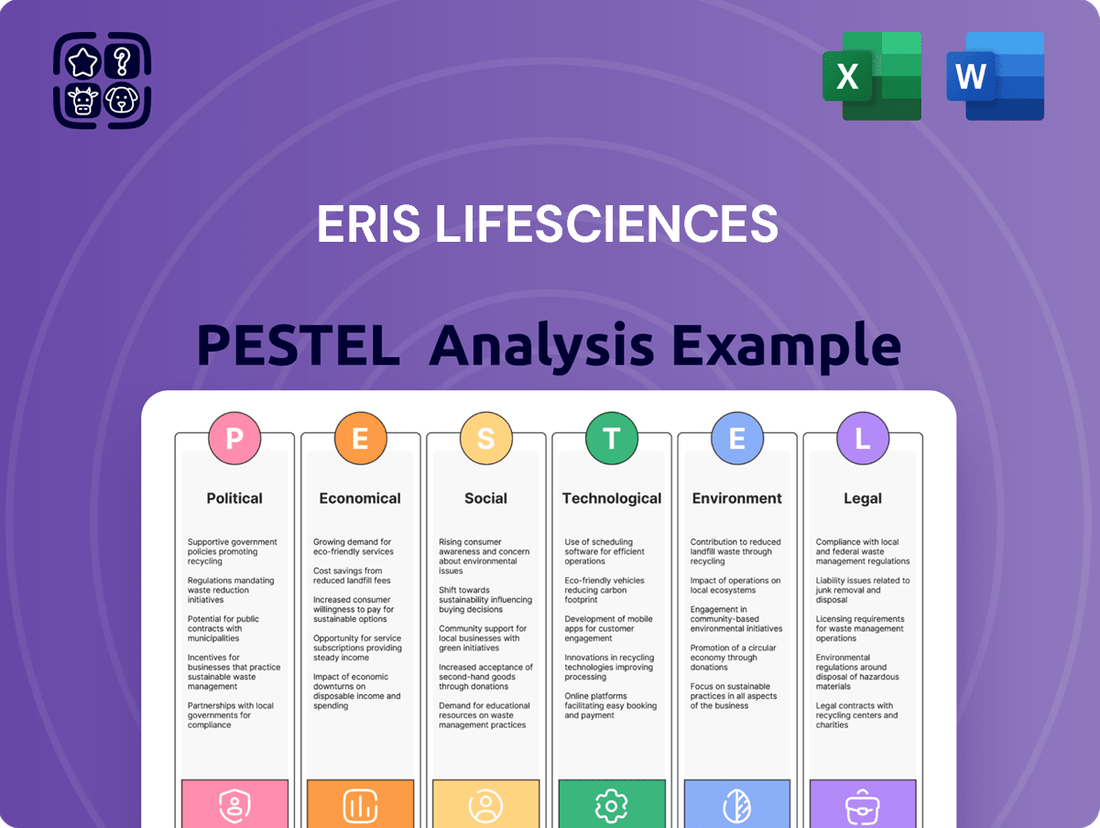

This PESTLE analysis of Eris Lifesciences examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations, providing a comprehensive view of the external landscape.

It offers actionable insights for strategic decision-making, helping to identify potential challenges and capitalize on emerging opportunities within the pharmaceutical sector.

The Eris Lifesciences PESTLE analysis offers a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategy meetings.

This analysis provides a concise yet comprehensive overview of Eris Lifesciences' operating environment, acting as a pain point reliever by streamlining the identification of key opportunities and threats for informed decision-making.

Economic factors

The Indian healthcare sector is on a robust growth trajectory, with projections indicating it will reach an impressive $638 billion by 2025. This surge is fueled by consistent economic expansion, a notable uptick in private healthcare expenditure, and a growing need for advanced and specialized medical services across the nation.

