Eris Lifesciences Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eris Lifesciences Bundle

Eris Lifesciences operates in a dynamic pharmaceutical landscape, where understanding the interplay of competitive forces is crucial for success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eris Lifesciences’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Indian pharmaceutical sector's dependence on imported Active Pharmaceutical Ingredients (APIs), predominantly from China, highlights a significant concentration of suppliers for crucial raw materials. This reliance can grant these suppliers substantial bargaining power, potentially impacting Eris Lifesciences' cost of goods.

Eris Lifesciences is actively working to counter this by pursuing backward integration and strategic acquisitions. For instance, their acquisition of Chemman Labs and investment in Levim Lifetech for bulk biologics manufacturing are key steps in reducing their reliance on external suppliers for critical components, thereby strengthening their position.

Switching Active Pharmaceutical Ingredient (API) suppliers in the pharmaceutical sector is a complex and costly undertaking. These costs stem from rigorous regulatory re-approvals, extensive quality control testing, and the potential for significant supply chain disruptions. For Eris Lifesciences, this means established API providers hold considerable sway.

These high switching costs effectively create a barrier, empowering existing API suppliers. Eris Lifesciences faces a challenge in readily shifting to new suppliers, thus reinforcing the bargaining power of their current partners. This dynamic is a key consideration in their procurement strategies.

Eris Lifesciences' strategic move towards insourcing manufacturing for key products, such as insulin, is a direct response to mitigate these supplier-driven costs. By bringing production in-house, the company aims to gradually reduce its reliance on external API suppliers and, consequently, lower its own switching costs in the long run.

Fluctuations in raw material costs, particularly for imported Active Pharmaceutical Ingredients (APIs), directly affect Eris Lifesciences' production expenses and profitability. For instance, in the fiscal year 2023, Eris Lifesciences reported a revenue of INR 2,590 crore, with its cost of materials consumed representing a significant portion of its operating expenses.

While Eris strives to maintain robust operating profit margins, which stood at approximately 21.5% in FY23, any substantial increase in input costs that cannot be effectively passed on to consumers could exert downward pressure on the company's financial performance.

Threat of Forward Integration by Suppliers

While not a frequent occurrence, substantial Active Pharmaceutical Ingredient (API) manufacturers do possess the capability to integrate forward into producing finished dosage forms. This would position them as direct rivals to companies like Eris Lifesciences, potentially impacting market dynamics.

However, the pharmaceutical sector presents considerable barriers to entry for such integration. The substantial capital investment required for manufacturing facilities and the complex regulatory pathways for marketing branded generics serve as significant deterrents, thus generally mitigating this threat.

Eris Lifesciences' robust brand equity and its well-entrenched distribution network across India act as crucial counterbalances against this potential threat. This established market presence provides a competitive advantage, making it more challenging for suppliers to successfully integrate forward.

- API Manufacturers' Integration Potential: Large API producers could shift into finished drug manufacturing, directly competing with pharmaceutical companies.

- Barriers to Forward Integration: High capital expenditure and stringent regulatory approvals for pharmaceutical production and marketing of branded generics significantly limit this threat.

- Eris Lifesciences' Defense: The company's strong brand recognition and extensive distribution channels in India provide a solid defense against potential supplier forward integration.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers. If Eris Lifesciences can readily source alternative raw materials or develop them internally, the leverage held by existing suppliers diminishes. This is particularly relevant in the pharmaceutical industry where innovation in chemical synthesis or the discovery of new drug formulations can introduce substitutes.

India's strategic push to bolster domestic manufacturing, especially for Active Pharmaceutical Ingredients (APIs), directly addresses this. For instance, the Production Linked Incentive (PLI) scheme for pharmaceuticals, launched in 2021, aims to reduce reliance on imports. By 2023-24, the scheme had already seen significant uptake, with companies investing in new API production facilities. This diversification of the supply chain for Eris Lifesciences could lead to more competitive pricing and greater flexibility, thereby weakening the bargaining power of any single supplier.

