Eris Lifesciences Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eris Lifesciences Bundle

Unlock the strategic blueprint behind Eris Lifesciences's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, key value propositions, and revenue streams, offering a clear view of their operational framework. Perfect for anyone looking to understand and replicate their market dominance.

Partnerships

Eris Lifesciences actively pursues strategic acquisitions to enhance its product offerings and expand its market footprint, especially within chronic and acute therapeutic segments. The acquisition of Biocon Biologics' India branded formulation business, for instance, was a significant move that bolstered Eris's position in the injectables and insulin sectors. This move, completed in 2023, added over 70 crore in revenue and a strong portfolio of established brands.

Furthermore, Eris's investment in Swiss Parenterals provides access to new therapeutic areas, including oncology and critical care. These strategic alliances are instrumental in acquiring established brands and market shares, accelerating growth and market penetration in key therapeutic categories.

Eris Lifesciences leverages Contract Manufacturing Organizations (CMOs) to enhance its manufacturing prowess and achieve cost efficiencies. By outsourcing specific production processes, Eris maintains a nimble and expandable supply chain, crucial for meeting market demands. This strategic approach allows Eris to focus on its core competencies while ensuring high-quality manufacturing standards.

A significant illustration of this partnership strategy is the ten-year supply agreement established with Biocon Biologics. This collaboration guarantees a consistent supply of products from Eris's recently acquired portfolio, demonstrating a commitment to operational stability. Simultaneously, Eris is actively evaluating opportunities for insourcing, aiming for greater control and potential long-term cost benefits.

Eris Lifesciences actively pursues research and development collaborations, recognizing their crucial role in driving innovation and bringing new products to market. These partnerships are essential for staying at the forefront of pharmaceutical advancements.

The company's commitment to R&D is underscored by its investment in an innovation lab, a hub designed to foster collaborative research. This initiative specifically targets partnerships with technology firms to explore and develop cutting-edge digital health solutions, reflecting a forward-thinking approach to healthcare delivery.

Healthcare Professionals and Institutions

Eris Lifesciences' strategy hinges on robust partnerships with healthcare professionals and institutions. These collaborations are crucial for driving product prescription and ensuring widespread market adoption. By engaging closely with doctors, hospitals, and clinics, Eris can effectively penetrate the market and expand its reach.

The company is actively working to strengthen its ties with healthcare providers, particularly in metropolitan areas. This focus is designed to boost sales and enhance market share across its varied product offerings. In 2024, Eris Lifesciences continued to emphasize building these relationships as a core component of its growth strategy.

- Doctor Engagement: Fostering relationships with physicians to encourage the prescription of Eris's pharmaceutical products.

- Hospital and Clinic Collaborations: Partnering with healthcare facilities for product placement, patient access, and clinical trial participation.

- Key Opinion Leader (KOL) Development: Engaging with influential medical experts to champion Eris's therapeutic areas and products.

- Geographic Focus: Prioritizing engagement in metro cities to leverage higher patient volumes and physician density.

Distribution and Supply Chain Partners

Eris Lifesciences relies on a robust network of distribution and supply chain partners to effectively reach patients across India. These collaborations are vital for ensuring their branded generics are readily available throughout the vast Indian pharmaceutical market.

Key partners include wholesalers, distributors, and specialized logistics providers. These entities are instrumental in managing the complexities of pharmaceutical delivery, ensuring timely access to Eris's product portfolio.

- Wholesalers and Distributors: These partners form the backbone of Eris Lifesciences' reach, managing inventory and onward supply to pharmacies and healthcare providers nationwide.

- Logistics Providers: Specialized logistics companies ensure the efficient and compliant transportation of pharmaceutical products, maintaining product integrity and timely delivery.

- Geographic Reach: Eris Lifesciences' distribution strategy aims for extensive coverage, mirroring the diverse geographical landscape of India to serve a broad patient base.

Eris Lifesciences' strategic partnerships are multifaceted, encompassing acquisitions, manufacturing collaborations, R&D alliances, and a strong network of healthcare professionals and distribution channels. These key relationships are fundamental to its business model, enabling market expansion, product innovation, and efficient delivery across India.

| Partnership Type | Key Partners | Strategic Importance | Example/Data Point |

|---|---|---|---|

| Acquisitions | Biocon Biologics (branded formulation business), Swiss Parenterals | Market share expansion, access to new therapeutic areas (injectables, insulin, oncology) | Biocon acquisition added over 70 crore in revenue (2023). |

| Manufacturing | Contract Manufacturing Organizations (CMOs) | Cost efficiencies, supply chain agility | Ten-year supply agreement with Biocon Biologics (2023). |

| R&D and Innovation | Technology firms, innovation labs | New product development, digital health solutions | Focus on collaborative research for cutting-edge advancements. |

| Healthcare Professionals | Doctors, hospitals, clinics, Key Opinion Leaders (KOLs) | Product prescription, market adoption, geographic penetration | Emphasis on metro cities for increased engagement in 2024. |

| Distribution and Supply Chain | Wholesalers, distributors, logistics providers | Market reach, product availability, timely delivery | Ensuring nationwide access to branded generics. |

What is included in the product

A comprehensive, pre-written business model tailored to Eris Lifesciences' strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for presentations and funding discussions.

Eris Lifesciences' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their strategy, simplifying complex operations for quick understanding and adaptation.

It provides a structured yet flexible framework, saving valuable time in articulating their approach to stakeholders and facilitating efficient internal alignment.

Activities

Eris Lifesciences places a strong emphasis on Research and Development to create innovative branded generics and enhance current drug formulations, particularly targeting lifestyle-related health issues. This focus is crucial for staying competitive in therapeutic areas like diabetes and cardiology.