Eris Lifesciences, with its strategic emphasis on managing chronic and lifestyle-related diseases, is perfectly positioned to leverage this expanding market. The company's product portfolio aligns directly with the increasing prevalence of conditions like diabetes and cardiovascular diseases, which are major drivers of healthcare spending.

India's healthcare sector is grappling with significant cost increases, with projections indicating a 13% rise in healthcare expenses for 2025. This surge is largely attributed to escalating hospitalization rates and the growing demand for sophisticated medical technologies and treatments.

This trend of medical inflation directly impacts both consumers and businesses, creating a need for careful financial planning to manage healthcare expenditures. For companies like Eris Lifesciences, this environment necessitates a strategic focus on developing and delivering affordable yet high-quality healthcare solutions to remain competitive and profitable.

The increasing prevalence of chronic and lifestyle diseases in India presents a significant economic opportunity for Eris Lifesciences. Conditions like diabetes, cardiovascular diseases, and obesity necessitate ongoing medical management, creating a sustained demand for the company's portfolio of chronic therapy drugs.

This trend is underscored by projections indicating India will have 134 million individuals with diabetes by 2045. Furthermore, non-communicable diseases (NCDs) are a substantial cause of mortality, responsible for roughly 63% of all deaths in the country, highlighting the critical need for effective and accessible treatments.

Foreign Direct Investment (FDI) and Partnerships

India's pharmaceutical sector is a magnet for foreign investment, with 100% FDI permitted through automatic approval for greenfield projects, signaling a welcoming environment for global players. This policy, in effect throughout 2024 and anticipated to continue into 2025, aims to boost domestic manufacturing and technological advancement.

Strategic alliances between Indian and international pharmaceutical companies are on the rise, fostering faster product launches and broader market access. These collaborations are crucial for navigating complex regulatory landscapes and leveraging diverse expertise.

Eris Lifesciences actively participates in this trend, exemplified by its strategic collaborations and acquisitions. For instance, partnerships like the one with Biocon Biologics are designed to bolster Eris's market presence and product portfolio, reflecting the broader industry's move towards consolidation and synergistic growth.

- FDI Inflow: India's pharmaceutical sector has consistently attracted significant FDI, with reports indicating substantial growth in the sector's FDI inflows in recent fiscal years leading up to 2024.

- Partnership Growth: The number of joint ventures and strategic partnerships in the Indian pharma industry has seen a steady increase, driven by the need for R&D collaboration and market expansion.

- Eris's Strategic Moves: Eris Lifesciences has been actively pursuing inorganic growth and strategic alliances to enhance its competitive edge and market penetration in key therapeutic areas.

Disposable Income and Health Insurance Penetration

Disposable income in India has seen a steady upward trend, with projections indicating continued growth. This rise directly impacts consumer spending on non-essential goods and services, including healthcare. As more households have greater discretionary funds, the ability to invest in personal well-being, such as health insurance and higher-quality pharmaceuticals, expands significantly.

Health insurance penetration in India is on the rise, though it still lags behind many developed nations. By the end of 2023, it was estimated that around 30-35% of the Indian population had some form of health insurance. This increasing coverage means a larger segment of the population can afford private healthcare services and branded generic medicines, which often represent higher-value products.

The confluence of rising disposable incomes and expanding health insurance coverage creates a more favorable market environment for companies like Eris Lifesciences. It translates into increased demand for their product portfolio, particularly branded generics that cater to a growing middle class seeking quality healthcare solutions. This trend is expected to bolster sales volumes and broaden market access for Eris Lifesciences in the coming years.

- Disposable income in India is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% between 2023 and 2028.

- Health insurance penetration in India reached an estimated 30-35% of the population by the end of 2023.

- Increased disposable income allows for greater spending on healthcare, including health insurance premiums and branded generic drugs.

- Growing health insurance coverage reduces out-of-pocket healthcare expenses, making quality treatments and medicines more accessible.