- Reduced Import Dependency: Government initiatives like the PLI scheme are actively promoting local API manufacturing, lessening dependence on foreign suppliers.

- Diversified Sourcing Options: The growth of domestic API production provides Eris Lifesciences with a broader range of potential suppliers, increasing competition among them.

- Potential for In-house Development: As the pharmaceutical landscape evolves, Eris Lifesciences may explore developing certain critical inputs in-house, further reducing reliance on external suppliers.

- Impact on Cost Structure: Greater choice and potential for in-house capabilities can lead to more favorable raw material costs, positively impacting Eris Lifesciences' overall profitability.

The bargaining power of suppliers for Eris Lifesciences is primarily influenced by the concentration of API manufacturers and the high switching costs involved in changing suppliers. Eris's strategy to mitigate this involves backward integration and insourcing, as seen with their investments in companies like Chemman Labs and Levim Lifetech. This proactive approach aims to reduce reliance on external sources for critical raw materials.

The Indian government's Production Linked Incentive (PLI) scheme, launched in 2021, is fostering domestic API manufacturing, which is expected to diversify Eris Lifesciences' supply chain and potentially reduce supplier leverage. This aligns with Eris's goal of increasing its self-sufficiency in key product manufacturing, such as insulin, thereby strengthening its negotiating position.

| Factor | Impact on Eris Lifesciences | Mitigation Strategy |

| API Supplier Concentration | High, particularly from China | Backward integration, strategic acquisitions (Chemman Labs) |

| Switching Costs | High due to regulatory approvals and quality testing | Insourcing of key product manufacturing (e.g., insulin) |

| Government Initiatives (PLI Scheme) | Promoting domestic API production, diversifying supply | Leveraging increased local sourcing options |