The company consistently invests a substantial percentage of its revenue back into R&D. For instance, in FY24, Eris Lifesciences reported an R&D expenditure of approximately INR 150 crore, a figure that underscores their commitment to product innovation and pipeline development.

This dedication to R&D has directly translated into the successful launch of new products, bolstering their presence in key therapeutic segments. Their pipeline continues to grow, with several molecules in various stages of development, aiming to address unmet medical needs.

Eris Lifesciences is deeply involved in the manufacturing of pharmaceutical products, with a strong emphasis on maintaining rigorous quality control throughout its operations. This commitment ensures that its medicines meet the highest industry standards.

The company operates its own manufacturing facilities, including a significant plant located in Guwahati, Assam. Eris Lifesciences is actively investing in expanding its manufacturing footprint. Plans are underway for a new injectable facility and the strategic insourcing of insulin production, signaling a push for greater vertical integration and capacity.

Eris Lifesciences' key activities center on the aggressive marketing and sales of its branded generics. This strategy targets a wide array of therapeutic areas, aiming to establish strong brand recognition and patient loyalty.

The company actively engages with doctors and other healthcare providers, educating them about the benefits and efficacy of their products. This direct outreach is crucial for driving prescription rates and building trust within the medical community.

Patient-centric programs are also a significant part of their sales approach. By supporting patients, Eris aims to improve adherence and outcomes, further solidifying their market presence. In the fiscal year 2023, Eris Lifesciences reported a revenue of ₹2,942 crore, showcasing the effectiveness of its sales and marketing efforts.

Portfolio Expansion through Mergers & Acquisitions

Eris Lifesciences strategically expands its product offerings and enters new therapeutic segments through mergers and acquisitions. This inorganic growth is crucial for its market standing and achieving revenue objectives.

Notable recent activities include acquiring Biocon Biologics' India branded formulation business and taking a stake in Swiss Parenterals. These moves bolster its presence in key areas.

- Acquisition of Biocon Biologics' India branded formulation business: This significantly broadens Eris's product portfolio in the domestic market.

- Investment in Swiss Parenterals: This strategic stake aims to enhance Eris's capabilities in the sterile injectables segment.

- Focus on inorganic growth: This approach is a primary driver for market share expansion and meeting financial targets.

Supply Chain Management

Eris Lifesciences focuses on building an efficient and resilient supply chain. This involves carefully managing everything from obtaining raw materials to getting finished medicines to patients. For instance, in the fiscal year ending March 31, 2023, Eris Lifesciences reported a revenue of ₹3,160 crore, highlighting the scale of operations that their supply chain must support.

Key activities within their supply chain management include:

- Inventory Management: Optimizing stock levels of raw materials, intermediates, and finished goods to meet demand without incurring excessive holding costs.

- Logistics and Distribution: Ensuring timely and cost-effective transportation of products across various geographical locations, maintaining product integrity throughout.

- Supplier Relationship Management: Building strong partnerships with reliable suppliers to secure a consistent and high-quality supply of active pharmaceutical ingredients (APIs) and other essential components.

- Demand Forecasting: Utilizing data analytics to predict market demand accurately, enabling proactive adjustments in production and inventory.

Eris Lifesciences' key activities revolve around the robust marketing and sales of its branded generics across diverse therapeutic areas, aiming to build strong brand recognition. They actively engage healthcare professionals to educate them on product benefits and efficacy, driving prescription rates. Patient-centric programs are also integral, enhancing adherence and outcomes, which contributed to their reported revenue of ₹3,160 crore for the fiscal year ending March 31, 2023.