India's economic growth underpins the healthcare sector's expansion, with the market projected to reach $638 billion by 2025. This growth is further supported by a rising disposable income, expected to grow at a CAGR of around 6.5% between 2023 and 2028, enabling greater consumer spending on healthcare. Increased health insurance penetration, estimated at 30-35% by the end of 2023, also boosts affordability for quality treatments and medicines, creating a favorable market for companies like Eris Lifesciences.

| Economic Factor | 2024/2025 Projection/Data | Impact on Eris Lifesciences |

| Healthcare Market Size | $638 billion by 2025 | Significant growth opportunity for chronic disease management products. |

| Disposable Income Growth | ~6.5% CAGR (2023-2028) | Increased consumer spending capacity on healthcare and branded generics. |

| Health Insurance Penetration | 30-35% (end of 2023) | Enhanced affordability of private healthcare and Eris's product portfolio. |

| Medical Inflation | 13% rise projected for 2025 | Necessitates focus on affordable, high-quality solutions to maintain competitiveness. |

Full Version Awaits

Eris Lifesciences PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Eris Lifesciences PESTLE Analysis. This detailed report will equip you with insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Eris Lifesciences. You'll gain a strategic understanding of the external forces shaping the company's operations and future growth.

Sociological factors

India's rapid urbanization, with over 35% of its population now living in cities as of 2023, is profoundly altering dietary habits and activity levels. This shift is directly contributing to a surge in non-communicable diseases (NCDs), with the World Health Organization reporting that NCDs accounted for 65% of all deaths in India in 2022.

Consequently, conditions like diabetes, hypertension, and cardiovascular diseases are becoming more prevalent, particularly among the working-age population. This growing disease burden creates a substantial and expanding market for pharmaceutical companies like Eris Lifesciences, whose primary focus lies in addressing these very chronic health challenges.

Eris Lifesciences' established strength in its cardio-metabolic franchise, which saw a 15% year-on-year growth in FY23, is well-positioned to capitalize on this trend. The company's strategic expansion into other chronic therapy areas further aligns with the evolving health landscape, driven by these changing lifestyles.

Consumers are increasingly prioritizing their well-being, with a significant rise in health awareness and a strong leaning towards preventive healthcare measures. This shift in mindset is directly impacting purchasing decisions, encouraging proactive health management.

This growing emphasis on prevention and early detection translates into greater consumer engagement with healthcare solutions. For Eris Lifesciences, this means a potential for increased demand for their chronic disease management products as individuals seek to identify and address health issues sooner, leading to better treatment adherence.

India's demographic shift towards an older population is a significant driver for Eris Lifesciences. As of 2024, projections indicate a substantial increase in the elderly demographic, leading to a higher prevalence of chronic conditions like cardiovascular diseases and diabetes, which are key focus areas for Eris. This trend directly translates into sustained and growing demand for the company's pharmaceutical offerings, particularly in therapeutic segments catering to age-related ailments.

Access to Healthcare and Affordability

Despite significant progress, ensuring equitable access to quality healthcare throughout India remains a persistent challenge, especially in its vast rural regions. Eris Lifesciences' strategic emphasis on providing affordable branded generics directly addresses this societal imperative for accessible medical treatments.

However, effectively bridging the existing disparities in healthcare infrastructure and the availability of skilled medical professionals is paramount for broader impact. For instance, as of recent reports, the doctor-to-population ratio in India hovers around 1:1,500, significantly lower than the WHO recommendation of 1:1,000, highlighting infrastructure and human resource gaps.

- Healthcare Access Gaps: Rural areas often face shortages of doctors, specialists, and advanced medical facilities, impacting timely and quality care.

- Affordability Focus: Eris Lifesciences' business model targets the need for cost-effective medications, a critical factor for a large segment of the Indian population.

- Infrastructure Challenges: The ongoing need to strengthen primary healthcare centers and improve diagnostic capabilities in underserved regions remains a key societal concern.