What is included in the product

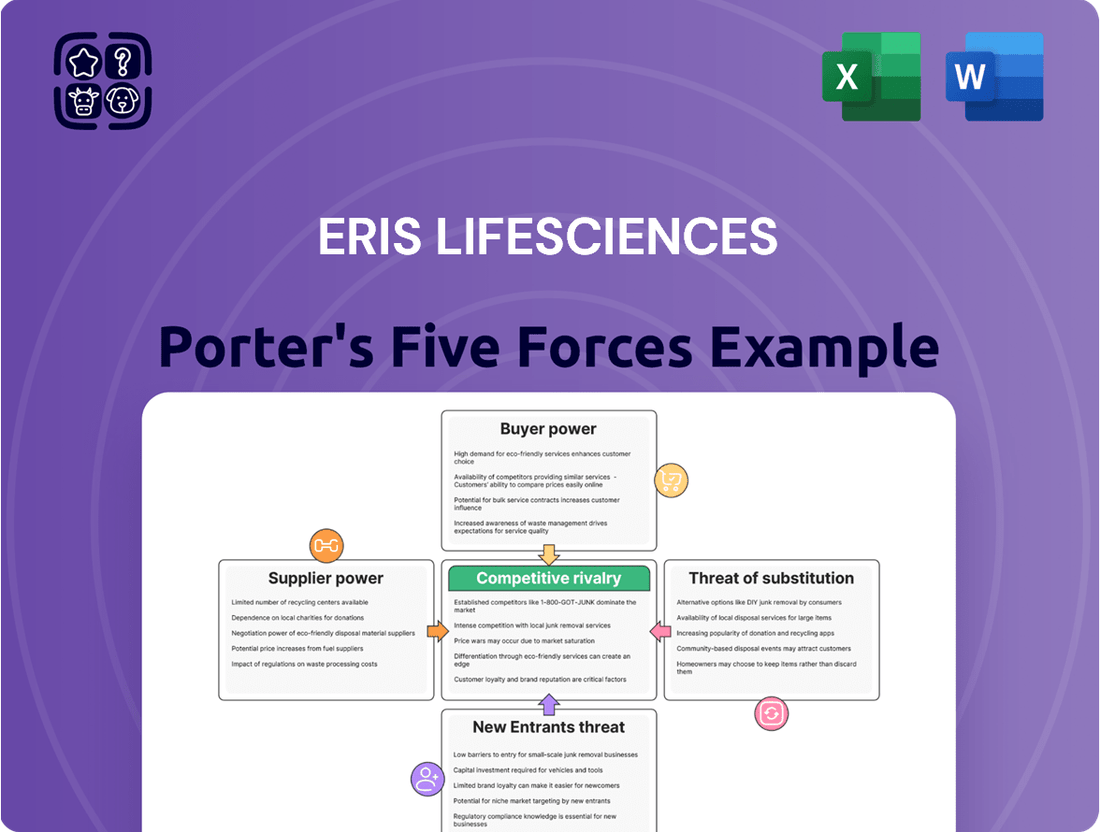

This analysis dissects the competitive forces impacting Eris Lifesciences, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes within the pharmaceutical sector.

Eris Lifesciences' Porter's Five Forces Analysis offers a clear, one-sheet summary of all competitive pressures, perfect for quick strategic decision-making regarding pain points.

Instantly understand strategic pressure points with a powerful spider/radar chart, allowing Eris Lifesciences to proactively address competitive threats.

Customers Bargaining Power

Customers in the Indian pharmaceutical market, especially for branded generics, exhibit high price sensitivity. This is driven by the extensive availability of alternatives and government-imposed price caps on essential medicines. For instance, in 2023, the National Pharmaceutical Pricing Authority (NPPA) revised prices for over 800 essential drugs, underscoring the regulatory influence on pricing.

This heightened price sensitivity significantly amplifies the bargaining power of customers. Eris Lifesciences, like its peers, faces considerable pressure to offer competitive pricing, directly impacting profit margins and strategic flexibility. The ability of customers to switch between brands based on minor price differences means companies must constantly balance affordability with profitability.

Eris Lifesciences' focus on the branded generics market means customers, including both patients and healthcare providers, benefit from a wide array of alternative products. This abundance of choices directly translates into increased bargaining power for these customers.

The sheer volume of generic alternatives available across various therapeutic categories compels Eris to actively differentiate its offerings. This differentiation is crucial and is achieved through building a strong brand reputation, ensuring consistent product quality, and demonstrating positive patient outcomes.

For instance, in 2023, the Indian pharmaceutical market, where Eris is a significant player, saw robust growth in the generics segment. This market dynamism underscores the competitive landscape where customer choice is paramount, directly impacting Eris's pricing strategies and market positioning.

Doctors and healthcare professionals are key influencers, acting as indirect customers for Eris Lifesciences. Their prescription decisions directly shape patient demand for the company's products, making their trust and adoption vital. In 2023, Eris Lifesciences continued its focus on medical education and engagement programs, a strategy that underpins its success in branded generics.

Eris Lifesciences actively cultivates relationships with these professionals by providing scientific data and product information. This engagement aims to ensure that their branded generics are considered and prescribed. Their efforts are crucial given that in the Indian pharmaceutical market, physician preference is a significant driver of sales for many therapeutic areas.

Distribution Channel Power

The bargaining power of customers in Eris Lifesciences' distribution channel is influenced by the network of wholesale drug distributors, stockists, and retail pharmacies. These intermediaries are essential for Eris to reach patients throughout India, making their cooperation vital for market penetration and sales growth. Favorable terms with these partners are key to ensuring product availability and competitive pricing.

The increasing prevalence of online pharmacies introduces a new layer of complexity to distribution power. These platforms can offer greater price transparency and convenience to end consumers, potentially shifting some leverage towards them and away from traditional brick-and-mortar channels. Eris Lifesciences must navigate these evolving dynamics to maintain strong relationships across its entire distribution ecosystem.

- Distribution Network Strength: Eris Lifesciences' reliance on its extensive network of over 15,000 stockists and distributors across India gives these intermediaries a degree of influence.