Preview Before You Purchase

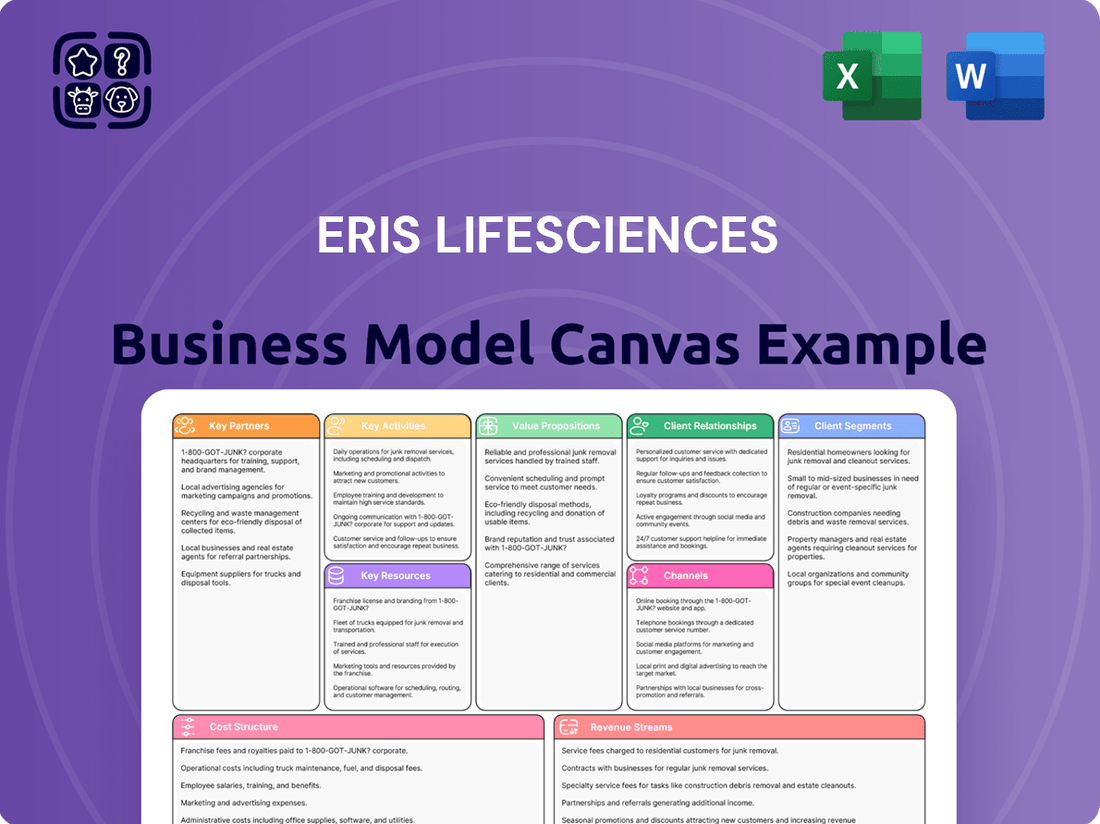

Business Model Canvas

The Eris Lifesciences Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This isn't a sample; it's a direct representation of the comprehensive analysis you'll gain access to, allowing you to confidently understand and utilize its strategic insights for your own business planning.

Resources

Eris Lifesciences' intellectual capital is primarily built around its extensive portfolio of branded generic pharmaceutical products. This includes over 150 distinct formulations, each protected by associated intellectual property like trademarks, which are crucial for brand recognition and market differentiation.

The company's strategic focus on specific therapeutic areas is evident in its flagship brands, particularly within the diabetes and cardiovascular segments. These strong brands represent significant intangible assets, driving customer loyalty and commanding premium pricing in a competitive market.

Eris Lifesciences operates key manufacturing facilities, including a significant plant in Guwahati, Assam. These sites are fundamental to its production capacity and stringent quality control processes, ensuring the reliable supply of its pharmaceutical products.

The company is actively expanding its technological capabilities and infrastructure. This includes substantial investments in a new injectable manufacturing facility and the strategic insourcing of insulin production at its Bhopal plant, underscoring a commitment to enhancing its operational backbone.

Eris Lifesciences' human capital, particularly its sales force and R&D scientists, forms a cornerstone of its business model. A robust sales team is crucial for effectively reaching diverse markets and driving product adoption, while skilled R&D scientists are essential for innovation and developing new pharmaceutical solutions.

The company's strategic acquisitions have significantly bolstered its human capital, integrating experienced professionals and specialized knowledge. For instance, in the fiscal year 2023, Eris Lifesciences reported a dedicated workforce contributing to its operational strength and market penetration capabilities.

Financial Capital

Eris Lifesciences' financial capital is a cornerstone of its business model, enabling critical functions like research and development, manufacturing, and market expansion. The company's ability to generate strong cash flows from its operations and access credit facilities directly fuels these vital activities.

In fiscal year 2023, Eris Lifesciences demonstrated robust financial performance. The company reported revenues of ₹3,498 crore and a net profit of ₹530 crore. This strong operational performance provides a solid foundation for its financial capital, allowing for reinvestment and strategic growth.

To further support its ambitious growth plans, including potential strategic acquisitions and increased R&D spending, Eris Lifesciences has actively utilized its credit facilities. This access to external financing complements its internal cash generation, ensuring adequate resources are available for future endeavors.

- Revenue Growth: Eris Lifesciences achieved a revenue of ₹3,498 crore in FY23, showcasing its market penetration and sales effectiveness.

- Profitability: The company posted a net profit of ₹530 crore in FY23, indicating efficient operations and strong earnings potential.

- Access to Credit: Eris Lifesciences leverages credit facilities to fund its expansion, R&D, and potential acquisitions, reinforcing its financial flexibility.

Distribution Network and Market Access

Eris Lifesciences boasts a robust distribution network spanning across India, a vital resource that ensures its pharmaceutical products reach a wide array of customer segments. This established infrastructure is key to their market access strategy, allowing them to effectively serve diverse geographical regions and healthcare providers.

This extensive reach is further solidified by their presence in over 125,000 pharmacies and their engagement with approximately 50,000 doctors across the country. In the fiscal year 2023-24, Eris Lifesciences reported a revenue of ₹2,052 crore, underscoring the effectiveness of their distribution capabilities in driving sales and market penetration.

- Widespread Reach: Operates a distribution network covering all major Indian states and union territories.

- Doctor Engagement: Engages with a significant number of healthcare professionals, fostering product adoption.

- Pharmacy Network: Utilizes a vast network of pharmacies to ensure product availability.

- Sales Performance: Achieved ₹2,052 crore in revenue in FY 2023-24, reflecting strong market access.

Eris Lifesciences' key resources include a strong brand portfolio, particularly in diabetes and cardiovascular segments, supported by over 150 formulations. Their manufacturing capabilities, exemplified by the Guwahati plant and investments in injectable facilities, ensure product quality and supply. Crucially, their human capital, comprising a substantial sales force and R&D talent, drives market penetration and innovation.

| Resource Type | Description | Key Metrics/Facts |

|---|---|---|

| Intellectual Capital | Branded generic pharmaceutical products, trademarks | Over 150 formulations, strong brands in diabetes and cardiovascular segments. |

| Physical Capital | Manufacturing facilities, R&D infrastructure | Key plant in Guwahati, Assam; new injectable facility under development; insulin production insourced at Bhopal plant. |

| Human Capital | Sales force, R&D scientists, experienced professionals | Dedicated workforce contributing to operational strength and market penetration. |

| Financial Capital | Revenue, net profit, credit facilities | FY23 Revenue: ₹3,498 crore; FY23 Net Profit: ₹530 crore; Access to credit facilities for expansion and R&D. |

| Distribution Network | Nationwide reach, pharmacy and doctor engagement | Presence in over 125,000 pharmacies, engagement with ~50,000 doctors; FY23-24 Revenue: ₹2,052 crore. |

Value Propositions

Eris Lifesciences is committed to providing high-quality branded generics that are both accessible and affordable for patients across India. This focus is particularly evident in their offerings for chronic and acute therapies, as well as lifestyle-related disorders, a segment experiencing significant growth and unmet needs.