- Skilled Workforce Development: Investing in training and retaining healthcare professionals, particularly in remote areas, is crucial for improving overall healthcare delivery.

Cultural Perceptions of Health and Medicine

Cultural beliefs about health significantly shape how people approach medical treatments. In India, for instance, traditional systems like Ayurveda and Unani remain influential, with a substantial portion of the population still relying on them. A 2023 report indicated that the Indian traditional medicine market was valued at approximately USD 10 billion, highlighting its continued relevance.

Eris Lifesciences, while focusing on modern pharmaceuticals, must navigate these deeply ingrained cultural perceptions. Successfully integrating or acknowledging these traditional practices in marketing and product development can foster greater trust and acceptance among consumers. For example, campaigns that highlight the scientific backing of modern medicine while respecting cultural health philosophies tend to resonate better.

The growing acceptance of modern medicine in India is evident, with the pharmaceutical market projected to reach USD 65 billion by 2024. However, this shift doesn't negate the importance of cultural sensitivity.

- Cultural Health Beliefs: Traditional medical systems like Ayurveda are widely used in India, influencing patient choices.

- Market Adaptation: Eris Lifesciences needs to align its strategies with local health perceptions for better product adoption.

- Marketing Strategies: Campaigns that bridge modern medicine with cultural respect can enhance brand acceptance.

- Market Growth vs. Tradition: While modern medicine is growing, understanding and respecting traditional practices remains crucial for market penetration.

India's demographic shift, with an increasing elderly population as of 2024, directly fuels demand for chronic disease management, a core area for Eris Lifesciences. This aligns with the growing prevalence of conditions like diabetes and cardiovascular diseases, key focus areas for the company.

Despite progress, significant healthcare access gaps persist, particularly in rural India, where doctor-to-population ratios remain below WHO recommendations. Eris Lifesciences' focus on affordable branded generics addresses this societal need for accessible treatments.

Cultural health beliefs, including the significant influence of traditional medicine valued at approximately USD 10 billion in 2023, shape consumer choices. Eris must navigate these perceptions, potentially by acknowledging or integrating traditional practices to build trust and acceptance.

| Sociological Factor | Impact on Eris Lifesciences | Supporting Data/Trend |

|---|---|---|

| Urbanization & NCDs | Increased demand for chronic disease management products. | Over 35% urban population (2023); 65% of deaths from NCDs (2022). |

| Aging Population | Sustained demand for age-related ailment treatments. | Projected increase in elderly demographic (2024). |

| Healthcare Access Gaps | Opportunity for affordable branded generics in underserved areas. | Doctor-to-population ratio ~1:1,500 (lower than WHO 1:1,000). |

| Cultural Health Beliefs | Need for culturally sensitive marketing and product integration. | Traditional medicine market valued at ~USD 10 billion (2023). |

Technological factors

Technological factors are significantly reshaping the pharmaceutical landscape. The integration of artificial intelligence (AI), advanced biotechnology, and digital health solutions is dramatically speeding up how new drugs are found and developed. This means faster innovation cycles and potentially more effective treatments reaching patients sooner.

Eris Lifesciences is actively embracing these technological shifts. The company's commitment to research and development, evidenced by its investments and the establishment of innovation labs focused on digital health, positions it to capitalize on these advancements. This strategic focus aims to drive the creation of novel product offerings and enhance existing ones.

Digital technologies are fundamentally reshaping how pharmaceutical companies operate, impacting everything from initial research and development to manufacturing, distribution, and how they interact with customers. For Eris Lifesciences, embracing these digital advancements, including generative AI, presents a significant opportunity to boost efficiency and refine data analysis capabilities. This digital shift is crucial for streamlining complex processes and staying competitive in the evolving healthcare landscape.

By integrating digital tools, Eris Lifesciences can achieve greater operational agility and unlock new insights from its data. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong market trend towards digital solutions. Leveraging these technologies can directly translate into improved decision-making and more effective resource allocation across the company's value chain.