- Online Pharmacy Growth: The Indian online pharmacy market is projected to reach $11.7 billion by 2025, indicating a significant shift in consumer purchasing habits and a growing channel for competition and bargaining.

- Channel Margin Importance: Maintaining healthy margins for distributors and pharmacies is crucial for securing shelf space and ensuring consistent product availability, thereby influencing Eris's pricing and promotional strategies.

Patient Awareness and Access to Information

Patient awareness is on the rise, with digital platforms offering unprecedented access to information on drug options and pricing. This transparency directly impacts the bargaining power of customers, making them more price-sensitive and inclined to explore alternatives. For instance, in 2024, the global digital health market was valued at over $300 billion, a testament to the widespread adoption of technology in healthcare information dissemination.

- Increased Price Sensitivity: Patients can now easily compare prices for the same or similar treatments across different providers or even different formulations of a drug.

- Demand for Value: Beyond just price, patients are increasingly seeking treatments that offer perceived higher value, whether through improved efficacy, fewer side effects, or better patient support services.

- Digital Information Channels: Websites, health apps, and online forums provide platforms for patients to share experiences and research treatment outcomes, further influencing their choices.

- Impact on Eris Lifesciences: Eris Lifesciences, like other pharmaceutical companies, must contend with a more informed patient base that can exert greater pressure on pricing and product differentiation.

Customers in India's pharmaceutical sector, particularly for branded generics, are highly price-sensitive due to numerous alternatives and government price controls. This sensitivity significantly bolsters their bargaining power, compelling Eris Lifesciences to maintain competitive pricing, which directly impacts profit margins. The company must balance affordability with profitability in a market where minor price differences can drive brand switching.

The bargaining power of Eris Lifesciences' customers is substantial, driven by a highly competitive market with abundant generic alternatives. This forces Eris to focus on differentiation through brand reputation, quality, and patient outcomes to counter price pressures. For instance, in 2023, the Indian pharmaceutical market's robust generics segment growth highlighted the critical role of customer choice in shaping Eris's pricing and market strategy.

Doctors and distributors, as key customer segments, wield significant influence. Physician preference, a major sales driver in India, necessitates Eris's engagement in medical education and data provision. Similarly, the extensive distribution network, comprising over 15,000 stockists, grants intermediaries leverage, impacting Eris's pricing and promotional strategies to ensure product availability.

| Customer Segment | Key Influencing Factors | Impact on Eris Lifesciences |

| Patients | High price sensitivity, access to online information, demand for value | Pressure on pricing, need for strong value proposition and brand trust |

| Healthcare Professionals (Doctors) | Brand reputation, clinical data, patient outcomes, medical education | Necessity for robust scientific engagement, physician preference programs |

| Distributors/Stockists | Channel margins, product availability, network strength | Requirement for favorable terms, efficient supply chain management |

| Online Pharmacies | Price transparency, convenience, growing market share | Need to adapt to evolving distribution channels and competitive pricing |

Full Version Awaits

Eris Lifesciences Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Eris Lifesciences' competitive landscape through Porter's Five Forces, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the pharmaceutical industry.

Rivalry Among Competitors

The Indian pharmaceutical market is a crowded space, with a vast number of domestic and international companies vying for market share. Eris Lifesciences, despite its strength in chronic and acute care segments, contends with formidable rivals such as Sun Pharma, Cipla, Lupin, and Dr. Reddy's Laboratories, all of which possess extensive product portfolios and significant market penetration.

The Indian pharmaceutical market is on a significant upward trajectory, with projections indicating it will reach ₹2.38 lakh crore by 2025. This rapid expansion, particularly in high-demand areas like cardiac and anti-diabetic treatments, creates a fertile ground for increased competition.

As the market grows, it naturally draws in a larger number of players, both established companies and new entrants. This influx intensifies the battle for market share, forcing companies to innovate and differentiate their offerings to stand out.