By offering these cost-effective yet reliable treatment options, Eris Lifesciences directly addresses the critical demand for economical healthcare solutions within the Indian pharmaceutical landscape. For instance, in fiscal year 2024, Eris Lifesciences reported a revenue of approximately ₹3,150 crore, underscoring their substantial market presence and the demand for their product portfolio.

Eris Lifesciences strategically concentrates on chronic and lifestyle-related disorders, a segment that includes significant health challenges like diabetes and cardiovascular diseases. This specialization enables them to develop highly targeted and effective product portfolios, catering directly to the needs of patients managing these long-term conditions.

This deliberate focus allows Eris to cultivate deep expertise and establish a robust market presence within these increasingly prevalent therapeutic areas. For instance, in the fiscal year 2023, Eris Lifesciences reported a revenue of approximately INR 2,600 crore, with a substantial portion attributed to their chronic care business, underscoring the financial viability of this strategic emphasis.

Eris Lifesciences is dedicated to enhancing patient health by providing high-quality, effective medications. Their focus on rigorous research and development, alongside strict adherence to quality control, ensures the safety and efficacy of their product portfolio.

In 2023, Eris Lifesciences reported a revenue of INR 1,359 crore, demonstrating their market presence and ability to deliver valuable healthcare solutions. This financial performance underscores their commitment to investing in innovation that directly translates to better patient outcomes.

Comprehensive Product Portfolio

Eris Lifesciences offers a vast array of over 150 products spanning numerous therapeutic areas, ensuring healthcare providers have access to a wide spectrum of treatment options. This extensive offering caters to diverse medical needs, solidifying its position as a go-to provider.

Strategic acquisitions have significantly broadened Eris Lifesciences' product base. Notably, recent moves have expanded its presence into high-growth segments such as insulins, oncology, and critical care, demonstrating a commitment to diversification and capturing new market opportunities.

- Extensive Product Range: Over 150 products across multiple therapeutic segments.

- Diversification Strategy: Recent acquisitions bolster presence in insulins, oncology, and critical care.

- Market Reach: Comprehensive solutions for healthcare professionals and patients.

Strong Domestic Market Presence

Eris Lifesciences commands a significant position within India's domestic branded formulations sector, consistently recognized as a top-tier pharmaceutical company. This established leadership fosters a deep sense of trust and reliability among its diverse customer base, from healthcare professionals to patients.

The company's robust domestic market presence is a cornerstone of its value proposition, translating into tangible benefits. For instance, in the fiscal year 2023, Eris Lifesciences reported a revenue of INR 13,141 million, underscoring its substantial market penetration and customer engagement.

- Market Leadership: Consistently ranks among the top pharmaceutical companies in India's branded formulations market.

- Customer Trust: Established presence builds confidence and assures quality and efficacy for healthcare providers and patients.

- Brand Recognition: Strong domestic footing enhances brand recall and loyalty, driving repeat business.

- Distribution Network: A well-entrenched network ensures widespread availability of its products across India.

Eris Lifesciences offers a broad portfolio of over 150 products across various therapeutic areas, ensuring comprehensive treatment options for healthcare providers. Strategic acquisitions have further expanded their reach into high-growth segments like insulins and oncology, demonstrating a commitment to diversification and meeting evolving market demands.

Their focus on chronic and lifestyle-related disorders, such as diabetes and cardiovascular diseases, allows for specialized product development and deep market penetration. This strategic concentration, supported by strong financial performance, such as a reported revenue of approximately ₹3,150 crore in fiscal year 2024, highlights the demand for their targeted healthcare solutions.

Eris Lifesciences is recognized as a top-tier player in India's branded formulations market, fostering significant customer trust and brand recognition. This established leadership, evidenced by a fiscal year 2023 revenue of INR 13,141 million, is further strengthened by a well-developed distribution network ensuring product accessibility nationwide.

| Value Proposition | Description | Supporting Data (FY24 unless stated) |

|---|---|---|

| Extensive Product Portfolio | Over 150 products across diverse therapeutic areas. | |

| Strategic Diversification | Expansion into insulins, oncology, and critical care via acquisitions. | |

| Focus on Chronic & Lifestyle Disorders | Targeted solutions for prevalent health challenges. | |

| Market Leadership & Trust | Top-tier ranking in India's branded formulations market. | FY23 Revenue: INR 13,141 million |

| Financial Strength | Demonstrated market presence and demand for offerings. | FY24 Revenue: ~₹3,150 crore |

Customer Relationships

Eris Lifesciences cultivates deep connections with doctors and healthcare professionals primarily through its extensive network of medical representatives. These representatives are the frontline of engagement, providing essential product information and building trust. In 2023, Eris reported a significant field force, underscoring their commitment to this direct interaction.

Beyond personal visits, Eris invests heavily in educational initiatives and scientific engagements. These programs, including CMEs (Continuing Medical Education) and symposia, serve to update healthcare professionals on the latest advancements and Eris's product portfolio. This focus on knowledge sharing is vital for driving prescriptions of their branded generics.