The pharmaceutical industry, including Eris Lifesciences, is significantly influenced by advancements in manufacturing technologies and automation. The introduction of revised Schedule M in India, for instance, mandates higher manufacturing standards, pushing companies to adopt more sophisticated processes. This regulatory push, effective from December 2023 for existing drug manufacturers, emphasizes quality control and Good Manufacturing Practices (GMP).

Eris Lifesciences can leverage technologies like compressed air dryers, which are crucial for ensuring the stability and efficacy of pharmaceutical products by maintaining optimal moisture levels during manufacturing. Such technological upgrades are not just about compliance; they directly contribute to operational efficiency and product integrity, which are key competitive advantages in the pharmaceutical sector.

Telemedicine and Digital Health Platforms

The healthcare landscape is rapidly evolving with advancements in technology, making care more accessible and tailored to individual needs. Telemedicine and digital health platforms are at the forefront of this transformation, offering new avenues for patient engagement and treatment delivery. For Eris Lifesciences, this presents a significant opportunity.

Integrating with or partnering with these digital health solutions can help Eris Lifesciences broaden its market presence and enhance patient care, especially for individuals managing chronic conditions. For instance, the global telemedicine market was valued at approximately $112.6 billion in 2023 and is projected to grow substantially, reaching an estimated $660.5 billion by 2030, according to various market research reports. This growth underscores the increasing adoption and acceptance of remote healthcare services.

- Increased Patient Accessibility: Telemedicine platforms allow patients to consult with healthcare professionals remotely, overcoming geographical barriers and reducing the need for in-person visits.

- Personalized Chronic Disease Management: Digital health tools can facilitate continuous monitoring of patient vitals and adherence to treatment plans, enabling proactive interventions for chronic disease management.

- Data-Driven Insights: The data generated from digital health platforms can provide valuable insights into patient populations, treatment effectiveness, and market trends, informing Eris Lifesciences' product development and marketing strategies.

- Partnership Opportunities: Eris Lifesciences can explore strategic alliances with established telemedicine providers or digital health startups to leverage existing infrastructure and patient bases.

Data Analytics and Personalized Medicine

The pharmaceutical industry's embrace of data analytics and artificial intelligence is revolutionizing drug discovery and patient care. For instance, in 2024, the global big data analytics in healthcare market was valued at over $30 billion and is projected to grow significantly, enabling more efficient clinical trials and personalized treatment plans. Eris Lifesciences can harness these advancements to refine its strategies in lifestyle disorder management.

Leveraging AI and big data allows for the identification of patient subgroups most likely to respond to specific therapies, a critical component of personalized medicine. This data-driven approach can lead to more targeted drug development and improved patient outcomes, which is particularly relevant for Eris Lifesciences' focus on chronic conditions like diabetes and cardiovascular diseases.

The trend towards personalized medicine, fueled by technological advancements, presents a strategic opportunity for Eris Lifesciences. By integrating advanced analytics into its R&D and marketing efforts, the company can develop more effective, patient-centric solutions. This aligns with the growing demand for treatments tailored to individual genetic and lifestyle factors, a market segment expected to see substantial growth through 2025 and beyond.

- AI in drug discovery: Companies are using AI to accelerate the identification of potential drug candidates, reducing R&D timelines and costs.

- Big data in clinical trials: Real-world data analysis is improving trial design and patient recruitment, leading to faster regulatory approvals.

- Personalized medicine growth: The market for personalized medicine is expanding, driven by genetic sequencing and advanced diagnostics.

- Eris Lifesciences' opportunity: Utilizing these technologies can enhance Eris's ability to develop and deliver targeted therapies for lifestyle disorders.

Technological advancements are central to Eris Lifesciences' strategy, particularly in areas like AI-driven drug discovery and digital health solutions. The company's investments in innovation labs underscore its commitment to leveraging these technologies for faster development cycles and improved patient outcomes. By embracing digital transformation, Eris aims to enhance operational efficiency and gain deeper insights from data, positioning itself for sustained growth in the dynamic pharmaceutical market.