The robust growth rate, while a positive indicator of market health, directly fuels competitive rivalry. Companies must constantly vie for customer attention and loyalty, often through aggressive marketing, pricing strategies, and product development.

Eris Lifesciences, operating in the branded generics space, focuses on differentiating its offerings through robust brand building, unwavering quality standards, and patient-centric services. This approach helps them stand out in a market where fundamental product innovation is inherently constrained by the nature of generics.

While molecular innovation is limited, competition in the generics sector often intensifies around pricing strategies, effective marketing campaigns, and strong distribution networks. Eris leverages these avenues to maintain its competitive edge.

To counter this, Eris Lifesciences actively invests in research and development, aiming for new product launches and pursuing 'first-to-market' opportunities. For instance, in the fiscal year 2023, Eris reported a significant 16% year-on-year growth in its domestic business, driven by new product introductions and market penetration.

Switching Costs for Customers

In the branded generics space, patients generally face low switching costs. This means if a patient isn't happy with a specific brand or finds a cheaper option, they can switch providers or medications without significant hassle or expense. This ease of switching directly impacts companies like Eris Lifesciences by intensifying competition.

For instance, in 2024, the Indian pharmaceutical market, where Eris Lifesciences is a significant player, saw numerous new product launches in therapeutic areas like cardiology and diabetes. This influx of alternatives makes it even simpler for patients to explore and adopt different brands, further reducing the stickiness of existing customer bases.

- Low Switching Barriers: Patients can readily switch between branded generic medications due to minimal financial or practical impediments.

- Impact on Eris Lifesciences: This low switching cost increases competitive pressure, demanding continuous innovation and competitive pricing from Eris.

- Market Dynamics: The availability of numerous affordable alternatives in 2024, particularly in high-volume therapeutic segments, exacerbates this challenge for established brands.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are a significant driver of competitive rivalry within the Indian pharmaceutical sector. Companies frequently engage in M&A to broaden their therapeutic portfolios and strengthen their market reach. This trend highlights a dynamic competitive landscape where consolidation is a key strategy for growth and market positioning.

Eris Lifesciences has actively participated in this M&A trend. Notable acquisitions include Biocon Biologics' branded formulations business and Swiss Parenterals. These strategic moves demonstrate Eris Lifesciences' commitment to diversification and scaling its operations, directly impacting the competitive intensity within its operating segments.

- Indian Pharma M&A Growth: The Indian pharmaceutical market has experienced robust M&A activity, with deal values often reaching significant figures as companies seek to gain scale and market share. For instance, in 2023, the sector saw a surge in inbound and outbound M&A, reflecting a strategic push for global competitiveness.

- Eris Lifesciences' Strategic Acquisitions: Eris Lifesciences' acquisition of Biocon Biologics' branded formulations business for approximately ₹1,200 crore (around $145 million USD) in 2023 significantly expanded its chronic therapy segment, particularly in areas like cardiology and diabetology.

- Impact on Rivalry: Such acquisitions not only bolster the acquiring company's market position but also intensify competition by increasing the scale and capabilities of key players, forcing rivals to adapt their strategies or consider similar consolidation moves.

Competitive rivalry is intense in the Indian pharmaceutical market, with Eris Lifesciences facing strong competition from established players like Sun Pharma and Cipla. The market's rapid growth, projected to reach ₹2.38 lakh crore by 2025, attracts numerous companies, intensifying the battle for market share and customer loyalty.

Eris differentiates itself through brand building and patient-centric services in the branded generics space, where low switching costs for patients amplify competitive pressure. The company's strategic acquisitions, such as the ₹1,200 crore deal for Biocon Biologics' branded formulations business in 2023, aim to bolster its market position and scale, further impacting the competitive landscape.