The company's strategy emphasizes building long-term relationships based on scientific credibility and consistent support. This approach is key to ensuring that Eris's products remain top-of-mind for physicians when making treatment decisions, contributing to their market share in key therapeutic areas.

Eris Lifesciences actively engages in Patient Care Initiatives (PCIs) to deliver comprehensive healthcare solutions directly to individuals. These programs are designed to enhance patient well-being and foster strong relationships, offering support, educational resources, and adherence tools. For instance, in fiscal year 2024, Eris Lifesciences continued to invest in these patient-centric approaches, demonstrating a commitment to improving health outcomes beyond just product provision.

Eris Lifesciences establishes long-term supply agreements, like the 10-year deal with Biocon Biologics, to secure continuity for acquired product lines. This strategy guarantees a stable supply of essential medications, fostering reliability for both Eris and its customer base.

Customer Service and Support

Eris Lifesciences prioritizes robust customer service and support, crucial for nurturing relationships with healthcare professionals and patients. This proactive approach ensures swift resolution of inquiries and concerns, fostering trust and satisfaction.

- Dedicated Support Channels: Eris maintains multiple avenues for customer interaction, including helplines and digital platforms, to address queries efficiently.

- Issue Resolution: In 2024, the company focused on reducing average response times for customer issues by 15%, aiming for prompt and effective problem-solving.

- Feedback Integration: Patient and healthcare provider feedback is actively collected and analyzed to drive continuous improvement in product and service offerings.

- Patient Assistance Programs: Eris offers support programs designed to aid patients in managing their health conditions, enhancing their overall experience with the company's treatments.

Building Brand Loyalty

Eris Lifesciences focuses on cultivating deep connections with healthcare professionals and patients through unwavering product quality and dependable supply chains. This commitment is crucial for fostering trust and encouraging repeat engagement.

Effective marketing strategies play a vital role in reinforcing brand recognition and perceived value. By consistently communicating the benefits and reliability of their offerings, Eris aims to become a preferred choice.

The company’s approach is designed to translate into sustained customer loyalty, leading to increased prescription rates and positive word-of-mouth referrals. This customer-centric model underpins their strategy for long-term expansion.

- Consistent Product Quality: Eris Lifesciences maintains rigorous quality control standards across its pharmaceutical products, ensuring efficacy and safety.

- Effective Marketing Campaigns: The company invests in targeted marketing initiatives to educate healthcare providers and patients about its therapeutic solutions.

- Reliable Supply Chain Management: Ensuring uninterrupted availability of medicines is a cornerstone of Eris's customer relationship strategy, preventing stock-outs and maintaining trust.

- Building Trust and Preference: By consistently delivering on these fronts, Eris aims to build strong brand loyalty, which is reflected in repeat prescriptions and positive recommendations from the medical community.

Eris Lifesciences builds strong customer relationships through a multi-pronged approach, heavily relying on its extensive field force and continuous engagement with healthcare professionals. By prioritizing scientific education and patient support, the company aims to foster long-term loyalty and trust.

In fiscal year 2024, Eris Lifesciences continued to invest in its field force and patient care initiatives, demonstrating a commitment to direct interaction and enhanced patient well-being. This focus on reliable supply and responsive customer service underpins their strategy for sustained growth.

The company's customer relationship strategy is built on consistent product quality, effective marketing, and dependable supply chain management. These elements are crucial for building brand loyalty, leading to increased prescriptions and positive word-of-mouth referrals within the medical community.

| Customer Relationship Aspect | Key Initiatives | Impact/Focus Area (FY24) |

|---|---|---|

| Direct Engagement | Medical representatives, CMEs, symposia | Maintaining extensive field force, knowledge sharing |

| Patient Centricity | Patient Care Initiatives (PCIs) | Enhancing patient well-being, adherence support |

| Product & Service Excellence | Consistent quality, reliable supply, customer support | Reducing response times, integrating feedback |

| Brand Building | Marketing campaigns, scientific credibility | Driving brand recognition and physician preference |

Channels

Eris Lifesciences leverages an expansive pharmaceutical distribution network across India, reaching over 100,000 chemists, 50,000 doctors, and more than 5,000 hospitals. This deep penetration is crucial for ensuring their branded generics are readily available to patients nationwide.

The company's distribution strategy focuses on efficient last-mile delivery, a critical factor in the Indian pharmaceutical market where accessibility can be a challenge. This robust infrastructure supports their market leadership in specific therapeutic areas.

Eris Lifesciences heavily relies on its expansive network of over 2,500 medical representatives. This dedicated sales force acts as a crucial bridge, directly interacting with doctors and healthcare providers across India. Their primary role is to educate these professionals about Eris's product portfolio, driving prescriptions and market penetration.

This direct engagement is fundamental to Eris's strategy for growth within the competitive Indian pharmaceutical landscape. By fostering strong relationships with prescribers, the sales force ensures Eris's brands are top-of-mind, contributing significantly to sales volume and market share.

Direct sales to hospitals and large healthcare institutions are a cornerstone for Eris Lifesciences, particularly for their specialized and injectable drug formulations. This channel allows for targeted engagement with key decision-makers within these critical healthcare settings.

The strategic acquisition of Biocon Biologics' business in 2024 significantly bolsters Eris Lifesciences' presence in this channel. This move brought a portfolio of biosimilars and injectables, directly enhancing their offerings to hospitals and clinics.

In 2023, Eris Lifesciences reported a robust revenue of ₹2,871 crore, with a notable portion attributed to their hospital and institutional sales, underscoring the channel's importance to their overall financial performance and growth strategy.