Legal factors

The Drugs and Cosmetics Act and its Rules, especially the updated Schedule M requiring Good Manufacturing Practices (GMP), are critical legal mandates for pharmaceutical firms in India. Eris Lifesciences must adhere to these rigorous quality standards across its manufacturing sites and operational procedures to ensure product integrity and avert regulatory repercussions.

The Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024, while not a direct government regulation, sets a benchmark for ethical conduct in the pharmaceutical sector. Eris Lifesciences, like its peers, is expected to align its marketing strategies with these principles, focusing on transparency and accountability to build trust with healthcare professionals and patients.

Adherence to the UCPMP is crucial for Eris Lifesciences to mitigate risks associated with misleading promotions or unethical inducements, which could lead to reputational damage and potential legal challenges. The industry's commitment to these guidelines, often monitored by self-regulatory bodies, underscores the importance of maintaining high standards in pharmaceutical marketing efforts.

Eris Lifesciences' research and development activities are steered by India's New Drugs and Clinical Trials Rules, 2019, and its subsequent amendments, which prioritize patient safety and data integrity. These regulations mandate the registration of Clinical Research Organizations, directly impacting how Eris manages its outsourced R&D partnerships.

Adherence to these evolving clinical trial regulations is crucial for Eris Lifesciences, as non-compliance can lead to significant delays or even halt product development. The company's strategic planning must account for the dynamic nature of these legal frameworks to ensure continued innovation and market access.

Patent Laws and Intellectual Property Rights

Changes to patent laws, like the recent amendments to the Indian Patent Rules in 2024 which tightened timelines for filing 'Requests for Examination' to 24 months from the date of filing the application, directly affect Eris Lifesciences' strategy for protecting its new drug formulations. These stricter regulations necessitate swift action to secure intellectual property, ensuring market exclusivity for its innovations. Failure to comply could jeopardize Eris Lifesciences' competitive edge in the pharmaceutical market.

Eris Lifesciences must navigate evolving intellectual property rights to maintain its market position. For instance, the ongoing global discussions around intellectual property waivers for essential medicines, particularly in light of potential future health crises, could influence the landscape of patent enforcement and licensing. Staying abreast of these developments is paramount for safeguarding its R&D investments.

- Stricter Filing Timelines: Amendments in 2024 mandate a 24-month window for filing 'Requests for Examination' for patent applications in India.

- Impact on Market Exclusivity: Timely patent protection is crucial for Eris Lifesciences to maintain exclusivity for its novel drug formulations.

- Global IP Landscape: Eris Lifesciences must monitor international trends in intellectual property rights, including potential waivers for essential medicines.

- Safeguarding R&D Investments: Effective IP management is vital to protect the significant investments made in research and development.

Acquisition and Merger Regulations

Eris Lifesciences' growth strategy heavily relies on acquisitions, such as its 2020 purchase of Biocon's branded formulations business for approximately $124 million and the earlier acquisition of Swiss Parenterals. These moves are meticulously reviewed under India's Competition Act, 2002, requiring approval from the Competition Commission of India (CCI) to ensure no adverse impact on market competition.

Navigating these merger and acquisition regulations is crucial for Eris. For instance, the CCI's approval process involves assessing market share, potential for market dominance, and the overall impact on consumers. Failure to comply can lead to significant penalties and hinder strategic expansion plans, underscoring the importance of robust legal due diligence and regulatory engagement.

- Regulatory Approvals: Acquisitions like the Biocon formulations deal necessitate clearance from the Competition Commission of India (CCI).

- Competition Law Compliance: Eris must adhere to provisions of the Competition Act, 2002, to prevent anti-competitive practices post-acquisition.

- Strategic Integration: Understanding and managing regulatory hurdles are vital for the smooth integration of acquired assets and achieving synergy benefits.