| Competitor | Key Therapeutic Areas | Market Share (Approx. FY23) | Recent Strategic Moves |

|---|---|---|---|

| Sun Pharma | Cardiology, Neurology, Dermatology | 10-12% | Focus on R&D, global expansion |

| Cipla | Respiratory, Cardiovascular, Anti-infectives | 6-8% | Partnerships, biosimilars development |

| Lupin | Cardiology, Diabetes, CNS | 4-5% | New product launches, digital health initiatives |

| Dr. Reddy's Laboratories | Oncology, Cardiovascular, Diabetes | 4-5% | Acquisitions, focus on complex generics |

| Eris Lifesciences | Cardiology, Diabetology, Neurology | 3-4% | Acquisition of Biocon Biologics' branded formulations business (2023) |

SSubstitutes Threaten

The threat of substitutes for Eris Lifesciences is significant, particularly concerning chronic lifestyle-related disorders. Alternative medical treatments and lifestyle interventions can directly reduce or replace the need for pharmaceutical products. For instance, dietary changes, regular exercise, and stress management techniques are increasingly recognized as effective substitutes for medications used to manage conditions like diabetes, hypertension, and obesity.

The prevalence of traditional and Ayurvedic medicines in India presents a significant threat of substitutes for Eris Lifesciences. These systems, deeply ingrained in Indian culture, offer alternative treatments for various ailments, potentially diverting demand from modern pharmaceuticals. For instance, the Indian traditional medicine market was valued at approximately USD 12.2 billion in 2023 and is projected to grow, indicating a substantial consumer base that may opt for these natural remedies over branded generics.

The growing emphasis on preventive healthcare and wellness programs poses a significant threat of substitutes for pharmaceutical companies like Eris Lifesciences. These initiatives, focusing on lifestyle modifications and early disease detection, aim to reduce the incidence and severity of chronic conditions, thereby potentially decreasing the demand for long-term medications.

For instance, the global wellness market was valued at over $5.6 trillion in 2022 and is projected to grow substantially. This expansion indicates a shift in consumer behavior towards proactive health management, which could directly impact the market for drugs treating lifestyle-related disorders, a key area for Eris Lifesciences.

Development of New, More Effective Drugs

The development of new, more effective drugs by innovator companies poses a significant threat of substitution for Eris Lifesciences. If these novel treatments offer superior efficacy or curative properties compared to Eris's branded generics, they could diminish the market relevance of existing treatments. For instance, breakthroughs in gene therapy or personalized medicine could fundamentally alter treatment paradigms in chronic diseases where Eris currently holds a strong position.

Eris Lifesciences strategically navigates this threat by concentrating on chronic conditions. These areas typically exhibit sustained and robust demand for generic medications due to factors like long-term patient needs and cost-consciousness. For example, Eris's strong presence in cardiovascular and diabetes segments, which represent a substantial portion of the Indian pharmaceutical market, benefits from the ongoing need for reliable and affordable treatments.

- Threat of Substitution: Novel Drugs The emergence of highly effective or curative drugs from innovator companies can render existing generic treatments less relevant.

- Eris's Mitigation Strategy Eris focuses on chronic conditions, ensuring sustained demand for its branded generics due to long-term patient requirements and cost sensitivity.

- Market Context In 2024, the global pharmaceutical market continued to see significant investment in R&D for novel therapies, particularly in areas like oncology and autoimmune diseases, highlighting the ongoing pressure from innovation.

- Eris's Market Position Eris Lifesciences' emphasis on chronic disease segments, such as diabetes and cardiology, which are estimated to constitute a significant portion of the Indian branded generics market, provides a degree of resilience against disruptive innovations in other therapeutic areas.

Biosimilars and Biologics

The increasing availability of biosimilars and biologics presents a potential substitute threat to traditional small-molecule drugs. While this segment is a growth avenue for many Indian pharmaceutical firms, it could divert market share from established therapies.

Eris Lifesciences has proactively addressed this by investing in the biologics and injectables space through strategic acquisitions. This move effectively transforms a potential competitive threat into a significant growth opportunity for the company.

- Biosimilar Market Growth: The global biosimilar market was valued at approximately USD 20.7 billion in 2023 and is projected to reach USD 80.5 billion by 2030, growing at a CAGR of 21.4%.