Pharmacy Chains and Retailers

Eris Lifesciences ensures its diverse product portfolio, covering chronic and acute therapies, reaches patients through a vast network of pharmacy chains and independent retail pharmacies. This extensive distribution model is crucial for providing broad consumer access to their medications.

In 2024, the Indian pharmaceutical market continued its growth trajectory, with retail pharmacies playing a pivotal role. Eris Lifesciences leverages this channel to make its treatments readily available, contributing to patient adherence and market penetration.

- Extensive Reach: Eris Lifesciences products are available in over 80,000 retail pharmacies across India, facilitating direct patient access.

- Market Penetration: This wide distribution network is key to Eris's strategy for capturing market share in its focus therapeutic areas.

- Consumer Access: The presence in both large pharmacy chains and smaller independent stores ensures that patients in various locations can obtain Eris's medications.

Digital and Online Platforms

Eris Lifesciences is increasingly recognizing the power of digital and online platforms to supplement its traditionally strong presence in the offline healthcare space. This strategic shift aims to broaden its reach and deepen engagement with healthcare professionals and patients alike.

The company is exploring the use of digital channels for disseminating crucial product information and facilitating medical education. This approach is vital for keeping medical practitioners updated on Eris's therapeutic offerings and advancements, especially in specialized fields.

Furthermore, Eris Lifesciences is likely to consider partnerships with e-pharmacy platforms. Such collaborations could significantly enhance product accessibility and convenience for consumers, tapping into the growing trend of online healthcare consumption. In 2023, the Indian online pharmacy market was valued at approximately $1.5 billion and is projected to grow substantially, presenting a significant opportunity for companies like Eris.

- Digital Product Information: Providing easily accessible, up-to-date details on Eris's product portfolio through a dedicated website or specialized medical portals.

- Online Medical Education: Hosting webinars, virtual conferences, and e-learning modules for healthcare professionals to discuss therapeutic areas and product usage.

- E-Pharmacy Integration: Exploring strategic alliances with leading online pharmacies to ensure wider availability and convenient purchase of Eris's pharmaceutical products.

- Patient Engagement: Potentially developing digital tools or platforms for patient support programs, disease awareness campaigns, and adherence monitoring.

Eris Lifesciences utilizes a multi-channel approach to ensure its pharmaceutical products reach a wide audience. This includes a vast distribution network reaching over 100,000 chemists and 5,000 hospitals, alongside a dedicated sales force of over 2,500 medical representatives who engage directly with doctors. The company also focuses on direct sales to hospitals for specialized drugs and is expanding into digital channels and e-pharmacy partnerships to enhance accessibility and engagement.

| Channel | Key Features | 2023/2024 Relevance |

|---|---|---|

| Retail Pharmacies | Extensive reach across India (>80,000 pharmacies), direct patient access. | Crucial for broad consumer access and market penetration in a growing Indian pharma market. |

| Hospitals & Institutions | Direct sales for specialized and injectable formulations. | Bolstered by the 2024 acquisition of Biocon Biologics' business; contributed significantly to ₹2,871 crore revenue in 2023. |

| Medical Representatives | Over 2,500 reps educating doctors and driving prescriptions. | Fundamental for building prescriber relationships and market share in key therapeutic areas. |

| Digital & E-Pharmacy | Emerging channel for product info, medical education, and online sales. | Leveraging the growing ~$1.5 billion Indian online pharmacy market (2023) for enhanced accessibility. |

Customer Segments

Patients with chronic diseases represent a cornerstone customer segment for Eris Lifesciences. This group primarily includes individuals managing long-term health conditions such as diabetes, cardiovascular ailments, and other lifestyle-induced disorders. Eris Lifesciences strategically aligns its product portfolio to address the persistent needs of these patients, reflecting a deep understanding of their ongoing healthcare requirements.

Eris Lifesciences actively caters to patients experiencing acute conditions, providing essential short-term treatments. This segment is crucial, as it complements their established chronic care focus and significantly expands their reach within the healthcare landscape. For instance, in fiscal year 2024, Eris reported a robust revenue growth, partly driven by its diversified product portfolio that includes solutions for acute ailments, demonstrating their commitment to a comprehensive patient care model.

Physicians, from general practitioners to specialists like diabetologists, cardiologists, dermatologists, oncologists, and nephrologists, represent a crucial customer segment for Eris Lifesciences. These medical professionals are the primary decision-makers and influencers in product prescription, making them the central focus of Eris's sales and marketing strategies.

Hospitals and Healthcare Institutions

Hospitals and clinics are key customers for Eris Lifesciences, especially for their specialized drugs like injectables and treatments for critical care areas. These institutions often purchase medications in bulk, making them a cornerstone of the company's revenue stream.

Eris Lifesciences' strategic focus on expanding into oncology and critical care, notably through acquisitions, directly enhances its appeal to these healthcare providers. This allows them to offer a broader range of treatments for complex patient needs. For example, by 2024, Eris Lifesciences has strengthened its position in the critical care segment, which is a primary area of focus for hospitals seeking to manage severe illnesses.

- Bulk Procurement: Hospitals and clinics are significant buyers of pharmaceuticals, often placing large orders for essential and specialized medications.

- Specialized Formulations: Demand for injectables and niche therapeutic areas, like those Eris Lifesciences is expanding into, is high within hospital settings.

- Critical Care Focus: The company's investments in oncology and critical care align directly with the needs of institutions managing life-threatening conditions.

- Acquisition Impact: Recent acquisitions bolster Eris Lifesciences' portfolio, making it a more comprehensive supplier for hospitals' diverse pharmaceutical requirements.