- Market Impact Assessment: The CCI evaluates the potential impact of mergers on market dynamics and consumer welfare before granting approval.

Eris Lifesciences operates within a stringent legal framework governing pharmaceutical operations in India. Compliance with the Drugs and Cosmetics Act and its Rules, including updated Good Manufacturing Practices (GMP), is paramount for product quality and avoiding penalties. The company must also align its marketing practices with the Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 to ensure ethical conduct and maintain stakeholder trust.

The company's R&D activities are guided by the New Drugs and Clinical Trials Rules, 2019, emphasizing patient safety and data integrity, impacting how Eris manages outsourced research. Furthermore, Eris must navigate evolving intellectual property laws, such as the 2024 amendments to Indian Patent Rules tightening filing timelines, to protect its innovations and secure market exclusivity.

Mergers and acquisitions, a key growth strategy for Eris Lifesciences, are subject to scrutiny under the Competition Act, 2002, requiring approval from the Competition Commission of India (CCI) to prevent anti-competitive practices. For example, the acquisition of Biocon's branded formulations business in 2020 underwent this regulatory review.

| Legal Area | Key Regulations/Codes | Eris Lifesciences Impact | 2024/2025 Relevance |

|---|---|---|---|

| Manufacturing & Quality | Drugs and Cosmetics Act & Rules (Schedule M - GMP) | Ensures product integrity, avoids penalties | Ongoing compliance with updated GMP standards |

| Marketing & Ethics | Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 | Promotes transparency, builds trust | Adherence to ethical promotion guidelines |

| Research & Development | New Drugs and Clinical Trials Rules, 2019 | Patient safety, data integrity, CRO registration | Managing outsourced R&D partnerships |

| Intellectual Property | Indian Patent Rules (2024 Amendments) | Secures market exclusivity, protects R&D investments | Swift action on 'Requests for Examination' (24-month window) |

| Competition & M&A | Competition Act, 2002 (CCI Approval) | Ensures fair market competition post-acquisition | Regulatory review for strategic expansion |

Environmental factors

Pharmaceutical manufacturing, including that of Eris Lifesciences, inherently produces diverse waste streams, notably chemical and hazardous byproducts. Strict adherence to environmental regulations concerning waste disposal and pollution control is paramount for minimizing ecological impact. For instance, India's Central Pollution Control Board (CPCB) mandates specific guidelines for hazardous waste management, which companies like Eris must follow to ensure responsible operations.

The pharmaceutical sector, including Eris Lifesciences, faces significant environmental pressures due to its reliance on water and energy for manufacturing. In 2023, the global pharmaceutical industry's water consumption was estimated to be in the billions of liters annually, with energy usage also being substantial to power complex production facilities and maintain sterile environments.

Eris Lifesciences, like its peers, must prioritize sustainable resource management. For instance, adopting advanced water recycling technologies could drastically cut consumption, and investing in renewable energy sources, such as solar power for its manufacturing plants, can mitigate its carbon footprint and operational costs, aligning with increasing investor and regulatory expectations for environmental stewardship in 2024 and beyond.

The environmental impact of Eris Lifesciences’ operations stretches across its entire supply chain, from the initial sourcing of raw materials to the final delivery of products. This includes the footprint associated with packaging materials and transportation logistics. Considering the growing global emphasis on sustainability, Eris Lifesciences is increasingly expected to manage and mitigate these upstream and downstream environmental effects.

In 2024, the pharmaceutical industry, including companies like Eris Lifesciences, faced heightened scrutiny regarding its supply chain's carbon emissions. For instance, the transportation of finished goods alone can contribute significantly to a company's overall environmental footprint. Exploring options like greener logistics partners or optimizing distribution routes are becoming critical strategic considerations for companies aiming to reduce their environmental impact.