- Eris's Strategic Acquisitions: Eris Lifesciences acquired Strides Pharma Science's domestic formulations business in 2020, which included a portfolio of injectables, bolstering its presence in this segment.

- Therapeutic Area Impact: In therapeutic areas like oncology and autoimmune diseases, where biologics are prevalent, biosimilars can offer cost-effective alternatives, impacting the market for originator small-molecule drugs.

The threat of substitutes for Eris Lifesciences is multifaceted, encompassing lifestyle changes, traditional medicine, and novel drug development. For instance, the growing wellness market, valued at over $5.6 trillion in 2022, highlights a consumer shift towards proactive health management, potentially reducing reliance on pharmaceuticals for chronic conditions. Similarly, the Indian traditional medicine market, worth approximately USD 12.2 billion in 2023, offers culturally ingrained alternatives that can divert demand from modern medicine.

Eris strategically focuses on chronic disease segments like diabetes and cardiology, where sustained demand for branded generics is driven by long-term patient needs and cost considerations. This focus provides a degree of insulation against disruptive innovations in other therapeutic areas. For example, while the global R&D investment in novel therapies continued strongly in 2024, Eris's established presence in essential chronic care segments ensures a steady market for its offerings.

The rise of biosimilars and biologics also presents a substitution threat, particularly in areas like oncology. However, Eris has proactively addressed this by investing in the biologics and injectables space, notably through acquisitions like Strides Pharma Science's domestic formulations business. This strategic move converts a potential threat into a growth avenue, as the global biosimilar market is projected to grow significantly, reaching USD 80.5 billion by 2030.

| Threat Category | Example for Eris Lifesciences | Market Data/Impact |

| Lifestyle & Wellness | Dietary changes, exercise for diabetes/hypertension | Global wellness market > $5.6 trillion (2022) |

| Traditional Medicine | Ayurvedic treatments for chronic ailments | Indian traditional medicine market ~ USD 12.2 billion (2023) |

| Novel Drug Development | Innovator drugs with superior efficacy | Continued strong R&D investment in 2024 |

| Biosimilars & Biologics | Cost-effective alternatives to biologics | Biosimilar market projected to reach USD 80.5 billion by 2030 |

Entrants Threaten

Entering the pharmaceutical sector, particularly in branded generics like Eris Lifesciences, demands significant upfront capital. Companies need to invest heavily in research and development to create new formulations and ensure product efficacy. For instance, establishing state-of-the-art manufacturing facilities compliant with stringent regulatory standards, such as those of the US FDA or EMA, can easily cost tens of millions of dollars.

Beyond manufacturing, building robust quality control systems and extensive distribution networks to reach a wide patient base also requires substantial financial resources. This high barrier to entry effectively deters many potential new players from challenging established companies like Eris Lifesciences.

The Indian pharmaceutical sector operates under a highly regulated environment. Stringent rules govern everything from initial drug approvals and good manufacturing practices (GMP) to pricing mechanisms. This complex web of regulations demands considerable specialized knowledge and substantial financial investment to navigate successfully.

For Eris Lifesciences, these stringent regulatory requirements act as a significant barrier to entry for potential new competitors. Companies looking to enter the market must invest heavily in compliance, research and development, and quality control to meet these standards, making it difficult for smaller or less-resourced entities to compete effectively.

Eris Lifesciences, operating in the branded generics space, benefits significantly from deeply entrenched brand loyalty and long-standing relationships with physicians. These established connections, cultivated over years of consistent product quality and effective marketing, create a substantial barrier for any new players attempting to enter the market. For instance, in 2023, Eris reported a revenue of INR 1,340 crore, a testament to its market penetration built on these relationships.

New entrants would face the daunting task of replicating this trust and market acceptance, requiring substantial financial investment and considerable time to build a comparable rapport with healthcare providers. The cost and effort involved in establishing a new brand and securing doctor endorsements are significant hurdles that deter potential competitors.