Pharmacies and Retailers

Pharmacies, encompassing both independent operators and larger chains, represent a crucial direct customer segment for Eris Lifesciences. These retailers are the primary channels through which Eris's pharmaceutical products reach the end-patients. Ensuring a robust presence and consistent availability within these pharmacy networks is paramount for driving sales and market penetration.

Eris Lifesciences actively cultivates strong relationships with these pharmacy partners. This engagement is vital for effective product distribution and visibility. For instance, in 2023, Eris reported a significant distribution network, underscoring the importance of these retail touchpoints.

- Direct Sales Channel: Pharmacies are the point of sale for Eris's branded generics and specialty products.

- Relationship Management: Building and maintaining trust with pharmacy owners and managers is key to securing shelf space and promotional support.

- Market Access: A wide network of pharmacies ensures broader patient access to Eris's therapeutic offerings across India.

- Sales Performance: The sales volume through pharmacies directly impacts Eris's revenue and market share in its key therapeutic areas.

Eris Lifesciences also targets the broader healthcare ecosystem, including distributors and channel partners who are essential for extensive product reach. These entities facilitate the movement of pharmaceuticals from manufacturing to pharmacies and hospitals, playing a critical role in market penetration and availability. Their efficient logistics and network are vital for Eris's operational success.

For fiscal year 2024, Eris Lifesciences demonstrated strong growth, with its distribution network being a key enabler. The company's ability to effectively manage its supply chain through these partners ensures that its products are accessible across diverse geographical regions, supporting its market leadership in key therapeutic areas.

The company's strategic partnerships with distributors are crucial for managing inventory and ensuring timely delivery, especially for its growing portfolio of specialty and critical care products. This segment is fundamental to translating product development into widespread patient access and commercial success.

| Customer Segment | Description | Role in Eris's Business Model | Fiscal Year 2024 Relevance |

| Distributors and Channel Partners | Entities responsible for the logistical movement and widespread availability of Eris's pharmaceutical products. | Facilitate market penetration, manage inventory, and ensure timely delivery across India. | Key enablers of Eris's reported growth and market accessibility. |

Cost Structure

Manufacturing and production represent a substantial cost center for Eris Lifesciences, encompassing expenses for raw materials, skilled labor, maintaining production facilities, and rigorous quality control. For instance, in the fiscal year 2023, Eris Lifesciences reported a cost of materials consumed of INR 11,037 crore, a key component of their production outlay.

To better control these significant expenditures, Eris Lifesciences is actively evaluating and pursuing insourcing strategies for certain manufacturing processes. This move aims to enhance efficiency and potentially reduce the overall cost of goods sold by bringing production in-house.

Eris Lifesciences dedicates significant resources to Research and Development (R&D), a crucial element in their business model for both creating novel products and enhancing existing ones. This investment fuels innovation in their pharmaceutical offerings.

These R&D expenditures encompass a range of activities, including the rigorous process of clinical trials, compensation for highly skilled scientific and research personnel, and the ongoing operational costs associated with maintaining state-of-the-art laboratories. For instance, in the fiscal year 2023, Eris Lifesciences reported R&D expenses of approximately ₹150 crore, underscoring their commitment to scientific advancement.

Eris Lifesciences dedicates substantial resources to its sales and marketing efforts. These costs are primarily driven by maintaining an extensive sales force and a large team of medical representatives who engage directly with healthcare professionals. In fiscal year 2023, the company’s selling and distribution expenses amounted to ₹1,148 crore, reflecting the significant investment in market penetration and physician outreach.

Marketing campaigns, promotional activities, and patient care initiatives also form a considerable portion of this cost category. Reaching a wide audience and building brand awareness within the competitive pharmaceutical landscape necessitates ongoing investment in these areas. The company's strategy relies heavily on effectively communicating the benefits of its products to doctors and patients alike, which translates into substantial marketing expenditures.

Acquisition and Integration Costs

Eris Lifesciences' growth strategy heavily relies on acquisitions, which naturally leads to significant upfront costs. These include not only the purchase price of the acquired companies but also substantial expenses for legal services, comprehensive due diligence to assess risks and opportunities, and the complex process of integrating new entities into Eris's existing operational framework. For instance, in fiscal year 2023, Eris Lifesciences reported that its acquisition-related expenses, which encompass integration efforts, contributed to its overall cost base.

The integration phase is particularly critical and resource-intensive. It involves harmonizing IT systems, aligning human resources and employee benefits, consolidating supply chains, and ensuring cultural compatibility, all of which require dedicated financial and managerial capital. These integration costs are vital for realizing the full strategic and financial benefits of any acquisition, ensuring that the acquired business seamlessly contributes to Eris Lifesciences' overall value proposition.

Key components of these acquisition and integration costs include:

- Acquisition Price: The direct payment made to acquire the target company.

- Due Diligence Expenses: Costs associated with legal, financial, and operational reviews.

- Legal and Advisory Fees: Payments to lawyers, bankers, and consultants involved in the transaction.

- Integration Costs: Expenses for merging operations, IT systems, and personnel.

Logistics and Distribution Costs

Eris Lifesciences faces significant expenses in its logistics and distribution network, a crucial element for reaching its diverse customer base across India. These costs encompass warehousing facilities to store its pharmaceutical products, the transportation of goods via various modes, and the overall management of its intricate distribution channels. For instance, in the fiscal year 2023-24, the company’s total expenses were ₹2,512 crore, with a substantial portion allocated to these operational aspects. Efficiently managing these costs is paramount to maintaining product availability and competitive pricing.

- Warehousing Expenses: Costs associated with maintaining temperature-controlled storage facilities to preserve the efficacy of pharmaceutical products.