Climate Change and Operational Resilience

Climate change presents significant environmental challenges for Eris Lifesciences, particularly concerning operational resilience. Extreme weather events, such as unseasonal monsoons or heatwaves, can directly impact the company's manufacturing facilities and, crucially, its pharmaceutical supply chains. For instance, disruptions in raw material sourcing due to floods or droughts could lead to production delays and increased costs, affecting product availability for patients.

Eris Lifesciences must proactively assess and strengthen its resilience against these environmental risks to ensure business continuity. This involves understanding the vulnerability of its key manufacturing sites and distribution networks to climate-related hazards. Building robust contingency plans and diversifying supply sources are essential steps to mitigate potential impacts.

In 2023, India, Eris Lifesciences' primary market, experienced varied weather patterns, including delayed monsoon onset in some regions and unseasonal rains in others, highlighting the real-time impact of climate variability on agricultural output, which can indirectly affect pharmaceutical raw material availability. The company's ability to adapt its logistics and sourcing strategies in response to such environmental shifts will be critical for maintaining stable operations and meeting market demand throughout 2024 and into 2025.

To enhance operational resilience against climate change, Eris Lifesciences could consider the following:

- Supply Chain Diversification: Reducing reliance on single geographical sources for critical raw materials to buffer against localized extreme weather events.

- Infrastructure Hardening: Investing in climate-resilient infrastructure for manufacturing plants and warehouses to withstand potential impacts of floods, storms, or heatwaves.

- Inventory Management: Optimizing inventory levels for key finished products and raw materials to manage short-term supply disruptions.

- Climate Risk Assessment: Conducting regular, detailed assessments of climate-related risks across the entire value chain to inform strategic planning and mitigation efforts.

Sustainability Reporting and ESG Compliance

There's a significant push for companies like Eris Lifesciences to be more transparent about their environmental impact and overall sustainability efforts. This means more detailed reporting on how they manage resources, reduce waste, and contribute positively to the environment.

Meeting these evolving stakeholder expectations and upcoming regulatory demands is becoming crucial. For instance, as of early 2024, many global markets are seeing increased scrutiny on carbon emissions and water usage, with disclosure requirements becoming more stringent.

Eris Lifesciences will likely need to showcase its commitment to ESG principles, which could involve investing in greener manufacturing processes or developing more sustainable product packaging. This focus on sustainability reporting is not just about compliance; it's about building trust and long-term value.

- Increased Investor Demand: A growing number of investors, particularly those focused on long-term growth, are prioritizing companies with strong ESG credentials. For example, ESG-focused funds saw significant inflows in 2023, indicating a clear trend.

- Regulatory Evolution: Governments worldwide are introducing or strengthening regulations around environmental disclosures. India, for example, has been progressively enhancing its Business Responsibility and Sustainability Reporting (BRSR) framework.

- Stakeholder Expectations: Consumers, employees, and the wider community are increasingly holding corporations accountable for their environmental and social impact, pushing for greater transparency and action.

Environmental factors significantly influence Eris Lifesciences, demanding careful management of waste, water, and energy. The company must navigate strict pollution control norms, like those set by India's CPCB, to handle diverse waste streams responsibly.

The pharmaceutical sector's substantial water and energy usage presents a key environmental challenge. Eris Lifesciences' commitment to sustainable resource management, including water recycling and renewable energy adoption, is crucial for mitigating its carbon footprint and meeting 2024/2025 expectations.

Climate change impacts operational resilience, with extreme weather events potentially disrupting Eris Lifesciences' supply chains and manufacturing. Proactive risk assessment and diversification are vital for business continuity in the face of climate variability, as seen with India's weather patterns in 2023.

Increased transparency and ESG reporting are becoming paramount for Eris Lifesciences, driven by investor demand and evolving regulations like India's BRSR framework. Demonstrating strong environmental stewardship is key to building trust and long-term value in 2024 and beyond.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eris Lifesciences is built upon a comprehensive review of official government publications, reputable financial news outlets, and leading healthcare industry reports. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable information.