Economies of Scale and Experience Curve

Existing players in the Indian pharmaceutical market, such as Eris Lifesciences, leverage significant economies of scale. This allows them to achieve lower per-unit costs in manufacturing, raw material procurement, and distribution networks. For instance, Eris Lifesciences' robust supply chain and large-scale production facilities in 2024 likely contribute to cost efficiencies that new entrants would struggle to replicate immediately.

New companies entering the market would face substantial hurdles in matching the cost advantages enjoyed by established firms. Without the benefit of an established experience curve, which leads to optimized processes and reduced waste over time, new entrants would likely operate at higher cost bases. This makes competing on price a considerable challenge, thereby acting as a deterrent.

- Economies of Scale: Eris Lifesciences benefits from bulk purchasing of raw materials and efficient large-scale manufacturing, driving down production costs.

- Experience Curve: Years of operational experience have allowed Eris to refine its processes, leading to improved efficiency and lower operating expenses compared to a new entrant.

- Distribution Network: Eris's established distribution channels across India provide a cost advantage in reaching a wide customer base, which a new player would need significant investment to build.

- Procurement Power: The company's size grants it greater bargaining power with suppliers, securing better pricing for active pharmaceutical ingredients and other inputs.

Intellectual Property and Patent Landscape

The pharmaceutical industry, even for companies like Eris Lifesciences primarily focused on generics, is heavily influenced by intellectual property and patent laws. New entrants seeking to introduce novel drugs must navigate a complex web of patents, which can involve substantial licensing fees or lengthy legal battles, creating a significant barrier to entry for truly innovative products. While this is less of a direct hurdle for generic manufacturers who typically enter after patent expiry, the underlying strength of patent protection in the broader market still shapes competitive dynamics.

The threat of new entrants for Eris Lifesciences, particularly in the generics space, is somewhat mitigated by the capital-intensive nature of pharmaceutical manufacturing and regulatory compliance. However, the ease with which some generic products can be developed and brought to market means that new players can emerge, especially in less complex therapeutic areas. For instance, in 2024, the Indian pharmaceutical market continued to see growth, with generic drug sales forming a substantial portion, indicating ongoing opportunities for new entrants to establish a foothold.

- Patent Expiries Drive Generic Opportunities: The expiration of patents on blockbuster drugs is a key driver for new entrants in the generics market, creating windows for competition.

- Regulatory Hurdles: While generics have fewer patent barriers, stringent regulatory approvals from bodies like the FDA and EMA still require significant investment and expertise, acting as a deterrent for some potential new entrants.

- Capital Investment: Establishing manufacturing facilities that meet Good Manufacturing Practices (GMP) and managing complex supply chains demands substantial capital, making it challenging for smaller entities to enter at scale.

The threat of new entrants for Eris Lifesciences is moderately low due to high capital requirements for manufacturing and R&D, coupled with stringent regulatory approvals. For example, establishing a pharmaceutical manufacturing unit compliant with GMP standards can cost upwards of $20 million. Furthermore, building an established distribution network and brand loyalty, as Eris has done, takes years and significant investment, creating a substantial barrier.

While the branded generics space offers opportunities, new players must overcome established relationships with healthcare professionals and the economies of scale enjoyed by incumbents. Eris Lifesciences' 2023 revenue of approximately INR 1,340 crore highlights its market penetration, which is difficult for newcomers to quickly replicate.

The Indian pharmaceutical market, though growing, remains challenging for new entrants due to complex regulations and the need for substantial investment in quality control and compliance. For instance, obtaining approvals from bodies like the CDSCO in India involves rigorous testing and documentation, adding to the cost and time to market.

New entrants face challenges in matching the cost efficiencies derived from economies of scale in procurement and manufacturing, as well as the advantages of an experience curve. Without these, competing on price with established players like Eris Lifesciences becomes a significant hurdle.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eris Lifesciences is built upon comprehensive data from annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry research firms and market intelligence platforms to provide a robust assessment of the competitive landscape.