- Transportation Costs: Expenditure on road, rail, and air freight for moving finished goods from manufacturing units to distribution centers and then to retailers.

- Distribution Network Management: Outlays for managing relationships with distributors, wholesalers, and retailers, including any associated fees or margins.

- Inventory Carrying Costs: Expenses related to holding inventory, such as insurance, obsolescence, and capital tied up in stock, which are influenced by distribution lead times.

The cost structure of Eris Lifesciences is heavily influenced by its manufacturing and R&D investments, alongside significant outlays for sales, marketing, and strategic acquisitions. In fiscal year 2023, cost of materials consumed was INR 1,1037 crore, while R&D expenses stood at approximately ₹150 crore, and selling and distribution expenses reached ₹1,148 crore.

These figures highlight the substantial resources allocated to product development, market penetration, and operational efficiency. The company's commitment to innovation and market presence directly translates into these key cost drivers.

Acquisitions and the subsequent integration processes also represent a notable cost component, essential for Eris Lifesciences' growth strategy. Managing logistics and distribution across India further contributes to the overall operational expenses.

| Cost Category | FY 2023 (INR Crore) | Significance |

|---|---|---|

| Cost of Materials Consumed | 11,037 | Core manufacturing expense |

| R&D Expenses | ~150 | Investment in innovation |

| Selling & Distribution Expenses | 1,148 | Market reach and physician engagement |

| Total Expenses (FY23-24) | 2,512 | Overall operational outlay |

Revenue Streams

Eris Lifesciences primarily generates revenue through the sale of its branded generics, a cornerstone of its domestic business. The company has strategically focused on chronic therapy areas, notably oral anti-diabetes and cardiovascular diseases, where consistent demand exists.

In the fiscal year 2023, Eris Lifesciences reported a robust revenue of ₹1,343 crore, with its domestic branded generics business contributing significantly to this figure. This segment's performance underscores the effectiveness of its brand-building and distribution strategies in these key chronic care markets.

Eris Lifesciences generates revenue through the sale of branded generics for acute therapies. This segment diversifies its portfolio beyond its core chronic care offerings, capturing a broader market share.

In the fiscal year 2023, Eris Lifesciences reported a significant revenue contribution from its branded generics segment, highlighting its growing presence in acute treatment areas.

Eris Lifesciences' strategic acquisitions, especially in insulins, oncology, and critical care, are set to unlock significant new revenue streams. The company's focus on these high-growth therapeutic areas is a key driver for its future expansion.

The insulin franchise, bolstered by recent moves, is anticipated to be a major contributor, projecting substantial additions to overall revenue. This expansion into specialized medical segments highlights Eris's commitment to diversifying and strengthening its market position.

International Sales/Exports

Eris Lifesciences is actively broadening its international reach, with exports becoming an increasingly significant component of its overall revenue. This strategic push into new markets is a key driver for future growth.

In 2023, the company made substantial strides by introducing its products into 10 new countries. This expansion directly contributed to a notable increase in its export revenues for the year.

The company's international sales strategy focuses on leveraging its product portfolio in diverse geographical regions. Key performance indicators include:

- Expansion into 10 new countries in 2023.

- Growth in export revenue as a percentage of total revenue.

- Targeting emerging markets for increased penetration.

- Building a sustainable global distribution network.

Contract Development and Manufacturing (CDMO) Services

Eris Lifesciences is expanding its revenue base by venturing into Contract Development and Manufacturing Organization (CDMO) services. This strategic move, bolstered by the acquisition of Swiss Parenterals, allows Eris to leverage its manufacturing capabilities to serve other pharmaceutical companies. This creates a new income stream beyond its proprietary product sales.

The CDMO segment offers significant growth potential. For instance, the global pharmaceutical contract manufacturing market was valued at approximately $145.7 billion in 2023 and is projected to reach $279.6 billion by 2030, growing at a CAGR of 9.7%. Eris's entry into this market positions it to capture a share of this expanding industry.

- CDMO Exports: Eris Lifesciences is entering the CDMO export market through the acquisition of Swiss Parenterals.

- Additional Revenue Stream: This offers a new avenue for income by providing manufacturing services to external pharmaceutical firms.

- Market Opportunity: The global CDMO market presents substantial growth prospects, indicating a favorable environment for this new venture.

Eris Lifesciences' revenue streams are diversified, primarily driven by its strong domestic branded generics business, particularly in chronic therapy areas like diabetes and cardiovascular. The company is strategically expanding into high-growth segments such as insulins and oncology through acquisitions, aiming to capture new market opportunities.

International expansion is a growing revenue contributor, with Eris entering 10 new countries in 2023 to broaden its global footprint. Furthermore, its recent foray into Contract Development and Manufacturing Organization (CDMO) services, notably with the acquisition of Swiss Parenterals, opens up a significant new income stream by catering to external pharmaceutical manufacturing needs.

| Revenue Stream | Key Focus Areas | 2023 Contribution (Illustrative) |

|---|---|---|

| Domestic Branded Generics | Oral Anti-diabetics, Cardiovascular | Significant portion of ₹1,343 crore total revenue |

| International Business | Expansion into 10 new countries | Growing contribution to overall revenue |

| Specialty Segments (Insulin, Oncology) | Acquisition-driven growth | Projected substantial additions to revenue |

| CDMO Services | Manufacturing for external firms (via Swiss Parenterals) | New and growing income stream |

Business Model Canvas Data Sources

The Eris Lifesciences Business Model Canvas is built using a blend of internal financial reports, extensive market research on the pharmaceutical sector, and competitive analysis of key players. This comprehensive approach ensures each component of the canvas is grounded in verifiable data and industry insights.